PDF attached includes our 2022-23 update crop-year rolling average price forecast

Widespread

commodity selling over global economic and recession concerns sent US agriculture futures lower, although losses in the soybean complex were trimmed on talk China was in for US soybeans. Monitor China/Taiwan tensions as it seems to be escalating. 2022 has

certainly been a strange year of geopolitical problems after emerging out of Covid lockdowns.

Under

the 24-H reporting system, private exporters reported sales of 264,000 tons of soybeans for delivery to unknown destinations during the 2022-23 marketing year.

USDA

announced the weekly USDA export sales report will be delayed until further notice. Our target was for a Tuesday release. Bloomberg – Vilsack said separately the agency was seeking to fix crop export data that was retracted last week after problems with a

new

reporting system. “We’re trying to make sure it got fixed,” Vilsack said,

declining

to provide timeline on when information would be released.

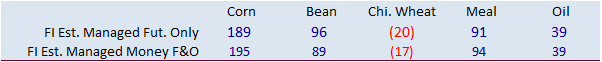

FI

will be running export sales estimates for last week (8/25) later this week.

Pakistan’s

flooding could amount to over 10 billion USD in damages. More than half a million people were displaced. The floods washed out infrastructure including textile mills. The morning weather forecast was largely unchanged for the US. The Midwestern areas will

see rain today, far north central areas Friday and south central areas Sunday. TX will see good rains through Friday before tapering off. NE and CO will remain dry. The WCB corn belt in general will see net drying over the next week. EU’s weather outlook

improved a touch with additional rain across central and southern France, Italy, Romania and Bulgaria.