PDF Attached

Lower

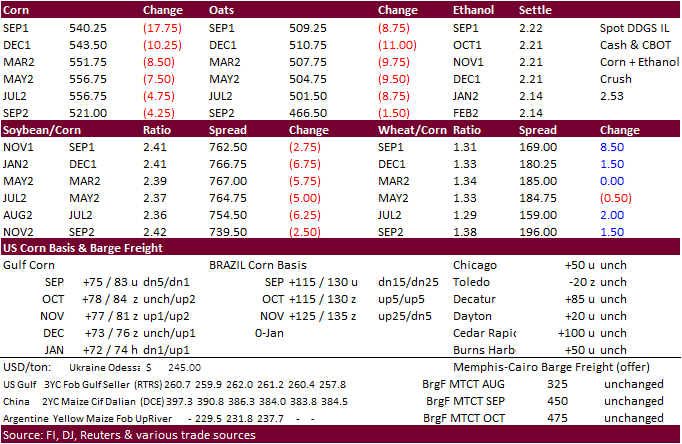

ag futures trade, including wheat despite an increase in global import demand (Egypt and Algeria). Hurricane Ida is disrupting US Gulf grain operations. Power outages/status should be heavily monitored. CBOT soybeans and corn nearby spreads collapsed today.

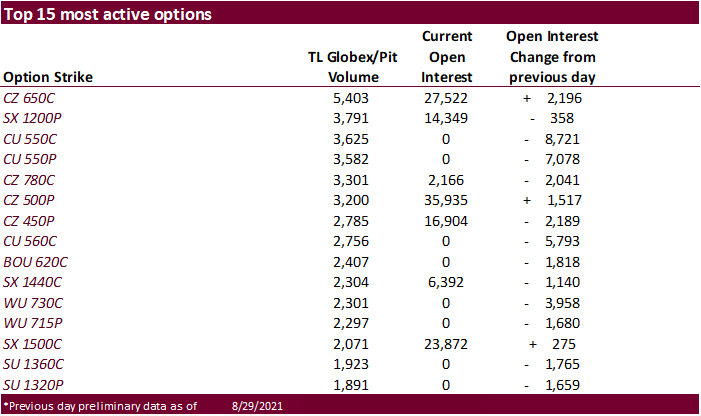

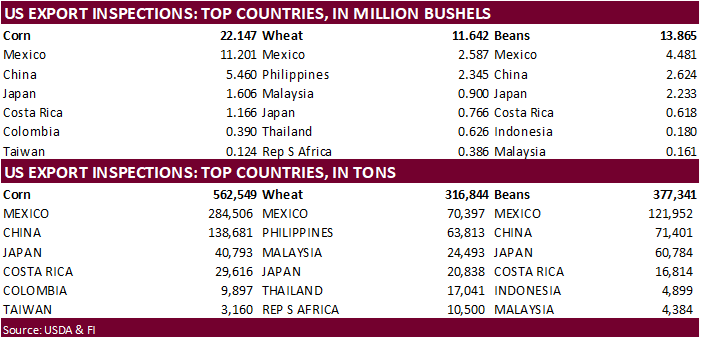

USDA export inspections were overall poor. US corn and soybean exports are expected to fall short of USDA’s projections for 2020-21. China demand for US soybeans needs to be monitored, in terms of commitments but more importantly shipments. Funds were heavy

sellers in corn and soybeans today.

WASHINGTON,

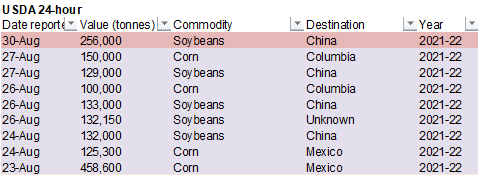

August 30, 2021- Private exporters reported to the U.S. Department of Agriculture export sales of 256,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year.

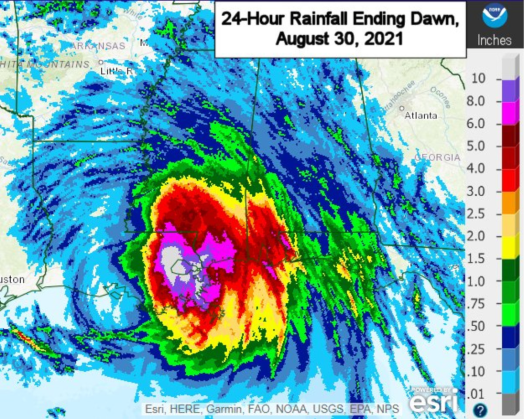

Ida

was so powerful it briefly changed the direction of the Mississippi River.

Source:

World Weather Inc. and FI

We

fielded several questions on Ida’s storm and grain export implications. Many USDA and private grain facilities that are located near or in the path of the hurricane in the Gulf states are closed and it may take at least one week for people to inspect and

report damage. We look for this week to be a wash for Gulf exports. Adding to the demand misery were overall poor USDA export inspections. We think downtime will be temporary for the Gulf unless power is out for more than a week.

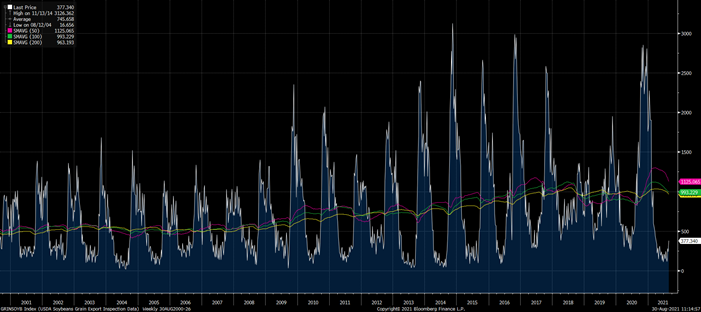

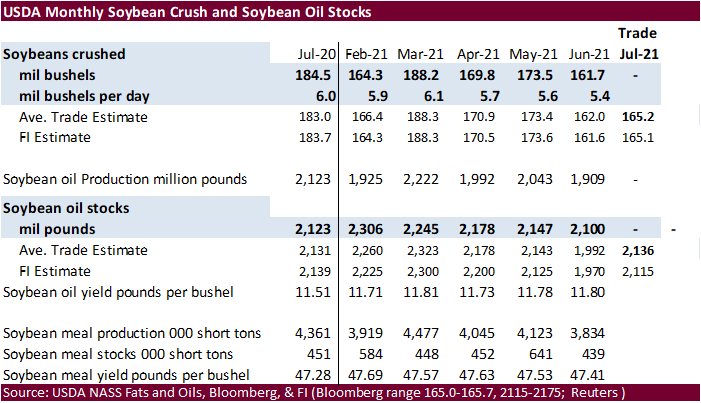

Chart:

long term soybean inspections since 2001 (below).

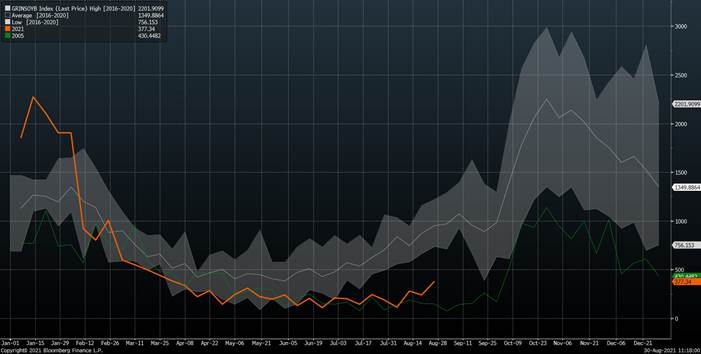

Below

is a seasonal that includes 2005. As you can see, there was no long term hiccup in total US export inspections for soybeans.

![[Image of WPC QPF U.S. rainfall potential]](https://www.eoxlive.com/wp-content/uploads/2021/08/image012-2.jpg)

https://www.nhc.noaa.gov/refresh/graphics_at4+shtml/093339.shtml?#contents

WORLD

WEATHER INC.

MOST

IMPORTANT WEATHER OF THE DAY

- Northwestern

India is advertised to receive a few waves of rain during the next two weeks - Rain

is possible during mid- to late week this week and again during mid-week next week in Gujarat , far southeastern Pakistan and in a few southern and eastern Rajasthan locations - Northwestern

Rajasthan remains driest and in need of rain in unirrigated fields - Gujarat

and northwestern Maharashtra may receive some heavy rainfall during the period which may induce flooding eventually, but the moisture will arrive before the monsoon ends and should support a better outlook for late season unirrigated crop development - India’s

other crop areas will be favorably moist except some areas in the far south and in parts of Punjab and those areas may have to be closely monitored

- Frost

and a few freezes occurred in northwestern parts of Russia this morning - The

impact of frost and freezes should have been low since normal first freeze dates are in the first week of September for some of these areas - Tropical

Storm Ida was located 65 miles south southwest of Jackson, Mississippi at 0700 CDT Today while moving northerly at 8 mph and producing maximum sustained wind speeds of 45 mph.

- Peak

wind speeds reported Sunday in the southeastern most point of Louisiana reached 128 mph and 122 mph at South Lafourche Airport in Louisiana just south of Cut Off, La.

- Peak

wind speeds in populated areas of Louisiana ranged from 45 to 86 mph and peak wind speeds in southern Mississippi reached 64 mph - Rainfall

has ranged from 3.00 to 12.00 inches so far with the greatest amounts from Houma to north of New Orleans - Flooding

from the storm surge was widespread in southeastern Louisiana, but damage assessments are incomplete - Ida

will move to near Vicksburg, MS Monday and eventually near Greenwood, MS this evening and then across central Tennessee and to southeastern Kentucky Tuesday and early Wednesday - The

tropical storm will be downgraded to depression status later today and will likely lose its tropical characteristics Tuesday night and Wednesday while pushing northeast through Kentucky and West Virginia toward the middle Atlantic Coast States - Total

rainfall of 10 to 16 inches will occur in southeastern Louisiana while 5.00 to 12.00 inches occurs in southern Mississippi with a few totals to 15.00 inches near the Mississippi coast. Rainfall from northeastern Mississippi to West Virginia will range from

2.00 to 5.00 inches - Flooding

will occur in many areas - The

most serious flooding and wind damage is over and should have occurred from southeastern Louisiana from New Orleans to Baton Rouge and southward to Houma and mid-day between Houma and Morgan City, La. - Some

additional flooding rain will impact a part of the region today before ending - Crop

damage from Hurricane Ida will be high for eastern sugarcane in Louisiana and low for the central production areas and minimal in the west - Damage

to soybeans should be low - Damage

to corn should be low - Damage

to cotton may be low except in a few southwestern production areas in Mississippi, but the loss is expected to be low or minimal elsewhere - Damage

to rice is expected to be low because of the most important production areas staying northwest of the greatest rainfall - Flooding

from northeastern Mississippi through central Tennessee to West Virginia is not expected to be serious enough to cause notable damage to 2021 summer crops - Tropical

Storm Nora beat up the central west coast of Mexico with excessive rain and some windy conditions during the weekend - Rain

totals reached 11.65 inches at Penitas, Colima through dawn Sunday while reaching 9.01 in Jalisco - Many

other areas along the southwest coast reported rainfall of 3.50 to more than 6.00 inches - Additional

rain has since fallen and will be reported later today - Nora

has dissipated overnight - heavy

rain is expected to slowly diminish along the central west coast; including Jalisco, Colima and Sonora where another 3.00 to 7.00 inches was suspected from Sunday through today - The

storm’s wind and rain has threatened a little citrus and sugarcane as well as a few corn and sorghum production areas - Remnant

moisture from Tropical Storm Nora will move through the southwestern United States and eventually reach the northern Plains and upper Midwest where rainfall later this week may be enhanced as the warm, moist, air reaches cooler air moving through the upper

Midwest - Mexico’s

west and southern crop areas will be a little too wet over the next couple of weeks resulting in some flooding and concern over crop conditions - Drier

weather will be needed soon - Northeastern

Mexico will remain in a drier than usual mode during much of the forecast period - Additional

rain fell during the weekend from the eastern U.S. Dakotas to Wisconsin and northern Lower Michigan reaching as far south as northern Iowa and eastern Nebraska - Rainfall

of 0.50 to 2.75 inches was common, although a band from interior southern Minnesota northwestern Wisconsin reported less than 0.70 inch with some areas getting no more than 0.20 inch - The

moisture was welcome and good in supporting improved late season crop conditions and production potentials, although some of the rain fell too late in the season to make big changes - Net

drying occurred in other Midwestern locations - U.S.

temperatures have been warm with highs in the upper 80s and 90s Fahrenheit in the central and southern Plains over the past week many extremes over 100 last week

- Highs

in the central and southern Midwest, Delta and southeastern states during the weekend were also in the upper 80s and lower 90s

- Temperatures

were more seasonably mild to cool in the far northern states - Lowers

U.S. Midwest crops will get moderate rainfall early this week as a frontal system briefly stalls as Hurricane Ida’s remnants pass to the south.

- Sufficient

rain will fall for a short term bout of improved topsoil moisture which will be very important because the following ten days will be dry biased

- U.S.

Delta weather will be quite wet early this week especially in the east while conditions in the west may dry down for a little while - The

following week to nearly ten days will then be dry - U.S.

West Texas crop areas will be warm with limited rainfall over the next week favoring improved cotton, corn and sorghum crop development conditions after mild to cool weather and frequent rain earlier this summer - A

cool front is expected during mid-week next week that will bring another chance for rain to the region - Portions

of the U.S. southeastern states will experience net drying over the next ten days, although some showers will be around - Georgia

to Virginia will be driest - Western

and northern Alabama will get some heavy rain from remnants of Hurricane Ida over the next two days - California

and the Pacific Northwest will be left dry during much of the next ten days - Moisture

from Tropical Storm Nora will reach across the central and southern Rocky Mountains and into the northern Midwest later this week enhancing rainfall for an extended period of improving crop and field conditions - Canada’s

southwestern Prairies will continue dry biased for at least the next ten days and probably for nearly two weeks - Rain

is expected in western, central and northern Alberta and in northern and eastern Saskatchewan and Manitoba which should help maintain either good soil moisture or an improving trend in topsoil moisture - The

rain will not be welcome in areas trying to harvest and there will be some concern over the quality of unharvested grain and oilseeds, but a sufficient break from the dry bias is expected in another week.

- Ontario

and Quebec weather will be well mixed, although rainfall will be lighter than usual; temperatures will be near to above average - Wheat

harvesting will advance well on the drier days - Corn

and soybean filling and maturing conditions will be good, but late season crops will need additional moisture over time - Argentina

will receive some rain during mid-week this week, briefly during the weekend and again in the second half of next week - If

all three rain events verify there would will be some beneficial improvement in topsoil moisture in wheat and other crop production areas; however, some of the advertised rain is overdone - Wheat

in Argentina needs rain especially in the west where is has been driest since the planting season ended - Brazil

weather will be dry in most center west and center south crop areas during the next ten days - Some

rain will occur in coastal areas of Bahia and Espirito Santo and periodic rain is predicted for areas in Parana southward where wheat development should advance well along with some early season corn planting. - Australia

crop weather will continue to include timely rainfall in southern parts of the nation during the next two weeks. Northern production areas will need some greater rain as winter wheat, barley and canola begin to reproduce in early September - Both

the GFS and European model runs have suggested rain may fall in Queensland and northern New South Wales this weekend into early next week, but confidence is low - Some

of the rain advertised is overdone - Temperatures

will be seasonable - China

weather is expected to remain active during the next two weeks with heavy rain expected in the coming ten days between the Yellow and Yangtze Rivers possibly inducing some new flooding and possible late season crop damage - Rain

amounts are advertised to vary from 3.50 to more than 8.00 inches with a few locations to get more than 15.00 inches - A

part of eastern Inner Mongolia, northern Jilin, Liaoning and northwestern Heilongjiang will also get a little too much rain, although flooding is not likely to be a problem - China

needs drier weather to protect late summer crop development and crop quality - Temperatures

will be seasonable - Southeast

Asia rainfall is expected to be frequent and sufficient to maintain favorable crop and soil conditions - Some

timely rain fell in Thailand during the weekend - Most

all crop areas will get rain multiple times over the next two weeks and sufficient amounts will occur to support better long term development potentials - Pakistan

rainfall will remain restricted, but some showers will occur in the next ten days - Russia’s

Southern Region, eastern Ukraine and Volga River Basin will get some welcome rain during the middle to latter part of this week - The

moisture will slow late season crop moisture stress, but it may not seriously change the bottom line on production because or previous dryness - Most

of Kazakhstan and neighboring areas of Russia’s southern New Lands will not receive much rain until possibly next week when some showers are likely - Dryness

has cut into some potential yields - The

lateness of the season will also limit further declines in late season crop production potentials - Losses

to sunseed and spring wheat production occurred in a part of this region and a few soybean crops have recently been stressed by dryness from eastern Ukraine into the lower Volga River Basin - Cooler

air will impact portions of northern Russia during the next couple of weeks beginning in the northern and eastern New Lands this week and then developing in the northwestern part of Russia during the weekend and early part of next week - Any

frost or freezes that might occur would be seasonable if confined to mostly the far north.

- Northwestern

Europe will continue dry through much of this workweek - Southern

France will also be dry, but it should receive some rain during the weekend into next week while northern France, Belgium, Netherlands, the U.K. and parts of Scandinavia will be dry biased into much of next week, despite a few eventual showers - Southeast

Europe’s dryness problems common to the Balkan Countries will be partially eased by showers and thunderstorms this week - Some

relief came to the region already during the weekend, but much more moisture is needed.

- North

Africa showers in the next two weeks will occur while temperatures are hot maintaining seasonably dry biased conditions - Colombia,

Venezuela and Central America will be plenty wet over the coming week to ten days - West-central

Africa rainfall over the next ten days will be greater than usual - Rain

fell during the weekend benefiting many areas, although Ghana would benefit from more rain - Cameroon

and southeastern Nigeria have been drier biased in recent weeks, although no critical problem with dryness is suspected

- Coffee,

cocoa, rice, sugarcane and cotton development has been and will continue to be good this year - East-central

Africa showers and thunderstorms have been and will continue to be timely and beneficial resulting in a good outlook for coffee, cocoa, rice, sugarcane and other crops that are produced from Ethiopia into Uganda and southwestern Kenya.

- Showers

in South Africa will be erratic and mostly very light over the coming week

- Net

drying is expected, although temperatures are seasonably mild limiting evaporative moisture losses - Southern

Oscillation Index was +3.73 today and the index should move higher for a while this week - New

Zealand weather will include near to below average rainfall during the next week except in western parts of South Island where rainfall will be more significant - Temperatures

will be seasonable to slightly cooler biased

Source:

World Weather Inc.

Monday,

Aug. 30:

- Canada’s

StatsCan releases production data for wheat, durum, canola, barley and soybeans - USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop conditions – corn, cotton, soybeans; spring wheat harvest, 4pm - Ivory

Coast cocoa arrivals - U.K.

public holiday: agriculture futures contracts closed on ICE Futures Europe

Tuesday,

Aug. 31:

- U.S.

agricultural prices paid and received - EU

weekly grain, oilseed import and export data - HOLIDAY:

Malaysia

Wednesday,

Sept. 1:

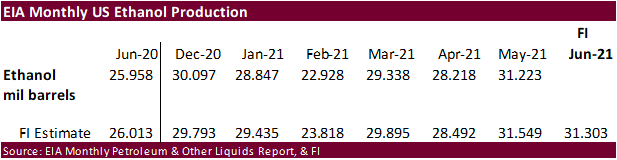

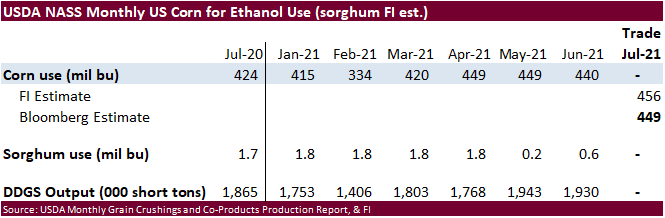

- EIA

weekly U.S. ethanol inventories, production - Australia

Commodity Index - U.S.

DDGS production, corn for ethanol, 3pm - Malaysia

August palm oil export data (tentative) - USDA

soybean crush, 3pm

Thursday,

Sept. 2:

- FAO

World Food Price Index - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - HOLIDAY:

Vietnam

Friday,

Sept. 3:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - HOLIDAY:

Vietnam

Source:

Bloomberg and FI

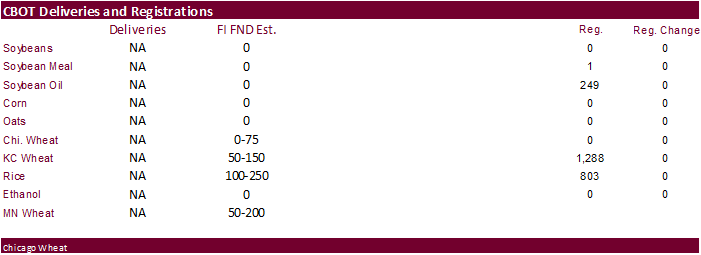

FND

delivery estimates:

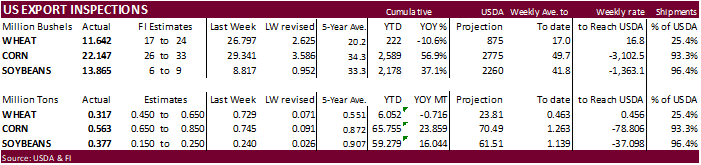

USDA

inspections versus Reuters trade range

Wheat

316,844 versus 400000-675000 range

Corn

562,549 versus 600000-800000 range

Soybeans

377,341 versus 100000-300000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING AUG 26, 2021

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 08/26/2021 08/19/2021 08/27/2020 TO DATE TO DATE

BARLEY

0 173 1,270 6,550 3,731

CORN

562,549 745,303 423,765 65,755,115 41,895,751

FLAXSEED

0 0 0 24 317

MIXED

0 0 0 48 0

OATS

0 0 100 100 900

RYE

0 0 0 0 0

SORGHUM

74,186 128,581 162,996 7,101,350 4,964,788

SOYBEANS

377,341 239,957 820,655 59,278,994 43,234,627

SUNFLOWER

0 0 0 240 0

WHEAT

316,844 729,288 535,415 6,051,848 6,768,081

Total

1,330,920 1,843,302 1,944,201 138,194,269 96,868,195

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

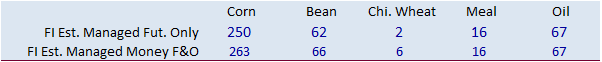

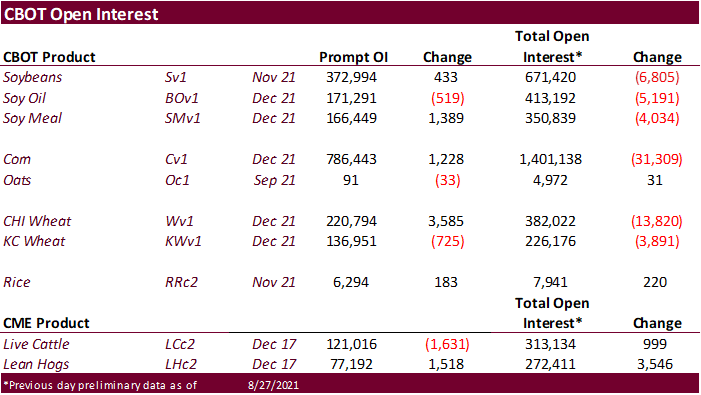

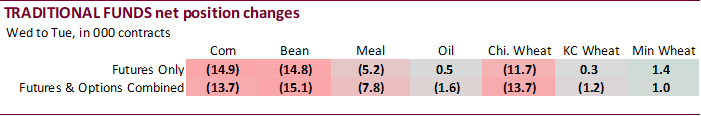

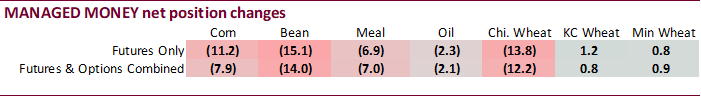

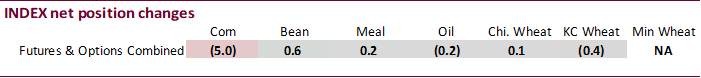

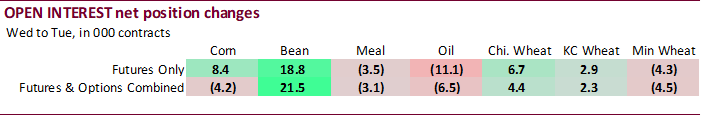

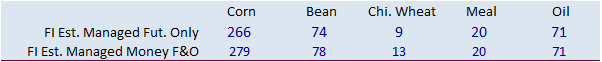

Commitment

of Traders

79

Counterparties Take $1140.711 Bln At Fed’s Fixed-Rate Reverse Repo (prev $1120.015 Bln, 76 Bidders)

BP

Will Not Restart Offshore Operations Until Pipeline Companies Confirm Systems Are Working Properly

EU

removes US from COVID19 safe list for non-essential visits (AFP)

·

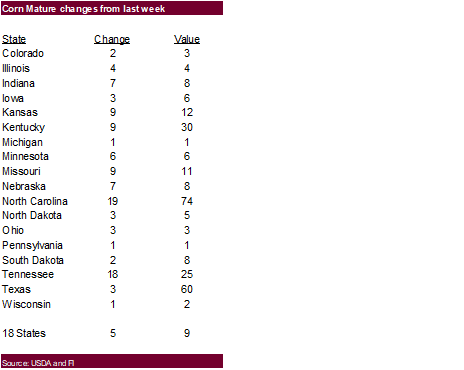

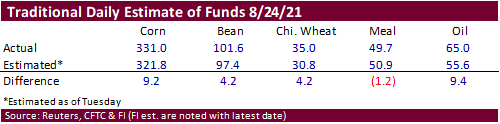

In a risk off session, CBOT corn futures traded lower led by the soon expiring September contract on favorable weekend weather and sharply lower soybeans along with poor export inspections. Funds sold an estimated net 16,000

corn contracts.

·

It’s rare to see September corn at $5.4025 and December at $5.4275 with extremely tight US corn stocks on hand.

·

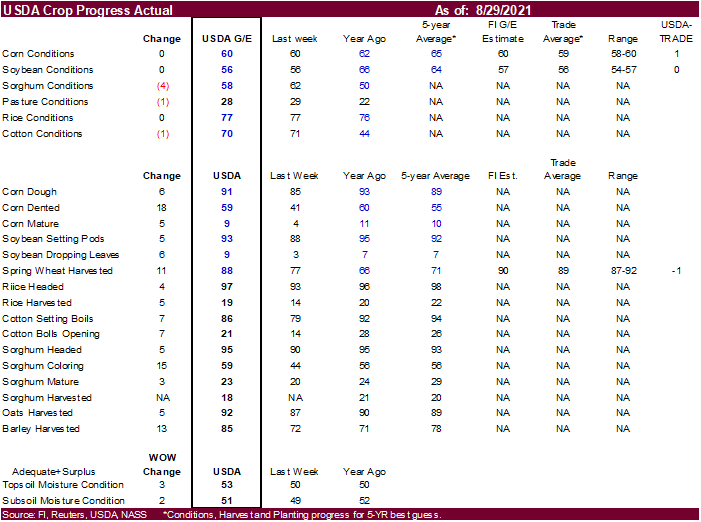

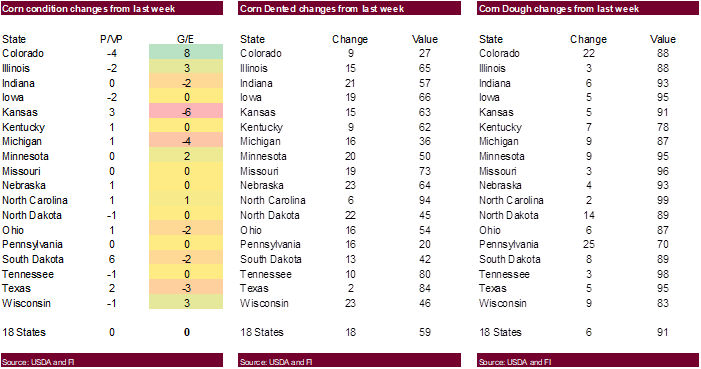

US corn conditions were unchanged but still below late August levels. We left production unchanged.

·

Many USDA and private grain facilities that are located near or in the (past) path of the hurricane in the Gulf are closed and it may take at least one week for people to inspect and report damage. We look for this week to be

a wash for Gulf exports. Adding to the demand misery were overall poor USDA export inspections. We think this slowdown will be temporary unless power is out for more than a week.

·

But don’t look for full export capacity to resume anytime soon. Cargill reported a grain terminal in Reserve, LA, sustained significant damage from Ida and there was no timeframe for resuming operations. Bunge and Archer-Daniels-Midland

said they were working to assess damage to their export facilities in the area, according to Reuters.

·

Power outages for the area will be an extremely key component to monitor this situation going forward.

·

About 12.5% of the US oil refineries are currently down (WTI was up only 29 cents and RBOB was higher). US crude oil companies will export the crude oil that will not be needed.

·

USDA US corn export inspections as of August 26, 2021 were 562,549 tons, below a range of trade expectations, below 745,303 tons previous week and compares to 423,765 tons year ago. Major countries included Mexico for 284,506

tons, China for 138,681 tons, and Japan for 40,793 tons.

·

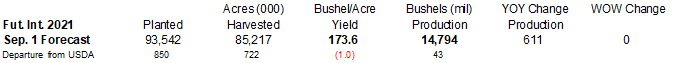

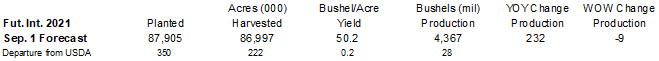

Allendale via Dow Jones: “The US corn crop is likely to reach 14.9B bushels and soybeans will amount to 4.3B bushels…based on its Nationwide Producer Yield Survey conducted from Aug. 16-27. The survey puts the 2021 corn yield

at 176.27 bushels per acre, higher than 164.57 estimated by the USDA. For soybeans, the yield is estimated at 50.14, versus 50.03 forecast by the USDA.

·

US corn and soybean crop conditions are lower than late Aug, so there could be some confusion over what USDA will report next month for US yields, IMO.

·

AgRural: Brazil is estimated to plant first crop corn at 2.973 million hectares (7.3 million acres) this season.

·

South Africa sees the corn production for 2021 at 16.316 million tons, up 6.6% from the 15.300 million tons harvested last season. The crop is expected to consist of 8.765 million tons of white maize, used for human consumption,

and 7.552 million tons of yellow maize, used mainly in animal feed (CEC).

·

China plans to buy more pork for reserves this week. They have already secured 50,000 tons since July.

Export

developments.

·

Taiwan’s MFIG seeks up to 65,000 tons of corn on Tuesday for Nov/early Dec shipment.

·

South Korea’s KFA bought 66,000 (138,000 sought) tons of optional origin corn at $321.69/ton for arrival around November 25 and November 30. It was thought to be SA or SAf origin.

Updated

8/20/21

December

corn is seen in a $4.75-$6.00 range

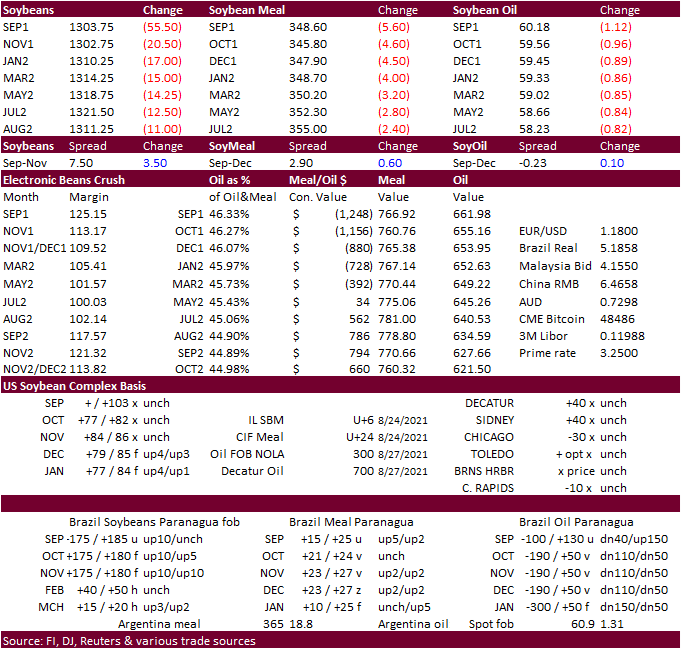

Soybeans

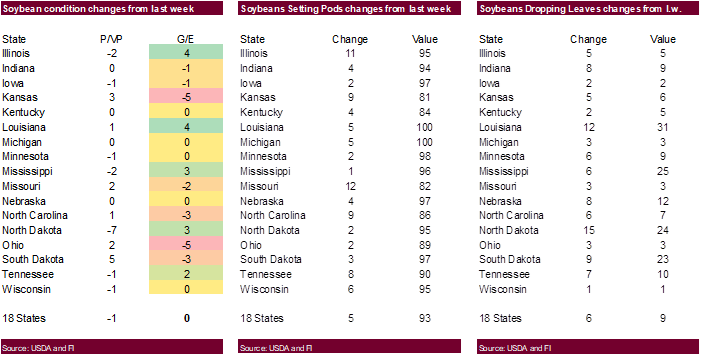

·

The CBOT soybean complex traded lower led by the collapsed in the nearby soybean September contract due to head into its scheduled delivery process on Tuesday. September soybeans were down 54.50 cents and new-crop November off

20.00 cents. Risk off was noted as the US Gulf storm Ida knocked off grain shipments/logistics. Slow US shipments over the past week (inspections expected to fall short of USDA’s crop-year projection) were also weighing on the Sep contract.

·

Soybean oil fell about 70-100 points despite higher energy price. Soybean meal traded $3.70-$6.60 lower despite a higher lead in offshore values Sunday into Monday morning.

·

Funds sold an estimated net 12,000 soybeans, 4,000 meal and 4,000 soybean oil.

·

Weekend rains were as expected and should benefit the overall US soybean crop.

·

US crop conditions were unchanged for the G/E categories but were slightly lower on the state adjusted basis. We made a small downward adjustment to US production.

·

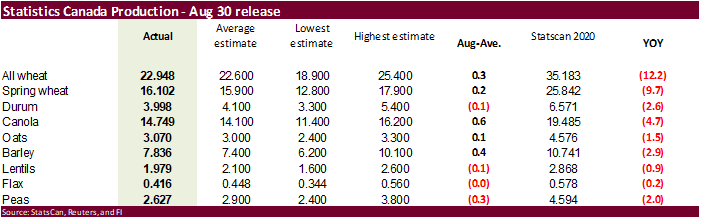

Stats Canada estimated the Canadian canola crop at a low 14.7 million tons, nearly 25 percent off 2020. USDA is at 16 million tons versus 19 MMT for 2020.

·

USDA US soybean export inspections as of August 26, 2021 were 377,341 tons, above a range of trade expectations, above 239,957 tons previous week and compares to 820,655 tons year ago. Major countries included Mexico for 121,952

tons, China for 71,401 tons, and Japan for 60,784 tons.

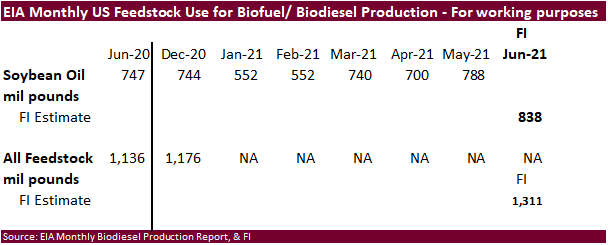

·

We attached some key global soybean related S&D charts to the comment. It will be interesting to see what 2021-22 global vegetable oil industrial demand will end up later this year after a few key countries clawed back on their

targets for biofuel (biodiesel) targets.

·

Ukraine sunflower oil exports are seen rising 18 percent to 6.35 million tons from 5.38 expected in 2020-21.

Export

Developments

- Under

the USDA 24-hour announcement system, private exporters sold 256,000 tons of soybeans for delivery to China during the 2021-22 marketing year.

Updated

8/27/21

Soybeans

– November $11.75-$15.00

Soybean

meal – December $320-$425

Soybean

oil – December 52-67 cent range

·

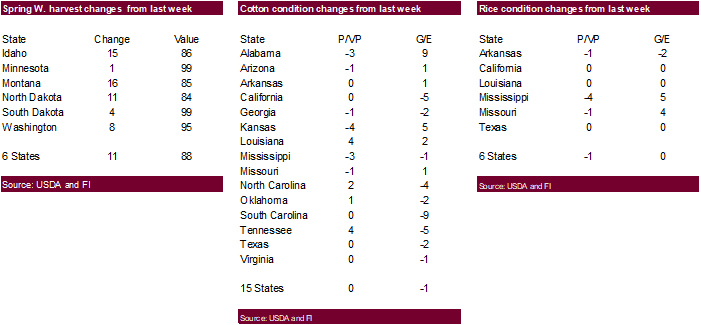

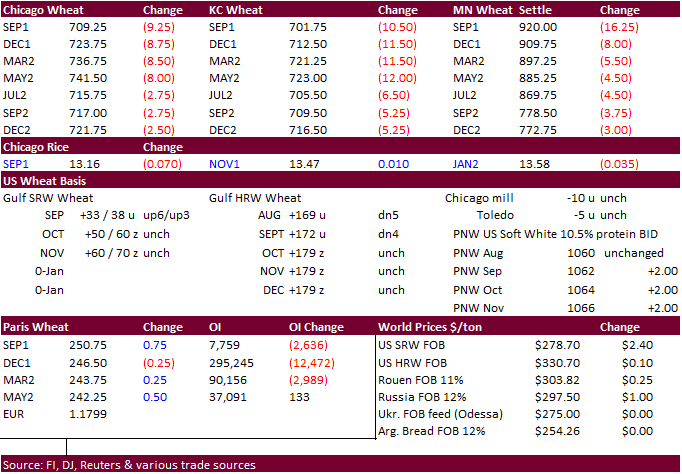

Wheat ended lower following steep losses in nearby soybeans and corn. MN wheat contracts continue to see harvest pressure. The Canadian all-wheat production estimate was reported near expectations. Chicago and KC were thought

to be lower from “risk off” trading and lower related markets. Losses early this week might be limited. Global wheat import demand remains firm with several tenders on deck. Egypt bought Ukraine wheat today and Algeria is in this Tuesday for milling wheat.

·

Funds sold an estimated net 7,000 Chicago wheat contracts.

·

USDA US all-wheat export inspections as of August 26, 2021 were 316,844 tons, below a range of trade expectations, below 729,288 tons previous week and compares to 535,415 tons year ago. Major countries included Mexico for 70,397

tons, Philippines for 63,813 tons, and Malaysia for 24,493 tons.

·

Stats Canada estimated the all-wheat crop at a 14-year low of 22.948 million tons. USDA is at 24 million tons for the all-wheat Canada production, down from 35.18 million tons for 2020 (last year same as StatsCan).

·

The USD was nearly unchanged as of 2:30 pm CT.

·

December Paris wheat was down 0.25 euros at 246.75.

·

Russian wheat export prices were up $4/ton at the end of last week to $299/ton fob, according to IKAR. Reuters noted export prices are up 7 consecutive weeks for Russian fob. Note Egypt turned to Ukraine for 180,000 tons.

·

Ukraine’s AgMin estimated the 80.6 million tons of grain in 2021, allowing for exports 60.68 million tons, including 32 million tons of wheat harvested and 37.1 million tons of corn produced.

·

Ukraine exported 7 million tons of grain since July 1, up 10% from 6.4 million tons during the same period last season, including 3.4 million tons of wheat and 1.18 million tons of corn. 2.4 million tons of barley also had been

exported.

·

Keep an eye on Bulgaria and Romania. They may supply exportable wheat to key importers this season.

Export

Developments.

·

Egypt bought 180,000 tons of Ukrainian wheat for October 15 through October 25 shipment.

- –

60,000 tons Romanian wheat at $308.50 a ton FOB plus $29.60 freight (ocean shipping) totaling $338.10 a ton c&f - –

60,000 tons Ukrainian wheat at $304.25 plus $36.08 freight totaling $340.33 a ton c&f - –

60,000 tons Romanian wheat at $308.50 plus $34.43 freight totaling $342.93 a ton c&f

·

Algeria seeks at least 50,000 tons of wheat on Tuesday for October shipment.

·

Jordan seeks 120,000 tons of feed barley on September 2 for LH October through FH December shipment.

·

Jordan seeks 120,000 tons of wheat on September 1.

·

Bangladesh seeks 50,000 tons wheat on September 1.

·

Turkey seeks 300,000 tons of milling wheat on September 2 for September 10 through October 10 shipment. They last bought 11.5% and 12.5% wheat on August 4 at $297.40-$308.90/ton c&f.

·

Taiwan weeks 48,875 tons of US wheat on September 3 for October 15-Novmeber 1 shipment. They last bought US wheat on August 6, various classes at various prices.

·

Pakistan seeks 550,000 tons of wheat on September 7 for October through November shipment.

·

Mauritius seeks 47,000 tons of wheat flour, optional origin, on Sept. 21 for various 2022 shipment.

Rice/Other

- Egypt

bought 200,000 tons of raw sugar for Oct-Dec shipment. - South

Korea seeks 42,200 tons of rice for arrival in South Korea between February 28 and April 2022. 20,000 tons of that is of US origin, rest optional .

Updated 8/17/21

December Chicago wheat is seen in a $6.80‐$8.25

range

December KC wheat is seen in a $6.60‐$8.00

December MN wheat is seen in a $8.45‐$9.80

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.