PDF Attached

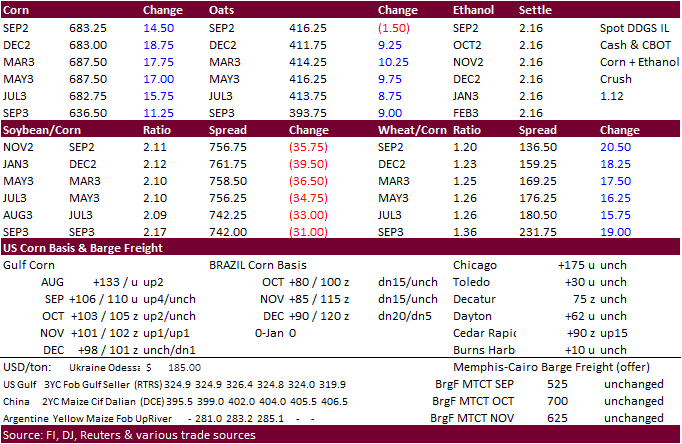

Corn

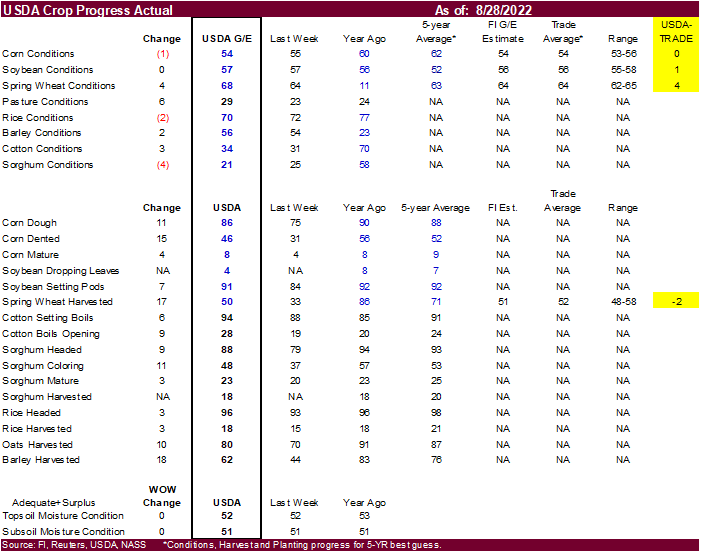

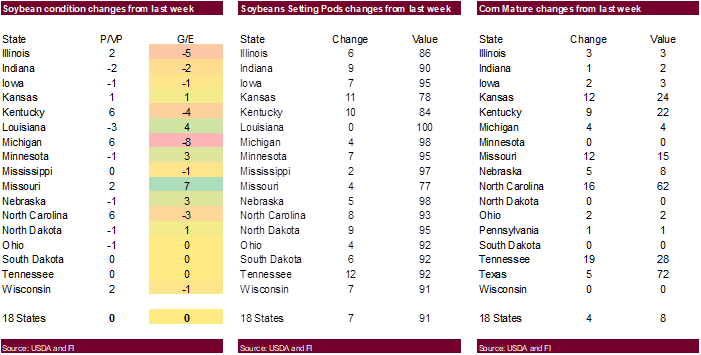

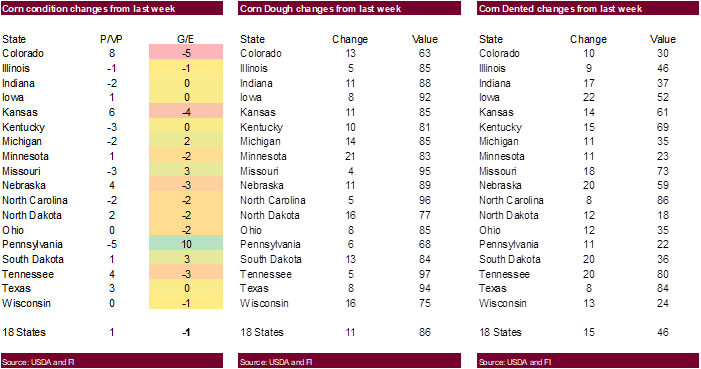

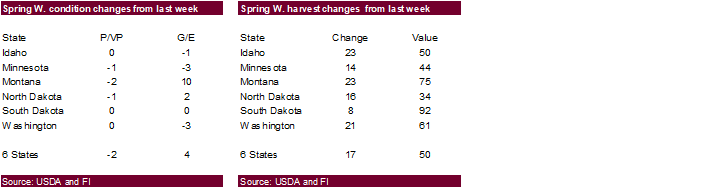

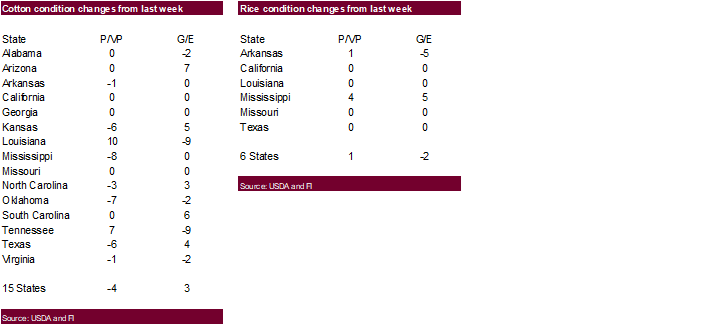

conditions for the combined good excellent conditions were down one but at expectations. Soybeans were unchanged but one point above the trade. Spring wheat was a surprise by climbing 4 points (4 above trade). Spring wheat harvesting was 50 percent but plenty

of time to catch up.

Calls:

Soybeans

2-5 higher. Although US unchanged G/E, several ECB states posted a decline while MN, MO, NE, and NE saw an increase.

Meal

steady to $1.00 higher

SBO

Steady to 20 higher

Corn

steady to 3 higher. NE, CO, KS TN led the declines. State changes to downside not as bad as last week. 46 percent of the US crop is dented.

Chicago

wheat steady to 3 lower following SW.

KC

wheat steady to 3 lower.

MN

wheat 2-5 lower from a 4 point improvement in G/E conditions. 50 percent of crop had been collected, still 21 points behind average.

Corn

and wheat ended sharply higher. Corn found support from the US crop tour results and sharply higher WTI crude oil. US wheat futures were sharply higher on technical buying and Ukraine wheat supply concerns. The soybean complex ended lower outside the September

contracts, led by soybeans. The Pro Farmer crop tour reported a US yield near USDA August estimate, and above expectations. Beneficial rain across the ECB over the weekly likely aided late crop development. The rally in WTI crude oil limited losses in soybean

oil. Meal ended moderately lower for the October position on tight US supplies.

Global weather is improving. 1-7 day for US precipitation is drier for both belts. The WCB will be mostly dry, and ECB will see scattered rains. For Texas and surrounding areas, rain will fall on and off over the next ten days, boosting soil moisture for the

upcoming winter wheat planting season. Rain

this week favor China Yangtze Valley, southern North China Plain, northern NE China. The rain will nowhere end the drought but is welcome.

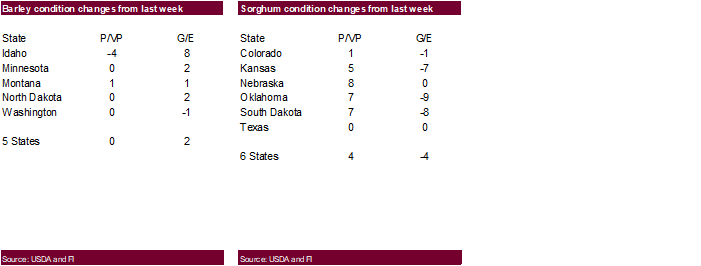

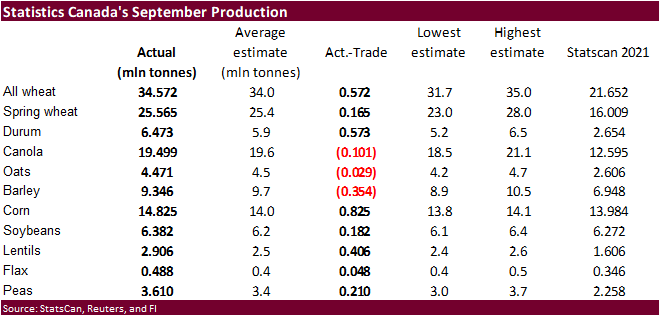

Statistics

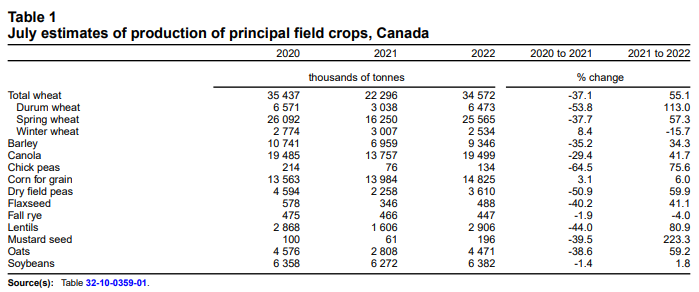

Canada initial model projection for 2022 Canadian production

Overall,

the report was seen supportive for canola and bearish for grains (exception barley). Statistics Canada reported all-wheat production at 34.572 million tons, 572,000 above an average trade guess. Canada corn production was estimated by StatsCan at 14.825 million

tons, 825,000 tons above an average trade guess and above 13.984 million tons a year ago. Statistics Canada initially reported 2022 canola production at 19.499 million tons, 101,000 tons below an average trade guess.

This

was first 2022 Canadian StatsCan supply estimate. To come up with production, they used satellite images and weather data to July 31. StatsCan will update production September 14, adding in August data and updated images.

Weather

US

1-7 day precipitation probabilities

World

Weather Inc.

WEATHER

EVENTS AND FEATURES TO WATCH

- China’s

Yangtze River Basin will see another week of drying after showers end today

- Some

relief from dryness occurred in northern and eastern parts of the basin briefly during the weekend - Typhoon

Hinnamnor will likely restrict rainfall in eastern China for much of the coming week after early Tuesday as the storm becomes very large and pulls moisture out of eastern China - Typhoon

Hinnamnor could have a negative impact on rice, sugarcane and citrus produced in parts of Japan and South Korea as well as the Ryukyu Islands of Japan later this week into early next week

- U.S.

weekend precipitation was greatest from Wisconsin and southeastern Minnesota through the heart of Iowa into a part of eastern Kansas - Moisture

totals varied from 1.00 to 2.46 inches from central Iowa into western and central Wisconsin where soil moisture was most significantly bolstered - Extreme

amounts reached 3.29 inches at Camp Douglas, Wisc. and 2.90 inches at Clarion, Iowa - Western

and southern Iowa did not receive much rain, but 0.45 to 1.61 inches occurred in northwestern Missouri and northeastern Kansas.

- Central

South Dakota and southwestern North Dakota also received some significant rain with 0.27 to 1.18 inches common and 2.61 inches at Pierre, S.D.

- Central

Illinois and central Indiana reported a few hundredths of an inch to 0.67 inch except in central Illinois where up to 1.31 inches resulted.

- Other

rain and thunderstorms of significance occurred in Florida, southern Georgia and southern Alabama along with Louisiana where 0.60 to 2.85 inches resulted.

- One

location in central Florida reported 3.19 inches - Much

of the interior southeastern states, Delta, eastern Midwest, southern and most of the far western states in the nation experienced net drying conditions - Temperatures

were warm in the Plains, Delta and southeastern states as well as in the westernmost states where 90s Fahrenheit were common

- Readings

were more seasonable in the Midwest and a little milder than usual in the northeastern states along with southeastern Canada’s crop areas - U.S.

Midwest weather will be wettest early this week with scattered showers and thunderstorms through Tuesday and then much drier into the weekend

- Rainfall

of 0.20 to 0.75 inch with a few greater amounts over 1.00 inch will result favoring areas from eastern Kansas to Michigan, Ohio, western Pennsylvania and Kentucky - Net

drying is expected Wednesday through Sunday - Rain

chances will rise again for the early to middle part of next week as tropical moisture moves northward from the Gulf of Mexico through the Delta - U.S.

southern Plains and southeastern states will experience periodic showers and thunderstorms through the next ten days with resulting daily rainfall of 0.05 to 0.50 inch and a few areas getting an inch or more - Daily

coverage will vary from 20-40% during the 10-day period - West

Texas, Edwards Plateau, the Texas Blacklands and portions of the Texas Coastal Bend regions will receive showers and thunderstorms through Thursday - The

rain will shift southward into South Texas while continuing in the Coastal Bend this weekend into early next week

- Rainfall

will vary from 0.40 to 1.50 inches in West Texas while 1.00 to 2.00 and local totals of three inches or more will be possible with Edwards Plateau, southern parts of West Texas and the Texas Blacklands wettest - Some

of this rainfall seems a little overdone and future model runs may reduce it, but for today most models have significant rain advertised for these areas - Canada’s

eastern Prairies will receive rain from a few lingering showers and thunderstorms today, but after that a full week of net drying is expected with a few areas going ten days without rain - Temperatures

will be warmer than usual, although briefly cooler today into Tuesday and again Thursday into Friday - Cooling

and a good chance for “some” rain will develop near and after Sep. 10. - Northern

U.S. Plains and Pacific Northwest will be mostly dry for ten days and temperatures will be warmer than usual - The

bottom line for the U.S. is mostly favorable for crops. Pockets of dryness remain over portions of the Midwest and they are not likely to go away, although showers and thunderstorms today will provide a little temporary relief. Drying through the weekend

will firm up the soil and induce a great environment for corn maturation and harvesting. Some rain is expected in the central and eastern Midwest next week. Western U.S. Midwest soybeans will rely on subsoil moisture to finish filling pods and some of the

driest areas near and west of the Missouri River will remain stressed enough to experience some shrinkage in bean sizes reducing yield somewhat. Rain in the southern Plains will continue to improve soil moisture which may be coming too late for a big change

in cotton, corn or sorghum production for 2022, but the moisture will be good for wheat planting and for improving livestock grazing conditions. Wheat planting conditions may not be as good in northern Kansas, Nebraska or parts of Colorado where dryness is

expected to prevail for a while. Dryness in the northern Plains and Pacific Northwest will expedite crop maturation and harvest progress, but rain will be needed soon to improve winter crop planting prospects.

- Tropical

cyclones are possible in the Atlantic Ocean this week - One

may evolve in the south-central tropical Atlantic and move northeast of the northern Leeward Islands late this week

- Another

may evolve off the west coast of Africa late this week and move west northwest over open water - Argentina

reported rain in Buenos Aires during the weekend with a few showers in Entre Rios and far northeastern parts of the nation - Temperatures

were very warm in the central and north with extremes in the 90s to near 100 Fahrenheit

- Argentina

rainfall will return again Wednesday into Thursday, but it will continue to disfavor the west leaving crop areas in that region quite dry - Southern

Brazil rainfall will be limited through mid-week this week and then southern parts of the nation (Parana southward) will receive rain and the moisture will maintain a good outlook for winter crops - Europe

weekend precipitation was greatest from eastern Germany and far western Poland into Slovenia, Italy and southeastern France - Moisture

totals varied from 0.30 to 1.65 inches - Net

drying occurred in all other areas - Temperatures

were warm with highest readings Friday through Sunday in the 70s and lower 80s in the northwest and in the 80s and lower to a few middle 90s Fahrenheit elsewhere.

- Western

Europe will be warm this week and next week while eastern Europe trends cooler

- Eastern

Europe and the western CIS temperatures will be cooler than usual during the second half of this week through much of next week – Coldest Sep1 to Sep. 6 - Frost

and a few light freezes will occur in northwestern Russia and some immediate neighboring areas of Scandinavia, the Baltic States and Belarus late in the weekend and especially early next week

- These

conditions will be considered normal and non-threatening to late summer or early winter crops - Western

CIS rainfall is not likely to be very great in key winter wheat and rye production areas for a while this week, but precipitation may begin to increase late this week and into the weekend just ahead of cooler air - Resulting

rainfall should not be very great, but up to 0.50 inch will help to ease dryness - More

rain will be needed since the ground is quite dry today - Russia’s

Southern Region will be last to get rain and a large part of the winter wheat crop from Russia is produced there making it very important for significant rain to fall - The

European forecast model suggests greater rain for this weekend and early next week than the GFS, but the rainfall is likely overdone - Russia’s

northern New Lands will get rain during mid- to late-week and during the weekend with a significant amount of moisture possible - The

moisture could disrupt sunseed and spring wheat maturation and harvest progress - Northwestern

India, Pakistan will experience drier weather this week after some areas became too wet last week - Damage

occurred to some of the Pakistan crop especially in Sindh. - Gujarat,

Rajasthan and Pakistan are not likely to see much rain over the next ten days leading to good drying conditions and improved crop maturation and harvest weather for early season cotton

- Punjab

and Haryana rainfall will be a little more significant slowing fieldwork and raising a little concern over cotton fiber quality.

- Rain

elsewhere in India will provide either a boost in soil moisture or maintain wet field conditions - Southern

parts of the nation will see the greatest increase in soil moisture - Most

of the nation will benefit from the expected rain, although parts of Madhya Pradesh, Chhattisgarh and Odisha will remain quite wet - Recent

drying in these three states has reduced flood potentials - Typhoon

Hinnamnor was located 825 east of Okinawa, Japan moving westerly at 22 mph while producing wind speeds of 83 mph - This

storm will continue moving westerly through Wednesday and then it may stall near the central Ryukyu Islands during the second half of this week - Many

of the computer weather forecast models intensify the storm to a significant typhoon late this week and into the weekend before turning the storm north northeast into the Sea of Japan impacting parts of South Korea and western Japan late in the weekend or

early next week - Confidence

is low in the long range outlook for this storm, but if the system intensifies as advertised it could have a significant impact on any landmass that it comes near to or moves over and for that reason it should be closely monitored.

- The

intensification seems overdone, but it will be closely monitored. - Tropical

Cyclone Hinnamnor’s presence near the Ryukyu Islands of Japan later this week and into the weekend could return drier weather to China’s Yangtze River Basin prolonging drought and promoting more very warm to hot weather - Eastern

China reported rain from Zhejiang and southern Jiangsu to Gansu, Shaanxi and western parts of Inner Mongolia during the weekend - Moisture

totals varied from 0.30 to 2.00 inches with locally great amounts to more than 4.00 inches

- The

moisture was great for future wheat planting and helped to ease dryness in the northern Yangtze River Basin and near the mouth of the river in Jiangsu and Zhejiang - Dry

conditions continued form eastern Sichuan to Hunan, parts of Guizhou and Jiangxi as well as parts of Fujian and eastern Guangdong - Dry

weather also occurred in portions of the North China Plain while Liaoning to southern and eastern Heilongjiang received some light to moderate rain - The

rain in western winter wheat production areas and the lower Yangtze River Basin was welcome and helped improve crop and field conditions

- Other

areas still need rain especially from Sichuan to Jiangxi, Fujian and eastern Guangdong - Temperatures

were very warm to hot in the driest areas with highs in the 90s to 104 degrees Fahrenheit - China

will experience scattered showers and thunderstorms through mid-week this week with 0.30 to 1.00 inch and local totals of 1.00 to 3.00 inches - Pockets

in the Yangtze River Basin will continue dry or mostly dry this week - Rain

will be greatest in the southern Coastal provinces and from northeastern Sichuan and southern Shaanxi to southern Shandong and northern Jiangsu - Northeastern

China will continue to see a mix of rain and sunshine early to mid-week this week with 0.10 to 0.75 inch of rain except in Heilongjiang where a few areas will get 1.00 to 2.50 inches - If

Tropical Cyclone Hinnamnor evolves as a significant typhoon in the Ryukyu Islands of Japan this week it would end rainfall in eastern China from the second half of this week through early next week

- Xinjiang,

China weather is expected to trend warmer in the next ten days to two weeks and precipitation is expected to diminish - This

pattern will be very good for cotton and corn maturation as well as early harvesting - Ontario

and Quebec weather remains mostly good for corn and soybeans with little change likely - rain

is most likely during mid-week this week; otherwise , the next full week will be dry - the

environment will be good for late season crop development and for maturation and early season harvesting - Mexico’s

drought in the northeast continues and will not likely end without the help of a tropical cyclone - Some

computer forecast models have suggested a tropical weather system is possible early next week, but confidence in that event is very low - Western

and southern Mexico rainfall is expected to be sufficient to support crop needs for a while, but summer monsoon has not been as good of a performer as predicted and greater rain is needed to prevent drought from being ongoing into 2023 - Central

America rainfall has occurred routinely and will continue to do so favoring many crops - Rain

in Australia is expected to be favorably mixed over the next two weeks - The

bottom line still looks very good for most of the nation’s crops - Temperatures

will be seasonable - Southeast

Asia rainfall is expected to be frequent and significant during the next ten days to two weeks

- All

areas are expected to be impacted and sufficient rain is expected to bolster soil moisture for long term crop development need

- South

Africa will receive erratic showers of limited significance in the south, west and east leaving north-central areas dry - Most

of the resulting rain is not likely to be great enough for a serious impact on soil moisture, but some southern areas will get enough to maintain favorable early spring crop development potential - The

outlook is not unusual for this time of year and crops are poised to perform well in the spring if timely rain evolves - Central

Africa showers and thunderstorms will slowly increase in key coffee and cocoa production areas during the next two weeks. Some western and southern Ghana locations and southeastern Ivory Coast locations may be a little slow in getting a general boost in soil

moisture, but crop conditions should stay mostly good - Nigeria,

Cameroon, Benin and other coffee and cocoa production areas should see relatively good crop weather over the next couple of weeks - North

Africa precipitation over the next two weeks will be sporadic and light having little to no impact on soil moisture

- East-central

Africa rainfall will continue to occur most frequent and significantly in Ethiopia, Uganda and southwestern Kenya over the next two weeks - Good

coffee, cocoa and other crop development conditions will prevail

Today’s

Southern Oscillation Index was +8.38 and it will move erratically higher over the next few days

Source:

World Weather INC

Bloomberg

Ag Calendar

Monday,

Aug. 29:

- USDA

export inspections – corn, soybeans, wheat, 11am - US

crop conditions for corn, soybeans and cotton; spring wheat harvesting, 4pm - EU

weekly grain, oilseed import and export data - Canada’s

Statcan publishes data on production of wheat, canola and barley - Vietnam’s

general statistics department releases coffee, rice and rubber export data for August - HOLIDAY:

UK

Tuesday,

Aug. 30:

- No

major event scheduled

Wednesday,

Aug. 31:

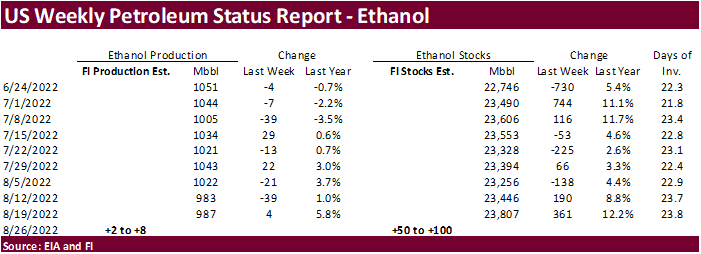

- EIA

weekly US ethanol inventories, production, 10:30am - Malaysia’s

August palm oil export data - US

agricultural prices paid, received, 3pm - HOLIDAY:

India, Malaysia

Thursday,

Sept. 1:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Cocoa

Association of Asia hosts International Cocoa Conference, day 1 - Australia

Commodity Index - USDA

soybean crush, DDGS production, corn for ethanol - HOLIDAY:

Vietnam

Friday,

Sept. 2:

- FAO

world food price index, grains supply and demand outlook - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Cocoa

Association of Asia hosts International Cocoa Conference, day 2

Source:

Bloomberg and FI

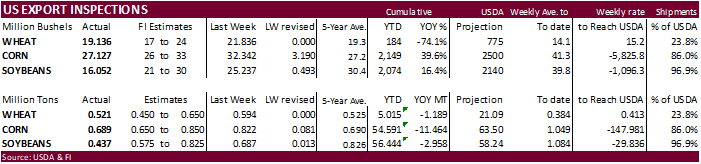

USDA

inspections versus Reuters trade range

Wheat

520,791 versus 250000-650000 range

Corn

689,052 versus 500000-850000 range

Soybeans

436,851 versus 500000-825000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING AUG 25, 2022

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 08/25/2022 08/18/2022 08/26/2021 TO DATE TO DATE

BARLEY

147 147 0 1,214 6,550

CORN

689,052 821,533 583,498 54,591,210 66,055,694

FLAXSEED

0 0 0 0 24

MIXED

0 0 0 0 48

OATS

0 798 0 6,386 100

RYE

0 0 0 0 0

SORGHUM

22,471 43,381 76,856 7,424,226 7,104,020

SOYBEANS

436,851 686,827 387,206 56,444,476 59,402,860

SUNFLOWER

288 432 0 3,316 240

WHEAT

520,791 594,273 435,399 5,014,620 6,203,627

Total

1,669,600 2,147,391 1,482,959 123,485,448 138,773,163

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

Macros

livesquawk

We expect 75bp at the meeting next week – Danske

–

In light of the numerous hawkish comments and sources stories during the weekend, we now change our ECB rate call.

–

We now expect ECB to hike 75bp next week, which will be followed by 50bp in October and 25bp in December, but acknowledge the increased uncertainty on the two latter hike size expectations. This is +25bp for our previous rate hike expectations at both the

September and the October meetings, respectively, and we now see the endpoint of the ECB deposit rate at 1.5%.

·

After a slow start to the upside, corn rallied by 18.75 cents to a 2-month month high. December settled at $6.83 per bushel. The buying was related to US corn crop supply concerns resulting in expectations

for USDA to tighten its 2022-23 US stocks when updated September 12. Technical buying was noted. Around 9:00 am CT, December corn stops were hit at 675 to 678.5, 5000 times.

·

Funds bought an estimated net 13,000 corn contracts.

·

WTI crude oil futures settled up $3.95 at $97.01/bbl, or 4.24%.

·

Headed into US corn harvest, it’s always tough for US corn futures to rally, but today proved otherwise.

·

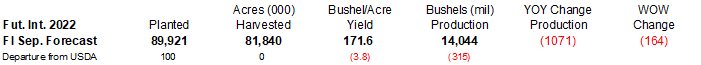

US corn conditions are down 1 point from the previous week but on our weighted average, the corn rating suggests a September yield of 171.6 bu/ac, 3.8 bu/ac below USDA. USDA’s combined G/E rating of lowest

since the drought year of 2012.

·

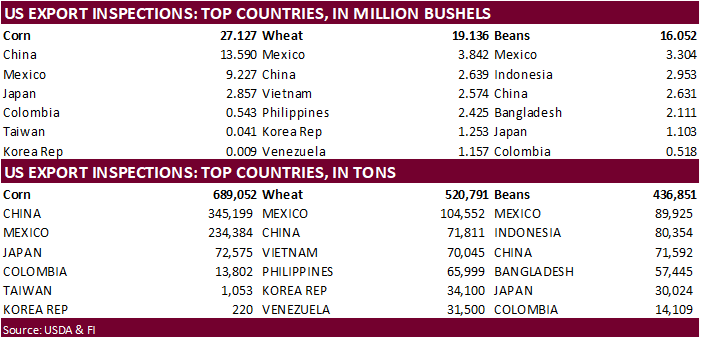

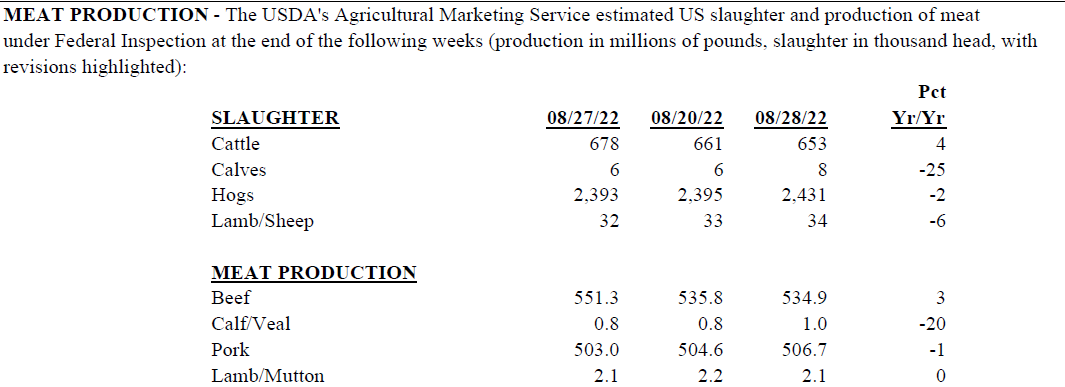

USDA US corn export inspections as of August 25, 2022 were 689,052 tons, within a range of trade expectations, below 821,533 tons previous week and compares to 583,498 tons year ago. Major countries included

China for 345,199 tons, Mexico for 234,384 tons, and Japan for 72,575 tons.

·

Canada corn production was estimated by StatsCan at 14.825 million tons, 825,000 tons above an average trade guess and above 13.984 million tons a year ago.

·

Ukraine graine exports are down 53 percent so far this year at 3.6 million tons. Exports included 2.33 million tons of corn, 981,000 tons of wheat and 289,000 tons of barley.

·

China plans to sell pork reserves from state reserves from September onward to ensure pork supplies.

·

China halted some meat imports from a Tyson plant after some pig trotters from the producer failed inspection.

·

CBOT corn deliveries are expected to be low, if any, on FND August 31 (Wednesday). Registrations stand at zero.

·

None reported

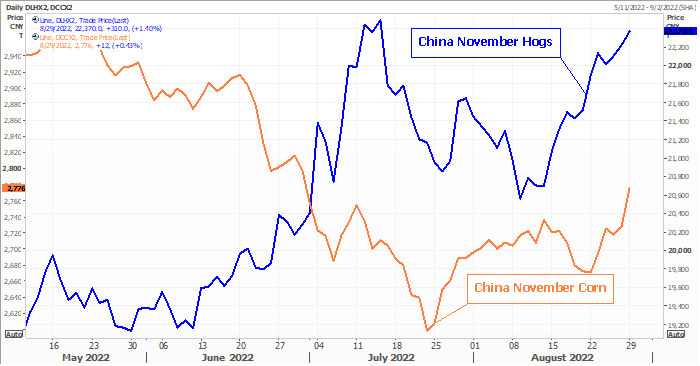

China

November Hogs are getting expensive again, but corn prices highest since June

Source:

Reuters and FI

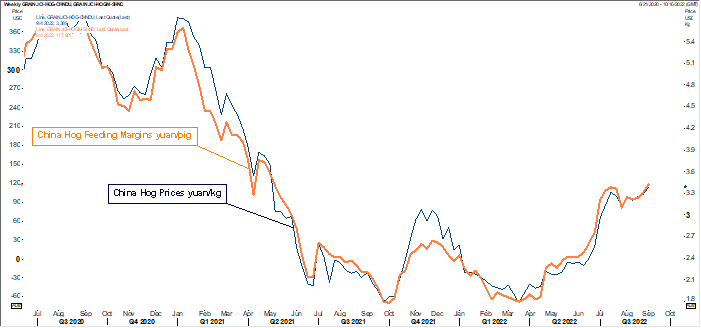

But

margins are looking ok

Source:

Reuters and FI

Trade

News Service

Updated

8/29/22

December

corn is seen in a $6.00-$7.00 range. Next level of resistance is seen at $7.25.

·

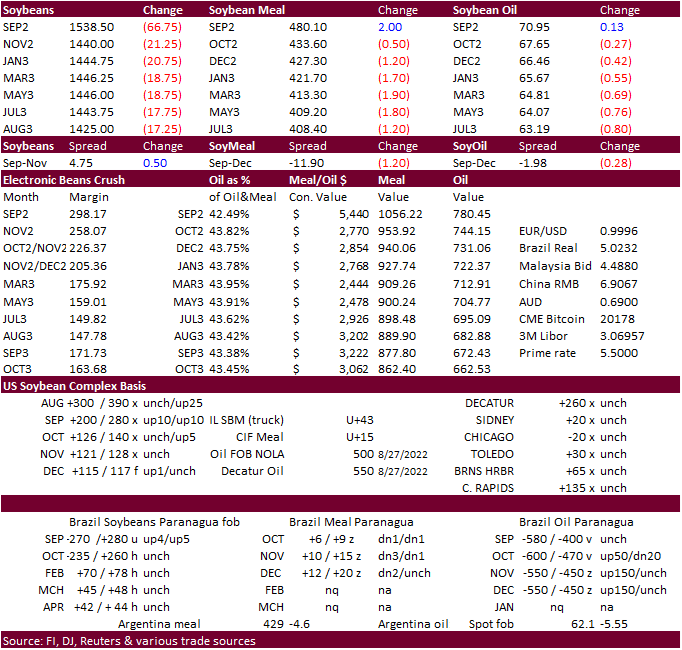

The soybean complex started mixed, endling lower led by soybeans after the crop tour reported a larger than expected US yield, and favorable US weather for late pod development. USDA export inspections

were below expectations. Soybean meal found support on concerns over tight nearby supplies. The October contract closed $0.50 lower and back months $1.40-$1.90 short ton lower. Soybean oil finished lower, but losses were limited after WTI rallied.

·

Soon to expiring soybeans finished 70.50 cents lower (66.75 cents modified). September soybean OI was about 12.3k as of Friday afternoon.

·

Funds sold an estimated net 9,000 soybeans ,were flat In soybean meal and sold 2,000 soybean oil.

·

Statistics Canada initially reported 2022 canola production at 19.499 million tons, 101,000 tons below an average trade guess.

·

September CIF meal basis fell $5/short ton to 15 over the Sep.

·

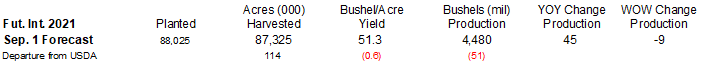

US soybean conditions were unchanged for the combined good and excellent categories. On a weighted basis, our soybean yield was lowered only a tenth of a percent to 51.3 compared to USDA’s 51.9 bu/ac.

·

USDA US soybean export inspections as of August 25, 2022 were 436,851 tons, below a range of trade expectations, below 686,827 tons previous week and compares to 387,206 tons year ago. Major countries

included Mexico for 89,925 tons, Indonesia for 80,354 tons, and China for 71,592 tons.

·

Brazil’s Datagro see the 2022-22 soybean crop for Brazil at 151.8 million tons.

·

Abiove estimated 2022-23 Brazil soybean production at 151 million tons. USDA is at 149 million, up from 126 million tons for 2021-22. Abiove looks for the soybean crop area to end up near 42 million hectares.

Crush was pegged at 49.2 million. They went onto say they don’t anticipate China to buy large quantities of soybean meal from Brazil, but purchases will be important.

·

Indonesia increased their allocation for biodiesel blend rate B30 to 11.03 million kiloliters from 10.15 million. Indonesia also increased its CPO export tax to $124/ton from $74/ton (reference price

for Sep 1-15 set at $903.02/ton).

·

We look for no FND deliveries for soybeans and meal. Soybean oil are expected to be zero to 100.

·

South Korea’s Agro-Fisheries & Food Trade Corp. seeks 30,000 tons of GMO-free soybeans on September 6 for arrival in SK between November 12 and Dec 12, and another arrival period of October 30 and November

30.

·

USDA’s AMS CCC seeks to sell 3,150 tons of vegetable oil on September 7 for shipment for Oct 1-31 (Oct 16 to Nov 15 for plants at ports).

·

For China’s 14th weekly soybean auction set for September 2, they look for sell 500,000 tons.

Updated

8/23/22

Soybeans

– November is seen in a $13.75-$16.00 range

Soybean

meal – December $390-$445

Soybean

oil – December 63.00-71.00

·

US wheat

futures ended sharply higher on technical buying (short covering) and Ukraine old & new-crop supply concerns. A Russian strike hit a fuel depot near the Zaporizhzha nuclear facility. The mid-day weather outlook took out rain across HRW wheat country for the

11-15 day outlook.

·

Funds bought an estimated net 13,000 Chicago wheat contracts.

·

Earlier in the day wheat traded two-sided Improving global weather and increasing Ukraine grain export flows initially pressure the US markets. The Ukraine AgMin said Ukraine agriculture exports could

rise to 6.0-6.5 million tons, and half of the 2022 wheat harvest could be exported. However, Ukraine’s AgMin warned winter wheat seedings on Ukraine controlled territory for the 2023 harvest could fall 20 percent year on year. Meanwhile the 2022 wheat harvest

is showing lower quality due to rains.

·

Ukraine is on the counter-offensive to retake a seized southern territory. New attacks endanger the safe passage agreement and grain stored in Ukraine facilities.

·

Statistics Canada reported all-wheat production at 34.572 million tons, 572,000 above an average trade guess.

·

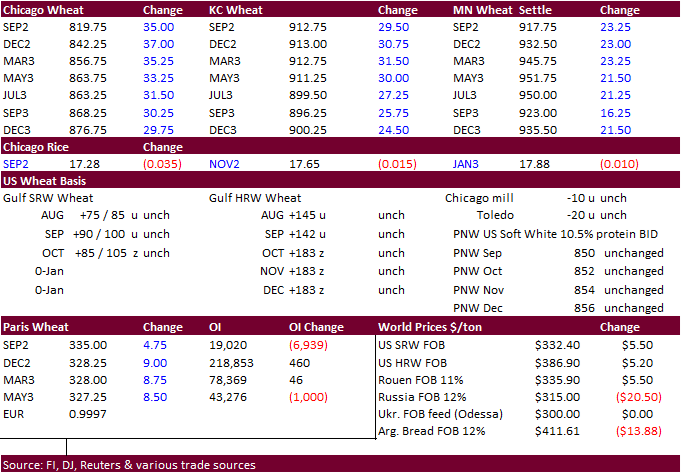

Paris December wheat was up 9.00 euros at 329.75 per ton.

·

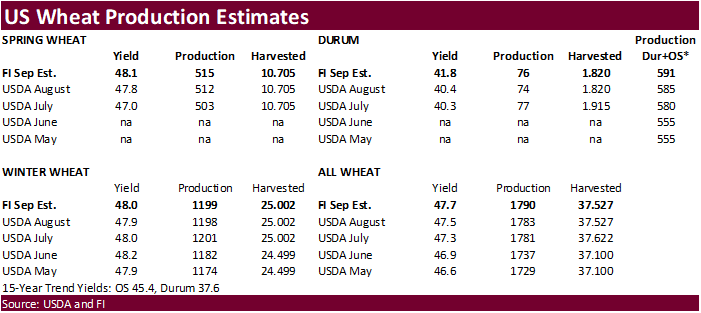

US spring wheat conditions increased 4 points. We increased spring wheat production to 515 million bushels from 508 million previous and compares to 512 USDA August. Durum was increased to 76 million

from 73 million and compares to 73.6 million USDA.

·

USDA US all-wheat export inspections as of August 25, 2022 were 520,791 tons, within a range of trade expectations, below 594,273 tons previous week and compares to 435,399 tons year ago. Major countries

included Mexico for 104,552 tons, China for 71,811 tons, and Vietnam for 70,045 tons.

·

Weather forecast is improving ahead of US winter wheat plantings. Parts of HRW wheat country will see rain on and off bias the southwestern areas over the next 7 days. Not all areas will see rain. NE,

CO, and surrounding areas may see little or no precipitation.

·

Bangladesh will buy 500,000 tons of Russian wheat after India banned wheat exports and Ukraine exports slowed.

Bangladesh

can pay in dollars. Bangladesh depends on India wheat but is scrambling to find alternative supplies. Last crop season,

5.4

million tons of wheat was imported, with 24% coming from India, 21% from Russia and 17% from Ukraine.

·

Ukraine grain/food exports are around 1.2 million tons as of early Monday.

·

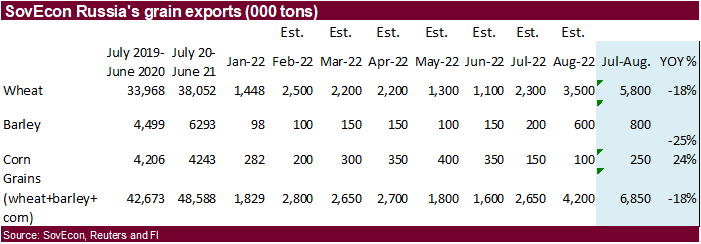

SovEcon increased their 2022-23 Russia wheat export projection by 0.2 million tons to 43.1 million.

·

(Bloomberg) — IKON Commodities raised its forecast for Australia’s 2022-23 wheat crop to 35.8 million tons as favorable conditions boost prospects across major growing regions in both the eastern and

western grain belts. Production outlook raised by 6.6%, or 2.2m tons, from a May forecast, and the nation is on track for third consecutive bumper harvest.

·

Algeria seeks at least 50,000 tons of wheat on Tuesday for LH Sep through Oct 31 shipment.

·

Bangladesh will import 500,000 tons of wheat from Russia at $430/ton in a government-to-government deal.

·

AgriCensus reported the Philippines are back in for wheat this week after skipping out on wheat last week.

·

Jordan seeks 120,000 tons of wheat on August 30.

·

Jordan seeks 120,000 tons of barley on August 31 for Dec-Feb shipment.

·

Bangladesh delated their 50,000 ton import tender of milling wheat set to close on September 1, to September 18. It’s for optional origin with shipment within 40 days of contract signing.

Rice/Other

·

Taiwan and Vietnam plant to raise their export price of rice but no details have been set.

·

Bangladesh seeks 50,000 tons of rice on September 6.

Updated

8/29/22

Chicago

– December $7.25-$10.00

KC

– December $8.00-$11.00

MN

– December $8.00-$11.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.