PDF Attached

US

export developments slowed late this week but heavy producer selling never slowed. Today was position day. USD was under major pressure.

MARKET

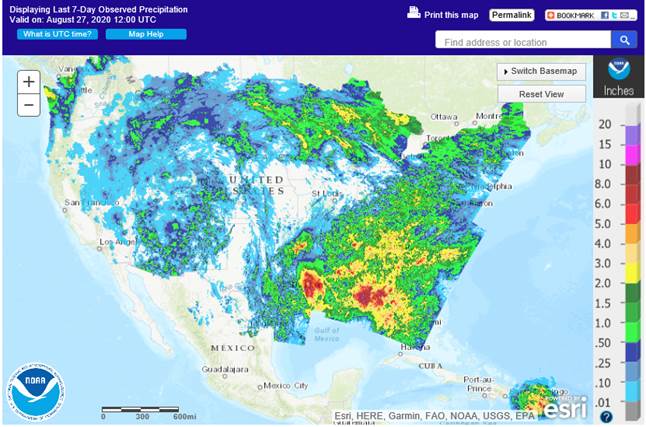

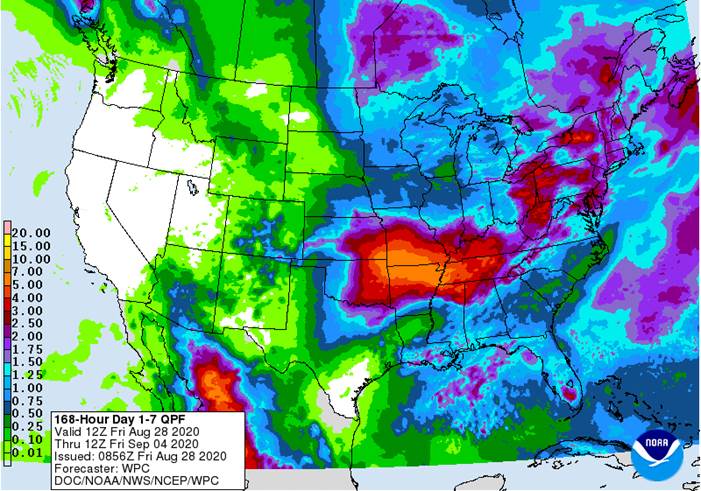

WEATHER MENTALITY FOR CORN AND SOYBEANS:

A

poor rain distribution in the western Corn Belt will maintain downward pressure on soybean yield potentials. Showers in other parts of the Midwest may offer at least some temporary relief, but a general soaking is unlikely for a while. Cooler temperatures

will be extremely helpful in slowing the decline in crop conditions, but without significant rain the decline in yield will continue for the driest areas.

Southern

Canada’s Prairies and the northwestern U.S. Plains will likely continue drier biased stressing some late season coarse grain and oilseed crops, but right now crop maturation is the priority and dry conditions are best for that. Ontario and Quebec corn and

soybeans are in good condition as they are in parts of the eastern Dakotas and western Minnesota.

Not

much change was noted for Europe during the weekend or for the coming ten days, but dryness will prevail in central and eastern Ukraine, the lower Danube River Basin and Russia’s Southern Region. Improving weather will occur in Russia’s New Lands protecting

some of the sunseed crop.

China

weather will trend drier in some east-central areas and that will be a welcome change. Typhoon Bavi brought significant rain to Northeast China Wednesday and Thursday. Northeastern China needs to dry down and should do so for a while, but another tropical

cyclone may impact the region late next week raising more concern over excessive moisture.

India’s

excessive rain in northwestern peanut, sorghum and soybean production areas earlier this week may have damaged some crops, but the losses should be low. Weather conditions are now improving. Another wave of less intensive rain will impact the same areas this

weekend and Monday returning some flood conditions, but improved weather is expected thereafter.

Australia

is drying out in the west where canola will soon need some moisture. Canola elsewhere in the nation remains favorably rated.

Brazil

corn planting and replanting conditions will be very good over the next ten days as dry weather prevails. Argentina rainfall in the northeast next week may improve some pre-planting soil moisture for corn and sunseed, but much more rain is needed throughout

the nation.

Harvest

weather in Europe will be good in the dry areas and slow in other areas. Dryness in eastern Ukraine, eastern Bulgaria, Romania and Russia’s Southern Region has reduced production for this year.

Overall,

weather today will likely continue to provide bullish bias, but its influence will begin to soften with the onset of cooler temperatures, but rain is still needed and crops will remain stressed until significant rain falls.

MARKET

WEATHER MENTALITY FOR WHEAT

Dry

weather in Canada’s southern Prairies and the northern U.S. Plains has helped small grain harvesting advance swiftly. Good harvest weather is also occurring in parts of Europe, but there will be some rain induced disruption for some areas in the coming week.

Eastern

Russia’s New Lands are drying down to support better grain maturation and harvest conditions. Rain has been a little too frequent in recent weeks raising concern over crop quality. The trend change is welcome.

Australia’s

winter crops are still poised to perform well this spring during reproduction, but Queensland needs rain immediately to maintain that outlook. Western Australia is also drying out and will need some timely rain soon. Recent frost and freezes may have negatively

impacted some of the Queensland crop and the combination of the freezes and dryness the state may not yield very well.

Eastern

South Africa needs some rain and that which is coming over the next couple of weeks may offer a little relief.

Argentina’s

rain this week was good for Buenos Aires and Entre Rios crops, but it failed to change drought conditions farther to the west and north leaving production potentials low.

Greater

rain may be needed in U.S. hard red winter wheat areas soon to support early planting in unirrigated areas.

Overall,

weather today will provide a mixed influence on market mentality.

Source:

World Weather Inc.

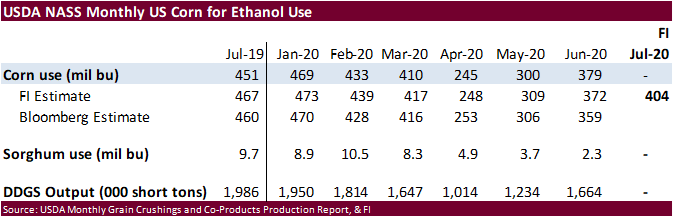

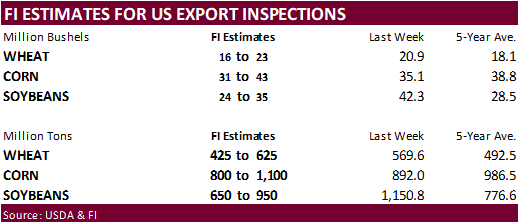

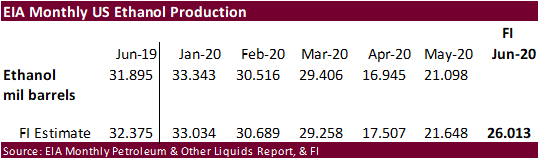

- USDA

weekly corn, soybean, wheat export inspections, 11am - U.S.

crop conditions for soybeans, corn, cotton; wheat harvesting progress, 4pm - Statcan

data for Canada wheat, barley, soy, canola and durum production - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals - Holiday:

U.K., Malaysia

TUESDAY,

SEPT. 1:

- Australia

commodity index - U.S.

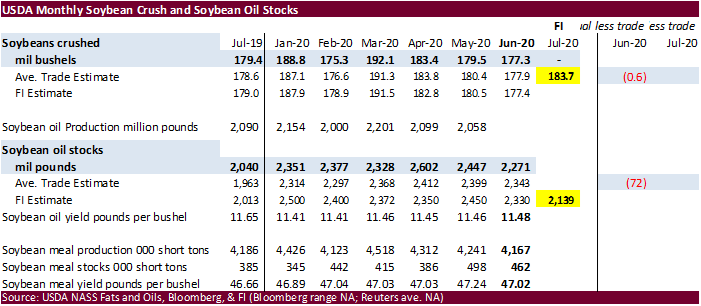

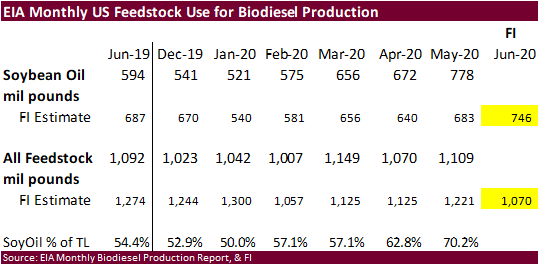

Purdue agriculture sentiment - USDA

soybean crush, 3pm - U.S.

corn for ethanol, DDGS production, 3pm - FO

Licht’s virtual Sugar and Ethanol Conference, Sao Paulo (Sept. 1-3) - Cotton

outlook update by International Cotton Advisory Committee in Washington - New

Zealand global dairy trade auction - Honduras,

Costa Rica coffee exports - Malaysia

palm oil export data for August 1-31

WEDNESDAY,

SEPT. 2:

- EIA

U.S. weekly ethanol inventories, production, 10:30am - UkrAgroConsult’s

Black Sea Grain Conference in Kyiv (Sept. 2-3) - Russia’s

Agriculture Ministry holds annual conference to discuss production and the industry - HOLIDAY:

Vietnam

THURSDAY,

SEPT. 3:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - FAO

World Food Price Index - Port

of Rouen data on French grain exports - New

Zealand commodity price

FRIDAY,

SEPT. 4:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - CNGOIC’s

monthly supply-demand report on Chinese feed grains and oilseeds - FranceAgriMer

weekly update on crop conditions - Statcan’s

data on Canada wheat, barley, soy, canola and durum stocks - HOLIDAY:

Thailand

Source:

Bloomberg and FI

Reuters

estimates for StatsCan production, due out Monday

Average estimate Lowest estimate Highest estimate Statscan 2019

(mln tonnes)

All

wheat 35.0 30.4 38.4 32.3478

Durum

6.5 5.6 7.2 4.977

Canola

20.0 19.2 21.0 18.6488

Oats

4.8 4.3 5.4 4.2373

Barley

10.3 9.0 11.1 10.3826

Corn

14.3 13.8 15.1 13.4039

Soybeans

6.1 5.9 6.5 6.0451

Lentils

2.7 2.3 3.1 2.1669

Flax

0.550 0.500 0.600 0.4861

Peas

4.6 4.3 4.9 4.2365

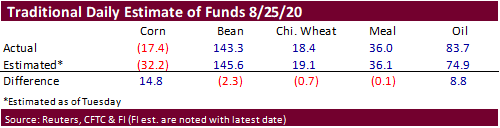

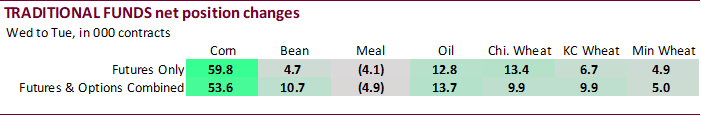

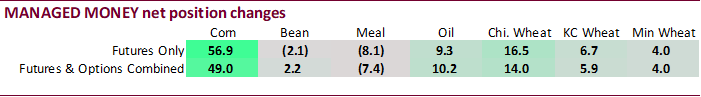

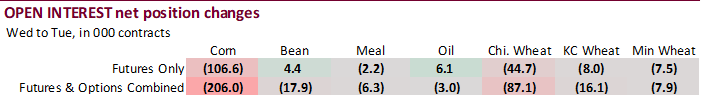

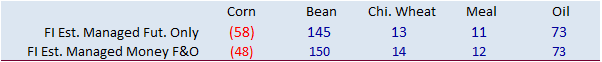

Traditional

funds were about 15,000 contracts more long than expected in down, during a week of massive short covering. Note corn OI fell 206,000 contracts for futures and options combined.

Full

list via Reuters:

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

-61,489 49,010 172,109 -2,896 -163,435 -53,942

Soybeans

109,288 2,230 126,177 -7,722 -265,542 -7,622

Soymeal

3,560 -7,419 82,441 -1,756 -123,573 6,750

Soyoil

67,690 10,164 93,308 1,586 -184,408 -14,953

CBOT

wheat 1,517 13,990 97,279 2,933 -93,293 -13,603

KCBT

wheat -21,116 5,889 50,377 2,931 -39,234 -13,489

MGEX

wheat -17,316 4,012 2,069 -139 10,227 -4,091

———- ———- ———- ———- ———- ———-

Total

wheat -36,915 23,891 149,725 5,725 -122,300 -31,183

Live

cattle 62,102 4,335 84,284 200 -150,489 -2,875

Feeder

cattle 7,176 -530 4,876 134 -5,879 842

Lean

hogs 27,202 7,275 48,010 1,390 -77,306 -8,390

US

Personal Income Jul: 0.4% (est -0.3%; prevR -1.0%; prevR -1.1%)

US

Personal Spending Jul: 1.9% (est 1.6%; prevR 6.2%; prev 5.6%)

US

Real Personal Spending Jul: 1.6% (est 1.3%; prevR 5.7%; prev 5.2%)

US

Wholesale Inventories (M/M) Jul P: -0.1% (est -0.9%; prevR -1.3%; prev -1.4%)

US

Retail Inventories (M/M) Jul: 1.2% (est -1.1%; prevR -2.7%; prev -2.6%)

US

Advance Goods Trade Balance Jul: -79.3B (est -72B; prevR -71B)

US

PCE Core Deflator (Y/Y) Jul: 1.3% (est 1.2%; prevR1.1%; prev 0.9%)

US

PCE Core Deflator (M/M) Jul: 0.3% (est 0.5%; prevR 0.3%; prev 0.2%)

US

PCE Deflator (M/M) Jul: 0.3% (est 0.4%; prevR 0.5%; prev 0.4%)

US

PCE Deflator (Y/Y) Jul: 1.0% (est 1.0%; prevR 0.9%; prev 0.8%)

Canadian

Quarterly GDP Annualized Q2: -38.7% (est -39.6%; prev -8.2%)

Canadian

GDP (M/M) Jun: 6.5% (est 5.8%; prevR 4.8%; prevR 4.5%)

Canadian

GDP (Y/Y) Jun: -7.8% (est -9.0%; prev -13.8%)

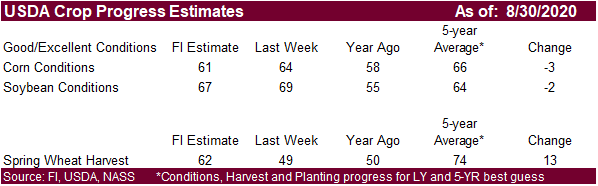

-

December

corn futures rallied into the close on sharply higher soybeans and USDA’s sale announcement. The sharply lower USD also helped create a two-sided trade. Traders started the day with profit taking. A short squeeze lifted September to close up 1.75 cents.

The back months ended moderately lower. -

Funds

bought an estimated net 4,000 corn contracts. -

CIF

corn barges loaded in August were bid at 63 cents a bushel over CBOT September futures, up two cents from Thursday. FOB corn export premiums for September loadings held at around 90 cents over September futures. -Reuters -

French

corn crop ratings were unchanged for the week ending August 24 at 62 percent.

-

Arc

Mercosul reported Brazil producers harvested 88.4 percent of the 2019-20 second corn crop, compared with 90.4 percent average.

-

Taiwan

announced they are easing restrictions on US beef and pork. Ultimately the two countries may reach a free trade agreement.

-

China

said the import ban of Australian beef was unrelated to political issues.

-

Results

awaited: China planned to auction off 10,000 tons of pork from reserves on August 28. More than 500,000 tons had been sold so far this year.

Corn

Export Developments

-

Under

the 24-hour USDA reporting system, US exporters sold 324,032 tons of corn to unknown for 2020-21.

-

December

is seen in a $3.40-$3.85 range.

-

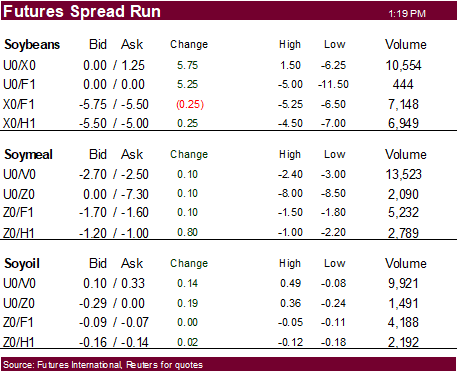

CBOT

November soybeans ended 13.25 cents higher at $9.5050, same price as September, on Chinese buying of US soybeans and US crop concerns along with persistent dryness in Argentina ahead of seeding season that starts in a couple weeks. Iowa is seeing their worst

drought since 2013, according to the local AgMin. 61% of the state is in a moderate to exceptional drought, up from 45% a week ago. November soybeans high their highest level since January 23.

-

Funds

bought an estimated net 13,000 soybean contracts, 5,000 soymeal, and sold 3,000 soybean oil. -

Offshore

values indicated values for SBO was well overvalued relative to meal this week, and today major profit taking commenced, despite a late week rally in Asian palm oil and Black Sea sunflower oil. CBOT October soybean meal finished up $6.40/short ton and October

soybean oil ended down 21 cents. Soon to be expiring September soybean oil finished up 8 points.

-

Sunflower

oil Black Sea cash prices were up around 8 percent this week. Malaysian palm futures gained 2.2% this week, ending two straight weekly losses.

-

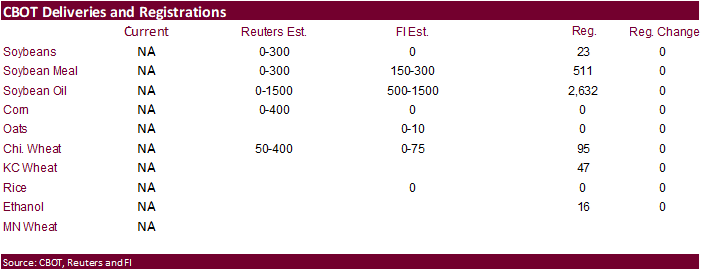

The

Sep/Oct soybean oil spread traded all the out to 49 inverse from a short squeeze, prompting us to lower our delivery estimate to 500-1500 contracts from 1500-2500 previous. The trade may not see any soybean deliveries. Soybean meal is expected to fall in

a 150-300 range. -

There

was talk China will need to fulfill a large portion of their January soybean coverage. We speculate China might be holding out on January coverage to see if Brazil soybean plantings start early this year. Brazil’s weather has been good recently that could

provide early plantings, in my opinion. We think China is less than 15 percent covered for January. We heard earlier Chinese coverage for October was complete, November 65-70% covered, and December 50%.

-

China

cash crush margins as of this morning, using our calculation, were 90 cents per bushel (91 previous) and compares to 116 cents a week ago and 85 cents around this time last year.

-

Results

awaited: China’s Sinograin will offer 98,831 tons of domestic soybeans on August 28. China’s Sinograin sold 51% of the 98,807 tons of soybeans offered at auction earlier this week.

-

Argentina

grain inspectors will delay a strike set to start today after the government stepped in.

-

Results

awaited: Algeria seeks 30,000 tons of soybean meal for shipment by September 25, optional origin.

-

November

soybeans are seen in a $9.25-$10.00 range. -

December

soybean meal is seen in a $290-$325 range. -

December

soybean oil is seen in a 32.50-35.00 range.

-

Chicago

wheat futures ended lower, KC unchanged to mixed, and Minneapolis lower.

And

lower USD and global crop concerns limited losses. Profit taking was noted.

-

Funds

sold an estimated net 3,000 Chicago wheat contracts. -

Germany’s

farm AgMin looks for wheat production to fall 5.1 percent to 21.88 million tons due to a 9.1 percent decrease in the area. In general, the crop is in good shape.

-

The

European Commission lowered its 2020-21 forecast for all cereals for the EU. Soft wheat production was projected at 113.5 million tons, down from the 116.6 million estimated a month ago.

-

Russian

wheat exports so far this season are running 12 percent lower from year ago.

-

Paris

December wheat was down 0.25 at 186.50 euros (5-week high).

US

Wheat Associates: The HRW harvest is nearly complete with data holding steady. The final 2020 SRW harvest report this week includes weighted flour, dough properties and baking evaluation data. SW harvest continues apace under hot, dry conditions; this is a

typically good SW crop with low protein, low moisture and good test weight. HRS harvest is nearly 60% complete and initial sample data show test weight average of 61.5 lb/bu (80.9 kg/hl) and average protein 15.0% (12% mb). Northern durum harvest is about 1/3rd

complete with the crop looking good overall. https://www.uswheat.org/wp-content/uploads/2020/08/HR_2020-8-28.pdf

-

After

picking up 60,000 tons of wheat this week, Jordan issued another import tender for 120,0,00 tons of wheat set to close Sep 2.

-

Syria

looks to sell and export 100,000 tons of feed barley with offers by Sep 1.

-

Syria

seeks 200,000 tons of soft wheat from EU/Russia on Sept. 9 and 200,000 tons of wheat from Russia on Sept. 14. -

Results

awaited: Pakistan seeks 1.5 million tons of wheat. Lowest offer was $233.85/ton for 200,000 tons of milling wheat.

·

Look for rice conditions to decline on Monday after storm Laura flattened rice across the lower US.

Updated

8/27/20

- Chicago

September is seen in a $5.35-$5.55 range. December $5.30-$5.75 range. - KC

September; $4.50-$4.75 range. December $4.50-$5.60. - MN

September $5.10-$5.30 range. December $5.25-$5.70.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.