PDF Attached

WASHINGTON,

August 27, 2021—Private exporters reported to the U.S. Department of Agriculture the follow activity:

Export

sales of 129,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year; and

Export

sales of 150,000 metric tons of corn for delivery to Colombia during the 2021/2022 marketing year.

WORLD

WEATHER INC.

MOST

IMPORTANT WEATHER OF THE DAY

- U.S.

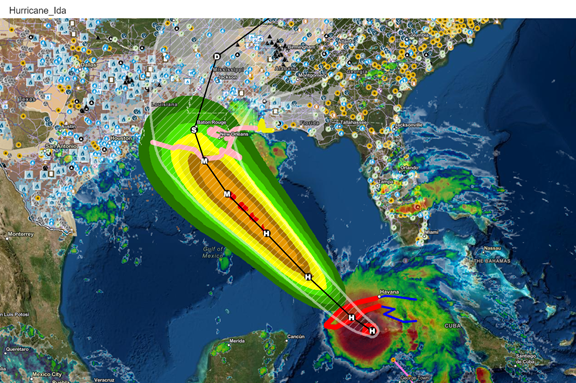

Delta crop damage is expected to be significant from Tropical Storm Ida when it arrives as a major hurricane in the south.

- The

storm will come inland wind speeds to 120mph - not

many crops are produced in southeastern Louisiana where the strongest wind, greatest storm surge and heaviest rain is expected - Sugarcane

will be most impacted in southeastern Louisiana - The

greatest wind speeds will likely drop to 90 mph as the storm moves far enough inland to start impacting more populated areas - New

Orleans should be protected from the highest wind speeds and this will not likely be another Katrina for New Orleans unless then storm shifts its path to the right and that still needs to be closely monitored - Damage

to crops farther north will be greatest in Mississippi and perhaps a few extreme northeastern Louisiana production areas – based on the current projected path - Wind

speeds of 40 to 60 mph will occur in southern Mississippi and 20 to 45 mph and a few stronger gusts in northern Mississippi - Lighter

winds will occur in northeastern Louisiana - Cotton

lodging is possible in southern most production areas - Open

boll cotton could be strung out of bolls, but that should not happen in too many areas since the bolls that are open are not fully open - The

potential for boll rot will rise for the cotton that is beginning to open bolls - Corn

in the lower Delta has been mostly harvested - Corn

in the northeastern part of the Delta could be lodged, but wind speeds should die down enough in that region to restrict damage - Rice

damage is possible due to the flooding and heavy rain - Much

of the most important rice production areas are in Arkansas where the impact from this storm is expected to be lightest as long as there is no westward shifting of the storm’s path - Soybeans

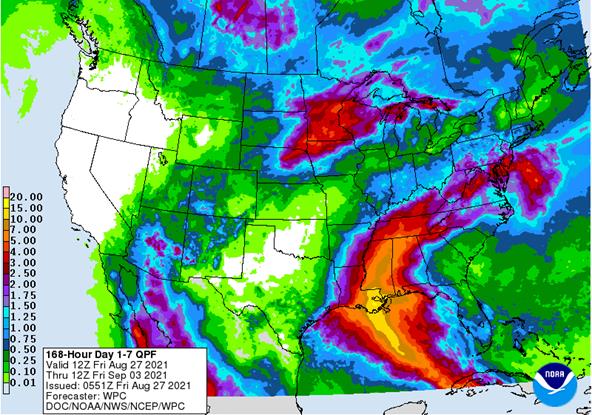

may be damaged in low-lying areas where flood water will be a problem - Rainfall

will vary from 8.00 to 12.00 inches and local totals over 15.00 inches with southeastern Louisiana and far southern Mississippi wettest - Rainfall

in the heart of Mississippi will range from 3.00 to 9.00 inches - Rainfall

in northeastern Louisiana will range from 2.00 to 5.00 inches - Eastern

Arkansas rainfall will vary from 1.00 to 3.00 inches and the same will be true for western Tennessee, based on the latest rainfall data this morning - Remnants

of Tropical Storm Ida will bring heavy rain to parts of Tennessee, southeastern Kentucky, the southern Appalachian Mountains and a few interior southeastern U.S. locations, but crop damage is not likely in those areas - Western

Cuba sugarcane will be damaged by Tropical Storm Ida today - Central

Cuba citrus and sugarcane areas will experience windy conditions with very heavy rainfall today and tonight - Flooding

may damage personal property, but crop losses are expected to be low - Some

citrus fruit droppage is possible in western production areas, but the impact should be low - Sugarcane

will be more seriously impacted, although only a small part of the nation’s total crop will be damaged and there will be some potential for recovery - Recent

rainfall in Canada’s eastern Prairies, the northeastern U.S. Plains and northern Midwest has improved crop and field conditions - No

further expansion of drought is expected - Late

season soybeans may benefit from the moisture with some higher yields - Follow

up rain is expected over the next ten days in each of these areas maintaining the same trends - Northwestern

U.S. Plains and southwestern Canada’s Prairies will continue to be too dry for a while longer, despite a few showers of limited significance - U.S.

southwestern Corn and Soybean Belt crop areas will experience at least another week to ten days of net drying

- Some

crop stress is expected over time, although the impact on late season production may be low - Most

other U.S. Midwest crop areas will see a good mix of rain and sunshine along with seasonable temperatures during the next two weeks maintaining good crop development - Portions

of U.S. west-central and southern Plains will experience net drying during the next ten days, despite some isolated to scattered showers and thunderstorms at times - U.S.

temperatures will be warmer than usual in much of the west and central parts of the nation during the coming week and possibly for nearly two weeks - Eastern

U.S. temperatures will be seasonable in this first week of the outlook and a little cooler biased in the following week - Southwest

U.S. monsoon moisture may increase in the Arizona, New Mexico and the southern Rocky Mountain region next week - The

monsoon usually begins to withdraw in the second week of September - Ontario

and Quebec, Canada soil moisture is decreasing, but summer crop conditions remain very good - Wheat

harvesting has and will continue to advance favorably - These

trends will continue for the next ten days - Argentina

is still expected to see waves of rain next week that will help improve topsoil moisture for southern and eastern winter crop areas - Showers

in the west will be welcome, but may be a little too light for a serious improvement to soil moisture especially in Cordoba - Brazil

rainfall potentials were reduced again in center west and center south crop areas for the second half of next week and into the following weekend - The

reduction in rain was needed - Most

of the region is now advertised to be mostly dry after rain was advertised by computer modeling earlier this week for that region – the change will verify - Coffee,

citrus and sugarcane areas do not get much moisture and concern over premature coffee flowering has ended

- Rain

is still needed to help freeze damaged crops recover before the growing season begins in late September and October - Colombia,

Venezuela, Central America and western and southern parts of Mexico will be plenty wet over the coming week to ten days - Tropical

storm Nora has formed off the southwest Mexico coast and will move up the coast this weekend and early next week producing torrential coastal rain and flooding - Rainfall

could vary from 10.00 to 20.00 inches in southwestern Mexico coastal states resulting in serious flooding, Mudslides and some potential damage to personal property, infrastructure and some crops. - Some

of this moisture will help to enhance southwestern U.S. rainfall and monsoon flow moisture next week - India’s

forecast today remains a little wetter for Gujarat and neighboring areas next week and into the following week - The

change was needed and if the rain falls as advertised some short term improvements to cotton, groundnut and other crop development potential will result - Southern

and eastern Gujarat and southern Rajasthan will benefit most from the rain - Western

and northern Rajasthan and Pakistan remain in a dry weather mode with little change likely for the next week to ten days - Weather

conditions elsewhere in India are quite favorable and summer crop production is expected to be good - Australia’s

winter crops remain favorably rated with little change likely in the next ten days - The

only exception is in Queensland and a few neighboring areas where there is need for rain especially with reproduction of wheat and barley coming soon - Recent

frost and freezes in Queensland may have impacted some of the region’s production potential, but most crops had not reached the most sensitive stage of reproduction which should minimize the impact.

- China

has been reporting localized pockets of heavy rainfall recently, but no widespread excessive rain event has occurred - Rainfall

this month has been greater than desired for many crops in the nation and that could have some impact on production - Flooding

has occurred periodically and some of it may have damaged a few crops - A

part of northeastern China’s small grain crop is probably too wet and may be suffering a quality decline, but corn, soybeans, rice, sugarbeets and other crops are likely in favorable condition - China

needs to dry down, but is unlikely to do so for a while - Parts

of Western Europe will be dry through Wednesday - Some

showers will evolve briefly in western Europe during the latter part of the week and into the following weekend and then another period of drying is likely

- The

drier weather may stress a few late season crops in France and the U.K., but it will be good for fieldwork and for expediting early season crop maturation - Relief

that comes next week will be beneficial - Eastern

Europe will experience frequent rainfall and milder than usual temperatures over the next week and then experience a short term bout of drier weather - Some

rain will fall in the Balkan Countries where dryness has been a threat to unirrigated summer crop production in recent weeks - Russia’s

New Lands and Kazakhstan have been drier biased this month. - Crop

conditions have been favorable except in and north of Kazakhstan where too much heat and dryness hurt wheat and sunseed production

- Net

drying will continue for one more week and then some rain will be possible - Western

Russia summer crop conditions have been good and little change is expected - Harvesting

2021 crops and the planting of 2022 crops is occurring, but a little slower than desired in some of the wetter areas in western and northern Russia and neighboring areas.

- Southeast

Asia crop areas will receive periodic showers and thunderstorms over the next two weeks - West-central

Africa rainfall over the next ten days will be sufficient to support most crops - Coffee,

cocoa, rice, sugarcane and cotton development has been and will continue to be good this year - East-central

Africa showers and thunderstorms have been and will continue to be timely and beneficial resulting in a good outlook for coffee, cocoa, rice, sugarcane and other crops that are produced from Ethiopia into Uganda and southwestern Kenya.

- Showers

in South Africa will be erratic and light over the coming week - The

precipitation will benefit many wheat, barley and canola crops - Southern

Oscillation Index was +3.27 Sunday, and the index should move in a narrow range over the next week to ten days with some upward movement

- New

Zealand weather will include near to below average rainfall during the next week with greater rain likely in the western parts of South Island in the first week of September - Temperatures

will be seasonable

Source:

World Weather Inc.

Sunday,

Aug. 29:

- Vietnam’s

statistics office publishes August imports and exports of commodities

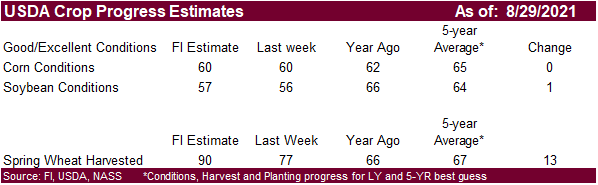

Monday,

Aug. 30:

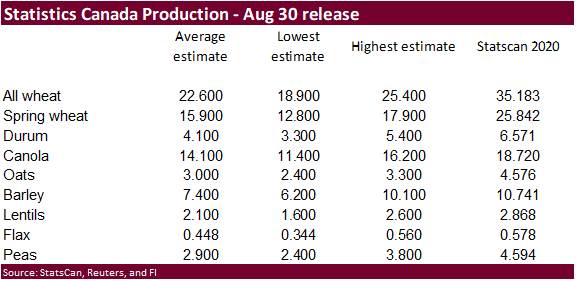

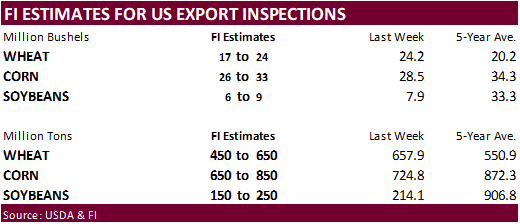

- Canada’s

StatCan releases production data for wheat, durum, canola, barley and soybeans - USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop conditions – corn, cotton, soybeans; spring wheat harvest, 4pm - Ivory

Coast cocoa arrivals - U.K.

public holiday: agriculture futures contracts closed on ICE Futures Europe

Tuesday,

Aug. 31:

- U.S.

agricultural prices paid and received - EU

weekly grain, oilseed import and export data - HOLIDAY:

Malaysia

Wednesday,

Sept. 1:

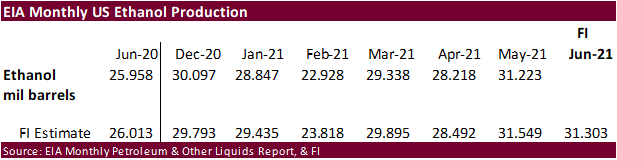

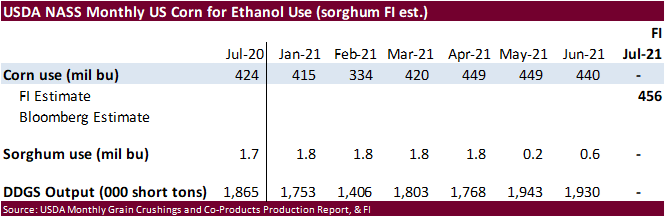

- EIA

weekly U.S. ethanol inventories, production - Australia

Commodity Index - U.S.

DDGS production, corn for ethanol, 3pm - Malaysia

August palm oil export data (tentative) - USDA

soybean crush, 3pm

Thursday,

Sept. 2:

- FAO

World Food Price Index - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - HOLIDAY:

Vietnam

Friday,

Sept. 3:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - HOLIDAY:

Vietnam

Source:

Bloomberg and FI

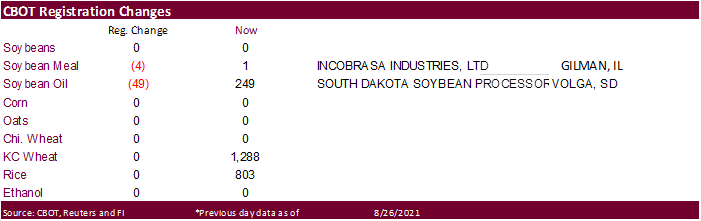

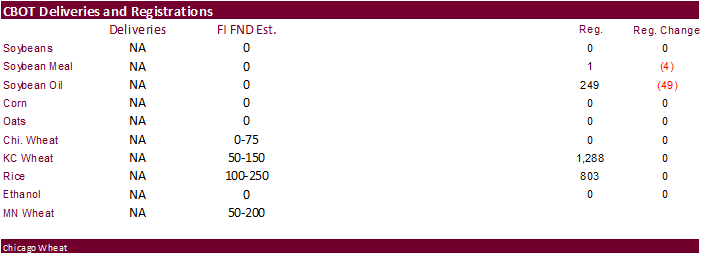

FND

delivery estimates:

StatsCan

is due out with Canadian production on Monday

SUPPLEMENTAL

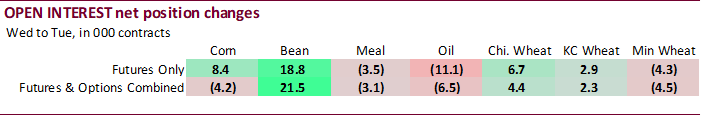

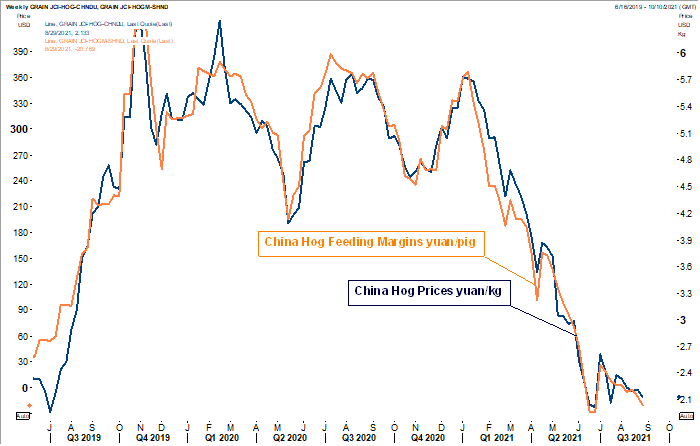

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

190,324 -8,719 409,351 -4,960 -518,262 18,125

Soybeans

22,251 -9,730 179,967 634 -179,566 16,559

Soyoil

32,321 -778 118,307 -223 -157,918 571

CBOT

wheat -19,233 -12,935 140,194 129 -111,530 11,645

KCBT

wheat 21,000 -821 67,405 -391 -90,933 717

=================================================================================

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

270,994 -7,918 228,513 1,298 -486,014 16,844

Soybeans

83,225 -13,954 96,603 6,863 -154,473 15,748

Soymeal

20,728 -7,012 86,629 625 -146,555 12,281

Soyoil

66,987 -2,107 103,113 -543 -170,255 1,741

CBOT

wheat 11,982 -12,202 64,377 5,279 -81,735 7,245

KCBT

wheat 47,391 843 41,073 -362 -84,795 1,054

MGEX

wheat 15,932 904 3,248 134 -31,746 -368

———- ———- ———- ———- ———- ———-

Total

wheat 75,305 -10,455 108,698 5,051 -198,276 7,931

Live

cattle 92,649 21,876 84,673 409 -182,164 -20,486

Feeder

cattle 12,539 1,767 4,141 -655 -2,277 -594

Lean

hogs 79,207 2,187 59,330 -566 -133,852 1,835

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

67,921 -5,777 -81,412 -4,447 1,985,043 -4,225

Soybeans

-2,701 -1,195 -22,653 -7,463 899,684 21,530

Soymeal

17,377 -748 21,821 -5,147 404,589 -3,050

Soyoil

-7,138 478 7,291 430 495,595 -6,509

CBOT

wheat 14,806 -1,482 -9,430 1,161 498,801 4,392

KCBT

wheat -6,198 -2,029 2,528 495 259,263 2,334

MGEX

wheat 2,855 145 9,710 -815 80,280 -4,472

———- ———- ———- ———- ———- ———-

Total

wheat 11,463 -3,366 2,808 841 838,344 2,254

Live

cattle 26,901 971 -22,059 -2,770 355,004 26,563

Feeder

cattle -1,111 266 -13,290 -785 59,259 2,662

Lean

hogs 12,652 -1,819 -17,336 -1,637 322,400 500

=================================================================================

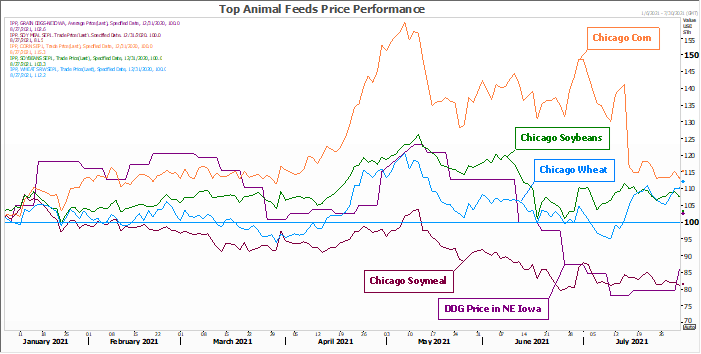

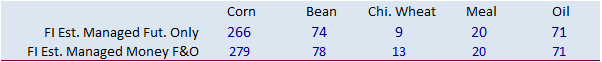

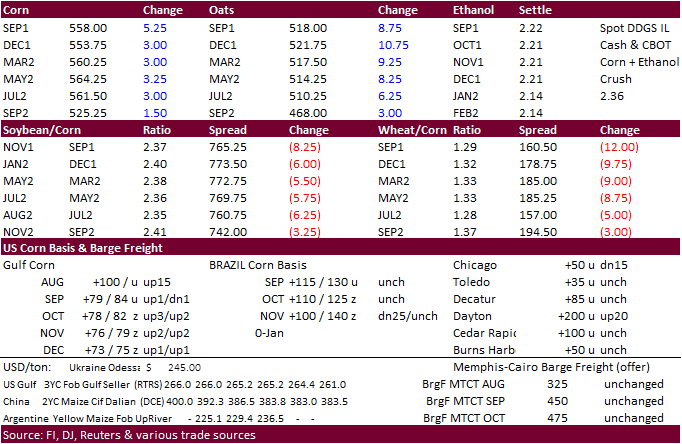

Corn

·

New-crop corn futures opened lower ahead of the weekend in part from rain prospects across the upper western Corn Belt but rallied to close higher on unwinding of soybean/corn spreads and strong cash prices across the US interior

and additional USDA corn sales. Corn harvesting is advancing in the south and this could keep FOB export prices in check for the Gulf, but northern feedlots and ethanol plants are still feeling the pain from extremely high spot basis. Dayton, OH corn basis

was up 20 cents to 200 over the Sep. Cedar Rapids is 100 over.

·

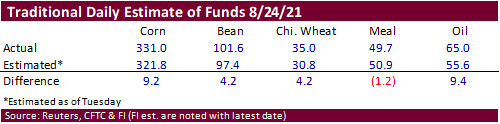

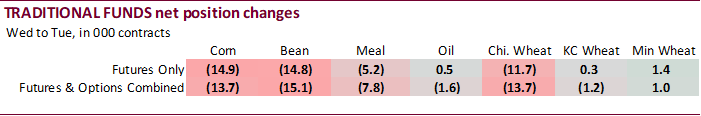

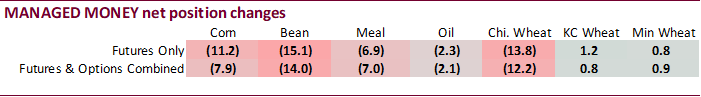

Funds bought an estimated net 3,000 corn contracts.

·

US weather outlook looks good over the near term with precipitation falling across the northern Midwest Saturday and central and eastern areas Sunday through Monday. North Dakota, Minnesota, Wisconsin, and Iowa over next three

days will see heavy rain.

·

China’s Sinograin sold 38,709 tons of imported corn at auction, 37% of the total offered.

·

WTI was $1.25 higher and USD 38 lower.

·

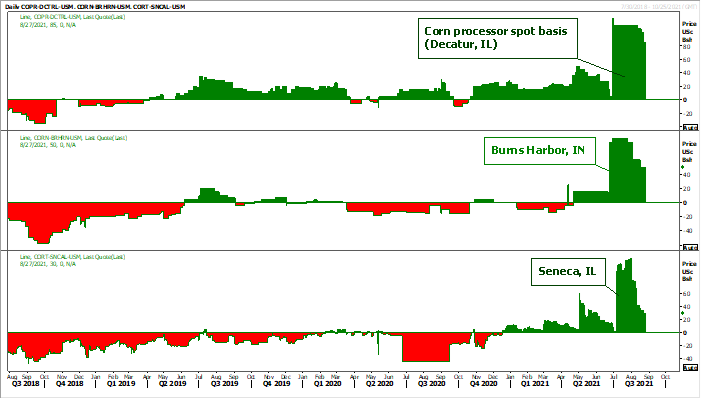

A USDA Attaché report on China pork outlook for 2022 calls for a 14% decrease in pork production, to 41.5 million tons, due to eroding hog margins and shrinking hog herds.

China

hog feeding margins and hog prices.

Source:

Reuters and FI

Export

developments.

-

Under

the USDA 24-hour announcement system, private exporters sold 150,000 tons of corn for delivery to Colombia during the 2021-22 marketing year.

-

South

Korea’s KFA seeks up to 138,000 tons of optional origin corn on August 27 for arrival around November 25 and November 30.

Updated

8/20/21

December

corn is seen in a $4.75-$6.00 range

·

This morning the CBOT soybeans complex was under pressure led by soybean oil in part to uncertainty over US biofuel 2021 and 2022 mandates, but soybean oil rebounded in part to a rally in WTI crude oil and RBOB. Soybeans and

soybean meal ended lower despite strong soybean demand. USDA announced China bought 129,000 tons of soybeans under the 24-hour system. China bought around 25 cargoes of soybeans this week from SA and the US.

·

Funds sold an estimated net 3,000 soybeans, sold 2,000 soybean meal, and bought 2,000 soybean oil.

·

We are hearing grain ships along the Paraguay River had to cut loads by as much as 50 percent due to low water levels.

·

Brazil is looking to lower their biodiesel blend rate to only 10 percent for November and December. Sep/Oct was 12%. In April (until Aug) they went to B10 from B13 due to price adjustments. This is bearish as Brazil can export

a little more soybean oil than expected.

·

Indonesia set its September CPO reference price at $1185.26/ton, up from $1048.62/ton for August.

·

China cash crush margins were last positive 121 cents on our analysis (123 previous) versus 110 cents late last week and 90 cents around a year ago.

·

Offshore values this morning were leading soybean oil 34 points higher (72 higher for the week to date) and meal $1.00 lower ($0.50 lower for the week).

·

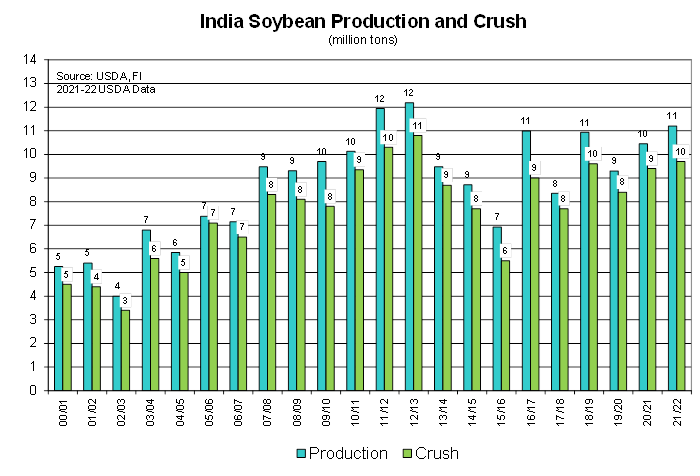

We are unsure India will import the full 1.2 million tons of GMO soybean meal the government recently approved as new-crop should be online by November. India’s soybean crush is projected by the USDA to increase next crop year.

India bought around 100,000 tons of Argentine soybean meal this week.

·

India’s issue with a shortfall in feed and vegetable oils is not a function of the size of last year’s soybean crop. Instead, we may have to dig a little deeper into total oilseed production, crush, and imports. Oilseed plantings

have expended slowly over the past several years. Feed demand is likely growing at a faster rate than oilseed production. We know Covid slowed vegetable oil imports and created logistical problems, but 1.2 million tons is a good size of soybean meal for

them to import before new-crop products come online. Problem is the GMO soybean meal can only come into the country at two ports, and one of those ports cannot handle large ships, so India may partially have to bring the meal in via containers.

Export

Developments

- Under

the USDA 24-hour announcement system, private exporters sold 129,000 tons of soybeans for delivery to China during the 2021-22 marketing year.

Updated

8/27/21

Soybeans

– November $11.75-$15.00

Soybean

meal – December $320-$425

Soybean

oil – December 52-67 cent range

(up 400, unchanged for the top end of range)

·

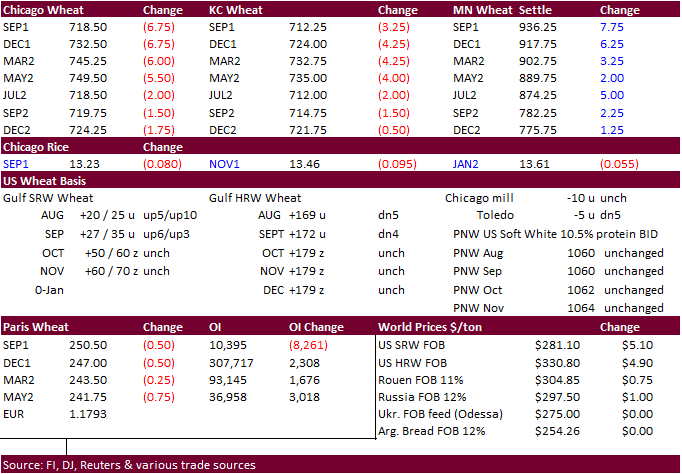

Wheat opened mixed on lack of direction. MN grinded higher on concerns over global high protein wheat supplies. The USD was 38 points lower, but this did little to support KC and Chicago wheat, which settled lower. Funds sold

an estimated net 3,000 wheat contracts.

·

December Paris wheat was down 0.50 euros at 246.75.

·

France soft wheat harvest progress advanced 5 percent points to 96 percent complete as of August 23, less than what we expected, and is about two weeks behind normal.

·

SovEcon sees Russia’s wheat exports lowest in 5 years at 33.9 million tons, a 3.2-million-ton reduction from previous forecast. Reuters last noted they are around 76.2 million tons for 2021 production, down from 85.9 million

from last year, but that figure may have been lowered for them to make such a large downward adjustment to exports.

·

Russia adjusted their wheat export tax by increasing it to $39.40/ton for next week from the current $31.70/ton.

·

Ukraine exported 7 million tons of grain since July 1, up 10% from 6.4 million tons during the same period last season, including 3.4 million tons of wheat and 1.18 million tons of corn. 2.4 million tons of barley also had been

exported.

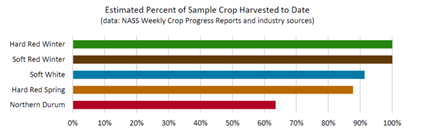

US

Wheat Associates:

“The

HRW harvest has officially wrapped up as samples continue to be analyzed in the lab. SW harvest is progressing under dry conditions and data continue to reflect a stressed crop. HRS harvest is nearly 90% complete and this year’s crop currently grades at U.S.

No. 1 Dark Northern Spring. The first northern durum samples are in with the current grade a U.S. No. 2 Hard Amber Durum.”

Export

Developments.

·

Egypt seeks wheat for October 15 through October 25 shipment.

·

The Philippines seek 60,000 tons of feed wheat on August 27 for Sep/Oct shipment.

·

Pakistan seeks 550,000 tons of wheat on September 7 for October through November shipment.

·

Jordan seeks 120,000 tons of wheat on September 1.

·

Bangladesh seeks 50,000 tons wheat on September 1.

·

Turkey seeks 300,000 tons of milling wheat on September 2 for September 10 through October 10 shipment. They last bought 11.5% and 12.5% wheat on August 4 at $297.40-$308.90/ton c&f.

·

Taiwan weeks 48,875 tons of US wheat on September 3 for October 15-Novmeber 1 shipment. They last bought US wheat on August 6, various classes at various prices.

·

Mauritius seeks 47,000 tons of wheat flour, optional origin, on Sept. 21 for various 2022 shipment.

Rice/Other

- South

Korea seeks 42,200 tons of rice for arrival in South Korea between February 28 and April 2022. 20,000 tons of that is of US origin, rest optional .

- Egypt

seeks 200,000 tons of raw sugar for Oct-Dec shipment on August 28.

Updated 8/17/21

December Chicago wheat is seen in a $6.80‐$8.25

range

December KC wheat is seen in a $6.60‐$8.00

December MN wheat is seen in a $8.45‐$9.80

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.