PDF Attached

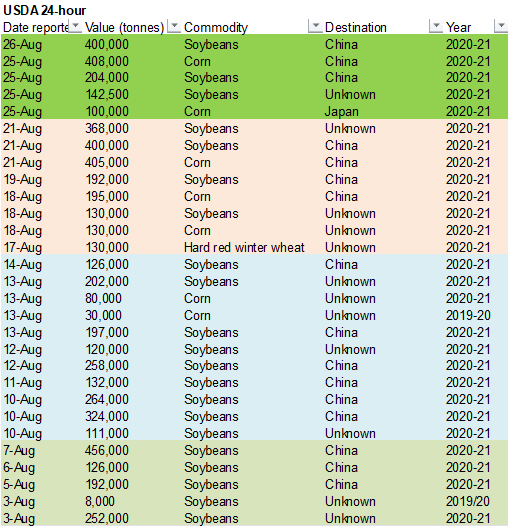

USDA

reported soybean sales to China. Tropical storm Laura was upgraded to be a catastrophic Category 4 hurricane. Bloomberg reported China may purchase about 40 million tons of US soybeans in 2020, a calendar year record.

![]()

MOST

IMPORTANT WEATHER AROUND THE WORLD

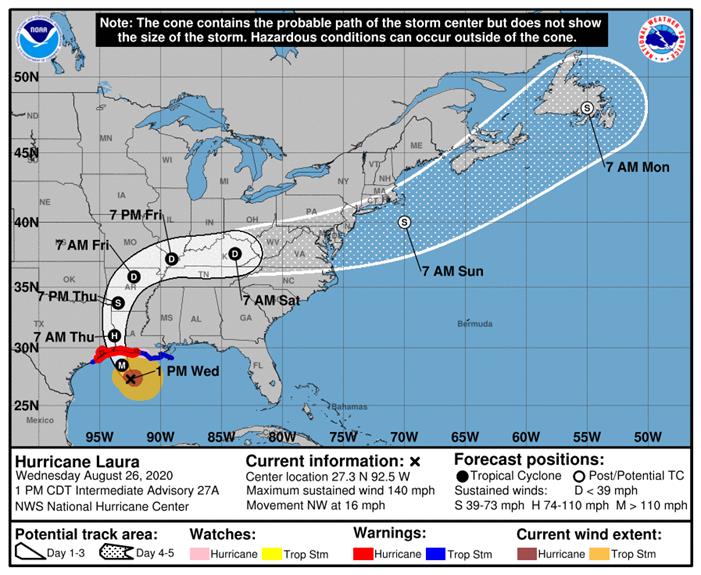

- Biggest

issues of concern - More

frost and freezes occurred in eastern Australia this morning; including Queensland and northern most New South Wales where winter crops will be first to reproduce soon - Hurricane

Laura will be impacting western Louisiana tonight and Thursday raising concern for the shipping and energy industries in that region; agricultural damage will be light and mostly confined to some western sugarcane

- Unusual

cold is expected to evolve in Canada’s Prairies next week that may bring a threat of frost and a few freezes eventually, but there is time for changes in the outlook - Northeastern

China is bracing for Typhoon Bavi and its heavy rain will induce more flooding in Liaoning and Jilin, China as well as northwestern North Korea - India

has a new monsoon low that will move across the interior east half of the nation in the coming week producing more heavy rain - Argentina

is beginning to receive rain today, but its distribution is going to be disappointing for those looking for a general soaking and/or a significant turnaround in winter crop conditions - West-central

Africa rainfall will continue lacking for another ten days leaving Ivory Coast and Ghana unusually dry since July1 - Hurricane

Laura will slam into southwestern Louisiana near the Lake Charles area tonight and Thursday as a Category Four storm with sustained wind speeds near 120 mph - At

0700 EDT today, the center of the storm was 280 miles south southeast of Lake Charles, La. at 26.4 north, 91.4 west moving northwesterly at 15 mph and producing maximum sustained wind speeds of 115 mph; tropical storm force wind was occurring out 175 miles

from the center of the storm while hurricane force wind was occurring out 70 miles - Laura

will intensify as it moves closer to land today with peak wind speeds possibly getting to 130 mph - Weakening

is expected just prior to landfall with wind speeds slipping back to 115 mph at the time of landfall - The

storm’s forecast path has not changed much overnight and little change was expected - The

greatest wind, rain and flooding will occur from the Port Arthur area of Texas to Jennings, La with some lighter impacts farther east to Lafayette, La.

- The

storm’s hurricane forecast wind speeds will likely extend outward 70 miles from the storm center suggesting nearly all of the Lake Charles, La. area will be subjected to damaging conditions - Louisiana’s

western coast line will be most vulnerable to the storm’s fury with a notable coastal storm surge, wind speeds may surpass 100 mph and rainfall of 5.00 to 15.00 inches will accompany the storm inland - Heavy

rain will reach into the northern Delta and the lower Midwest late this week and during the weekend respectively - Crop

damage is possible in western sugarcane production areas in Louisiana - Rice,

corn, sorghum and soybeans areas in the western Delta are not likely to be seriously impacted, although some rain and breezy conditions will occur - Northern

Delta crop areas will get some heavy rain late Thursday and Friday resulting in some flooding, but no serious impact on crops is expected - Personal

property damage will be greatest around the Lake Charles area of southwestern Louisiana - Typhoon

Bavi was located 176 miles southwest of Kunsan, Air Base in South Korea at 0900 GMT today near 34.5 north, 124.4 east moving northerly at 12 mph while producing a maximum sustained wind speed of 110 mph with typhoon force wind occurring out 35 miles from

the center of the storm - Tropical

storm force wind speeds were occurring out 160 miles from the storm center - Bavi

will move north northeast into the Yellow Sea today and then move across northeastern China into southeastern Russia Thursday and Friday - Very

heavy rain and windy conditions will impact a part of the western Korean Peninsula and into Liaoning China during the middle to latter part of this week

- Damaging

wind and flooding rain could impact rice in parts of northwestern North Korea and northeastern China - Northeastern

China already received significant rain early this week saturating the soil ahead of the typhoon and that raises the potential for more serious flooding as the storm arrives; this will impact Liaoning, southern Jilin and North Korea - A

new tropical cyclone is forming east of the Philippines that is expected to become a very intense storm and threaten Japan and the Korean Peninsula next week

- East-central

China will experience net drying this week as Typhoon Bavi moves up the East China Sea and Yellow Sea - Totally

dry weather is not expected, but warm temperatures and quick evaporation will lead to some firming soil - The

change will be welcome after recent abundant rain - Southeastern

China will experience more frequent rainfall over the coming week ending the recent stretch of drier days that has firmed the soil in some areas after recent months of flooding - Xinjiang

China will continue to experience milder than usual conditions at times today and Thursday with some rain expected in the northeast

- Recent

temperatures have been milder than usual which may be reducing some of the degree day accumulations for cotton and other crops - Warming

is expected late this week through much of next week which may help cotton finish out in a more favorable weather environment - Flooding

on the Yangtze River will continue for a while as the region continues to drain surplus water from behind the Three Gorges Dam - India

rain in this coming week will become greatest from Odisha and West Bengal to Madhya Pradesh with amounts of 3.00 to 7.00 inches common and local totals over 10.00 inches - Some

of this region is already saturated and flooding will result causing some concern over rice, sugarcane, pulse, soybean and other crops produced in the region - Frequent

rain may impact northern India during the weekend and early next week perpetuating concern over some crop conditions - Early

maturing cotton may be opening bolls and could encounter some decline in fiber quality because of the rain in far northern India during the weekend and early next week - Australia

experienced additional frost and a few freezes in southeastern Queensland and New South Wales this morning, but no more damage of significance than that which occurred during the weekend was suspected - Australia

rainfall over the coming week will be most significant in Victoria while most other areas in the nation are left dry - Rain

will evolve in Western Australia early next week before moving east across the remaining southern crop areas in the nation through Friday, September 4.

- Queensland

still needs rain immediately to support reproduction that is expected to begin in early September - Europe

will experience alternating periods of rain and sunshine during the next ten days favoring the North and Baltic Sea regions and areas from the Alps into western Ukraine, northern Romania and western Russia - Some

relief from dryness is expected in some areas of France and Germany during this period of time, but most of the greatest rain will fall after the middle part of next week - Temperatures

will be seasonable in the west and above average in the southeast - Eastern

and southern Ukraine, Russia’s Southern Region, southeastern Romania and eastern Bulgaria will continue too dry for at least another ten days, despite a few sporadic showers - Rain

is most likely from Moldova to eastern Bulgaria next week and it may bring a little relief to persistent dryness - Any

showers that occur in eastern Ukraine or Russia’s Southern region will be minimal and offer little to no relief to persistent dryness - Russia’s

central and eastern New Lands will receive rain periodically during the next ten days - Drying

is needed to support wheat and sunseed maturation and harvesting - Argentina

is still expected to receive significant rain in a part of its winter wheat and barley production region over the next two days - Total

rainfall of 0.20 to 0.70 inch will occur in many areas through Thursday with local totals of 1.00 to 2.00 inches – some of this rain has already begun - Wettest

in Entre Rios, the northeast half of Buenos Aires and a few immediate neighboring areas of Santa Fe - The

bottom line will be good for many winter crops, although rainfall in Cordoba will still be too light for a serious change in drought status and follow up rain will be of critical importance - There

will not be much follow up rain through September 7 – at least not in the driest areas - Brazil

rainfall this week will be confined to the upper east coast through mid-week and then alternating periods of light rain and sunshine will occur in Rio Grande do Sul during the following full week - Aggressive

corn planting is expected - Wheat

development will continue to advance well - Some

areas in Rio Grande do Sul may become too wet over time - Temperatures

will be warmer in Argentina and southern Brazil this week after last week’s bitter cold - U.S.

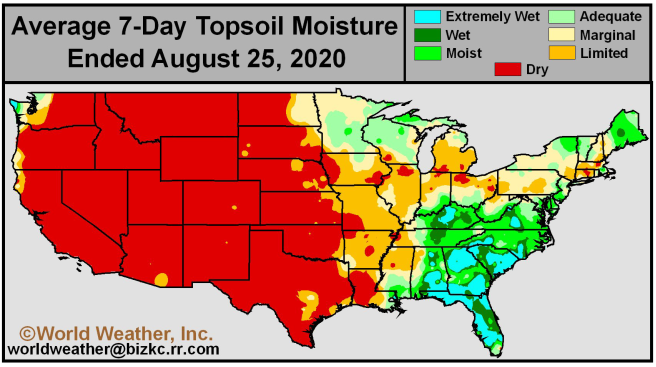

weather - Limited

rainfall is expected and warm temperatures will prevail for the next couple of days in the Midwest - Rain

in the Midwest is expected from Minnesota to Michigan late this week with 1.00 to 2.50 inches resulting - A

cool front moving across the Midwest early next week will bring rain to many of the areas that have been driest for the longest period of time in the western Corn Belt, but some of the rain will be disappointing - Rainfall

in western Iowa will still be light, but there will be some relief - The

Midwest cool front and rainfall will move from west to east Monday into Wednesday morning - Heavy

rain will come northward from western Louisiana into central Arkansas from Hurricane Laura Thursday and Friday - Rainfall

of 6 to 15 inches will occur in southwestern Louisiana - Rainfall

of 4.00 to 8.00 inches will occur from northwestern Louisiana to central Arkansas - Rainfall

of 2 to 4.00 inches and local totals 6.00 inches will impact the northern Delta Friday with 1.00 to 3.00 inches near and south of the Ohio River Valley Friday into Saturday - Southeastern

U.S. will experience frequent showers and thunderstorms for the next week - Net

drying will occur in the Great Plains and Midwest during mid-week next week, but a part of the Plains will get some rain Sunday into Monday - Resulting

moisture will be restricted and light - West

Texas will not receive much rain of significance and will stay very warm to hot over the next week - Some

cooling may occur late next week and into the following weekend with a few thundershowers possible - U.S.

Week two weather will bring another shot of colder air into the Plains and Midwest September 4-6 inducing some rain as it progresses across the region - Drier

weather will then follow - Cooler

air advertised in Canada’s Prairies and the northwestern U.S. Plains August 30-September 5 will bring down temperatures and induce a little precipitation - Some

frost or a brief bout of light freezing conditions might occur in a small part of Alberta and far northern Saskatchewan during this period

- Hot

weather will continue to impact the northern U.S. Plains and southern Canada for another day or two with additional bouts of 80- and 90-degree afternoon highs while rainfall is minimal - A

few extremes near 100 will occur in eastern Montana and especially South Dakota - Some

cooling will occur late this week - Greater

relief should come in the Aug. 30-Sep. 6 period as a notable cool airmass arrives - West-central

Africa will receive a few showers and thunderstorms during the coming ten days, but Ivory Coast and Ghana will continue dry biased - A

drier bias is expected in coffee, cocoa, sugarcane and rice production areas from the south half of Ivory Coast to southwestern Nigeria over the next week to ten days, but rain will be possible in other areas - Seasonal

rains will return to this area in September - The

longer range outlook calls for abundant rain in these areas later this year - Interior

southern Pakistan received some rain Tuesday and a little more will fall today - Some

benefit is expected to rice, sugarcane and cotton, but more is needed - Temperatures

will be warmer than usual - A

good mix of rain and sunshine is expected in mainland areas of Southeast Asia - Indonesia

rainfall continues erratic - Rainfall

over the next ten days will continue erratic, but at least some rain will fall in each production area at one time or another - Rain

is needed most in parts of Sumatra and western Java -

Ontario

and Quebec weather is mostly good with alternating periods of rain and sunshine over the next two weeks -

Temperatures

will be seasonable -

South

Africa rain over the coming week will be erratically distributed over the next ten days -

Eastern

winter wheat and barley areas still need a general rain to support dryland crops which represent 8% of the total crop in the region -

Temperatures

will be warm in the northeast and mild to cool in the west -

Mexico

precipitation in the coming week to ten days will be greatest in western and southern parts of the nation benefiting many corn, sorghum and dry bean production areas -

Coffee,

citrus, sugarcane and many fruit and vegetable crops will also benefit -

Northeastern

Mexico will be mostly dry -

Some

of the region is still drought stricken -

Central

America rainfall will be frequent enough to support all crop needs -

New

Zealand rainfall will be erratically distributed for a while and temperatures will be a little cooler biased -

Southern

Oscillation Index was +5.23 this morning and it will continue positive this week

Source:

World Weather Inc.

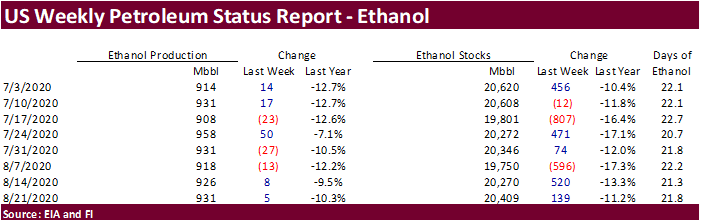

- EIA

U.S. weekly ethanol inventories, production, 10:30am

THURSDAY,

August 27:

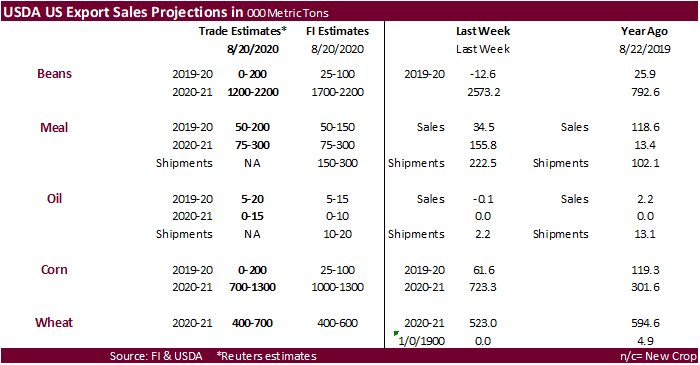

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - International

Grains Council monthly report - Port

of Rouen data on French grain exports - EARNINGS:

Sime Darby Plantation

FRIDAY,

August 28:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - U.S.

agricultural prices paid, received, 3pm

Source:

Bloomberg and FI

US

Durable Goods Orders Jul P: 11.2% (est 4.7%; prevR 7.7%; prev 7.6%)

-

December

corn futures traded much of the day lower technical selling but US and Ukraine crop concerns paired losses. September and December settled 0.25 cent lower, despite higher soybeans and strength in wheat.

-

December

corn appears it could fill the $3.4550-$3.4800 gap before moving back high on US crop production concerns.

-

Funds

sold an estimate net 1,000 corn contracts. -

USD

was down 2 points and WTI crude down 2 cents by 2 pm CT. -

Tropical

storm Laura was upgraded this morning to be a catastrophic Category 4 hurricane. Laura will touch land late today/early Thursday, impacting US Gulf shipments and creating localized flooding which will threaten the lower Delta/SW unharvested crops.

-

Environmental

Protection Agency’s Andrew Wheeler mentioned the agency has yet to decide on U.S. biofuel blending requirements for 2021 or on petitions from refiners. The decision on 2021 Renewable Volume Obligations (RVO) by the Nov. 30 deadline may not occur due to the

impact of the COVID-19 pandemic. -

UkrAgroConsult

estimated Ukraine’s 2020-21 corn crop at 36 million tons, down 5 percent from their previous estimate of 38 million tons. Net drying has been eroding crop conditions. This would be down from their 2019 forecast of 35.9 million tons.

-

With

the rise in corn prices, the EU lowered their corn import tariff to 0.26 euros ($0.31) per ton, from 5.48 euros previously.

-

A

Reuters poll for South Africa’s corn production came in at 15.386 million tons for 2019-20, down from 15.545 estimated by the CEC in July. That includes 8.954MMT white and 6.432 million tons of yellow.

-

China

plans to auction off 10,000 tons of pork from reserves on August 28. More than 500,000 tons had been sold so far this year.

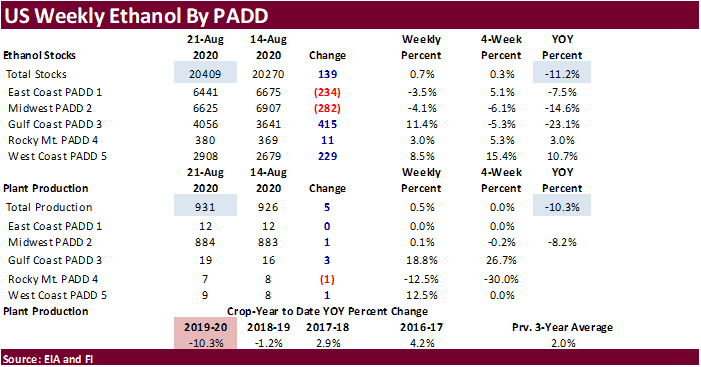

Weekly

ethanol production increased 5,000 barrels to 931,000 and stocks increase 139,000 barrels to 20.409 million. Production was about 10 percent lower than this time last year and stocks are off 11 percent.

A

Bloomberg poll looked for production to be down 2,000 and stocks to decrease 126,000 barrels. FI was looking for an increase in production and stocks. Weekly gasoline supplied was 9.1 million barrels, highest since mid-March.

Corn

Export Developments

-

Tunisia

may have bought 75,000 tons of barley for Sep-Oct shipment. The barley was believed to have been bought in three 25,000-ton consignments at $206.67 a ton c&f, $208.17 a ton c&f and $209.17 a ton c&f.

-

September

corn is seen in a $3.30 and $3.55 range. December $3.40-$3.75 range.

-

CBOT

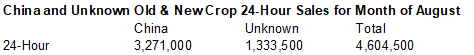

soybeans were higher again on

strong US export demand (400k soybeans sold to China) and crop loss concerns for IA and now lower Delta. During the session CBOT November soybeans traded at their highest level since mid-February. IA is forecast to get less than expected rain over the next

week. -

September

position was up 5.75 points and November up 4.00 cents. Soybean meal was moderately lower on follow through soybean oil/meal spreading.

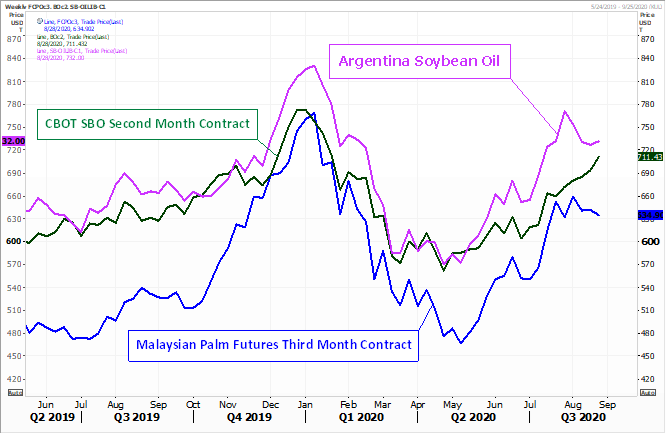

Soybean

oil stared lower but rallied later on tight global inventories to end 20 to 26 points higher.

It’s

getting harder for importers to source Q4 soybean oil from Argentina and US. Spot Argentina soybean oil fob increased $10-$11/ton from the previous day.

-

Funds

bought an estimated net 8,000 contracts, sold 1,000 meal and bought 2,000 soybean oil.

-

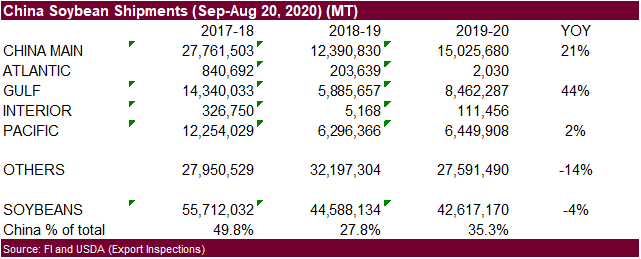

Bloomberg

reported China may purchase about 40 million tons of US soybeans in 2020, a calendar year record. That would be about 25% more than in 2017 and 10% greater than the record set in 2016.

-

A

quick look at USDA outstanding sales and shipments plus two weeks of 24-hour sales suggests China committed at least 22 million tons for 2020, and that does not include sales to “unknown.” We believe the US will see shipping logistical problems if China were

to import the full 40 million tons of soybeans during 2020 as shipments to date are a fraction of that amount. USDA export inspections show roughly 5.4 million tons of US soybeans were shipped to China from early January through August 20. Weekly soybean

exports to China may have to average at least 1.8 million tons a week from September through December to reach about 40 million tons.

-

We

heard China bought at least 6 cargoes of US soybeans out of the US Gulf and PNW for shipment between October and November.

-

China’s

Sinograin will offer 98,831 tons of domestic soybeans on August 28. China’s Sinograin sold 51% of the 98,807 tons of soybeans offered at auction earlier this week. AgriCensus noted Sinograin has a target to sell up to 3 million tons of soybeans from reserves

and replenish supplies with recent purchases. This rotation will ensure temporary supplies for the upcoming marketing year.

-

Anec

sees August soybean exports at 6.02 million tons. -

Argentina

soybean producer selling improved from the previous week but the volume is still too small to boost crushing volumes.

-

SGS

reported August 1-25 palm exports at 1.158 million tons, down 16 percent from previous month. Note they reported shipments for the 1-20 period down 18 percent.

-

Under

the 24-hour reporting system, private exporters reported to the U.S. Department of Agriculture export sales of 400,000 tons of soybeans for delivery to China during the 2020/2021 marketing year. -

Results

awaited: Algeria seeks 30,000 tons of soybean meal for shipment by September 25, optional origin.

-

Results

awaited: Syria

seeks 50,000 tons of soybean meal and 50,000 tons of corn on Aug 25 for delivery within four months of contract signing.

-

September

soybeans are seen in a $9.05-$9.35 range.

November $8.80-$9.50. -

September

soybean meal is seen in a $285 to $300 range. December $285-$325. -

September

soybean oil range is seen in a 31.75 to 32.25 range.

December 29.75-34.00 range.

-

US

wheat futures started lower on technical selling but turned higher. Lack of precipitation across the US Great Plains and confirmation of a much smaller EU wheat crop underpinned prices.

-

CBOT

September and December wheat nearly hit a one-month high but for the third day the contract was unable to break above its 200-day MA.

-

Funds

bought an estimated net 5,000 Chicago wheat contracts. - Late

yesterday models indicated hurricane Laura changed paths and the wheat planting areas in the Plains may miss out needed rain. Crop planting starts in a couple weeks. See cone model in the weather section.

-

The

Rosario Grains Exchange announced about 800,000 hectares of Argentina’s wheat production area was affected by the recent frost events. This represent about half of the 1.6 million hectare planted area.

-

Agritel

looks for French wheat exports to decline 40 percent in 2020-21 to 13 million tons (20.9 year earlier) due to a short soft wheat production of 29.2 million tons, down from 2019 output of 39.5 million tons. The 29.2-million-ton estimate is unchanged from

their previous estimate. -

Ukraine

exported 6 million tons of grain since July 1, 1.7 million tons less than year earlier.

-

Paris

December wheat was down 0.25 euro at 184.00.

-

Turkey

bought about 390,000 tons of red milling wheat with lowest price at $209/ton c&f and 110,000 tons of durum wheat with lowest price at $322.49/ton c&f. The lowest price for barley was $192 c&f.

- Red

wheat shipment period is between Sep 4 and Oct 10 - Durum

shipment period is between Sept. 15 and Oct. 10. - Feed

barley shipment period is between Sept. 11 and Sept. 25. -

Jordan

bought 60,000 tons of hard wheat for FH October shipment at $237.50/ton c&f.

-

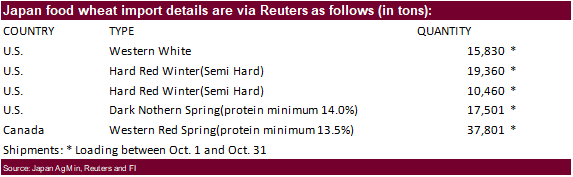

Japan

received no offers for 80,000 tons of feed wheat and 100,000 tons of feed barley (SBS) for November 30 loading.

-

Japan

seeks 100,952 tons of food wheat this week.

-

Taiwan

seeks 100,645 tons of US wheat on Aug 27 for Oct/Nov shipment. -

Syria

looks to sell and export 100,000 tons of feed barley with offers by Sep 1.

-

Syria

seeks 200,000 tons of soft wheat from EU/Russia on Sept. 9 and 200,000 tons of wheat from Russia on Sept. 14. -

Results

awaited: Pakistan seeks 1.5 million tons of wheat. Lowest offer was $233.85/ton for 200,000 tons of milling wheat.

·

The tropical storm will not be good for unharvested rice. 17 percent of the US rice crop had been harvested as of Sunday.

Updated

8/25/20

- Chicago

September is seen in a $5.10-$5.45 range. December $5.15-$5.50 range. - KC

September; $4.20-$4.60 range. December $4.35-$4.75. - MN

September $5.00-$5.30 range. December $5.10-$5.45.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.