PDF Attached

WASHINGTON,

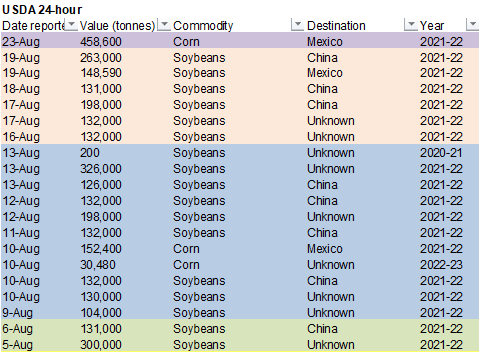

August 23, 2021-Private exporters reported to the U.S. Department of Agriculture export sales of 458,600 metric tons of corn for delivery to Mexico during the 2021/2022 marketing year.

Strong

start to CBOT contracts led by a sharply lower USD and higher outside commodity markets but gains were given up in soybean meal, followed by corn and back month Minneapolis wheat. Soybeans closed well off session highs. Soybean oil was up sharply as WTI

crude advanced $3.50/barrel.

Calls:

Corn

3-6 higher

Soybeans

5-9 higher

Chicago

and KC wheat unchanged to 3 higher. MN could trade lower.

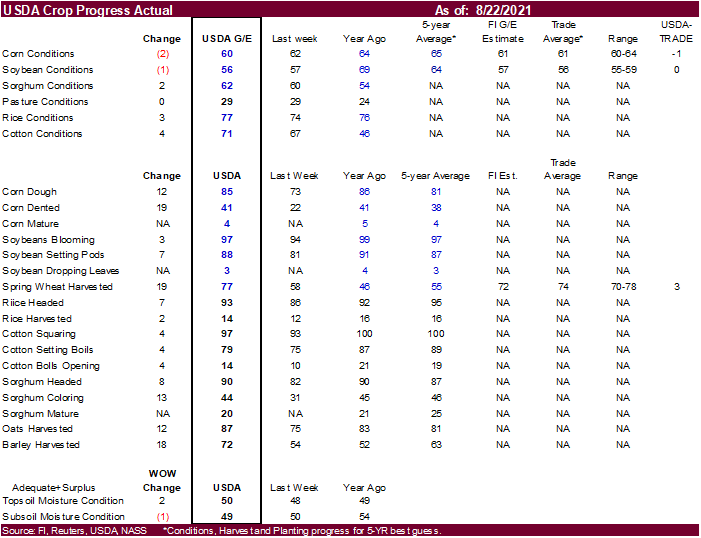

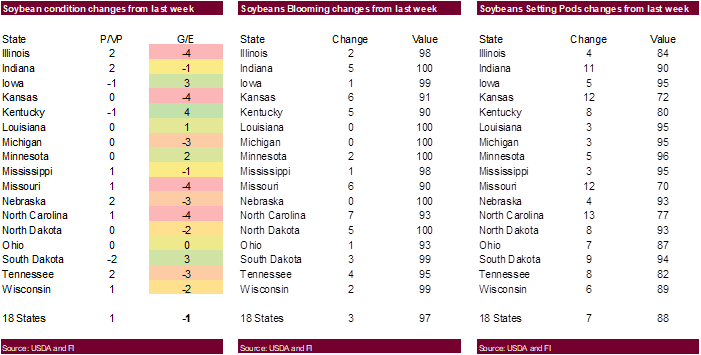

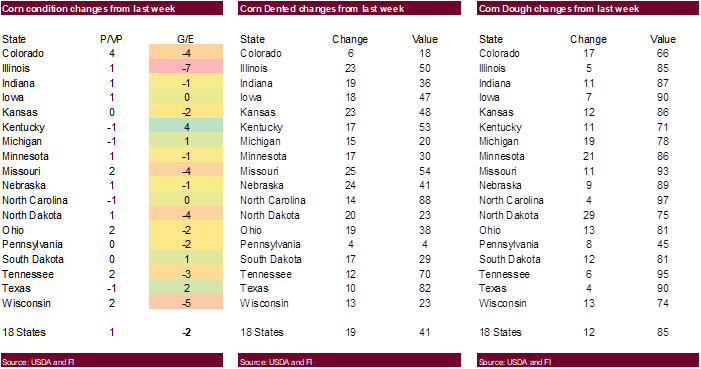

Corn

and soybean conditions declined from the previous week by 2 and one point, respectively. Trade was looking for a one point declined for each. At 60 and 55 for corn and soybeans respectively, they both are at a season low. We lowered our corn and soybean

yields (see respected sections).

WORLD

WEATHER INC.

MOST

IMPORTANT WEATHER OF THE DAY

·

U.S. northern Plains and Canada Prairies received partial relief from drought during the weekend

o

Rainfall of 1.00 to 3.50 inches occurred from north-central North Dakota to southwestern Manitoba while 0.77 to 3.00 inches occurred from northern Minnesota to southeastern Manitoba

o

Southeastern Saskatchewan reported 0.30 to 1.00 inch with local totals to 1.57 inches

o

Lighter rain fell in the remainder of the Prairies and northern Plains with many areas getting less than 0.40 inch

o

The moisture brought relief to drought, although much more moisture is needed. There has been and will continue to be a short term bout of improved late season crop development, especially for corn, soybeans and flax

·

Thunderstorms also occurred in parts of Iowa, Kansas and Missouri during the weekend with rainfall of 1.00 to 2.00 inches in several areas in northern Iowa, northeastern Kansas and northwestern into central Missouri

o

The moisture was welcome and good for late season crops

·

U.S. Tennessee River Basin, Alabama, eastern Mississippi and areas east into the southeastern states also received Rain and thunderstorms during the weekend with parts of western Kentucky, Tennessee and from east-central Mississippi

into southern Alabama ranged from 1.00 to 3.00 inches with local totals of 3.00 to 5.28 inches in parts of Tennessee

o

Rainfall elsewhere was more limited except near the Atlantic Coast

·

Hurricane Henri produced rain from eastern North Carolina northward through the middle U.S. Atlantic coastal region to southern New England where 2.00 to 5.00 inches was common, but upwards to 8.00 inches fell from eastern West

Virginia to western Long Island, New York.

o

Wind speeds were not excessive in coastal areas and Henri was downgraded to tropical storm status prior to reaching land Sunday afternoon

o

Henri remains a tropical depression over northern New England today and it will continue to move easterly toward Nova Scotia Canada over the next two days

·

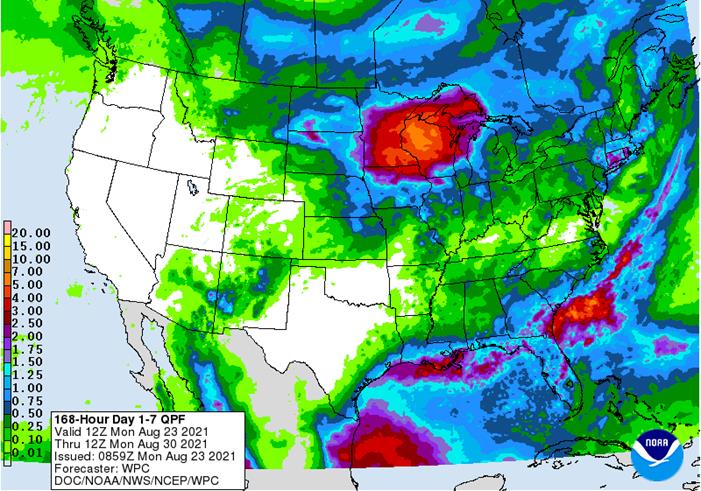

U.S. weather for the coming week

o

Rain will fall over the coming week in the northern Plains and Great Lakes region where 0.50 to 1.60 inches and a few totals of 2.00 to nearly 6.00 inches possible in parts of Minnesota and Wisconsin

o

Rainfall elsewhere will not likely be nearly as great resulting from erratic showers and thunderstorms

§

Amounts will vary from trace amounts to 0.75 inch

o

Net drying is expected in the central and southern Plains, the southwestern Corn Belt and in random locations form the Ohio River Valley into the middle Atlantic Coast region.

o

All of the far western U.S. including the Pacific Coast States and Great Basin will be dry

o

Temperatures will be above normal in much of the nation excepting the Pacific Northwest and areas from southern Texas to the southeastern states where readings will be near normal.

·

U.S. week two weather, August 30-September 5

o

Temporary cooling is likely in the Midwest and the northern U.S. Plains followed by some warming once again

o

Scattered showers and thunderstorms are expected, although the precipitation will be highly variable and erratic leading to many areas of net drying and a few areas of either status quo soil moisture or a temporary boost in topsoil

moisture

o

A new tropical cyclone will impact northeastern Mexico early next week with remnant moisture expected to drift into South Texas for a while

o

Another tropical cyclone “may” evolve and threaten the central Gulf of Mexico coast, although this event is too far out in time to have much confidence

§

The GFS advertised this event and confidence is very low

·

West Texas rainfall will be restricted during the coming week with temperatures seasonably warm

o

Some showers may evolve next week depending on the direction of movement the new tropical cyclone takes after reaching Tamaulipas, Mexico early next week

o

Warming is needed along with dry conditions for a while

·

South Texas rainfall will be minimal this week, but may increase next week in response to the new tropical cyclone

o

Harvest progress is expected to be slowed or stalled by rain next week due to rain

·

A new tropical disturbance is expected in the Caribbean Sea late this week off the coasts of Nicaragua and Honduras that may move across the Yucatan Peninsula as a tropical storm or hurricane this weekend

o

The storm will then move to the central and or upper east coast of Mexico early next week

o

Some rain from this event will impact those areas already impacted by heavy rain from Hurricane Grace during the weekend, although the greatest rain is expected to occur a little farther north in Tamaulipas, Mexico

§

Some rain from the storm may impact South Texas, as well

·

Hurricane Grace reached Veracruz Mexico Saturday as a Category 3 storm producing 125 mph maximum sustained wind speeds.

o

Winds died down to 110 mph as soon as the storm reached the coast and additional weakening occurred in the following few hours

o

Torrential rainfall to more than 10.00 inches resulted in mudslides and significant flooding

§

Damage to personal property and agriculture resulted, although the assessment of damage is just beginning

o

The remnants of Hurricane Grace moved across Central Mexico without much incident and the system became Tropical Storm Marty in the eastern Pacific Ocean overnight

§

Grace’s remnants (Marty) will not produce any additional adverse weather in Mexico or any part of North America

o

In the meantime, damage is suspected in citrus, sugarcane and perhaps some coffee areas, although coffee was probably not seriously harmed

·

Argentina weather during the weekend was mostly dry and mild to warm

·

Argentina is unlikely to get significant precipitation for the next ten days

o

Temperatures will be close to normal

·

Brazil weather during the weekend was dry except for a few showers in the far south

·

Brazil weather will trend wetter in the south this week from Rio Grande do Sul to Parana Tuesday into Saturday

o

Rainfall will vary from 0.30 to 1.50 inches with local totals over 3.00 inches near the coast of Parana, eastern Santa Catarina and southern Rio Grande do Sul

o

Some computer forecast models have suggested significant rain for much of Brazil’s agricultural region during the second half of next week through the first week of September.

§

A close watch on this advertised rain event is warranted, although it appears to be a little overdone and changes are expected in future model runs

o

Temperatures will trend a little cooler next week during the rainier period

·

Europe weekend precipitation was limited, and temperatures were seasonable

o

Rain fell mostly in the U.K. across northern and eastern France and parts of Germany to northern Poland and the Baltic States where rainfall was no more than 0.75 inch

·

CIS precipitation during the weekend was somewhat restricted, but some showers scattered around the region

o

Net drying occurred in many areas

o

Temperatures were seasonable in the west, but very warm from western Kazakhstan north into the central and southern New Lands

·

Europe rainfall this week will be greatest from eastern Germany, Australia and into a part of Belarus this week while dry weather occurs farther west

o

Some partial relief is expected in the drought stricken areas of the Balkan Countries later this week and more likely next week

o

Much of the region may get relief from dryness during the Aug. 30-Sep. 5 period, but confidence in the amount of rain that falls is still low

o

Temperatures will be mild to cool from central through eastern Europe this week and then a little warmer next week

·

CIS temperatures will be above normal again this week from southern and eastern Ukraine through the eastern Russia New Lands and Kazakhstan

o

Rainfall will be minimal east of the Ural Mountains region this week while scattered showers occur to the west

§

Much of the rain will be light, however, which may limit increases in topsoil moisture

·

India rain during the weekend was most limited in interior southern, far eastern and northwestern parts of the nation

o

Rain was greatest in Maharashtra, western Madhya Pradesh, southeastern Rajasthan, Haryana and Uttar Pradesh where amounts of 1.00 to 3.00 inches resulted with a few totals over 4.00 inches

§

Crop conditions remained mostly good for much of the nation, although the areas noted above that were a little drier biased do need greater rain

·

China rain during the weekend was greatest from Liaoning to Heilongjiang where 1.35 to more than 3.50 inches resulted

o

One location in southeastern Liaoning reported 5.00 inches

o

Parts of the region from southeastern Jilin to central Heilongjiang reported 3.50 to 7.52 inches of rain resulting in some flooding

o

Rain also fell significantly from northeastern Sichuan to Shaanxi and southwestern Shanxi as well as from Hubei to southern Shandong and northern Jiangsu where 2.50 to more than 7.00 inches resulted

§

One location in northeastern Sichuan reported 16.10 inches of rain

o

Net drying occurred in many other areas

o

Southwestern China (including Yunnan, Guizhou, Guangxi, Hunan and parts of Guangdong) were driest

·

China temperatures were seasonable during the weekend and will remain that way in both of the coming two weeks

·

Australia will get some much needed moisture in northeastern New South Wales and in a few Queensland winter crop areas early this week

o

Moisture totals will vary up to 0.30 inch in southeastern Queensland while 0.30 to 0.80 inch and local totals of 1.00 to 2.00 inches in northeastern New South Wales

o

Most other areas will be dry until late Wednesday into Friday when rain will develop in Western Australia and in several other coastal areas from South Australia into Victoria and western New South Wales

§

Moisture totals will vary up to 0.60 inch

o

Not much other precipitation is expected from late this week through mid-week next week

o

Rain will then return to southwestern Australia late next week that will move from west to east over the following weekend

§

New South Wales may be wettest Sep. 3-5

o

The bottom line will be favorable for wheat, barley and canola with an ongoing need for greater rain in Queensland

·

Australia rainfall during the weekend was restricted with only a few areas from Victoria to central New South Wales getting up to 0.25 inch of rain

o

A few locations in far southwestern parts of Western Australia also received some light rain while Queensland and South Australia were dry

·

Southeast Asia crop areas reported showers and thunderstorms during the weekend, but net drying occurred in many mainland production areas and in parts of the central and southern Philippines

o

Rainfall was greatest in Kalimantan and eastern Malaysia

o

Some relief from dryness also occurred in far southern Sumatra, Indonesia which was welcome to some rice, coffee and sugarcane areas

·

West-central Africa rainfall during the weekend included another boost in topsoil moisture in Ivory Coast where 0.71 to 1.42 inches resulted

o

Rain also fell significantly in Benin while Ghana rainfall was much more sporadic and light.

o

Most of the region will be impacted by rain at one time or another during the next couple of weeks maintaining good crop conditions

·

East-central Africa showers and thunderstorms have been timely and beneficial resulting in a good outlook for coffee, cocoa, rice, sugarcane and other crops that are produced from Ethiopia into Uganda and southwestern Kenya.

o

This trend will continue for the next ten days favoring good crop development

·

South Africa rainfall during the weekend was limited to a few showers in the eastern part of the nation and moisture totals were light

·

Showers in South Africa will be erratic and light most of this week

o

Week two rainfall, Aug. 30-Sep 5 will increase in southwestern parts of the nation

·

Southern Oscillation Index was +3.54 Sunday, and the index should move in a narrow range over the next week to ten days

·

Mexico rainfall will be more limited for a while this week – at least in the interior two-thirds of the nation

o

Rain will fall heavily in some eastern and western coastal areas

o

Torrential rainfall, excessive wind and considerable property and agricultural damage occurred in Veracruz during the weekend because of Hurricane Grace

o

A new tropical cyclone will threaten Tamaulipas and northern Veracruz early next week

·

Central America rainfall will be routine and sufficient to maintain a very good outlook for all crops in the region from Panama to Guatemala

Source:

World Weather Inc.

Monday,

Aug. 23:

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop conditions – corn, cotton, soybeans, wheat, 4pm - Monthly

MARS bulletin on crop conditions in Europe - Ivory

Coast cocoa arrivals

Tuesday,

Aug. 24:

- EU

weekly grain, oilseed import and export data - U.S.

poultry slaughter

Wednesday,

Aug. 25:

- EIA

weekly U.S. ethanol inventories, production - Malaysia

Aug. 1-25 palm oil export data - Unica

cane crush, sugar production (tentative)

Thursday,

Aug. 26:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - International

Grains Council monthly report - Port

of Rouen data on French grain exports

Friday,

Aug. 27:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

USDA

inspections versus Reuters trade range

Wheat

657,854 versus 300000-575000 range

Corn

724,784 versus 500000-950000 range

Soybeans

214,061 versus 100000-350000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING AUG 19, 2021

— METRIC TONS —

————————————————————————–

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 08/19/2021 08/12/2021 08/20/2020 TO DATE TO DATE

BARLEY

173 866 0 6,550 2,461

CORN

724,784 781,528 892,031 65,101,475 41,471,986

FLAXSEED

0 0 0 24 317

MIXED

0 0 0 48 0

OATS

0 0 0 100 800

RYE

0 0 0 0 0

SORGHUM

128,581 55,261 70,357 7,026,709 4,801,792

SOYBEANS

214,061 277,686 1,223,251 58,875,757 42,413,972

SUNFLOWER

0 0 0 240 0

WHEAT

657,854 560,640 569,593 5,663,570 6,232,666

Total

1,725,453 1,675,981 2,755,232 136,674,473 94,923,994

————————————————————————–

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

76

Counterparties Take $1135.697 Bln At Fed’s Fixed-Rate Reverse Repo (prev $1111.905 Bln, 78 Bidders)

-

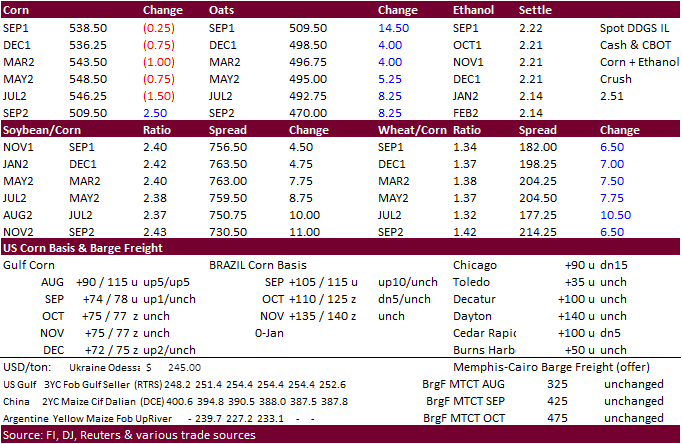

Corn

started higher but ended lower after buying dried. September was down 0.75 and December off 1.50 cents. Corn rallied early on light technical buying, USDA sales of 458,600 tons of new-crop corn to Mexico, and weekend weather showing some areas of the WCB

missed out on rain. Higher soybeans and wheat also added to the higher trade. Ongoing concerns the EPA could lower biofuel mandates and a Pro Farmer production estimate of 15.116 billion bushels limited gains. Cattle futures were up sharply after USDA reported

July placements less than the average trade guess. -

Funds

sold an estimated net 2,000 contracts.

-

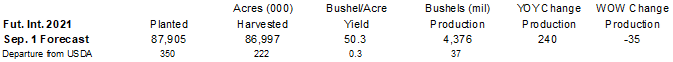

US

corn conditions for the combined good/excellent conditions fell two points from the previous week to 60 percent and compares to 64 year ago. Trade was looking for one point lower. We lowered our US corn yield from 174.5 to 173.6/bu per acre.

-

Rain

this week will be heaviest across the Minnesota and Wisconsin, and far northern IA.

-

USDA

US corn export inspections as of August 19, 2021 were 724,784 tons, within a range of trade expectations, below 781,528 tons previous week and compares to 892,031 tons year ago. Major countries included China for 340,775 tons, Mexico for 256,214 tons, and

Nicaragua for 26,542 tons.

-

AgRural:

Center-South corn area had been 79% harvested and 4.1% of new-crop corn had been planted.

Export

developments.

- Results

awaited: Qatar seeks about 100,000 tons of barley on August 18 for Sep-Nov delivery.

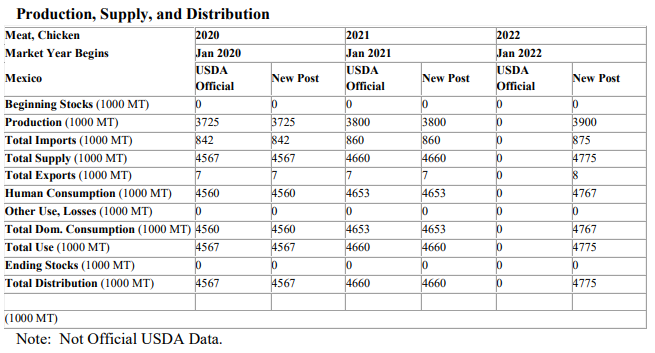

Mexico

chicken outlook via USDA Attaché

September

corn is seen is a $5.20-$5.60 range.

December

corn is seen in a $4.75-$6.00 range

-

The

CBOT complex traded higher early on Monday. Soybean meal turned lower before the electronic close on renewed oil/meal spreading, and prices eroded throughout the day session. Soybean oil supported the soybean market by traded sharply higher on technical

buying and $3.40/barrel rally in WTI crude oil. Soybeans lost steam to the upside by afternoon trading led by the nearby September contract (up 0.25). November soybeans ended 2.0 cents higher and May 2022 up 4.50 cents. US weather appears to be less threatening

this week although temperatures across many parts of the Corn Belt will be above normal. Note many of the outside related markets failed to follow the sharply lower US trade on Friday.

-

Funds

bought an estimated net 2,000 soybeans, sold 5,000 soybean meal, and bought 7,000 soybean oil.

-

US

soybean conditions for the combined good/excellent conditions fell one point from the previous week to 56 percent and compares to 69 year ago. Trade was looking for a one point decline. We lowered our US soybean yield from 50.7 to 50.3/bu per acre.

-

Traders

are awaiting details on EPA’s proposal to lower US biofuel mandates. -

USDA

US soybean export inspections as of August 19, 2021 were 214,061 tons, within a range of trade expectations, below 277,686 tons previous week and compares to 1,223,251 tons year ago. Major countries included China for 69,542 tons, Mexico for 55,196 tons, and

Indonesia for 6,319 tons. -

USAD

soybean inspections, like corn, are expected to fall short of USDA’s 2020-21 crop-year projection.

-

Cargo

surveyor SGS reported month to date August 20 Malaysian palm exports at 783,027 tons, down 9.9% from the same period a month ago. ITS reported a 10.1% decrease.

Export

Developments

- Results

awaited: South Korea’s Agro-Fisheries & Food Trade Corp. seeks 3,700 tons of non-GMO soybeans (August 19) for arrival between Oct. 20 and Nov. 19.

Updated

8/20/21

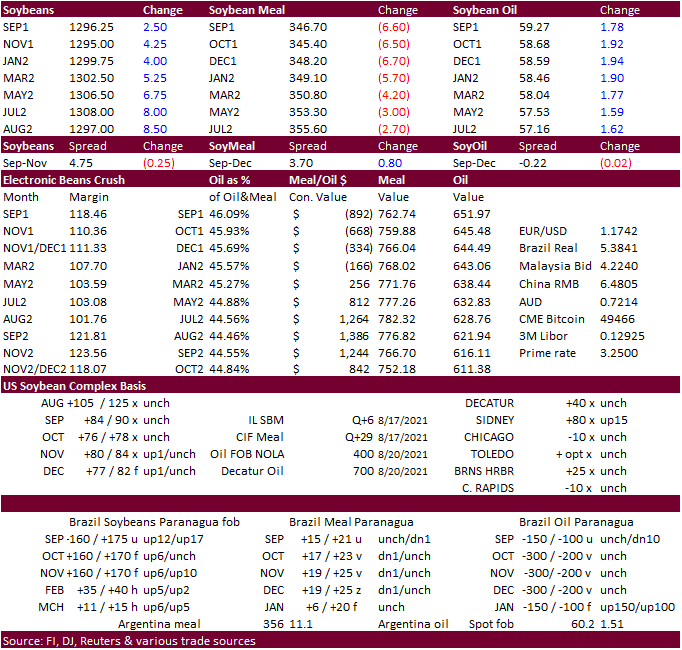

September

soybeans are seen in a $12.75-$13.50 range; November $11.75-$15.00

September

soybean meal – $345-$370; December $320-$425

September

soybean oil – 56-60; December 48-67 cent range

- US

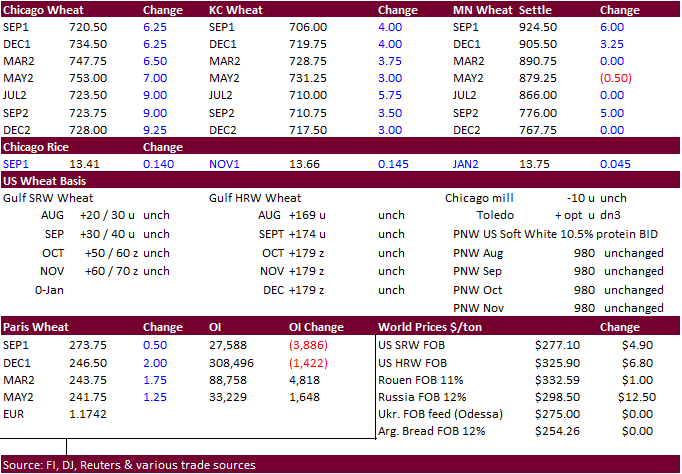

wheat futures traded higher for most of the day, but prices gave up some of the gains. Chicago and KC ended higher. MN ended mixed in the back months. USDA export inspections for wheat were very good. The USD was 54 points lower as of 2 pm CT. Global

import demand remains robust. Funds bought an estimated net 3,000 Chicago wheat contracts.

- The

US spring wheat is 77 percent complete with harvest, up from 58 percent last week and 55 percent 5-year average.

- USDA

US all-wheat export inspections as of August 19, 2021 were 657,854 tons, above a range of trade expectations, above 560,640 tons previous week and compares to 569,593 tons year ago. Major countries included China for 169,541 tons, Philippines for 118,156 tons,

and Korea Rep for 81,916 tons. - EU

wheat traded higher on quality concerns and higher US wheat futures. December Paris wheat was up 2.00 euros at $246.50 at the time this was written. September was up 0.50 euro at 273.50.

- EU’s

crop monitoring service MARS estimated the EU average soft wheat yield at 5.98 tons per hectare, down from 6.05 in July, but still 5.0% above the average EU soft wheat yield of the past five years.

- President

Putin said the Russian 2021 grain crop could end up around 127 million tons.

- IKAR

noted Russian 12.5% wheat from Black Sea ports for supply in September was $295 a ton (FOB) at the end of last week, up $8 from the previous week. SovEcon reported wheat prices were up $13 to $299 a ton.

- Russia

harvested 62.2 million tons of grain before drying and cleaning with an average yield of 3.13 tons per hectare as of Aug. 23 (AgMin).

- Pakistan

received offers for 400,000 tons of wheat for Sep/Oct shipment. Lowest was $355.99/ton.

- Mauritius

seeks 47,000 tons of wheat flour, optional origin, on Sept. 21 for various 2022 shipment.

- Turkey

confirmed they bought 245,000 tons of feed barley late last week. - Jordan

seeks 120,000 tons of feed barley on August 26. - Morocco

seeks 363,000 tons of US durum wheat under a tariff import quota on August 24 for shipment by December 31.

- Jordan

seeks wheat on Aug 25. - Bangladesh

seeks 50,000 tons wheat on September 1.

Rice/Other

- Egypt

seeks 200,000 tons of raw sugar for Oct-Dec shipment on August 28. - U.S.

FROZEN BEEF STOCKS 401.259 MLN LBS JULY 31 -USDA - U.S.

FROZEN PORK BELLY STOCKS 27.738 MLN LBS JULY 31 -USDA - U.S.

FROZEN ORANGE JUICE STOCKS 0.695 BLN LBS JULY 31 -USDA

Updated 8/17/21

December Chicago wheat is seen in a $6.80‐$8.25 range

December KC wheat is seen in a $6.60‐$8.00

December MN wheat is seen in a $8.45‐$9.80

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.