PDF Attached

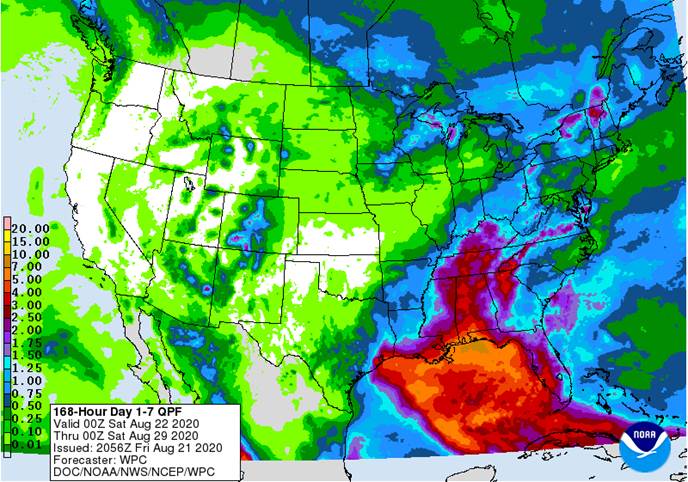

QPF 7-day Precipitation Forecast

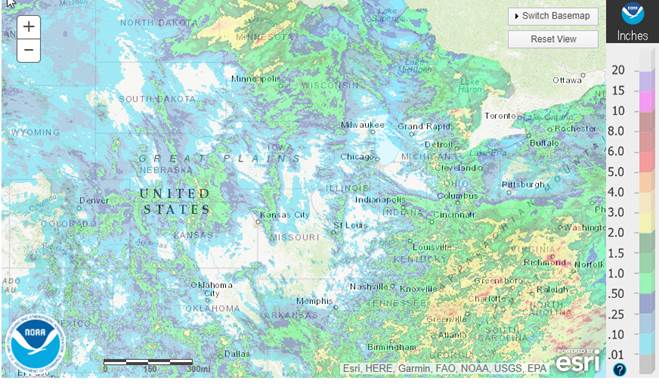

US Rainfall Last 7 days

MARKET WEATHER MENTALITY FOR CORN AND SOYBEANS:

U.S. weather will remain good for crop development over the next seven days, despite net drying in many areas. Weather in the last days of August and early September will trend a little wetter offering some relief to dryness in a part of the Midwest. Cooling is expected as well and that should help induce some better crop conditions even though moisture deficits will continue.

China weather will remain mostly favorable in key crop areas while India will experience a slowly increasing problem with excessive soil moisture and flooding. Australia crops will remain in favorable condition while the southwestern Canada Prairies will experience another week of drying.

Ontario and Quebec crops will remain good like those in many U.S. production areas.

Europe and the CIS weather will remain most stressful for crops in eastern and southern Ukraine into Russia’s Southern Region. Partial relief will occur in “some” crop areas in France while Germany and other areas in northeastern Europe experience good crop conditions.

Southeast Asia still needs greater rain in Indonesia while conditions in the Philippines and mainland areas of are improving.

Brazil early season corn planting conditions will improve following this week’s rain and colder weather.

Worry about drought in Argentina will slowly rise as September planting season gets closer for early corn. Showers next week during the middle part of the week will help improve early season topsoil moisture, but follow up rain will be very important.

Overall, weather today will likely provide a mixed influence on market mentality with a slight bullish bias.

MARKET WEATHER MENTALITY FOR WHEAT AND OTHER SMALL GRAINS

Harvest weather in Canada has been improving with the net drying conditions that have been prevailing recently. A mostly good harvest environment should continue. Harvesting in the northern Plains is advancing swiftly as well.

Europe harvest weather remains fair to good and the same is true for the western CIS. There is need for net drying in western parts of the CIS while the New Lands need to dry out to protect small grain quality.

Australia’s winter crops are in mostly good condition, although showers this weekend will be too brief and light for much change in soil moisture. Frost and freezes today and those coming during the weekend should not induce much permanent damage.

Eastern South Africa wheat areas are still too dry and need rain in the next few weeks to support reproduction.

Argentina rain next week will be welcome wherever it occurs, but there will be needed for much more rain to improve soil moisture enough to turn around wheat and barley production potentials. Southern Brazil cold today and that which is coming during the weekend should only damage a very small percentage of wheat.

Overall, weather today will produce a mixed influence on market mentality.

Source: World Weather Inc.

- ICE Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly update on crop conditions

- China International Cereals and Oils Industry Summit, day 2

- Malaysia palm oil export data for August 1-20

- U.S. cattle on feed, 3pm

SUNDAY, August 23:

- China customs publishes data on imports of corn, wheat, sugar and cotton

MONDAY, August 24:

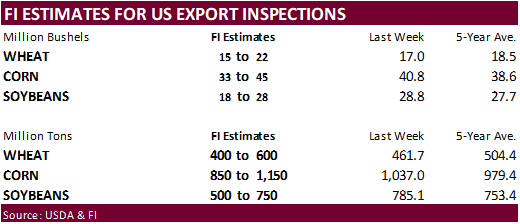

- USDA weekly corn, soybean, wheat export inspections, 11am

- U.S. crop conditions for soybeans, corn, cotton; wheat harvesting progress, 4pm

- Monthly MARS bulletin on crop conditions in Europe

- EU weekly grain, oilseed import and export data

- Brazil Unica sugar production, cane crush (tentative)

- U.S. cold storage data for pork and beef, poultry slaughter, 3pm

- Ivory Coast cocoa arrivals

- EARNINGS: IOI Corp, FGV

TUESDAY, August 25:

- China customs publishes country-wise soybean and pork import data

- Malaysia palm oil export data for August 1-25

WEDNESDAY, August 26:

- EIA U.S. weekly ethanol inventories, production, 10:30am

THURSDAY, August 27:

- USDA weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am

- International Grains Council monthly report

- Port of Rouen data on French grain exports

- EARNINGS: Sime Darby Plantation

FRIDAY, August 28:

- ICE Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly update on crop conditions

- U.S. agricultural prices paid, received, 3pm

Source: Bloomberg and FI

USDA August Monthly Cattle-on-Feed Report

Numbers USDA’s Average Range

2020 2019 estimated of analysts’ of analysts’

% of prev yr estimates estimates

On-feed Aug 1 11.284M 11.112M 102 100.8 99.7- 101.4

Placed in Jul 1.893M 1.705M 111 106.2 101.7- 108.7

Marketed in Jul 1.990M 2.002M 99 99.6 98.8- 101.5

Source: Dow Jones Newswires and FI

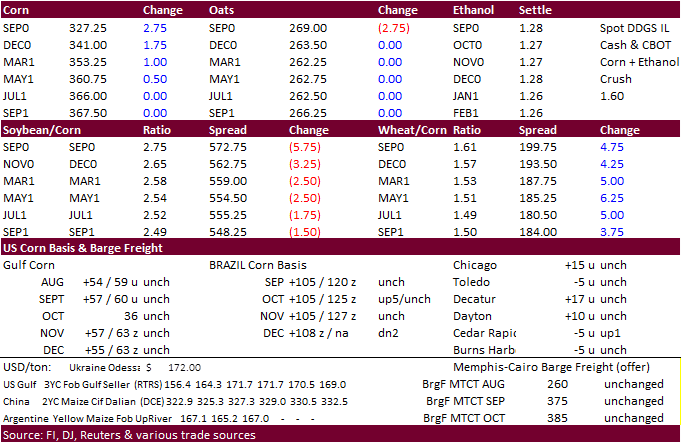

- US corn futures rose on export demand and Iowa crop damage reports from yesterday’s state tour.

- With the bullish news behind us, we have the weekly crop conditions and the next WASDE on September 11 for traders to focus on.

- France’s farm office, FranceAgriMer estimates their corn crop at 62% G/E for the week ending August 17, from 65% the week earlier.

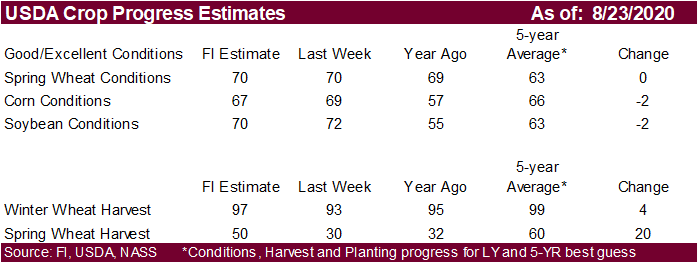

- US corn conditions are expected to be down 1-3 points when updated on Monday. Recall IA declined 10 points last week.

- EPA reported that the US generated 1.17 billion D6 ethanol blending credits in July compared to 1.07 billion D6 credits in June.

- Pro Farmer crop tour wrapped up and they issued final results of 177.5 bu/acre for corn on production of 14.82 billion bushels.

- Funds were and estimated net buyers of 8,000 corn contracts on the session.

- CFTC reported that corn specs cut net shorts by 61,636 to 132,622 contracts for the week ended August 18.

Corn Export Developments

- USDA 24-hour sales reported 405,000 tons of corn were sold to China for 2020/21 MY.

- Since China began their corn reserves sales program on May 28, they sold an estimated 52 million tons. This should be a record.

Updated 8/17/20

- September corn is seen in a $3.15 and $3.45 range. December $3.20-$3.65 range.

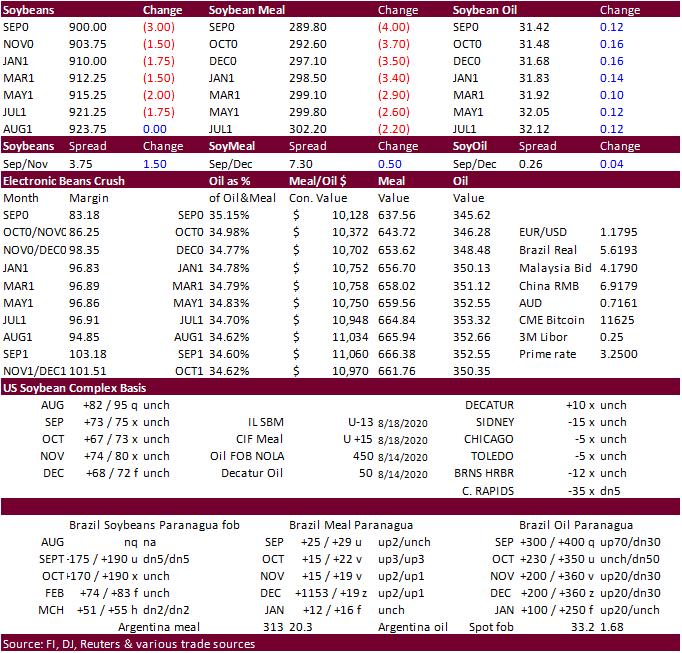

- Soybeans traded lower following meal and the chance of rain next week as two tropical storms converge in the US Gulf. Underpinning the soybean market was the large bean sale reported on the 24-hour window.

- China and the United States may hold trade electronic video talks over the next week to discuss the Phase 1 trade deal.

- We look for US soybean conditions to decline 1-2 points when updated Monday. Last week we saw IA soybean conditions fall 8 points (10 for corn) and expect a decline of 3-6 points this week from net drying bias western IA and additional data gathering from the derecho event.

- Palm oil ended the session down over 2% on weak export data and increased production out of Indonesia.

- EPA reported that the US generated 382 million D4 bio-diesel blending credits in July compared to 387 million D4 credits in June.

- Pro Farmer crop tour wrapped up and they issued final results of 52.5 bu/acre for soybeans on production of 4.3562 billion bushels.

- CFTC reported that soybean specs bought a net 76,495 contracts to flip to a net long of 68,411 contracts for the week ended August 18.

- Funds were a net estimated seller of 2,000 soybean contracts and 4,000 soymeal contracts and buyers of 1,000 bean oil on the session.

- USDA 24-hour sales reported 368,000 tons of soybeans were sold to unknown buyers for 2020/21 MY.

- USDA 24-hour sales reported 400,000 tons of soybeans were sold to China for 2020/21 MY.

- Syria seeks 50,000 tons of soybean meal and 50,000 tons of corn on Aug 25 for delivery within four months of contract signing.

- September soybeans are seen in a $8.80-$9.30 range. November $8.80-$9.50.

- September soybean meal is seen in a $285 to $310 range. December $285-$320.

- September soybean oil range is seen in a 30.00 to 33.50 range. December 29.75-35.00 range.

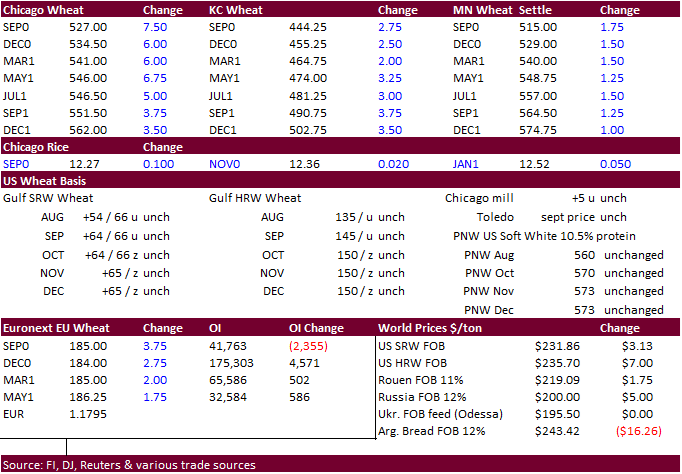

- US wheat futures traded higher on global production concerns and inflation hedge buying.

- Chicago December settled 6.50 cents higher. KC was up 4 cents (Dec) and MN up 1.50 cents (Dec).

- A Russian Ag Consultancy raised its forecast for the Russian 2020 wheat crop to 81.2 million tons from 80.9 million tons previously.

- The USD rose today, but is still near the lows, helping keep US wheat attractive to global buyers.

- Paris milling wheat ended up 2.75 euros to 183.75 euro/ton on Argentine cold weather.

- CFTC reported that wheat specs cut net shorts by 7,623 to 25,766 contracts for the week ended August 18.

- Funds were an estimated net 5,000 wheat contract buyer on the session.

- Results awaited: Pakistan seeks 1.5 million tons of wheat. Lowest offer was $233.85/ton for 200,000 tons of milling wheat.

- Turkey seeks 390,000 tons of red milling wheat and 110,000 tons of durum wheat on August 25. They also seeks feed barley.

- Red wheat shipment period is between Sep 4 and Oct 10

- Durum shipment period is between Sept. 15 and Oct. 10.

- Feed barley shipment period is between Sept. 11 and Sept. 25.

- Japan seeks 80,000 tons of feed wheat and 100,000 tons of feed barley (SBS) on August 26 for November 30 loading.

- Syria looks to sell and export 100,000 tons of feed barley with offers by Sep 1.

- Syria seeks 200,000 tons of soft wheat from EU/Russia on Sept. 9 and 200,000 tons of wheat from Russia on Sept. 14.

- Results awaited: South Korea’s Agro-Fisheries & Food Trade Corp. seeks 60,556 tons of rice from Vietnam and other origins, on Aug. 19, for arrival in South Korea between Dec. 31, 2020, and February 28, 2021.

Updated 8/17/20

- Chicago September is seen in a $4.90-$5.35 range. December $5.00-$5.50 range.

- KC September; $4.15-$4.55 range. December $4.30-$4.75.

- MN September $4.90-$5.25 range. December $5.05-$5.40.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.