PDF Attached

Wheat

rallied late, pairing much of the losses in corn Soybeans, meal and oil ended lower. No USDA 24-hour sales were posted today. Weather models are showing a good warmup for the US Midwest late this weekend into early next week, with precipitation limited

over the next week. China

sold just over 4 million tons of corn from reserves at an average price of 1,959 yuan per ton. Japan bought 117,063 tons of food wheat.

KEY

WEATHER ISSUES OF THE DAY

-

Tropical

Depression 13 has formed in the Atlantic and will pass to the northeast of the Greater Antilles this weekend -

The

most favored path for the storm is for it to move to the west of the Florida Peninsula until it gets close to the Panhandle and then a turn to the northeast is possible -

Wednesday’s

mid-day and evening model runs tried to shift the high pressure ridge off the Florida east coast to the west or intensify it to shift the storm farther to the west, but this solution does not look as viable today and a return to the old philosophy has returned

taking the storm inland through northwestern Florida and then across Georgia to the Carolinas -

Landfall

in northwestern Florida may occur during mid-week next week, but the storm may be large enough in size that western Florida could be impacted with heavy rain and breezy conditions as it moves northward off the west coast -

The

greatest wind and flooding rain will occur along the upper west coast of Florida’s peninsula and in the eastern half of the Panhandle -

Citrus

would not be seriously harmed if this path verifies, but some models are trying to bring the storm over the heart of the peninsula and some caution is advised -

Cotton,

corn, peanuts and soybeans from northern Florida and southern Georgia to the Carolinas might be impacted by some heavy rain and flooding, but not much excessive wind is expected based on the latest forecast data and the storm would probably have a low impact

other than flooding -

There

is still considerable time for change in this outlook -

Tropical

Wave in central Caribbean Sea is still expected to become a tropical depression prior to moving across the Yucatan Peninsula Saturday.

-

The

storm may break up as it moves across the Yucatan Peninsula and it will try to reorganize as it moves over the western Gulf of Mexico -

The

storm is most likely to impact the Texas coast early to mid-week next week and probably the lower or central coast, although confidence is still very low -

Heavy

rain and some windy conditions will accompany the storm, but its impact on agriculture will be low other than delaying some harvest activity -

Hurricane

Genevieve has brushed the southern Baja California, Mexico coast this morning producing tropical storm force wind and heavy rain over a part of the peninsula resulting in some minor damage to crops and structures -

The

storm has weakened to a category one hurricane and its most significant wind speeds remain just offshore at 80 mph. -

Genevieve

will move away from North America over the next few days and will likely dissipate over open water in the eastern Pacific Ocean late this weekend -

An

impressive cold surge will impact southeastern Australia over the next few days bringing snow to the mountains and freezes to crop areas of Victoria and southern New South Wales -

Some

frost and a few freezes may impact northern New South Wales and southern Queensland where winter wheat and barley may experience some threatening conditions -

Most

of the winter crops in this region are in the joint to boot stage with some heading in Queensland -

Crops

should handle temperatures to 28 degrees Fahrenheit (-2C) in northern New South Wales and to 30F (-1C) in Queensland -

World

Weather, Inc. does not believe there will be much, if any, permanent damage to crops -

Australia

rainfall in the coming week to ten days will be limited to southernmost parts of the nation with Victoria wettest

-

Dryness

remains a concern for Queensland and South Australia with some wheat and barley reproduction expected early next month in southern Queensland making rain very important

-

Argentina

temperatures were quite cold this morning with many 20- and 30-degree Fahrenheit lows -

Portions

of the drought-stricken Cordoba reported lows to 12 degrees Fahrenheit in the far west of the province while readings in the upper teens and 20s occurred elsewhere in the province -

The

drought helped these temperatures get colder than usual -

No

permanent crop damage was suspected, although vegetative development was burned by the freeze -

Some

of Cordoba’s crop might not have been planted and much of it may not have emerged or established well because of drought -

Argentina

still has a good chance for rain during the middle part of next week -

The

rain will offer relief from persistent dryness and should translate into improved winter crop conditions for Buenos Aires, southeastern Santa Fe and Entre Rios -

Some

relief from dryness is expected in Cordoba and the remainder of Santa Fe, but much more rain will have to occur before the drought can end and before concern over winter crop development will stop -

Concern

over spring planting moisture for early corn and sunseed has been rising recently too, but this rain event has to be followed by additional bouts of moisture to improve the planting prospects -

No

follow up rain is currently expected through September 4. -

Recent

rain in interior southern Brazil has saturated the soil once again and some winter crop areas are now too wet -

The

moisture will be good for future corn planting and the establishment of corn that has already been planted

-

More

rain will fall later today through Saturday in southern Brazil adding a little more concern over the wet bias for winter crops and expanding some moisture increases a little farther north in Sao Paulo -

Recent

rain in Brazil has likely induced some citrus and coffee flowering in northern Parana, Mato Grosso do Sul and southern Sao Paulo, but the key coffee areas of southern Minas Gerais have not been negatively impacted -

Rain

moving farther north today into Saturday will bring some moisture to coffee, northern citrus and northern sugarcane areas in Sao Paulo and some southern Minas Gerais and Zona de Mata locations, but the impact on coffee will be kept low with little to no flowering

expected -

Frost

and freezes will occur in southern Brazil wheat and corn production areas from Rio Grande do Sul to southern Parana over the next two mornings burning some wheat vegetative development -

There

is some concern over crops in southern Parana and Santa Catarina, but most of the wheat in those areas is not far enough advanced to be permanently harmed -

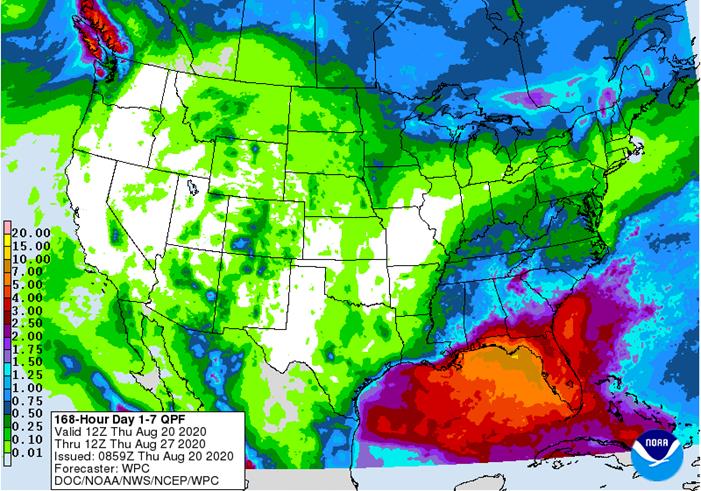

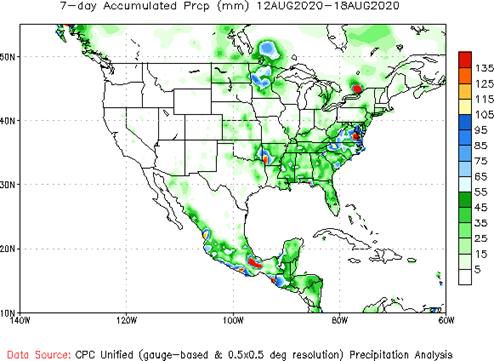

U.S.

Midwest, Plains and far western states will receive restricted amounts of rain over the next ten days -

Net

drying is expected in most areas except the far northern Midwest and from the Ohio River Valley into the Tennessee River Valley and southeastern states where scattered showers are likely -

Temperatures

will be seasonable in most of the Midwest, Delta and southeastern states into the weekend, but will trend warmer next week for a little while accelerating drying rates between showers and thunderstorms -

Temperatures

in the Great Plains will reach into the 90s frequently over the next week -

West

Texas will see a few showers, but no general soaking and temperatures will continue warm -

Far

western U.S. heat wave will continue to slowly abate -

Northern

U.S. Plains and Canada’s central and southwestern Prairies will experience restricted rainfall and warm to hot temperatures -

Some

of the greater rain advertised in the Midwest during the last days of August and early September is overdone and will not be a great as advertised by the GFS model run, although cooler air coming southward from Canada will help to induce some rainfall -

Cold

air advertised in Canada’s Prairies and the north-central United States August 31-September 3 is too intense and will not likely verify -

The

06z GFS model predicted the air would be cold enough for frost and freezes in these areas and that will not verify -

Excessive

heat occurred in the northwestern U.S. Plains and Canada’s central and southwestern Prairies Wednesday -

Afternoon

highs were in the 90s to 102 degrees from southern Saskatchewan and southern Alberta into Montana and the southwestern Prairies

-

Eastern

and southern Ukraine, Russia’s Southern Region, southeastern Romania and eastern Bulgaria will continue too dry for at least another ten days, despite a few sporadic showers -

Rain

is most likely from Moldova to eastern Bulgaria next week and it may bring a little relief to persistent dryness -

Any

showers that occur in eastern Ukraine or Russia’s Southern region will be minimal and offer little to no relief to persistent dryness -

Russia’s

central and eastern New Lands will receive rain the remainder of this week and into early next week, but drying may evolve shortly after that and the change will be welcome -

Some

areas in the region are becoming a little too wet and need to dry down to protect small grain and sunseed quality -

China

will continue to experience alternating periods of rain and sunshine during the coming week to ten days -

Most

of the nation east of Tibet has saturated soil and flooding has been an issue at times throughout the summer -

The

exception is the Yangtze River Basin where net drying has been occurring recently -

China’s

Yangtze River Basin is expected to trend wetter again next week and into early September, but flooding like that of earlier this summer is not expected -

Xinjiang

China will continue to experience milder than usual conditions at times over the next week and some rain will fall periodically in the northeast -

Recent

temperatures have been milder than usual which may be reducing some of the degree day accumulations for cotton and other crops -

India

will receive some heavy rain in central parts of the nation during the coming week to ten days -

Flooding

is expected in Madhya Pradesh, southern Rajasthan and parts of Gujarat as well as in a few areas southeast to West Bengal -

Rainfall

of 6.00 to more than 15.00 inches may occur by the end of next week -

Crop

damage is possible -

A

more limited rainfall pattern is expected in far southern India -

West-central

Africa will receive a few scattered showers and thunderstorms over the next few days offering some rain to the dry areas of Ivory Coast and Ghana -

The

precipitation will be welcome, but more will be needed after weeks of dryness -

Seasonal

rains will return to this area late this month and more likely in September -

The

longer range outlook calls for abundant rain in these areas later this year -

Europe

weather over the next ten days will bring brief periods of rain to many areas, but net drying will continue in central through southern France, Spain, southern Portugal, the Italian Peninsula and eastern Bulgaria to southern and eastern Romania and Moldova -

Crop

moisture stress will continue in each of these areas until greater rain falls -

Temperatures

will be near to above average over the next ten days

-

Western

CIS crop areas will experience an erratic rainfall pattern over the next ten days resulting in areas of net drying and some pockets of significant rain -

Drying

in the western parts of the CIS will be good for early season crop maturation and harvest progress

-

Late

season crops in the south will continue stressed, but good soil moisture in the north and west will support crops when rain is not falling -

Temperatures

will be seasonable -

Interior

southern Pakistan rainfall will be restricted over the next two weeks leaving rice, sugarcane and cotton dependent upon irrigation for normal crop development -

Temperatures

will be warmer than usual -

Some

areas near the India border will trend a little wetter for a few days -

Greater

rain is needed in parts of Myanmar, Cambodia and Vietnam, although very few areas are considered too dry -

Rain

is expected to fall periodically over these areas resulting in abundant soil moisture and some local flooding -

Indonesia

rainfall continued erratic Wednesday -

Recent

rain has been most significant in “portions” of Kalimantan and a few Malaysian locations while more limited in other areas -

Rainfall

over the next ten days will continue erratic, but at least some rain will fall in each production area at one time or another -

Rain

is needed most in parts of Sumatra and western Java -

Ontario

and Quebec weather is mostly good with alternating periods of rain and sunshine over the next two weeks -

Temperatures

will be seasonable -

South

Africa rain will continue periodically in the far south over the next week, but most of it will be near the coast and it will not be frequent enough to seriously bolster topsoil moisture for long term crop use -

Eastern

winter wheat and barley areas still need a general rain to support dryland crops which represent 8% of the total crop in the region -

Temperatures

will be cooler than usual -

Mexico

precipitation in the coming week to ten days will be greatest in western and southern parts of the nation benefiting many corn, sorghum and dry bean production areas -

Coffee,

citrus, sugarcane and many fruit and vegetable crops will also benefit -

Northeastern

Mexico will be mostly dry -

Some

of the region is still drought stricken -

Central

America rainfall will be frequent enough to support all crop needs -

New

Zealand rainfall will be above average this week except in southern parts of South Island where it will be lighter than usual

-

Southern

Oscillation Index was +6.31 this morning and it will continue to rise over the next few days

Source:

World Weather Inc.

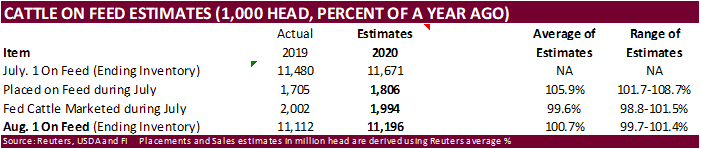

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Brazil

Conab sugar, cane and ethanol production - Port

of Rouen data on French grain exports - China

International Cereals and Oils Industry Summit - USDA

red meat production, 3pm - HOLIDAY:

Malaysia - EARNINGS:

Cherkizovo

FRIDAY,

August 21:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - China

International Cereals and Oils Industry Summit, day 2 - Malaysia

palm oil export data for August 1-20 - U.S.

cattle on feed, 3pm

Source:

Bloomberg and FI

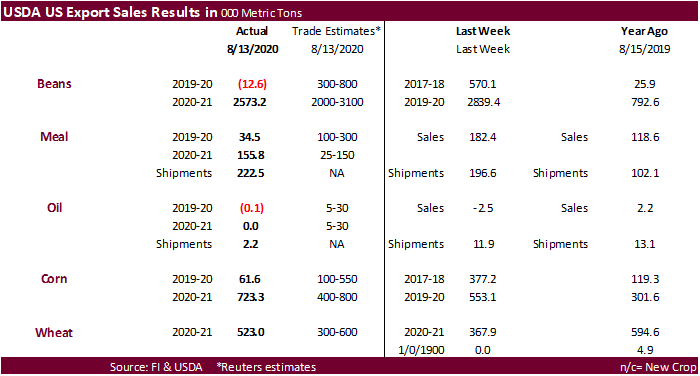

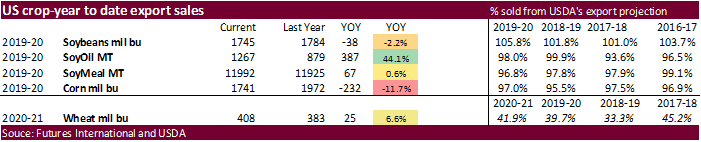

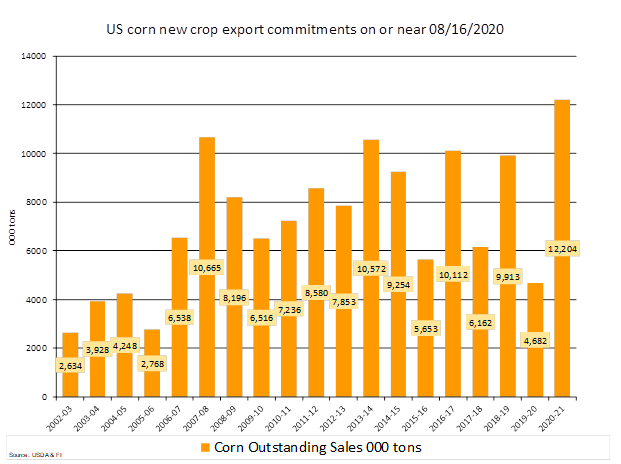

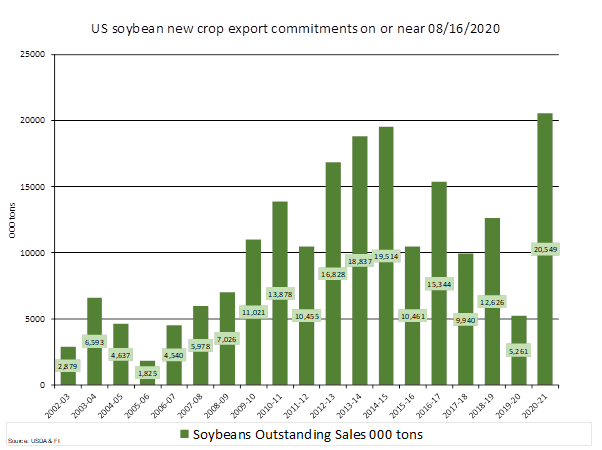

USDA

export sales

showed net reductions for current crop-year for soybean oil and soybeans. New-crop soybeans were excellent at 2.57 million tons but new-crop soybean oil were zero. Soybean meal sales were light. Corn export sales were thin for old crop and new-crop were

within expectations. All-wheat sales were within expectations. Pork sales were good at 20,600 tons. Sorghum sales were 122,000 tons for new-crop. Overall, the USDA export sales report might weigh on soybean oil futures prices and

US

Philly Fed Business Outlook Aug: 17.2 (est 20.8; prev 24.1)

US

Initial Jobless Claims Aug 15: 1106K (est 920K; prevR 971K; prev 963K)

US

Continuing Claims Aug 8: 14844K (est 15000K; prevR 15480K; prev 15486K)

-

US

corn futures traded lower on US/China trade concerns and ongoing field (tour) reports of good US corn yields for states outside storm damaged IA. A late rally in wheat paired losses in corn. Corn futures settled only 0.50 cent lower (all front month contracts

through Sep 2021). Oats saw bull spreading with Sep up 4 cents and December up 0.75 cent.

-

The

Pro Farmer crop tour: (results for MN and IA out later) -

Day

4…Minnesota – good yields, some evidence of wind/hail damage for some fields

-

Day

3…Western IA – below average -

Day

3…Illinois – 189.4 vs. 171.2 for 2019 and 181.5 average -

Day

2…Nebraska – 175.15 vs. 172.55 for 2019 and 172.38 average -

Day

2…Indiana – 179.84 vs. 161.46 for 2019 and 171.67 average -

Day

1…Ohio – 167.69 vs. 154.35 for 2019 and 166.18 average -

Day

1…South Dakota – 179.24 vs. 154.08 for 2019 and 160.02 average -

The

US dollar traded two-sided. -

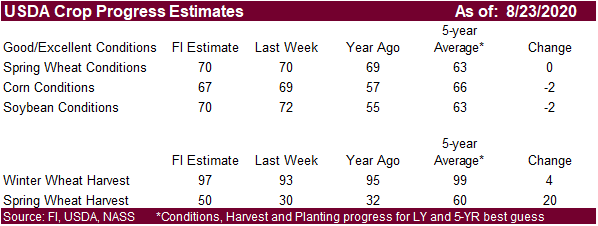

US

corn conditions are expected to be down 1-3 points when updated on Monday. Recall IA declined 10 points last week. Data collected this week suggests damage from the derecho storm was larger than we expected. Elsewhere, crop conditions are expected to improve.

-

US

interior basis for corn were up 5 cents at Decatur, Illinois, and 3 cents in Cincinnati, Ohio. Cedar Rapids, Iowa was down 1 cent.

-

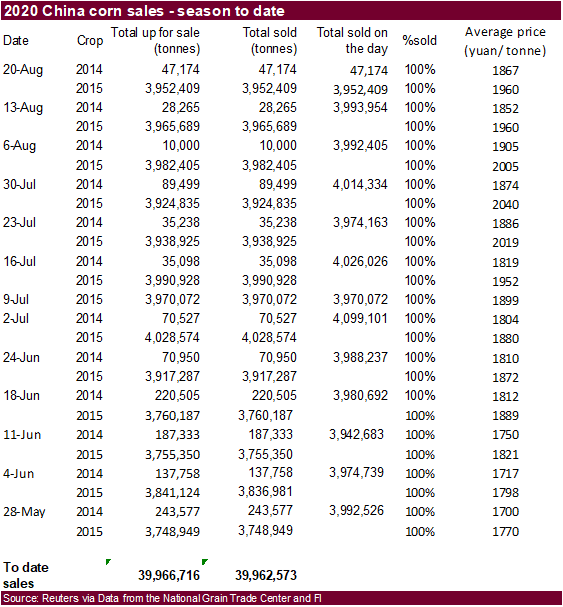

China

corn futures are still near a 5-year high. -

China

plans to sell 10,000 tons of pork from state reserves on August 21. About 500,000 tons have been sold so far this season.

Corn

Export Developments

-

China

sold just over 4 million tons of corn from reserves at an average price of 1,959 yuan per ton.

-

September

corn is seen in a $3.15 and $3.45 range. December $3.20-$3.65 range.

-

The

soybean complex traded lower with focus on bear spreading, dropping from a 7-month high made on Wednesday. September soybeans were down 9.50 cents and November off 8.25 cents. The Brazilian real traded as high as 5.6725. The Senate overturned a presidential

veto related to public servant wages. Note Brazilian producers get paid in USD. Lack of bullish news and high pod counts for selected states from the crop tour, excluding IA, added to the negative undertone.

-

Sep

soybean meal was down $1.90 and Sep soybean oil off 37 points. Sep/Oct soybean oil spreads corrected a touch.

-

Soybean

oil kicked off the bearish sentiment for the soybean complex, following a lower lead in China vegetable oils. Malaysia was on holiday. WTI crude oil was lower. USDA export sales for soybean oil were disappointing but current crop year to date commitments

are above a 5-year average for this time of year. -

Old

crop soybean sales were also disappointing but new crop was as expected, and large. New-crop soybean outstanding sales for this time of year are now at a record. Soybean meal sales were ok.

-

We

look for US soybean conditions to decline 1-2 points when updated Monday. Last week we saw IA soybean conditions fall 8 points (10 for corn) and expect a decline of 3-6 points this week from net drying bias western IA and additional data gathering from the

derecho event. -

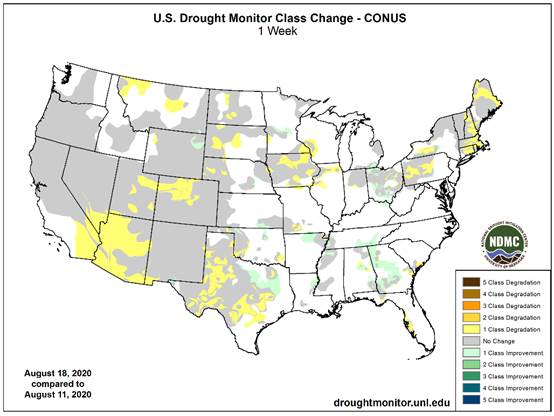

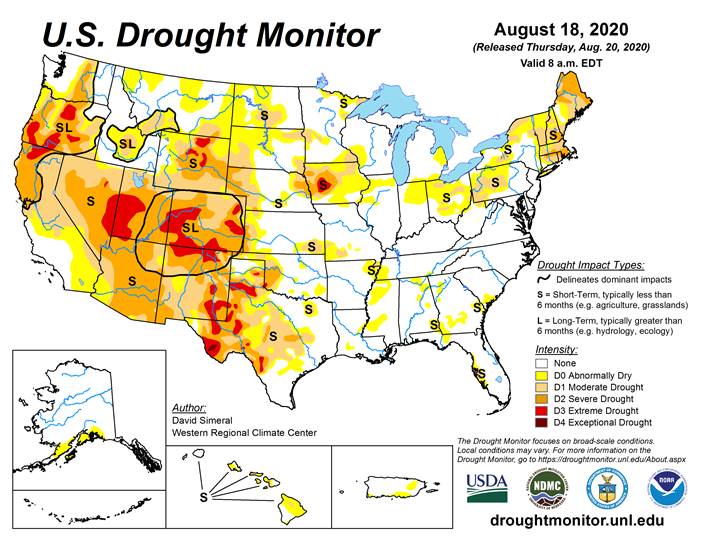

Note

drought conditions expanded across IA and northern IL for the week ending August 18.

https://droughtmonitor.unl.edu/data/chng/png/20200818/20200818_conus_chng_PW.png

-

China

and the United States may hold trade talks over the next week to discuss the Phase 1 trade deal. -

The

CME Group plans to launch a new South America soybean (PLATTS) futures contract on September 21.

-

We

heard China bought 1-2 US Q4 Gulf soybean cargoes on Wednesday. -

The

Pro Farmer crop tour: -

Day

4…Minnesota – good pod counts (results for MN and IA out later) -

Day

3…Western IA – below average -

Day

3…Illinois – 1247.38 vs. 997.68 for 2019 and 1185.79 average -

Day

2…Nebraska – 1297.93 vs. 1210.83 for 2019 and 1213.64 average -

Day

2…Indiana – 1281.12 vs. 923.94 for 2019 and 1134.86 average -

Day

1…Ohio – 1155.68 pods vs. 764.01 for 2019 and 1039.74 average -

Day

1…South Dakota – 1250.86 pods vs. 832.85 for 2019 and 919.04 average

·

AmSpec reported Aug 1-20 Malaysian palm exports at 925,083 tons, down 20.9 percent from July 1-20 of 1.171MMT.

·

ITS reported an 18.2 percent decrease to 946,338 tons.

-

No

USDA 24-hour sales were posted. -

Syria

seeks 50,000 tons of soybean meal and 50,000 tons of corn on Aug 25 for delivery within four months of contract signing.

-

September

soybeans are seen in a $8.80-$9.30 range. November $8.80-$9.50. -

September

soybean meal is seen in a $285 to $310 range. December $285-$320. -

September

soybean oil range is seen in a 30.00 to 33.50 range. December 29.75-35.00 range.

-

US

wheat futures

traded mixed but rallied in afternoon trading to close higher. Some traders noted cold temperatures could have negatively impacted the Argentina wheat crop but our weather person believes minimal damage occurred. Production concerns spanning across parts

of Europe added to the positive undertone. Global import interest was robust earlier this week. It will be interesting if Pakistan bought the 1.5 million tons of wheat, they sought earlier this week.

-

Chicago

September ended at an August 4 high, appreciating 7.50 cents while December settled 6.50 cents higher. KC was up 4 cents (Sep) and MN up 2.50 cents (Sep).

-

Kazakhstan

harvested 14 percent of their grain as of August 20, about double from a year ago.

-

Results

are awaited on Pakistan in for wheat. Lowest

offer was $233.85/ton for 200,000 tons of milling wheat. -

China

has booked roughly 700,000 tons of wheat from France so far since June 1, and another 700,000 tons of barley. These large bookings, which could expand by 1-2 million tons later in the crop year by China, may impact feedgrain supplies for Europe, enticing

end users to source soybean/canola meal and corn from North America. -

Paris

December wheat was down 0.50 euro at 181.25 euros or $214.87/ton.

-

Results

awaited: Pakistan seeks 1.5 million tons of wheat. Lowest offer was $233.85/ton for 200,000 tons of milling wheat.

-

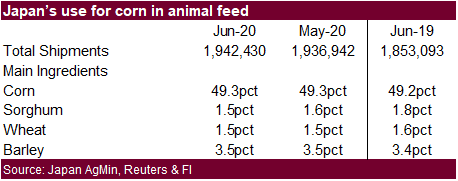

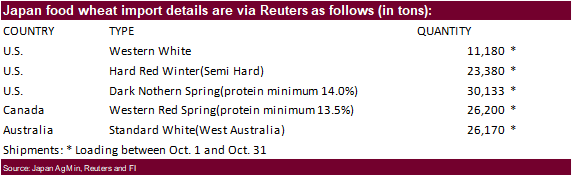

Japan

bought 117,063 tons of milling wheat.

-

Turkey

seeks 390,000 tons of red milling wheat and 110,000 tons of durum wheat on August 25. They also seeks feed barley.

-

Red

wheat shipment period is between Sep 4 and Oct 10 -

Durum

shipment period is between Sept. 15 and Oct. 10. -

Feed

barley shipment period is between Sept. 11 and Sept. 25. -

Japan

seeks 80,000 tons of feed wheat and 100,000 tons of feed barley (SBS) on August 26 for November 30 loading.

-

Syria

looks to sell and export 100,000 tons of feed barley with offers by Sep 1.

-

Syria

seeks 200,000 tons of soft wheat from EU/Russia on Sept. 9 and 200,000 tons of wheat from Russia on Sept. 14.

Updated

8/17/20

-

Chicago September is seen in a $4.90-$5.35 range. December $5.00-$5.50

range. -

KC September; $4.15-$4.55 range. December $4.30-$4.75.

-

MN September $4.90-$5.25 range. December $5.05-$5.40.

U.S. EXPORT SALES FOR WEEK ENDING 8/13/2020

FAX 202-690-3275

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR |

CURRENT YEAR |

YEAR |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

188.2 |

1,642.5 |

1,519.6 |

104.0 |

2,367.0 |

2,515.5 |

0.0 |

0.0 |

|

SRW |

46.7 |

691.1 |

688.3 |

34.0 |

384.9 |

624.0 |

0.0 |

0.0 |

|

HRS |

129.7 |

1,877.6 |

1,510.9 |

105.0 |

1,430.0 |

1,293.5 |

0.0 |

5.0 |

|

WHITE |

90.6 |

1,244.8 |

947.0 |

164.0 |

1,012.0 |

878.1 |

0.0 |

0.0 |

|

DURUM |

67.9 |

254.9 |

296.5 |

0.0 |

209.3 |

148.1 |

0.0 |

0.0 |

|

TOTAL |

523.0 |

5,710.9 |

4,962.3 |

406.9 |

5,403.2 |

5,459.3 |

0.0 |

5.0 |

|

BARLEY |

0.0 |

31.1 |

46.5 |

0.3 |

8.2 |

10.2 |

0.0 |

0.0 |

|

CORN |

61.6 |

3,002.5 |

2,172.4 |

1,197.0 |

41,218.9 |

47,930.9 |

723.3 |

12,203.6 |

|

SORGHUM |

-4.6 |

289.1 |

85.0 |

48.5 |

4,340.0 |

1,639.8 |

122.0 |

1,845.1 |

|

SOYBEANS |

-12.7 |

5,534.2 |

4,499.3 |

899.0 |

41,963.8 |

44,118.8 |

2,573.2 |

20,548.7 |

|

SOY MEAL |

34.5 |

1,464.0 |

1,848.3 |

222.5 |

10,528.0 |

10,076.9 |

155.8 |

1,211.2 |

|

SOY OIL |

-0.2 |

175.3 |

144.7 |

2.2 |

1,091.4 |

734.5 |

0.0 |

80.7 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

2.3 |

144.8 |

272.5 |

22.3 |

26.7 |

92.8 |

0.0 |

0.0 |

|

M S RGH |

0.0 |

28.1 |

27.3 |

0.1 |

0.8 |

1.5 |

0.0 |

0.0 |

|

L G BRN |

0.9 |

9.0 |

1.1 |

0.8 |

1.5 |

1.3 |

0.0 |

0.0 |

|

M&S BR |

0.1 |

30.1 |

0.1 |

0.8 |

1.7 |

0.2 |

0.0 |

0.0 |

|

L G MLD |

18.7 |

54.8 |

190.5 |

2.7 |

6.0 |

84.0 |

0.0 |

0.0 |

|

M S MLD |

3.2 |

54.4 |

97.5 |

14.6 |

19.1 |

33.4 |

0.0 |

0.0 |

|

TOTAL |

25.2 |

321.2 |

589.0 |

41.2 |

55.8 |

213.2 |

0.0 |

0.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

128.0 |

5,995.0 |

7,247.8 |

421.5 |

700.1 |

690.9 |

4.9 |

321.1 |

|

PIMA |

16.7 |

181.2 |

125.6 |

8.5 |

14.1 |

23.1 |

0.0 |

0.0 |

This

summary is based on reports from exporters for the period August 7-13, 2020.

Wheat: Net

sales of 523,000 metric tons (MT) for 2020/2021 were up 42 percent from the previous week, but down 8 percent from the prior 4-week average. Increases primarily for the Philippines (182,900 MT), Brazil (90,000 MT), unknown destinations (86,000 MT), Mexico

(79,500 MT, including decreases of 11,000 MT), and Italy (65,800 MT, including 10,000 MT switched from unknown destinations and decreases of 100 MT), were offset by reductions for Indonesia (20,000 MT). Exports of 406,900 MT were down 13 percent from the

previous week and 23 percent from the prior 4-week average. The destinations were primarily to Japan (133,000 MT), Mexico (97,900 MT), Sri Lanka (65,500 MT), Yemen (47,200 MT), and South Korea (28,000 MT).

Corn:

Net sales of 61,600 MT for 2019/2020 were down 84 percent from the previous week and 63 percent from the prior 4-week average. Increases primarily for Japan (70,200 MT, including 64,900 MT switched from unknown destinations), Colombia (52,300 MT, including

50,000 MT switched from unknown destinations and decreases of 8,400 MT), Guatemala (26,800 MT, including 32,000 MT switched from El Salvador and decreases of 4,800 MT), Mexico (10,600 MT, including decreases of 3,400 MT), and China (8,600 MT), were offset

by reductions for unknown destinations (87,600 MT), El Salvador (29,200 MT), and Peru (8,000 MT). For 2020/2021, net sales of 723,300 MT were primarily for unknown destinations (365,100 MT), Mexico (94,800 MT), South Korea (66,200 MT), Japan (55,500 MT),

and Taiwan (41,300 MT). Exports of 1,197,000 MT were down 10 percent from the previous week, but up 19 percent from the prior 4-week average. The destinations were primarily to China (382,400 MT), Mexico (297,800 MT), Japan (210,000 MT), Colombia (112,000

MT), and Guatemala (98,700 MT).

Optional

Origin Sales:

For 2019/2020, the current outstanding balance of 390,000 MT is for South Korea (260,000 MT), Vietnam (65,000 MT), and Taiwan (65,000 MT). For 2020/2021, the current outstanding balance of 260,000 MT is for Vietnam (195,000 MT) and South Korea (65,000 MT).

Barley:

No net sales for 2020/2021 were reported for the week. Exports of 300 MT were down 93 percent from the previous week and 77 percent from the prior 4-week average. The destination was Taiwan.

Sorghum:

Net sales reductions of 4,600 MT for 2019/2020 were down noticeably from the previous week and from the prior 4-week average. Increases reported for China (48,400 MT, including 48,500 MT switched from unknown destinations and decreases of 100 MT), were more

than offset by reductions for unknown destinations (53,000 MT). For 2020/2021, net sales of 122,000 MT were reported for unknown destinations (68,000 MT) and China (54,000 MT). Exports of 48,500 MT were down 90 percent from the previous week and 77 percent

from the prior 4-week average. The destination was China.

Rice:

Net

sales of 25,200 MT for 2020/2021 were primarily for Haiti (15,300 MT), Mexico (5,000 MT), Canada (1,900 MT, including decreases of 300 MT), Saudi Arabia (1,800 MT), and South Korea (400 MT). Exports of 41,200 MT were primarily to Mexico (23,300 MT), Japan

(12,000 MT), Canada (1,700 MT), Saudi Arabia (900 MT), and Taiwan (900 MT).

Soybeans:

Net sales reductions of 12,700 MT for 2019/2020–a marketing-year low–were down noticeably from the previous week and from the prior 4-week average. Increases primarily for the Netherlands (137,000 MT, including 132,000 MT switched from unknown destinations

and decreases of 3,200 MT), Indonesia (88,800 MT, including 49,800 MT switched from unknown destinations and decreases of 600 MT), Spain (40,000 MT, switched from unknown destinations), Japan (38,700 MT, including 36,200 MT switched from unknown destinations

and decreases of 200 MT), and France (23,000 MT, including 25,000 MT switched from unknown destinations and decreases of 2,000 MT), were offset by reductions for unknown destinations (342,800 MT) and China (32,800 MT). For 2020/2021, net sales of 2,573,200

MT were primarily for China (1,654,000 MT), unknown destinations (701,000 MT), Pakistan (66,000 MT), Bangladesh (55,000 MT), and Taiwan (24,000 MT). Exports of 899,000 MT were down 19 percent from the previous week, but up 22 percent from the prior 4-week

average. The destinations were primarily to China (411,500 MT), the Netherlands (137,000 MT), Mexico (80,000 MT), Indonesia (77,600 MT), and Japan (41,600 MT)

Exports

for Own Account:

For 2019/2020, the current exports for own account outstanding balance is 61,600 MT, all Canada.

Soybean

Cake and Meal:

Net sales of 34,500 MT for 2019/2020–a marketing-year low– were down 81 percent from the previous week and 77 percent from the prior 4-week average. Increases primarily for Canada (19,400 MT, including decreases of 200 MT), the Philippines (6,900 MT), Honduras

(3,100 MT, including decreases of 100 MT), Taiwan (3,000 MT), and Sri Lanka (2,100 MT), were offset by reductions for Colombia (6,000 MT) and Israel (1,000 MT). For 2020/2021, net sales of 155,800 MT were primarily for Mexico (54,000 MT), unknown destinations

(33,000 MT), Canada (20,000 MT), Morocco (15,000 MT), and Honduras (14,400 MT). Exports of 222,500 MT were up 13 percent from the previous week and 9 percent from the prior 4-week average. The destinations were primarily to the Philippines (95,800 MT), Colombia

(38,000 MT), Israel (26,400 MT), Canada (23,000 MT), and Mexico (20,000 MT).

Soybean

Oil: Net

sales reductions of 200 MT for 2019/2020 resulting in increases for Canada (600 MT, including decreases of 800 MT), Mexico (200 MT), and Belgium (100 MT), were more than offset by reductions for unknown destinations (1,000 MT). Exports of 2,200 MT were down

82 percent from the previous week and 92 percent from the prior 4-week average. The destinations were primarily to Canada (1,700 MT), Mexico (400 MT), and Belgium (100 MT).

Cotton:

Net sales of 128,000 RB for 2020/2021 primarily for China (56,800 RB), Vietnam (24,800 RB, including 3,300 RB switched from South Korea), Bangladesh (22,000 RB), Pakistan (14,800 RB, including decreases of 2,400 RB), and Mexico (11,700 RB), were offset by

reductions primarily for Indonesia (3,500 RB), South Korea (3,300 RB), and Honduras (1,400 RB). For 2021/2022, net sales of 4,900 RB resulting in increases for Indonesia (9,300 RB), were offset by reductions for Malaysia (4,400 RB). Exports of 421,500 RB

were primarily to China (192,000 RB, including 12,900 RB late – see below), Vietnam (82,100 RB, including 9,900 RB late – see below), Turkey (44,800 RB, including 17,000 late – see below), Pakistan (26,800 RB), and Indonesia (19,200 RB, including 4,100 RB

late – see below). Net sales of Pima totaling 16,700 RB were primarily for India (8,100 RB), China (2,600 RB), Pakistan (1,800 RB), Turkey (1,600 RB), and Bahrain (900 RB). Exports of 8,500 RB were primarily to India (3,100 RB), China (2,300 RB), Pakistan

(1,600 RB), Italy (400 RB), and Bangladesh (300 RB).

Exports

for Own account:

For 2020/2021, new exports for own account totaling 7,400 RB were to China (3,600 RB), Vietnam (3,000 RB), and Malaysia (800 RB). Exports for own account totaling 9,300 RB to China (8,400 RB) and Vietnam (900 RB) were applied to new or outstanding sales.

The current exports for own account outstanding balance of 30,600 RB is for China (19,400 RB), Indonesia (3,900 RB), Malaysia (3,300 RB), Vietnam (3,000 RB), and Bangladesh (1,000 RB).

Late

Reporting:

For 2020/2021, exports totaling 47,900 RB were reported late. The destinations were to Turkey (17,000 RB), China (12,900 RB), Vietnam (9,900 RB), Indonesia (4,100 RB), Egypt (1,100 RB), Mexico (900 RB), Thailand (900 RB), Honduras (500 RB), Bangladesh (500

RB), and South Korea (100 RB).

Hides

and Skins:

Net sales of 640,300 pieces for 2020 were up 49 percent from the previous week and 57 percent from the prior 4-week average. Increases primarily for China (545,100 whole cattle hides, including decreases of 16,200 pieces), South Korea (37,300 whole cattle

hides, including decreases of 4,500 pieces), Mexico (30,800 whole cattle hides, including decreases of 700 pieces), Cambodia (12,000 whole cattle hides), and Taiwan (8,700 whole cattle hides), were offset by reductions for Indonesia (100 whole cattle hides)

and Japan (100 pieces). Additionally, net sales reductions of 400 kip skins were reported for Belgium. Exports of 478,800 pieces reported for 2020 were up 2 percent from the previous week and from the prior 4-week average. Whole cattle hides exports were

primarily to China (383,200 pieces), Mexico (38,500 pieces), South Korea (25,200 pieces), Brazil (7,400 pieces), and Vietnam (3,900 pieces). In addition, exports of calf skins were to Italy (10,400 calf skins) and kip skins to Belgium (3,800 kip skins).

Net

sales of 258,700 wet blues for 2020 were up 92 percent from the previous week and up noticeably from the prior 4-week average. Increases were primarily for Thailand (68,100 unsplit), China (67,300 unsplit , including decreases of 1,100 unsplit), Vietnam (51,700

unsplit), Italy (43,900 unsplit, including decreases of 100 unsplit), and India (14,900 unsplit). Exports of 98,000 wet blues for 2020 were up 2 percent from the previous week, but down 8 percent from the prior 4-week average. The destinations were primarily

to China (40,000 unsplit), Italy (26,700 unsplit and 4,500 grain splits), Thailand (7,800 unsplit), Mexico (3,800 grain splits and 2,600 MT unsplit), and Brazil (3,800 grain splits). Net sales of 37,700 splits reported for China (38,100 pounds, including

decreases of 3,200 pounds), were offset by reductions for Vietnam (500 pounds). Exports of 321,000 pounds were to Vietnam (280,000 pounds) and China (41,000 pounds).

Beef:

Net

sales of 20,000 MT reported for 2020 were up 69 percent from the previous week and 13 percent from the prior 4-week average. Increases primarily for South Korea (8,700 MT, including decreases of 400 MT), Japan (4,800 MT, including decreases of 300 MT), Taiwan

(1,800 MT, including decreases of 100 MT), Mexico (1,600 MT, including decreases of 100 MT), and Hong Kong (1,100 MT, including decreases of 200 MT), were offset by reductions primarily for China (500 MT) and Colombia (100 MT). For 2021, net sales of 500

MT were primarily for Canada (400 MT). Exports of 18,300 MT were up 9 percent from the previous week and 8 percent from the prior 4-week average. The destinations were primarily to Japan (5,800 MT, including 800 MT late – see below), South Korea (5,400 MT),

Taiwan (1,800 MT), Canada (1,200 MT), and Mexico (1,100 MT).

Late

Reporting:

For 2020, exports totaling 800 MT were reported late. The destination was Japan.

Pork:

Net

sales of 20,600 MT reported for 2020 were up 97 percent from the previous week, but down 27 percent from the prior 4-week average. Increases primarily for Mexico (7,800 MT, including decreases of 300 MT), China (6,500 MT, including decreases of 6,700 MT),

Japan (2,400 MT, including decreases of 300 MT), Canada (1,900 MT, including decreases of 400 MT), and South Korea (900 MT, including decreases of 1,000 MT), were offset by reductions primarily for Australia (800 MT) and New Zealand (300 MT). For 2021, total

net sales of 100 MT were for Australia. Exports of 31,800 MT were down 9 percent from the previous week and 7 percent from the prior 4-week average. The destinations were primarily to Mexico (9,900 MT), China (9,500 MT), Japan (4,200 MT), Canada (2,300 MT),

and South Korea (1,400 MT).

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.