PDF Attached

Wheat

advanced on strong global import demand and crop concerns for parts of Europe. Soybean complex was little changed while corn fell on lack of bullish news and China/US trade concerns.

![]()

KEY

WEATHER ISSUES OF THE DAY

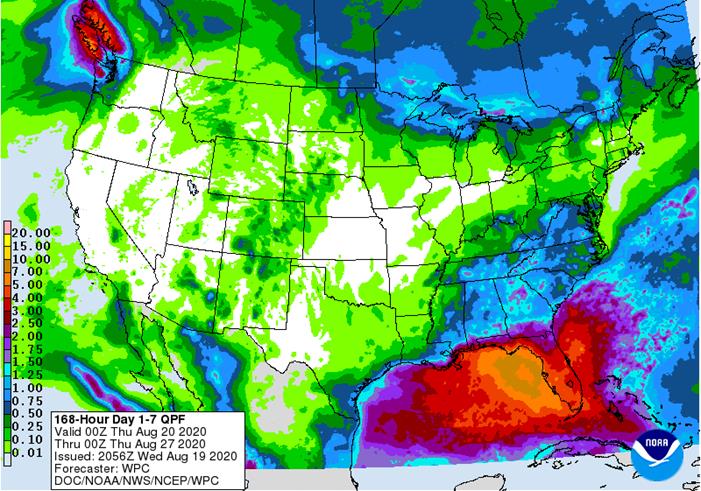

- Tropical

Storm Higos moved into Guangdong, China Tuesday and was dissipating today over the interior of that state - Some

flooding and strong wind impacted coastal areas - Tropical

waves in the Caribbean Sea and tropical Atlantic Ocean are still being monitored for impact on North America - A

tropical wave in the Caribbean Sea will reach the Yucatan Peninsula this weekend as a tropical depression or a weak tropical storm - The

system will then move over the Gulf of Campeche later in the weekend or early next week with landfall in northeastern Mexico expected early in the week - A

tropical wave 1000 miles east of the Windward Islands will become a tropical depression and probably a tropical storm as it moves through the northern Leeward Islands and to near Puerto Rico this weekend - The

storm will them move through Hispaniola and Cuba before reaching the eastern Gulf of Mexico

- Landfall

will be possible between New Orleans and Tampa, Florida, during mid-week next week, but confidence is very low because of its interaction with the Greater Antilles - Hurricane

Genevieve continues east of western Mexico and will stay out to sea far enough to minimize its impact on western Mexico; however, some wind, rain and rough seas will impact a part of Baja California in the next few days - Better

model agreement is in place today for the U.S. outlook over the next week to ten days after Tuesday’s GFS model runs were too wet - U.S.

Midwest, Plains and far western states will receive restricted amounts of rain over the next ten days - Net

drying is expected in most areas except the far northern Midwest and from the Ohio River Valley into the Tennessee River Valley and southeastern states where scattered showers are likely - Temperatures

will be seasonable in most of the Midwest, Delta and southeastern states, but warmer biased at times in the Great Plains and far western United States - West

Texas will see a few showers, but no general soaking and temperatures will continue warm - Far

western U.S. heat wave will continue to slowly abate - Northern

U.S. Plains and Canada’s central and southwestern Prairies will experience restricted rainfall and warm to hot temperatures - Excessive

heat occurred in the northwestern U.S. Plains and Canada’s central and southwestern Prairies Tuesday - Afternoon

highs were in the 90s to 103 degrees from southern Saskatchewan and southern Alberta into Montana and the southwestern Prairies

- Argentina

is still quite dry, but has a chance for rain during mid-week next week - Drought

threatens the nation’s wheat crop and possibly early season corn planting later next month - Rain

next week will vary from 0.20 to 0.75 inch with a few greater amounts - Driest

in the west and north and wettest southeast - Southern

Brazil has received enough rain to bolster soil moisture in much of the region recently

- Wheat

quality might have been at some risk because of wet conditions, but early corn planting will benefit greatly from the moisture - Cold

air in southern Brazil this weekend and early next week could induce some frost and light freezes which may have some impact on reproducing and filling winter wheat - Eastern

and southern Ukraine, Russia’s Southern Region, southeastern Romania and eastern Bulgaria will continue too dry for at least another ten days, despite a few sporadic showers - Russia’s

central and eastern New Lands will receive rain the remainder of this week and into early next week, but drying may evolve shortly after that and the change will be welcome - Some

areas in the region are becoming a little too wet and need to dry down to protect small grain and sunseed quality - China

will continue to experience alternating periods of rain and sunshine during the coming week, but the last days of August are starting to look drier for east-central parts of the nation and the change will be welcome - Most

of the nation east of Tibet has saturated soil and flooding has been an issue at times throughout the summer - Xinjiang

China will continue to experience milder than usual conditions at times over the next week and some rain will fall periodically in the northeast - Recent

temperatures have been milder than usual which may be reducing some of the degree day accumulations for cotton and other crops

- India

will receive some heavy rain in central parts of the nation during the coming week to ten days - Flooding

is expected in Madhya Pradesh, southern Rajasthan and parts of Gujarat as well as in a few northern Telangana, Chhattisgarh and Odisha locations - Crop

damage is possible - Australia

rainfall in the coming week to ten days will be limited to southernmost parts of the nation with Victoria wettest

- Dryness

remains a concern for Queensland and South Australia with some wheat and barley reproduction expected early next month in southern Queensland making rain very important

- Dryness

in west-central Africa will prevail over the next ten days, although a few more showers and thunderstorms will occur infrequently - The

precipitation will be welcome, but not likely enough to counter evaporation leaving an ongoing need for greater rain - Seasonal

rains will return to this area late this month and more likely in September - The

longer range outlook calls for abundant rain in these areas later this year - Europe

weather over the next ten days will bring brief periods of rain to many areas, but net drying will continue in central through southern France, Spain, southern Portugal, the Italian Peninsula and eastern Bulgaria to southern and eastern Romania and Moldova - Crop

moisture stress will continue in each of these areas until greater rain falls - Temperatures

will be near to above average over the next ten days

- Western

CIS crop areas will experience an erratic rainfall pattern over the next ten days resulting in areas of net drying and some pockets of significant rain - Drying

in the western parts of the CIS will be good for early season crop maturation and harvest progress

- Late

season crops in the south will continue stressed, but good soil moisture in the north and west will support crops when rain is not falling - Temperatures

will be seasonable - Interior

southern Pakistan rainfall will be restricted over the next two weeks leaving rice, sugarcane and cotton dependent upon irrigation for normal crop development - Temperatures

will be warmer than usual - Some

areas near the India border will trend a little wetter for a few days - Greater

rain is needed in parts of Myanmar, Cambodia and Vietnam, although very few areas are considered too dry - Rain

is expected to fall periodically over these areas resulting in abundant soil moisture and some local flooding - Indonesia

rainfall continued erratic Tuesday - Recent

rain has been most significant in “portions” of Kalimantan and a few Malaysian locations while more limited in other areas - Rainfall

over the next ten days will continue erratic, but at least some rain will fall in each production area at one time or another - Rain

is needed most in parts of Sumatra and western Java -

Ontario

and Quebec weather is mostly good with alternating periods of rain and sunshine over the next two weeks -

Temperatures

will be seasonable -

South

Africa rain will continue periodically in the southwest over the next week, but most of it will be near the coast and it will not be frequent enough to seriously bolster topsoil moisture for long term crop use -

Eastern

winter wheat and barley areas still need a general rain to support dryland crops which represent 8% of the total crop in the region -

Temperatures

will be cooler than usual -

Mexico

precipitation in the coming week to ten days will be greatest in western and southern parts of the nation benefiting many corn, sorghum and dry bean production areas -

Coffee,

citrus, sugarcane and many fruit and vegetable crops will also benefit -

Northeastern

Mexico will be mostly dry -

Some

of the region is still drought stricken -

Central

America rainfall will be frequent enough to support all crop needs -

New

Zealand rainfall will be above average this week except in southern parts of South Island where it will be lighter than usual

-

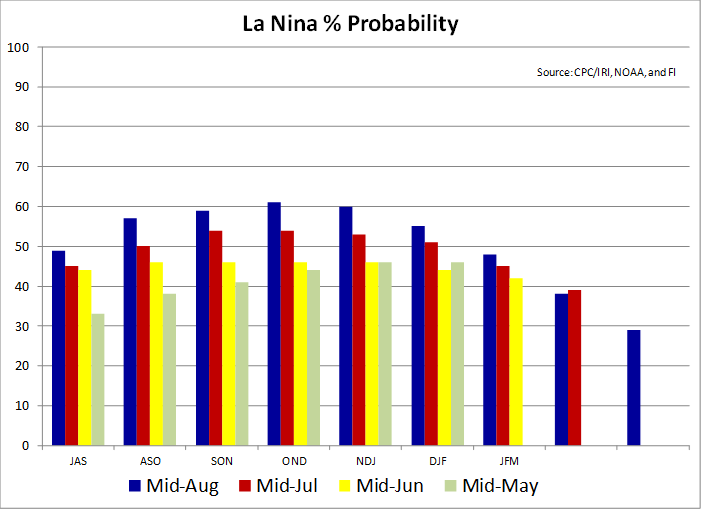

Southern

Oscillation Index was +5.92 this morning and it will continue to rise over the next few days

Source:

World Weather Inc.

- EIA

U.S. weekly ethanol inventories, production, 10:30am - ISO

online conference on Sugar and Health - USDA

total milk production

THURSDAY,

August 20:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Brazil

Conab sugar, cane and ethanol production - Port

of Rouen data on French grain exports - China

International Cereals and Oils Industry Summit - USDA

red meat production, 3pm - HOLIDAY:

Malaysia - EARNINGS:

Cherkizovo

FRIDAY,

August 21:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - China

International Cereals and Oils Industry Summit, day 2 - Malaysia

palm oil export data for August 1-20 - U.S.

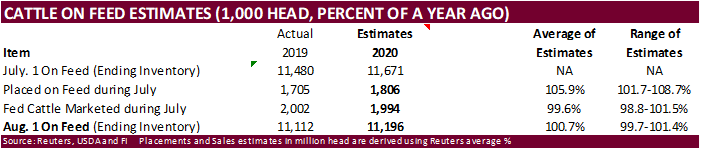

cattle on feed, 3pm

Source:

Bloomberg and FI

ProFarmer

Stats: based on what FI collected

#

times ProFarmer was below USDA’s Aug corn yield over the past 13 years: 8 or 62% of the time

#

times ProFarmer was above USDA’s Aug corn yield over the past 13 years: 5 or 38% of the time

#

times ProFarmer was below USDA’s Aug soybean yield over the past 13 years: 10 or 77% of the time

#

times ProFarmer was above USDA’s Aug soybean yield over the past 13 years: 3 or 23% of the time

Canadian

CPI NSA (M/M) Jul: 0.0% (exp 0.4%; prev 0.8%)

–

CPI (Y/Y) Jul: 0.1% (exp 0.6%; prev 0.7%)

–

CPI Core Median (Y/Y) Jul: 1.9% (exp 2.0%; prev 1.9%)

–

CPI Core Common (Y/Y) Jul: 1.3% (exp 1.6%; prev 1.5%)

–

CPI Core Trim (Y/Y) Jul: 1.7% (exp 1.8%; prev 1.8%)

Canadian

Wholesale Trade Sales (M/M) Jun: 18.5% (exp 10.5%; prev 5.7%)

-

US

corn futures did manage to trade sided after opening lower but closed 1.00-2.00 lower. The negative undertone complimented the positive feedback from the Pro Farmer tour, poor rate of corn for ethanol use, and soybean/corn spreading. Note most of IA will

be surveyed on Thursday. President Trump cancelled the China/US trade talks that should have started last week.

- The

Pro Farmer crop tour: - Day

3…early reports of poor conditions across central and west-central IA. - Day

3…Illinois – “good corn and not bad soybeans” - Day

2…Nebraska – 175.15 vs. 172.55 for 2019 and 172.38 average - Day

2…Indiana – 179.84 vs. 161.46 for 2019 and 171.67 average - Day

1…Ohio – 167.69 vs. 154.35 for 2019 and 166.18 average - Day

1…South Dakota – 179.24 vs. 154.08 for 2019 and 160.02 average -

USD

rallied 63 points as of around 2:10 PM CT. -

CBOT

corn and soybean registrations were again zero at Toledo and northwest Ohio.

-

China

plans to sell 10,000 tons of pork from state reserves on August 21. About 500,000 tons have been sold so far this season.

-

Argentina’s

BA Grains Exchange sees 2020-21 corn plantings at 6.2 million hectares, below 6.3 million planted last year.

-

The

USDA Broiler Report showed US eggs set in the US down slightly and chicks placed down 3 percent. Cumulative placements from the week ending January 4, 2020 through August 15, 2020 for the United States were 6.14 billion. Cumulative placements were down 1

percent from the same period a year earlier.

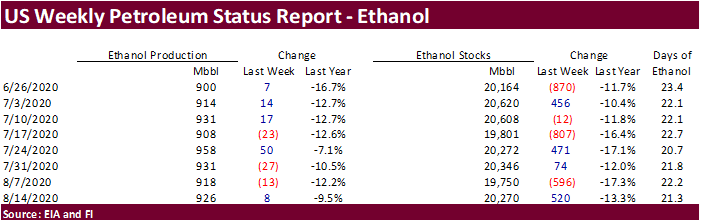

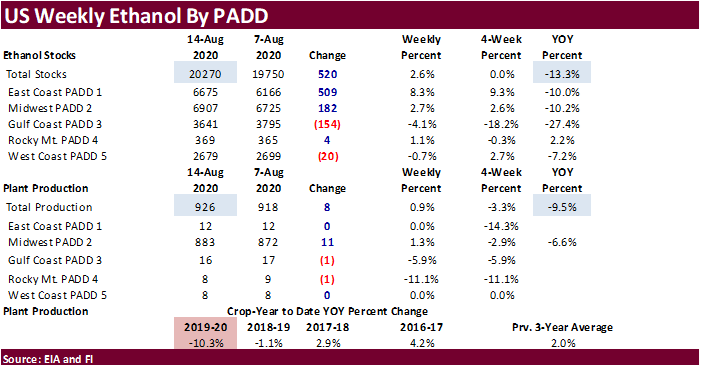

Weekly

US ethanol production

improved 8,000 barrels from the previous week to 926,000 barrels, just shy of the September 2019 to date average of 929,000 barrels, 10 percent below the week average for the 2018-19 Sep-Aug corn crop year. A Bloomberg poll looked for weekly US ethanol production

to be up 1,000 barrels. US ethanol stocks grew a large 520,000 barrels to 20.270 million, opposite from a predicted 444,000 barrel decrease the trade expected. We see this having little influence on US corn futures. Over the past three weeks weekly ethanol

production average 930,000 barrels. If this average remains unchanged over the next couple weeks, US corn for ethanol use may fall about 19 million bushels shy of USDA’s projection of 4.850 billion bushels.

Corn

Export Developments

-

September

corn is seen in a $3.15 and $3.45 range. December $3.20-$3.65 range.

-

The

soybean complex traded choppy on Wednesday on lack of direction. Soybeans and soybean oil started the day higher and ended that way but most of the session gains were erased on a sharply higher USD. Soybean meal finished moderately lower in the front four

contracts. September soybean oil during the overnight session reached its highest level since February 14. Malaysian palm futures were up 26MYR and cash palm rose $12.00/ton, which lent support to SBO. Soybeans hit a 7-month high. China bought additional

US soybeans. -

Argentina

is considering a cut in their export tax for soybean meal, but details are lacking.

-

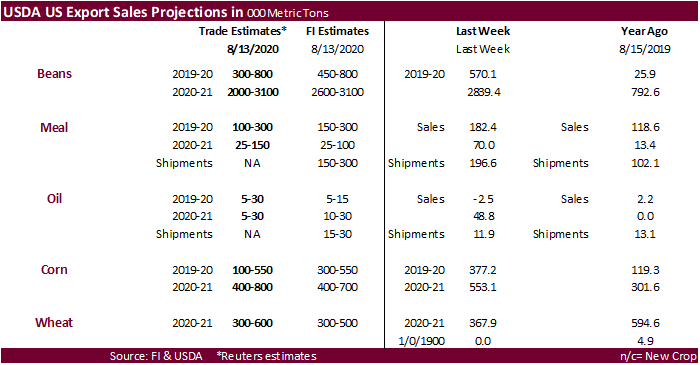

We

look for a very large new-crop export sales figure for soybeans at between 2.6 to 3.1 million tons. If figures fall short for soybeans, then we speculate some of the sales last week were recorded in the previous week report.

- The

Pro Farmer crop tour: - Day

3…early reports of poor conditions across central and west-central IA. - Day

3…Illinois – “good corn and not bad soybeans” - Day

2…Nebraska – 1297.93 vs. 1210.83 and 1213.64 average - Day

2…Indiana – 1281.12 vs. 923.94 and 1134.86 average - Day

1…Ohio – 1155.68 pods vs. 764.01 for 2019 and 1039.74 average - Day

1…South Dakota – 1250.86 pods vs. 832.85 for 2019 and 919.04 average

·

Aug 1-20 Malaysian palm export data is due out Thursday and we look for a 15 to 20 percent decline from the same period last month. SGS reported 1-15 Aug exports of palm were 20 percent below same

period month earlier at 664,392 tons.

·

Indonesia is look at increasing palm export tariffs to keep domestic prices of palm oil cheap enough to promote their biodiesel expansion initiative of 30 percent blend rate. That rate may increase

to 40 percent sometime in 2021.

-

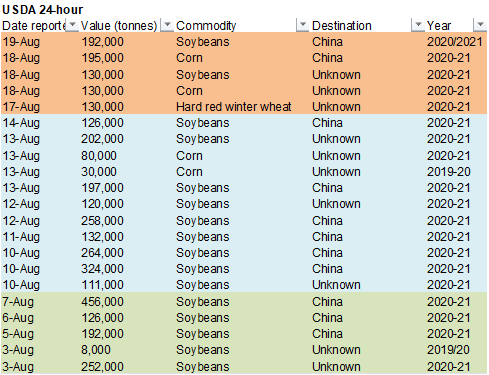

USDA

24-hour: Private exporters sold 132,000 of soybeans to China for 2020-21 delivery.

-

September

soybeans are seen in a $8.80-$9.30 range. November $8.80-$9.50. -

September

soybean meal is seen in a $285 to $310 range. December $285-$320. -

September

soybean oil range is seen in a 30.00 to 33.50 range. December 29.75-35.00 range.

-

US

wheat futures

traded higher despite a sharply higher USD. Prices followed strength in EU wheat and Algeria’s purchase of about 560,000 tons of milling wheat. Results are awaited on Pakistan in for wheat (Lowest offer was $233.85/ton for 200,000 tons of milling wheat).

Japan seeks milling and feed wheat. -

Ukraine’s

grain crop was estimated at 70 million tons from 75.1 million record in 2019, according to the econ minister. Corn was seen at 35 million. About 61 percent of the grain crop was collected as of Aug 13.

-

Ukraine

grain exports so far this season are running at 5.1 million tons, down 19.8 percent from the same period year earlier – econ minister. 3.03MMT wheat and 1.56MMT barley and 502,000 tons of corn were recorded as of Aug 19.

-

Paris

December wheat was up 1.00 euros at 181.75.

-

Algeria

bought about 560,000 tons of milling wheat for Sep and or Oct shipment at around $231-$232/ton.

-

Results

awaited: Pakistan seeks 1.5 million tons of wheat. Lowest offer was $233.85/ton for 200,000 tons of milling wheat.

-

Jordan

passed on 120,000 tons of wheat. -

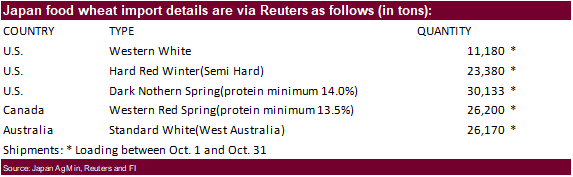

Japan

seeks 117,063 tons of milling wheat on August 20.

-

Japan

is also in for 80,000 tons of feed wheat and 100,000 tons of feed barley (SBS) on August 26 for November 30 loading.

-

Turkey

seeks 390,000 tons of red milling wheat and 110,000 tons of durum wheat on August 25. They also seeks feed barley.

- Red

wheat shipment period is between Sep 4 and Oct 10 - Durum

shipment period is between Sept. 15 and Oct. 10. - Feed

barley shipment period is between Sept. 11 and Sept. 25. -

Syria

looks to sell and export 100,000 tons of feed barley with offers by Sep 1.

-

Syria

seeks 200,000 tons of soft wheat from EU/Russia on Sept. 9 and 200,000 tons of wheat from Russia on Sept. 14.

·

Results awaited: South Korea’s Agro-Fisheries & Food Trade Corp. seeks 60,556 tons of rice from Vietnam and other origins, on Aug. 19, for arrival in

South Korea between Dec. 31, 2020, and February 28, 2021.

Updated

8/17/20

- Chicago

September is seen in a $4.90-$5.35 range. December $5.00-$5.50 range. - KC

September; $4.15-$4.55 range. December $4.30-$4.75. - MN

September $4.90-$5.25 range. December $5.05-$5.40.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.