PDF Attached

Corn

steady to 2 lower

Soybeans

steady

Wheat

steady to 3 lower

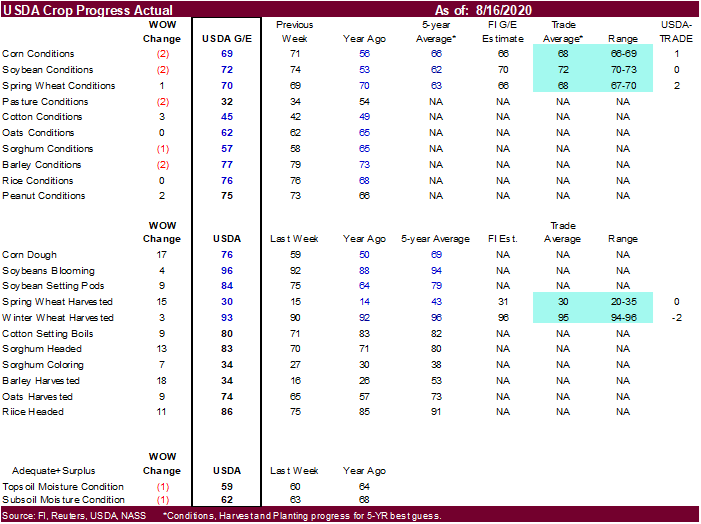

US

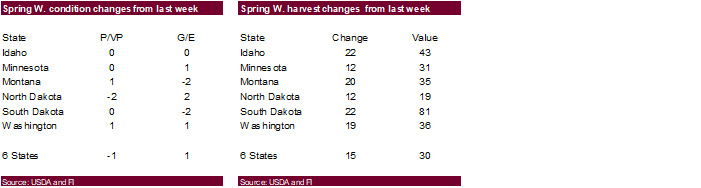

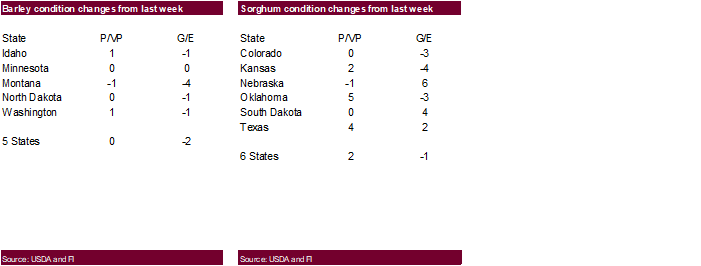

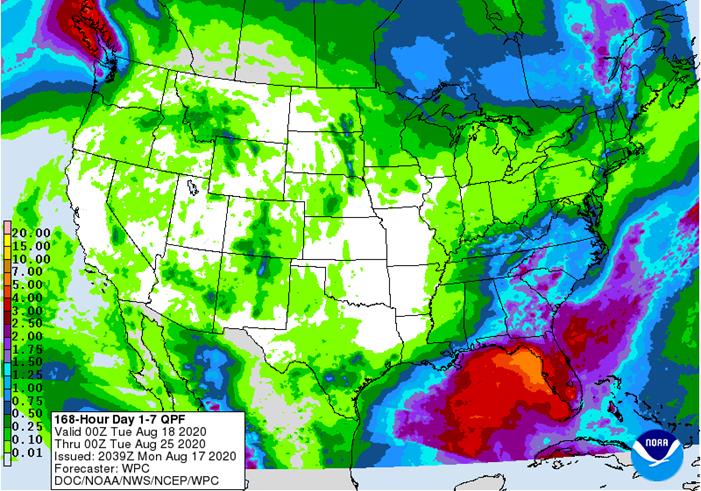

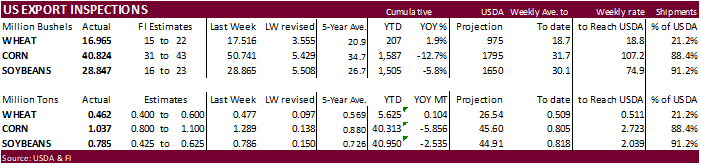

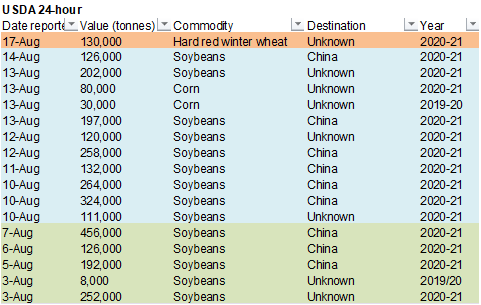

corn and soybean crop conditions declined 2 points. Spring wheat improved by one. Large rally in CBOT ag commodities today. US weather will be dry this week. Under the 24-hour announcement system, private exporters sold 130,000 tons of HRW wheat to unknown.

Inspections and NOPA crush reports were supportive.

NOT

MANY CHANGES DURING THE WEEKEND

- U.S.

weekend weather was wettest in the upper Midwest with some heavy rain in Minnesota where flooding continued after starting late last week - Net

drying occurred across many other Midwestern locations - Rain

was heavy in North Carolina and Virginia where some flooding resulted - Scattered

showers of lighter intensity occurred in the Delta and southeastern states keeping the southeastern states abundantly moist and only offering pockets of improved soil moisture in the Delta - Scattered

showers in western Texas helped to bring down afternoon temperatures during the weekend, but temperatures were hot late last week - Rainfall

was mostly less than 0.50 inch, but highest temperatures slipped to the 90s after being well over 100 Friday - Most

of the central through northwestern U.S. Plains and far western states were dry

- Excessive

heat occurred in the western United States during the weekend - Extreme

highs to 123 degrees Fahrenheit occurred at Needles, California - Highs

of 100 to 106 as far north as Washington and Oregon - Arizona

cotton areas experienced extreme highs ranged from 108 to 116 degrees stressing crops and inducing a huge demand for irrigation - The

extreme temperatures also impacted northwestern Mexico - Temperatures

were seasonable in the eastern parts of the nation

- U.S.

outlook does not support much rain in the heart of the Midwest, the Great Plains or far western U.S. this week - Scattered

showers will occur in the northern Midwest and throughout the southeastern states - Net

drying is expected elsewhere, although there will be a few periodic showers - Crop

stress will be on the rise in areas that already have limited soil moisture including parts of Iowa and surrounding areas and the Delta into the Tennessee River Basin

- Crop

production potentials will not change in this coming week, but the topsoil will dry down making rain next week more important for late season crops - Weekend

rain in Ohio and southeastern Michigan will buy those areas a little time before turning too dry since soil moisture was already rated poorly Friday before the rain fell

- U.S.

weather outlook next week will bring a couple of frontal systems into the Midwest offering some additional cooling after a brief period of warming and some rain - Net

drying will continue in the Plains and southwestern Corn Belt through much of next week - Southwest

monsoon flow will remain restricted - Increased

tropical activity in the Atlantic Ocean, Caribbean Sea and Gulf of Mexico in the next two weeks may contribute to less rain in the Plains and heart of the Midwest - Warm

weather will prevail in the central and western U.S. through next week

- The

Tropics and subtropics should be closely monitored - We

are moving into the a more favored period for tropical cyclone development; the most favored period for storm development through the end of this month - Tropical

Storm Josephine dissipated during the weekend - Tropical

Storm Kyle dissipated during the weekend - Tropical

disturbances are present in the tropical Atlantic, but they may be slow to evolve into tropical cyclones - Tropical

disturbance will be possible in the Gulf of Mexico next week after evolving in the Caribbean Sea later this week – this system may impact Texas early next week, but it is too soon to have much confidence - A

second tropical disturbance may move across the Lesser Antilles late this week and into the weekend and could develop further, but it may interact with the greater Antilles keeping its intensity variable - This

system could be headed for the eastern Gulf of Mexico for mid- to late-week next week, but confidence is extremely low

-

West

Texas will experience a few showers and thunderstorms erratically over the next two weeks -

Resulting

rainfall will not be enough to seriously change soil or crop conditions, but may hold down temperatures periodically

-

U.S.

northwestern Plains and southwestern Canada’s Prairies will not receive much rain for the next week favoring harvest progress for early season crops, but stressing some of the late season crops -

Rain

is possible next week that might offer some temporary reprieve from this week’s drying -

Manitoba

crop weather will be best for late season crops -

Temporary

dry and warm weather in Alberta will be welcome for many crop areas that have been too wet this summer in the west and north -

Alberta

will receive rain in the west and north this weekend and possibly again during mid-week next week keeping the west and north wet

- Eastern

and southern Ukraine into Russia’s Southern Region will continue dry or mostly dry through much of the next ten days - Crop

moisture stress will continue to rise threatening unirrigated, corn, soybeans, sunseed, potatoes, sugarbeets and other crops

- Russia’s

eastern New Lands will continue to receive periods of rain this week and a few areas may get a little too wet raising some concern over sunseed and spring wheat quality

- Weekend

rainfall in France impacted much of the nation with 0.10 to 0.40 inch and a few local totals over 1.00 inch

- Most

of the greatest rainfall was in the far eastern parts of the nation

- Rain

elsewhere in Europe during the weekend was greatest from southeastern Germany to Romania, Serbia, Bosnia and a few areas in western Bulgaria - From

0.35 to 1.35 inches, but several areas reported up to 2.25 inches and there a few totals that reached up near and over 5.00 inches in Macedonia and Montenegro - Weekend

temperatures were a little warmer than usual with highs in the upper 70s and 80s north and 80s and lower to a few middle 90s south

- Some

rain fell in the dry areas of Ghana and Ivory Coast during the weekend, but coverage was poor in Ivory coast - Rainfall

varied from 0.25 to 0.40 inch in Ghana while one location in western coffee and cocoa areas in Ivory Coast received up to 3.00 inches

- Many

other areas in Ivory Coast were dry

- Dryness

in west-central Africa will prevail over the next ten days, although a few more showers and thunderstorms will occur infrequently - The

precipitation will be welcome, but not likely enough to counter evaporation leaving an ongoing need for greater rain - Seasonal

rains will return to this area late this month and more likely in September - The

longer-range outlook calls for abundant rain in these areas later this year

- Europe

weather over the next ten days will bring brief periods of rain to many areas, but net drying will continue in central through southern France, Spain, southern Portugal, the Italian Peninsula and eastern Bulgaria to southern and eastern Romania and Moldova - Crop

moisture stress will continue in each of these areas until greater rain falls - Temperatures

will be near to above average over the next ten days

- Western

CIS crop areas will experience an erratic rainfall pattern over the next ten days resulting in areas of net drying and some pockets of significant rain - Drying

in the western parts of the CIS will be good for early season crop maturation and harvest progress

- Late

season crops in the south will continue stressed, but good soil moisture in the north and west will support crops when rain is not falling - Temperatures

will be seasonable

- India

weather over the next ten days to two weeks will be abundantly wet with bouts of flooding from Chhattisgarh, Odisha and parts of northern Telangana through Madhya Pradesh to parts of southern Rajasthan and portions of Gujarat - Some

crop damage will be an increasing risk as time moves along - Temperatures

will be a little milder than usual in the wettest areas keeping evaporation rates low - Interior

southern India will experience net drying

- Southern

Pakistan rainfall will be restricted over the next two weeks leaving rice, sugarcane and cotton dependent upon irrigation for normal crop development - Temperatures

will be warmer than usual

- Weekend

rain in India was locally heavy in eastern Madhya Pradesh where nearly 10.00 inches resulted in one location. Rainfall of 1.00 to 4.00 inches occurred in Rajasthan except in the northwest where no more than 0.92 inch resulted - Other

areas of moderate rain occurred in Telangana and near the west coast from Goa through western Maharashtra to southern Gujarat - Dry

weather occurred in the far south and in pockets of Bihar, Jharkhand, northern Madhya Pradesh and from Haryana into Punjab - Himachal

Pradesh also received some heavy rainfall of more than 8.00 inches resulting in some local flooding

- Pakistan

was mostly dry and very warm during the weekend

-

Southeastern

Manitoba received some welcome rain briefly Friday into Saturday morning -

Rain

totals ranged up to 1.35 inches with one location getting nearly 2.50 inches -

Mostly

dry weather occurred in many other areas in the Prairies and temperatures were seasonable

- Rain

fell across Thailand, Laos and some immediate neighboring areas during the weekend resulting in good soil moisture and crop conditions

- Greater

rain is needed in parts of Myanmar, Cambodia and Vietnam, although very few areas are considered too dry - Rain

is expected to fall periodically over these areas resulting in abundant soil moisture and some local flooding

- Indonesia

rainfall was erratic and very light during the weekend in Sumatra, western Java and Sulawesi - Rain

was more significant in “portions” of Kalimantan and a few Malaysian locations, but more rain is needed in parts of the region - Weather

over the next ten days will continue erratic, but at least some rain will fall in each production area at one time or another

- China

rainfall during the weekend was most significant in central Sichuan where flooding resulted after 27.75 inches of rain resulted - Heavy

rain also fell in western Shandong were 4.00 to 12.91 inches resulted - Some

flooding occurred in western Shandong and northwestern parts of North Korea with more than 8.00 inches resulting in North Korea - Rainfall

of 1.00 to more than 7.00 inches occurred in many other areas from southern Gansu and Shaanxi to southern Hebei and the remainder of Shandong - Some

areas in Heilongjiang and southern Liaoning also reported rain with amounts to 0.83 inch except in eastern Heilongjiang where a local total of 5.51 inches resulted - Heavy

rain also continued in Guangxi where another 2.25 to more than 7.70 inches resulted during the weekend after significant rain fell late last week - Net

drying occurred in the Yangtze River Basin where sunny and warm weather prevailed

- China

will experience alternating periods of rain and sunshine during the coming week to ten days - Most

areas will be impacted with rain at one time or another - Rainfall

will be lightest and least frequent in the lower Yangtze River Basin and interior southeastern parts of the nation

-

Xinjiang,

China weather during the weekend included scattered showers and thunderstorms some of which were locally heavy in the northeast -

Northeastern

areas were wettest and coolest -

Highest

temperatures in the northeast were limited to the 70s and lower 80s -

Dry

and warm weather occurred in the west with highs in the lower 90s and lows were in the 60s

- Tropical

Disturbance near the northern tip of Luzon Island has potential to develop into a tropical cyclone this week - Movement

will be west northwesterly toward southwestern Guangdong and southern Guangxi with landfall possible Wednesday and Thursday - Heavy

rain is expected from these areas to the Vietnam/Guangxi, China border in the second half of this week

- Australia

reported rain in many crop areas during the Friday through Sunday period, although amounts were mostly light - The

moisture was still beneficial for most crops - Rainfall

ranged from 0.05 to 0.62 inch in New South Wales, up to 0.43 inch in South Australia, 0.05 to 0.88 inch in southeastern Queensland while 0.35 to 0.88 inch resulted in New South Wales and amounts to 0.79 inch in Victoria - Temperatures

were mild to warm

- Australia’s

weather over the next ten days will not include much rain outside of coastal areas - Victoria

will be wettest with some 1.00 to 3.00 inches expected by Sunday - Rain

elsewhere will be less than 0.30 inch - Queensland

will be dry and rain will be limited in interior crop areas - Temperatures

will be close to normal in the west and south and a little cooler than usual in the southeastern corner of the nation

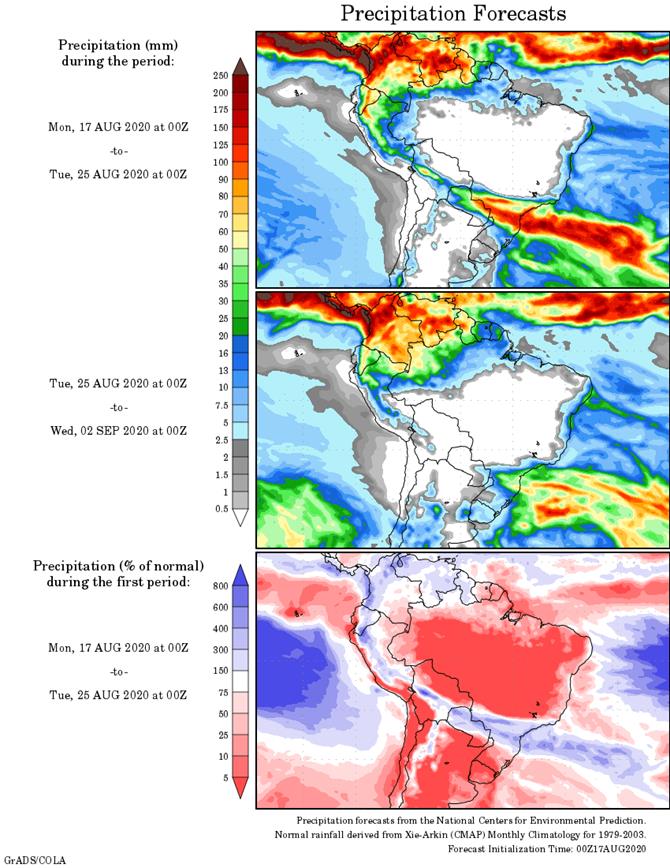

- Argentina

will be mostly dry for the next week to 8 or 9 days - Scattered

showers are expected in the last days of August, but the resulting precipitation will not be significant enough to change drought status

- Argentina

weather during the weekend was dry and mild to warm with highs in the 50s and 60s south and in the 60s and 70s north followed by morning frost and freezes

- Southern

Brazil received rain during the weekend from southern and central Mato Grosso do Sul to southern Sao Paulo, Parana to northern Rio Grande do Sul - Rain

amounts varied from 1.00 to 4.00 inches in Parana and 0.35 to 1.50 inches in most other areas - Temperatures

were seasonably mild in far southern Brazil and warm elsewhere - Extreme

highs in the 90s to 102 degrees Fahrenheit occurred in most of central through northern parts of Brazil

- Brazil

rain this workweek will be greatest from southern Mato Grosso do Sul to Parana where 2.00 to more than 6.00 inches of rain will result by Friday - Follow

up rain is expected next week, but it will be much lighter - Some

flooding will occur this week which may threaten some of the winter wheat crop - Lighter

rain will occur farther north in Sao Paulo, southern Minas Gerais and Rio de Janeiro this week and next week with the only concern being for coffee in a few of the mountainous areas where a little flowering is possible - Early

season corn planting will increase following this rainy period - Much

cooler than usual temperatures will occur this week from southern Brazil and Paraguay into eastern and central Argentina - Next

week will continue cool in Argentina

-

Ontario

and Quebec weather is mostly good with alternating periods of rain and sunshine over the next two weeks -

Temperatures

will be seasonable

-

South

Africa rain will continue periodically in the southwest over the next week, but most of it will be near the coast and it will not be frequent enough to seriously bolster topsoil moisture for long term crop use -

Eastern

winter wheat and barley areas still need a general rain to support dryland crops which represent 8% of the total crop in the region -

Temperatures

will be cooler than usual

-

Mexico

precipitation in the coming week to ten days will be greatest in western and southern parts of the nation benefiting many corn, sorghum and dry bean production areas -

Coffee,

citrus, sugarcane and many fruit and vegetable crops will also benefit -

Northeastern

Mexico will be mostly dry -

Some

of the region is still drought stricken

-

Central

America rainfall will be frequent enough to support all crop needs

-

New

Zealand rainfall will be above average this week except in southern parts of South Island where it will be lighter than usual

-

Southern

Oscillation Index was +4.70 this morning and it will continue positive this week

Source:

World Weather Inc.

- USDA

weekly corn, soybean, wheat export inspections, 11am - U.S.

crop conditions for soybeans, corn, cotton; wheat harvesting progress, 4pm - U.S.

monthly green coffee stockpile data from Green Coffee Association - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals - HOLIDAY:

Indonesia

TUESDAY,

August 18:

- New

Zealand global dairy trade auction

WEDNESDAY,

August 19:

- EIA

U.S. weekly ethanol inventories, production, 10:30am - ISO

online conference on Sugar and Health - USDA

total milk production

THURSDAY,

August 20:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Brazil

Conab sugar, cane and ethanol production - Port

of Rouen data on French grain exports - China

International Cereals and Oils Industry Summit - USDA

red meat production, 3pm - HOLIDAY:

Malaysia - EARNINGS:

Cherkizovo

FRIDAY,

August 21:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - China

International Cereals and Oils Industry Summit, day 2 - Malaysia

palm oil export data for August 1-20 - U.S.

cattle on feed, 3pm

Source:

Bloomberg and FI

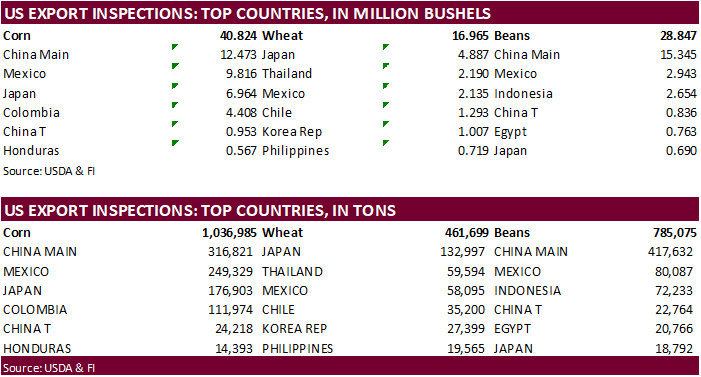

USDA

inspections versus Reuters trade range

Wheat

461,699 versus 400000-600000 range

Corn

1,036,985 versus 800000-1100000 range

Soybeans

785,075 versus 425000-800000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING AUG 13, 2020

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 08/13/2020 08/06/2020 08/15/2019 TO DATE TO DATE

BARLEY

1,996 0 0 2,461 2,938

CORN

1,036,985 1,288,883 510,334 40,312,783 46,168,508

FLAXSEED

0 0 0 317 48

MIXED

0 0 0 0 0

OATS

0 0 0 800 299

RYE

0 0 0 0 0

SORGHUM

83,934 109,012 56,802 4,723,598 1,999,455

SOYBEANS

785,075 785,568 1,158,755 40,950,167 43,485,255

SUNFLOWER

0 0 0 0 0

WHEAT

461,699 476,698 564,632 5,625,441 5,521,334

Total

2,369,689 2,660,161 2,290,523 91,615,567 97,177,837

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

US

Empire Manufacturing Aug: 3.7 (exp 15.0; prev 17.2)

US

MBA Mortgage Delinquencies Q2: 8.22% (prev 4.36%)

–

Mortgage Foreclosures Q2: 0.68% (prev 0.73%)

-

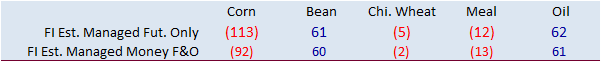

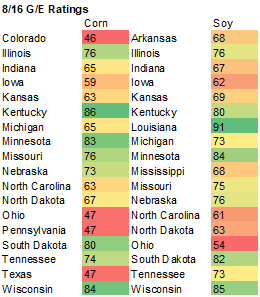

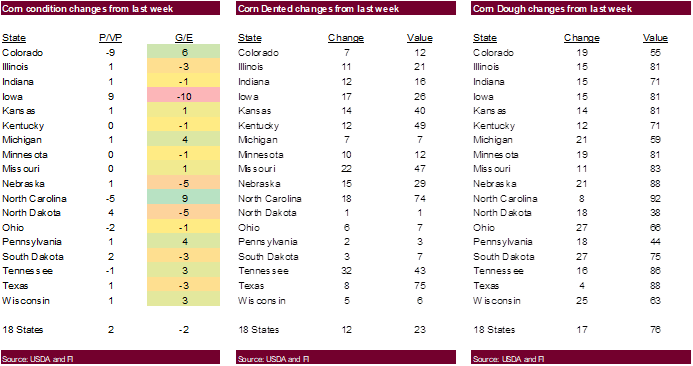

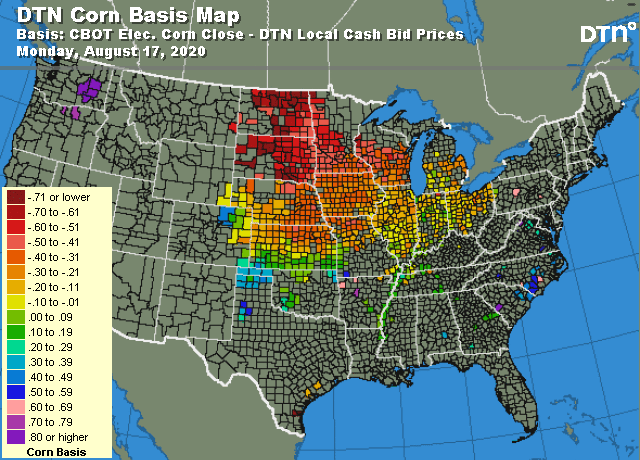

Corn

futures hit

a one-month high on US and China crop concerns. This afternoon the trade saw an updated US corn crop condition and the combined good and excellent conditions fell only 2 points from the previous week to 69 percent. The trade was looking for a three-point

decline. The US corn condition declined less than what we expected. IA was down 10 points and ND fell 5 points. IL fell 3 points. MI increased 4 points and CO was up 6. NC increased 9 points.

-

Funds

bought an estimated net 23,000 corn contrasts. -

Corn

basis was up 10 cents at a processor in Cedar Rapids, IA. -

Short

covering was a feature. USD was trading 28 points lower by afternoon trading.

-

The

Pro Farmer crop tour reported

corn

yields well above average in southeastern South Dakota and southwestern Ohio. Day 1 results should be out later today.

-

Excessive

heat occurred across western US over the weekend, including the PNW. The US will be mostly dry this week bias western Corn Belt. Some rain is seen for Ohio and southeastern Michigan. The western US will cool down a touch and east will be briefly hot for

the eastern US. Net drying will continue in the Plains and southwestern Corn Belt through much of this week.

-

IA

was granted emergency relief aid by President Trump. IA initially was looking for around 4 billion USD in disaster aid after the derecho storm. 37.7 million acres of farmland across the Midwest, including 14 million in Iowa, was impacted by the storm.

-

Ukraine

will see warm temperatures and little precipitation this week. -

Drought

and heavy rains are negatively impacting China’s grain production with some areas seeing a reduction in output as much as ten percent from the previous year. It’s difficult to peg a number for the China grain crop but traders should be monitoring upcoming

changes in government estimates. -

Heavy

rain occurred in China’s Guangxi province where another 2.25 to more than 7.00 inches resulted during the weekend after significant rain fell late last week. China will experience alternating periods of rain and sunshine during the coming week to ten days.

-

China

government think tank: China’s food supply gap may reach 130 million tons by end of 2025. China’s arable land use rose by 15.7% from 1981 to 2016, and could increase another 14% by 2032, when the population is expected to peak-

China

Institute of Water Resources and Hydropower Research. -

China’s

chicken production continues to expand as ASF hit hog production. USDA predicts an 18 percent increase in 2020 chicken production to a record 14.85 million tons from last year. China slaughtered 9.3 billion chickens last year, including 4.4 billion white-feathered

broilers, in part to a booming fast food business. -

China

pig herd in July was up 13.1 percent form year ago. This is the first year on year increase since April 2018.

-

China’s

hog prices were up in early August by 1.1 percent compared with the previous 10 days – National Bureau of Statistics (NBS). -

USDA

plans to resurvey Iowa corn and soybean producers to collect new acreage data.

-

USDA

Risk Management Agency: The storm may have affected 14 million acres of insured crops, including 8.2m of corn and 5.6m of soybeans.

Corn

Export Developments

·

None reported

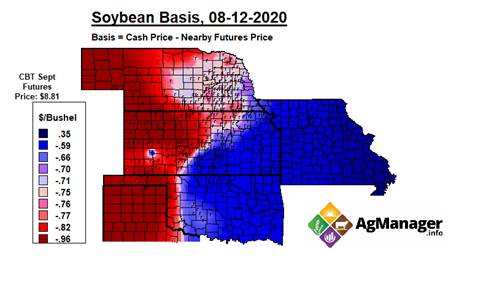

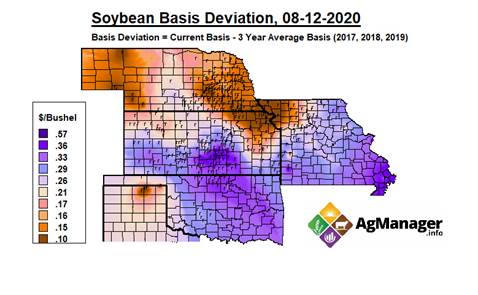

Kansas

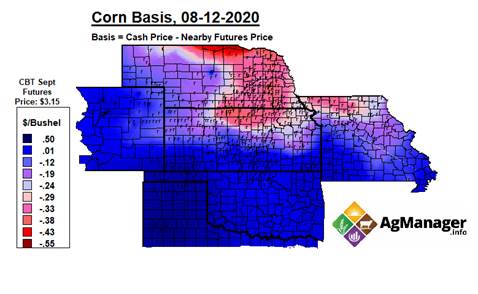

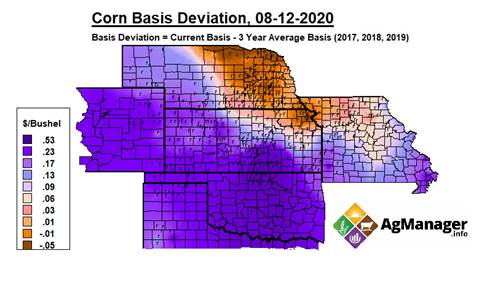

State University basis maps

-

September

corn is seen in a $3.15 and $3.45 range. December $3.20-$3.65 range.

-

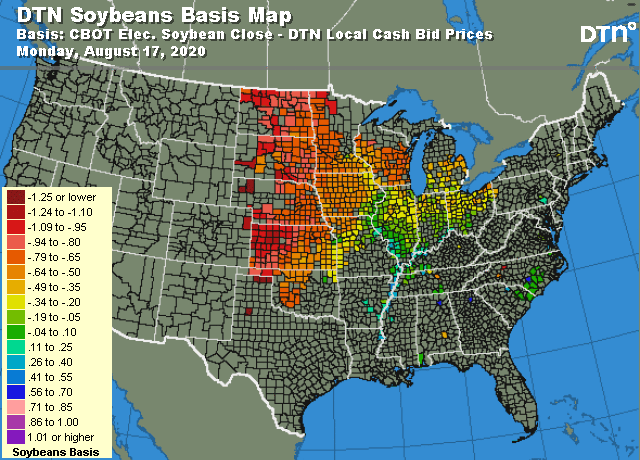

Soybeans

traded

to their highest level since early March. Both September meal and soybean meal traded and ended above its 200-day MA. Soybean oil found strength from higher palm oil, higher soybeans and a supportive NOPA crush report. Soybeans were higher on US crop concerns

and a weather outlook that looks dry for the US over the next 7 days. There were no USDA 24-hour soybean announcements this morning.

-

Funds

bought an estimated net 15,000 soybeans, 8,000 meal and 5,000 soybean oil.

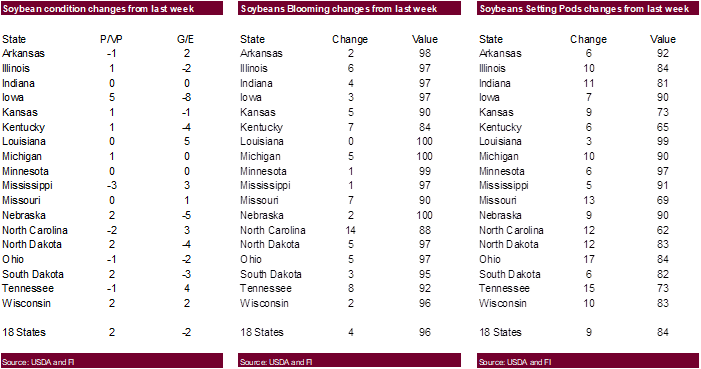

-

US

soybean conditions fell 2 points from the previous week to 72 percent, at trade expectations.

-

September

soybeans reached the top end of our trading range ($9.15) and we adjusted our soybean complex trading ranges today.

-

NOPA

was friendly for soybean oil and soybeans. Look for soybean oil demand to be very good through Q4 on strong biodiesel demand, less imports of competing vegetable oils, and expanded opening of US restaurants.

-

The

Pro Farmer crop tour started and pod counts are running above year ago for southeastern South Dakota and southwestern Ohio.

-

AgRural

projected a 2.74 percent increase in the Brazil soybean area for the upcoming 2020-21 (2021-22 local marketing year) to 37.9 million hectares and sees production at 129.3 million tons from their 2019-2020 forecast of 123.9 million tons. USDA is at 131 million

tons for 2020-21, up from 126.0 million tons this season. -

We

heard China bought up to 25 soybean cargoes last week, down from about 50 previous week.

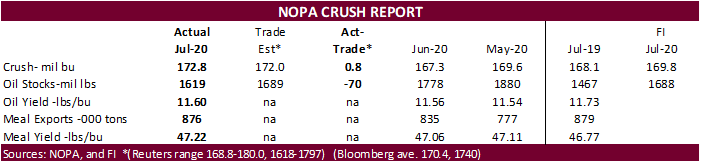

NOPA

July Crush. The

daily July NOPA United States crush rate was little changed from June, with 5.5 million bushels crushed per day, up from 4.7 million in July 2019. At 172.8 million bushels for the month of July, this was 0.8 million bushels above a Reuters trade guess and

compares to 167.3 million in June and 168.1 million in July 2019. This was a little surprising because we heard downtime picked up last month compared to June. The crush rate for the southwest and ECB was strong while the far northwest WCB states fell from

the previous year.

Soybean

oil stocks were 1.619 billion pounds, 70 million below trade expectations, and down sharply from 1.778 billion for the end of June but above 1.467 billion year earlier. Domestic use for soybean oil was much better than we thought, given the higher than projected

crush rate and an upward revision to the soybean yield from 11.56 pounds per bushels during June to 11.60 pounds for the month of July. Note the record soybean oil yield for the month of July was 11.93 pounds in 2013.

Soybean

meal exports were a healthy 876,000 short tons during July, up from 835,000 short tons during June and compares to 879,000 year ago. For the month of July, exports were the second highest in our recorded history. The soybean meal yield improved to 47.22

from 47.06. Domestic meal demand was good during June.

Our

previous 2019-20 September through August soybean crush was upward revised 3 million bushels from 2.161 billion bushels (2.168 Oct-Sep) to 2.164 billion (2.172 Oct-Sep). USDA is using 2.160 billion bushels for 2019-20 (Sep-Aug) and 2.180 billion for 2020-21.

We

look for USDA/NASS to report a 183.7 million bushels crush for July, up from 179.4 million for July 2019.

·

Egypt’s GASC seeks at least 30,000 tons of soybean oil and 10,000 tons of sunflower oil on Tuesday for Oct 25-Nov 20 shipment.

Kansas

State University basis maps

-

September

soybeans are seen in a $8.80-$9.30 range. November $8.80-$9.50. -

September

soybean meal is seen in a $285 to $310 range. December $285-$320. -

September

soybean oil range is seen in a 30.00 to 33.50 range. December 29.75-35.00 range.

-

US

wheat futures ended sharply higher, to about a two-week high, on short covering despite another upward revision to the Russian grain crop. Funds bought an estimated net 9,000 Chicago wheat.

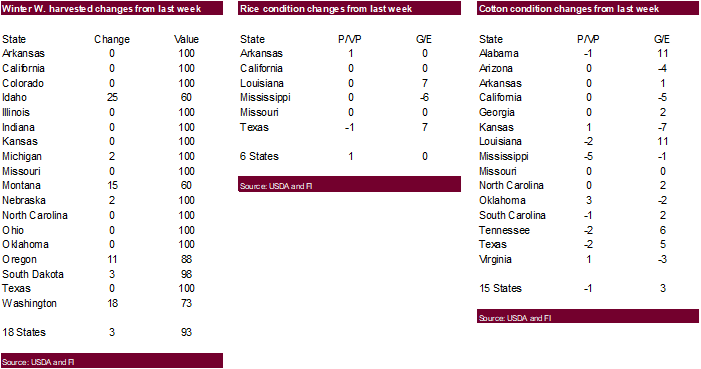

-

US

spring wheat conditions improved 1 point to 70 percent from the previous week. Traders were looking for a one-point decrease. Winter wheat harvest progress increased 3 points to 93 percent, 2 points below expectations and below an average of 96 percent.

Spring wheat harvest progress jumped 15 points to 30 percent, at trade expectations and compares to 43 percent average.

-

USDA

reported 130,000 tons of HRW wheat was sold to unknown, and some traders think it was for China. On July 10, China bought 130,000 tons of hard red winter wheat and 190,000 tons of hard red spring wheat.

-

We

updated our US wheat Sep and Dec trading range estimates. -

IKAR

increased their view of the Russia wheat crop to 82 million tons from 81 million previous.

-

IKAR:

Russian wheat with 12.5% protein loading from Black Sea ports was at $201 a ton free on board (FOB) for supply in August-September at the end of last week, down $4 from the week before.

-

Australia’s

Grain Industry Association GIWA expects Western Australia wheat crop up 63 percent from 2019 to 8.89 million tons.

-

Ukraine’s

economy ministry and traders agreed to cap wheat exports at 17.5 million tons for 2020-21. Ukraine exported 20.5 million tons of wheat in 2019-20. Ukraine harvested 25.5 million tons of wheat from 96% of the projected area as of mid-August. They produced

28.3 million tons of wheat last year. -

Paris

December wheat was up 2.25 euros or 1.25 percent at 182.50, highest since July 31.

-

Under

the 24-hour announcement system, private exporters sold 130,000 tons of HRW wheat to unknown.

-

Algeria

seeks at least 50,000 tons of milling wheat on August 18 for Sep shipment.

-

Pakistan

seeks 1.5 million tons of wheat on August 18. -

Turkey

seeks 390,000 tons of red milling wheat and 110,000 tons of durum wheat on August 25. They also seeks feed barley.

-

Red

wheat shipment period is between Sep 4 and Oct 10 -

Durum

shipment period is between Sept. 15 and Oct. 10. -

Feed

barley shipment period is between Sept. 11 and Sept. 25. -

Syria

looks to sell and export 100,000 tons of feed barley with offers by Sep 1.

-

Syria

seeks 200,000 tons of soft wheat from EU/Russia on Sept. 9 and 200,000 tons of wheat from Russia on Sept. 14.

·

Results awaited: Mauritius seeks 6,000 tons of white rice on August 17 for October through December delivery.

·

South Korea’s Agro-Fisheries & Food Trade Corp. seeks 60,556 tons of rice from Vietnam and other origins, on Aug. 19, for arrival in South Korea between Dec. 31, 2020, and February 28, 2021.

Updated

8/17/20

- Chicago

September is seen in a $4.90-$5.35 range. December $5.00-$5.50 range. - KC

September; $4.15-$4.55 range. December $4.30-$4.75. - MN

September $4.90-$5.25 range. December $5.05-$5.40.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.