PDF Attached

President

Joe Biden was expected to sign the Inflation Reduction Act (IRA) into law today. Grain and the soybean complex prices fell from ongoing economic concerns, good US weather, increasing Ukraine port shipments, US crop progress and sharply lower WTI crude oil.

Most of the US Midwest crop areas during the next ten days will see some rain. The southern US Plains will see precipitation Wednesday night into Friday and more significantly Monday through Wednesday of next week. The northwestern US Plains and Canada’s southwestern

Prairies will see net drying over the next week. The EU will see an increase in rains this week.

Weather

World

Weather Inc.

WEATHER

TO WATCH AROUND THE WORLD

- U.S.

western Corn Belt received some welcome rain Monday and early today - Rainfall

of 0.45 to 2.47 inches occurred in most of western Iowa and in the far southeastern corner of South Dakota and northeastern Nebraska.

- Another

narrow band of significant rain occurred from central Missouri through the far southwestern corner of Iowa where 1.00 to 3.02 inches resulted - Central

Iowa and northeastern Missouri reported rainfall of up to 0.50 inch as did eastern Nebraska, although a few locations in the interior southeast of Nebraska received more than 1.00 inch - The

moisture was all welcome and good for previously stressed corn and soybean crops. Some areas will need more rain to more adequately recharge the soil with moisture, but with cooler temperatures in the coming week the moisture will be conserved, and crop development

will benefit. - Rain

is expected in most of the U.S. Midwest, Delta and southeastern states over the next ten days resulting in favorable support for normal crop development especially with temperatures being normal to a little below normal - Areas

that do not get much precipitation should still see relatively good crop development continue due to the absence of excessive heat and the presence of some moisture in the soil - Timely

rainfall will be important for most areas - West

Texas, the Texas Blacklands and the Texas Panhandle will receive showers late Wednesday into Friday follow by a greater rainy period Aug. 22-24 - Rainfall

late this week will vary from 0.15 to 0.70 inch with a few totals near or slightly above 1.00 inch - Rainfall

Aug. 22-24 should range from 0.50 to 1.50 inches with high coverage especially in West Texas cotton areas - Local

rain totals will reach 2.00 inches in a few areas - Both

the GFS and ECMWF models are suggesting additional rain after mid-week next week to further break drought in the southern Plains - Some

of this advertised rain seems a little overdone, but if it verifies it would be a boon for the region after a very stressful summer of excessive heat and dryness - Some

of this rain comes too late in the season to induce a serious improvement in crop production, although there will be some new plant growth and eventually new cotton boll setting, but the bolls will be very small and may not change production very much.

- The

moisture will be good for wheat planting in early September especially if follow up rain occurs late this month - The

moisture will also help greatly in beginning to improve range and pasture conditions with a greater outlook for autumn grazing conditions - Showers

reach the U.S. Pacific Northwest Sunday into Monday, but will not have much impact on the region’s soil moisture or crop development - Rain

is possible briefly in the northwestern U.S. Plains early next week, although confidence is not very high - U.S.

southwest monsoon is expected to be quite active during the next ten days with moisture abundance expected from northwestern Mexico into the southern U.S. Rocky Mountain region

- The

breakdown of high pressure in the central U.S. this week and next week will allow some of this moisture to stream across Texas and Oklahoma - Cool

temperatures in the central and eastern U.S. over the next ten days will be good for most crops and should help to conserve soil moisture through slower evaporation rates - Canada’s

central and southwestern Prairies are not advertised to receive much rain over the next week to ten days

- Crop

moisture stress will continue for late season crops, but early maturing crops will be sped to maturity and harvesting will advance swiftly - Ontario

and Quebec, Canada, Manitoba Canada, eastern Saskatchewan, Canada and western, central and northern Alberta will get timely rain supporting coarse grain and oilseed development over the next two weeks. - Northeastern

Mexico drought is not likely to change much without a tropical cyclone coming inland.

- No

change in South America’s predicted weather is expected over the next ten days

·

Western wheat areas in Argentina will continue drier biased and in need of greater precipitation

·

Eastern Argentina will continue to have favorable soil moisture

·

Southern Brazil will remain wet along with Paraguay

- Some

areas may be a little too wet - Scattered

showers across Europe this week will offer temporary relief to persistent dryness, but rarely will there be enough rain for a lasting change in soil moisture. - Short

term improvements in crop and field conditions are expected in some areas, but more rain will be needed to end drought - Drier

weather may resume for a little while during the weekend and especially next week - River

and stream flow will remain dismally low - Russia’s

Southern Region will receive some needed showers in the second half of this week with 0.10 to 0.75 inch and a few amounts over 1.00 inch resulting - Temporary

relief from warm and dry weather is expected, but the warm and dry bias will resume this coming weekend and last through most of next week

- Temperatures

will continue to be warmer than usual with frequent highs in the 90s to near 100 Fahrenheit except Wednesday through Friday at which time highs may briefly slip to the 80s and lower 90s - Summer

coarse grain and oilseed crops might be negatively impacted by the limited rainfall and warm bias that will prevail in unirrigated areas - Western

and central portions of Russia’s New Lands will be dry biased and warmer than usual during the next ten days to two weeks - This

may stress some sunseed, but may occur late enough in the year to have a low impact on spring wheat - China’s

Yangtze River Basin continued to experience dry and hot weather Monday as has been the case for the past week with little change likely for another week to ten days - Extreme

highs ranged from 100 to 108 Fahrenheit - The

ground has become excessively dry and rain will be needed for late season rice and other crop development - Northeastern

China and the North China Plain remain very wet and in need of net drying - Very

little change in weather is expected in this region through the next ten days - Xinjiang,

China will continue to receive a mix of weather during the next two weeks maintaining a favorable summer crop outlook for corn, cotton and other crops - Xinjiang

may be a little cooler than usual this week with a few showers expected - India’s

greatest rain Monday occurred in Madhya Pradesh and it will move through Rajasthan to Pakistan and northeastern Gujarat today through Thursday - Some

local flooding is expected - Water

supply is being improved greatly this year in Pakistan and far northwestern India - Waves

of rain will continue across central India from Odisha, West Bengal and far northeastern Andhra Pradesh to Rajasthan and northeastern Gujarat through the next ten days - Sufficient

rain will fall to maintain saturated soil - Some

flooding is expected and a little crop damage is possible, but only in local areas and the impact on production should be low - Far

northern and southern India will not likely see nearly as much rain with net drying in the south - Significant

rain will fall in Pakistan as well as central India - Rainfall

this summer has been much greater than usual in Pakistan bolstering water supply and possibly supporting much larger than usual rice, cotton and other crops - Australia

weather will remain well mixed with rain and sunshine the next ten days - Rain

will fall in most of the wheat, barley and canola areas maintaining moisture abundance and keeping the crop poised for an excellent start to the growing season

- Korean

Peninsula will receive waves of rain over the next two weeks resulting in favorable soil moisture

- Mainland

areas of Southeast Asia will get plenty of rain, but nothing too extreme over the next ten days - Philippines

and Indonesia weather will continue frequently wet during the next ten days

- East-central

Africa will be most significant in Ethiopia, although Uganda and Kenya rainfall is also expected to be favorable - Flooding

has been occurring in parts of Ethiopia recently and it may continue at times - Tanzania

is normally dry at this time of year and it should be that way for the next few of weeks - West-central

Africa rainfall has been and will continue sufficient to support coffee, cocoa, sugarcane, rice and cotton development normally - Some

greater rain would still be welcome in the drier areas of Ivory Coast and Ghana

- Seasonal

rains have shifted northward leading to some drying in southern areas throughout west-central Africa – this is normal for this time of year - Cotton

areas are expecting frequent rainfall in the next couple of weeks with a few areas in Mali, northern Ivory Coast and Senegal becoming a little too wet

- South

Africa’s crop moisture situation is favorable for winter crop establishment, although some rain would be welcome - Restricted

rainfall is expected for a while, but the crop is rated better than usual because of frequent rainfall during the autumn planting season and timely rain since then - Crops

are semi-dormant and unlikely to develop aggressively for a few weeks leaving plenty of time for seasonal rains to resume normally - Central

America rainfall will continue to be abundant to excessive and drying is needed - Too

much moisture could induce some areas of flooding - Some

crop conditions would improve with a little less rain - Mexico

rain will be most abundant in the west and southern parts of the nation - Drought

will prevail in the northeast, although there will be some increase in shower and thunderstorm activity near the Rio Grande for a while this week and in a more broad-based event next week as weather patterns change temporarily - Rain

in the Greater Antilles will occur periodically, but no excessive amounts are likely - Rain

in the past 30-days has been notably lighter than usual because of limited tropical activity

- No

change in this drier bias is expected for a while - Today’s

Southern Oscillation Index was +10.76and it will move erratically over the next week - New

Zealand weather is expected to turn warmer this week with rain becoming heavy at times in North Island and in northern and western parts of South Island - Some

flooding will be possible

Source:

World Weather INC

Bloomberg

Ag Calendar

Tuesday,

Aug. 16:

- New

Zealand global dairy trade auction - EU

weekly grain, oilseed import and export data

Wednesday,

Aug. 17:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - HOLIDAY:

Indonesia

Thursday,

Aug. 18:

- China’s

second batch of July trade data, including corn, pork and wheat imports - International

Grains Council report - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

Friday,

Aug. 19:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Brazil’s

Conab releases sugar, cane and ethanol output data - US

cattle on feed, 3pm - EARNINGS:

Deere

Saturday,

Aug. 20:

- China’s

third batch of July trade data, including soy, corn and pork imports by country - AmSpec

to release Malaysia’s Aug. 1-20 palm oil export data

Source:

Bloomberg and FI

Soybean

and Corn report:

2022

U.S. Corn Yield Lowered 1.0 bu/ac to 173.0 bu/ac

2022

U.S. Soybean Yield Unchanged at 50.5 bu/ac

Macros

99

Counterparties Take $2.165 Tln At Fed Reverse Repo Op (prev $2.176 Tln, 102 Bids)

US

Housing Starts Jul: 1.446Mln (est 1.527Mln, prev 1.559Mln)

Housing

Starts M/M Jul: -9.6% (est -2.1%, prev -2%)

US

Building Permits Jul: 1.674Mln (est 1.64Mln, prevR 1.696Mln)

Building

Permits M/M Jul: -1.3% (est -3.3%, PrevR 0.1%)

US

Housing Starts Decline To Lowest Level Since Early 2021 – BBG

Manufacturing

Production Jul: 0.7% (est 0.3%, prev -0.5%)

US

Industrial Production M/M Jul: 0.6% (est 0.3%, prev -0.2%)

Capacity

Utilization Jul: 80.3% (est 80.2%, prev 80%)

Canada

CPI NSA M/M Jul: 0.1% (est 0.1%, prev 0.7%)

CPI

Y/Y Jul: 7.6% (est 7.6%, prev 8.1%)

·

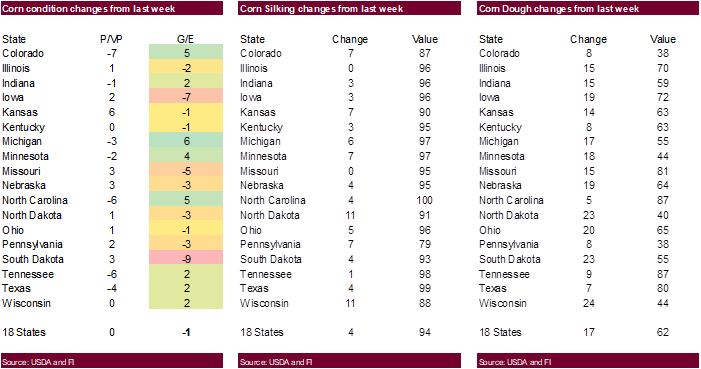

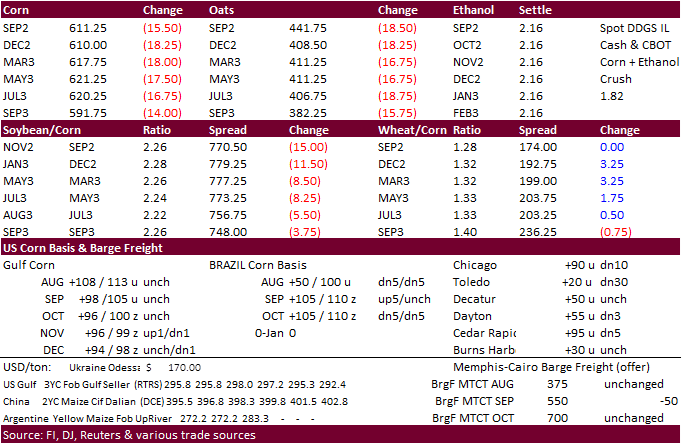

Corn futures extended losses after crop conditions dipped only one point last week to 57 percent G/E, and a US weather forecast calling for rain across the Corn Belt over the next week. September and December corn futures reached

a one-week low.

·

Spill over economic concerns after China cut interest rates yesterday also continued to weigh on grain prices. USD was lower by nearly 10 points by 1:00 PM CT. WTI crude oil was down more than $3.50 around the same time, just

before the CBOT agriculture close, and settled at $86.53/Bbl, lowest settle since January 25.

·

Funds sold an estimated net 10,000 corn contracts.

·

Cooler temperatures for the US is seen as beneficial for corn maturity. Rain fell across western and south-central IA, NE and northern Missouri. Most of the US Midwest crop areas during the next ten days will see some rain.

·

The EU will see an increase in rains this week.

·

EU corn imports reached 3.59 million ton since July 1, against 1.78 million tons previous period year earlier.

·

Turkey reported five more grain ships left Ukraine carrying corn and wheat. One of the ships is bound for Africa (donation).

·

A Ukraine official projected Ukraine could export 3 million tons of grain from ports during the month of September and four million tons from then. Up to 30 applications were turned in for ships to arrive in Ukraine over the next

two weeks.

·

Some speculate the Ukraine winter grain area could drop 30 to as much as 60 percent for 2023 production without state assistance.

·

85 percent of Brazil’s center-south corn crop had been collected as of late last week.

·

Anec sees Brazil corn exports during August reaching 8.09 million tons versus 7.88 million seen last week.

·

China may reduce Australian meat imports citing foot and mouth disease, a claim that Australia rejects.

·

A Bloomberg poll looks for weekly US ethanol production to end up unchanged at 1022 thousand (1003-1034 range) from the previous week and stocks up 24,000 barrels to 23.256 million.

Due

out Friday

·

None reported

Updated

8/16/22

September

corn is seen in a $5.70 and $6.60 range

December

corn is seen in a $5.50-$7.00 range

·

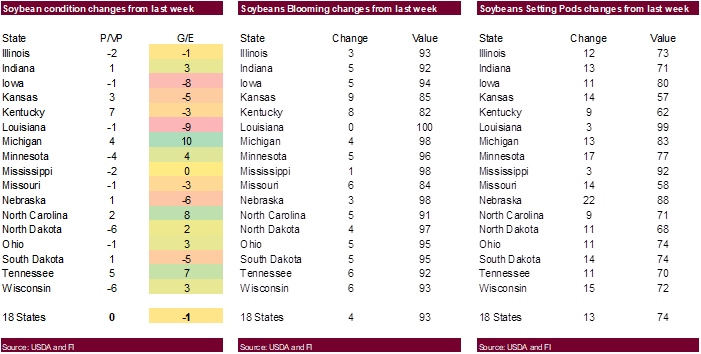

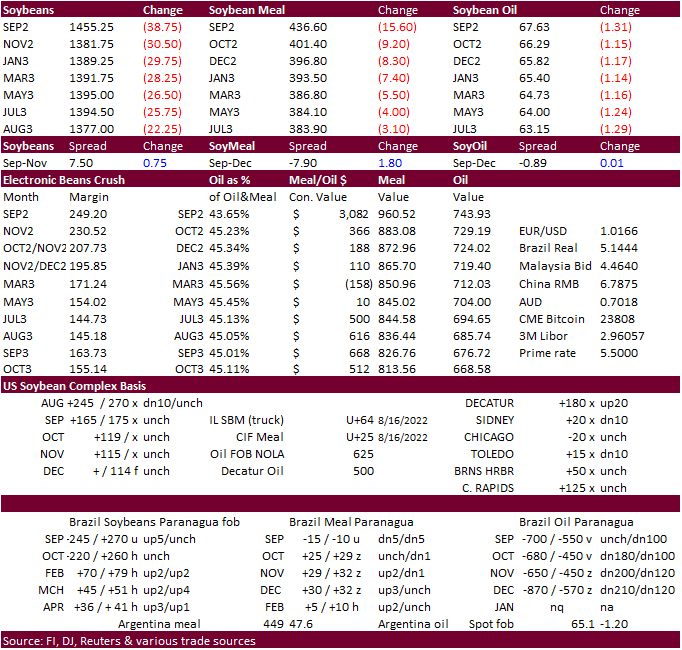

Soybeans,

meal and soybean oil were lower from good US weather and China economic concerns. WTI crude oil traded sharply lower, pressuring soybean oil. US soybean crop conditions were down one point last week to 58 percent. Some traders were looking for a larger decline.

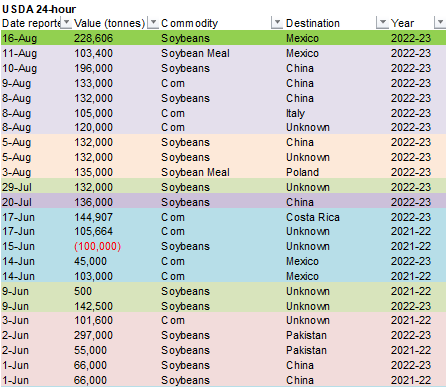

USDA announced 228,606 tons of soybeans were sold to Mexico for new-crop delivery.

·

Funds sold an estimated net 12,000 soybeans, sold 4,000 meal and sold 5,000 soybean oil.

·

Some traders are eying the SX gap of $13.4925.

·

September Board crush margins traded lower after hitting as contract high of $2.5975 yesterday. The back months were higher.

·

SGS reported Aug 1-15 Malaysian palm oil exports at 516,072 tons, a 9.5 percent decrease from the same period last month.

·

Malaysia’s ringgit hit a 5-1/2 year low, and this helped lift Malaysia October palm oil higher.

·

Anec sees Brazil soybean exports during August reaching 5.74 million tons versus 5.67 million seen last week.

·

European Union soybean imports so far for 2022-23 (July 1 start) reached 1.57 million tons by Aug. 14, against 1.77 million tons by the same week in last season. EU rapeseed imports reached 718,647 tons, compared with 435,611

tons a year earlier. Soymeal imports were 1.67 million tons against 1.98 million tons the prior season. EU sunflower oil imports were at 191,978 tons, against 188,648 tons a year earlier.

Export

Developments

·

Egypt bought 47,000 of local soybean oil. They were looking for arrival Oct. 1-25 and/or Nov. 1-20, 2022. No prices were provided.

·

Tunisia seeks 6,000 tons of crude degummed vegetable oil on Wednesday for August 27 to September 10 shipment.

·

Private exporters reported sales of 228,606 tons of soybeans for delivery to Mexico during the 2022-23 marketing year.

·

Results awaited: The CCC seeks 4350 tons of vegetable oil for use in export programs on Aug 16 for Sep 9-oct 15 shipment, October for plants at ports.

Updated

8/16/22

Soybeans

– September $13.75-$15.25

Soybeans

– November is seen in a $12.50-$16.00 range

Soybean

meal – September $395-$460,

December $380-$445

Soybean

oil – September 66.50-70.00,

December 61.00-72.00

·

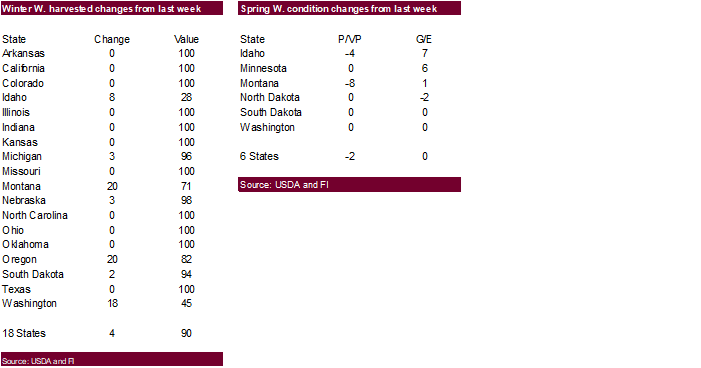

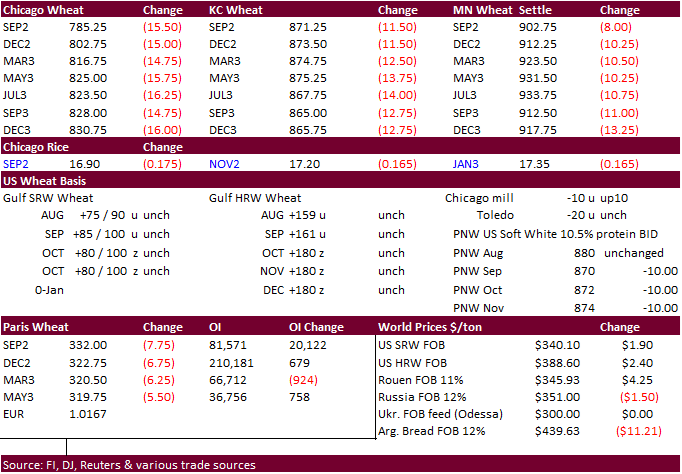

US and EU wheat futures were

lower on follow through selling, unchanged US spring wheat crop condition (64 percent G/E), improving weather for the EU and increase in Ukraine port shipments.

·

Funds sold an estimated net 8,000 Chicago wheat contracts.

·

SovEcon increased their estimate for the Russia wheat crop to 94.7 million tons from previous 94.7 million tons. They warned Russian wheat exports have been “painfully slow” because on Western sanctions. For all grains they are

at 142.6 million tons, including 15.1 million tons of corn and 20.6 million tons of barley.

·

USDA is at 88 million tons for the Russia wheat crop, a figure that will likely increase next month.

·

Ukraine is working with officials to help free up a detained wheat vessel purchased by Egypt.

·

Some sources told AgriCensus that Ukraine will see a large feed wheat crop this season. One estimated 60/40 or 50/45 of it as feed.

·

European Union soft wheat imports so far for 2022-23 (July 1 start) reached 3.58 million tons,

compared

with 3.14 million tons by the same week in 2021-22.

·

Paris September wheat was down 7.75 euros at 332 euros.

·

Iraq’s state grains buyer seeks 50,000 tons of milling wheat from the United States on September 17.

·

Jordan bought about 60,000 tons of wheat, optional origin. The wheat was bought at $385.50 a ton, c&f, for shipment in the first half of February 2023.

·

Jordan seeks 120,000 tons of barley on August 17 for LH Dec through LH Feb shipment.

·

Japan’s AgMin seeks 70,000 tons of feed wheat and 40,000 tons of feed barley on August 19 for arrival by January 26, 2023.

Rice/Other

·

Cotton futures extended their rally on US crop concerns.

·

Iraq’s state grains buyer seeks 50,000 tons of rice on September 17.

Updated

8/10/22

Chicago – September $7.60 to $8.20 range, December $7.00-$10.50

KC – September $8.30 to $9.10 range, December $7.00-$10.75

MN – September $8.65‐$9.50, December $8.00-$11.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.