PDF Attached

USDA

report day.

Wide

trading ranges today with a higher finish for the soybean complex and corn. Most wheat contracts were lower but well-off session lows. Bottom picking after a bearish reaction to the USDA report was noted. US weather forecast improved for the US Midwest with

a wetter bias for the southwestern areas early next week. GP is unchanged. A high-pressure ridge is still advertised for the western North America during the second week of the outlook.

USDA

S&D Reaction: Bearish

soybeans as the initial USDA survey revealed a higher-than-expected yield than trade expectations, but the US lost 311,000 harvested acres. Corn was seen friendly with global stocks down 6.3 million tons. Wheat was neutral, in our opinion, and prices should

remain trading weather and demand.

USDA

NASS briefing

https://www.nass.usda.gov/Newsroom/Executive_Briefings/index.php

USDA

OCE Secretary’s Briefing

https://www.usda.gov/oce/commodity-markets/wasde/secretary-briefing

US

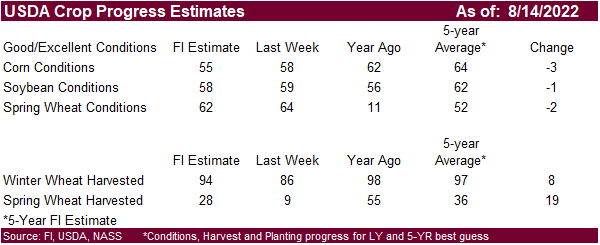

2021-22 soybean ending stocks were estimated at 225 million bushels, 10 million above July. US soybean exports were lowered 10 million bushels to 2.160 billion. USDA likely will need to take exports down at least another 15 million bushels, in our opinion.

USDA reported the US soybean crop at 4.531 billion bushels, 26 million above July and 50 million above an average trade guess. The yield was 51.9 bu/ac, 0.4 bu above July and 0.8 bu above an average trade guess. The US soybean harvested area was down 311,000

acres. Recall USDA resurveyed ND, SD, and MN. New-crop US soybean ending stocks were raised 15 million bushels to 245 million (225 for 2021-22), 15 million above trade expectations. With supply up 36 million bushels, new-crop exports were taken up 20 million

bushels to 2.155 billion. Residual was revised higher by 1 million. We are still in the camp that 2022-23 US ending stocks could fall below 200 million bushels based on higher crush and export estimates, and lower yield. The new-crop meal S&D was left unchanged.

US soybean oil for biofuel was lowered 200 million pounds to 10.5 billion, in line with our projection. Slower than expected growth of renewable biodiesel production and higher use of other feedstock inputs led to a shortfall in SBO use expectations. The new-crop

soybean demand was also left unchanged, but stocks were lifted 150 million pounds to reflect the lower 2021-22 industrial use and 50-million-pound cut to soybean oil imports for the current year.

World

new-crop soybean ending stocks were upward revised 1.8 million tons to 101.4 million, in part to higher global production and an upward revision to 2021-22 world ending stocks. USDA left old and new-crop Brazil and Argentina production unchanged but lowered

2021-22 (Oct-Sep) Brazil exports by 1 million tons to 80 million. 2022-23 new crop China soybean production was revised 900,000 tons higher to 18.4 million tons. If realized that is a 12.2% increase from 2021.

Argentina

imports of soybeans were upward revised 500,000 tons. With production problems in SA, we wonder if they could turn to the US for soybeans if they get cheap enough during harvest

US

2021-22 corn ending stocks were estimated at 1530 million bushels, 20 million above July. 2021-22 corn for ethanol use was lowered 25 million bushels to 5.350 billion and food raised 5 million. USDA may have to lower 2021-22 corn exports in the next report

unless shipments increase during the balance of this month. USDA reported the US corn crop at 14.359 billion bushels, 146 million below July and 33 million below an average trade guess. The yield was 175.4 bu/ac, 1.6 bu below July and 0.5 bu below an average

trade guess. The corn harvested area was lowered 140,000 acres. US 2022-23 corn ending stocks were lowered 82 million bushels (14 million below trade expectations). With US supply down 127 million bushels, USDA lowered feed by 25 million bushels and exports

by 25 million. They took food up 5 million.

For

world corn, USDA made some ending stock adjustments for the 2020-21 and 2021-22 crop years. There were no major changes to the large corn producing countries for 2021-22 (Brazil and Argentina left unchanged), but world ending stocks were lowered 0.4 million

tons to 276.4 million. The lower supply and production cuts for new-crop 2022-23 prompted USDA to lower 2022-23 global stock by 6.3 million tons to 306.7 million tons, 3.1 million below trade expectations. EU corn production was lowered 8 million tons to 60

million, 11 million below 2021. This is still too high, by at least 5 million tons, in our opinion. World corn production was lowered 6.3 million tons to 1180 million tons, 3.2% below year ago.

US

2022 production changes in wheat by class were seen neutral, but USDA made several changes to many countries. The US wheat production was revised up 2 million bushels to 1.783 billion, 8 million below an average trade guess. US winter wheat production was

revised down 5 million with a reduction in HRW and WW more than offsetting an increase in SRW. Other spring wheat was revised higher by 9 million bushels to 512 million and durum was revised lower by 4 million to 74 million. US 2022-23 all-wheat ending stocks

were estimated at 610 million bushels, 29 million below July and compares to 660 million at the end of 2021-22. USDA made minor changes to its old crop US all-wheat demand by lowering exports by 4 million bushels, raising FSI by 10 and revising lower feed

by 6 million bushels. For new-crop, USDA took FSI up 6 million and exports were raised 25 million.

Like

corn, USDA made adjustment to world wheat ending stocks for the 2020-21 and 2021-22 crop years. The 2021-22 world wheat ending stocks were lowered a large 3.8 million tons to 276.4 million tons. USDA trimmed old crop stocks for three out of the six major exporting

countries. 2022-23 world production was upward revised a large 8 million tons to a record 779.6 million tons, while stocks were seen down 200,000 tons from last month.

Output

for Russia, Australia (+3), and China (+3) were increase. Russia alone was taken up 6.5 million tons to 88 million tons. Reductions were posted for India (-3) and the EU (-2). The global feed and export demand was raised by USDA. A short corn crop in the EU

could boost EU wheat for feed from USDA current projection of 43.0 million tons (45.5 MMT year ago), despite the 4.5% decrease in 2022 EU wheat production.

Attached

PDF includes FI snapshot and supply projections

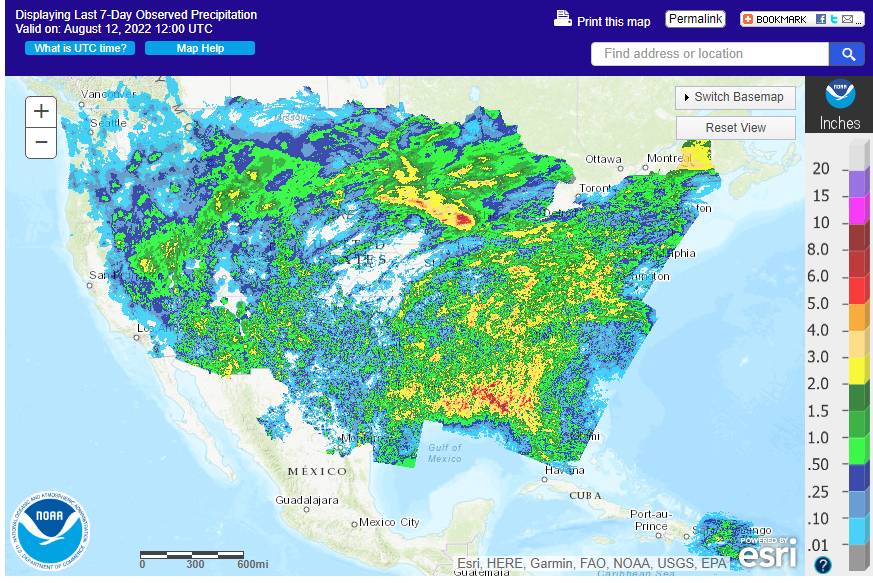

7-day

WEATHER

TO WATCH AROUND THE WORLD

-

U.S.

operational computer weather forecast model runs were still divergent today and the best solution is a compromise between the GFS and European models -

Showers

and thunderstorms will occur in nearly all crop areas in the U.S. Midwest, Delta and southeastern states -

Resulting

rainfall combined with mild to cool temperatures will help keep soil conditions at status quo which implies no further declines in crop and field conditions during the forecast periods -

There

may not be many areas of sustainable improvement either and the need for greater rain may continue for some areas.

-

U.S.

forecast models all keep the high-pressure ridge to the west during the next couple of weeks so that no excessive heat reaches into the Midwest, Delta or southeastern states -

Such

conditions are very helpful for late season crops especially those that have experienced the greatest stress this summer -

The

production year is still poised to be relatively good with the only problem areas in the far westernmost parts of the Midwest and in the Great Plains -

U.S.

Delta and southeastern states to see a good mix of weather next ten days supporting mostly favorable crop development -

Rain

in West Texas late next week and especially August 22-24 may offer a little topsoil moisture boost briefly, but no general “fix all” to drought is expected -

No

serious change in cotton, corn or sorghum production potential is expected, but some temporary improvement in topsoil moisture might occur in parts of the region -

A

high-pressure ridge and more dry and very warm weather is possible later this month in the southern Plains -

Cooling

in the U.S. Plains next week will bring temperatures back to a normal to below range for a week to ten days

-

U.S.

Pacific Northwest will experience some warmer biased weather next week and in the following week while rainfall stays below normal -

Eastern

U.S. Midwest will be quite mild in the second week of the forecast with some periodic light showers from the Great Lakes region into the middle Atlantic Coast -

Not

much change was noted in Europe with showers expected to begin next week to take the edge of stress off of some crop areas, but no general soaking will occur -

Temperatures

will be cooler in week two, but still quite warm through the coming weekend and early next week

-

Southeastern

Europe will also experience periodic showers and thunderstorms during the next two weeks resulting in partial relief from dryness, but greater rain will still be needed to end the stressful environment

-

Russia’s

Southern Region, easternmost Ukraine, western Kazakhstan and the middle Volga River Basin is still expected to see a full week to nearly 10 days of very warm to hot temperatures and limited rainfall

-

The

west half of Russia will be warmer than usual over the next two weeks with the area noted above to be most above normal with 80- and 90-degree Fahrenheit highs expected frequently and a few extremes near 100 -

There

will be some potential for scattered showers during mid-week next week, but early indications suggest most of the rain will prove to be inconsequential to production expectations -

Southeastern

China is still advertised to be drier than usual and very warm to hot over the next ten days -

The

area includes all of the Yangtze River Basin with extreme highs in the 95- to 108-degree range daily through Aug. 25 -

Xinjiang,

China weather will remain mostly well mixed for summer crop development in both corn and cotton production areas as well as many other crop areas -

Northeastern

China and parts of the North China Plain will stay plenty wet over the next ten days and some drying will be needed -

Locally

heavy rain is expected and with the ground already saturated with some recent flooding the potential for crop damage may rise during the periods of heavier rain -

East-central

through northwestern India will experience frequent waves of significant rain keeping the ground quite wet

-

Areas

of flooding are expected, but no generalized serious flood or widespread crop damage is expected -

Southern

India will be drier than usual -

Timely

rain will occur in the Ganges River Basin, but moisture deficits will remain in the area possibly impacting some sugarcane, rice and pulse production -

Significant

rain will fall in Pakistan as well as central India -

Rainfall

this summer has been much greater than usual in Pakistan bolstering water supply and possibly supporting much larger than usual rice, cotton and other crops -

Australia

weather will remain well mixed with rain and sunshine the next ten days -

Rain

will fall in most of the wheat, barley and canola areas maintaining moisture abundance and keeping the crop poised for an excellent start to the growing season -

Western

Argentina will continue drier biased -

A

few mostly insignificant showers will occur -

Dryness

remains a concern, although rain earlier this week was good for some improved wheat establishment -

Southern

and a few west-central Brazil and Paraguay areas will be wet biased over the next ten days -

The

moisture will be good for winter wheat and for some of the minor early season corn planting that may already be under way or soon will be

-

Recent

rain in Parana, Sao Paulo, Mato Grosso do Sul and southern Minas Gerais was good for sugarcane, citrus and some coffee.

-

Coffee

flowering may be under way in a few areas, although most of the precipitation in Sul de Minas was a little too light to induce flowering -

Canada’s

southwestern Prairies will continue drying out over the next ten days to two weeks, but some scattered showers and thunderstorms will be possible in the southeastern Prairies for brief periods of time late this weekend into next week

-

Korean

Peninsula will receive waves of rain over the next two weeks resulting in significant soil moisture improvements -

Southern

parts of North Korea and much of South Korea will frequent bouts of receive heavy rain

-

Flooding

is possible in both areas , although today’s forecast is not as wet as it was earlier this week

-

Tropical

Storm Meari was approaching the Tokyo area of Honshu, Japan today and will pass over Tokyo Bay Saturday while producing wind speeds to more than 50 mph and waves of heavy rain -

The

storm will quickly move back over open water Saturday evening and will move away from Japan -

Some

heavy rain and local flooding is expected in central Honshu, but no damaging wind is expected and flooding should be confined to a small region near Tokyo -

A

sukhovei is evolving and continue into next week in Russia’s Southern Region, western Kazakhstan and eastern Ukraine -

A

“sukhovei” is a hot, dry, wind that blows across the Russian Steppes periodically, but in serious episodes it can generate enough heat, low humidity and strong wind to desiccate a crop over a relatively short period of time.

-

World

Weather, Inc. is concerned about this coming event because of the potential for it to be a longer lasting one that should result in a prolonged period of 90- and a few lower 100-degree high temperatures, low humidity and wind speeds of 25 to 40 mph with higher

gusts late this week into next week -

Soil

moisture is already low in the lower Volga River Basin and western Kazakhstan including the eastern half of Russia’s Southern Region -

A

sukhovei now would not bode well for crops in that region -

Soybeans,

sunseed and corn are produced in the region among other crops -

These

areas in Russia are already in a net drying mode and the Sukhovei will only exacerbate the situation raising unirrigated crop stress and a potential threat to production

-

Some

disruption to the warm and dry biased weather is expected briefly during mid-week next week when scattered showers develop and the wind turns southeasterly -

The

Sukhovei will likely resume again during the second weekend of the two-week outlook and could last long enough to resume crop moisture stress and a threat to production in a few areas -

Mainland

areas of Southeast Asia will get plenty of rain, but nothing too extreme over the next ten days -

Philippines

and Indonesia weather will continue frequently wet during the next ten days

-

East-central

Africa will be most significant in Ethiopia this week while Uganda and Kenya rainfall becomes remains lighter

-

Flooding

has been occurring in parts of Ethiopia recently and it may continue at times -

Tanzania

is normally dry at this time of year and it should be that way for the next few of weeks -

“Some”

increase in rain is expected in Uganda next week -

West-central

Africa rainfall has been and will continue sufficient to support coffee, cocoa, sugarcane, rice and cotton development normally -

Some

greater rain would still be welcome in the drier areas of Ivory Coast and Ghana

-

Seasonal

rains have shifted northward leading to some drying in southern areas throughout west-central Africa – this is normal for this time of year -

Cotton

areas are expecting frequent rainfall in the next couple of weeks -

South

Africa’s crop moisture situation is favorable for winter crop establishment, although some rain would be welcome -

Restricted

rainfall is expected for a while, but the crop is rated better than usual because of frequent rainfall during the autumn planting season and timely rain since then -

Central

America rainfall will continue to be abundant to excessive and drying is needed -

Mexico

rain will be most abundant in the west and southern parts of the nation -

Drought

will prevail in the northeast until a tropical cyclone can impact the region, although a temporary increase in rainfall may occur briefly for a while August 20-27 -

Rain

in the Greater Antilles will occur periodically, but no excessive amounts are likely -

Today’s

Southern Oscillation Index was +9.47and it will move erratically over the next week -

New

Zealand weather is expected to be quite cool into next week with rain becoming heavy at times in North Island and northern parts of South Island -

Some

flooding will be possible

Source:

World Weather INC

Bloomberg

Ag Calendar

Friday,

Aug. 12:

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, 12pm - China’s

agriculture ministry (CASDE) releases monthly report on supply and demand for corn and soybeans - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - New

Zealand food prices - FranceAgriMer

weekly update on crop conditions - EARNINGS:

Olam, Golden Agri - HOLIDAY:

Thailand

Monday,

Aug. 15:

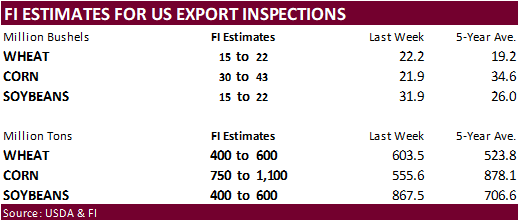

- USDA

export inspections – corn, soybeans, wheat, 11am - US

crop conditions for wheat, corn, soybeans and cotton; wheat harvesting, 4pm - Malaysia’s

Aug 1-15 palm oil export data - HOLIDAY:

Argentina, France, India, Bangladesh

Tuesday,

Aug. 16:

- New

Zealand global dairy trade auction - EU

weekly grain, oilseed import and export data

Wednesday,

Aug. 17:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - HOLIDAY:

Indonesia

Thursday,

Aug. 18:

- China’s

second batch of July trade data, including corn, pork and wheat imports - International

Grains Council report - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

Friday,

Aug. 19:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Brazil’s

Conab releases sugar, cane and ethanol output data - US

cattle on feed, 3pm - EARNINGS:

Deere

Saturday,

Aug. 20:

- China’s

third batch of July trade data, including soy, corn and pork imports by country - Amspec

to release Malaysia’s Aug. 1-20 palm oil export data

Source:

Bloomberg and FI

USDA

FSA crop acreage data

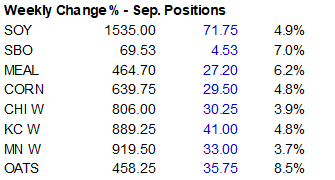

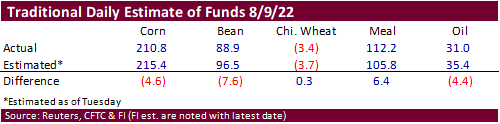

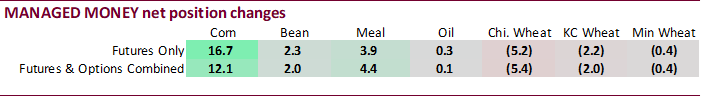

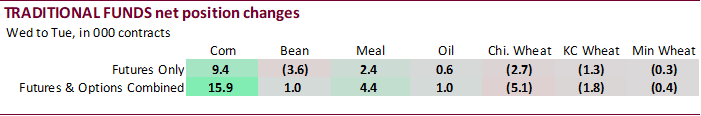

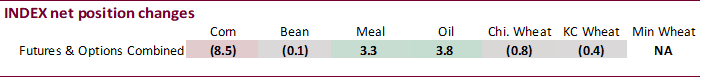

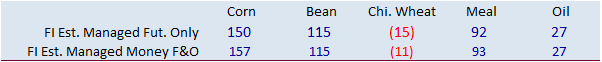

Not

much in the way of actual vs. estimate deviations for the week ending Tuesday, August 9. Funds were still short Chicago wheat (and are going home Friday), something to watch as they can easily add long positions.

Reuters

Table

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

54,670 19,425 372,220 -8,455 -377,473 -14,133

Soybeans

35,010 498 146,796 -117 -152,933 -2,452

Soyoil

-3,915 -1,462 98,621 3,778 -100,661 -6,172

CBOT

wheat -57,907 -3,432 118,604 -790 -55,356 537

KCBT

wheat -13,622 -1,712 49,892 -386 -35,116 1,564

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

142,062 12,141 242,968 -7,606 -373,542 -11,476

Soybeans

101,509 2,039 89,029 -1,297 -151,179 -1,736

Soymeal

84,382 4,365 85,297 3,390 -213,939 -8,988

Soyoil

22,210 69 82,870 3,442 -114,087 -8,300

CBOT

wheat -20,348 -5,378 69,041 1,613 -48,028 -167

KCBT

wheat 8,023 -1,970 29,790 185 -31,253 1,095

MGEX

wheat -1,015 -363 1,473 76 -518 407

Total

wheat -13,340 -7,711 100,304 1,874 -79,799 1,335

Live

cattle 49,072 11,067 59,953 -453 -121,615 -9,397

Feeder

cattle 479 668 3,198 -184 3,485 -126

Lean

hogs 65,153 8,402 50,574 -51 -109,656 -13,081

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

37,931 3,777 -49,418 3,164 1,803,434 -32,259

Soybeans

-10,487 -1,077 -28,872 2,072 749,412 15,515

Soymeal

19,134 61 25,126 1,172 455,180 11,836

Soyoil

3,051 932 5,955 3,855 457,240 29,532

CBOT

wheat 4,678 248 -5,341 3,684 429,529 6,722

KCBT

wheat -5,403 154 -1,156 534 180,595 -5,427

MGEX

wheat 2,536 -26 -2,477 -96 61,446 -985

Total

wheat 1,811 376 -8,974 4,122 671,570 310

Live

cattle 16,685 -235 -4,095 -981 311,042 -1,055

Feeder

cattle 39 33 -7,200 -391 56,315 2,527

Lean

hogs 3,902 3,309 -9,973 1,421 310,366 23,604

US

Import Price Index M/M Jul: -1.4% (est -1%, prevR 0.3%)

Import

Price Index Y/Y Jul: 8.8% (est 9.4%, prev 10.7%)

Export

Price Index M/M Jul: -3.3% (est -1%, prev 0.7%)

Export

Price Index Y/Y Jul: 13.1% (prev 18.2%)

US

Univ. Of Michigan Sentiment Aug P: 55.1 (est 52.5; prev 51.5)

–

Current Conditions: 55.5 (est 57.8; prev 58.1)

–

Expectations: 54.9 (est 48.5; prev 47.3)

–

1-Year Inflation: 5.0% (est 5.1%; prev 5.2%)

–

5-10 Year Inflation: 3.0% (est 2.8%; prev 2.9%)