PDF Attached includes updated S&D’s and price projections

Another

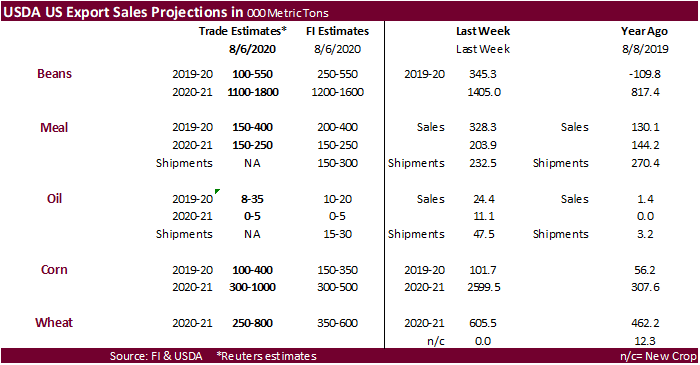

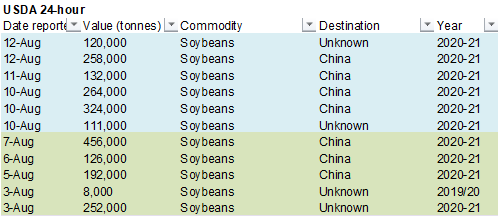

258k soybeans were announced by USDA for China

and 120k to unknown. Initial reaction to USDA’s Aug report was neutral to bearish, but the market responded by short covering positions in corn and soybeans. Wheat ended lower in Chicago and MN, mixed in KC. Traders remain focused

on the weather event that occurred Monday.

![]()

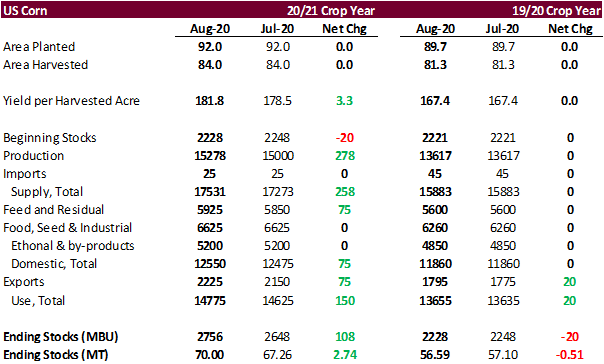

US

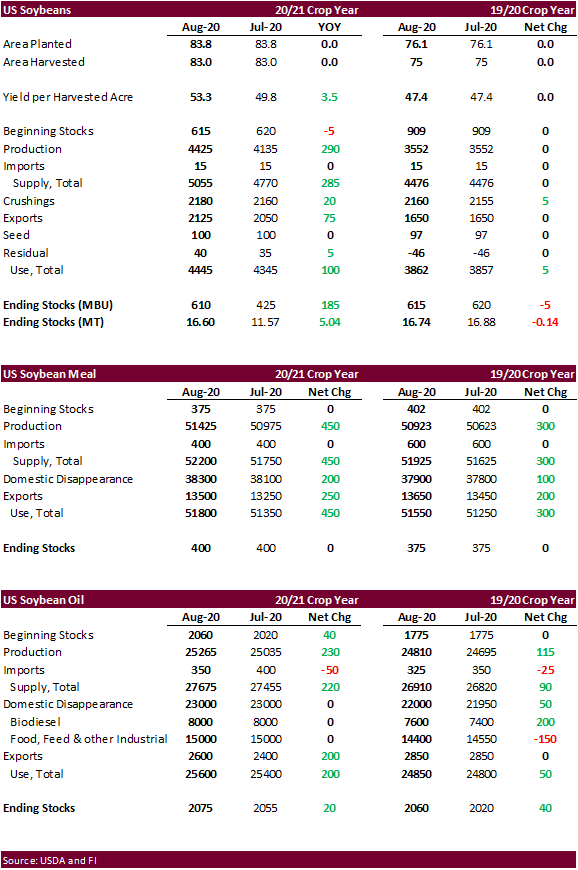

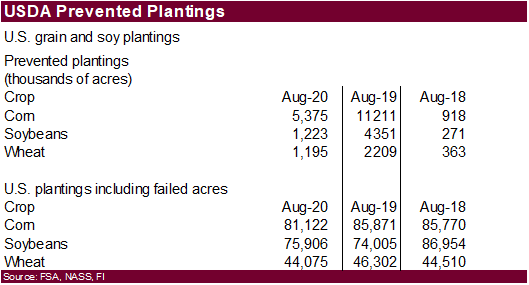

soybean old crop stocks within expectations but new-crop was upward revised 86 million bushels, a bearish indicator. USDA did not upward revise old crop soybean exports, too low in our opinion. US soybean production came in 171 million bushels above trade

expectations as the yield was reported at a record 53.3 bushels per acre, above previous 51.9 for 2016-17. Brazil 2019-20 soybean exports were taken up 4.5 MMT to 93.5 million tons. World soybean production was taken up 7.9 million tons, offset by an upward

revision to 2020-21 China imports by 3.0 million to 99 million. We believe China will import of 100 million tons of soybeans in 2020-21. Brazil soybean exports were taken up 1 million tons for 2020-21 to 84 million tons, 9.5 million below 2019-20.

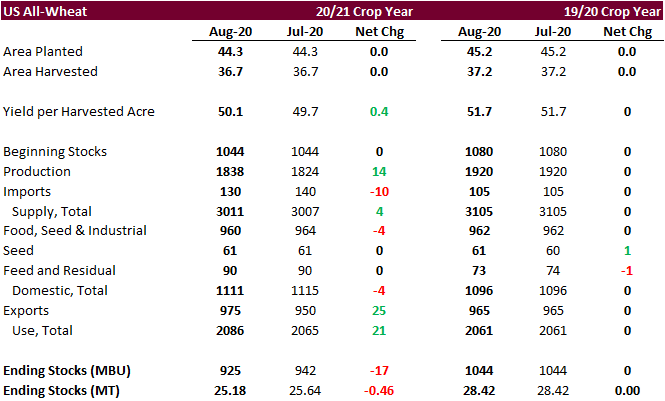

US

wheat stocks were reported 21 million bushels below expectations although production came in slightly above expectations. World wheat was downward revised 3.3 million tons in large part to a 4 million ton decrease to the EU wheat crop. World ending stocks

were taken up 2 million tons. Ukraine 2020-21 wheat production was lifted higher by 0.5MMT and Russia by 1.5MMT. USDA took Brazil wheat production higher by 1.1MMT to 6.8MMT.

We

see this report as less influential for price reaction unlike other August report years, but short covering rallied soybeans and corn. The trade will shift back their focus to US weather developments and impact from the recent derecho that ripped across IA

and IL. Another focus point the trade will be watching will be upcoming soybean and corn shipments after China committed a good amount of product. Look for prices to remain subdued over the short term. If crop damage was not as widespread as speculated

early this week, we would not rule out $2.95 Dec corn, $8.40 Nov soybeans, and $4.75 Dec Chicago wheat.

Note

on crop damage: IA damage via twitter…

https://twitter.com/kennedyclouds/status/1293262701934895110?s=21

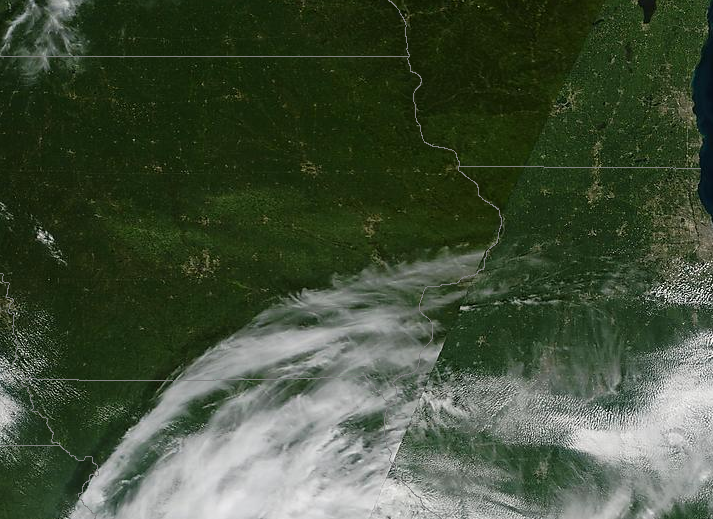

WEATHER

HOT SPOTS IN THE WORLD

- Argentina

remains too dry and concern remains for its wheat and barley production potential - Cordoba

remains driest with parts of Santa Fe, La Pampa and northwestern Buenos Aires drying out recently - The

trend will not change much for at least the next week - Cordoba

is unlikely to see significant rain for the next two weeks - World

Weather, Inc. is looking for a little better opportunity for some rain in September in the driest areas - China’s

flooding is over and the Yangtze River Basin is drying out - The

drying trend will continue for the next couple of weeks - Some

locally heavy rain and local flooding is still possible in northern parts of the nation periodically in the next two weeks, but no new crop damage is expected - India

may be facing a greater amount of flooding next week and into the following weekend as rain intensity increases along with its persistence - A

close watch on Madhya Pradesh and immediate neighboring areas is warranted for the next couple of weeks - Most

of India’s crops remain in very good condition, despite some ongoing dryness in northwestern Rajasthan, Himachal Pradesh and Jammu and Kashmir - Russia’s

New Lands have either received significant rain recently or going to be receiving it in this coming week - Spring

wheat and sunseed crop improvements have occurred recently and will continue, although some of the coming improvement is occurring a little late

- Reports

of lower corn production have been received from Ukraine - Dryness

in Ukraine and Russia’s Southern Region has been serious in recent weeks and all unirrigated summer crop yields are likely down

- Eastern

and southern Ukraine and most of Russia’s Southern region away from Krasnodar and Georgia has been too dry for many weeks - Relief

from dryness is unlikely for at least another week to ten days, but some rain may come later this month - The

moisture will arrive too late, however. - Relief

from drought in France, Germany, Belgium, the U.K. and Netherlands will begin today and last for the next week

- Improving

soil moisture will be great for future winter crop seeding, but may only stop the recent declines in summer crop condition and yield - A

reversal in the production potential losses in France is highly unlikely, but the rain will stop the decline - West-central

Africa dryness in Ivory Coast, Ghana and neighboring areas is not unusual for this time of year, but the dryness started early and has festered long enough to be of some concern to rice, sugarcane, coffee and cocoa - Seasonal

rains are expected to return, albeit a little slower than usual - Once

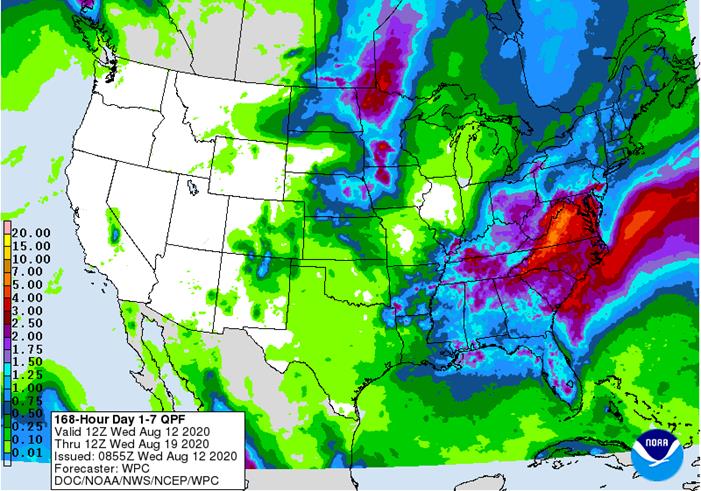

the seasonal rains resume they may become heavy in late September and October - U.S.

weather looks non-threatening for the next two weeks - Showers

will occur in the first week of the outlook benefiting many areas, but not all - Cooler

than usual conditions in the Midwest next week will greatly reduce evaporation, slow crop development rates and conserve soil moisture

- Crop

conditions will be mostly good - Warming

in the last ten days of August will come with much less rainfall and the impact will be to dry down many Midwestern crop areas, but that will only benefit corn maturation

- Some

soybeans could become stressed, but the growing season will be winding down before too long limiting the amount of time that dryness could impact crops -

West

Texas will get some showers and thunderstorms this week and into early next week, but they will be brief and light failing to soak the region -

Sufficient

moisture will be present to help keep temperatures from becoming excessively hot -

Highest

temperatures the remainder of this week will occur through Saturday when readings range from 97 to 108 degrees Fahrenheit -

Temperatures

will not be quite as warm late in the coming weekend or next week due to some higher relative humidity and a few showers

-

High

temperatures may slip to the upper 80s and 90s -

U.S.

northwestern Plains and southwestern Canada’s Prairies will not receive much rain for the next ten days favoring harvest progress for early season crops, but stressing some of the late season crops -

Far

western U.S. weather will be mostly dry and warm during the next ten days as the monsoon flow remains sporadic and light -

Ontario

and Quebec weather is mostly good with alternating periods of rain and sunshine over the next two weeks -

Recent

rain bolstered topsoil moisture and removed concern over dryness

-

Xinjiang,

China weather during the weekend was warm and dry -

Highest

temperatures reached the 80s Fahrenheit northeast and the 90s to 108 in other crop areas -

The

region will not likely see much change in weather this week -

Cotton

and other crops are suspected of developing favorably, although cool conditions in the minor production areas of the northeast have reduced yields and may be delaying maturation for some crops. -

More

frequent and more abundant rain is expected in mainland areas of Southeast Asia during the coming ten days -

The

moisture boost will be good for rice, sugarcane, coffee and a host of other crops -

Flooding

rain is expected in western and southern Myanmar over the next couple of weeks -

Rain

continues erratic and mostly absent in Sumatra, Java and parts of Borneo in Indonesia and Malaysia -

Temperatures

have been ebbing warmer than usual as well -

Rainfall

will continue erratic and light for a while in these areas, but some slowly increasing rainfall is expected late this week through most of next week -

Philippines

rain recently has been bolstering soil moisture in many areas from western Luzon Island southward to northern Mindanao -

Recent

rainfall has been supportive of crops and little change will occur over the next ten days -

South

Africa rain will continue periodically in the southwest over the next couple of weeks, but most of it will be near the coast and it will not be frequent enough to seriously bolster topsoil moisture for long term crop use -

Eastern

winter wheat and barley areas still need a general rain to support dryland crops which represent 8% of the total crop in the region -

Temperatures

will be cooler than usual -

Australia

rainfall will impact most winter crop areas during the next ten days -

However,

much of the resulting rain will be light and there will be some ongoing need for greater rain in Queensland and South Australia -

The

bottom line remains a very good outlook for the nation’s winter crops, although there will still need follow up rain to fix long term moisture deficits in Queensland as well as South Australia -

Southern

Brazil will receive rain today through August 20 and it will be good for winter wheat, corn planting and early corn establishment -

Most

of the precipitation will fall in Rio Grande do Sul, Santa Catarina, Parana, Paraguay and southern Mato Grosso do Sul leaving areas to the north drier biased; including Sao Paulo and a few locations in southern Minas Gerais and Rio Grande do Sul -

Dry

weather is expected elsewhere in Brazil except coastal areas from Espirito Santo to Bahia where rain is expected periodically -

Mexico

precipitation in the coming week to ten days will be greatest in western and southern parts of the nation benefiting many corn, sorghum and dry bean production areas -

Coffee,

citrus, sugarcane and many fruit and vegetable crops will also benefit -

Northeastern

Mexico will be mostly dry -

Some

of the region is still drought stricken -

Central

America rainfall will increase this week and continue plentiful next week -

New

Zealand rainfall will be below average this week and above normal in parts of the nation in the August 20-26 period -

Southern

Oscillation Index was +3.86 this morning and it will continue positive most of this week -

Tropical

Depression 06W remains south of Japan’s main islands will move toward the southern Ryukyu Islands over the next several days -

The

storm is very small and expected to move west southwesterly over open water for the next few days while changing little in intensity -

The

system is not likely to impact any major landmass as a significant tropical cyclone

-

Tropical

Depression Eleven is still far from land in the Atlantic Ocean and it is expected to become a tropical storm and pass northeast of the northern Leeward Islands this weekend

Source:

World Weather Inc.

7

Day Precipitation Outlook

- USDA’s

monthly World Agricultural Supply and Demand (Wasde) report, noon - China

CASDE monthly crop supply and demand report - Vietnam

data on coffee, rice and rubber exports in July - EIA

U.S. weekly ethanol inventories, production, 10:30am - U.S.

soybean, corn acreage, noon - EARNINGS:

BRF, Marfrig - HOLIDAY:

Thailand

THURSDAY,

August 13:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - New

Zealand Food Prices - EARNINGS:

JBS, Olam

FRIDAY,

August 14:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - EARNINGS:

Golden Agri-Resources

SATURDAY,

August 15:

- Malaysia

palm oil export data for Aug 1-15 from AmSpec

Source:

Bloomberg and FI

US

CPI (M/M) Jul: 0.6% (est 0.3%; prev 0.6%)

US

CPI Ex Food, Energy (M/M) Jul: 0.6% (est 0.2%; prev 0.2%)

US

CPI (Y/Y) Jul: 1.0% (est 0.7%; prev 0.6%)

US

CPI Ex Food, Energy (Y/Y) Jul: 1.6% (est 1.1%; prev 1.2%)

US

Real Avg Weekly Earnings (Y/Y) Jul: 4.3% (prevR 4.7%)

US

Real Avg Hourly Earnings (Y/Y) Jul: 3.7% (prevR 4.1%)

-

Corn

futures ended 2.25-3.75 higher on short covering despite what was perceived as a bearish report. With an 18.7 percent projected US 2020-21 STU, up from 16.3% for 2019-20, and a massive short position held by funds, it’s hard to justify a short position in

this market, at least for the short term, when traders rallied the corn market after USDA reported a record corn yield. Funds bought an estimated net 10,000 corn contracts. Another supporting factor was a higher trade in energies and downward revisions to

Black Sea corn production estimates by private companies. WTI

crude oil rallied $1.10 by 2:00 PM CT. -

The

Iowa State AgMin mentioned about 10 million acres were potentially impacted by the derecho storm on Monday, and tens of millions of bushels of commercial grain storage, and millions of bushels of on-farm grain storage was impacted, destroyed, or severely damaged.

Combined soybean and corn harvested acres for IA were reported by USDA at 22.870 million, with 59 percent comprising of corn. If one were to back in say, 50 percent of 10 million acres dedicated for corn, and an average yield of 190 bu/acre (202 was reported

for August report for IA), that would equate to roughly 950 million bushels of corn affected by the derecho storm or 35 percent of the projected US carryout of 2.756 billion. We don’t think all of the area will be a loss, but even is a quarter of that amount

translates to a total loss would amount to 238 million bushels, 9 percent of USDA’s projected 2020-21 carryout. Note USDA increased the 2020 US corn crop by 290 million bushels from their June estimate.

-

Black

Sea wheat estimates are seeing an upgrade but corn estimates are shrinking. SovEcon raised its forecast for Russia’s 2020 wheat crop by 1.6 million tons to 80.9 million tons and for barley by 500,000 tons to 19.5 million tons. However, they applies a downward

revision to the corn crop by 1.2 million tons to 13.6 million tons lowered the total 2020 grain crop by 400,000 tons to 126.1 million tons. Earlier today Ukraine grain traders union UGA decreased their production estimate for Ukraine corn to 36.4 million

tons from a previous estimate of 38.9 million tons, citing dry weather. Ukraine harvested 35.9 million tons of corn in 2019.

-

China’s

National Meteorological Center warned of heavy rainstorms for parts of China’s northwest, north, northeast, southwest and southeastern coastal areas until Thursday.

-

The

European Union re-introduced their import duty for corn, increasing their levy to 5.48 euros ($6.42) per ton. -

Bloomberg

Economics: China’s shortfall in meeting its phase-one commitments. It found that “purchases fell substantially short in agriculture, where staying on track to hit the target over the first six months of 2020 implied exports of almost $17 billion; actual purchases

came in at just $6.5 billion.” “U.S. energy exports reached only about a fifth of their target.”

-

The

USDA Broiler Report showed eggs set in the US down 1 percent and chicks placed down 3 percent. Cumulative placements from the week ending January 4, 2020 through August 8, 2020 for the United States were 5.95 billion. Cumulative placements were down slightly

from the same period a year earlier.

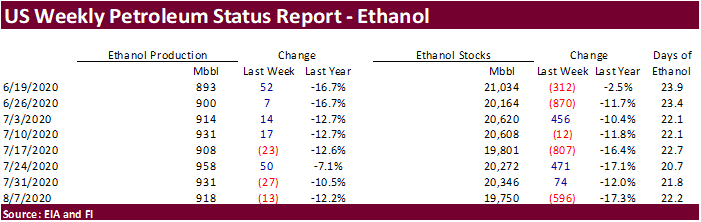

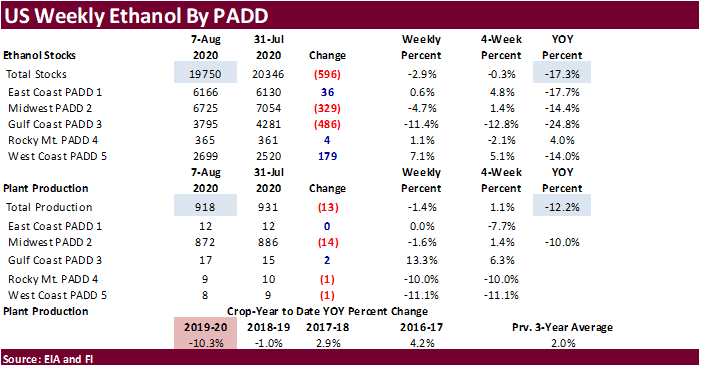

The

ethanol data was perceived to be bearish for US corn futures. Weekly

US ethanol production declined 13,000 barrels to 918,000, opposite from a Bloomberg trade poll expecting an increase of 14,000 barrels. Ethanol stocks decreased 596,000 barrels. The trade was looking for an increase of 77,000 barrels.

Corn

Export Developments

·

Israel seeks on July 20 seeks about 200,000 tons of corn and 350,000 tons of soybean meal.

·

Taiwan’s MFIG on August 13 seeks up to 65,000 tons of optional origin corn for October 28-Nov 16 shipment. Egypt is in for wheat.

-

September

corn is seen in a $3.05 and $3.25 range. December $2.95-$3.35 range.

-

Soybeans

ended 7.25-12.50 cents higher, soybean meal $0.10-$0.40 higher, and soybean oil up sharply by 94-104 points. Part of the reason for soybean oil to rally by a large amount was higher WTI crude oil. Soybean oil also rallied from higher overnight palm oil futures.

Soybeans traded above its 50-day MA. Short covering was a major factor for the soybean rally, despite USDA reporting a US soybean production that would be the second largest in history. USDA did raise their outlook for China soybean imports to a record 99

million tons for 2020-21, from 96 million in July. Note USDA has an 84 million Brazil soybean export outlook for Brazil, down 9.55 million from 2019-20, an indication they are still confident China will continue to buy US soybeans throughout next year.

-

Funds

bought an estimated net 8,000 soybeans, bought 1,000 soybean meal and bought 9,000 soybean oil.

-

We

heard China bought up to 5 US Q4 soybean cargoes out of the Gulf and PNW on Tuesday.

-

US

and China officials will meet soon to discuss the Phase One trade deal. -

In

its monthly CASDE update, China increased its soybean import projection and corn consumption for 2019-20. China looks for 96 million tons of soybeans to be imported this crop year, up 2 million tons from previous.

-

China’s

Sinograin will sell 24,611 tons of domestic soybean reserves on Thursday. -

The

third month palm futures contract rebounded overnight to end up 40 points and cash was up $2.00/ton on Indonesia production data. China vegetable oil prices were down 1.1-2.4 percent, meal slightly lower and soybeans down 44 yuan or 0.3%.

-

Gapki

estimated Indonesia palm oil stocks at the end of June increased 12% to 3.95MMT from 3.53 million tons in May. June palm production rose 13.6% to 4.51 million tons from 3.97 million tons a month earlier.

-

SGS:

Malaysian palm Aug 1-10 palm exports fell 19.4 percent to 372,067 tons from 461,806 tons month ago.

·

Under the 24-hour reporting system, private exporters reported:

–Export

sales of 258,000 metric tons of soybeans for delivery to China during the 2020/2021 marketing year

–Export

sales of 120,000 metric tons of soybeans for delivery to unknown destinations during the 2020/2021 marketing year

·

Israel seeks on July 20 seeks about 200,000 tons of corn and 350,000 tons of soybean meal.

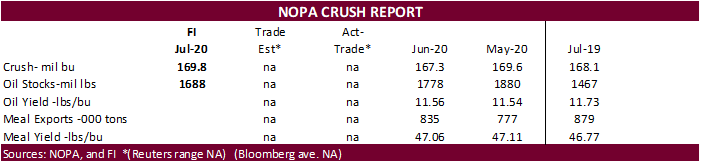

NOPA.

We

are hearing downtime during July was larger than June and much larger than July 2019.

-

September

soybeans are seen in a $8.60-$8.95 range. November $8.60-$9.00. -

September

soybean meal is seen in a $280 to $290 range. December $285-$300. -

September

soybean oil range is seen in a 30.00 to 32.50 range. December 29.75-33.00 range.

-

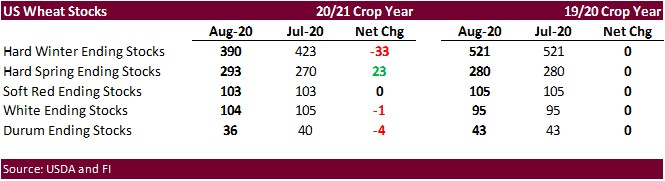

US

wheat futures

ended lower in Chicago and MN, and mixed (bull spreading) in KC. USDA reported a 0.4 bu/ac increase in the US all-wheat yield, and increased production by 14 million bushels. US hard winter wheat ending stocks were lowered a large 33 million bushels to 390

million, well below 521 million at the end of 2019-20. Hard spring were raised 23 million to 293 million, above 280 million at the end of 2019-20.

-

After

the close Egypt announced they are in for wheat. -

Funds

sold an estimated net 4,000 Chicago wheat contracts. -

Australia

will see rain through Saturday for New South Wales and Victoria, and parts of southern Queensland, eastern South Australia, and southwestern Western Australia.

-

StoneX

sees a 26.9 million-ton Australia wheat production, above ABARES’s 26.61-million-ton latest estimate.

-

Agritel

increased their production outlook for Russian wheat to 80.5 million tons from 77.5 million tons in late June.

-

Lebanon

said they have enough wheat to meet four months of consumption after accounting for existing stocks and expected imports.

-

Jordan

passed on 120,000 tons of optional origin wheat for Nov-Dec shipment. -

Egypt

after the close announced they are in for wheat. Payment will be at sight. Yesterday Egypt bought 120,000 tons of Russian wheat.

-

Syria

seeks 200,000 tons of soft wheat from EU/Russia on Sept. 9 and 200,000 tons of wheat from Russia on Sept. 14.

·

The World Food Program plans to send 50,000 tons of wheat to Lebanon.

-

Pakistan

seeks 1.5 million tons of wheat on August 18. -

Syria

looks to sell and export 100,000 tons of feed barley with offers by Sep 1.

·

Vietnam July rice exports increased 6.5 percent from June to 479,633 tons, bringing year to date exports to 4 million tons, up 0.6 percent.

·

Mauritius seeks 6,000 tons of white rice on August 17 for October through December delivery.

·

South Korea’s Agro-Fisheries & Food Trade Corp. seeks 60,556 tons of rice from Vietnam and other origins, on Aug. 19, for arrival in South Korea between Dec. 31, 2020, and February 28, 2021.

Updated

8/12/20

- Chicago

September is seen in a $4.70-$5.15 range. December $4.80-$5.30. - KC

September; $4.00-$4.40 range. December $4.10-$4.45. - MN

September $4.75-$5.05 range. December $4.95-$5.25.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.