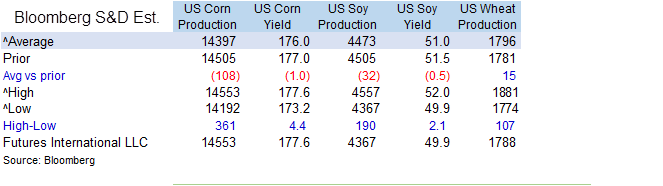

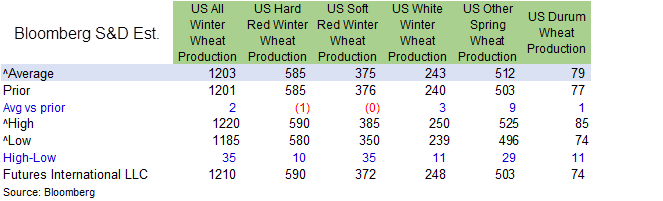

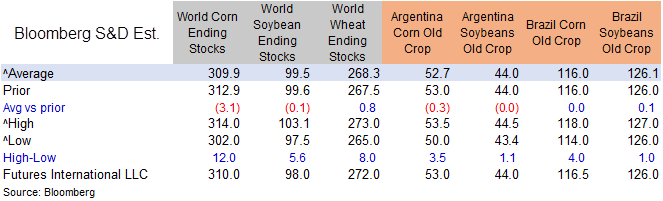

PDF attached does not include daily estimate of funds. FI snapshot for upcoming USDA report attached

USDA

positioning day.

Private

exporters reported sales of 103,400 tons of soybean cake and meal for delivery to Mexico during the 2022-23 marketing year.

US

energy markets were sharply higher, lending support to the agriculture markets bias soybean oil and corn. Soybeans found support from higher products. Positioning weighted on Sep/Nov soybean spreads while bull spreading returned to the meal market. August

goes off the board on Friday. EU and US WCB production concerns supported corn. US wheat prices were higher on follow through fund buying. China’s CASDE & USDA will be released on Friday. On Monday NOPA will update their July crush. US weather forecast was

largely unchanged. Net drying bias west-central WCB and potential second week net drying for the Midwest as a high-pressure ridge settles over western North America through the middle of next week. Parts of the GP will see rain today and some precipitation

will develop for the upper Midwest over the weekend.

Weather

US

CPC: La Niña is expected to gradually decrease from 86% in the coming season to 60% during December-February 2022-23.

WEATHER

TO WATCH AROUND THE WORLD

- Computer

weather forecast model divergence remains significant for the U.S. today with some questionable logic especially in the GFS model runs of late - Rain

is expected to impact some of the U.S. crop areas next week when colder air impacts the Midwest and Great Plains; however, the Gulf of Mexico should not be available as a good moisture source when the cool air arrives which should limit rain intensity - It

will rain, but some of the amounts will turn out lighter than expected for key corn and soybean production areas - Further

adjustments to the outlook will be forthcoming in the next few days and the end result will likely put the U.S. outlook back into an old familiar weather pattern of limited rainfall in the west and central parts of the Midwest while the east becomes quite

cool and showery - There

is potential for increased rainfall briefly in the southern U.S. Plains next week as the cold air arrives in Texas and Oklahoma with more rain possible as the frontal system bringing the cool air becomes stationary and eventually lifts back to the north - The

moisture in the southern Plains, although welcome, will come too late in a punishing summer to have much impact on production - In

the meantime, the U.S. Midwest will see a short-term bout of rain early to mid-week next week followed by more dry weather especially in the central and western parts of the Corn and Soybean Belt - Temperatures

in the U.S. Plains will be very warm to hot through the weekend then much milder for the following ten days

- Most

of the Midwest will trend cooler than usual next week and in the following weekend when readings will be well below normal

- Some

highs will become limited to the 70s and lower 80s with a few upper 60s in the north especially during week two of the outlook - High

temperatures in the Plains will be in the 90s to 104 degrees Fahrenheit at times over the next four days

- Cooling

expected during the early to middle part of next week with highs eventually cooling to the 80s and 90s with some 70s in the north - U.S.

Delta and southeastern states to see a good mix of weather next ten days supporting mostly favorable crop development - Rain

in West Texas next week and in the following weekend may offer a little topsoil moisture boost briefly, but no general “fix all” to drought is expected - No

change in cotton, corn or sorghum production potential is expected, but some temporary improvement in topsoil moisture might occur in parts of the region - A

high-pressure ridge and more dry and very warm weather is expected later this month in the southern Plains - Cooling

in the U.S. Plains next week will bring temperatures back to a normal to below range for several days, but a ridge of high pressure will return after August 20 returning warm and dry biased conditions - U.S.

Pacific Northwest will experience some warmer biased weather next week and in the following week while rainfall stays below normal - Eastern

U.S. Midwest will be quite cool in the second week of the forecast with some periodic light showers from the Great Lakes region into the middle Atlantic Coast - Not

much change was noted in Europe with showers expected to begin next week to take the edge of stress off of some crop areas, but no general soaking will occur - Temperatures

will be cooler in week two, but still quite warm through the coming weekend and early next week

- Southeastern

Europe will also experience periodic showers and thunderstorms during the next two weeks resulting in partial relief from dryness, but greater rain will still be needed to end the stressful environment

- Russia’s

Southern Region, easternmost Ukraine, western Kazakhstan and the middle Volga River Basin is still expected to see a full week to nearly 10 days of very warm to hot temperatures and mostly dry conditions

- The

west half of Russia will be warmer than usual over the next two weeks with the area noted above to be most above normal with 90-degree Fahrenheit highs expected frequently and a few extremes near 100 - Southeastern

China is still advertised to be drier than usual and very warm to hot over the next ten days - Xinjiang,

China weather will remain mostly well mixed for summer crop development in both corn and cotton production areas as well as many other crop areas - Northeastern

China and parts of the North China Plain will stay plenty wet over the next ten days and some drying will be needed - East-central

through northwestern India will experience frequent waves of significant rain keeping the ground quite wet

- Southern

India will be drier than usual - Timely

rain will occur in the Ganges River Basin, but moisture deficits will remain in the area possibly impacting some sugarcane, rice and pulse production - Significant

rain will fall in Pakistan as well as central India - Rainfall

this summer has been much greater than usual in Pakistan bolstering water supply and possibly supporting much larger than usual rice, cotton and other crops - Australia

weather will remain well mixed with rain and sunshine the next ten days - Rain

will fall in most of the wheat, barley and canola areas maintaining moisture abundance and keeping the crop poised for an excellent start to the growing season - Western

Argentina will continue drier biased - A

few mostly insignificant showers will occur - Dryness

remains a concern, although rain earlier this week was good for some improved wheat establishment - Southern

and a few west-central Brazil and Paraguay areas will be wet biased over the next ten days - The

moisture will be good for winter wheat and for some of the minor early season corn planting that may already be under way or soon will be

- Recent

rain in Parana, Sao Paulo, Mato Grosso do Sul and southern Minas Gerais was good for sugarcane, citrus and some coffee.

- Coffee

flowering may be under way in a few areas, although most of the precipitation in Sul de Minas was a little too light to induce flowering - Canada’s

southwestern Prairies will continue drying out over the next ten days to two weeks, but some scattered showers and thunderstorms will be possible in the southeastern Prairies for brief periods of time late this weekend into next week

- Korean

Peninsula will receive waves of rain over the next two weeks resulting in significant soil moisture improvements - Southern

parts of North Korea and much of South Korea will frequent bouts of receive heavy rain

- Flooding

is possible in both areas , although today’s forecast is not as wet as it was earlier this week

- A

tropical disturbance moving through Guangdong China Tuesday and Wednesday resulted in some significant rain and flooding

- Some

of the rainfall excess also impacted Guangxi and neighboring areas of both Vietnam and southern Yunnan, China

- The

situation is less threatening to crop areas east of Guangdong today relative to forecasts of earlier this week - Tropical

Depression Nine has formed 437 miles south southwest of Yokosuka, Japan at 28.9 north, 135.9 east moving westerly at 5 mph. - The

depression will become a tropical storm and will brush the central south coast of Honshu, Japan – near Tokyo – Friday into Saturday before moving back out to sea later in the weekend - Some

heavy rain is expected in central Honshu, but no damaging wind is expected and flooding should be confined to a small region near Tokyo - A

sukhovei is evolving and continue into next week in Russia’s Southern Region, western Kazakhstan and eastern Ukraine - A

“sukhovei” is a hot, dry, wind that blows across the Russian Steppes periodically, but in serious episodes it can generate enough heat, low humidity and strong wind to desiccate a crop over a relatively short period of time.

- World

Weather, Inc. is concerned about this coming event because of the potential for it to be a longer lasting one that should result in a prolonged period of 90- and a few lower 100-degree high temperatures, low humidity and wind speeds of 25 to 40 mph with higher

gusts late this week into next week - Soil

moisture is already low in the lower Volga River Basin and western Kazakhstan including the eastern half of Russia’s Southern Region - A

sukhovei now would not bode well for crops in that region - Soybeans,

sunseed and corn are produced in the region among other crops - These

areas in Russia are already in a net drying mode and the Sukhovei will only exacerbate the situation raising unirrigated crop stress and a potential threat to production

- Heavy

rain is predicted for southern Myanmar rice and sugarcane areas possibly resulting in some crop damage during the next couple of weeks - Other

areas in mainland areas of Southeast Asia will get plenty of rain, but nothing too extreme - Philippines

and Indonesia weather will continue frequently wet during the next ten days

- East-central

Africa will be most significant in Ethiopia this week while Uganda and Kenya rainfall becomes remains lighter

- Flooding

has been occurring in parts of Ethiopia recently and it may continue at times - Tanzania

is normally dry at this time of year and it should be that way for the next few of weeks - “Some”

increase in rain is expected in Uganda next week - West-central

Africa rainfall has been and will continue sufficient to support coffee, cocoa, sugarcane, rice and cotton development normally - Some

greater rain would still be welcome in the drier areas of Ivory Coast and Ghana

- Seasonal

rains have shifted northward leading to some drying in southern areas throughout west-central Africa – this is normal for this time of year - Cotton

areas are expecting frequent rainfall in the next couple of weeks - South

Africa’s crop moisture situation is favorable for winter crop establishment, although some rain would be welcome - Restricted

rainfall is expected for a while, but the crop is rated better than usual because of frequent rainfall during the autumn planting season and timely rain since then - Central

America rainfall will continue to be abundant to excessive and drying is needed - Mexico

rain will be most abundant in the west and southern parts of the nation - Drought

will prevail in the northeast until a tropical cyclone can impact the region - Rain

in the Greater Antilles will occur periodically, but no excessive amounts are likely - Today’s

Southern Oscillation Index was +9.21and it will move erratically lower over the next week - New

Zealand weather is expected to be quite cool the remainder of this week with rain slowly resuming across the north - Next

week will trend warmer and wetter for most areas, but especially in the north

Source:

World Weather INC

Bloomberg

Ag Calendar

Thursday,

Aug. 11:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Brazil’s

Conab to publish output and planting data for soybeans and corn - HOLIDAY:

Japan

Friday,

Aug. 12:

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, 12pm - China’s

agriculture ministry (CASDE) releases monthly report on supply and demand for corn and soybeans - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - New

Zealand food prices - FranceAgriMer

weekly update on crop conditions - EARNINGS:

Olam, Golden Agri - HOLIDAY:

Thailand

Source:

Bloomberg and FI

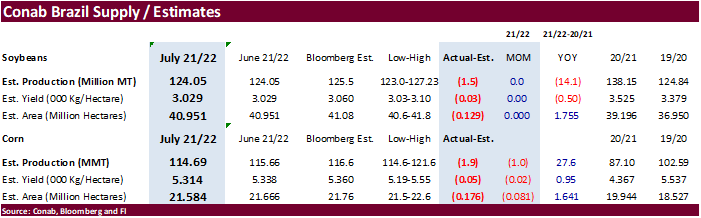

Brazil’s

Conab left

their soybean supply unchanged from the previous month with production at 124.1 million tons. The trade was looking for a 1.5 MMT increase. The Brazil corn production was lowered 1.0 million tons, a surprise, to 114.7 million tons. The trade was looking for

115.7 million tons, supportive for corn futures, IMO.

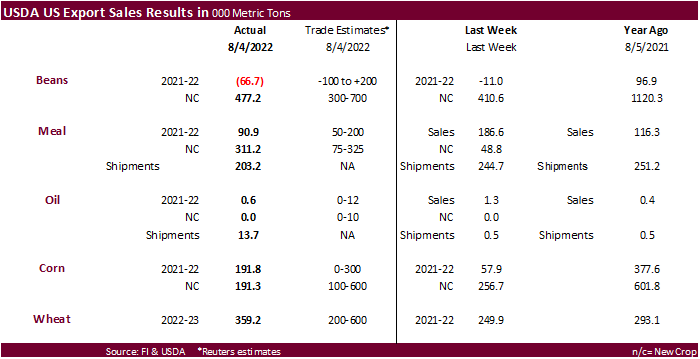

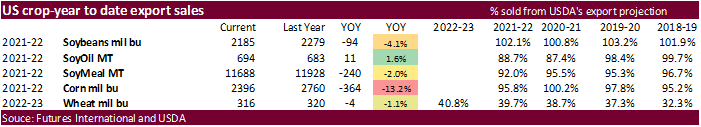

USDA

Export Sales

USDA

export sales were within expectations for soybeans, good for new-crop meal (shipments were not bad), and slow for soybean oil (shipments increased to 13,700 tons). For new crop soybeans net sales of 477,200 MT were primarily for China (195,000 MT) and unknown

destinations (184,200 MT). China bought a small amount of sorghum. USDA US corn export sales were near the low end of expectations on a combined crop year basis and wheat within expectations.

USDA

IMPORTANT NOTICE: The upgraded Export Sales Reporting and Maintenance System 2.0 (ESRMS 2.0) is scheduled to be launched on Thursday, August 18, 2022. ESRMS 2.0 will be available from the following url:

https://esrms.fas.usda.gov/#/home

US

Initial Jobless Claims Aug 6: 262K (est 265K; prev 260K)

US

Continuing Claims Jul 30: 1428K (est 1420K; prev 1416K)

US

PPI Final Demand (M/M) Jul: -0.5% (est 0.2; prev 1.1%)

US

PPI Final Demand (Y/Y) Jul: 9.8% (est 10.4; prev 11.3%)

US

PPI Ex Food and Energy (M/M) Jul: 0.2% (est 0.4; prev 0.4%)

US

PPI Ex Food and Energy (Y/Y) Jul: 7.6% (est 7.7; prev 8.2%)

OPEC:

Cuts Full-Year 2022 World Oil Demand Growth Forecast To 3.1 Million BPD (Prev. Forecast 3.36 Mln BPD)

103

Counterparties Take $2.199 Tln At Fed Reverse Repo Op (prev $2.178 Tln, 96 Bids)