PDF Attached

Private

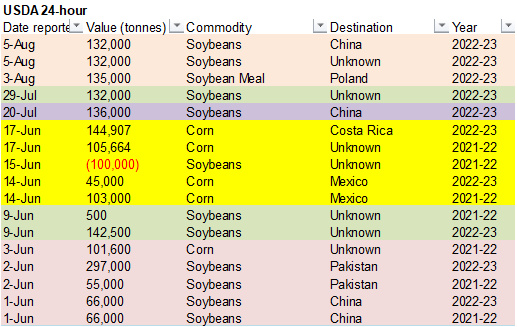

exporters reported the following sales activity:

-132,000

metric tons of soybeans for delivery to China during the 2022/2023 marketing year

-132,000

metric tons of soybeans for delivery to unknown destinations during the 2022/2023 marketing year

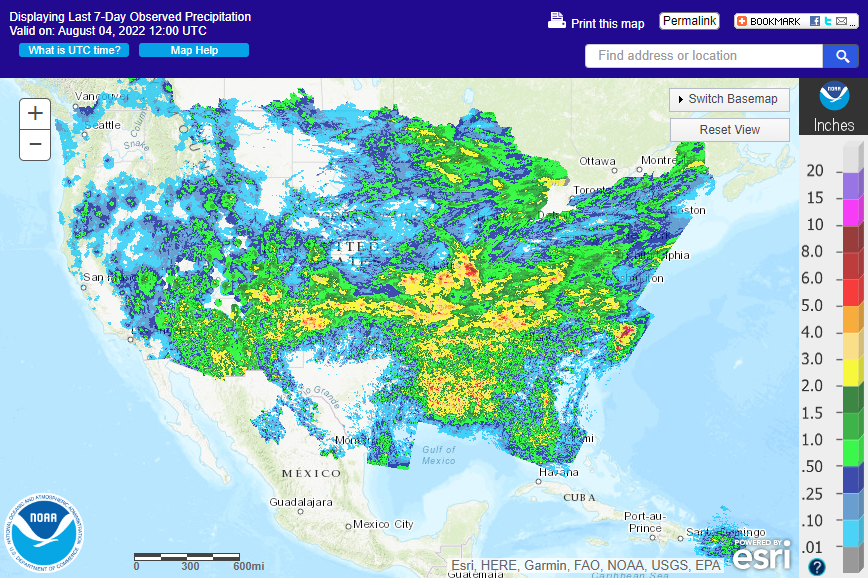

The

Midwest will see an increase in rain across Midwest this weekend. For the WCB, northwestern Iowa and northeastern Nebraska could see up to 1.00 inch by Sunday and

1-2 inches could occur from eastern South Dakota into central and southern Minnesota. But note weather models still vary. Some weather forecasts showing a little warmer and drier on the 6-10 day forecast.

Grain

prices ended mixed with corn higher (unwinding of S/C spreads) and wheat lower. Soybean oil revered and closed up more than 200 points. Bull spreading in soybeans led to a higher close in Sep and lower settlement in the back months. Meal was lower. The USD

rallied post US jobs report. Both WTI and US equities were mixed.

WEATHER

TO WATCH AROUND THE WORLD

- Extremely

important rainfall expected in western U.S. Corn Belt early next week - The

amount and coverage of rainfall will dictate much about the status of western Corn and Soybean Belt crop conditions in the second half of August - Crop

moisture stress is high today in South Dakota, southern Minnesota, western Iowa and eastern Nebraska - Top

and subsoil moisture is low - Rainfall

should be sufficient early next week to bring relief to these drier areas with rainfall of 0.50 to 1.50 inches and local totals over 2.00 inches - Subsoil

moisture should not change much - West-central

and southwestern Corn and Soybean Belt crop areas are drying down and rainfall early next week will have much to say about that drying trend - World

Weather, Inc. believes rain will fall, but it will likely prove to be too light to seriously buck the drying trend under way in southwestern Iowa, southeastern Nebraska and parts of Kansas - The

northwestern three fourths of Iowa has been dry or mostly dry for the past seven days - Some

areas in the southwest of Iowa and east-central Nebraska have reported less than 0.50 inch of rain over the past two weeks - Rainfall

of 0.20 to 0.75 inch is expected in these areas early next week which may only offer pockets of temporary relief - Central

and southern U.S. Plains and west-central and southwestern Corn and Soybean Belt areas may experience a week to ten days of dry weather following the early week rain event

- Hotter

temperatures will evolve in the second weekend of the two week outlook and may persist through the following week accelerating dryness and raising some greater crop stress - Rain

next week in eastern U.S. Midwest will be sufficient to bolster or maintain favorable soil moisture for long term crop development

- Cooling

is expected in the northern U.S. Plains Saturday into Saturday with highs limited to the upper 60s and 70s Fahrenheit after being in the 90s and lower 100s at times this week - Cooling

is also expected in the U.S. Midwest next week reducing evaporation rates and decreasing crop and animal stress - Dryness

in the U.S. Carolinas and southeastern Georgia will continue into Wednesday and then rain is expected that will provide some welcome relief

- Scattered

showers occurred in the Texas Panhandle and into a part of West Texas Thursday resulting in some localized relief to dryness - A

couple of locations reported more than 1.00 inch of moisture, but those were the exceptions and not the rule - Most

of the precipitation was not enough to counter evaporation - Northern

Texas and Oklahoma crop areas will have an opportunity for scattered showers and thunderstorms during mid-week next week offering localized areas of relief, but it will not last long enough to make much difference - West

Texas rainfall during mid- to late week next week will vary from 0.10 to 0.75 inch with a few greater amounts - Hot

temperatures in the southern U.S. Plains will continue through the weekend, but next week will gradually cool down to a more reasonable range of temperatures - U.S.

ridge of high pressure will be strengthen in the central Plains in the second half of next week and it could prevail into mid-month - U.S.

Midwest temperatures are expected to be warm in the far west over the next few days and seasonable elsewhere - Cooling

is expected early to mid-week next week - Temperatures

will trend warmer again in the Great Plains and western most Corn Belt during the Aug. 12-18 period. - Central

U.S. Delta will dry out over the next five days and then get a chance for rain once again - Northern

and southern parts of the Delta should see more timely rainfall in support of crop development - U.S.

Pacific Northwest, the northwestern Plains and central through southwestern Canada’s Prairies will be drying out over the next ten days

- Crop

stress is already evolving again in the southwestern and central parts of the Prairies and late season crops could suffer some yield and quality declines if significant rain does not evolve soon - U.S.

Pacific Northwest is seeing less oppressive heat for a while, but rainfall will be minimal - Hotter

conditions may return for a while next week - Canada’s

central and southern Prairies and neighboring areas of the far northern U.S. Plains will experience net drying conditions for the next ten days resulting in rising crop stress and higher potential for late season yield reductions in some crop areas - The

ground is already firming up significantly in the southwestern Canada Prairies and the northwestern U.S. Plains, although cooling this weekend and some rain in the U.S. northern Plains may offer a temporary reprieve - Rain

in Canada, though, will not be significant - Northern

parts of Canada’s Prairies received some welcome rain earlier this week and soil conditions are rated well from northern and central Alberta to northern Saskatchewan and in many areas across Manitoba.

- Showers

occurred in northern France, Belgium and a part of western Germany Thursday, but rainfall was no more than 0.50 inch with many areas getting no more than 0.35 inch - The

precipitation will continue today while shifting to the northeast into Poland and Czech Republic - Northwestern

Europe will dry out again for at least a week and possibly ten days after today’s rain abates - Southern

areas in Europe will experience some showers and local thunderstorms later this weekend into next week - All

of the precipitation will be light, but whatever rain falls will be welcome - Not

much relief from drought and dryness is anticipated - Dryness

in Europe remains most serious in France, but is also occurring in many other western and southeastern parts of the continent - Temperatures

will be warmer than usual in most of Europe for the next week to ten days - Some

excessive heat is possible in France and Germany next week - Much

of Russia’s crop region will also be warmer than usual over the next two weeks with temperatures most anomalously warm in this first week of the outlook

- Russia’s

Southern Region and eastern Ukraine as well as the New Lands of Russia are unlikely to get much rain in the coming week to ten days, although scattered showers are forthcoming.

- More

moisture is needed especially from eastern parts of Russia’s Southern region northward through a large part of the New Lands, although there is no crisis

- Warm

temperatures and restricted rain will lead to drying and a close watch on future rain distribution may be warranted as the region slowly dries down - India’s

Monsoon Depression expected to come out of the Bay of Bengal late Sunday or Monday will move across the nation next week still has potential to produce some flooding rain from Odisha and northeastern Andhra Pradesh to Gujarat, southern Rajasthan and especially

Maharashtra and southern Madhya Pradesh - Some

crop and property damage will be possible - India’s

biggest weather need today is for greater rain in Uttar Pradesh, Bihar and Jharkhand where early season rainfall was well below average - Argentina’s

driest wheat areas are advertised to get rain early next week, but the area of significant rain is not large - Portions

of Cordoba, La Pampa and neighboring areas of Santa Fe and San Luis are included in the rain event, but confidence is not high over its significance

- Rainfall

of 0.10 to 0.60 inch and local totals to 1.00 inch are possible - Brazil

rainfall advertised from western Mato Grosso into Rio Grande do Sul, Santa Catarina, Parana and Sao Paulo for early next week may be a little overdone, but some moisture is expected - Sugarcane

and wheat areas will benefit most from the precipitation - Only

a minimal amount of rain will reach into Sao Paulo and southern Minas Gerais coffee, citrus and sugarcane areas and that which does occur will be light - Cotton

harvesting will be briefly delayed in Mato Grosso because of the rain, but no serious quality change is expected - Northeastern

Mexico and Texas dryness will not change much until a tropical cyclone comes along which may occur later this summer or early in the autumn - Ontario

and Quebec crop conditions remain favorably rated with a good mix of weather expected over the next couple of weeks - Some

crop moisture stress is occurring in Ontario where rain is needed - No

tropical cyclones or potential for tropical cyclones are present in the Atlantic Ocean Basin; including the Gulf of Mexico or the Caribbean Sea for the next five days - A

tropical disturbance is evolve into a tropical depression off the southwest coast of Mexico in the next two days, but it will move away from land - No

other tropical systems are present today in the eastern Pacific Ocean - No

tropical cyclones were present in the western Pacific or Indian Oceans today,

- Eastern

China’s weather in the next ten days will be drier than usual in the interior southeast and favorably to excessively wet from the Yellow River Basin and North China Plain into northeastern China - Xinjiang,

China will see a good mix of weather over the next two weeks maintaining favorable crop development and normal yield potentials

- Sumatra,

Indonesia rainfall continues a little too erratic and greater moisture is still needed in some areas, despite a little rain earlier this week - Greater

rain is expected to slowly evolve over the next two weeks - All

other Southeast Asian nations will experience an abundance of rainfall during the next few weeks resulting in some flooding in the Philippines and the Maritime provinces - Australia

weather in the coming ten days will be favorable for most winter crops - A

good mix of rain and sunshine is expected that will favor well established crops prior to spring growth - South

Korea rice areas are still dealing with drought, despite some rain that fell recently.

- Some

additional rain is expected over the next couple of weeks - East-central

Africa rainfall is increasing and will be greatest in central and western Ethiopia, but Uganda and Kenya will get some much needed improved rainfall - Tanzania

is normally dry at this time of year and it should be that way for the next few of weeks - West-central

Africa rainfall has been and will continue to be sufficient to support coffee, cocoa, sugarcane, rice and cotton development normally - Some

greater rain would still be welcome in the drier areas of Ivory Coast and Ghana

- Seasonal

rains have shifted northward leading to some drying in southern areas throughout west-central Africa - Cotton

areas are expecting frequent rainfall in the next couple of weeks - South

Africa’s crop moisture situation is favorable for winter crop establishment, although some additional rain might be welcome - Restricted

rainfall is expected for a while, but the crop is rated better than usual - Central

America rainfall will continue to be abundant to excessive and drying is needed - Mexico

rain will be most abundant in the west and southern parts of the nation - Rain

in the Greater Antilles will occur periodically, but no excessive amounts are likely - Today’s

Southern Oscillation Index was +9.33 and it will move higher over the next week - New

Zealand weather is expected to be well mixed over the next two weeks - Temperatures

will be cooler than usual

Source:

World Weather INC

Bloomberg

Ag Calendar

Friday,

Aug. 5:

- FAO

World Food Price Index - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Malaysia’s

Aug. 1-5 palm oil export data

Sunday,

Aug. 7:

- China’s

first batch of July trade data, incl. soybean, edible oil, rubber and meat imports

Monday,

Aug. 8:

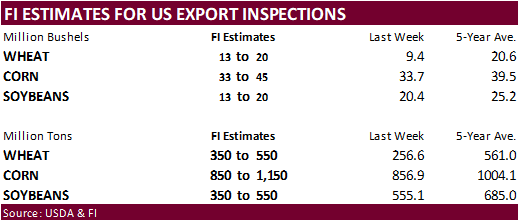

- USDA

export inspections – corn, soybeans, wheat, 11am - US

crop conditions for wheat, corn, soybeans and cotton; spring wheat harvest, winter wheat progress, 4pm - Vietnam

Customs releases July coffee, rice, rubber export data - HOLIDAY:

Pakistan

Tuesday,

Aug. 9:

- EU

weekly grain, oilseed import and export data - HOLIDAY:

Singapore, India, Bangladesh

Wednesday,

Aug. 10:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - Malaysian

Palm Oil Board’s data on stockpiles, production and exports - Malaysia’s

Aug 1-10 palm oil export data - Brazil’s

Unica to release cane crush, sugar production data (tentative)

Thursday,

Aug. 11:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Brazil’s

Conab to publish output and planting data for soybeans and corn - HOLIDAY:

Japan

Friday,

Aug. 12:

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, 12pm - China’s

agriculture ministry (CASDE) releases monthly report on supply and demand for corn and soybeans - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - New

Zealand food prices - FranceAgriMer

weekly update on crop conditions - EARNINGS:

Olam, Golden Agri - HOLIDAY:

Thailand

Source:

Bloomberg and FI

US

yield estimates

IHS

Markit (8/5/22)

Corn

176.9 production 14,497 LY 177

Soy

51.8 production 4,530 LY 51.4

STONEX

Corn

production at 14.417 billion bushels, yield of 176.0 bu/ac

Soybean

production at 4.490 billion bushels, yield of 51.3 bu/ac (Reuters)

Soybean

and Corn Advisory

2022

U.S. Corn Yield Lowered 1.0 bu/ac to 174.0 bu/ac

2022

U.S. Soybean Yield Lowered 0.5 bu/ac to 50.5 bu/ac

Barchart

is at 51.4 & 177.8

FI

is at 49.9 & 177.6

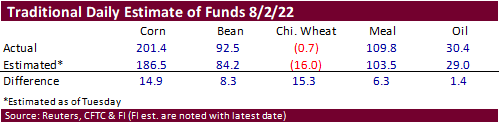

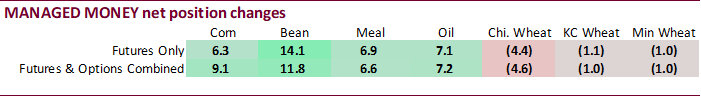

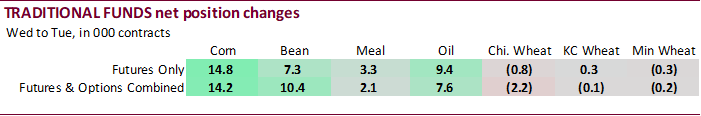

CFTC

Commitment of Traders report

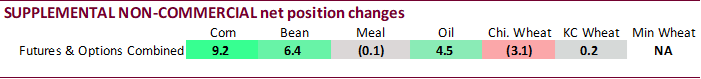

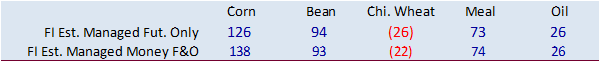

The

traditional funds were more long than expected for all the major agriculture commodities we track. There were no major surprises other than the net position for Chicago wheat ended up around flat rather than net short 16,000 contracts. Indexes began rebuilding

long positions in corn and soybeans.

Reuters

table

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

35,246 9,156 380,675 3,944 -363,339 -5,967

Soybeans

34,512 6,420 146,913 4,756 -150,482 -10,419

Soyoil

-2,453 4,498 94,843 5,352 -94,489 -8,280

CBOT

wheat -54,475 -3,136 119,394 1,053 -55,893 4,000

KCBT

wheat -11,909 195 50,278 -1 -36,679 -265

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

129,921 9,133 250,573 -3,111 -362,067 -3,993

Soybeans

99,471 11,795 90,326 -660 -149,443 -8,955

Soymeal

80,018 6,638 81,907 1,982 -204,952 -5,811

Soyoil

22,141 7,233 79,428 817 -105,787 -6,876

CBOT

wheat -14,970 -4,579 67,428 1,440 -47,861 2,660

KCBT

wheat 9,992 -1,049 29,605 430 -32,348 -437

MGEX

wheat -652 -1,010 1,397 182 -925 1,615

———- ———- ———- ———- ———- ———-

Total

wheat -5,630 -6,638 98,430 2,052 -81,134 3,838

Live

cattle 38,004 499 60,407 578 -112,217 -1,508

Feeder

cattle -189 1,104 3,382 -90 3,611 -20

Lean

hogs 56,750 5,676 50,626 2,465 -96,575 -8,558

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

34,153 5,104 -52,582 -7,133 1,835,694 22,869

Soybeans

-9,410 -1,424 -30,943 -756 733,897 9,698

Soymeal

19,072 -4,506 23,954 1,697 443,344 5,299

Soyoil

2,119 396 2,100 -1,570 427,708 12,866

CBOT

wheat 4,429 2,396 -9,026 -1,917 422,808 18,367

KCBT

wheat -5,559 985 -1,690 72 186,023 4,670

MGEX

wheat 2,562 817 -2,381 -1,604 62,431 -577

———- ———- ———- ———- ———- ———-

Total

wheat 1,432 4,198 -13,097 -3,449 671,262 22,460

Live

cattle 16,920 -881 -3,115 1,312 312,097 -2,820

Feeder

cattle 5 -300 -6,809 -694 53,788 2,410

Lean

hogs 593 927 -11,394 -511 286,762 16,303

US

Nonfarm Payrolls Jul: 528K (est 250K; prev 372K)

US

Unemployment Rate Jul: 3.5% (est 3.6%; prev 3.6%)

US

Average Hourly Earnings (M/M) Jul: 0.5% (est 0.3%; prev 0.3%)

US

Average Hourly Earnings (Y/Y) Jul: 5.2% (est 4.9%; prev 5.1%)

US

Private Payrolls Jul: 471K (est 230K; prev 381K)

US

Manufacturing Payrolls Jul: 30K (est 20K; prev 29K)

US

Average Weekly Hours All Employees Jul: 34.6 (est 34.5; prev 34.5)

US

Labour Force Participation Rate Jul: 62.1% (est 62.2%; prev 62.2%)

Canadian

Net Change In Employment Jul: -30.6K (est 15.0K; prev -43.2K)

Canadian

Unemployment Rate Jul: 4.9% (est 5.0%; prev 4.9%)

Canadian

Hourly Wage Rate Permanent Employment Jul: 5.4% (est 5.9%; prev 5.6%)

Canadian

Participation Rate Jul: 64.7% (est 64.9%; prev 64.9%)

Canadian

Full Time Employment Change Jul: -13.1K (prev -4.0K)

Canadian

Part Time Employment Change Jul: -17.5K (prev -39.1K)

97

Counterparties Take $2.195 Tln At Fed Reverse Repo Op (prev $2.192 Tln, 101 Bids)

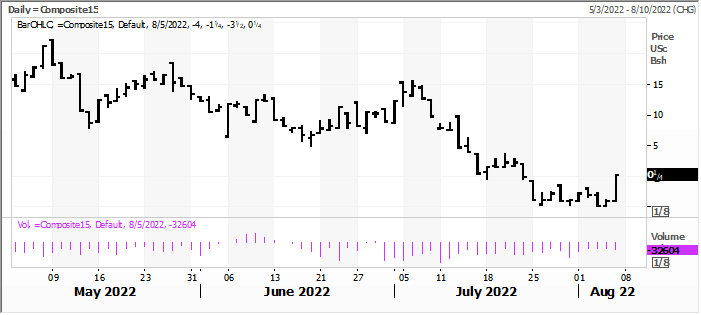

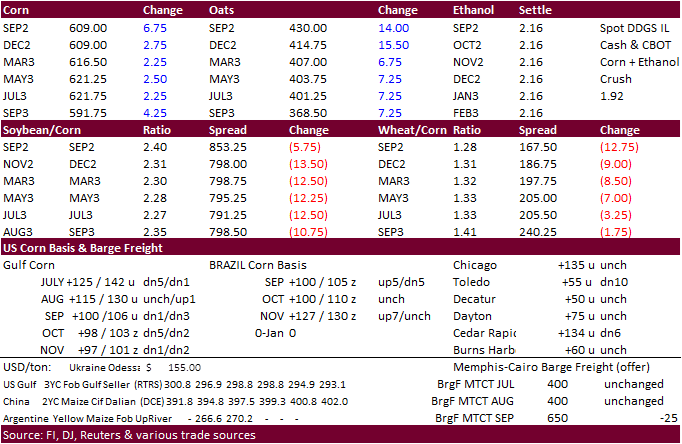

Corn

·

Corn ended higher on Friday from fund buying, unwinding of short-term soybean/corn spreads, and uncertainty over Ukraine shipment volume over the next month. The US WCB has an opportunity for rain over the weekend bias northern

areas. The far western areas of the WCB will continue to see crop stress.

·

September corn closed 8 cents higher and December up 3.75 cents, ending a downtrend in the CU-CZ spread.

·

US Jobs data was a surprise and unemployment declined to 3.5%, lifting the USD by 87 points.

·

Funds bought an estimated net 3,000 corn contracts.

·

AgriCensus noted China agreed to change its protocol to allow corn imports from Brazil by the end of the year. The window for 2022 corn shipments to China from Brazil is closing, IMO, based on where US new-crop corn is currently

priced.

·

French corn ratings dropped again. 63% of the corn crop was in good or excellent condition by August 1, down from 68% the previous week, and compares to 90% year ago. The French corn ratings is down 20 points since early July.

·

The French corn crop was seen at 12.66 million tons for 2022, down 19 percent from 2021 and 9.1% percent below the five-year average.

·

Russia’s AgMin warned they may lower their 2022-23 grain export forecast from current 50 million tons if the production does not reach the projected 130 million ton estimate.

·

The US weather forecast still calls for rain to increase across the Midwest for this weekend and parts of the far northwestern Corn Belt, where net drying has stressed crops.

·

Three ships carrying corn set sail from Ukraine on Friday.

-

12,000

tons from Chornomorsk to Turkey -

13,041

tons from Chornomorsk to Britain -

33,000

tons from Odesa to Ireland

·

Since July 1, Ukraine’s 2022-23 grain exports are down 49 percent from the same period a year ago.

·

US gasoline prices have dropped for seven straight weeks.

·

US ethanol exports during June were 101.48 million gallons, down from 147.06 million gallons in May (a four-year high), and up from 82.09 million gallons exported during the same month of last year. (Ethanol Producer magazine)

·

US DDGS exports during June were 1.01 million tons, up from 966,108 tons in May and 938,280 tons in June 2021.

EIA:

U.S. propane spot prices have declined from multiyear highs

https://www.eia.gov/todayinenergy/detail.php?id=53339&src=email

Updated

8/4/22

September

corn is seen in a $5.50 and $6.45 range

December

corn is seen in a $5.00-$7.50 range

·

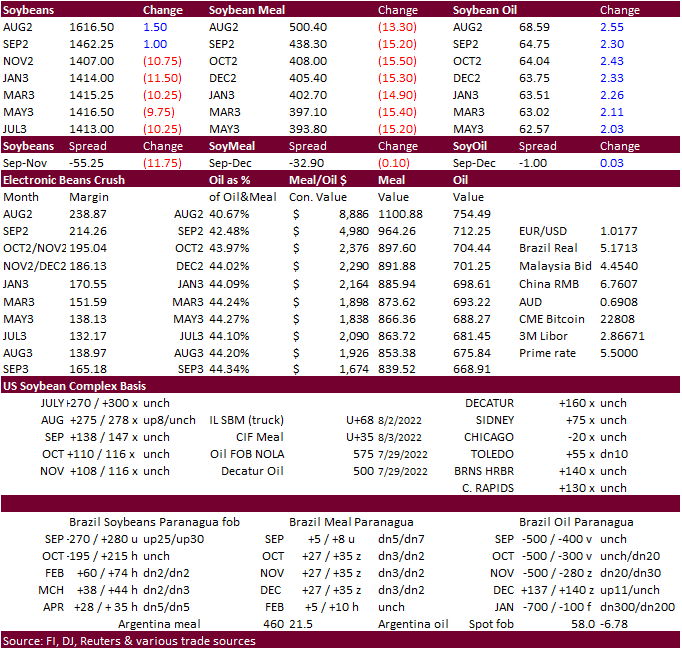

Soybeans traded two-sided, ending 2.0 cents higher basis September and lower in the back months on technical selling after the large runup in prices on Thursday. The September/November soybean spread was on fire by mid-morning

on talk China was looking around for spot US soybeans, based on Thursday’s spread close. The Sep/Nov spread widened 11.75 cents today to 54.25/58.75 (post modified), September premium.

·

Funds sold an estimated net 4,000 soybean contracts, 5,000 soybean meal and bought 5,000 soybean oil.

·

Soybean oil share saw a large correction, and then some, with a reversal in product spreading. September was up 4%.

·

News was light.

·

There were 17 CBOT soybean meal deliveries posted Thursday evening.

·

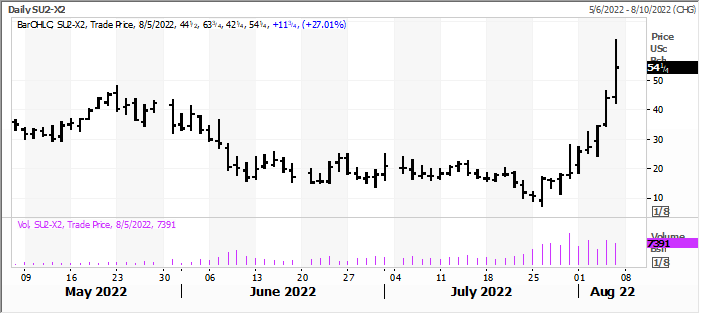

Malaysia October palm was up 57 MYR to 3878/ton and cash up $17.50 at $965/ton.

·

ITS reported Malaysia 1-5 August palm exports up 21.5% from the July 1-5 period.

·

Data from MPOA showed CPO production for the month of July was down 1.14 percent.

·

For the week palm oil futures were down 9.6 percent.

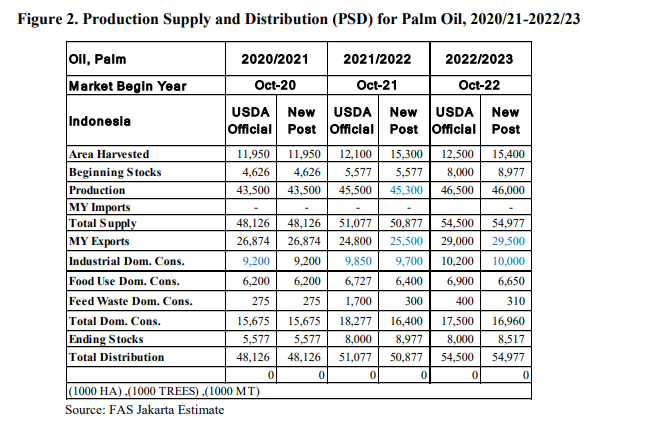

USDA

Attaché: Indonesia Oilseeds and Products Update

U

of I: An Estimate of Soybean Production From the 18 Leading Soybean States

Ibendahl,

G. “An Estimate of Soybean Production From the 18 Leading Soybean States.”

farmdoc

daily

(12):115, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 4, 2022.

Export

Developments

·

China looks to sell a half a million tons of soybeans out of reserves on August 12.

·

Private exporters reported the following sales activity:

-132,000

metric tons of soybeans for delivery to China during the 2022/2023 marketing year

-132,000

metric tons of soybeans for delivery to unknown destinations during the 2022/2023 marketing year

Updated

8/4/22

Soybeans

– September $14.00-$15.50

Soybeans

– November is seen in a $12.25-$16.00 range

Soybean

meal – September $400-$500

Soybean

oil – September 60.00-65.00.

·

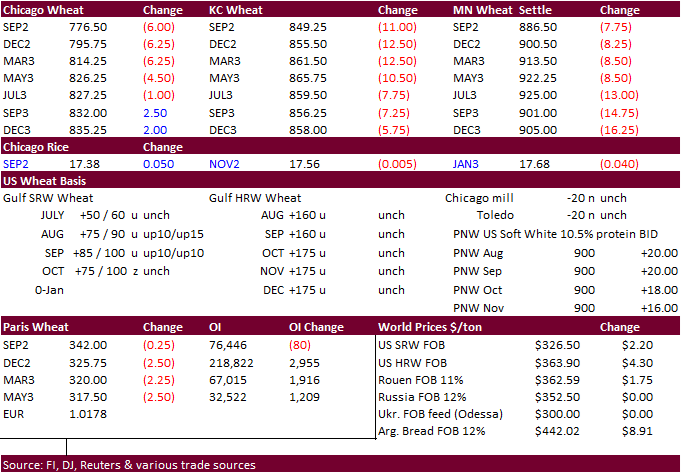

US wheat futures ended lower on lack of bullish news and Philippines passing on wheat.

Funds

sold an estimated net 3,000 Chicago wheat contracts.

·

The USD rallied more than 80 points post US jobs report, and was up 87 by 3:00 pm CT.

·

Ukraine may start exporting wheat this September, according to the Ukraine AgMin.

·

Paris September wheat was down 0.25 euro at 342.50 euros.

·

Russia’s AgMin warned they may lower their 2022-23 grain export forecast from current 50 million tons if the production does not reach the projected 130 million ton estimate.

·

Russia may limit seed imports by imposing quotas in effort to boost domestic production and use. They currently depend on heavy imports of seeds for their crops.

·

The Canadian Prairies will see above normal rainfall across the northern Prairies over the next 10 days while drier weather for the southern areas could increase crop stress.

·

Rhine River water level problems continue to drive up shipping costs. According to Reuters, “Spot prices for a liquid tanker barge from Rotterdam to Karlsruhe, south of Kaub, rose to about 94 euros ($96.15) a ton on Friday, up

2 euros on the day, moving even further away from prices around only 20 euros a ton in June, vessel brokers said.”

·

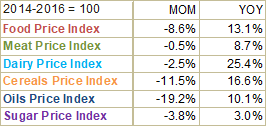

The FAO food price index fell 9% in July and is lowest since January.

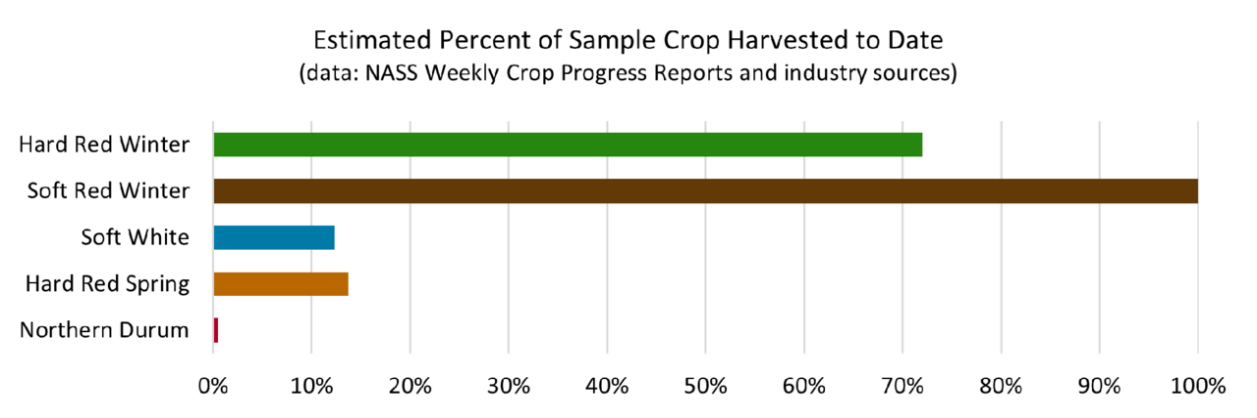

US

Wheat Associates

“The

HRW harvest is moving north with quality data holding steady. The final 2022 SRW harvest report this week includes flour, dough properties and baking evaluation data. SW harvest continues apace under hot, dry conditions; this is an typically good SW crop with

low protein, low moisture and good test weight. A delayed HRS harvest is underway with sample data expected in the coming weeks. The Northern Durum harvest started this week in Montana.”

“Basis

was mixed in in both the Gulf and Pacific Northwest (PNW). In the Gulf, HRS basis was down while HRW was flat and SRW remains firm. Out of the PNW, HRS was flat and HRW was up, while Soft White was down. Demand for HRS remains sluggish as many buyers look

ahead to harvest. Slow movement of HRW from the country elevators to the export market kept Gulf HRW quiet this week. Increased export business out of the PNW firmed basis, though a progressing Soft White harvest placed downward pressure on prices.”

·

The Philippines passed on 150,000 tons of milling wheat and 150,000 tons of feed barley for OND shipment.

·

Jordan seeks 120,000 tons of wheat on Aug 9 for Jan/Feb shipment.

·

Jordan seeks 120,000 tons on Aug. 10 for Dec through Feb shipment.

Rice/Other

·

Mauritius seeks 6,000 tons of rice, optional origin, for October 1 and December 31 delivery.

Updated

4/4/22

Chicago

– September $7.35 to $8.50 range, December $7.00-$10.50

KC

– September $7.70 to $9.00 range, December $7.00-$10.75

MN

– September $8.25‐$9.75, December $8.00-$11.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.