PDF Attached

US soybean complex main balances attached. Dec Corn, Dec HRW, and Dec HRS contracts all hit new contract lows today. All major CBOT ag markets ended lower. The US high pressure ridge for the US is now projected to be short lived.

Weather conditions in India and China have not changed much recently and little change was expected for a while. Crop conditions will remain mostly good for corn and soybeans in both countries as well as for some groundnuts, rice, cotton and sorghum in India. China may have lost a little production this year from too much rain in southern parts of the nation’s grain and oilseed production region.

Net drying will occur in parts of Canada’s Prairies for a while this week into next week which may stress a few crops like those of the northwestern Plains. Crop conditions are improving in Mexico and still look good for Australia with significant rain coming soon to that nation.

Early season corn planting will advance quickly in Brazil, but rain is needed to improve soil moisture for emergence and establishment. Dryness and some excessive heat will be a concern for summer coarse grain and oilseed crops in parts of western and southeastern Europe as well as eastern Ukraine into Russia’s Southern Region. Dryness will also continue in some of the sunseed areas of Russia’s eastern New Lands.

Some concern over net drying will also continue in oil palm production areas of Indonesia.

Overall, weather today will likely produce a mixed influence on market mentality with a bearish bias remaining

MARKET WEATHER MENTALITY FOR WHEAT: Most of the damage done to this year’s spring cereals has already been done and no further change of great significance is expected unless the harvest season turns wet. Some lower production is expected from Russia and Europe due to dryness in the New Lands and in various areas in northwestern and far southeastern Europe. China’s spring wheat has performed well. Australia’s winter crops will benefit greatly from rain coming over the next two weeks and some ongoing dryness in Canada’s Prairies may further stress late filling crops. Argentina drought will not change over the next two weeks.

Overall, weather today will likely leave a neutral influence on market mentality.

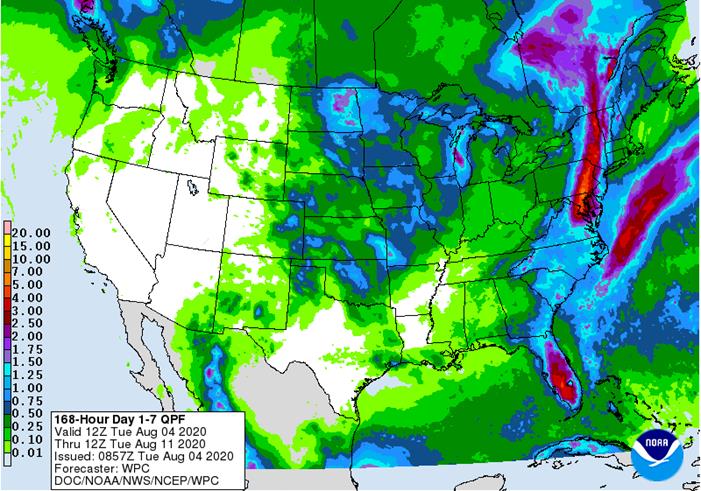

7 Day Precipitation Outlook

- U.S. Purdue Agriculture Sentiment

- New Zealand global dairy trade auction

- Australia commodity index

WEDNESDAY, August 5:

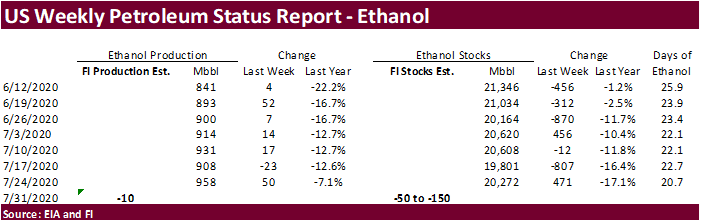

- EIA U.S. weekly ethanol inventories, production, 10:30am

- China’s CNGOIC to release supply-demand reports on corn, soybeans

- French Agriculture ministry’s 2020 grain estimates

- Malaysia’s palm oil export data for August 1-5

- New Zealand Commodity Price

THURSDAY, August 6:

- FAO World Food Price Index

- USDA weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am

- Port of Rouen data on French grain exports

FRIDAY, August 7:

- China’s foreign trade data for July, including imports of soybeans and meat

- ICE Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly update on crop conditions

Source: Bloomberg and FI

- US soybeans, corn and wheat area on the defensive on large crop production prospects. The US corn crop could end up being a bin buster this year. Figure of speech since the US should have enough storage but some US region might temporarily see a problem for storage.

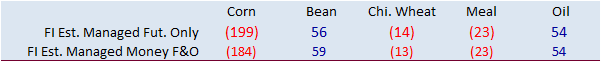

- Funds sold an estimated net 33,000 corn contracts.

- The September corn contract traded at a lifetime low, reaching $3.0825/bu and it settled there. September corn was $4.04 a year ago. December also hit a contract low and that market could be headed down into the $3.05-$3.10 area by late this week.

- We are hearing corn yields in one part of Louisiana were coming in around 255 bushels per acre. The state yield was 165 for 2019.

- USD turned around to trade 17 lower by 2 PM CT and WTI rebounded to end 68 cents higher.

- UGA: Ukraine 2020-21 corn estimate was raised to 38.9 million tons, a record, versus 36.8MMT earlier. Exports may reach 33MMT tons vs 31m tons expected earlier.

- The U.S. DOE completed their review from refiners request for RFA biofuel exemptions and issued recommendations that will be sent to the EPA for a 90-day review period. Renewable Fuels Association said there are 52 “gap year” exemption requests for 2011 to 2018 and another 28 requests for 2019 and 2020 that have yet to be ruled on by the EPA. We are hearing recommendations include partial exemptions.

- Heat and dryness remain a concern for parts of Ukraine and Romania.

- IA, NE, and OH need additional rain.

- IEG is due out Wednesday with US and world crop reports. StoneX: US corn yield and production: 182.4/15.320 billion; soybeans: 54.2/4.496 billion. Soybean and Corn Advisory: corn 180.0, up 1.5 previous; soybeans 52.0, up 1.0 previously. FI is using 181.0.

- Economist predicts revenue for corn farmers will hit 14-year low https://www.radioiowa.com/2020/08/04/economist-predicts-revenue-for-corn-farmers-will-hit-14-year-low/

- Bloomberg: “Corn starch plants in China, the second-biggest consumer of the grain, are running at about 60% of capacity, according to SHZQ Futures, adding some have halted or scaled back output on costs. The government is expected to release feed-grade wheat, said the China National Grain and Oils Information Center.”

- A Bloomberg poll looks for weekly US ethanol production to be down 6,000 at 952,000 barrels (922-970 range) from the previous week and stocks to increase 163,000 barrels to 20.435 million.

Corn Export Developments

- None reported

- September corn is seen in a $3.00 and $3.25 range. December lows could reach $2.95 (Updated 8/3). The US is staring down at a large crop.