PDF attached

Soybeans:

Down 2-4

Soybean

meal: Steady to $1.50 lower

Soybean

oil: 10-20 points higher

Corn:

unchanged to 2 lower

Chicago

wheat: 1-3 lower

KC

wheat: 2-4 lower

Minn

wheat: 3-5 lower

We

updated our price trading ranges

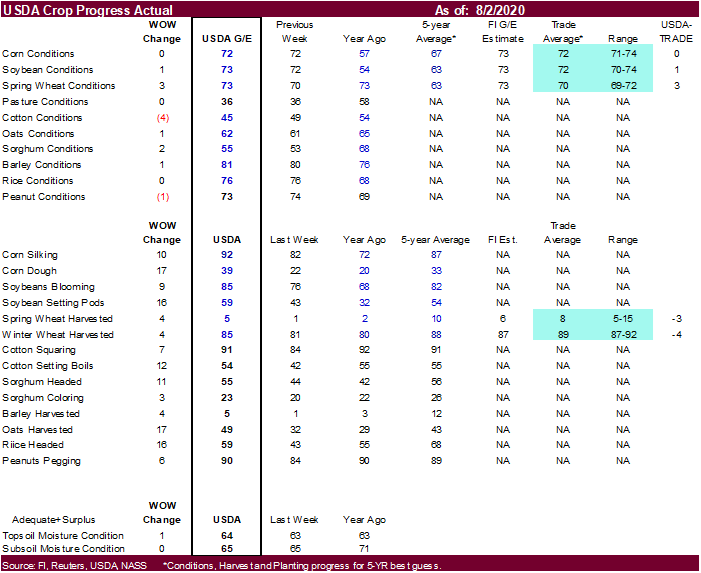

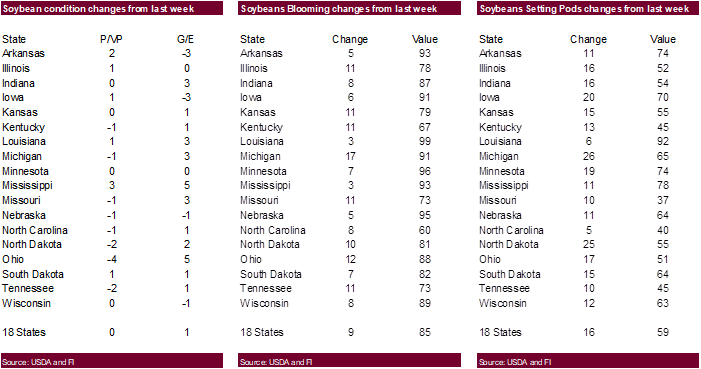

US

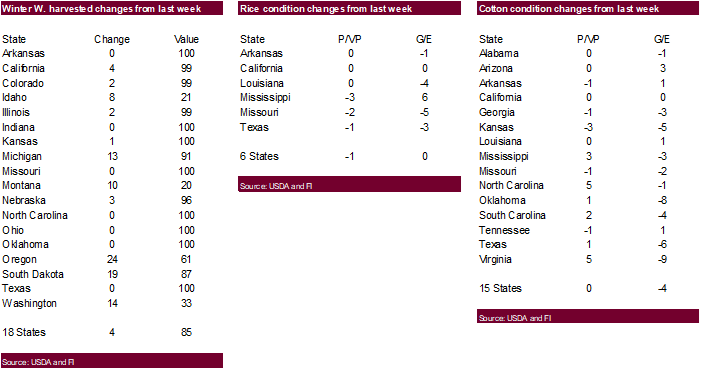

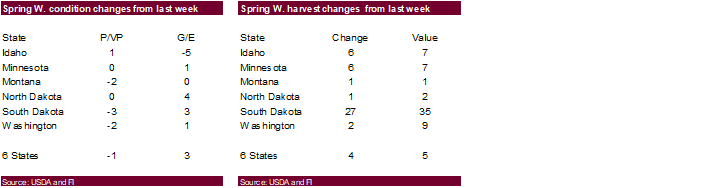

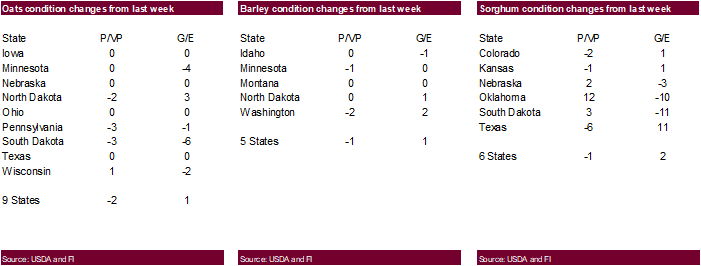

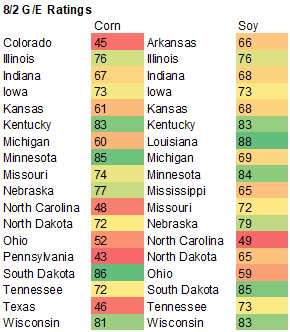

soybean crop ratings increased one point (trade looking for unchanged) to 73. Corn was unchanged, as expected. Spring wheat conditions increased 3 points to 73 (trade was unch.). US wheat harvesting progress fell below trade expectations. This morning

USDA reported 260,000 tons of soybeans to unknown.

7

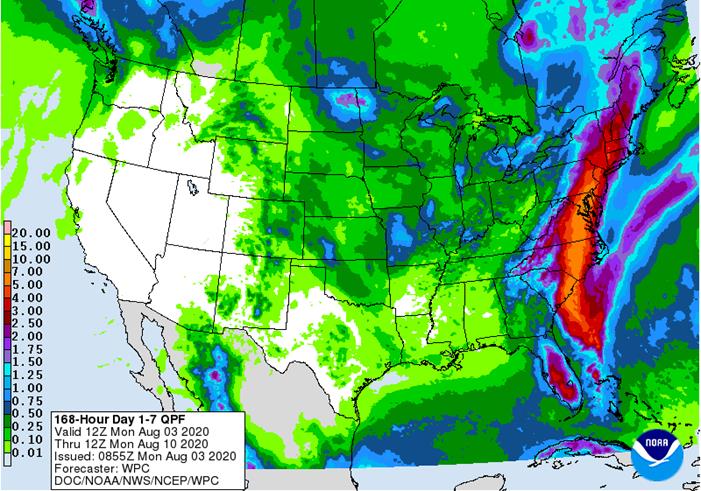

Day Precipitation Outlook

MARKET

WEATHER MENTALITY FOR CORN AND SOYBEANS: U.S. weather is expected to be mostly favorable as it should continue to be in India and China.

Net

drying will occur in parts of Canada’s Prairies for a while this week into next week which may stress a few crops like those of the northwestern Plains. Crop conditions are improving in Mexico and still look good for Australia with significant rain coming

soon to that nation.

Early

season corn planting will advance quickly in Brazil, but rain is needed to improve soil moisture for emergence and establishment. Dryness and some excessive heat will be a concern for summer coarse grain and oilseed crops in parts of western and southeastern

Europe as well as eastern Ukraine into Russia’s Southern Region. Dryness will also continue in some of the sunseed areas of Russia’s eastern New Lands.

Some

concern over net drying will also continue in oil palm production areas of Indonesia.

Overall,

weather today will likely produce a mixed influence on market mentality with a bearish bias remaining.

MARKET

WEATHER MENTALITY FOR WHEAT: Most of the damage done to this year’s spring cereals has already been done and no further change of great significance is expected unless the harvest season turns wet. Some lower production is expected from Russia and Europe

due to dryness in the New Lands and in various areas in northwestern and far southeastern Europe. China’s spring wheat has performed well. Australia’s winter crops will benefit greatly from rain coming over the next two weeks and some ongoing dryness in Canada’s

Prairies may further stress late filling crops. Argentina drought will not change over the next two weeks.

Overall,

weather today will likely leave a neutral to slightly bullish bias to market mentality.

- USDA

weekly corn, soybean, wheat export inspections, 11am - International

Cotton Advisory Committee updates global outlook - ABAG,

Brazil’s agri-business association, hosts annual conference - U.S.

crop conditions for soybeans, corn, cotton; wheat harvesting progress, 4pm - USDA

soybean crush, 3pm - U.S.

DDGS production, corn for ethanol, 3pm - Malaysia

palm oil export data for July 1-31 from AmSpec, SGS - Honduras,

Costa Rica coffee exports for July - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals - HOLIDAY:

Canada

TUESDAY,

August 4:

- U.S.

Purdue Agriculture Sentiment - New

Zealand global dairy trade auction - Australia

commodity index

WEDNESDAY,

August 5:

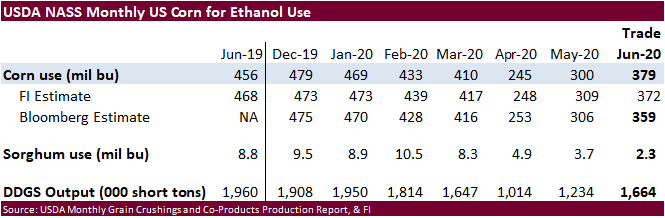

- EIA

U.S. weekly ethanol inventories, production, 10:30am - China’s

CNGOIC to release supply-demand reports on corn, soybeans - French

Agriculture ministry’s 2020 grain estimates - Malaysia’s

palm oil export data for August 1-5 - New

Zealand Commodity Price

THURSDAY,

August 6:

- FAO

World Food Price Index - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports

FRIDAY,

August 7:

- China’s

foreign trade data for July, including imports of soybeans and meat - ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

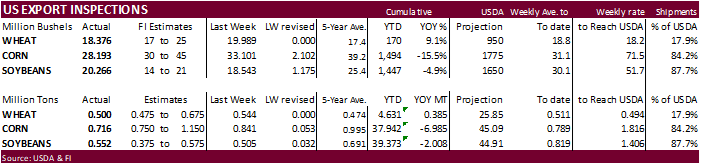

USDA

inspections versus Reuters trade range

Wheat

500,110 versus 450000-675000 range

Corn

716,127 versus 700000-1150000 range

Soybeans

551,543 versus 375000-700000 range

Reuters

headlines for selected Brazil exports:

·

BRAZIL JULY SOYBEAN EXPORTS TOTAL 10.37 MILLION T VERSUS 7.44 MILLION T IN SAME MONTH YEAR AGO – GOVERNMENT DATA

·

BRAZIL JULY CORN EXPORTS TOTAL 4.15 MILLION TNS VERSUS 5.9 MILLION TNS IN SAME MONTH YEAR AGO – GOVERNMENT DATA

·

BRAZIL JULY SUGAR EXPORTS TOTAL 3.48 MILLION TNS VERSUS 1.82 MILLION TNS IN SAME MONTH YEAR AGO – GOVERNMENT DATA

·

BRAZIL JULY COFFEE EXPORTS TOTAL 167,800 TNS VERSUS 175,000 TNS IN THE SAME MONTH A YEAR AGO – GOVERNMENT DATA

·

BRAZIL JULY BEEF EXPORTS TOTAL 169,200 TNS VERSUS 133,200 TNS IN THE SAME MONTH A YEAR AGO – GOVERNMENT DATA

·

BRAZIL JULY CHICKEN EXPORTS TOTAL 337,500 TNS VERSUS 371,800 TNS IN THE SAME MONTH A YEAR AGO – GOVERNMENT DATA

·

BRAZIL JULY PORK EXPORTS TOTAL 90,200 TNS VERSUS 61,480 TNS IN THE SAME MONTH A YEAR AGO – GOVERNMENT DATA

(Reuters)

– U.S.

manufacturing activity

accelerated to its highest level in nearly 1-1/2 years in July as orders increased despite a resurgence in new COVID-19 infections, which is raising fears about the sustainability of a budding economic recovery.

-

Corn

futures ended 1.50 cents higher basis Sep and Dec was up the same amount. The Sep-Dec spread remains wide at 11 cents, Dec premium.

-

Technical

buying was noted after prices hit a one-month low on Friday despite a higher USD.

-

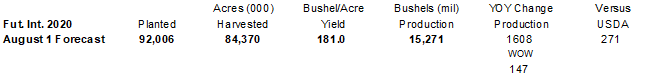

StoneX:

US corn yield and production: 182.4/15.320 billion; soybeans: 54.2/4.496 billion

-

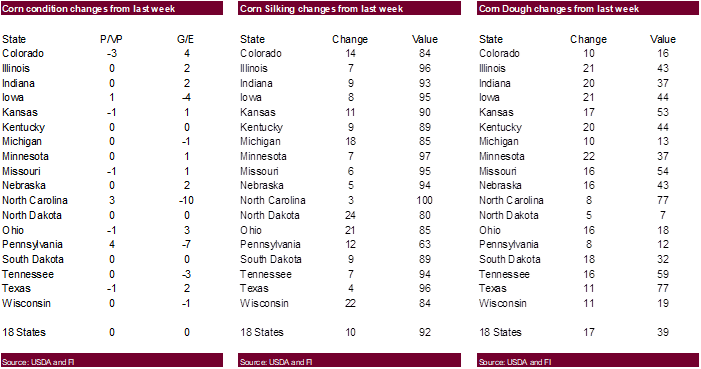

US

corn conditions were unchanged at 72% G/E, at trade expectations, and compare to 57% a year ago. Corn dough 39% vs 22% last week, and 20% a year ago. Corn silking 92% vs 82% last week, and 72% a year ago.

-

US

end users were active in buying US corn but from what we understand, its only in the front months as the CBOT corn carry is wide.

-

US

export business is slow. -

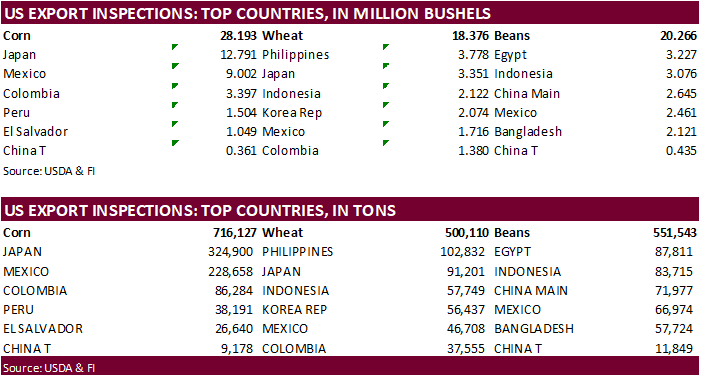

USDA

US corn export inspections as of July 30, 2020 were 716,127 tons, within a range of trade expectations, below 840,796 tons previous week and compares to 645,822 tons year ago. Major countries included Japan for 324,900 tons, Mexico for 228,658 tons, and Colombia

for 86,284 tons. -

Australia

reported an outbreak of H7N7 bird flu at a free-range egg farm in the state of Victoria.

Corn

Export Developments

-

None

reported

From

Trade News Service:

- September

corn is seen in a $3.00 and $3.25 range. December lows could reach $2.95 (Updated 8/3). The US is staring down at a large crop.