PDF Attached

USDA

reported 222,000 tons of meal to the Philippines and 114,300 tons of corn to Mexico.

Last

seven days

KEY

ISSUES INTO THE WEEKEND AND NEXT WEEK

-

At

1100 EDT, Hurricane Isaias was located 365 miles south southeast of Great Abaco Island or 295 miles southeast of Nassau, Bahamas moving northwesterly at 16 mph and producing maximum sustained wind speeds of 75 mph -

Hurricane

force wind was occurring out 35 miles and tropical storm force wind was occurring out 205 miles -

Some

strengthening is expected over the next couple of days -

The

storm will reach the northwestern Bahamas Saturday after being over the southeastern Bahamas today -

The

storm will be near the east coast of Florida Saturday -

Hurricane

watch was issued for a part of the east-central Florida coast while tropical storm warnings are in effect for many other coastal areas -

The

storm will move along the Florida coast during the weekend, but its center should stay far enough off the coast to keep most of the damaging properties east of Florida citrus and sugarcane areas -

Strong

wind speeds will occur in some of the eastern parts of these crop areas, but damage is expected to be kept low -

Some

sugarcane lodging is possible, but damage should be low -

A

small amount of citrus fruit droppage is possible near the coast and minor limb breakage is possible

-

Landfall

in the Carolinas is possible late Sunday into Monday with some crop damage expected

-

Damage

to eastern corn and some soybean and cotton is possible in eastern North Carolina if the storm moves inland and projected -

However,

its fast forward movement and weakening could spare much of the region from much negative impact -

Another

tropical wave in the central tropical Atlantic Ocean is being monitored for possible development into a tropical cyclone next week, but the system should stay well east of North America -

Monsoon

depression in the northwestern South China Sea will bring heavy rain to northern Vietnam, Guangxi, Hainan and southwestern Guangdong, China this weekend;

rainfall of 4.00 to 12.00 inches and locally more is expected resulting in flooding -

Little

wind damage is expected, but some flooding could raise a little concern for rice and sugarcane -

The

area impacted will be low -

Tropical

wave will bring torrential rain to another part of southern China’s coast during the weekend and next week -

This

event will produce 5.00 to 12.00 inches of rain and local totals to 15.00 inches in southern Guangdong

-

Greater

flooding and possible crop damage to rice and sugarcane may come from this event because of its very slow movement and constant rain -

Flooding

rain is expected from Shandong, northeastern Henan and immediate neighboring areas of China into the Korean Peninsula next week -

Damage

to rice and personal property may be greatest in North Korea, northern South Korea and a few areas in Shandong -

This

event occurs from multiple days of significant rain occurring mostly during the workweek next week -

Yangtze

River Basin will experience net drying during the coming ten days to two weeks;

totally dry weather is not expected, but flood water will recede and some of the higher ground will begin to dry down -

Damage

to crops from flooding in this region will not be reversible

-

Xinjiang,

China is not likely to change much over the next week to ten days -

Daily

high temperatures will be in the upper 70s and 80s northeast and in the upper 80s and 90s elsewhere followed by lows in the 50s and 60s with a few lower 70s in the southwest -

Rain

is expected in northeastern areas only with Monday, Wednesday and Thursday wettest with daily rainfall of 0.05 to 0.50 inch

-

Dry

conditions will prevail elsewhere -

Increased

monsoonal rainfall is expected in much of mainland areas of Southeast Asia during the coming week to ten days bringing flooding rain to parts of Laos and southern Myanmar as well as other areas in random locations in Thailand, Cambodi8a and northern Vietnam -

Vietnam’s

Central Highlands may continue to receive lighter than usual rainfall -

Australia

will receive some timely rainfall over the next ten days in virtually all of its wheat, barley and canola production areas -

The

moisture will start to improve field conditions in the very dry areas of South Australia and parts of Queensland -

Ongoing

favorable crop conditions will continue in Western Australia, New South Wales and Victoria where the bulk of winter grain and oilseed is produced -

Philippines

rainfall has been improving recently and this trend will continue -

France

will continue drier biased over the next ten days to two weeks, although a few showers will impact a part of the nation -

Resulting

rainfall will not be enough to seriously bolster topsoil moisture or change production potentials -

Hotter

temperatures Thursday raised crop stress for many areas that have been too dry recently -

Southern

France continues to experience routinely occurring highs in the 90s and over 100 degree temperatures stressing corn and other crops -

The

heat in these areas will continue for a while with some temporary relief this weekend -

Spain

will continue hot with restricted rainfall for a while -

Hot

weather will return to western Europe in the second half of next week and into the following weekend -

Recent

hot weather in the southern Balkan Countries of Europe has occurred in the drought stricken region and relief is unlikely in the area for a while -

Eastern

and southern Ukraine into Kazakhstan and parts of Russia’s Southern Region continues quite dry and warm to hot -

Some

showers are expected during the coming week to ten days, but relief from dryness is expected to be erratic and quite brier -

A

more general soaking of rain is needed -

Russia’s

eastern New Lands will continue to experience restricted rainfall over the next ten days -

Temperatures

will be trending warmer than usual late next week and into the week of August 10 -

Recent

rain in western Russia New Lands has been good for improving spring wheat, sunseed and other crops -

The

greatest improvement in soil moisture has occurred in the Ural Mountains region and in a small part of Russia butting up against the northwestern Kazakhstan border -

Other

western CIS crop areas are favorably moist with little change likely -

East-central

and northeastern Europe will trend a little warmer in the coming week some showers expected to maintain favorable crop conditions -

Indonesia

and Malaysia rainfall is expected to remain lighter than usual especially from the Malay Peninsula and Sumatra into western Kalimantan and western Java -

South

Africa will experience coastal showers over the next week to ten days leaving most interior crop areas dry -

Rain

is needed in eastern wheat production areas while crops in the west are favorably established -

Argentina

rain prospects were cut by today’s forecast model runs leaving Cordoba in the midst of significant winter drought -

Santa

Fe also continues drying out along with many other areas in northwestern parts of the nation -

Buenos

Aires will get some rain periodically keeping its wheat and barley crop favorably rated -

Brazil

weather is expected to be mostly dry for the coming ten days -

Dryness

will be good for early corn planting, but rain will soon be needed in some of the areas to be planted first -

Sao

Paulo, Parana and Mato Grosso do Sul will need rain first, but there is still time for improvement

-

Wheat

conditions are rated well -

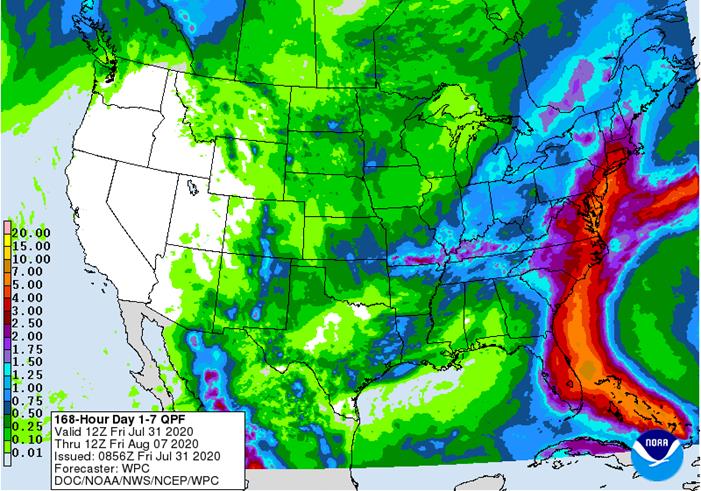

U.S.

weather is still expected to be favorable over the next two weeks -

First

week conditions will be cooler than usual in the Midwest, northern Delta and interior southeastern states -

Second

week Midwest weather is expected to warmer and a little drier -

Net

drying is expected in the second and third weeks of August for many areas in the Midwest, despite some periodic showers due to warmer (not hot) temperatures and more sporadic and light resulting rainfall -

Crop

conditions will remain favorable for much of the U.S. Midwest during the two weeks, although moisture stress will continue in parts of Iowa and in random locations across the northeastern Midwest -

Iowa

will continue to have opportunity for some rain periodically, but resulting amounts are probably going to continue a little light leaving moisture deficits in place and warmer weather coming in the second week of the outlook will accelerate drying rates between

rain events to perpetuate the low soil moisture bias -

West

Texas crop weather will experience a few showers infrequently over the next two weeks and temperatures will be seasonably warm, but not excessively hot

-

U.S.

northwestern Plains and neighboring areas of Canada’s Prairies will continue to experience poor rainfall distributions and warm temperatures biases for a while resulting in low soil moisture and some crop stress -

U.S.

Delta weather will be mixed with some areas wetter biased and others a little dry -

U.S.

southeastern states will see a mix of weather, but some crop damage may occur in eastern North Carolina early next week because of Hurricane Isaias -

The

storm will move fast, however, and it will be weakening when it arrives which should help to reduce the negative impact -

Canada’s

Prairies will be quite warm next week after cooling down briefly this weekend

o

Additional cooling is expected near mid-month

-

Ontario

and Quebec weather is mostly good, but pockets of dryness are expected over the next ten days -

Mexico

precipitation in the coming week will be greatest in western and southern parts of the nation benefiting many corn, sorghum and dry bean production areas -

Coffee,

citrus, sugarcane and many fruit and vegetable crops will also benefit -

Northeastern

Mexico will trend drier after rain fell beneficially from Tropical Depression Hanna early this week -

Central

America rainfall will be erratic this week and may trend heavier and more widespread next week -

India’s

weather is expected to remain favorable for summer crop development even though some of the rain amounts will be more erratic and lighter than usual

-

Northwestern

Rajasthan will experience the least amount of rain over the next ten days as will central and southern Pakistan -

Far

southern India and a few locations from Odisha into southern Bangladesh will also receive well below average rainfall -

Greater

rain is needed in Ivory Coast and Ghana where rainfall this month has been well below average -

The

region is not likely to see much moisture of significance for a while -

Temperatures

may be a little cooler than usual -

New

Zealand rainfall over the next couple of weeks will be erratic and most often light with temperatures warmer than usual -

Southern

Oscillation Index was +4.05 this morning and the index is expected to slowly fall over the next few days

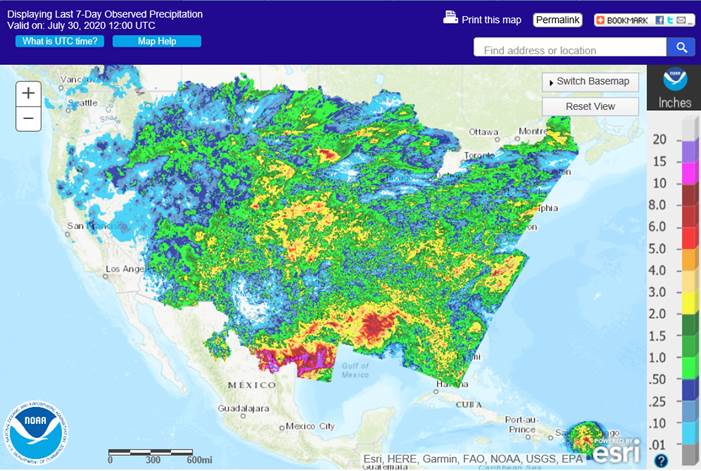

7

Day Precipitation Outlook

Bloomberg

Ag Calendar

FRIDAY,

July 31:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Malaysia’s

palm oil export data for July 1-31 (tentative) - U.S.

agricultural prices paid, received, 3pm - HOLIDAY:

Singapore, Indonesia, Malaysia

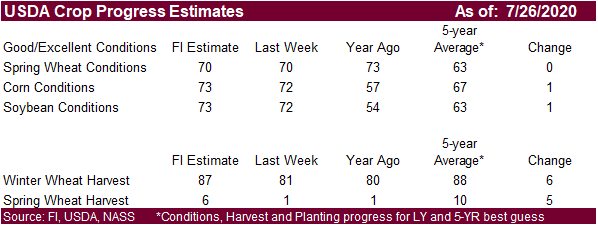

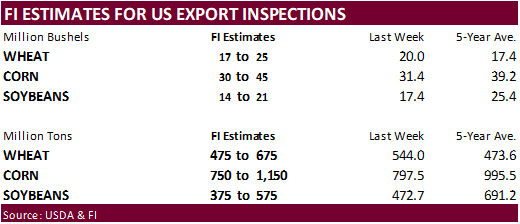

- USDA

weekly corn, soybean, wheat export inspections, 11am - International

Cotton Advisory Committee updates global outlook - ABAG,

Brazil’s agri-business association, hosts annual conference - U.S.

crop conditions for soybeans, corn, cotton; wheat harvesting progress, 4pm - USDA

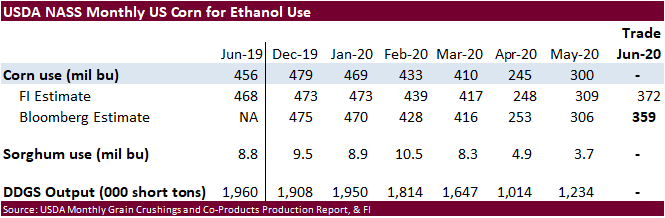

soybean crush, 3pm - U.S.

DDGS production, corn for ethanol, 3pm - Malaysia

palm oil export data for July 1-31 from AmSpec, SGS - Honduras,

Costa Rica coffee exports for July - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals - HOLIDAY:

Canada

TUESDAY,

August 4:

- U.S.

Purdue Agriculture Sentiment - New

Zealand global dairy trade auction - Australia

commodity index

WEDNESDAY,

August 5:

- EIA

U.S. weekly ethanol inventories, production, 10:30am - China’s

CNGOIC to release supply-demand reports on corn, soybeans - French

Agriculture ministry’s 2020 grain estimates - Malaysia’s

palm oil export data for August 1-5 - New

Zealand Commodity Price

THURSDAY,

August 6:

- FAO

World Food Price Index - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports

FRIDAY,

August 7:

- China’s

foreign trade data for July, including imports of soybeans and meat - ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

-143,280 -5,510 208,092 2,100 -98,295 -2,958

Soybeans

62,161 -13,649 129,002 7,123 -205,949 5,124

Soymeal

-19,464 9,713 77,112 336 -97,106 -6,240

Soyoil

37,549 652 83,848 -1,219 -137,957 4,578

CBOT

wheat 1,699 1,225 80,537 -7,397 -77,523 3,315

KCBT

wheat -19,026 -867 48,059 2,236 -30,170 -2,034

MGEX

wheat -21,125 -472 2,313 243 12,734 505

———- ———- ———- ———- ———- ———-

Total

wheat -38,452 -114 130,909 -4,918 -94,959 1,786

Live

cattle 33,622 3,949 82,692 -1,793 -126,082 -3,764

Feeder

cattle 5,453 991 4,208 89 -4,599 -242

Lean

hogs 10,721 209 45,406 810 -62,580 -702

US

Personal Income Jun: -1.1% (est -0.6%; prev -4.2%)

US

Personal Spending Jun: 5.6% (est 5.2%; prev 8.2%)

US

Real Personal Spending Jun: 5.2% (est 5.0%; prev 8.1%)

US

Consumer spending jumps 5.6% in June, but the recovery already appears to be slowing – MW

Incomes

fall 1.1% as stimulus fades, fewer people return to work

US

PCE Deflator (M/M) Jun: 0.4% (est 0.4%; prev 0.1%)

US

PCE Deflator (Y/Y) Jun: 0.8% (est 0.9%; prev 0.5%)

US

PCE Core Deflator (M/M) Jun: 0.2% (est 0.2%; prevR 0.2%; prev 0.1%)

US

PCE Core Deflator(Y/Y) Jun: 0.9% (est 1.0%; prev 1.0%)

US

Univ. Of Michigan Sentiment Jul F: 72.5 (est 72.9; prev 73.2)

–

Conditions Jul F: 52.8 (est 85.5; prev 84.2)

–

Expectations Jul F: 65.9 (est 65.5; prev 66.2)

–

1-Year Inflation Jul F: 3.0% (prev 3.1%)

–

5-10 Year Inflation Jul F: 2.6% (prev 2.7%)

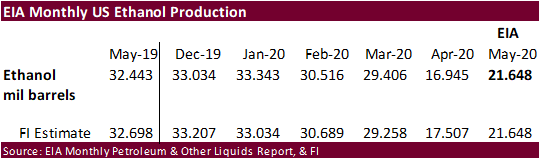

EIA:

US May Gasoline Demand Down 23.5% Or 2.213M Bpd Vs Last Year At 7.188M Bpd (Vs -37.4% In April)

US Crude Oil Production Fell 1.989M Bpd In May To 10.001M Bpd (Vs Revised 11.99M Bpd In April)

-

Corn

ended unchanged to 0.50 cent higher on the last trading day of the month. September corn was down 7 percent this month, or 23.50 cents. It’s hard to imagine China bought 5.6 million tons of corn from the US this month and China corn futures rose to fresh

5-year highs, yet US corn futures remained near 6-year lows. -

Traders

were hopping for additional 24-hour sales for China but saw two cargoes worth of corn sold to Mexico.

-

China

corn prices were up 11 percent during the month of July, largest advance since 2004. Futures rallied even after China sold about 40 million tons of corn out of reserves since late May.

-

FranceAgriMer

reported French corn condition down 3 points to 77 percent as of July 27 from the previous week.

-

BA

Grains Exchange left their Argentina corn production unchanged at 50 million tons.

-

July

Ukraine grain exports fell 33 percent from a year ago to 2.33 million tons, according to the AgMin. They include 1.19 million tons of wheat, 424,000 tons of corn and 714,000 tons of barley. Ukraine harvested a record 75.1 million tons of grain in 2019.

This year weather problems could yield a smaller crop.

Corn

Export Developments

-

Under

the 24-hour announcement system, private exporters sold 114,300 tons of corn to Mexico for 2020-21 shipment.

- September

corn is seen in a $3.10 and $3.35 range over the short term. December lows could reach $3.10. We can’t justify below $3.00 unless a shock in the September grain stocks report occurs, or China’s production gets upward revised by a large amount.