PDF Attached

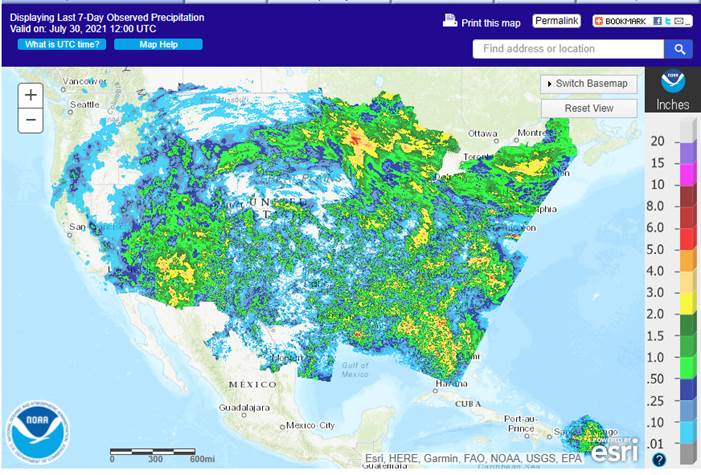

Thunderstorms

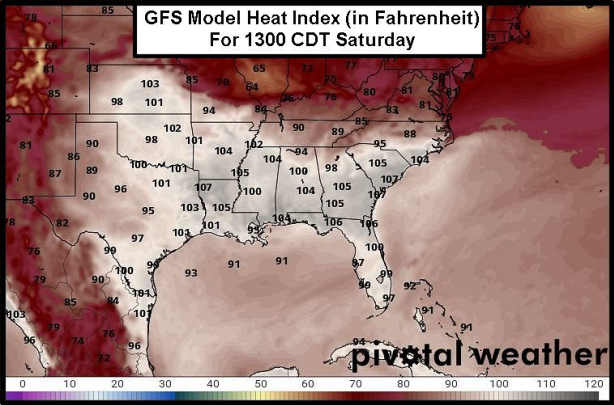

from South Dakota through Iowa and surround areas occurred today. Heat stress will occur across the southern US for livestock & crops this weekend. Ridging will return to the US second week of August. Frost and freezes occurred in southern Brazil overnight

damaging some winter wheat and immature corn.

Source:

World Weather Inc.

WORLD

WEATHER INC.

MOST

IMPORTANT WEATHER OF THE DAY

- Frost

and freezes occurred again this morning in Brazil crop areas - Low

temperatures in the 20s and 30s Fahrenheit occurred in most wheat production areas from Parana into Rio Grande do Sul - Low

temperatures in the upper 20s and 30s occurred in Safrinha corn areas from southern Mato Grosso do Sul into western Parana - Low

temperatures in southern coffee areas of Minas Gerais were 27 to 35 Fahrenheit with widespread frost

- Sugarcane

areas reported lows in the 30s and lower 40s with only a few light freezes - Citrus

areas were mostly in the upper 30s and 40s with a few pockets of soft frost suspected in areas where low temperatures dipped to 35 - The

bottom line likely damaged immature corn and some of the more advanced wheat. Coffee experienced widespread frost adding to the damage of last week and has the poorest environment for recovery in the next few weeks because of ongoing dryness and expected warming.

Sugarcane was only impacted to a low degree, although last week’s freezes had a bigger impact. Citrus was least impacted and may have come through the night unscathed by the cold - Another

cold night will impact Brazil crop areas tonight - Frost

is expected once again in Sul de Minas, Sao Paulo and northern Parana coffee areas - Frost

will also occur in a part of wheat production areas in Parana and in a few sugarcane and citrus areas, but temperatures will be a little warmer than those of today in many areas.

- Heavy

rain fell in Hebei and northern Shandong, China Thursday with some of the rain shifting into western Liaoning early today

- Rain

fall reached over 10.00 inches in central Hebei while varying from 2.00 to more than 5.00 inches in other areas - Local

flooding occurred in central Hebei while flood water in areas to the south in east-central China began to recede as dry weather evolved - China

has experienced crop damage in the past two weeks because of excessive rain and flooding in Hebei, Shandong, Henan, Jiangsu, Anhui and northern Zhejiang - The

impact on agriculture varies greatly from one area to another, but production cuts are strongly suspected in ports of this region - India

will experience another monsoon depression through Monday that will bring heavy rain from the lower Ganges River Basin into northern and eastern Madhya Pradesh and areas northward

- Some

flooding is expected, and a little crop damage is possible - Rainfall

may range from 4.00 to 12.00 inches and locally more - Some

of this rain will reach southern Rajasthan - Southern

India will be drier than usual - Northwestern

Rajasthan and southern Pakistan will not be impacted by much rain and the same may be true for apart of northwestern Gujarat - Drought

in Canada’s Prairies and the northern U.S. Plains will not change over the next ten days as dry and periods of warm weather prevail - Some

showers are possible at the end of next week and into the following weekend that might offer pockets of temporary relief in the northern Plains - Dryness

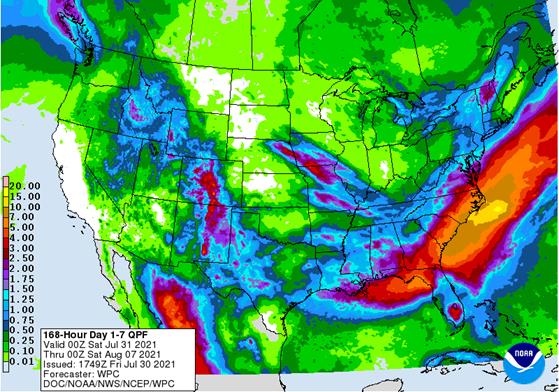

from Canada and the northern U.S. Plains is expected to slowly expand into a larger part of the western Corn Belt over the next few weeks - Rain

will fall tonight into Saturday from South Dakota into Missouri that will disrupt the drying trend for that part of the region, but drying is expected to prevail in northeastern Iowa, northwestern Illinois, parts of Wisconsin and Minnesota as well as eastern

North Dakota and northeastern South Dakota - Rainfall

will range from 0.30 to 1.00 inch with numerous 1.00 to 2.00-inch totals and local amounts over 3.00 inches

- Crop

improvement is expected in the areas that get the greatest rainfall - Hot

weather in the southern U.S. Plains, Delta and southeastern states may persist through the weekend with daily highs in the 90s and slightly over 100 resulting in stress to livestock and crops - Very

high humidity is expected in the Delta and southeastern states inducing extreme heat indices which could threaten livestock and human health - Relief

to the hottest conditions is expected in the central Plains Sunday and in the southern states Monday into Tuesday of next week - U.S.

central Plains will continue a little dry and very warm at times raising potential for crop stress to harm unirrigated summer crop returns - Cooler

temperatures in the U.S. Midwest this weekend into early next week will help conserve soil moisture through slower evaporation - High

temperatures will be restricted to the 70s and 80s for a while - Excessive

heat and dryness will impact far western Canada and the U.S. Pacific Northwest this weekend into early next week - The

heat will impact the western Canada Prairies during the early part of next week before expanding in the western U.S. and the eastern Prairies - Some

of the heat in western North America will reach the U.S. Great Plains during the middle to latter part of next week with some temporary expansion into the western and central Corn Belt at the end of next week and into the following weekend - Some

relief may occur thereafter - Late

August is still expected to be cooler in the eastern parts of the U.S. - U.S.

Delta and southeastern states along with the Blacklands of Texas and most of western Texas will see a good mix of weather for the next two weeks supporting most crop needs - South

Texas early harvesting of cotton, sorghum and corn should advance relatively well over the next week, but some rain could evolve late next week and on into the second week of August - Support

for tropical cyclone evolution remains high in the eastern Pacific Ocean over the next week

- Three

disturbances have already been identified in the region today by the U.S. National Hurricane Center - Some

of this higher potential for tropical cyclone activity is expected to move into the Caribbean Sea and Gulf of Mexico during the second week of the two week outlook before shifting into the Atlantic Ocean near mid-month and beyond - Recent

surface ocean cooling has begun in the tropical Atlantic and if this continues the tropical cyclone season this year may be less than previously expected - Philippines

rainfall lightened for a little while Thursday after torrential rain occurred earlier in this past week and frequently during the month - Flooding

in western Luzon has likely hurt rice production - Indonesia

rainfall continues lighter than usual and a boost in rainfall will soon be needed to protect short, rooted crops in Sumatra, Java and parts of Kalimantan - Mainland

areas of Southeast Asia are expected to dry down for a little while, although scattered showers will continue - Europe

rain will fall frequently, but lightly during the next ten days - Too

much moisture will threaten the quality of unharvested small grains and late winter rapeseed - Rain

intensity will not be as great as that of earlier this month, but still enough to raise concern over unharvested crop quality and to induce new delays to fieldwork - Southeastern

Europe still needs a boost in soil moisture, despite some beneficial rain that fell earlier this month - Net

drying is expected for the next ten days and temperatures will frequently be warmer than usual - Some

hot temperatures are expected at times - Southeastern

Canada corn, soybean and wheat production areas continue to experience a favorable mix of weather - Wheat

areas would benefit from an extended period of dry weather to support the best harvest conditions - Australia

weather will be favorably mixed for canola, wheat and barley - Crops

have established well in most of the nation - Queensland

and northern New South Wales need more rain - Most

CIS crop areas will see a good mix of weather during the next couple of weeks - However,

dryness will remain in parts of Russia’s Southern Region and areas east northeast through Kazakhstan - Ukraine

soil and crop conditions should remain favorably rated, although some increase in rainfall may be needed in parts of the region - Ethiopia

rainfall has been sufficient to support coffee and other crops recently, but Uganda and Kenya rainfall has been light - The

pattern will continue for a while longer - West-central

Africa rainfall has diminished seasonably for a while - Rain

will be needed in Ghana and Ivory Coast soon - South

Africa weather is expected to be dry for a while, but recent rain has western wheat and barley crops well established - A

boost in rainfall is needed in unirrigated eastern wheat production areas - Argentina

needs rain in its western wheat production areas, although cold weather has the crop dormant or semi-dormant right now leaving the need for a moisture boost to a time later in August and September prior to aggressive spring crop development - Southern

Oscillation Index has reached +16.57 and it is peaking after a strong rising trend since June 22 when the index was -3.36 - Mexico

weather has improved with increased rainfall in the south and west parts of the nation - Drought

conditions are waning, and crops are performing better - Dryness

remains in eastern Chihuahua and northeastern parts of the nation - Weather

over the next ten days will offer some relief, but more rain will be needed in the drier areas - Central

America rainfall has been plentiful and will remain that way - Both

Honduras and Nicaragua have received frequent bouts of rain this month easing long term dryness, but more may be needed in some locations - Flooding

rainfall occurred in a part of the region from southern Nicaragua into Panama during the weekend - New

Zealand rainfall during the coming week will be near to above normal in western portions of South Island while near to below average in most other areas - Temperatures

will be seasonable

Source:

World Weather Inc.

Monday,

Aug. 2:

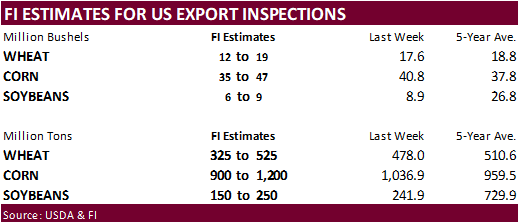

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop conditions – corn, cotton, soybeans, wheat, 4pm - U.S.

corn for ethanol, soybean crush, DDGS production, 3pm - Ivory

Coast cocoa arrivals

Tuesday,

Aug. 3:

- EU

weekly grain, oilseed import and export data - Australia

Commodity Index - New

Zealand global dairy trade auction

Wednesday,

Aug. 4:

- EIA

weekly U.S. ethanol inventories, production - New

Zealand Commodity Price - France

agriculture ministry updates 2021 crop estimates

Thursday,

Aug. 5:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - China’s

CNGOIC to publish monthly soy and corn reports - FAO

World Food Price Index - Port

of Rouen data on French grain exports - Malaysia

Aug. 1-5 palm oil export data - Risi

pulp conference, Sao Paulo - BayWa

earnings

Friday,

Aug. 6:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Saturday,

Aug. 7

- China’s

first batch of July trade data, incl. soybean, edible oil, rubber and meat imports

Source:

Bloomberg and FI

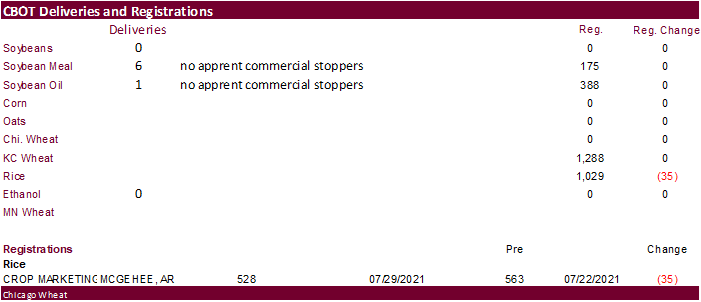

First

Notice Day Deliveries were released Thursday evening.

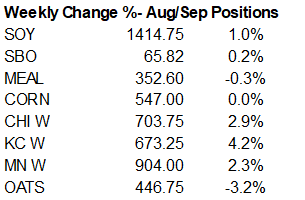

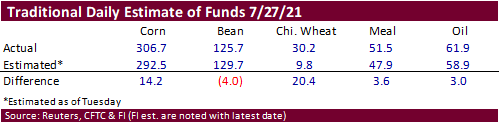

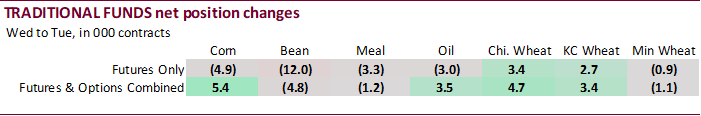

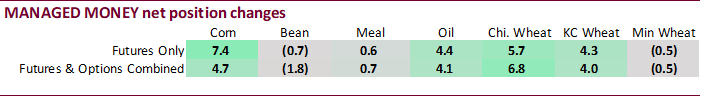

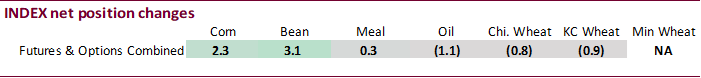

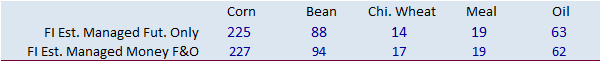

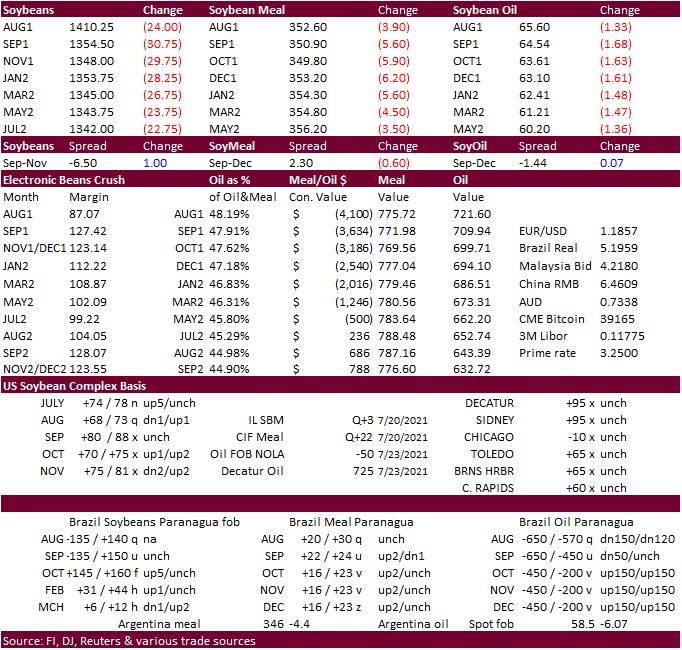

Position

changes for traditional funds and managed money for the major ag markets were minor. Funds were more long than expected for corn and wheat, and slightly less long than expected for soybeans.

86

Counterparties Take $1.039Tln At Fed’s Fixed-Rate Reverse Repo (prev $987.283 Bln, 76 Bidders)

US

Fed’s Reverse Repo Volume Hits Record USD1Tln For First Time Ever – Reuters

US

Personal Income Jun: 0.1% (est -0.3%; prevR -2.2%; prev -2.0%)

US

Personal Spending Jun: 1.0% (est 0.7%; prevR -0.1%; prev 0.0%)

US

PCE Core Deflator (Y/Y) Jun: 3.5% (est 3.7%; prev 3.4%)

US

PCE Core Deflator (M/M) Jun: 0.4% (est 0.6%; prev 0.5%)

US

PCE Deflator (Y/Y) Jun: 4.0% (est 4.0%; prevR 4.0%; prev 3.9%)

US

PCE Deflator (M/M) Jun: 0.5% (est 0.6%; prevR 0.5%; prev 0.4%)

US

Real Personal Spending Jun: 0.5% (est 0.3%; prevR -0.6%; prev -0.4%)

US

Chicago PMI Jul: 73.4 (est 64.2; prev 66.1)

US

University Of Michigan Sentiment Final Jul: 81.2 (est 80.8; prev 80.8)

US

University Of Michigan Current Condition Final Jul: 84.5 (est 84.5; prev 84.5)

US

University Of Michigan Expectations Final Jul: 79.0 (est 78.4; prev 78.4)

US

University Of Michigan 1 Year Inflation Final Jul: 4.7 (est 4.8%; prev 4.8%)

US

University Of Michigan 5-10 Year Inflation Final Jul: 2.8 (prev 2.9%)

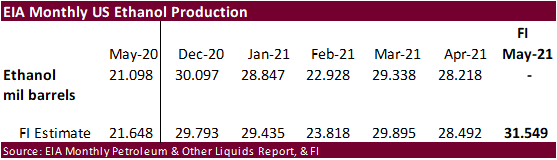

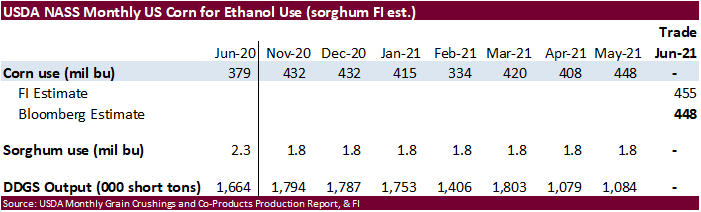

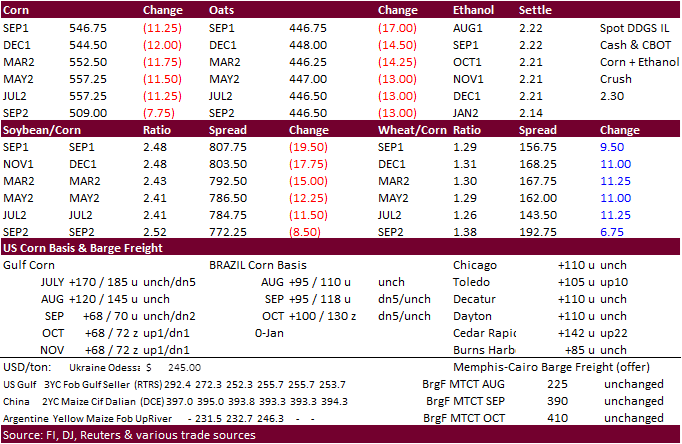

Corn

- Positioning

along with improving US Midwest weather conditions pressured soybeans and corn today. September corn shed 11 cents and December was off 11.25 cents. For the month of July December corn was down 7.4%. Some traders prefer to go home flat over the weekend,

especially when weather is the center of attention. - Funds

sold an estimated net 10,000 corn contracts. - US

western Corn Belt will saw today, lasting into early Saturday. South Dakota saw a fair amount of rain already as of early this morning. Frost and freezes occurred in southern Brazil overnight damaging some winter wheat and immature corn. More cold weather

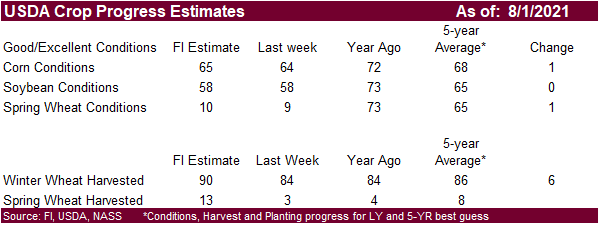

is on the way. Flooding in China occurred in Hebei. - 36%

of U.S. corn crop is experiencing moderate to severe drought, unchanged from last week.

- Planalytics:

175.3 US corn yield.

Export

developments.

- China

auctions: - 25,999

imported GNO corn and 5,423 non-GMO imported corn, 13% and 11% respectively of what was offered. They were looking to sell 202,264 tons of imported US corn and 49,695 tons of imported Ukrainian corn.

- Qatar

seeks about 100,000 tons of barley on August 18 for Sep-Nov delivery.

Export

developments.

- Jordan

passed on 120,000 tons of feed barley for Nov/Dec shipment.

- China

will auction off 202,264 tons of imported US corn and 49,695 tons of imported Ukrainian corn on July 30.

- Qatar

seeks about 100,000 tons of barley on August 18 for Sep-Nov delivery.

September

corn is seen is a $5.00-$6.25 range

December

corn is seen in a $4.25-$6.00 range.

Soybeans

-

Soybeans

ended 19.50-29.75 cents lower on end of week/month profit taking and rain occurring across parts of the dry areas of the WCB today. Canadian canola was down sharply. Volume for both commodities was below average. Offshore values were leading the CBOT products

lower this morning. Soybean meal lost $11.10 to $18.00. SBO settled 72-112 points lower. Malaysian pam October futures were down 58 points and cash off $7.50/ton to $1,080.00/ton. -

Funds

sold an estimated net 11,000 soybeans, sold 2,000 soybean meal and sold 8,000 soybean oil.

-

Decatur,

IN soybeans basis was 10 cents lower at 85 over the November and Council Bluff, IA, was lowered 15 cents to 70 over November futures. Lafayette, IN was down 5 cents to 95 over November.

-

Paraguay

truck drivers went on strike yesterday over transportation costs and rising fuel costs.

-

Earlier

this week 50,000 tons of Argentina SME traded. Shipping problems due to low water levels are forcing some boats to top off in neighboring Brazil (we heard that happened recently for a boat carrying SBO).

-

November

Canadian canola closed the 844 gap today. We remain bullish canola as many trade estimates are sub 17MMT for Canada production. USDA is at 20.2 million tons. November for the day was down $36.20, or 4.1%, at $842.20/ton.

- China

cash crush margins were last positive 50 cents on our analysis (previous 36), versus negative 9 cents late last week.

-

India’s

government kept their veg oil import tariff unchanged.

Export

Developments

- The

USDA seeks 2,880 tons of packaged oil for use under the PL480 program on August 3 for Sep 1-30 shipment.

Updated

7/26/21

August

soybeans are seen in a $13.50-$15.00 range; November $11.75-$15.00

August

soybean meal – $330-$400; December $320-$425

August

soybean oil – 64.50-70.00; December 48-67 cent range

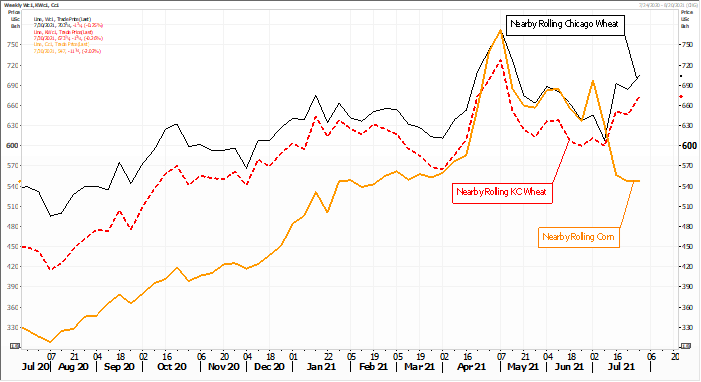

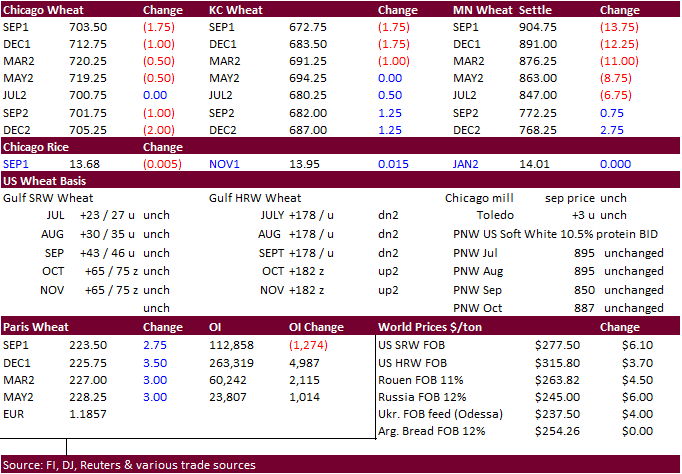

- Chicago

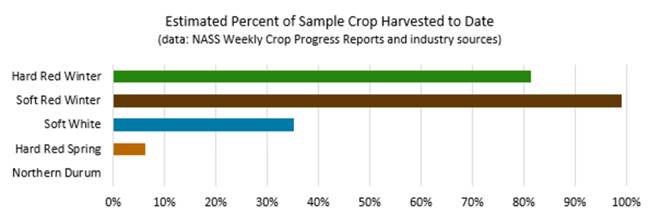

and KC saw a lower trade but paired losses by late morning but fell again early afternoon. Minneapolis was on the defensive all session, in part to buy the rumor, sell the fact.

Yesterday

afternoon we got confirmation the spring wheat crop will end up short this year.

The

average annual Wheat Quality Council tour spring wheat yield for North Dakota was estimated at 29.1 bushels per acre, lowest since data began in 1993, and well below the 5-year average of 43.6 bushels per acre. USDA is at 28.0 bushels per acre.

- After

the close Egypt announced they seek wheat for September through October shipment.

- Funds

sold an estimated net 1,000 SRW wheat contracts. - Argentina’s

BA Grains Exchanged warned the wheat crop in areas were frosts occurred could have been impacted, but they left their 19 million ton estimate unchanged. Nearly all the wheat has been planted as of earlier this week.

- Ukrainian

harvested 24.3 million tons of grain from 36.7% of its planted area, including 6.9 million tons of barley and 16.9 million tons of wheat (AgMin).

- December

Paris wheat was up 3.35 at 225.50 euros. - France

harvested 47% of the soft wheat crop as of July 26, up from 14% from the previous week, and compares with 87% by the same time last year. - EU

Commission: EU’s soft-wheat production was estimated at 127.7 million tons, up from 125.8 projected in June.

- Russia’s

wheat export customs duty will be left unchanged at $31.40/ton. - IKAR

lowered Russia’s wheat production forecast for 2021 to 78.5 million tons from 81.5 million.

- US

Wheat Associates: “The U.S. winter wheat harvest is rapidly progressing in northern and Pacific Northwest regions with warm, dry conditions holding on. HRW crop conditions remain variable. Harvest of a larger SRW crop is all but complete and all samples have

been tested. The Wheat Quality Council Hard Spring and Durum Tour saw crops that will have much lower than average yields but with promising quality. Winter SW harvest is moving ahead of normal. Durum conditions are slightly better than HRS but remain drought

and heat stressed.“

-

Egypt

seeks wheat for September through October shipment. - Pakistan

bought about 220,000 tons of wheat out of 500,000 tons sought at $304/ton c&f for September shipment.

- Turkey’s

TMO seeks up to around 900,000 tons of 11.5-12.5% milling wheat (395k) and feed barley (515k) for late September 16-30 shipment. The barley is sought on August 3 and wheat on August 4. Turkey is one of Russia’s best customer.

- Results

awaited: Ethiopia seeks 400,000 tons of wheat on July 19.

Rice/Other

- Results

awaited: Mauritius seeks 6,000 tons of white rice on July 27 for October through December shipment.

Updated 7/29/21

September Chicago wheat is seen in a $6.25‐$7.50 range

September KC wheat is seen in a $5.90‐$7.25

September MN wheat is seen in a $8.50‐$10.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.