PDF Attached does not include daily estimate of funds.

After text please find updated US S&D’s for the soybean complex.

USD

was down 45 points by early afternoon. Grains rallied on US weather, higher soybean oil and strength in outside commodity markets.

WASHINGTON,

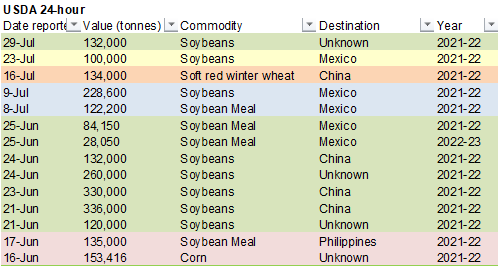

July 29, 2021–Private exporters reported to the U.S. Department of Agriculture export sales of 132,000 metric tons of soybeans for delivery to unknown destinations during the 2021/2022 marketing year.

WORLD

WEATHER INC.

MOST

IMPORTANT WEATHER OF THE DAY

- Frost

and freezes occurred this morning from Argentina through southern Brazil - The

cold in Argentina and Rio Grande do Sul, Brazil as well as Uruguay should not have permanently harmed winter wheat or barley because of semi-dormancy - The

cold did bring another round of concern over immature corn in Safrinha corn production areas, although freezes earlier this month probably had a bigger impact on crops - Patches

of soft frost may have impacted a few northern Parana coffee areas this morning, but no serious impact was suspected - No

crop threatening cold occurred in Sul de Minas, Brazil coffee areas today - Additional

cold will impact Brazil crop areas through Sunday – mostly from southern Minas Gerais into Rio Grande de Sul - Frost

damage is expected in Sul de Minas, Sao Paulo and northern Parana coffee areas - Frost

damage in sugarcane areas of Sao Paulo, northern Parana and Mato Grosso do Sul is expected as well, although the cold will not kill these crops, but maintain concern over their production potential in the coming year - Frost

in citrus areas will be light enough to have a minimal impact on production potentials - Heavy

rain fell in Hebei and Shandong, China Wednesday and early today with 6.00 to 13.11 inches of rain resulting - Some

of the rain also impacted easternmost Henan and northern portions of both Jiangsu and Anhui - Flooding

occurred in much of this region, but mostly in Shandong - China

has experienced crop damage in the past two weeks because of excessive rain and flooding in Hebei, Shandong, Henan, Jiangsu, Anhui and northern Zhejiang - The

impact on agriculture varies greatly from one area to another, but production cuts are strongly suspected in ports of this region - India

will experience another monsoon depression through Monday that will bring heavy rain from the lower Ganges River Basin into northern and eastern Madhya Pradesh and areas northward

- Some

flooding is expected and a little crop damage is possible - Southern

India will be drier than usual - Northwestern

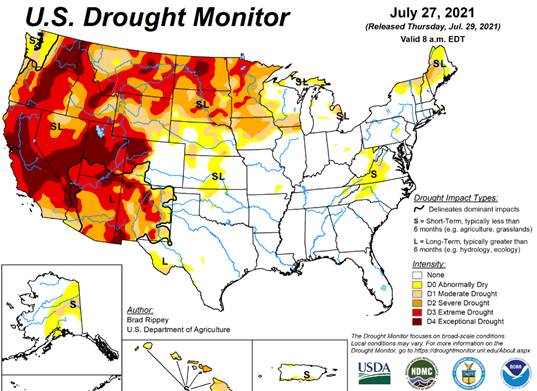

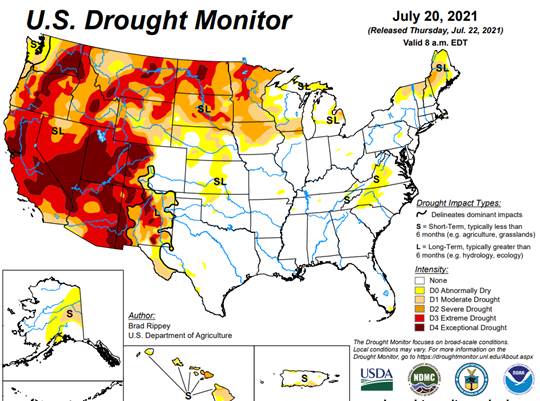

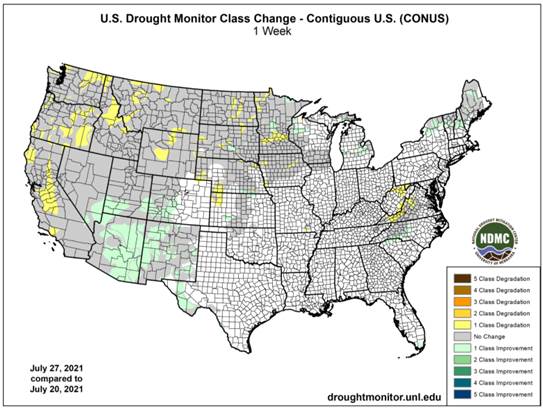

Rajasthan and southern Pakistan will not be impacted by much rain and the same may be true for apart of northwestern Gujarat - Drought

in Canada’s Prairies and the northern U.S. Plains will not change over the next ten days as dry and periods of warm weather prevail - Dryness

from Canada and the northern U.S. Plains is expected to slowly expand into a larger part of the western Corn Belt over the next few weeks - Rain

is expected from South Dakota into Missouri Friday into Saturday that will disrupt the drying trend for that part of the region, but drying is expected to prevail in northeastern Iowa, northwestern Illinois, parts of Wisconsin and Minnesota as well as eastern

North Dakota and northeastern South Dakota - Rainfall

will range from 0.30 to 0.00 inch with numerous 1.00 to 2.00-inch totals - Crop

improvement is expected in the areas that get the greatest rainfall - Excessive

heat occurred again Wednesday in South Dakota this time impacting the central and eastern parts of the state with extreme highs of 100 to 108 Fahrenheit - Cooling

occurred in Montana and far northwestern South Dakota as well as in parts of western North Dakota - Today’s

hottest weather in the U.S. will occur from the central Plains into the lower Midwest and southward to the Delta and southeastern states as well as in many far western U.S. locations - Most

highs will be in the 90s, but extremes over 100 are expected in parts of Kansas and in the far western states from the Pacific Northwest into the southwestern desert region - Hot

weather in the southern U.S. Plains, Delta and southeastern states may persist through the weekend with daily highs in the 90s and slightly over 100 resulting in stress to livestock and crops - Very

high humidity is expected in the Delta and southeastern states inducing extreme heat indices which could threaten livestock and human health - Relief

to the hottest conditions is expected in the central Plains Sunday and in the southern states Monday into Tuesday of next week - Cooler

temperatures in the U.S. Midwest this weekend into early next week will help conserve soil moisture through slower evaporation - High

temperatures will be restricted to the 70s and 80s for a while - Excessive

heat and dryness will impact far western Canada and the U.S. Pacific Northwest this weekend into early next week - The

heat will impact the western Canada Prairies during the early part of next week before expanding in the western U.S. and the eastern Prairies - Some

of the heat in western North America will reach the U.S. Great Plains during the middle to latter part of next week with some temporary expansion into the western and central Corn Belt at the end of next week and into the following weekend - Some

relief may occur thereafter - Late

August is still expected to be cooler in the eastern parts of the U.S. - U.S.

Delta and southeastern states along with the Blacklands of Texas will see a good mix of weather for the next two weeks supporting most crop needs - South

Texas early harvesting of cotton, sorghum and corn should advance relatively well over the next week, but some rain could evolve late next week and on into the second week of August - Support

for tropical cyclone evolution remains high in the eastern Pacific Ocean over the next week to ten days - Some

of this higher potential for tropical cyclone activity is expected to move into the Caribbean Sea and Gulf of Mexico during the second week of the two week outlook before shifting into the Atlantic Ocean near mid-month and beyond - Recent

surface ocean cooling has begun in the tropical Atlantic and if this continues the tropical cyclone season this year may be less than previously expected - Additional

torrential rain fell in west-central Luzon Island, Philippines Wednesday with another 7.00 inches of rain noted. - Flooding

in western Luzon may be hurting rice production - Indonesia

rainfall continues lighter than usual and a boost in rainfall will soon be needed to protect short rooted crops in Sumatra, Java and parts of Kalimantan - Europe

rain will fall frequently, but lightly during the next ten days - Too

much moisture will threaten the quality of unharvested small grains and late winter rapeseed - Rain

intensity will not be as great as that of earlier this month, but still enough to raise concern over unharvested crop quality and to induce new delays to fieldwork - Hot

temperatures returned to the Balkan Countries of southeastern Europe Wednesday - Highest

afternoon temperatures were in the 90s to 102 degrees Fahrenheit - Soil

moisture was already a little light and the heat likely accelerated the decline

- Southeastern

Europe still needs a boost in soil moisture, despite some beneficial rain that fell earlier this month - Net

drying is expected for the next ten days and temperatures will frequently be warmer than usual - Some

hot temperatures are expected at times - Southeastern

Canada corn, soybean and wheat production areas continue to experience a favorable mix of weather - Wheat

areas would benefit from an extended period of dry weather to support the best harvest conditions - Australia

weather will be favorably mixed for canola, wheat and barley - Crops

have established well in most of the nation - Queensland

and northern New South Wales need more rain - Most

CIS crop areas will see a good mix of weather during the next couple of weeks - However,

dryness will remain in parts of Russia’s Southern Region and areas east northeast through Kazakhstan - Ukraine

soil and crop conditions should remain favorably rated, although some increase in rainfall may be needed in parts of the region - Ethiopia

rainfall has been sufficient to support coffee and other crops recently, but Uganda and Kenya rainfall has been light - The

pattern will continue for a while longer - West-central

Africa rainfall has diminished seasonably for a while - Rain

will be needed in Ghana and Ivory Coast soon - South

Africa weather is expected to be dry for a while, but recent rain has western wheat and barley crops well established - A

boost in rainfall is needed in unirrigated eastern wheat production areas - Argentina

needs rain in its western wheat production areas, although cold weather has the crop dormant or semi-dormant right now leaving the need for a moisture boost to a time later in August and September prior to aggressive spring crop development - Southern

Oscillation Index has reached +16.49 and it is peaking after a strong rising trend since June 22 when the index was -3.36 - Mexico

weather has improved with increased rainfall in the south and west parts of the nation - Drought

conditions are waning and crops are performing better - Dryness

remains in Chihuahua and northeastern parts of the nation - Weather

over the next ten days will offer some relief, but more rain will be needed in the drier areas - Central

America rainfall has been plentiful and will remain that way - Both

Honduras and Nicaragua have received frequent bouts of rain this month easing long term dryness, but more may be needed in some locations - Flooding

rainfall occurred in a part of the region from southern Nicaragua into Panama during the weekend - New

Zealand rainfall during the coming week will be near to above normal in western portions of South Island while near to below average in most other areas - Temperatures

will be seasonable

Source:

World Weather Inc.

Bloomberg

Ag Calendar

Thursday,

July 29:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - International

Grains Council monthly report - Port

of Rouen data on French grain exports

Friday,

July 30:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - U.S.

agricultural prices paid, received

Source:

Bloomberg and FI

CBOT

First Notice Day delivery estimates by FI

Soybeans

zero (registrations went to zero earlier this week)

Soybean

meal 0-100 (bias zero…175 registered)

Soybean

oil 50-200 (bias light…73 registered out of 388 are “old”)

USDA

Export Sales

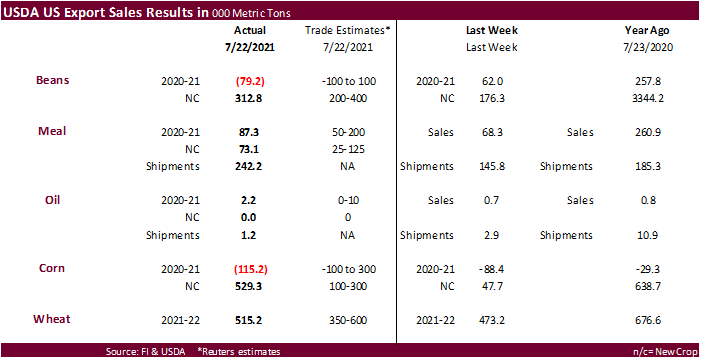

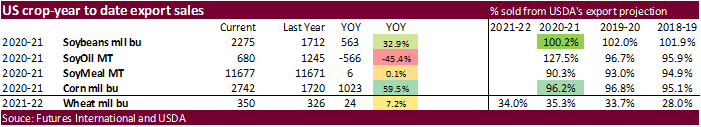

Overall

favors meal over oil, ok of soybeans and corn (poor old-crop/improvement for new-crop), and positive for wheat. The USDA all-wheat export sales were 515,200 tons and included China for 128,900 tons (130,000 was switched from unknown) and Mexico for 85,600

tons. Old crop corn posted another week of reductions (115,200 tons) and new crop was 529,300 tons, a big improvement from recent weekly sales for 2021-21. New-crop corn destinations included Mexico (172,000 MT), unknown destinations (150,000 MT), Colombia

(129,100 MT), and Japan (50,000). US soybean export sales were negative 79,200 tons old crop and 312,800 tons new-crop, both within expectations. Soybean oil sales were poor and meal sales were low but within expectations. Meal shipments of 242,200 tons

are supportive and included the Philippines (48,500 MT), Ireland (44,000 MT), the Dominican Republic (32,700 MT), Mexico (32,600 MT), and Ecuador (29,100 MT). Pork sales were excellent at 38,500 tons, with bulk for Mexico. There were only 2,000 tons of sorghum

export sales and barley posted a small 200 ton reduction.

US

EIA Natural Gas Storage Change (BCF) Jul 23: 36 (est 43; prev 49)

EIA-US

Salt Dome Cavern Natgas Stocks -10 (BCF)

76

Counterparties Take $987.283Bln At Fed’s Fixed-Rate Reverse Repo (prev $965.189 Bln, 74 Bidders)

US

Initial Jobless Claims Jul 24: 400K (est 385K; prevR 424K; prev 419K)

US

Continuing Claims Jul 17: 3269K (est 3189K; prevR3262K; prev 3236K)

US

GDP Annualized (Q/Q) Q2 A: 6.5% (est 8.4%; prev 6.4%)

US

GDP Price Index Q2 A: 6.0% (est 5.4%; prev 4.3%)

US

Personal Consumption Q2 A: 11.8% (est 10.5%; prev 11.4%)

US

Core PCE (Q/Q) Q2 A: 6.1% (est 6.1%; prev 2.5%)

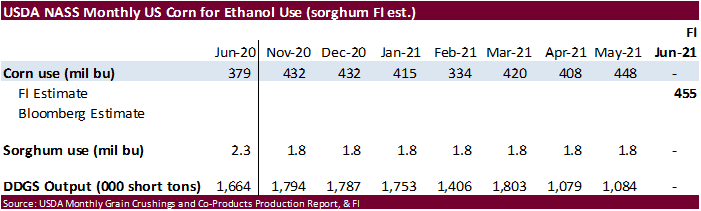

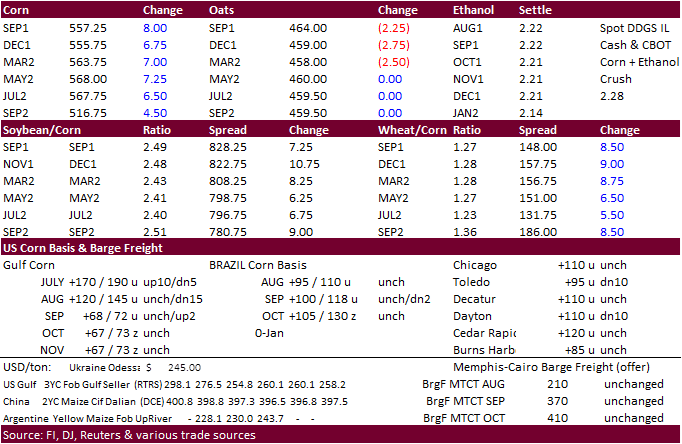

- Corn

traded higher following a rally in wheat and soybeans along with a 45 point decline in the USD. New-crop export sales were good. News was light and commercial trading was slow. Jordan passed on barley. Rain that fell across MN, WI, northern IL, into IN

and Michigan was beneficial over the past day. Look for Missouri, southern Iowa and northeastern Nebraska to see light rain over the next few days. Eastern Corn Belt looks good over the next week.

- African

Swine fever was discovered in Dominican Republic, first detection for the Americas in about 40 years.

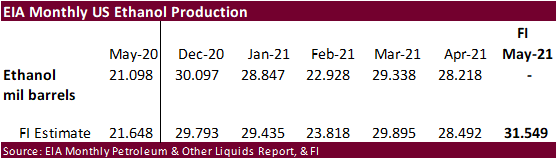

- EIA

weekly petroleum status report showed ethanol production last week dropped a more than expected 14,000 barrels to 1.014 million (Bloomberg poll looked for up 3,000) and stocks build of 215,000 barrels to 22.733 (trade up 130k). Stocks are highest since February

19, 2021 and production lowest since May 7.

Export

developments.

- Jordan

passed on 120,000 tons of feed barley for Nov/Dec shipment.

- China

will auction off 202,264 tons of imported US corn and 49,695 tons of imported Ukrainian corn on July 30.

- Qatar

seeks about 100,000 tons of barley on August 18 for Sep-Nov delivery.

September

corn is seen is a $5.00-$6.25 range

December

corn is seen in a $4.25-$6.00 range.

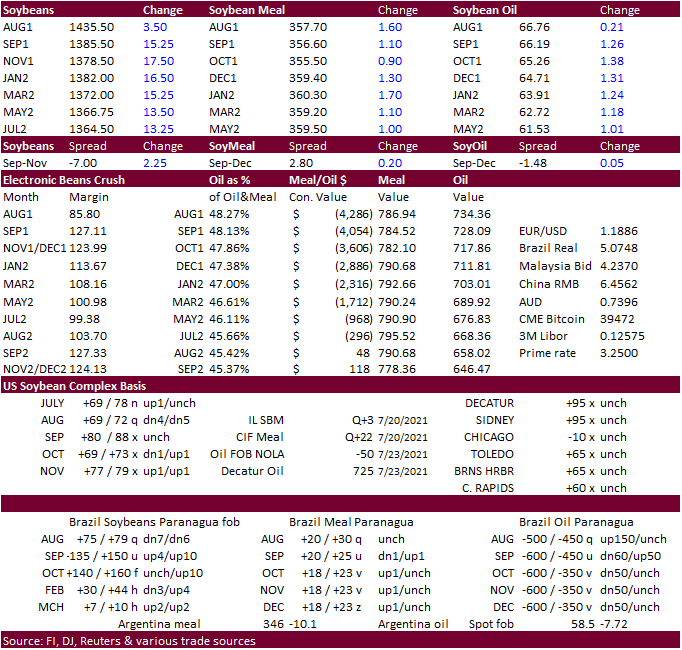

Soybeans

-

Soybeans

traded higher (2.25 cents in August and 16.75 cents in November) on follow through buying in soybean oil and rebound in soybean meal. As soybean oil gradually traded higher by afternoon trading, that put some pressure on meal (spreading), and meal closed

moderately higher in August and $1.00-1.30 higher in the back months. US new-crop soybean sales improved. Private estimates are now calling for the Canadian canola crop to fall below 17 million tons this year. November Canadian canola was down 4.60 at $878.40/ton.

It nearly tested its 20-MA of 859.90 by making a low of 866.00. -

Soybean

oil rallied more than 150 points by late morning but closed 114 to 136 points higher in the back months. August was up only 38points. Malaysian pam October futures were up 119 points and cash rallied $25/ton to $1,087.50.

-

Reuters

on first notice day delivery estimates: Early indications are for minimal deliveries – while registrations as of last night sat at zero for beans; 175 for soymeal and 388 for bean oil.

-

Paraguay

truck drivers went on strike yesterday over transportation costs and rising fuel costs.

-

CNGOIC

reported China’s soybean crush increased 150,000 tons to 1.9 million at the end of last week, a one-month high. Crush margins improved slightly this week but remain unfavorable. Soybean stocks increased 350,000 tons to 7.32 million tons.

-

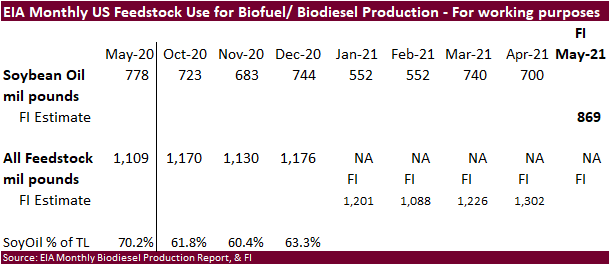

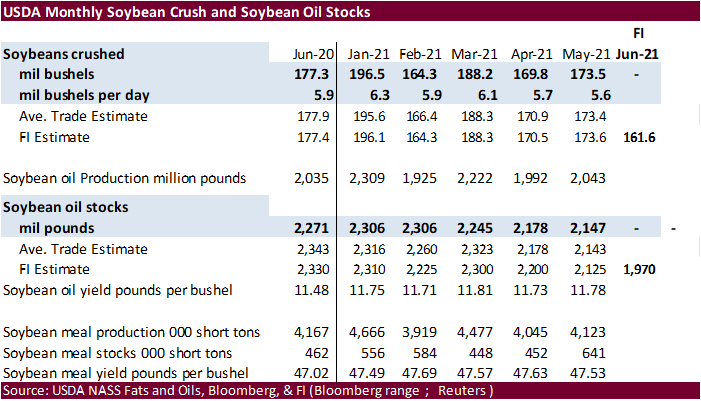

We

think USDA will trim the 2020-21 US crush by 10 million bushels next month and report the US yield near 50.7 bushels per acre (near USDA’s current estimate). We still calculate 2021-22 SBO stocks much lower than USDA’s projection, in part to a crush that

is lower than USDA’s June estimate. -

The

EU extended tariffs on biodiesel imports from the US for another 5 years. US biodiesel is expensive anyway, and it would not make sense for the EU to open their doors when they have biofuel plants in their backyards.

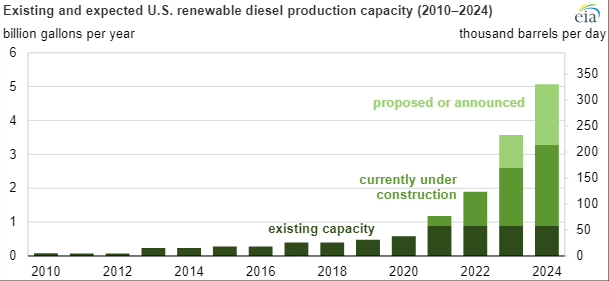

U.S.

renewable diesel capacity could increase due to announced and developing projects

https://www.eia.gov/todayinenergy/detail.php?id=48916&src=email

Source:

EIA

Export

Developments

- Under

the 24-hour announcement system, private exporters sold 132,000 tons of soybeans to unknown for 2021-22 delivery.

- The

USDA seeks 2,880 tons of packaged oil for use under the PL480 program on August 3 for Sep 1-30 shipment.

Updated

7/26/21

August

soybeans are seen in a $13.50-$15.00 range; November $11.75-$15.00

August

soybean meal – $330-$400; December $320-$425

August

soybean oil – 64.50-70.00; December 48-67 cent range

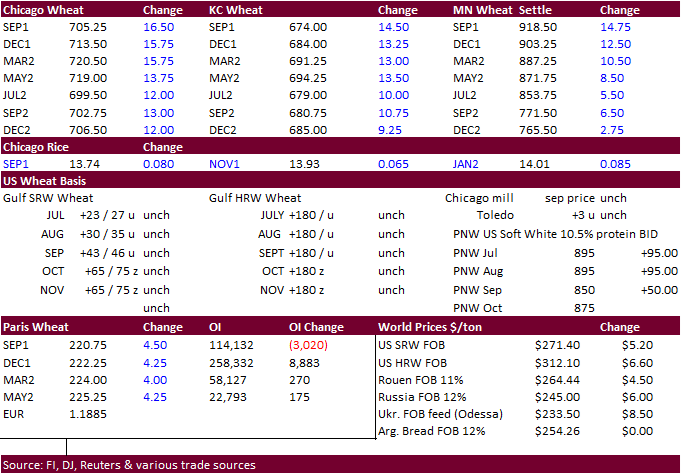

- US

wheat traded sharply higher led by fund buying in Chicago wheat on poor results from the US spring wheat crop tour and a downgrade to the US and Canadian wheat crop by IGC. Minneapolis gave up some ground against Chicago and KC. The USD was down 45 points

by 1:30 pm CT. EU wheat rallied to a 11-week high. December

Paris wheat was up 4.25 at 222.25 euros. Talk of Russian wheat production problems added to the bullish sentiment.

- The

International Grains Council (IGC) lowered their 2021-22 global wheat crop due to a downward revision with North America, by 1 million tons to 788 million. U.S. wheat crop was seen at 47.5 million tons from 51.1 million, and Canada to 28.5 million from 32.3

million. - Day

3 reports from the wheat crop tour showed variable yields, depending on which routes scouts were taking. Results should be out soon. Day 2 of the US spring wheat crop tour reported the average yield for northwest North Dakota came out to a low 24.6 bushels

per acre, well below 40.8 in 2019 (no tour in 2020) and 5-year average of 42.4 bu/ac. Day 1 US spring wheat crop tour pegged the high protein spring wheat yield at 29.5 bushels per acre, well below a 5-year average of 43.3.

- Russia’s

state weather forecaster cut its estimate for the 2021 grain crop by 3 million tons to 121 million tons. Russia produced 133.5 million tons of grain in 2020.

- Turkey’s

TMO seeks up to around 900,000 tons of 11.5-12.5% milling wheat (395k) and feed barley (515k) for late September 16-30 shipment. The barley is sought on August 3 and wheat on August 4. Turkey is one of Russia’s best customer.

- Results

awaited: Ethiopia seeks 400,000 tons of wheat on July 19.

Rice/Other

- Results

awaited: Mauritius seeks 6,000 tons of white rice on July 27 for October through December shipment.

Updated

7/29/21

September Chicago wheat is seen in a $6.25-$7.50 range

September KC wheat is seen in a $5.90-$7.25

September MN wheat is seen in a $8.50-$10.00

(up 0.40 & up 0.75 for the range)

Overall favors meal over oil, ok of soybeans and corn (poor old-crop/improvement for new-crop), and positive for wheat.

U.S. EXPORT SALES FOR WEEK ENDING 07/22/2021

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR

AGO |

CURRENT YEAR |

YEAR

AGO |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

222.8 |

1,689.5 |

1,732.0 |

164.4 |

1,023.2 |

1,792.4 |

0.0 |

0.0 |

|

SRW |

167.9 |

1,077.2 |

659.9 |

58.1 |

390.7 |

266.7 |

-5.0 |

0.0 |

|

HRS |

97.5 |

1,538.1 |

1,808.3 |

92.4 |

834.7 |

1,047.1 |

0.0 |

0.0 |

|

WHITE |

27.1 |

1,062.0 |

1,280.4 |

30.2 |

438.3 |

546.1 |

0.0 |

0.0 |

|

DURUM |

0.0 |

8.4 |

207.0 |

0.0 |

41.7 |

177.8 |

0.0 |

0.0 |

|

TOTAL |

515.2 |

5,375.3 |

5,687.6 |

345.0 |

2,728.6 |

3,830.2 |

-5.0 |

0.0 |

|

BARLEY |

-0.1 |

23.0 |

36.3 |

0.4 |

2.0 |

2.4 |

0.0 |

0.0 |

|

CORN |

-115.2 |

7,543.2 |

5,677.7 |

1,361.0 |

62,112.1 |

38,003.4 |

529.3 |

16,656.7 |

|

SORGHUM |

2.0 |

643.2 |

723.9 |

69.6 |

6,537.1 |

3,640.7 |

0.0 |

1,594.9 |

|

SOYBEANS |

-79.3 |

2,808.7 |

7,448.7 |

244.2 |

59,100.0 |

39,146.7 |

312.8 |

10,177.7 |

|

SOY MEAL |

87.3 |

1,914.8 |

1,794.6 |

242.2 |

9,762.1 |

9,876.5 |

73.1 |

1,130.4 |

|

SOY OIL |

2.2 |

17.9 |

215.2 |

1.2 |

661.6 |

1,029.8 |

0.0 |

0.6 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

6.5 |

192.5 |

93.3 |

3.8 |

1,615.1 |

1,329.4 |

11.5 |

16.5 |

|

M S RGH |

0.0 |

7.8 |

23.6 |

0.2 |

26.1 |

72.9 |

0.0 |

7.0 |

|

L G BRN |

0.2 |

11.4 |

9.9 |

0.3 |

40.3 |

59.1 |

0.0 |

0.7 |

|

M&S BR |

0.2 |

0.4 |

31.7 |

0.4 |

156.6 |

86.6 |

0.0 |

0.0 |

|

L G MLD |

1.4 |

45.3 |

66.9 |

3.0 |

648.4 |

864.8 |

80.2 |

80.5 |

|

M S MLD |

2.5 |

68.7 |

80.6 |

46.7 |

626.5 |

667.6 |

0.1 |

12.4 |

|

TOTAL |

10.7 |

326.1 |

305.9 |

54.3 |

3,113.0 |

3,080.4 |

91.8 |

117.1 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

-1.2 |

1,585.8 |

3,340.7 |

238.3 |

14,603.5 |

13,784.2 |

192.2 |

3,164.7 |

|

PIMA |

4.2 |

98.2 |

136.8 |

9.3 |

743.1 |

466.6 |

0.2 |

5.5 |

This

summary is based on reports from exporters for the period July 16-22, 2021.

Wheat: Net

sales of 515,200 metric tons (MT) for 2021/2022 were up 9 percent from the previous week and 46 percent from the prior 4-week average. Increases primarily for China (128,900 MT, including 130,000 MT switched from unknown destinations and decreases of 1,100

MT), Mexico (85,600 MT, including decreases of 11,100 MT), the Philippines (59,100 MT), Taiwan (52,100 MT), and Thailand (47,000 MT), were offset by reductions primarily for unknown destinations (5,000 MT) and Indonesia (1,600 MT). Total net sales reductions

for 2022/2023 of 5,000 MT were for unknown destinations. Exports of 345,000 MT were down 27 percent from the previous week, but up 2 percent from the prior 4-week average. The destinations were primarily to Mexico (84,600 MT), China (65,300 MT), the Philippines

(57,200 MT), Nigeria (51,000 MT), and Taiwan (44,600 MT).

Corn:

Net sales reductions of 115,200 MT for 2020/2021–a marketing-year low–were up 30 percent from the previous week, but down noticeably from the prior 4-week average. Increases primarily for Japan (36,300 MT, including 39,900 MT switched from unknown destinations

and decreases of 16,100 MT), Venezuela (30,000 MT switched from unknown destinations), Barbados (6,300 MT), Canada (5,200 MT, including decreases of 700 MT), and Taiwan (2,500 MT), were more than offset by reductions primarily for China (119,300 MT) and unknown

destinations (71,600 MT). For 2021/2022, net sales of 529,300 MT were primarily for Mexico (172,000 MT), unknown destinations (150,000 MT), Colombia (129,100 MT), and Japan (50,000 MT). Exports of 1,361,000 MT were up 36 percent from the previous week and

21 percent from the prior 4-week average. The destinations were primarily to China (698,700 MT), Japan (308,500 MT), Mexico (256,900 MT), Venezuela (30,000 MT), and Jamaica (19,000 MT).

Optional

Origin Sales:

For 2020/2021, the current outstanding balance of 30,500 MT is for unknown destinations. For 2021/2022, the current outstanding balance of 60,000 MT is for unknown destinations.

Barley:

Total net sales reductions for 2021/2022 of 100 MT were for China. Exports of 400 MT were up 62 percent from the previous week and up noticeably from the prior 4-week average. The destinations were to China (200 MT) and Canada (200 MT).

Sorghum:

Net sales of 2,000 MT for 2020/2021 resulting in increases for China (69,000 MT, including 68,000 MT switched from unknown destination) and Mexico (1,000 MT), were offset by reductions for unknown destinations (68,000 MT). Exports of 69,600 MT were up 18

percent from the previous week and up noticeably from the prior 4-week average. The destination was primarily to China (69,000 MT).

Rice:

Net sales of 10,700 MT for 2020/2021 were down 85 percent from the previous week and 64 percent from the prior 4-week average. Increases primarily for Mexico (6,900 MT), Canada (2,200 MT), Jordan (1,400 MT), Belgium (500 MT), and Saudi Arabia (300 MT), were

offset by reductions for Japan (900 MT). For 2021/2022, net sales of 91,800 MT were primarily for Iraq (80,000 MT), Guatemala (7,500 MT), and Honduras (4,000 MT).

Exports of 54,300 MT were down 32 percent from the previous week and 12 percent from the prior 4-week average. The destinations were primarily to Japan (40,100 MT), Mexico (4,600 MT), Canada (2,600 MT), Jordan (2,600 MT), and South Korea (1,600 MT).

Exports

for Own Account:

For 2020/2021, new exports for own account totaling 100 MT were for Canada. The current exports for own account outstanding balance is 100 MT, all Canada.

Soybeans:

Net sales reductions of 79,300 MT for 2020/2021 were down noticeably from the previous week and from the prior 4-week average. Increases primarily for Taiwan (12,800 MT), Mexico (6,100 MT, including decreases of 100 MT), Vietnam (5,800 MT, including decreases

of 100 MT), South Korea (4,800 MT), and Bangladesh (4,500 MT), were offset by reductions for Japan (74,800 MT) and unknown destinations (51,500 MT). For 2021/2022, net sales of 312,800 MT primarily for Mexico (160,500 MT), China (121,000 MT), Pakistan (66,000

MT), and Taiwan (21,500 MT), were offset by reductions for unknown destinations (64,000 MT). Exports of 244,200 MT were up 49 percent from the previous week and 34 percent from the prior 4-week average. The destinations were primarily to Mexico (106,700

MT), Bangladesh (59,500 MT), Canada (33,200 MT), Japan (20,600 MT), and Indonesia (13,000 MT).

Exports

for Own Account:

For 2020/2021, the current exports for own account outstanding balance is 5,800 MT, all Canada.

Soybean

Cake and Meal:

Net sales of 87,300 MT for 2020/2021 were up 28 percent from the previous week, but down 40 percent from the prior 4-week average. Increases primarily for the Dominican Republic (32,800 MT), Mexico (25,500 MT, including decreases of 4,000 MT), Colombia (18,000

MT), unknown destinations (18,000 MT), and Canada (11,700 MT, including decreases of 1,400 MT), were offset by reductions for Slovenia (42,000 MT), Panama (5,100 MT), and Belgium (800 MT).

For 2021/2022, net sales of 73,100 MT were reported for Slovenia (42,000 MT), Canada (19,100 MT), Panama (7,100 MT), Honduras (3,600 MT), and Guatemala (1,300 MT).

Exports of 242,200 MT were up 66 percent from the previous week and 49 percent from the prior 4-week average. The destinations were primarily to the Philippines (48,500 MT), Ireland (44,000 MT), the Dominican Republic (32,700 MT), Mexico (32,600 MT), and

Ecuador (29,100 MT).

Late

Reporting: For

2020/2021, exports totaling 1,500 MT of soybean cake and meal were reported late to Panama.

Soybean

Oil:

Net sales of 2,200 MT for 2020/2021 were up noticeably from the previous week and from the prior 4-week average. Increases were reported for Canada (1,300 MT) and Mexico (900 MT). Exports of 1,200 MT were down 58 percent from the previous week and 48 percent

from the prior 4-week average. The destinations were to Mexico (900 MT) and Canada (300 MT).

Cotton:

Net sales reductions of 1,200 RB for 2020/2021–a marketing-year low were–down noticeably from the previous week and from the prior 4-week average. Increases reported for Mexico (2,400 RB), Pakistan (900 RB), Peru (500 RB), South Korea (400 RB), and Egypt

(100 RB), were more than offset by reductions for Indonesia (2,200 RB), Vietnam (2,000 RB), China (900 RB), and Japan (400 RB). For 2021/2022, net sales of 192,200 RB primarily for Bangladesh (55,000 RB), Mexico (39,600 RB), Pakistan (33,700 RB), Vietnam

(25,300 RB), and Turkey (14,300 RB), were offset by reductions for Guatemala (200 RB). Exports of 238,300 RB were down 3 percent from the previous week and 5 percent from the prior 4-week average. Exports were primarily to Turkey (54,200 RB), Pakistan (48,800

RB), Vietnam (29,300 RB), China (27,500 RB), and Indonesia (18,500 RB). Net sales of Pima totaling 4,200 RB were up 22 percent from the previous week, but down 2 percent from the prior 4-week average. Increases were primarily for Peru (2,300 RB) and India

(900 RB). For 2021/2022, net sales of 200 RB were reported for Thailand (100 RB) and Japan (100 RB). Exports of 9,300 RB were down 10 percent from the previous week and 14 percent from the prior 4-week average. The destinations were primarily to India (6,300

RB), Peru (1,500 RB), China (700 RB), Germany (400 RB), and Pakistan (200 RB).

Exports

for Own Account:

For 2020/2021, the current exports for own account totaling 1,000 RB to Vietnam were applied to new or outstanding sales. The outstanding balance of 4,700 RB is for China.

Export

Adjustments: Accumulated

exports of upland cotton to Thailand were adjusted down 352 RB for week ending July 15th. This shipment was reported in error.

Hides

and Skins:

Net sales of 388,600 pieces for 2021 were up 9 percent from the previous week, but down 24 percent from the prior 4-week average. Increases primarily for China (254,000 whole cattle hides, including decreases of 6,600 pieces), Brazil (59,600 whole cattle

hides, including decreases of 600 pieces), South Korea (23,000 whole cattle hides, including decreases of 900 pieces), Taiwan (22,800 whole cattle hides, including decreases of 100 pieces), and Mexico (13,300 whole cattle hides, including decreases of 1,300

pieces), were offset by reductions for Japan (400 pieces) and Thailand (300 pieces). Net sales of 1,300 kip skins were reported for China. Exports of 391,100 pieces were down 26 percent from the previous week, but up 1 percent from the prior 4-week average.

Whole cattle hides exports were primarily to China (259,100 pieces), South Korea (48,200 pieces), Mexico (28,100 pieces), Brazil (11,400 pieces), and Taiwan (11,000 pieces). In addition, exports of 1,400 kip skins were to Belgium.

Net

sales of 52,000 wet blues for 2021 were down 81 percent from the previous week and 73 percent from the prior 4-week average. Increases were primarily for Vietnam (23,100 unsplit, including decreases of 700 unsplit), Italy (18,800 unsplit, including decreases

of 200 unsplit and 100 grain splits), Mexico (5,100 unsplit and 200 grain splits), and the Dominican Republic (4,500 unsplit). Total net sales for 2022 of 4,000 unsplit were for Mexico. Exports of 161,100 wet blues were down 13 percent from the previous

week, but up 11 percent from the prior 4-week average. The destinations were to Italy (57,200 unsplit and 6,000 grain splits), Vietnam (34,300 unsplit), China (32,700 unsplit), Mexico (11,200 unsplit and 10,300 grain splits), and the Dominican Republic (3,200

unsplit). Net sales of 507,200 splits were primarily for China (286,400 pounds) and Taiwan (169,000 pounds, including decreases of 3,000 pounds). Exports of 624,000 pounds were to Taiwan (464,000 pounds) and Vietnam (160,000 pounds).

Beef:

Net

sales of 22,500 MT reported for 2021 were down 11 percent from the previous week, but up 28 percent from the prior 4-week average. Increases were primarily for South Korea (8,200 MT, including decreases of 500 MT), Japan (6,100 MT, including decreases of

600 MT), and China (4,500 MT, including decreases of 100 MT). Exports of 19,100 MT were down 11 percent from the previous week, but up 4 percent from the prior 4-week average. The destinations were primarily to South Korea (5,100 MT), Japan (4,400 MT), China

(3,100 MT), Taiwan (1,700 MT), and Mexico (1,500 MT).

Pork:

Net

sales of 38,500 MT reported for 2021 were up 57 percent from the previous week and 43 percent from the prior 4-week average. Increases were primarily for Mexico (25,100 MT, including decreases of 800 MT), Chile (3,300 MT, including decreases of 100 MT), Japan

(3,200 MT, including decreases of 200 MT), Honduras (2,300 MT), and Colombia (2,000 MT, including decreases of 100 MT). Total net sales for 2022 of 400 MT were for Chile. Exports of 29,900 MT were down 3 percent from the previous week, but up 1 percent from

the prior 4-week average. The destinations were primarily to Mexico (12,300 MT), China (5,700 MT), Japan (4,000 MT), South Korea (2,100 MT), and Canada (1,700 MT).

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.