PDF Attached

Corn,

soybeans and wheat traded lower on good US crop ratings. Egypt

bought 470,000 tons of wheat. Palm

futures are down 6 percent this week and 15 percent for the year. The ringgit is at a 6-week high against the USD.

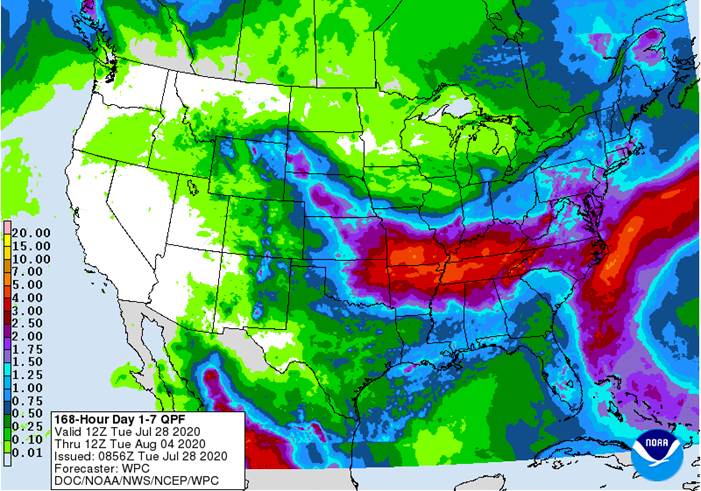

7

Day Precipitation Outlook

MOST

SIGNIFICANT WEATHER AROUND THE WORLD

-

U.S.

crop weather will remain mostly good, but drying is expected in the coming week to ten days across northwestern parts of the Corn and Soybean Belt -

Northwestern

and central Iowa is already too dry along with parts of southeastern South Dakota and a few Minnesota locations -

Rainfall

will be greatest in the lower Midwest over the next week to ten days and that region will be plenty moist to support crop needs -

Rainfall

should increase in northwestern U.S. Corn Belt late in the first week of August and more likely in the second week -

Temperatures

will be non-threatening over the next two weeks

-

U.S.

Southern Plains will continue to receive enough rainfall periodically to curb some of the recent heat and supplement irrigation (where available) -

Crop

and livestock stress will not be nearly as extreme as it was earlier this month anytime soon, although warming is expected in the second half of next week and into the following weekend

-

U.S.

Delta weather will be favorably mixed with some of the driest areas getting some periodic rainfall to ease dryness, but more rain will be needed

-

U.S.

southeastern states should start to dry down for a while late this week and especially during the weekend and early part of next week

-

Tropical

disturbance east of the Leeward Islands in Atlantic Ocean will become a tropical depression or a tropical storm later this week and it will influence the Lesser Antilles and could threaten Puerto Rico before moving to the Bahamas this weekend -

This

system has potential to bring stormy conditions to the U.S. and possibly Florida, although it is too soon to be precise on the system’s intensity or precise path because it has not yet fully evolved

-

West

Texas cotton areas will experience some welcome showers and that will help hold back some of the excessive heat of late

-

Crops

in the region will experience some improvement

-

U.S.

Northern Plains and much of Canada’s Prairies will experience limited rainfall and warm temperatures over the next week

-

Western

Alberta may have another bout of heavier rainfall coming over the next week, but it should be of short duration

-

Mexico

precipitation in the coming week will be greatest in central and southern parts of the nation benefiting many corn, sorghum and dry bean production areas -

Coffee,

citrus, sugarcane and many fruit and vegetable crops will also benefit -

Northern

Mexico and especially the northeast will trend drier after rain fell beneficially from Tropical Depression Hanna Monday

-

Central

America rainfall will be erratic this week and may trend heavier and more widespread next week

-

Western

Europe weather will trend hotter over the next few days -

Highs

in France will reach into the 80s and 90s while the U.K. reaches into the 80s

-

Germany

will experience late week high temperatures in the 80s and lower 90s -

Very

little rain will fall through the end of this week

-

Western

Europe will cool down late this week and into the weekend with some limited rainfall expected -

No

general soaking will occur to bring significant relief to drought in France or dryness in other areas

-

Eastern

Europe dryness remains in the lower Danube River Basin and southern Balkan Countries -

Little

relief is expected despite a few showers and thunderstorms infrequently

-

Dryness

remains quite serious in southern and eastern Ukraine into western Kazakhstan and parts of Russia’s Southern Region and this region is unlikely to see much opportunity for relief anytime soon -

Crop

stress in unirrigated areas is quite high and production of dryland corn, soybeans, sunseed and other crops will be down

-

Russia’s

New Lands are expecting some periodic showers and thunderstorms this week and milder temperatures -

Partial

relief to dryness is expected, but a general soaking of rain is not very likely outside of a few Ural Mountains’ region crop areas -

A

new high-pressure ridge is expected to evolve next week that will return warmer temperatures and bring back drying which increases the importance of rain for this week

-

China

received some additional heavy rain Monday with amounts of 2.00 to more than 5.00 inches occurring from northeastern Guangxi through central Hunan to southern Anhui and southeastern Hubei -

One

location in Anhui received more than 6.00 inches of rain -

Flooding

occurred again, but the flooding resulting from this rain and that which occurred in Sichuan last weekend was not as serious as the torrential rains that occurred earlier this month and in June that caused devastating floods in the Yangtze River Basin

-

China’s

weather is expected to progressively improve over the next two weeks with less frequent less intensive rain expected as time moves along -

A

tropical cyclone that will move over the East China Sea this weekend into next week should remove some of the potential for rain in east-central China and that will be a big relief

-

Northern

China will experience a good mix of rain and sunshine over the next two weeks resulting in ongoing favorable crop conditions -

There

is some potential for heavy rain early next week in the Korean Peninsula and China’s Northeast Provinces if a tropical cyclone evolves and moves through those areas as advertised

-

Xinjiang,

China continued a little milder than usual in the northeast Monday and degree day accumulations continue to slip below average

-

Xinjiang,

China is not likely to change much over the next week to ten days -

Daily

high temperatures will be in the upper 70s and 80s northeast and in the upper 80s and 90s elsewhere followed by lows in the 50s and 60s with a few lower 70s in the southwest -

Rain

is expected in northeastern areas only with Monday, Wednesday and Thursday wettest with daily rainfall of 0.05 to 0.50 inch

-

Dry

conditions will prevail elsewhere

-

India’s

weather is expected to remain favorable for summer crop development even though some of the rain amounts will be more erratic and lighter than usual

-

Some

net drying is expected -

Central

and northwestern Rajasthan will experience the least amount of rain over the next ten days as will central and southern Pakistan -

Far

southern India and a few locations from Odisha into southern Bangladesh will also receive well below average rainfall

-

Southeast

Asia rainfall continued erratic Monday with very little change likely through the next couple of weeks -

Parts

of western Thailand, Vietnam and a few areas in Laos and Cambodia have received below average rainfall in recent weeks -

Crop

conditions have not been ideal, although there has been sufficient rain to prevent crop failure -

Greater

rain is needed, though -

This

trend will ease somewhat in the next two weeks with greater rainfall anticipated, but the greatest rainfall is expected to remain pocketed so that some areas will still need greater rain

-

Indonesia

rainfall need is greatest for parts of Sumatra and Java

-

Philippines

rainfall recently has been improving and this trend will continue for a while

-

Tropical

Storm Douglas has moved beyond Hawaii and its impact on the state was much less than feared

-

Tropical

Depression Hanna dissipated over northeastern Mexico Monday

-

Canada’s

Prairies will experience net drying in southern and some central areas where the need for rain will be steadily rising as August begins -

Rain

is expected frequently in western and northern Alberta and more infrequently in northern Saskatchewan and Manitoba in the coming week

-

Rain

may improve next week in southeastern parts of the Prairies, but southwestern areas (including southern and east-central Alberta and west-central and southwestern Saskatchewan) may continue to dry out

-

Eastern

Australia received some additional rainfall Monday with northern and eastern New South Wales and far southeastern Queensland reporting up to 0.68 inch of moisture after rain fell during the weekend

-

Australia

rainfall over the next ten days will be erratic and often too light to benefit crop or field conditions, but winter crops should remain in favorable condition -

South

Australia and portions of Queensland still have the greatest need for additional moisture -

Western

Australia may receive some needed rain late next week while many other areas will remain drier biased

-

Argentina

will be mostly dry over the coming week -

Some

rain may evolve in the south next week, but it is not likely to reach into the drought-stricken areas of Cordoba or immediate neighboring areas

-

Southern

Brazil remains favorably moist -

More

rain will fall periodically in far southern Brazil during the next couple of weeks -

Winter

crop conditions are mostly good in Rio Grande do Sul and areas north into Parana, but Sao Paulo and a few other areas have been quite dry recently -

Summer

crop harvest progress has been good -

Conditions

for early season corn planting are looking favorable, but timely rain will need to continue in August to ensure early crops are successful

-

Harvest

weather in center west and center south Brazil for Safrinha crops has been and will continue to be good

-

Ontario

and Quebec, Canada have some pockets of dryness, but most crops in the two provinces are still developing relatively well -

Any

missed rain could lead to greater crop stress and a close watch on the situation is warranted -

Timely

rain should occur in most of the region, but resulting amounts may vary greatly leaving a few areas in need of greater rain

-

South

Africa weather over the next couple of weeks will include limited rainfall and temperatures will trend a little warmer over time.

-

West-central

Africa will receive periods of rain over the next couple of weeks maintaining a favorable environment for coffee, cocoa, cotton, rice and sugarcane -

Greater

rain is needed in Ivory Coast and Ghana where rainfall so far this month has been notably lighter than usual -

Most

of the rain expected this week will continue erratic and often light -

Temperatures

may be a little cooler than usual -

New

Zealand rainfall over the next couple of weeks will be erratic and most often light with temperatures being near normal -

Southern

Oscillation Index was +5.96 this morning and the index will remain positive the remainder of this week and into the weekend

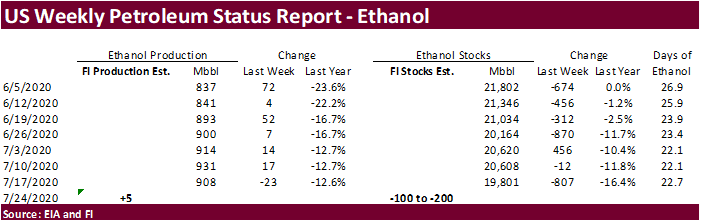

- EIA

U.S. weekly ethanol inventories, production, 10:30am - Vietnam’s

General Statistics Office releases data on exports of coffee, rice and rubber

THURSDAY,

July 30:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - The

Australian Grains Industry Conference (online event) - Poland

to publish grain harvest estimates

FRIDAY,

July 31:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Malaysia’s

palm oil export data for July 1-31 (tentative) - U.S.

agricultural prices paid, received, 3pm - HOLIDAY:

Singapore, Indonesia, Malaysia

Source:

Bloomberg and FI

-

Corn

futures fell

for the third straight session, declining 3.50-5.00 cents on Tuesday. December is sitting at $3.30, lowest close since June 29. Good US crop ratings pressured prices. The unfavorable weather that traders were concerned about FH July didn’t seem to have

an impact on the national crop rating. We are hearing some fields will see record yields south of Memphis.

-

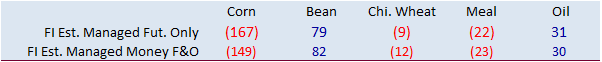

Funds

sold an estimated net 18,000 corn. Note funds sold all five major commodities for the session, first time this has happened since July 13.

-

A

Bloomberg poll looks for weekly US ethanol production to be up 8,000 at 916,000 barrels (899-940 range) from the previous week and stocks to increase 183,000 barrels to 19.984 million. -

USD

was up 5 as of 2:16 PM CT. -

China

corn futures traded lower, off a 5- year high, after the government announced effective July 30 bidders will have to pay an extra deposit on trades, and also set delivery requirements to make sure companies where not hording corn supplies.

·

Corn and Soybean Advisory are using 178.5 corn and 51.0 soybeans (yields). Most of the trade is at 180 or above.

-

In

a Reuters survey, traders see South Africa’s corn crop (2019-20) at 15.461 million tons, 9.081 white and 6.443 million yellow. 15.461 million tons is 37 percent more than 2019. More than 50 percent of the corn crop has been harvested and delivered to silos.

Corn

Export Developments

-

Syria

seeks 50,000 tons of soybean meal and 50,000 tons of corn on Aug 25 for delivery within four months of contract signing.

- September

corn is seen in a $3.10 and $3.35 range over the short term. December lows could reach $3.10. We can’t justify below $3.00 unless a shock in the September grain stocks report occurs, or China’s production gets upward revised by a large amount.