PDF Attached

CALLS:

Soybeans down 5, Corn down 2-3, and wheat down 4-5.

Egypt

is in for wheat. USDA announced 250,371 tons of soybeans to Mexico and 132,000 tons of soybeans to China. USD was down 74 this afternoon and gold up a strong amount. US weather looks very good over the next 10 days with no excessive high-pressure ridge and

no prolonged periods of hot temperatures.

Euro

– Monthly

7

Day Precipitation Outlook

-

Hurricane

Douglas was a major hurricane this morning located 1010 miles east southeast of Hilo, Hawaii moving west northwesterly at 18 mph and producing maximum sustained wind speeds of 130 mph -

Hurricane

force wind is occurring out 30 miles from the storm center while tropical storm force wind was occurring out 90 miles -

Douglas

will continue to move toward the Hawaiian Islands and will impact the region this weekend with some damaging wind, heavy rain and flooding -

The

storm’s current path takes the system north of the Big Island of Hawaii Saturday night into Sunday as a weakening hurricane -

The

storm will move very near to or directly across Maui and have impacts on Lanai and Molokai as well as some of the smaller islands nearby as a tropical storm -

The

storm’s small size will help limit the extent of damage, but there is a strong potential that the storm will move across some of the central Islands causing some damage

-

Kauai

and some of the neighboring islands will not be seriously impacted by the storm, although some high wind speeds and heavy rain is expected

-

Tropical

Storm Gonzalo may become a hurricane before reaching the southern Windward islands Saturday -

At

0800 EDT, the storm was 580 miles east of the southern Windward Islands moving westerly at 15 mph and producing maximum sustained wind speeds of 60 mph -

The

storm will pass through the southern Windward Islands Saturday and move into the eastern Caribbean Sea where it will remain through Monday morning – the storm may weaken or possibly dissipate as it moves toward Central America

-

Tropical

Storm Hanna was located 285 miles east of Corpus Christi, Texas at 27.1 north, 92.8 west moving west northwesterly at 9 mph and producing maximum sustained wind speeds of 40 mph -

Hanna

will likely move inland near Corpus Christi, Texas Saturday -

The

storm will bring heavy rain to portions of southern Texas and could raise some crop quality issues to open boll cotton in southern Texas

-

Flooding

is expected along the lower Texas coast where 3.00 to 8.00 inches and local totals over 10.00 inches will be possible -

The

storm will ultimately end up in northeastern Mexico early next week

-

Southwestern

and some central Canada Prairies crop areas will experience a steady drying trend and warm temperatures over the next week to ten days

-

Crop

moisture stress will be on the rise -

Late

season canola and flax might be impacted with lower yields -

Early

season crops will likely be far enough advanced to no be seriously impacted; this includes spring cereals

-

China’s

weather is expected to improve during the next two weeks with no more widespread excessive rain events expected -

Some

localized areas of heavy rain will be possible with local flooding, but most of the nation’s damaging weather is over and an assessment of the losses will be made as flood water recedes

-

Recent

flooding in China has damaged many crops, but assessing the losses has not yet been done because flooding is still under way in many areas

-

Northern

China crops are in mostly good condition, although some flooding recently occurred in Henan and Shandong that might have induced some damage in low-lying areas

-

Xinjiang,

China continues cooler than usual and degree day accumulations are falling below average -

Weather

conditions will remain unsettled and a little cooler biased for a while -

Showers

will stay near the mountains -

Northeastern

Xinjiang cotton areas will see daily highs in the upper 70s and 80s for a while and lows in the 50s and 60s -

Other

cotton areas in the province will see daily highs in the middle 80s through the middle 90s with lows in the 60s -

Warming

is needed, but not likely for the next ten days

-

India’s

monsoon continues to perform mostly very well, but recent rain has become lighter than usual -

Rainfall

in the central and north has been a little light recently and greater rain is needed especially in Rajasthan -

August

will be a better month for rainfall in the far northwest -

Total

rainfall this summer is expected to be slightly greater than usual, but some of that is predicated upon developing La Nina conditions in late August and September -

Rain

has been well enough distributed in recent weeks to support very good crop conditions in most of the nation

-

Southern

Pakistan has not had much rain so far this summer, but improved rainfall is expected next month

-

Mainland

areas of Southeast Asia have been getting enough rain to support crops, but the monsoon has been lackluster recently and greater rain is needed to begin improving long term soil moisture and water supply -

Portions

of western Thailand and Vietnam have been reporting the lightest rainfall relative to normal and a boost in rain is needed

-

The

erratic rainfall is expected to continue for a little while longer, but August should bring greater precipitation

-

Philippines,

Indonesia and Malaysia rainfall has also been a little erratic recently, but like the mainland areas of Southeast Asia crop conditions are mostly rated well with little immediate change likely -

Eastern

Australia will receive rain today and Saturday in New South Wales and southeastern Queensland to improve topsoil moisture and support establishing winter crops -

Lingering

showers are expected into early next week -

Other

areas in Australia will see little rain over the next ten days except near the coasts, but winter crops have stablished relatively well this year -

Rain

is still needed in South Australia and more will be needed in Queensland, but the outlook leading into spring is still looking much better than that of the past couple of years

-

Argentina

has received some welcome rain in parts of Buenos Aires and La Pampa over the past two days improving wheat conditions -

Cordoba

is unlikely to get much rain of significance and it produces 20-23% of the total wheat crop -

Cordoba

has been quite dry since the planting season began and a cut in production has already occurred and more will be possible if dryness prevails much longer -

Other

crop areas in Argentina have had timely rainfall to support wheat and barley, although this week’s rain was a little disappointing in parts of Santa Fe which has also been experiencing some dryness -

Drier

weather will be returning to Argentina this weekend and it may last ten days leaving the dry areas without much hope for change

-

Southern

Brazil’s soil conditions and weather will continue plenty moist for a while -

Winter

crop conditions are mostly good in Rio Grande do Sul and areas north into Parana, but Sao Paulo and a few other areas have been quite dry recently -

Summer

crop harvest progress has been good -

Conditions

for early season corn planting are looking favorable, but timely rain will need to continue in August to ensure early crops are successful

-

Harvest

weather in center west and center south Brazil for Safrinha crops has been and will continue to be good

-

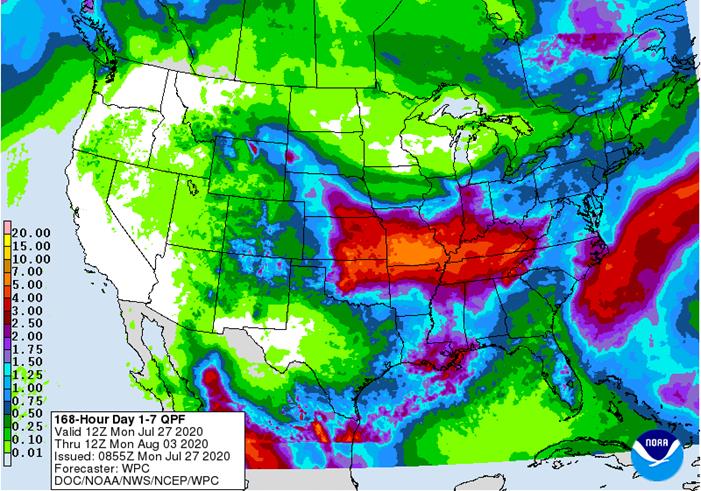

U.S.

weather is expected to remain favorable over the next ten days, despite an erratic distribution of rain -

No

extreme heat is expected -

Showers

will continue periodically -

The

second week of the outlook will trend a little drier, but the models are likely to fall back into a classic mid-summer weather pattern of periodic showers and thunderstorms and warm temperatures in weeks 2 and 3 -

This

pattern usually leads to net drying which is not unusual for August -

Pockets

of dryness will evolve and some new crop stress will be possible, but much of this is going to occur in August and not in this next ten days – no widespread serious moisture shortage is expected through the second week of August -

Corn

pollination and early season soybean blooming will continue to advance well in this environment

-

West

Texas received some scattered showers and thunderstorms this week with a few more expected today and possibly into the weekend before drier weather evolves for a little while -

Some

additional shower activity is possible late next week and into the following weekend, but it may be less significant than that of this week -

Most

of the daily rainfall expected through the weekend and that which occurs late next week will be erratic and not great enough to seriously change soil moisture, but it will help put a little moisture in the air and supplement some irrigation -

Many

areas will still be dry -

No

extreme heat is expected for at least the next ten days -

Daily

highs in the 90s will occur often with a few readings near 100 during the weekend and through mid-week next week

-

U.S.

Delta is one of the drier areas in the U.S. crop region with central parts of the region driest -

Showers

will occur periodically over the next couple of weeks resulting in some relief in the driest areas, but more rain may still be needed

-

U.S.

southeastern states are seeing enough rain to maintain mostly good crop conditions, but very warm temperatures are accelerating drying rates between rain events -

Daily

highs in the 90s will prevail for the next week temperatures will be warmest next week

-

Far

northwestern U.S. Plains will struggle for big soakings of rain over the next couple of weeks and net drying is expected -

Temperatures

will also be quite warm at times

-

U.S.

Pacific Northwest rainfall will be minimal over the next two weeks

-

California

and the Great Basin will be dry and warm for a while

-

Drying

will continue from portions of central and eastern Ukraine through a part of Russia’s Southern Region to Kazakhstan -

Dryness

has been eased recently in northeastern Ukraine and a little more rain may fall next week after a period of drying

-

France

remains too dry and parts of the United Kingdom, Belgium, Netherlands and northwestern Germany also need rain -

These

areas will not get much moisture, but there will be a few showers coming up briefly this weekend and next week

-

Germany,

the U.K., Belgium and Netherlands may get enough rain for temporary crop improvements in a few areas next week

-

Portions

of the southernmost Balkan Countries in southeastern Europe need greater rain to improve dryland crops

-

Scattered

showers will occur during the coming week to ten days -

No

rain is expected in the southern Balkans or from eastern Ukraine into western Kazakhstan

-

Ontario

and Quebec, Canada have some pockets of dryness, but most crops in the two provinces are still developing relatively well -

Any

missed rain could lead to greater crop stress and a close watch on the situation is warranted

-

South

Africa weather over the next couple of weeks will include limited rainfall and temperatures will trend a little warmer over time.

-

West-central

Africa will receive periods of rain over the next couple of weeks maintaining a favorable environment for coffee, cocoa, cotton, rice and sugarcane -

Greater

rain is needed in Ivory Coast and Ghana where rainfall so far this month has been notably lighter than usual

-

Russia’s

New Lands will receive some cooler temperatures and scattered showers during the coming week to ten days resulting in better soil and crop conditions after recent dry and warm weather -

Not

all areas will get adequate relief and will need additional rain -

About

30% of the spring wheat and sunseed areas will get relief -

All

other areas will need significant rain

-

Northeastern

Mexico will continue very dry and warm to hot over the next two weeks -

Scattered

showers and thunderstorms are likely elsewhere with rainfall mostly near to above average

-

Improving

soil moisture in many areas will lead to better crop development potential

-

Central

America rainfall will be well mixed over the next ten days with rain falling in most areas, although amounts may be a little lighter than usual in Honduras

-

New

Zealand rainfall over the next couple of weeks will be erratic and most often light with temperatures being near to below average

-

Southern

Oscillation Index was +4.18 this morning and the index will rise additionally this week

- USDA

weekly corn, soybean, wheat export inspections, 11am - U.S.

crop conditions for soybeans, corn, cotton; winter wheat progress, 4pm - MARS

crop bulletin – monthly report on crop conditions in Europe - International

Sugar Organization webinar on China’s market - EU

weekly grain, oilseed import and export data - Indonesia

palm oil export tax for August to be announced sometime during the week - Ivory

Coast cocoa arrivals - HOLIDAY:

Thailand

TUESDAY,

July 28:

- EARNINGS:

Minerva - HOLIDAY:

Thailand

WEDNESDAY,

July 29:

- EIA

U.S. weekly ethanol inventories, production, 10:30am - Vietnam’s

General Statistics Office releases data on exports of coffee, rice and rubber

THURSDAY,

July 30:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - The

Australian Grains Industry Conference (online event) - Poland

to publish grain harvest estimates

FRIDAY,

July 31:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Malaysia’s

palm oil export data for July 1-31 (tentative) - U.S.

agricultural prices paid, received, 3pm - HOLIDAY:

Singapore, Indonesia, Malaysia

Source:

Bloomberg and FI

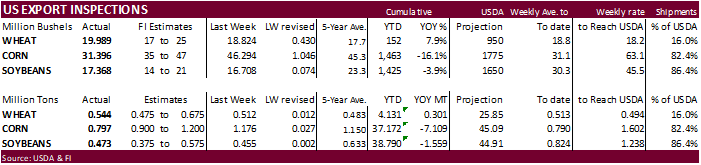

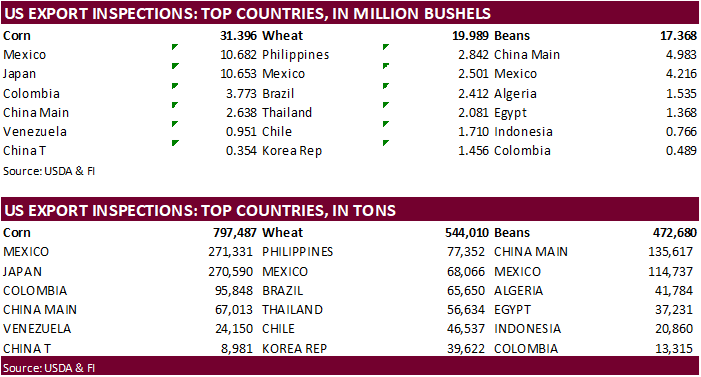

USDA

inspections versus Reuters trade range

Wheat

544,010 versus 450000-700000 range

Corn

797,487 versus 900000-1200000 range

Soybeans

472,680 versus 350000-700000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING JUL 23, 2020

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 07/23/2020 07/16/2020 07/25/2019 TO DATE TO DATE

BARLEY

0 49 931 416 2,938

CORN

797,487 1,175,910 670,962 37,172,067 44,281,166

FLAXSEED

0 0 24 317 48

MIXED

0 0 0 0 0

OATS

0 100 0 500 299

RYE

0 0 0 0 0

SORGHUM

83,988 124,654 9,126 4,348,077 1,840,728

SOYBEANS

472,680 454,719 1,066,123 38,789,707 40,348,754

SUNFLOWER

0 0 0 0 0

WHEAT

544,010 512,305 421,468 4,130,890 3,829,816

Total

1,898,165 2,267,737 2,168,634 84,441,974 90,303,749

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

US

Durable Goods Orders Jun P: 7.3% (est 7.0%; prevR 15.1%; prev 15.7%)

US

Durable Goods Ex-Transportation Jun P: 3.3% (est 3.5%; prevR 3.6%; prev 3.7%)

US

Cap Goods Orders Nondef Ex-Air Jun P: 3.3% (est 2.4%; prev 1.6%)

US

Cap Goods Ship Nondef Ex-Air Jun P: 3.4% (est 2.8%; prev 1.5%)

-

Corn

futures ended unchanged

to 1.25 cents lower on lack of direction. Soybeans were higher while wheat was under pressure. Lower USD limited losses.

Weekend rains were very good for

the northern US Great Plains. Funds sold an estimated net 5,000 corn. -

US

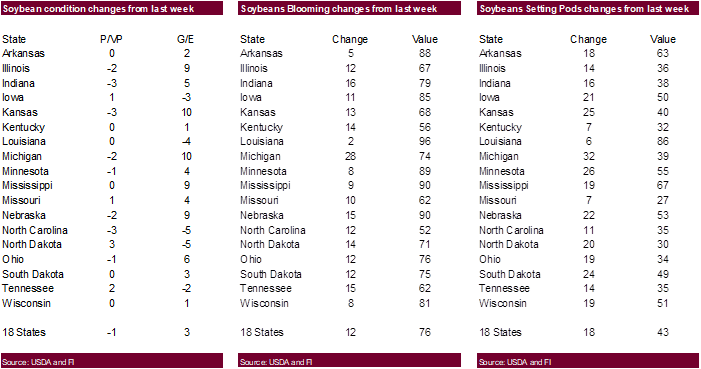

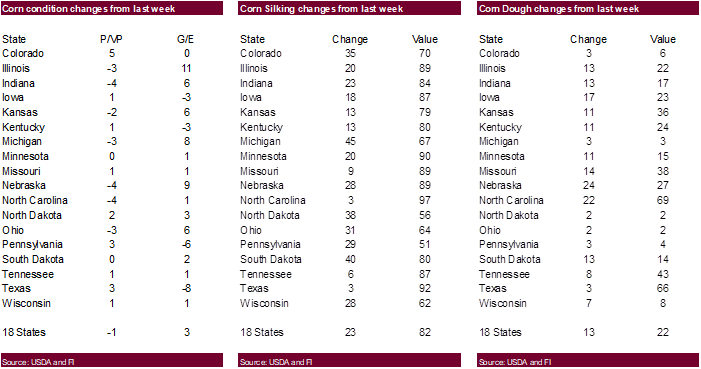

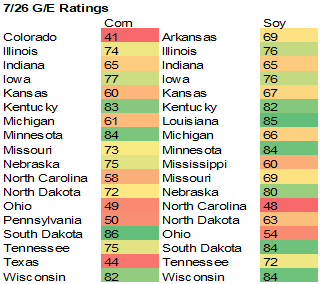

corn and soybean ratings this afternoon were up by 3 each and should set a bearish undertone tonight. Note IA, where dryness occurred, corn was 77 G/E.

·

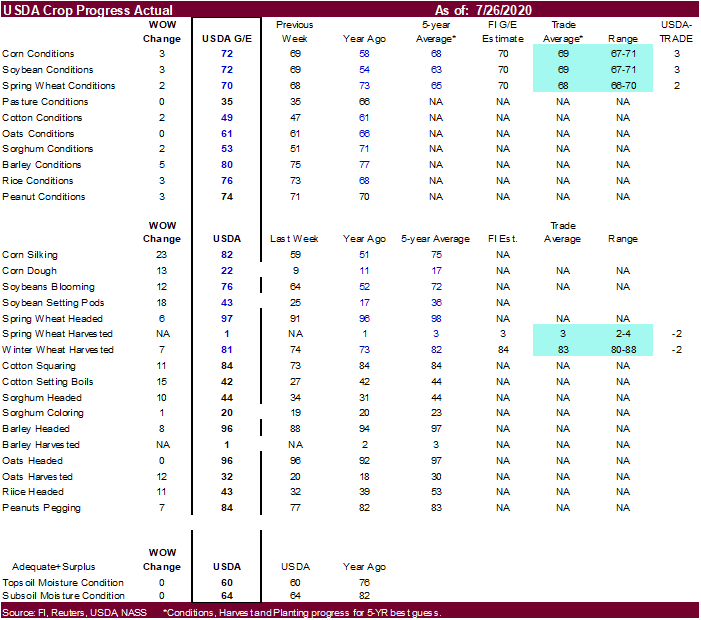

US CORN – 72 PCT CONDITION GOOD/EXCELLENT VS 69 PCT WK AGO (58 PCT YR AGO) -USDA

·

US CORN – 82 PCT SILKING VS 59 PCT WK AGO (75 PCT 5-YR AVG) -USDA

·

US CORN – 22 PCT DOUGH VS 9 PCT WK AGO (17 PCT 5-YR AVG) -USDA

-

China

corn futures (one point up 4.3% overnight) reached a 5-year high on tight supplies even after record reserves auction volumes. Corn futures settled near 2340 CNY, equating to about $8.50 per bushel or $335 / ton. China has been battling drought conditions

across the northeast and pig numbers are on the rise. Meanwhile bad flooding occurred over the weekend again across the upper reaches of the Yangtze River.

-

Note

China corn production could fall from last year. USDA currently projects 2020 China corn production at 260 million tons, down from 260.77 million tons for 2019-20. China’s AgMin sees a 266MMT crop with demand at 285 million tons. It’s in our opinion China’s

government will grant additional TRQ’s corn imports to meet rising feed demand, and today we saw conformation they did by adding another 2 million tons to a total of 9.2 million tons. It’s either that or China might be forced to import more than 100 million

tons of soybeans. -

We

didn’t see any major global tender business over the weekend. -

In

a Reuters survey, traders see South Africa’s corn crop (2019-20) at 15.461 million tons, 9.081 white and 6.443 million yellow. 15.461 million tons is 37 percent more than 2019. More than 50 percent of the corn crop has been harvested and delivered to silos.

-

USDA

last week reported US calve slaughter down 33 percent from a year ago and calf/veal production off 21 percent. Hogs slaughter was up 10 percent from the previous year and pork production up 12 percent.

Corn

Export Developments

-

Syria

seeks 50,000 tons of soybean meal and 50,000 tons of corn on Aug 25 for delivery within four months of contract signing.

China

corn futures – monthly, second month rolling contract

Source:

Reuters and FI

- September

corn is seen in a $3.10 and $3.35 range over the short term. December lows could reach $3.10. We can’t justify below $3.00 unless a shock in the September grain stocks report occurs, or China’s production gets upward revised by a large amount.