PDF Attached

US

infrastructure bill debates began today.

![]()

WORLD

WEATHER INC.

MOST

IMPORTANT WEATHER OF THE DAY

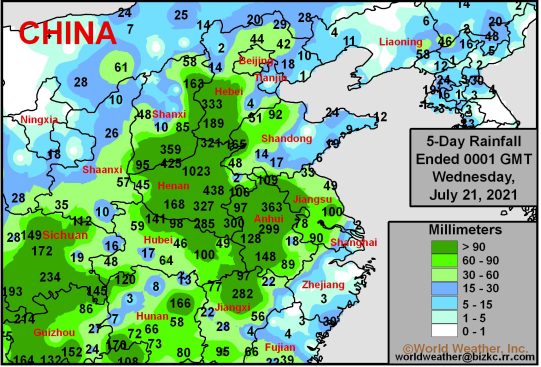

- China’s

central Yellow River Basin has been inundated with excessive rain and serious flooding this week.

o

Rainfall in the 24 hours ending at dawn today varied up to 30.71 inches in a part of Henan

- Many

surrounding areas reported 4.00 to more than 10.00 inches of rain Tuesday

o

Rainfall in central Henan has reached 40.28 inches since last Friday

o

Crop damage from flooding this week alone has likely occurred in various locations from western Hebei and southern Shanxi through Henan to northern and western Anhui

o

A second area of less serious flooding has occurred from Sichuan to Guangxi and a part of southeastern Yunnan during this past week

o

Damage to corn, soybeans, groundnuts, rice and minor cotton may have occurred

- Typhoon

In-Fa will bring torrential rain to southeastern China this weekend with landfall in Zhejiang expected

o

Portions of Jiangsu, Anhui and Zhejiang will experience flooding from the storm and coastal wind speeds in Zhejiang will be great enough for property damage

- Rainfall

will vary from 8.00 to 15.00 inches and possibly more if the storm stalls over the region too long - Tropical

Storm Cempaka produced nearly 10.00 inches of rain in southern Guangdong, China Tuesday and early today

o

The storm will move westward and bring some heavy rain to far southeastern Guangxi before cutting across the Gulf of Tonkin to northern Vietnam Thursday into the weekend

- Some

damage to rice and sugarcane may occur, although most of the excessive rain has been along the coast and does not extend very far inland - U.S.

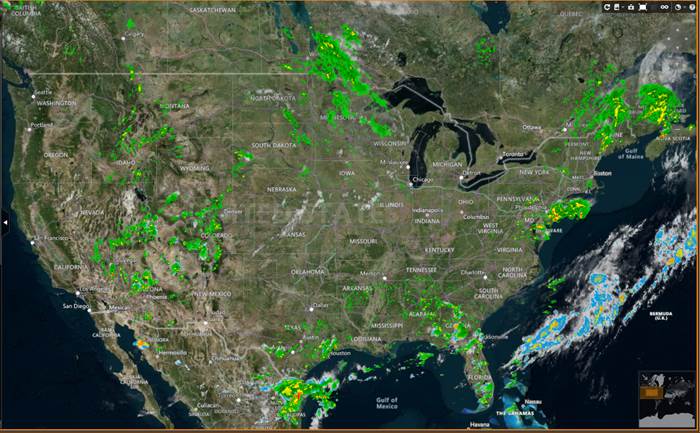

weather will include a week to ten days of limited rain and warm to hot temperatures in the Great Plains and western Corn Belt

o

Highest temperatures in the Plains will be in the 90s to 105 degrees Fahrenheit while readings from Minnesota to Missouri will eventually range in the lower and middle 90s

o

Quick drying is expected, although crop areas with favorable subsoil moisture will manage through the period of stress without much impact on production

- Rain

must occur immediately following this period of accelerated drying and rising crop stress to protect production potentials - Early

August weather should bring some showers to the northern U.S. Plains and northern and eastern Midwest, but the southwestern Corn Belt is not likely to get much rain

o

Rainfall in the northern Plains and upper Midwest will likely be restricted in the first days of August, but some moisture and relief from previous heat and dryness should occur briefly

- U.S.

eastern Midwest, Delta and southeastern crop areas will see a good mix of rain and sunshine during the next ten days to two weeks maintaining a favorable crop development environment

o

Less rain in the U.S. Delta will be welcome and should help support improved corn drying and maturation conditions with some harvesting to begin soon

- Texas

weather will be mostly good for all summer crops

o

Restricted rain and warmer temperatures will slowly firm up the soil and stimulate more aggressive crop development in those areas with abundant soil moisture

o

Dry weather in South Texas after Friday will be good for early cotton maturation and the start of harvesting

- U.S.

far western states will continue dry biased through the next ten days with warm temperatures, but no oppressive heat - Monsoon

moisture in the southern Rocky Mountain region and Arizona will be frequent and significant enough to improve soil moisture and induce a little runoff

o

Crop conditions will steadily improve in Arizona because of expected rainfall

- Portions

of Canada’s Prairies will continue to suffer from ongoing dryness

o

Central, northern and western Alberta will experience the most significant rainfall during the next ten days translating into improving crop development

o

Showers in southern Manitoba and southeastern Saskatchewan Tuesday and overnight was disappointing with no more than 0.50 inch of moisture resulting through 0100 CDT today

o

Temperatures are not quite as oppressively hot in Canada as they have been in the past and that is slowing the decline in crop conditions, but the trend remains

- Southeast

Canada’s corn, soybean and wheat conditions are rated favorably and weather conditions during the next two weeks will be favorably mixed - Brazil

weather overnight was less threatening than earlier this week with a few areas of frost, but no significant freezes in any sugarcane, citrus or coffee production areas - Europe

is taking a break from frequent rain that occurred from eastern France to Poland last week and during the weekend

o

The drier weather is needed

o

Too much rain too often delayed small grain maturation and harvest progress and reduced crop quality

- Some

winter oilseed conditions may have also been compromised - Rain

will return to Europe from France to Poland this weekend and next week possibly delaying fieldwork and returning concern over unharvested winter crop quality - Russia’s

Southern New Lands and northwestern Kazakhstan will receive rain over the next two to three days

o

The moisture will be good for developing crops and should reduce heat and moisture stress that has evolved recently

- More

rain will be needed soon, though - Net

drying will continue in northwestern Russia for a while possibly resulting in a little crop moisture stress for the driest areas

o

Rain may improve in these areas next week

- Southwestern

Xinjiang, China was unusually mild to cool again Tuesday

o

High temperatures were in the 80s and lower 90s northeast and only in the 70s and lower 80s southwest

o

Much of the cool weather was due to rain in the southwest where up to 0.62 inch of moisture was noted

o

Warming and drier weather will occur over the next week

- Xinjiang

degree day accumulations continue behind normal

o

Warming is needed and expected along with drier weather

- India

rainfall over the next two weeks will slowly increase bringing rain to most of the nation and improve crop and field conditions over time

o

There is some concern over net drying in the far south and extreme northwest, but most other areas will receive sufficient rain to bolster soil moisture and support improving crop development and long term moisture supply

- Brazil

will see some periodic rain in the south during the next ten days - Argentina

weather will be mostly dry over the next ten days

o

Some winter wheat would welcome rain especially in the west, but crop conditions are much better than last year at this time

o

Crops are mostly semi-dormant right now

o

No meaningful precipitation fell during the weekend

- Ivory

Coast and Ghana rainfall will be restricted over the next couple of weeks

o

Seasonal rainfall should return normally in September, but August rainfall will be lighter than usual

- Other

areas in West Africa will see a better distribution of rain - East-central

Africa rainfall will continue favorable for coffee and cocoa, although some areas in Uganda and Kenya may receive less than usual rainfall

o

Ethiopia rainfall is expected to continue improving after a slow start to the rainy season

- Southern

Oscillation Index has reached back about +13.91 and it is expected to remain strongly positive this week while slowly leveling off after a strong rising trend since June 22 when the index was -3.36 - Southeast

Asia rainfall recently and that which is expected in the next two weeks will continue somewhat erratic

o

Laos, Cambodia and Philippines will see the greatest rainfall

o

Sumatra and Java, Indonesia and Peninsular Malaysia may experience less than usual rainfall for a while

o

Thailand will also experience less than usual rainfall, although there has been some beneficial moisture recently

- Australia

weather in the first half of July has been ideal for improving winter wheat, barley and canola establishment in much of the nation

o

Some additional rain is still needed in South Australia, northwestern Victoria and from western New South Wales to western crop areas of Queensland

- South

Africa has been cold during the past week with waves of rain in the southwest

o

Weekend rainfall was still cool, but rain ended in many areas

o

The moisture has been good for future wheat development

o

Dryness remains in some of the unirrigated eastern wheat production areas

o

Some warming is expected over the coming week, but the precipitation anomalies will prevail

- Mexico

weather has improved with increased rainfall in the south and west parts of the nation

o

Drought conditions are waning, and crops are performing better

o

Dryness remains in Chihuahua and northeastern parts of the nation

o

Weather over the next ten days will offer some relief, but more rain will be needed in the drier areas

- Central

America rainfall has been plentiful and will remain that way except in Honduras where recent rainfall has been lighter and more sporadic than usual

o

Nicaragua has received frequent bouts of rain this month easing long term dryness, but more may be needed in some locations

- New

Zealand rainfall during the coming week will be near to above normal in North Island and western portions of South Island while below average in eastern South Island

o

Temperatures will be seasonable

Source:

World Weather Inc.

Source:

World Weather Inc.

Reuters

radar as of 3:00 pm CT

Bloomberg

Ag Calendar

Wednesday,

July 21:

- EIA

weekly U.S. ethanol inventories, production - Malaysia

July 1-20 palm oil export data - HOLIDAY:

India

Thursday,

July 22:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - USDA

to release world supply-demand outlook for orange and its juice - Port

of Rouen data on French grain exports - USDA

total milk, red meat production - U.S.

cold storage data – pork, beef, poultry - HOLIDAY:

Japan

Friday,

July 23:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - U.S.

cattle on feed, poultry slaughter, cattle inventory - HOLIDAY:

Japan

Source:

Bloomberg and FI

US

DoE Crude Oil Inventories (W/W) 16-Jul: 2107K (est -4500K; prev -7896K)

71

Counterparties Take $886.206 Bln At Fed’s Fixed-Rate Reverse Repo (prev $848.102 Bln, 75 Bidders)

Canada

New Housing Price Index Jun: 0.6% (prev 1.4%)

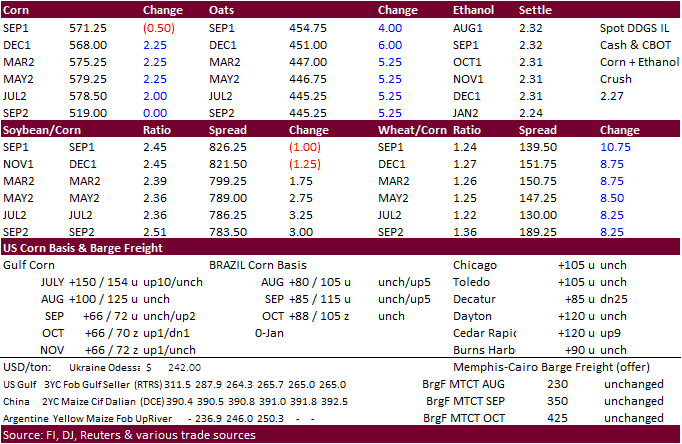

- After

a choppy trading range, September corn ended unchanged at $5.7175, while the back months 0.75-2.75 cents higher. $5.88 would fill a September corn gap. December was up 2.75 at $5.6850/bu ($5.7350 would that gap). US and China weather concerns limited losses

earlier. - It

may take weeks to figure out the impact from the heavy rain across China on crops. Zhengzhou, Henan, experienced heavy flooding earlier this week. That province is a large producer of wheat as well. Torrential rain fell in Henan, China Tuesday with one

location reporting 30.7 inches of rain in 24 hours. Some fear ASF will rapidly spread and hog farm damage could impact production over the short term. Meanwhile, China corn futures fell to a November low of 2,509 yuan per ton on Tuesday before rebounding

a touch on Wednesday. China imports of corn from the US were an all-time high.

- Fastmarkets

noted Argentina posted corn export licenses of 475,000 tons overnight, largest in a month. They also mentioned Brazil feedlots may have booked up to 1 million tons of Argentina corn over the last week and half.

- China

will auction 23,488 tons of Ukrainian imported corn at an auction on July 23 in Shandong and Guangdong provinces. - The

USDA Broiler Report showed eggs set in the US up 2 percent and chicks placed down 2 percent. Cumulative placements from the week ending January 9, 2021 through July 17, 2021 for the United States were 5.24 billion. Cumulative placements were up 1 percent

from the same period a year earlier.

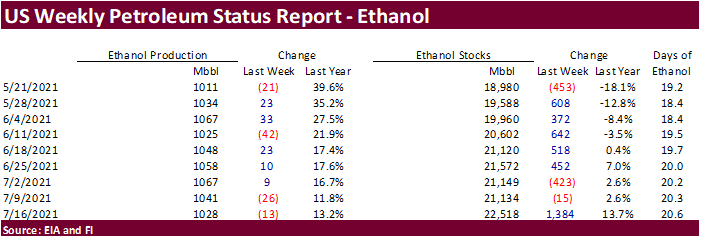

Weekly

ethanol production

fell for the second consecutive week to 1.028 million barrels, down 13,000 barrels (PADD2 down 13k), and stocks shot up 1.384 million barrels to 22.518 million, highest since mid- February 2021. Traders were looking for a 1,000 barrel increase in production

and stocks to be up 243,000 barrels. Note nearly every week in history we see ethanol stocks shoot up more than 1 million barrels, they tend to correct (draw) the following week or two. We don’t read too much into this report today. Ethanol in-transit during

the previous weeks when production was running much higher than 1.028 million was likely finally accounted in stocks. US gasoline demand improved from 9.283 million barrels to 9.295 million from the previous week and is 8.7% higher than this time last year

and 3.9% lower than 2019. The ethanol blend rate was 91.7% for finished motor gasoline, down from 92.2% previous week.

US

DoE Crude Oil Inventories (W/W) 16-Jul: 2107K (est -4500K; prev -7896K)

–

Distillate Inventories (W/W): -1349K (est 650K; prev 3657K)

–

Cushing Crude Inventories (W/W): -1347K (prev -1589K)

–

Gasoline Inventories (W/W): -121K (est -1050K; prev 1038K)

–

Refinery Utilization (W/W): -0.4% (est 0.5%; prev -0.4%)

Export

developments.

- China

plans to increase pork reserves on July 21 by buying from the domestic market.

- Jordan

seeks 120,000 tons of feed barley on July 28 for Nov/Dec shipment.

U

of I: 2018-2020 corn and soybean price timeline

Swanson,

K., C. Zulauf, N. Paulson and G. Schnitkey. “Timeline of a Rare Series of Disruptive Events for United States Agriculture.”

farmdoc daily (11):108, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 20, 2021.

Updated

07/13/21

September

corn is seen is a $4.75-$6.25 range

December

corn is seen in a $4.25-$6.00 range.

Soybeans

-

Soybean

complex ended mixed after a choppy trade. August soybeans fell 4.25 cents, September was off 1.25 and November finished 1.25 cents higher. Soybean meal rallied $4.30 to $5.80 higher. Soybean oil lost 95 to 156 points (Aug down 156) despite a $3.00 higher

move in September crude oil. -

November

Canadian canola was down 30.70 at 878.40/ton. Some noted milder temperatures and more rain in the forecast for the Canadian Prairies.

-

Brazil’s

2021-22 soybean production was estimated at 144.7 million tons, up 6% from this year, according to Pátria Agronegócios. The soybean area is seen up 6.7% to 40.85 million hectares.

-

Argentina’s

June soybean crush was 4.093 million tons, down from 4.301 million tons in May and up from 3.657 million form June 2020. January through June Argentina soybean crush was 22.1 million tons, up from 19.1 million during the first half of 2020. Argentina producers

sold an estimated 25.1 million tons of soybeans as of July 14, up 660,400 tons from the week before, and below 27.2 million tons from this time last year.

-

Malaysia

is back from holiday and that market closed only 2 points lower. Cash was off $7.50 to $1,015/ton.

-

AmSpec

reported Malaysian palm oil exports for the July 1-20 period fell 7.9 percent to 863,586 tons from 937,135 tons shipped during June 1 – 20. ITS reported a 6.6 percent decrease to 883,085 tons. The EU was the top destination so far this month. SGS reported

869,542 tons, 9.6% lower. -

India

was on holiday today.

- Results

awaited: South Korea’s Agro-Fisheries & Food Trade Corp. seeks around 7,600 tons of GMO-free soybeans on July 21 for arrival in South Korea between Aug. 20 and Oct. 20.

US

rolling soybeans vs. EU and Canadian rapeseed/canola ($/ton)

Source:

Reuters and FI

Updated

7/21/21

August

soybeans are seen in a $13.25-$15.25 range; November $11.75-$15.00

August

soybean meal – $330-$410; December $320-$425

August

soybean oil – 64.50-70.00; December 48-67 cent range (up 2 cents, unchanged back end)

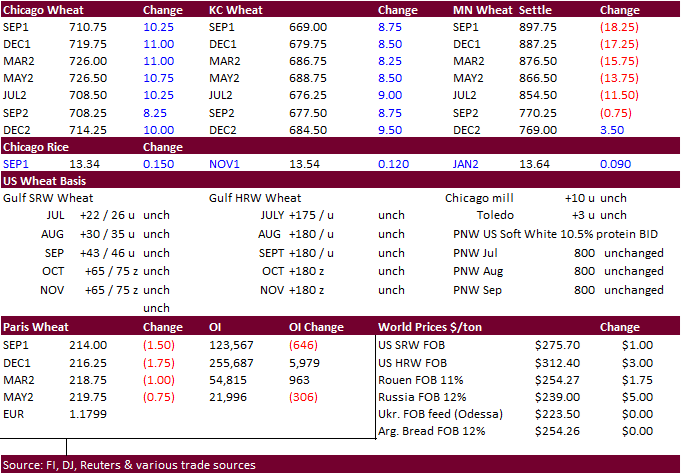

- US

wheat ended mixed (Chi & KC higher, MN lower) from follow through correction in Minneapolis spreads against Chicago and KC. Overnight there was talk of Chinese buyers seeking US hard red winter wheat for Sep/Oct, but nothing showed up under the 24-hour announcement

system. Last week we saw a rare snap purchase by China of soft red winter wheat.

The

northern Great Plains have a chance for rain late this month. - Minneapolis

September is down 46.75 cents since hitting an absolute contract high on Monday.

- The

US Plains will see another week of warm to hot temperatures and drying, as well as portions of Canada’s Prairies. A ridge is likely July 24-30 which will lead to net drying in at least part of the western Corn Belt and in much of the Hard Red Winter Wheat

Region and Northern Plains. Weather disturbances moving along the northern part of the ridge will likely provide at least some temporary relief though to northern hard red winter wheat areas and in the eastern part of the Northern Plains.

- The

Rhine river in southern Germany remains closed to shipping but will likely reopen soon from falling water levels. The northern sectors are open.

- USD

was down 23 points as of 2:30 pm CT. - Europe

will be trending wetter again this weekend through next week. (WW) - December

Paris wheat was down 2.00 at 216.50 euros after hitting a 2-month high this week.

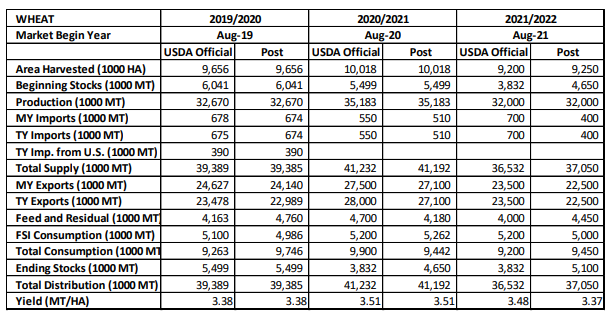

USDA

Attaché: Canada Grain and Feed update

(wheat production same as USDA official)

- Thailand

tendered for 138,000 tons of feed wheat and ended up passing on it. Lowest price was thought to be $308/ton c&f for October shipment. They were in for Oct-Dec shipment.

- Ethiopia

seeks 400,000 tons of wheat on July 19.

- Pakistan’s

TCP seeks 500,000 tons of wheat on July 27. 200,000 tons are for August shipment, and 300,000 tons are for September shipment.

Rice/Other

- South

Korea seeks 91,216 tons of rice from China, the United States and Vietnam for arrival in South Korea between Oct. 31, 2021, and April 30, 2022.

- Bangladesh

seeks 50,000 tons of rice on July 18. - Mauritius

seeks 6,000 tons of white rice on July 27 for October through December shipment.

Updated

7/21/21 – revised again due to unwinding of MN/Chi & MN&KC spreading)

September Chicago wheat is seen in a

$6.25-$7.50 range (up 25 back end)

September KC wheat is seen in a

$5.90-$7.25 (up 25 back end)

September MN wheat is seen in a $7.75-$9.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.