PDF Attached

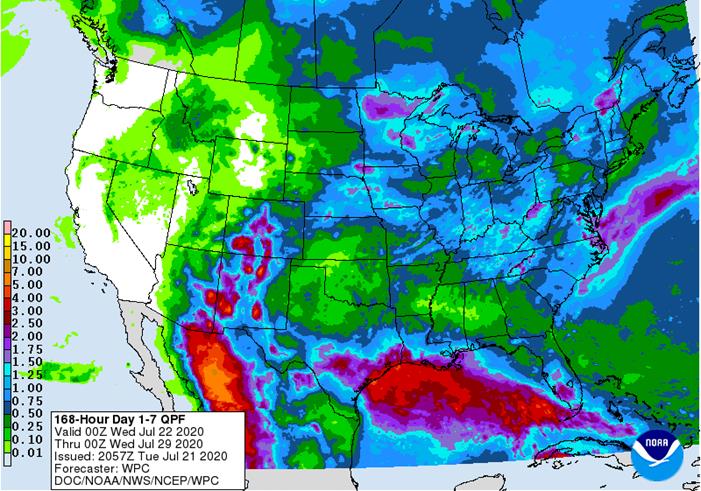

7 Day Precipitation Outlook

UNITED STATES

- Not significant changes to the general theme of weather has evolved on recent forecast model runs

- The environment will continue sufficiently moist to support most summer crop development in the Midwest with a few exceptions

- Portions of the Delta will continue to dry down and parts of the southern and northwestern Plains will experience similar conditions

- Monsoon moisture will continue to stream into the southern Rocky Mountain region adding a moisture source for crop areas during the next few weeks

- The second week of the outlook still brings some ridge building to the middle of the nation, but an active jet stream prevails with some cool air periodically in Canada and warm air in the U.S. along with plenty of humidity around resulting in favorable support of some periodic rainfall

- Pockets of drying in the key corn and soybean production areas will continue, but the worst areas of dryness may remain small in size for the next couple of weeks

- Sufficient subsoil moisture will carry many crops during periods of more limited rainfall except in the areas that have been driest for the longest periods of time

- Rain is needed most in a part of northwestern and central Iowa and in random locations in central Illinois, east-central Indiana and quite a few areas in Ohio

- The Delta also needs greater rain

- Despite the stressful environment for some of these drier areas most of the nation’s crop of corn and soybeans is evolving favorably

- West Texas rainfall is expected to be briefly enhanced by a tropical wave that will push into the region this weekend after bringing some rain to the Louisiana and upper Texas coast and the Texas Blacklands; the moisture will be greatly diminished by the time it gets to West Texas, but sufficient amounts of rain will remain to support at least “some” increased rainfall briefly before drier and warmer weather resumes.

EUROPE/BLACK SEA

- No significant change was suggested in this first week of the outlook

- Western Europe will continue to receive restricted rainfall while central and northeastern Europe remains wettest along with the western CIS

- 06z GFS model run brings significant rain to the North and Baltic Sea regions in the last days of July and first days of August

- The increase may have been a little overdone today, but some increase is expected

- GFS shifted rain from southeastern Ukraine to northeastern Ukraine this weekend

- The change was needed

- GFS added a little rain to central and northeastern Ukraine July 31-Aug 2

- Some of the increase was expected

The bottom line does not bring much change to the European Continent in this first week of the outlook and if rain evolves in the following week as advertised there would be some relief to dryness in parts of northwestern Europe while conditions elsewhere are mostly status quo. The lack of rain in this first week of the outlook in France and neighboring areas will maintain a stressful environment for summer crops even though there is not much heat. In the meantime, limited rain is still advertised from eastern and southern Ukraine into Russia’s Southern Region raising concern about long term soybean, corn and sunseed production in unirrigated areas.

RUSSIA NEW LANDS

- GFS models overnight reduced rain in the northern and eastern New Lands during this first week of the outlook

- Some of the reduction was needed and was consistent with other forecast models

- The second week of the outlook is still offering scattered showers throughout much of the New Lands, but rainfall is minimal near the Kazakhstan border where it is already drier than usual

The bottom line offers only partial relief to the dryness situation in the central New Lands. Rain is going to occur in the Ural Mountains region during the balance of this week with sufficient rain in some areas to dramatically increase soil moisture. However, many other New Lands’ locations will not get much rain until next week and at that time the rain is expected to be light and somewhat sporadic, although most areas get at least some moisture. The environment should provide some relief to moisture stress for sunseed and spring wheat, although it is questionable how much relief will occur in areas nearest to Kazakhstan.

CHINA

- No change was suggested in the first week of the outlook

- Rain was reduced in east-central and southeastern China for mid-week next week into the following weekend

- Some of the reduction was needed; scattered showers and thunderstorms still occur in many areas

- Some increase in rainfall was suggested for the northeastern provinces in the early days of August

- Some of the increase may have been overdone

- Drier weather is now being advertised for the Yangtze River Basin beginning July 31 and lasting through August 4

A good mix of weather is expected in northern China over the next two weeks with most areas getting alternating periods of rain and sunshine. There will be some areas of net drying, however, and those pockets will be closely monitored in the most important corn and soybean production areas in the northeast for a while. In the meantime, additional rain will impact the Yangtze River Basin over the coming week to ten days, but the last days of July and early August may be drier and there will be no one in China complaining about that change for a while. Localized areas of flooding will still continue until the drier days of late July and August arrive.

AUSTRALIA

- Rain Thursday and Friday was increased in southeastern Queensland and reduced in central New South Wales while increased east of the Great Dividing Range in New South Wales

- Some of these changes were needed

- Rainfall in the second week of the outlook is quite restricted in much of the nation

- The nation is advertised to be too dry and a change in the outlook will likely evolve in future model runs

Rain in New South Wales and Queensland Thursday into Friday will be welcome and good for crops. Greater rain will still be needed in Queensland and South Australia

SOUTH AMERICA

- No significant changes were noted overnight

Source: World Weather Inc. and FI

- USDA total milk production, 3pm

- New Zealand global dairy trade auction

WEDNESDAY, July 22:

- EIA U.S. weekly ethanol inventories, production, 10:30am

- U.S. cold storage – pork, beef, poultry, 3pm

- Thai Rice Exporters Association’s briefing on rice export outlook in 2H

THURSDAY, July 23:

- USDA weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am

- China trade data, including cotton, corn, wheat and sugar imports

- International Grains Council monthly report

- Port of Rouen data on French grain exports

- USDA red meat production, 3pm

- HOLIDAY: Japan

FRIDAY, July 24:

- ICE Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- U.S. Cattle on Feed, Poultry Slaughter, 3pm

- FranceAgriMer weekly update on crop conditions

- Brazil Unica cane crush, sugar production (tentative)

- HOLIDAY: Japan

SATURDAY, July 25:

- AmSpec to release Malaysia’s palm oil export data for July 1-25

- China’s 3rd batch of June trade data, incl. country breakdowns for energy and commodities (tentative)

· Chicago Fed National Activity Index Jun 4.11 (est 4.00; prevR 3.50; prev 2.61)

· Philadelphia Fed Non-Manufacturing Regional Business Activity Index Jul 0.7 (prev -3.6)

· Canadian Retail Sales (M/M) May 18.7% (est 20.0%; prev -26.4%)

-Canadian Retail Sales Ex. Auto (M/M) May 10.6% (est 11.9%; prev -22.0%)

· Canada New Housing Price Index (M/M) Jun 0.1% (est 0.1%; prev 0.1%)

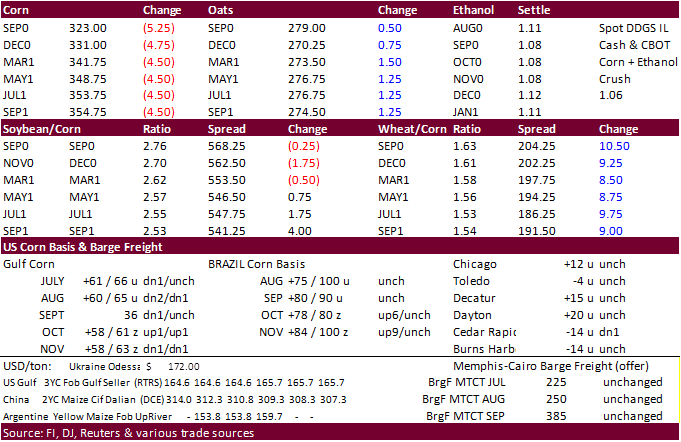

- Corn traded lower on improved crop conditions and the favorable weather for the developing crop.

- Spreading vs SRW and HRW futures was noted as the benchmark Wheat/Corn and KC Wheat/Corn spreads widened.

· December corn traded below a support level of $3.3050. Next level of support is seen at $3.2725.

- The upcoming week will include good rainfall coverage. Temperatures for the US will be above normal but nonthreatening. This should be more greenhouse-like than a desert which should help corn through pollination.

- There were no corn and soybean deliverable stocks at Toledo, according to a weekly CBOT report.

· China plans to auction off another 10,000 tons of frozen pork on July 23.

· China may auction off rice and wheat stocks to animal end users after corn prices appreciated 20 percent this year, according to a Reuters story. Up to 10 million tons of rice may be sold during the program.

- BB: Ukraine 2020-21 Corn Crop Estimate Raised 5.6% to 38m Tons: UAC

- BB: Mexico’s 2020-21 Corn Output, Imports Seen Rising, USDA FAS Says

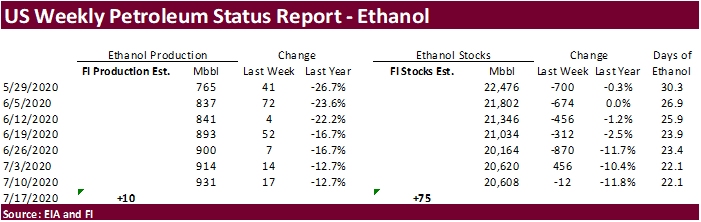

- A Bloomberg poll looks for weekly US ethanol production to be up 18,000 at 949,000 barrels (938-960 range) from the previous week and stocks to increase 244,000 barrels to 20.885 million.

- Funds were net sellers of 18,000 corn contracts on the session.

Corn Export Developments

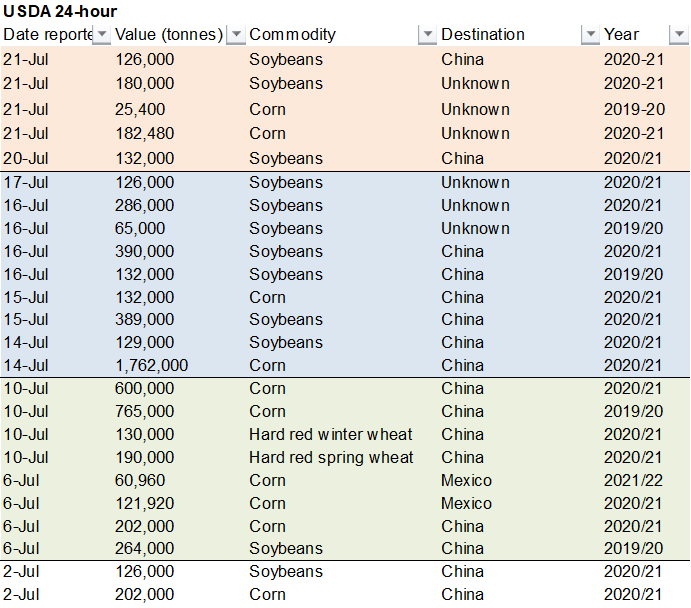

- Under the 24-hour announcement system, private exporters sold 207,880 tons of corn for delivery to unknown destinations. Of the total, 25,400 metric tons is for delivery during the 2019/2020 marketing year and 182,480 metric tons is for delivery during the 2020/2021 marketing year.

- South Korea’s NOFI group were seeking 207,000 tons of corn and 70,000 tons of wheat. Reuters reported they bought 65,000 tons of corn ($190.93/ton fob) and 60,000 tons of feed wheat ($232.90/ton fob).

Updated 7/20/20

- September corn is seen in a $3.15 and $3.40 range over the short term. December lows could reach $3.10.

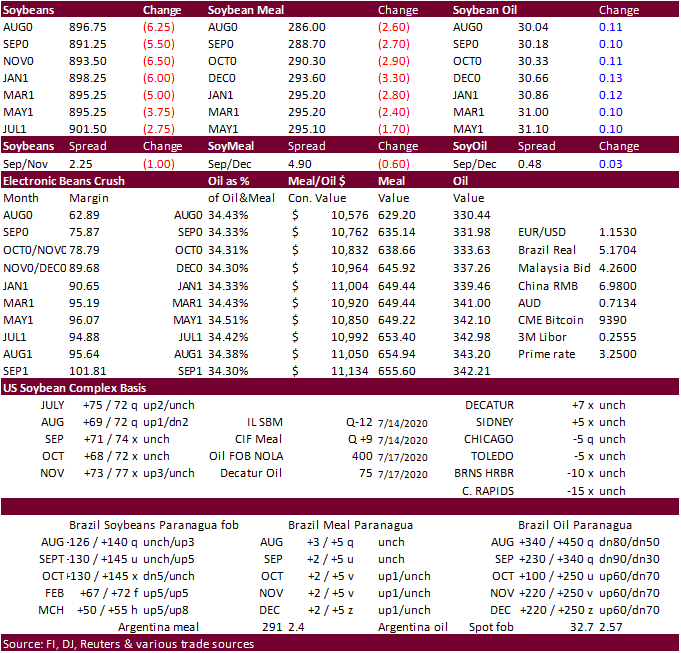

- Soybeans closed lower today on the upgraded crop conditions and profit-taking following a string of gains over the past five sessions.

- Soybean meal finished lower following corn and other proteins, while soybean oil futures saw a bullish session following crude despite weaker global vegoils.

- USDA announced 5 new crop cargoes were sold to China.

- We heard China bought an estimated 35 to 40 soybean cargoes last week, mostly for Q4 shipment.

· China plans to sell 61,100 tons of soybeans from reserves on Friday, according to Bloomberg. 54,000 tons, we read via AgriCensus, will be included for auction consisting of 2017 and 2018 imported soybeans. They noted around 3 million tons could be auctioned.

· The BRL hit a one month high. Stimulus package was helping that currency.

· Funds were net sellers of 6,000 soybean contracts, 3,000 soybean meal futures, and buyers of a net 1,000 soybean oil contracts.

- Under the 24-hour announcement system, private exporters sold:

- 126,000 tons of soybeans for delivery to China during the 2020/2021 marketing year;

- 180,000 tons of soybeans for delivery to unknown destinations during the 2020/2021 marketing year.

- August soybeans are seen in a $8.75-$9.22 range.

- August soybean meal is seen in a $285 to $315 range.

- August soybean oil range is seen in a 28.50 to 31.00 range over the short term

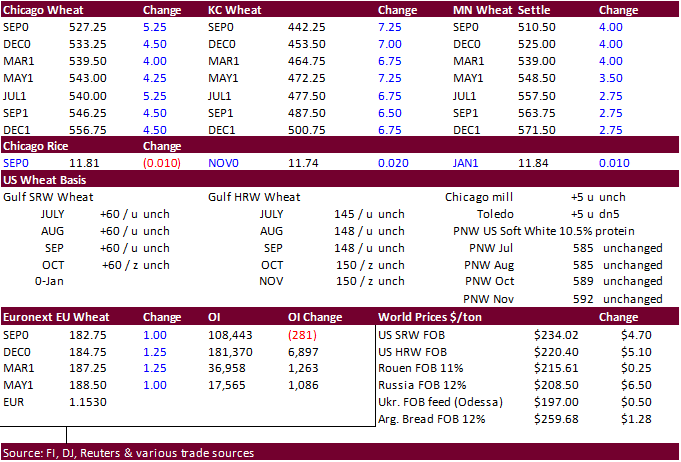

- US wheat ended higher today on the weaker dollar and wheat vs corn spreading.

- HRW basis was firm but no sovereign global business was done of note.

· Paris December wheat settled up 1.25 euro at 184.75 euro/MT.

· Germany will see a hotter and drier forecast, facilitating harvesting of their wheat.

- Ukraine grain stocks were a tight 5.53 million tons as of July 1 (9.2MMT year earlier) in part to 1.81 million tons held for wheat.

- USD closed 0.712 lower at 95.060 and the Euro reached an 18-month high vs the dollar on the EU stimulus pact.

- Funds were net buyers of 5,000 wheat contracts on the session.

- Egypt bought 112,000 tons of Ukraine wheat for August 21-31 shipment. Details are below.

- 60,000 tons of Ukrainian wheat at $208.98 and $15.50 freight equating to $224.48 from Ochakov, Ukraine

- 55,000 tons of Ukrainian wheat at $213.50 and $13.78 freight equating to $227.28 from Chronomorsk, Ukraine

- South Korea’s NOFI group were seeking 207,000 tons of corn and 70,000 tons of wheat. Reuters reported they bought 65,000 tons of corn ($190.93/ton fob) and 60,000 tons of feed wheat ($232.90/ton fob).

- Jordan bought 60,000 tons of wheat at $235.50/ton CRF for FH October shipment, down from $244.50/ton CRF they paid in mid-July.

- The Philippines seek 110,000 tons of feed wheat on July 22.

- Thailand seeks 98,000 tons of Australian feed barley and 192,600 tons of feed wheat on July 22 for October-December shipment for wheat and December and February shipment for barley.

- Taiwan seeks 98,230 tons of US wheat on Wednesday.

- Japan in an SBS import tender seeks 80,000 tons of feed wheat and 100,000 tons of barley on July 22 for arrival by December 24.

- Ethiopia postponed an import tender for 400,000 tons of wheat to July 24 from July 20.

- Syria seeks 200,000 tons of milling wheat from Russia by July 28.

· China may auction off rice and wheat stocks to animal end users after corn prices appreciated 20 percent this year, according to a Reuters story. Up to 10 million tons of rice may be sold during the program.

Updated 7/20/20

- Chicago September is seen in a $5.00-$5.50 range.

- KC September; $4.25-$4.50 range.

- MN September $4.80-$5.20 range.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.