PDF Attached

UNITED STATES

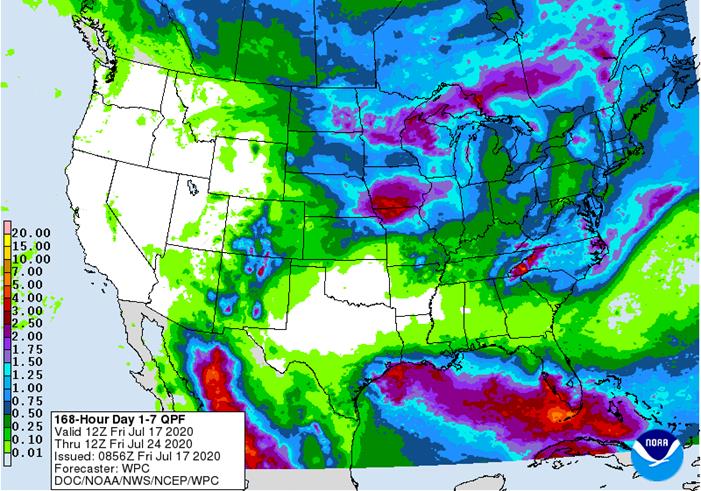

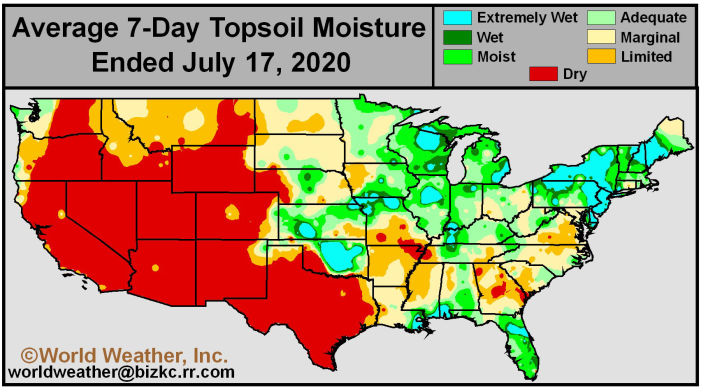

- Today’s GFS model runs bring a tropical wave through the Gulf of Mexico next week that may or may not turn into a tropical cyclone, but its mere presence in the Gulf will help limit Gulf of Mexico moisture from streaming into the U.S. Midwest. That will not stop rain from falling, but it will help to make the greater rain a little more localized

- All of the models are presenting rain to portions of the Midwest over the coming week and some of it is advertised to be heavy with portions of Iowa included

- The European model suggests a part of southern Minnesota and northern Iowa along with eastern South Dakota may be missed by rain again

- Precipitation in parts of Michigan, northeastern Indiana and northern Ohio is advertised to be light by the European model, as well

- GFS moisture is being painted with a broad brush once again and caution is advised to not be surprised a week from now when the precipitation has not been as uniform as the GFS suggests

- Texas may benefit from the possible tropical cyclone next week with landfall at the end of next week

- Some of this moisture is poised to reach West Texas and that could help to generate some much needed moisture in many parts of Texas and also help keep the temperatures down too

- GFS week two rainfall scattered erratically across key U.S. crop areas with some areas getting more rain than others, but the potential for rain periodically remains

- GFS suggests improved monsoon flow will occur through the Rocky Mountains to the northern Plains as the month draws to a close

- This was increased on the 06z model run relative to the previous model run

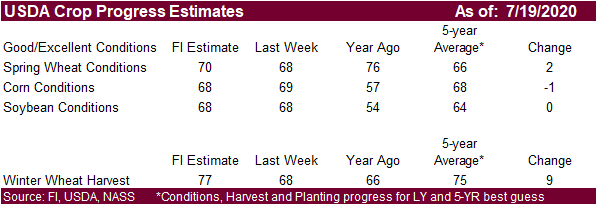

The bottom line is still hard to get very excited about problems in key U.S. crop areas during the next two weeks. However, keep a close eye on the distribution of rainfall because some areas may be missed by some of the rain a little more often than others. No widespread dryness problem is expected through the end of this month and corn pollination will likely complete relatively well. Soybeans will also move into August in mostly good shape, but there will be some pockets of dryness that will have to be closely monitored.

EUROPE/BLACK SEA

- 06z GFS model run reduced some of the rain advertised for late next week and into the following weekend in northwestern Europe

- Some of the reduction of rainfall was needed

- The model run still suggests some improved opportunity for showers in the second week of the outlook as we discussed last evening

- The rain that falls will not be a drought buster, but could offer a little relief for the U.K. and a few areas in France and Germany

- Both the European and Canadian model runs only allow rain into the U.K. and leave France, Belgium and Germany out of the rain through day ten

- Most of the precipitation should occur in days 10-14, but it will not be a general soaking

RUSSIA NEW LANDS

- No theme changes were made overnight

- A gradual breakdown of the high-pressure ridge over the New Lands is expected next week and the showers and thunderstorms expected will be erratic and light initially, but may improve over time

- Partial relief is expected, but no generalized heavy rain event is expected, and several areas will continue in need of greater rain after the second week has come to an end

CHINA

- Flooding rain is expected through the weekend from southeastern Sichuan, Guizhou northern Hunan to Jiangsu and far southern and eastern most Shandong

- Rain totals of 4.00 to 12.00 inches and locally more will result; a few amounts to 15.00 inches will not be out of the realm of possibilities

- Some heavy rain is also expected in North Korea and a few immediate neighboring areas of Liaoning and southern Jilin

- Improved weather is expected in east-central China next week with flood water receding

- Greater rain was suggested for northeastern China from Hebei to Heilongjiang during the July 27-30 period

- Some of the rainfall was overdone

The bottom line is a good mix of rain and sunshine for northern and far southern China over the next ten days, but this weekend’s excessive rain event will raise the potential for some crop damage in east-central parts of the nation; including southeastern Henan, Jiangsu, northern Anhui and possible far southern Shandong. Improving weather will occur after the first part of next week for the flood ravaged areas.

AUSTRALIA

- Beneficial rain fell in Western Australia overnight with some of the previously driest areas in the north and east part of the wheat, barley and canola production region getting some of the greater rainfall

- Crops will respond well

- Otherwise, the forecast has not changed for this coming week. Some rain is expected in southeastern Queensland late next week; otherwise, showers will be mostly confined to coastal areas in the next seven days

- Rain is still advertised in New South Wales and southeastern Queensland during the second weekend of the outlook, although the intensity of that event has been reduced over that of Thursday

- Not much other change was noted

SOUTH AMERICA

- No theme changes were noted, but the latest GFS model run maintains that most of the rain late this weekend into early next week will be in Buenos Aires and La Pampa, limiting the amount of relief that will occur in Cordoba or Santa Fe. That will leave the downward pressure on wheat production potentials in Cordoba and Santa Fe and there will be no other precipitation opportunities through the end of this month.

- The moisture will be great for Buenos Aires wheat which may be about 44% of the total crop

- Rain has to fall soon to stop the decline in production potentials

SOUTHEAST ASIA

Recent comments in the marketplace about recent excessive rainfall in Indonesia causing a threat to the oil palm crop are untrue. Flooding may be temporarily causing some transportation issues, but the crop has been unaffected and will not be affected

- Indonesia, like many other areas in southern Asia will be experiencing greater rainfall later this year as La Nina evolves, but most of the recent heavy rain has little to do with that phenomenon

Source: World Weather Inc. and FI

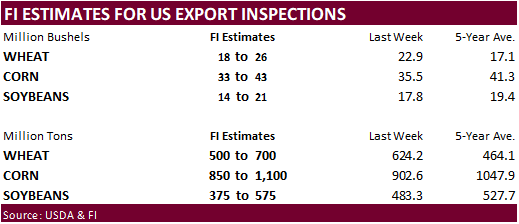

- USDA weekly corn, soybean, wheat export inspections, 11am

- U.S. crop conditions of soybeans, corn, cotton; winter wheat progress, 4pm

- EU weekly grain, oilseed import and export data

- Malaysia’s palm oil export data for July 1-20

- Ivory Coast cocoa arrivals

TUESDAY, July 21:

- USDA total milk production, 3pm

- New Zealand global dairy trade auction

WEDNESDAY, July 22:

- EIA U.S. weekly ethanol inventories, production, 10:30am

- U.S. cold storage – pork, beef, poultry, 3pm

- Thai Rice Exporters Association’s briefing on rice export outlook in 2H

THURSDAY, July 23:

- USDA weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am

- China trade data, including cotton, corn, wheat and sugar imports

- International Grains Council monthly report

- Port of Rouen data on French grain exports

- USDA red meat production, 3pm

- HOLIDAY: Japan

FRIDAY, July 24:

- ICE Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- U.S. Cattle on Feed, Poultry Slaughter, 3pm

- FranceAgriMer weekly update on crop conditions

- Brazil Unica cane crush, sugar production (tentative)

- HOLIDAY: Japan

SATURDAY, July 25:

- AmSpec to release Malaysia’s palm oil export data for July 1-25

- China’s 3rd batch of June trade data, incl. country breakdowns for energy and commodities (tentative)

Source: Bloomberg and FI

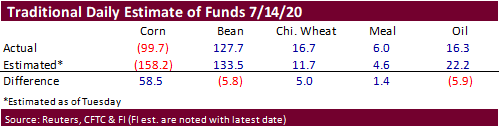

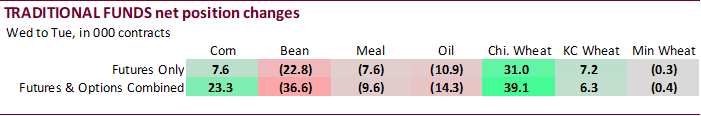

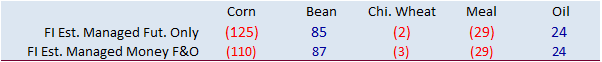

CFTC commitment of traders reported again showed a large discrepancy in the corn position relative to trade estimates.

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn -133,625 8,116 204,324 8,526 -95,685 -15,105

Soybeans 65,975 -33,268 123,534 5,431 -211,898 36,449

Soymeal -30,451 -8,541 73,095 -994 -87,224 13,977

Soyoil 10,198 -9,219 88,094 -383 -110,801 15,876

CBOT wheat -8,327 25,203 93,062 -6,629 -85,706 -25,975

KCBT wheat -23,566 9,107 43,949 1,895 -20,975 -10,547

MGEX wheat -18,526 -417 2,278 201 11,100 -733

———- ———- ———- ———- ———- ———-

Total wheat -50,419 33,893 139,289 -4,533 -95,581 -37,255

Live cattle 21,678 -1,230 84,122 -7 -112,828 119

Feeder cattle 1,472 -107 4,083 23 -2,440 -347

- Corn finished the week on a high note on technical buying after the bearish sentiment from favorable US weather stalled mid-week. September ended 3.25 cents higher and December 2.75 cents higher. The bull spreading may reflect spot export demand. South Korea bought a lot of corn this week and it appears the majority of it was South American origin. But US demand increased late in the work week after futures slumped Monday and Tuesday.

- For the week, December fell the second consecutive week. It was down 5 cents or 1.5 percent. Resistance for December corn is seen near 3.48, support 3.3050.

- CIF corn basis was up 3-5 cents.

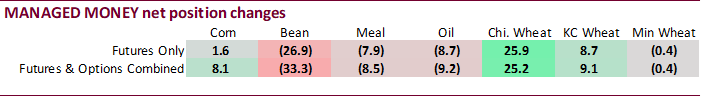

- Managed money funds cut their bearish position (F&O) by 8,100 contracts to a 14-week low.

· The USD was 33 lower by late Friday.

· Safras & Mercado estimated the Brazilian corn production for the upcoming 2020-21 season (plantings starts September) at a record 116 million tons, up from their 2019-20 forecast of 107.3 million tons. They see the planted area at 19.66 million hectares, up 1 percent from 2019-20. This comes as trade estimates for the upcoming soybean planted area to rise 2 to 3 percent.

- South Korea’s MFG group bought 138,000 tons of corn from SA at $188.70/ton c&f for Oct/early Nov shipment.

- Results awaited: Saudi Arabia seeks 720,000 tons of barley on Friday.

Corn cash VIX

- September corn is seen in a $3.20 and $3.65 range over the short term. December lows could reach $3.10.