PDF Attached includes crush, ethanol, and funds

Higher trade in soybeans and sharply higher trade in wheat on good global import demand. Corn traded two-sided, ending unchanged to slightly higher due to ideal US weather.

![]()

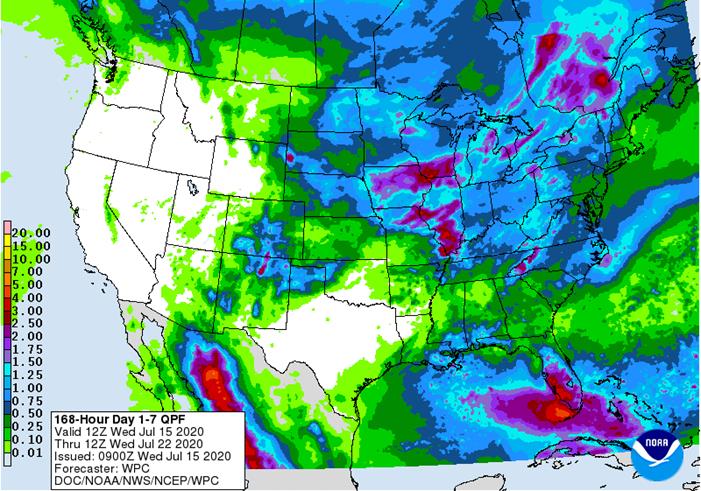

MARKET WEATHER MENTALITY FOR CORN AND SOYBEANS: U.S. weather is advertised to be unsettled enough over the next two weeks to limit problems with moisture stress to small parts of the production region. However, watch closely, some very warm temperatures are expected in southern areas this weekend into next week that might accelerate drying and surprise some traders how quickly the ground has firmed back up again after recent rain. The majority of Midwestern crop areas will see a favorable mix of weather during the next ten days, but that does not mean a little moisture stress will not take place in a few pockets.

Concern over crop conditions in France and neighboring areas of the U.K, and Germany will continue as well as in the Balkan Countries and from eastern Ukraine to Russia’s Southern Region, despite some recent shower activity.

Worry over Russia’s central New Lands where sunseed is produced may continue this workweek, but relief is expected briefly this weekend into next week. China’s biggest threat is due to flooding, but only a minor amount of corn, soybean and groundnuts are being lost from that event.

Australia and Canada’s canola crops are improving with little change likely. There are still some notable concerns about too much moisture in parts of Alberta and northwestern Saskatchewan and not enough in parts of the eastern Canada Prairies. Southern parts of the Prairies will be drying out soon.

Overall, weather today will generate a mixed influence on market mentality.

MARKET WEATHER MENTALITY FOR WHEAT: Most of the damage to world wheat has likely been swallowed by the market with recent USDA and other agency reports. Dryness continues in northwestern and southeastern Europe, Russia’s Southern Region and now Russia’s central New Lands, although rain is expected in the central New Lands this weekend into next week.

China’s spring wheat crop is likely developing well and Australia’s crop looks a little better as each weak moves along. Western Argentina, however, is still too dry. Argentina will get some rain late this weekend into early next week to offer “some” relief. South Africa has received some welcome rain recently to improve its western wheat crop, but small grains farther east are still quite dry.

Spring wheat in the northern U.S., Plains, Pacific Northwest and Canada’s Prairies varies greatly with too much moisture in western Alberta and some pockets of notable dryness from North Dakota into eastern Saskatchewan.

Overall weather today will likely have mixed influence on market mentality.

Source: World Weather Inc. and FI

- EIA U.S. weekly ethanol inventories, production, 10:30am

- Brazil chicken, pork group ABPA’s press conference on output, exports

- International Sugar Organization’s online conference on Covid-19 impact on sugar and alcohol

- Malaysia’s palm oil export data for July 1-15

THURSDAY, July 16:

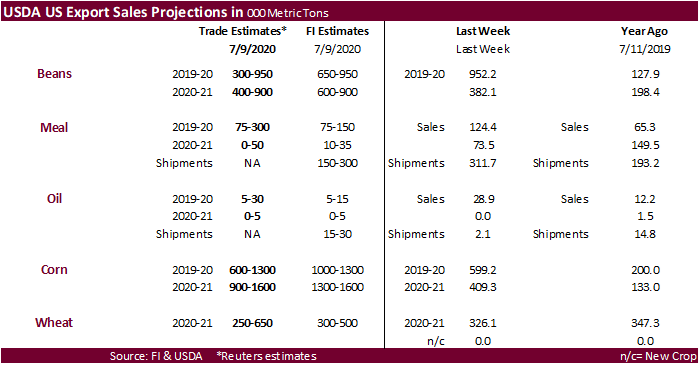

- USDA weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am

- Port of Rouen data on French grain exports

- North America 2Q cocoa grindings

- European Cocoa Association 2Q grind data

FRIDAY, July 17:

- ICE Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly update on crop conditions

- Cocoa Association of Asia releases 2Q cocoa grind data

Source: Bloomberg and FI

US Empire Manufacturing (Jul): 17.2 (est 10, prev -0.2)

Canada Manufacturing Sales (M/M) May: 10.7% (est 9.8%, prev -28.5%)

US Import Price Index (M/M) Jun: 1.4% (est 1%, prev 1%)

US import Price Index (Y/Y) Jun: -3.8%(est -3.7%, prev -6%)

US Export Price Index (M/M) Jun: 1.4% (est 0.8%, prev 0.5%)

US Export Price Index (Y/Y) Jun: -4.4% prev 6%)

- September corn snapped a three-day losing streak. Nearly all the contracts traded two-sided from higher soybeans. USDA reported additional corn sales to China, but traders again shrugged off the news. The US weather outlook this morning was largely unchanged but some of the models disagree for the US with changes in the distribution of rain for week one and week two. The southwestern areas may end up the driest over the next couple of weeks. Bottom line is US weather looks good.

- Funds were even in corn.

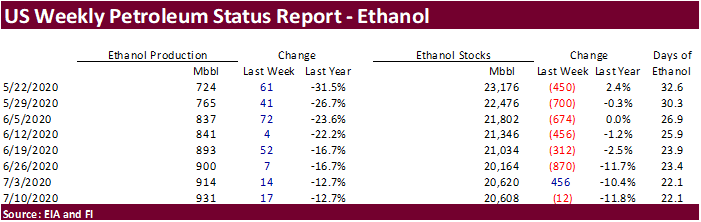

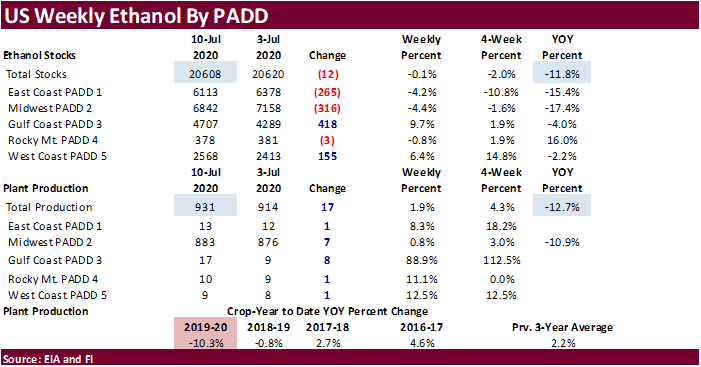

- US ethanol production increased from the previous week and stocks were down slightly.

- We heard China was also in for Black Sea corn yesterday. Ukraine exported about 3 million tons of corn to China during FH 2020. With 3.2+ million tons sold from the US recently, the 7.2-million-ton import quota by China could be fulfilled by the end of this month, assuming all of what was sold reaches China by the end of 2020, in my opinion.

- APK-Inform: Ukraine’s grain exports 50.6 million tons, up from 48.9 million tons a month earlier. Ukrainian corn production 36.6 million tons from 35.4 million tons.

· The USD was 40 lower by 7:24 am CT.

- Traders should monitor central Iowa, northern Indiana and Ohio, where those states are expected to get rain over the next couple of weeks.

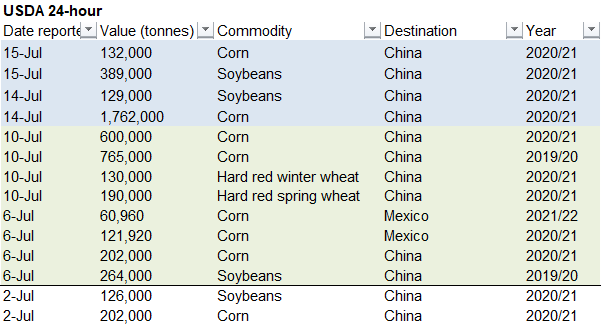

- Under the 24-hour announcement system, US exporters sold 132,000 tons of corn and 389,000 tons of soybeans to China.

- South Korea’s FLC bought 65,000 tons of corn at $188.74/ton c&f for November 20 arrival. Later we learned they also bought 65,000 tons for October 10 arrival at 184.78/ton.

- South Korea’s MFG bought 65,000 tons of corn at $188.74/ton c&f for December 30 arrival. They passed on a second cargo.

- Results awaited: Iran seeks 200,000 tons of corn and 200,000 tons of barley on Wednesday for Aug/Sep delivery.

- September corn is seen in a $3.20 and $3.65 range over the short term. December lows could reach $3.10.