PDF Attached

WTI

crude oil and related products were a concern for most US commodity markets, along with a higher USD. USDA revealed little changes to US and world demand, although some respects should be noted to lower US soybean crush. Fundamentals and world economic outlooks

have not changed. We remain concerned over global recession.

Full

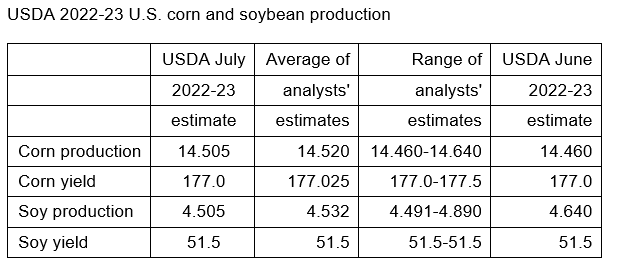

USDA versus estimate tabled attached

WORLD

WEATHER HIGHLIGHTS FOR JULY 12, 2022

•

U.S. Weather is still a little tenuous with erratic rainfall expected and areas of net drying

•

Soil moisture is still rated favorably in many Midwestern areas, but not in Missouri, parts of Kansas, portions of Indiana and a few other areas

•

U.S. Delta crop areas are too dry in the north

•

U.S. west-central and southern Plains are still in a serious drought with little change likely

•

Hot weather and limited rain will impact the central and southern Great Plains over the next two weeks with the hottest conditions coming later this week and during most of next week with daily highs over 100 degrees Fahrenheit

•

Western U.S. Corn Belt will be most at risk of expanding heat and dryness next week with Missouri, Kansas, Nebraska, southwestern Iowa and South Dakota expecting hot temperatures and little to no rain

•

Pockets of eastern Midwest dryness will persist over the next couple of weeks, but rain is expected from the eastern Dakotas through southern Minnesota to parts of Ohio and northern Indiana later this week

•

Texas drought will continue serious for cotton, corn and sorghum areas through the end of this month

•

Argentina wheat areas may get a few showers later this week, but drought busting rain is not expected

•

Western Europe will continue dry for ten days and temperatures will rise above normal stressing all crops and livestock, but especially unirrigated coarse grain and oilseed crops

•

Favorable weather is expected in most other areas

Source:

World Weather INC

Wednesday,

July 13:

- China’s

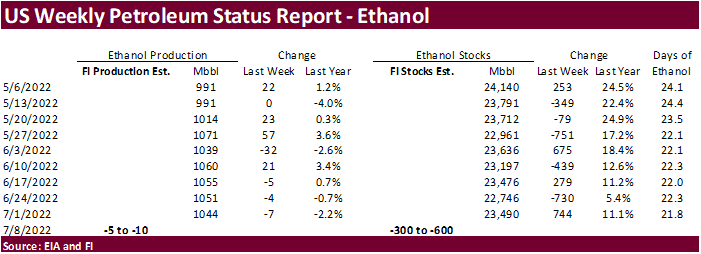

first batch of June trade data, incl. soybean, edible oil, rubber and meat imports - EIA

weekly U.S. ethanol inventories, production, 10:30am - France

AgriMer monthly grains outlook - New

Zealand food prices - HOLIDAY:

Thailand

Thursday,

July 14:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - HOLIDAY:

France

Friday,

July 15:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China’s

1H pork output and hog inventory - Malaysia’s

July 1-15 palm oil export data - FranceAgriMer

weekly update on crop conditions - The

Cocoa Association of Asia releases 2Q cocoa grind data

Source:

Bloomberg and FI

Macros

96

Counterparties Take $2.146 Tln At Fed Reverse Repo Op (prev $2.164 Tln, 96 Bids)

IMF

Cuts US 2022 GDP Growth Forecast To 2.3% VS June Est. 2.9%

Raises

2022 US Jobless-Rate Est. To 3.7% VS 3.2% In June

Cuts

US GDP, Raises Jobless Forecasts On Inflation Risks

·

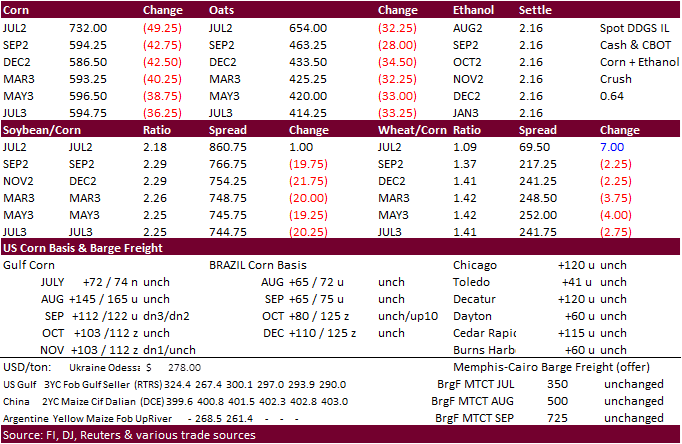

CBOT corn trended lower ahead of the USDA report and dropped thereafter after US producers realized we are in for a large crop. I except state yields to exceed USDA next month.

·

In this month’s China S&D update, the ministry made no changes to last month’s estimates on corn production, consumption or imports.

·

With US demand decreasing, look for prices to trend lower for the remainder of the summer.

·

South Korea’s MFG bought 68,000 tons of corn at $3333.75/ton c&f from either South Africa or South America for arrival around November 14.

Bloomberg

est.

September

corn is seen in a $5.50 and $7.50 range

December

corn is seen in a wide $5.00-$8.00 range