PDF Attached

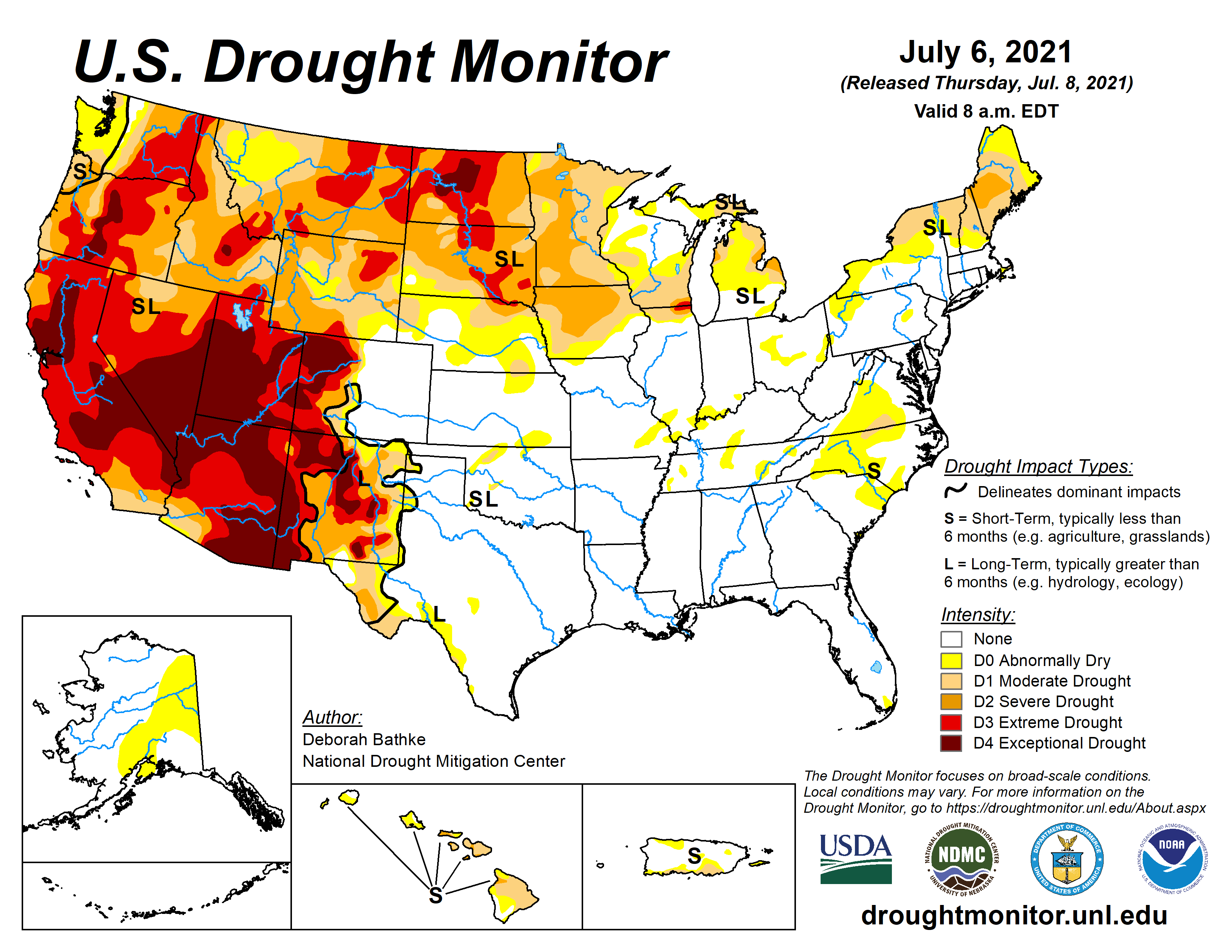

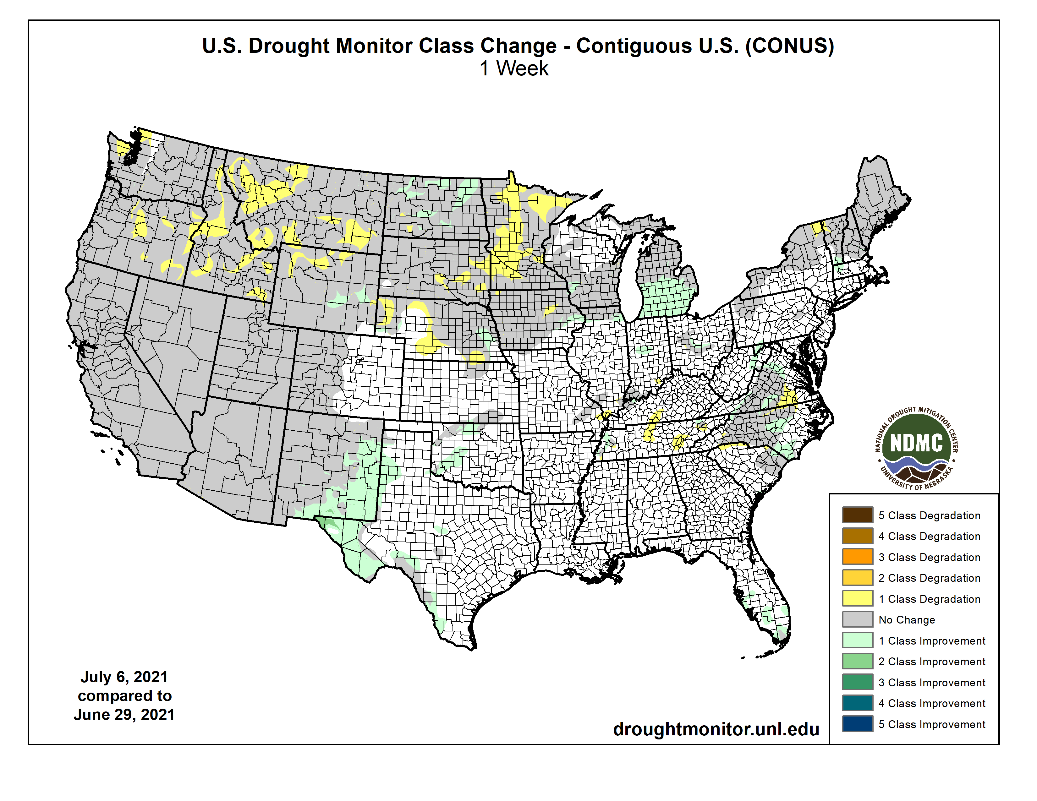

US weather looks wet and cool through the weekend for majority of the Midwest while record breaking temperatures that occurred late last month across the PNW could be tested this weekend into early next week. A ridge of high pressure is being advertised in the U.S. Plains during the second week of the two-week outlook. The southern US is expected to dry down during the 6-10 day which will facilitate winter wheat harvesting. 11-15 day still calls for drier conditions for the Great Plains and majority of the western Corn Belt.

The US Climate Prediction Center (CPC) predicted a 51% chance of El Niño neutral conditions for the northern hemisphere summer and fall, and the chance of La Niña potentially developing during the September-November season and lasting through the 2021-22 winter was at 66%.

Colorado State University increased the number of named tropical storms for the 2021 Atlantic hurricane season from 17 to 20.

1-7 DAY PRECIPITAION FORECAST

WORLD WEATHER INC.

MOST IMPORTANT WEATHER OF THE DAY

- Central and eastern U.S. Midwest crop conditions are still rated quite favorably with high yields expected

o Weather conditions over the next two weeks will not change these conditions leaving production potentials high

- Western U.S. Corn and Soybean production areas in the Midwest will benefit from periodic rainfall during the next seven days resulting in good support of crop development

o Some of the driest areas in Iowa and the Dakotas will get some needed relief with rain frequency rising enough in Iowa to induce some welcome improvements to topsoil moisture

o Rain frequency and amounts in the Dakotas and Minnesota will not be ideal, but enough rain will fall to offer “some” relief from recent dryness.

- Minnesota and northeastern South Dakota will likely receive the least frequent and least significant rain leaving concern over long term crop development

- U.S. Pacific Northwest and California will see no relief to drought over the next two weeks

- Monsoonal moisture from Mexico will bring frequent showers and thunderstorms to the southern half of the Rocky Mountain region and some crop areas in Arizona and New Mexico during the coming ten days

- Tropical Storm Elsa brought windy conditions and some heavy rainfall to northern Florida and then from there top the Carolina coast Wednesday and early today

o Rainfall of 2.00 to 4.73 inches resulted in some localized flooding

o Heavier rainfall occurred earlier this week in west-central Florida

o No excessive wind caused damage in agricultural areas

- Tropical Storm Elsa will continue to produce heavy rainfall in parts of the Carolinas and eastern Virginia today with 1.00 to 3.00 inches and local totals over 4.00 inches expected

o Elsa’s remnants will move northeast along the upper U.S. Atlantic Coast Friday before reaching Nova Scotia and Newfoundland, Canada during the weekend

o No crop damage is expected

- West Texas will experience a period of beneficial drying during the next ten days

o Some showers will pop up occasionally, but resulting rainfall is not likely to be great enough to counter evaporation

o Temperatures will be a little cooler than usual over the coming week which may raise some concerns, but as long as it turns warmer later this month and into August crops should develop well

- U.S. second week weather will be dominated by a returning high pressure ridge that will have its axis near the Front Range of the Rocky Mountains and in the High Plains region

o The ridge of high pressure will bring hotter conditions into the U.S. Plains possibly impacting a part of the northern Plains as well as the central and southwestern Plains in the July 15-22 period.

- Some of the heat will reach into the western fringes of the Corn Belt late this month

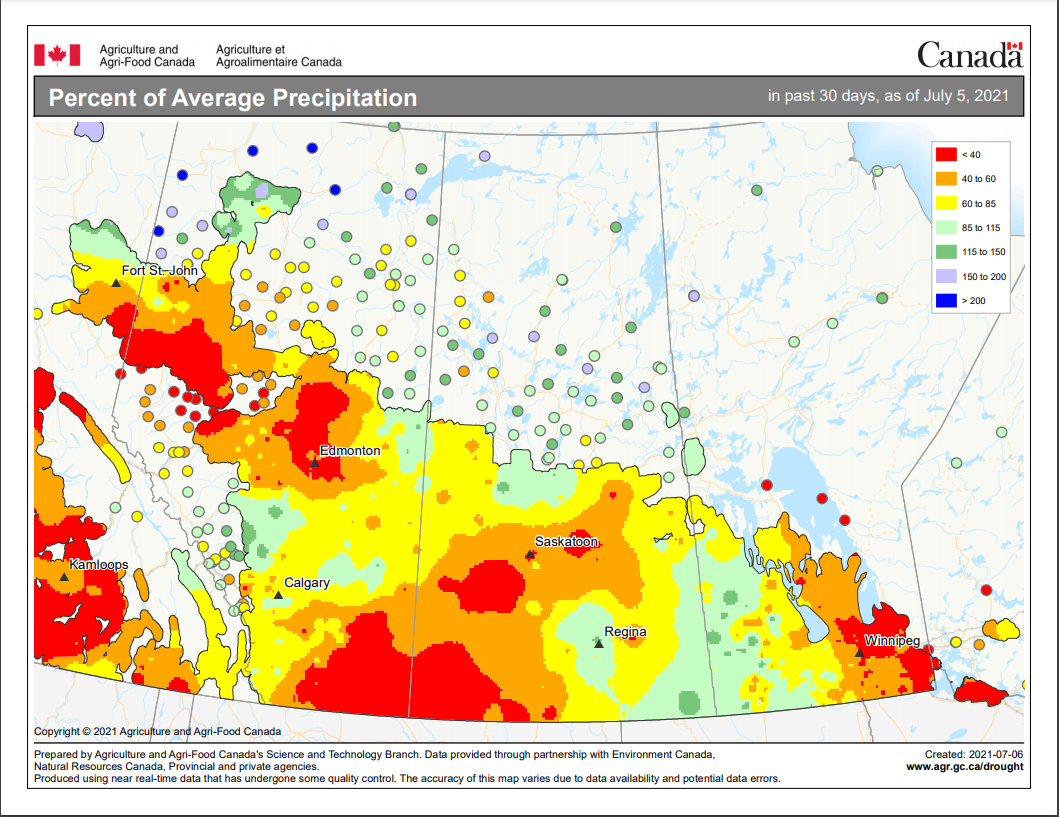

- Canada’s Prairies have seen some relief to dryness in southwestern Alberta and a few random other areas recently, but much more rain is needed in key production areas

o Dryness is most serious in southern Alberta and southwestern through central Saskatchewan as well as in a few Manitoba locations

- Rain in Canada’s Prairies during the coming week will be greatest in central and western Alberta and in some southern Saskatchewan locations

o A few random areas of beneficial moisture may also occur in parts of Manitoba, but the precipitation is not likely to be very great in very many locations

- Southeast Canada will receive sufficient rainfall to induce abundant soil moisture in a part of Ontario during the coming week to ten days

o Some flooding will be possible

- Mexico rainfall will be greatest in the west, central and north, but not the northeast

o Crop and soil moisture will slowly improve

- Rain has begun to fall significantly in northern parts of Kazakhstan and some neighboring areas of Russia’s New Lands

o Temporary improvements to spring wheat, sunseed and other crops will result as this pattern prevails over the coming week

o Drying will resume in the July 16-22 period, although temperatures will not be excessively warm

- Interior western Russia, including the Volga Basin, will receive very little rain over the coming week

o Dry conditions will also impact eastern portions of Russia’s Southern Region and in far western Kazakhstan

o Temperatures will be warmer than usual this week which will accelerate the region’s drying trend while raising the potential for some crop stress

- Brazil and Argentina precipitation Wednesday was minimal

- Argentina will receive some rain periodically over the coming ten days which should benefit winter wheat and barley establishment

o The precipitation will be greatest next week

- Brazil will be dry this week and will receive rain in the far south during mid- to late-week next week ahead of cooler temperatures

- Brazil grain, sugarcane, coffee and citrus areas are not vulnerable to any threatening cold temperatures for at least the next ten days.

- Europe will experience periodic rain from eastern France and the U.K. to Scandinavia, Poland, Austria and northern Italy during the coming ten days

o Net drying is expected in portions of the interior Balkans region

- Some welcome rain will fall in a few of the drier areas of the Balkan Counties periodically over the next two weeks, but the greatest rain is at least a full week away

- China remains plenty wet if not a little too wet in some areas

o Wednesday’s rainfall was greatest in local areas in the northern Yangtze River Basin and in a few random locations in Hebei, Shandong and the far northeastern corner of the nation.

- Much of China will receive frequent rainfall over the next two weeks raising the need for drying in many areas.

o Additional flooding is expected

o Rain amounts this week will be lighter than usual in Hunan, southeastern Guizhou, Jiangxi, Guangxi, Guangdong and Fujian raising the need for rain soon

- Week two precipitation is advertised to be much greater once again in these provinces providing timely relief from dryness

- Xinjiang, China weather Wednesday was dry and seasonably warm to hot

o Highest temperatures were in the 90s to near 100 Fahrenheit

- Low temperatures were in the 60s and lower 70s

- Xinjiang weather will continue good for the next few days, but some thunderstorms are expected late this weekend and especially early next week in northeastern parts of the region

o Seasonably warm temperatures will continue all of this week

- Northern India will be dry through the end of this workweek and then rain will develop during the weekend and continue to expand across the north next week

o The rain will be extremely important to the north where it has been quite dry recently.

o Temperatures will be warm in the north and seasonable in the south.

- A tropical depression in the East China Sea moved into northeastern Vietnam Wednesday and will produce some additional heavy rain today

o The storm will not induce any damage to crops or property

- North Africa has been and will continue to be mostly dry supporting late season winter crop harvesting

- Australia weather will continue well mixed over the next two weeks supporting improved winter crop establishment

o Rain is needed in northwestern Victoria and South Australia

- Thailand, Cambodia and Vietnam started to receive needed rain Wednesday and they will experience greater over the coming week

o A general improvement in crop conditions, soil moisture and eventually the water supply is expected

- Thailand, corn, rice, sugarcane and other crops were becoming stressed because of dryness recently. The same may have been occurring in some Cambodia and Vietnam locations

- Indonesia and Malaysia rainfall is expected to be sufficient to maintain or improve soil moisture for all crops

- Philippines rainfall will slowly increase during the next two weeks which should be welcome initially

- West Africa rainfall from Ivory Coast and Ghana to Cameroon and Nigeria will be lighter than usual during the coming ten days, but timely rainfall will maintain favorable crop conditions

o Ivory Coast and Ghana will experience the least rainfall and have the greatest increase in rainfall needs over the next two weeks

- Erratic rainfall has been and will continue to fall from Uganda and Kenya into parts of Ethiopia

o A boost in precipitation is needed and expected

- Ethiopia rainfall is expected to gradually improve while a boost in precipitation will continue needed in other areas

- South Africa will experience additional showers in the far west periodically this week

o The moisture will be good for winter crops, but more moisture will be needed in Free State and other eastern wheat production areas

o Summer crop harvesting has advanced well this year and the planting of winter grains has also gone well, but there is need for moisture in eastern winter crop areas

- Nicaragua and Honduras have been and will continue to receive some welcome rain recently, but moisture deficits are continuing in some areas

o Additional improvement is needed and may come slowly

- Southern Oscillation Index is mostly neutral at +6.38 and the index is expected to continue rising for a few more days

- New Zealand rainfall during the coming week to ten days will be erratic and lighter than usual while temperatures are near to slightly below average

Source: World Weather, Inc.

Bloomberg Ag Calendar

Thursday, July 8:

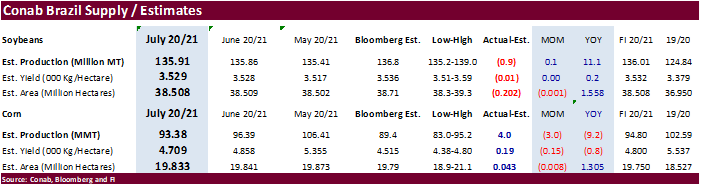

- Brazil’s Conab releases data on yield, area and output of corn and soybeans

- FAO World Food Price Index

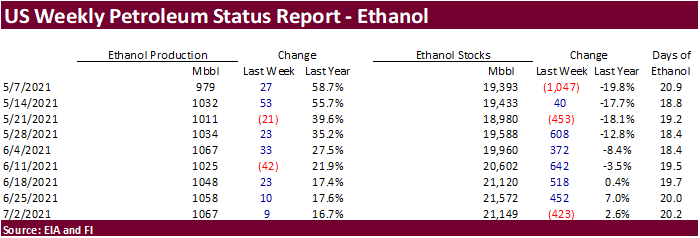

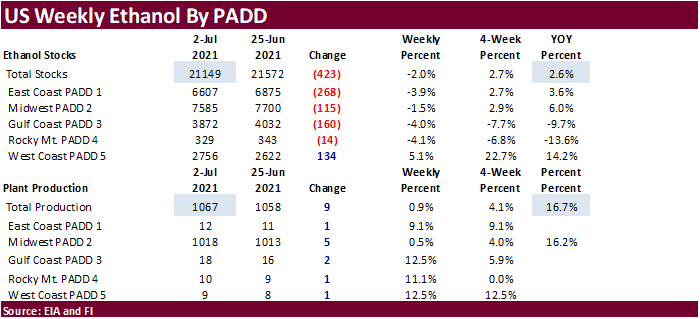

- EIA weekly U.S. ethanol inventories, production

- Brazil Coffee Council Conference, Sao Paulo

- Port of Rouen data on French grain exports

- EARNINGS: Suedzucker, Agrana

Friday, July 9:

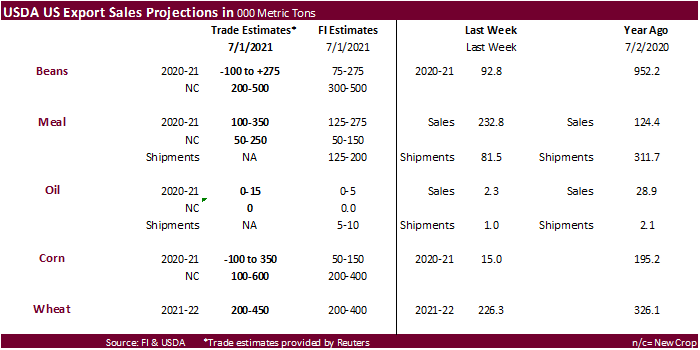

- USDA weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am

- ICE Futures Europe weekly commitments of traders report (6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly update on crop conditions

Source: Bloomberg and FI

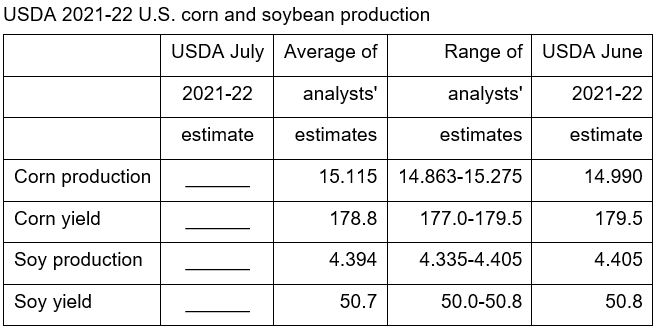

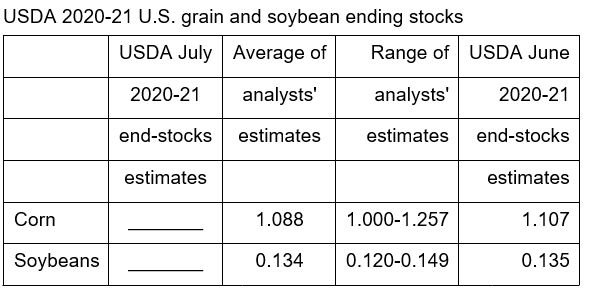

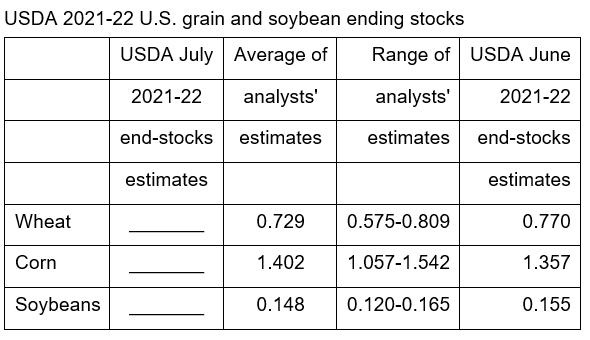

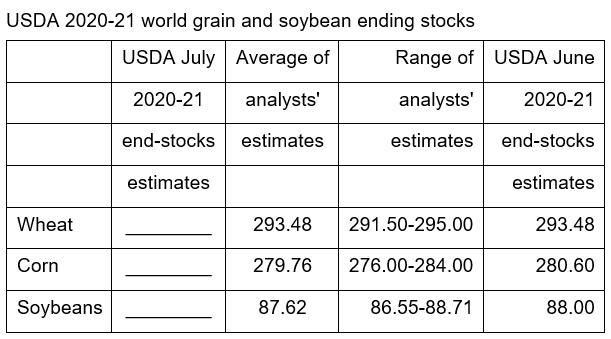

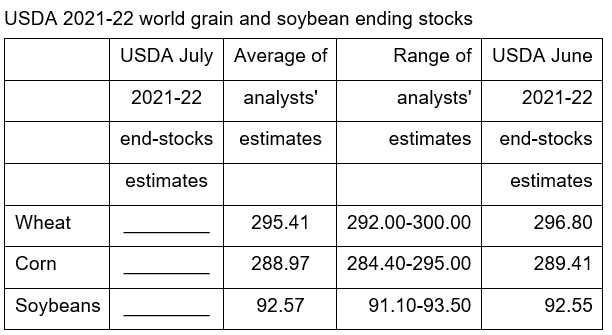

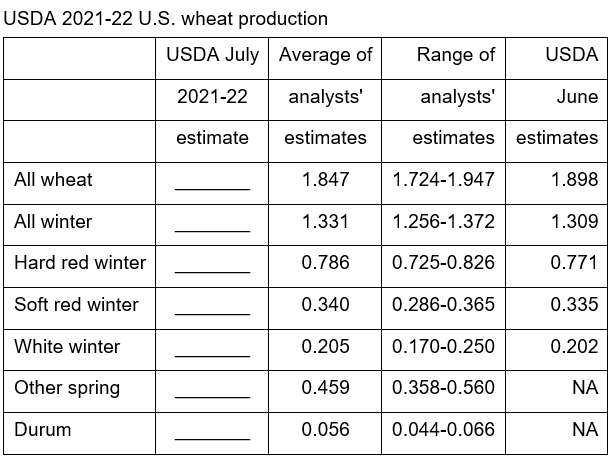

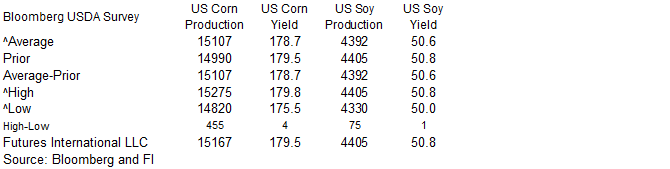

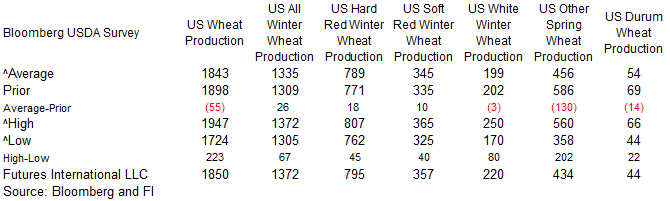

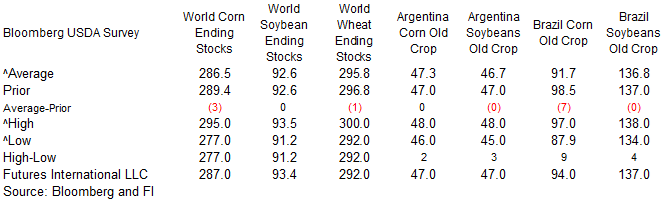

Reuters estimates for USDA

US Initial Jobless Claims Jul 3: 373K (est 350K; prevR 371K; prev 364K)

US Continuing Claims Jun 26: 3339K (est 3350K; prevR 3484K; prev 3469K)

US EIA Natural Gas Storage Change (BCF) 02-Jul: +16 (est +27; prev +76)

– EIA-US EAST NATGAS STOCKS +8 BCF

– EIA-US MIDWEST NATGAS STOCKS +15 BCF

– EIA-US PACIFIC NATGAS STOCKS +2 BCF

– EIA-US SOUTH CENTRAL NATGAS STOCKS -14 BCF

– EIA-US SALT DOME CAVERN NATGAS STOCKS -10 BCF

-US DoE Crude Oil Inventories Jul 2 : -6866K (est -4000K; prev -6718K)

-US DoE Cushing OK Crude Inventory Jul 2: -614K (prev -1460K)

-US DoE Gasoline Inventories Jul 2: -6075K (est -1750K; prev 1522K)

-US DoE Distillate Inventories Jul 2: 1616K (est 150K; prev 869K)

-US DoE Refinery Utilization Jul 2: -0.70% (est 0.40%; prev 0.70%)

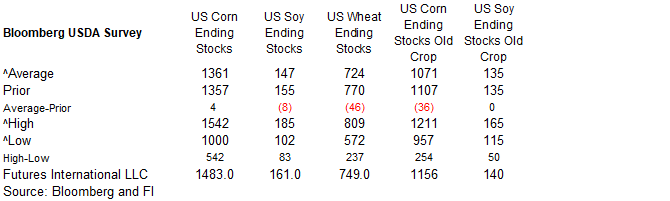

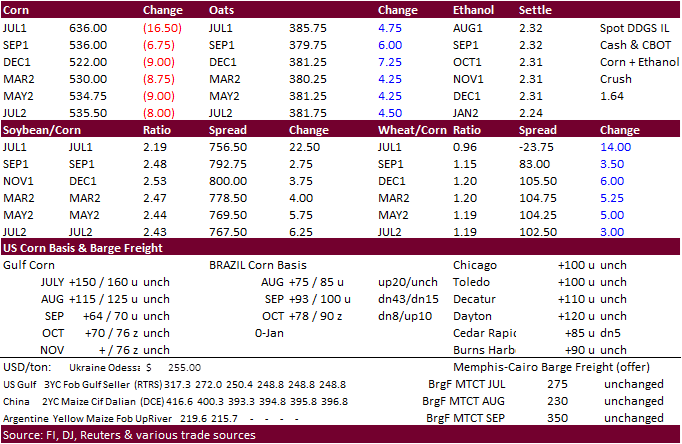

- US corn futures ended lower on mild temps and increased precipitation in the forecasts. The bearish Conab report.

- The short-term US weather outlook calling for cool and wet conditions for the majority of the Corn Belt before drier weather sinks in later this month.

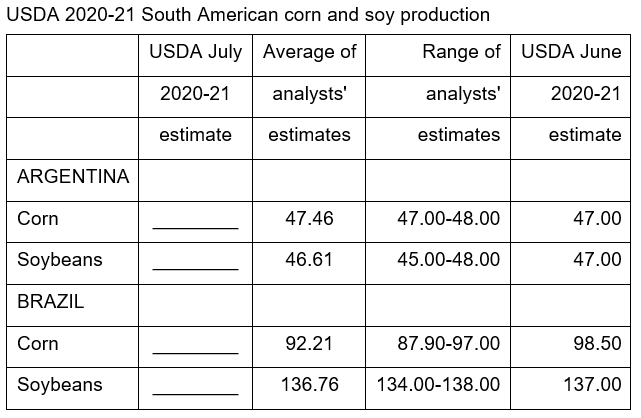

- Conab reported a 3 million ton decrease in the Brazil corn crop to 93.38 million tons, 4 million above a Bloomberg survey. Production is 9.2 million tons below a year ago.

- US Weekly Crude Oil Production last week rose to 11.3mln bpd, the highest since May 2020 – RTRS

- Weekly ethanol production matched the season high of 1.067 million barrels for the week ending July 2. It was up 9,000 barrels while the trade was looking for a 3,000-barrel reduction. Stocks decreased by 423,000 barrels and are down for the first time since May 21.

- Funds were an estimated net seller of 8,000 corn futures.

- Argentine corn harvest at 56%complete according to the BA Exchange’s weekly crop report. This is progressing slowly and cites the wet weather as the reason.

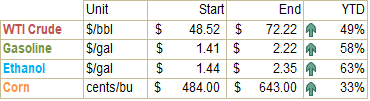

Year to date performance

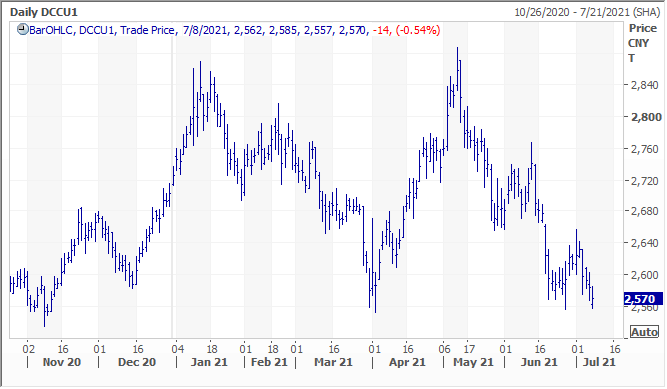

China September corn nearing recent lows

Export developments.

- China plans to auction more than 130,000 tons of imported corn from the United States and Ukraine on July 9 (Sinograin). 123,954 US & 6,340 Ukraine.

- Turkey seeks 440,000 tons of feed barley on July 12 for shipment between July 29 and August 16.

Updated 07/01/21

September corn is seen is a$4.50-$6.25 range.

December corn is seen in a $4.25-$6.00 range.

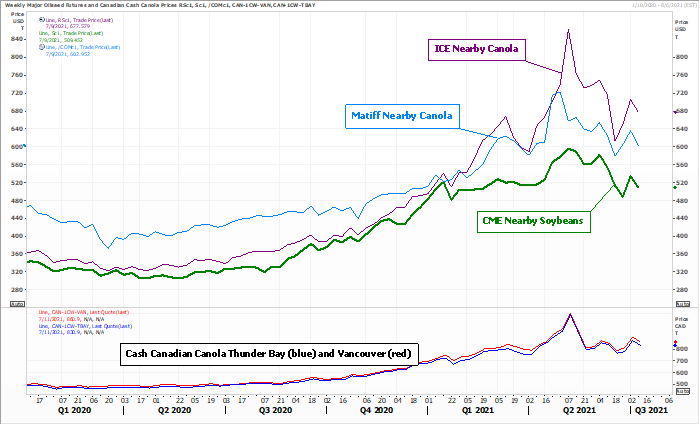

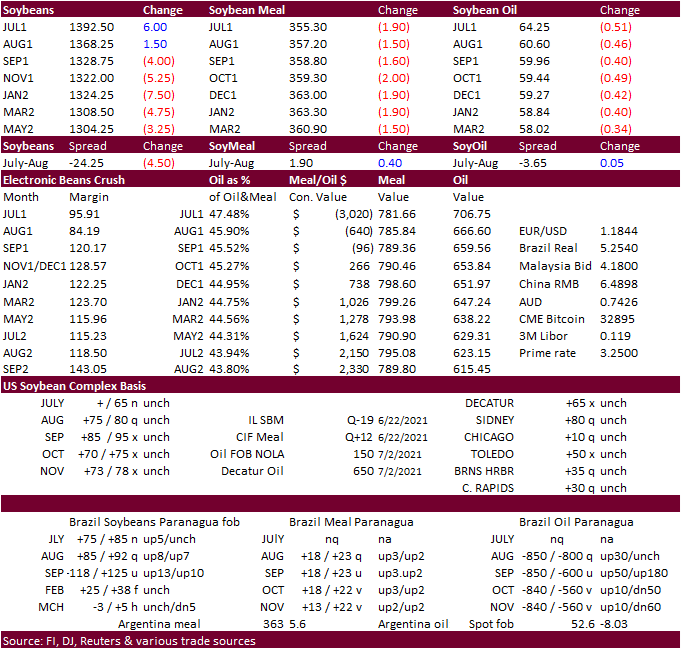

- The US soybean complex is ended lower following corn and the bearish weather. Conab reported a neutral Brazil soybean production estimate.

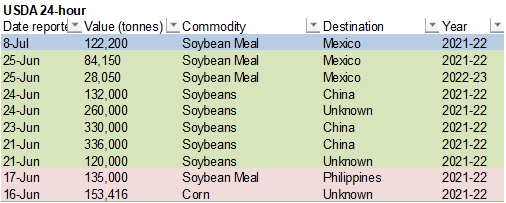

- USDA this morning announced 122,200 tons of new-crop soybean meal was sold to Mexico under the 24-hour announcement system.

- Conab reported a 100,000 ton increase in the Brazil soybean production to from the previous month to 135.91 million tons, 900,000 tons below a Bloomberg survey. Production is up 11.1 million tons from a year ago.

- Argentina is on holiday Friday.

- India’s oil secretary announced they plan to introduce 20% ethanol blend by 2023. It stands at 9.3% and expected to rise to 10% next year.

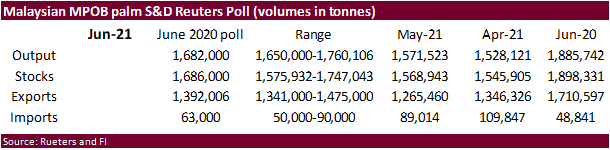

- Malaysian palm oil fell for the third consecutive day with September down 26MYR to 3771. Cash was up $2.50/ton to $982.50/ton.

- Funds were an estimated net seller of 4,000 soybean futures contracts, 2,000 net soymeal contracts, and 2,000 net bean oil contracts.

Due out Monday:

Soybeans vs. Canada canola and EU Canola

- WASHINGTON, July 8, 2021—Private exporters reported to the U.S. Department of Agriculture export sales of 122,200 metric tons of soybean cake and meal for delivery to Mexico during the 2021/2022 marketing year.

Updated 6/30/21

August soybeans are seen in a $12.75-$15.00 range; November $11.75-$15.00

August soybean meal – $330-$410; December $320-$425

August soybean oil – 60-66; December 46-67 cent range

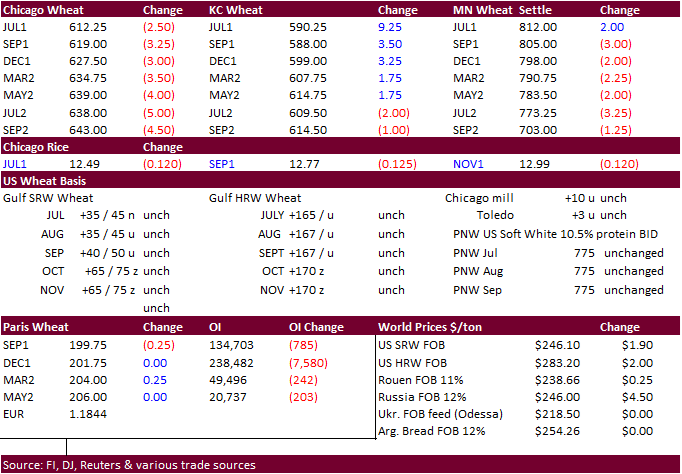

- US wheat closed lower following corn and soybeans. The favorable weather in the Southern Plains should allow for harvest to pick up the pace. The wet weather in the WCB and Northern Plains is helping the corn and beans, but maybe too late to help out the poorly rated spring what crop.

- FOA world food prices fell during the month of June from May, first time in a year led by a decline in vegetable oil (down 9.8%), cereal, and dairy prices. June price index averaged 124.6 points versus a revised 127.8 in May.

- Note for the month of May the FOA world food price index of 127.8 was the highest since May 2011.

- September Paris wheat was down 0.25 euro at 199.75/ton.

- The Euro rebounded rebounding from a 3-month low hit earlier this week against the USD earlier.

- Funds were an estimated net seller of 2,000 wheat futures contracts.

- Pakistan’s TCP seeks 500,000 tons of wheat on July 27. 200,000 tons are for August shipment, and 300,000 tons are for September shipment.

- Thailand may have bought 65,000 tons ($281) out of 230,700 tons sought, of animal feed wheat for Aug-Sep shipment.

- Results awaited: Algeria seeks 50,000 tons of milling wheat on July 8 for July shipment, valid until July 9.

- The Philippines seek up to 200,000 tons of feed wheat and milling wheat on Thursday, July 8. It includes 150,000 tons of feed wheat and 50,000 tons of milling wheat, all optional origin, for September, October and November shipment.

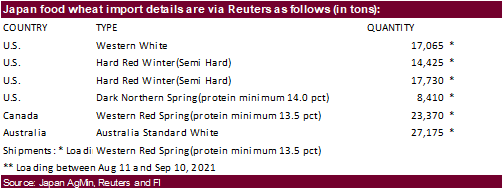

- Japan’s AgMin bought 108,175 tons of food-quality wheat from the United States, Canada and Australia in a regular tender.

- Saudi Arabia’s SAGO seeks 360,000 tons of wheat on July 12, split between hard wheat 12.5 percent protein and soft wheat 11% protein, for October shipment.

- Japan seeks 80,000 tons of feed wheat and 100,000 tons of barley on July 14.

- Bangladesh’s seeks 50,000 tons of milling wheat on July 15.

- Bangladesh’s seeks 50,000 tons of milling wheat on July 18.

- Ethiopia seeks 400,000 tons of wheat on July 19.

Rice/Other

- South Korea seeks 91,216 tons of rice from China, the United States and Vietnam for arrival in South Korea between Oct. 31, 2021, and April 30, 2022.

- Bangladesh seeks 50,000 tons of rice on July 18, not on the July. They delayed it.

Updated 6/30/21

September Chicago wheat is seen in a $5.90-$7.00 range

September KC wheat is seen in a $5.60-$6.70

September MN wheat is seen in a $7.50-$9.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.