PDF Attached

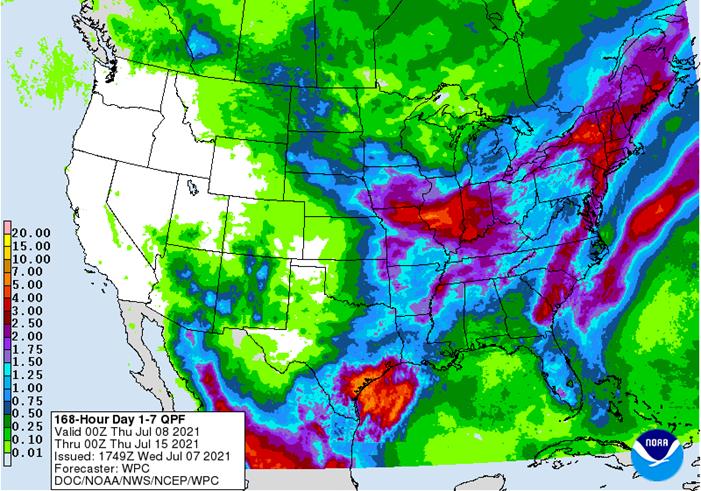

1-7

DAY

MOST

IMPORTANT WEATHER OF THE DAY

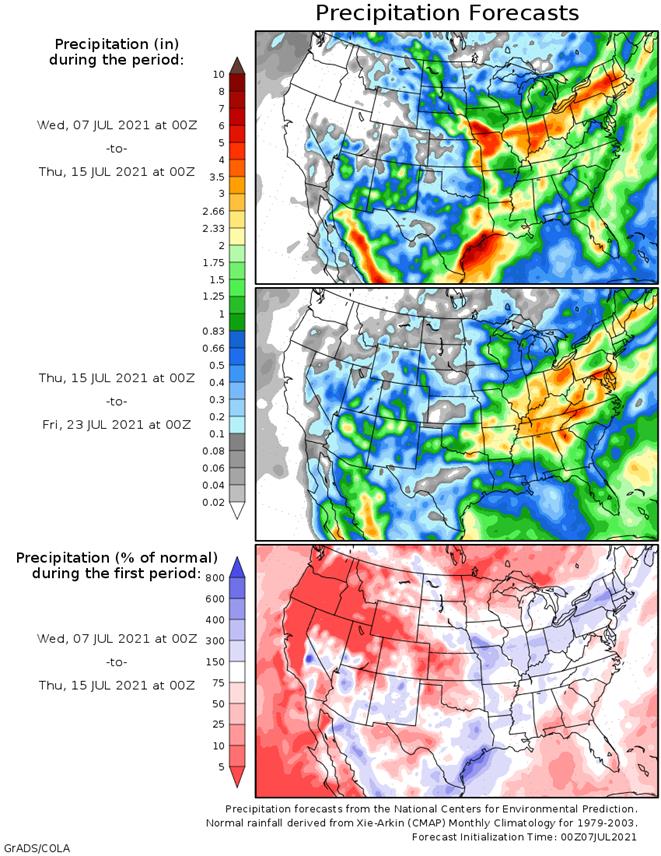

- Despite

the rumors, U.S. Midwest weather will remain mostly good in the central and east for the next ten days and probably for the next two weeks - Warming

and less rain is expected in the western Corn Belt during the second week of the forecast, July 15-22

o

The greatest warmth during that period will be in the Great Plains where highs in the 90s and over 100 will be possible

o

The stage may be setting up for a surge of warmer weather for the western Corn Belt in the last ten days of this month, but if that occurs it would be temporary with the ridge shifting back to the west soon after that period

- Sufficient

soil moisture and precipitation is expected to carry on normal crop development in the central and eastern U.S. Midwest corn and soybean production areas for much of July

o

Western Corn Belt will need to be closely monitored for a new period of net drying in the middle to latter part of this month

- The

northern Plains, upper Midwest and southern Canada Prairies will be the most persistent dry region – despite some rain in this first week of the outlook - Unsettled

weather through Friday of this week in southern Canada’s Prairies, the northern Plains and a part of the northwestern Corn Belt should bring some rain, but only temporary relief is expected

o

Greater rain will be needed to induce a more lasting improvement in soil moisture

o

Week two weather, July 15-22, will be trending drier and warmer once again which will reverse the improving trend from this first week of the outlook

- Some

greater rain is possible in the northern and far western Prairies during the period - Southern

U.S. Plains weather is expected to steadily improve over the next week to ten days

o

Less frequent and less significant rain is expected in West Texas where warmer temperatures and sunshine will help to stimulate aggressive crop development after recent rain of significance

- Tropical

Storm Elsa will move into northern Florida this morning and will trek to the northeast through southeastern Georgia, the Carolinas and eastern Virginia later today through Friday before following the upper Atlantic Coast to Nova Scotia and Newfoundland, Canada

this weekend

o

The storm will produce some strong wind, heavy rain and flooding, but the impact on agriculture is expected to be low

o

No other tropical cyclones or disturbances are likely in the Gulf of Mexico, Caribbean Sea or Atlantic Ocean through the next week and maybe ten days

- Drought

will continue in the U.S. Pacific Northwest where no rain is expected and very warm to hot temperatures are likely for another ten days – at least - Southwest

U.S. monsoon rainfall is expected to increase in the coming week to ten days in Arizona, New Mexico, Colorado and southern Utah - Mexico

rainfall will be greatest in the west, central and north, but no the northeast

o

Crop and soil moisture will slowly improve

- Additional

rain is expected in Alberta and portions of Saskatchewan, Canada through Friday and then in the western and northern Prairies next week supporting better crop development in each of those areas - Rain

is expected to fall significantly in northern parts of Kazakhstan and some neighboring areas of Russia’s New Lands

o

Temporary improvements to spring wheat, sunseed and other crops will result

- Interior

western Russia, including the Volga Basin, will receive very little rain over the coming week

o

Dry conditions will also impact eastern portions of Russia’s Southern Region and in far western Kazakhstan

o

Temperatures will be warmer than usual this week which will accelerate the region’s drying trend and raising the potential for some crop stress

- Brazil

and Argentina precipitation Tuesday was minimal - Argentina

will receive some rain periodically over the coming ten days which should benefit winter wheat and barley establishment

o

The precipitation will be greatest in the July 15-22 period

- Brazil

will be dry this week and will receive rain in the far south during mid- to late-week next week ahead of cooler temperatures - Brazil

grain, sugarcane, coffee and citrus areas are not vulnerable to any threatening cold temperatures for at least the next ten days.

- Europe

will experience periodic rain from France and the U.K. to Scandinavia, Poland, Austria and northern Italy during the coming ten days

o

Net drying is expected in portions of the interior Balkans region

- Some

welcome rain will fall in a few of the drier areas of the Balkan Counties periodically over the next two weeks, but the greatest rain is likely at full week away - China

remains plenty wet if not a little too wet in some areas

o

Tuesday’s rainfall was greatest from far eastern Sichuan to northern Jiangsu with 1.00 to more than 5.00 inches resulting

- Net

drying occurred in many other areas, although showers occurred near the south coast and the Northeast Provinces - All

of China will continue to receive frequent rainfall over the next two weeks raising the need for drying in many areas.

o

Additional flooding is expected

o

Rain amounts this week will be lighter than usual in Hunan, southeastern Guizhou, Guangxi, Guangdong and Fujian raising the need for rain soon

- Week

two precipitation is advertised to be much greater once again in these provinces providing timely relief from dryness - Xinjiang,

China weather Tuesday was dry and seasonably warm to hot

o

Highest temperatures were in the 90s to near 100 Fahrenheit

- Low

temperatures were in the 60s and lower 70s - Xinjiang

weather will continue good for the next few days, but some thunderstorms are expected late this week and especially during the weekend in northeastern parts of the region

o

Seasonably warm temperatures will continue all of this week

- Northern

India will be dry through the end of this workweek and then rain will develop during the weekend and continue to expand across the north next week

o

The rain will be extremely important to the north where it has been quite dry recently.

o

Temperatures will be warm in the north and seasonable in the south.

- Tropical

Depression 07W formed during the weekend in the Philippines Sea moved into Fujian China early today producing some heavy rain in the province and neighboring areas - A

tropical depression in the East China Sea will move into northeastern Vietnam late today and Thursday

o

Heavy rain will result, but the storm will not have time to become a significant tropical cyclone producing damaging wind or serious flooding

- Southeast

Canada corn, soybean and wheat conditions have improved greatly in recent weeks

o

A more erratic and lighter rainfall bias is expected over the next ten days and temperatures will be seasonably cool maintaining good crop development potential

- North

Africa has been and will continue to be mostly dry supporting late season winter crop harvesting

- Australia

weather will continue well mixed over the next two weeks supporting improved winter crop establishment

o

Rain is needed in northwestern Victoria and South Australia

- Thailand,

Cambodia and Vietnam will experience greater rain this week

o

A general improvement in crop conditions, soil moisture and eventually the water supply is expected

- Thailand,

corn, rice, sugarcane and other crops were becoming stressed because of dryness recently. The same may be occurring in some Cambodia and Vietnam locations - Indonesia

and Malaysia rainfall is expected to be sufficient to maintain or improve soil moisture for all crops - Philippines

rainfall will be lighter and more sporadic than usual during the coming week to ten days

- West

Africa rainfall from Ivory Coast and Ghana to Cameroon and Nigeria will be lighter than usual during the coming ten days, but timely rainfall will maintain favorable crop conditions

o

Ivory Coast and Ghana will experience the least rainfall and have the greatest increase in rainfall needs over the next two weeks

- Erratic

rainfall has been and will continue to fall from Uganda and Kenya into parts of Ethiopia

o

A boost in precipitation is needed and expected

- Ethiopia

rainfall is expected to gradually improve while a boost in precipitation will continue needed in other areas - South

Africa will experience additional showers in the far west periodically this week

o

The moisture will be good for winter crops, but more moisture will be needed in Free State and other eastern wheat production areas

o

Summer crop harvesting has advanced well this year and the planting of winter grains has also gone well, but there is need for moisture in eastern winter crop areas

- Nicaragua

and Honduras have been and will continue to receive some welcome rain recently, but moisture deficits are continuing in some areas

o

Additional improvement is needed and may come slowly

- Southern

Oscillation Index is mostly neutral at +5.65 and the index is expected to continue rising for a few more days - New

Zealand rainfall during the coming week to ten days will be erratic and lighter than usual in South Island and wetter biased in North Island

Source:

World Weather, Inc.

Bloomberg

Ag Calendar

Thursday,

July 8:

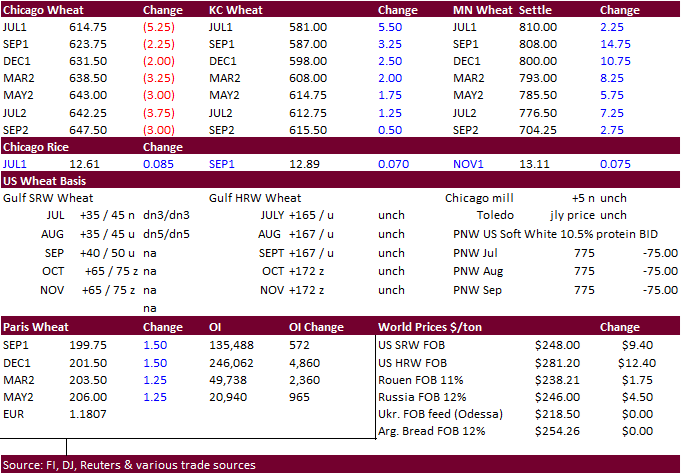

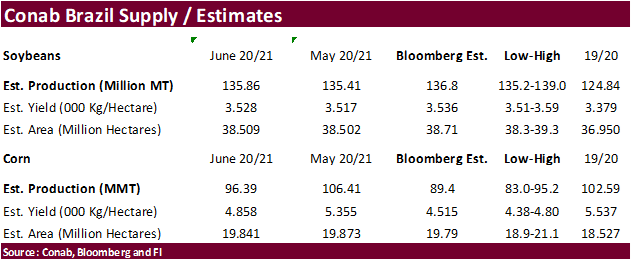

- Brazil’s

Conab releases data on yield, area and output of corn and soybeans - FAO

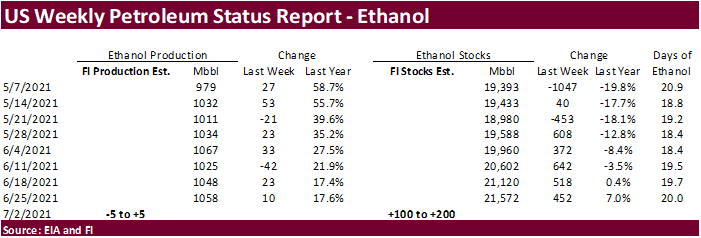

World Food Price Index - EIA

weekly U.S. ethanol inventories, production - Brazil

Coffee Council Conference, Sao Paulo - Port

of Rouen data on French grain exports - EARNINGS:

Suedzucker, Agrana

Friday,

July 9:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

US

JOLTS Job Openings May: 9209K (est 9325K; prev R 9193K)

65

Counterparties Take $785.72 Bln At Fed’s Fixed-Rate Reverse Repo (prev $772.581Bln, 66 Bidders)

EIA

US Crude Output To Fall 210,000 BPD To 11.10 Mln BPD In 2021 (Vs Fall Of 230K BPD Forecast Last Month)

–

US Petroleum Demand To Rise 1.04 Mln BPD To 20.68 Mln BPD In 2022 (Vs Rise Of 1 Mln BPD Previously Forecast)

–

US Petroleum Demand To Rise 1.52 Mln BPD To 19.64 Mln BPD In 2021 (Vs Rise Of 1.49 Mln BPD Previously Forecast)

–

US Crude Output To Rise 750K BPD To 11.85 Mln BPD In 2022 (Vs Rise Of 710K BPD Forecast Last Month)- Eia

*FOMC

Minutes: Fed Officials Continued to Debate Launching Standing Repo Facility

*FOMC

Minutes: Standing Repo Facility Drew Favorable Response From Officials

*FOMC

Minutes: Officials Tied Upside Inflation Surprise to Supply Related Issues

*FOMC

Minutes: Most Officials Expected Inflation Jump to Subside

*FOMC

Minutes: ‘Various’ Officials Expected Taper Conditions to Be Meet Earlier Than Expected

*FOMC

Minutes: Several Fed Officials Wanted Taper of MBS Buying Before Treasurys

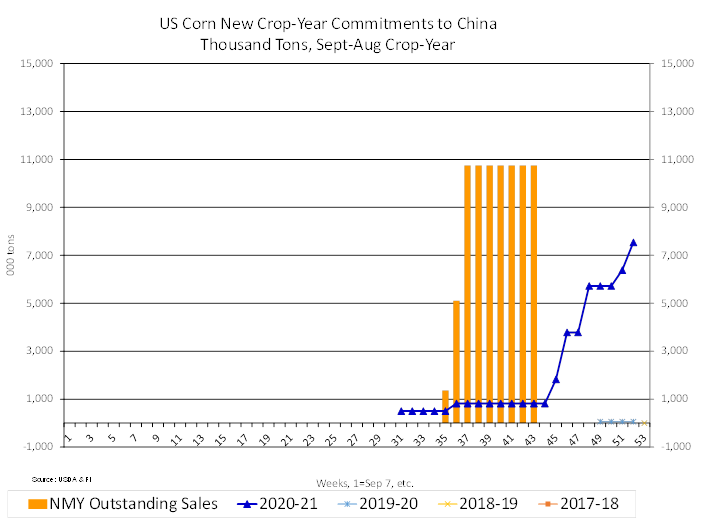

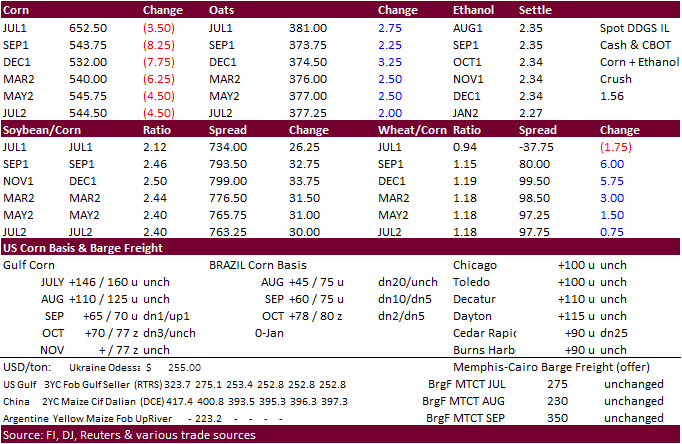

- US

corn futures

traded the day session mostly lower in the non-expiring months in part to stabilizing US corn conditions (unchanged from previous week). Soybean/corn spreading was noted. South Korea passed on corn. Some analysts think China peaked on buying corn from the

US and Ukraine. But later we heard there might be China interest for new-crop corn at around $5.25 December corn futures (6 cents away from that point). There was a good amount of December corn option interest today (mostly sell flow).

- Conab

is due out Thursday morning. A Bloomberg survey calls for 136.84 million tons for 2020-21 Brazil soybean production, up about 1MMT from the previous month and corn at 89.36 million, down 7MMT from June. If realized, soybean production would be 12 million

tons above year ago and corn down 13.2 million tons from 2020-21. - US

RIN prices have eased to around $1.44 (ethanol) from 1.54 this time last week.

- DTN:

Philippine pork imports rose six times from a year ago in April and May after the government cut import tariffs and increased allowed overseas purchases to stabilize supply and prices.

- The

latest crop ratings did prompt us to slightly lower our US spring, durum, corn and soybean crop yields. For the next report, USDA will release initial surveyed spring and durum production. August is the first survey for soybeans and corn, so we don’t see

USDA adjusting soy & corn yields in the July report, but adjust production based on the new harvested area.

Export

developments.

- Jordan

bought 60,000 tons of feed barley at $271.95/ton c&f for Nov/Dec 2021 shipment.

- South

Korea’s NOFI passed on 138,000 tons of corn and bought 65,000 tons of feed wheat at $286.39/ton c&f for arrival in November.

- Turkey

seeks 440,000 tons of feed barley on July 12 for shipment between July 29 and August 16.

- China

plans to auction more than 130,000 tons of imported corn from the United States and Ukraine on July 9 (Sinograin). 123,954 US & 6,340 Ukraine.

Updated

07/01/21

September

corn is seen is a$4.50-$6.25 range.

December

corn is seen in a $4.25-$6.00 range.

-

The

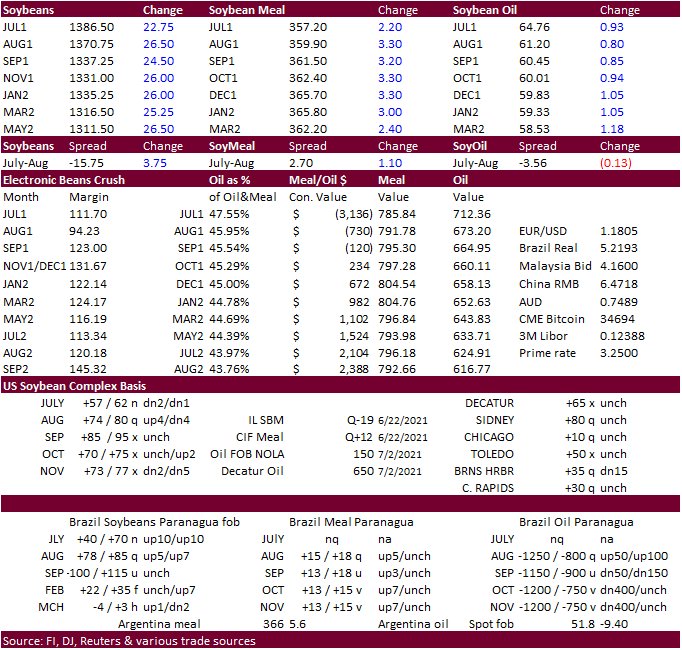

US soybean complex traded in a wide two-sided range. Canola,

soybeans and spring wheat bounced higher during the day session. Some might be looking at the longer-term weather models hinting a drier forecast for last half July for the Midwest.

Technical

buying and spreading against corn/wheat could have had some upward price influence for soybeans. There was talk the selling yesterday was overdone. Note some of the far western areas of the US Corn Belt missed out of rain from early Tuesday into Wednesday.

-

November

canola was up $19.50 to $790.90 per ton, and the November-January spread traded 3,617 times.

- Argentina

port workers went on strike again slowing loadings and shipments of key agriculture commodities. They are looking for higher salaries. Not all areas of Rosario were affected.

-

Abiove

estimated 2021 Brazil soybean exports at 86.7 million tons, up from 85.7 million previously. Stocks were lowered 1 million to 4.16 million and crush unchanged at 46.5 million tons. The group warned a 10 percent biodiesel mix could result in producers planting

less soybeans next season. They like to see it at 13%. -

We

think at current prices levels, Brazil producers are in the position to expand the planted area by 4-5%.

- Conab

is due out Thursday morning. A Bloomberg survey calls for 136.84 million tons for 2020-21 Brazil soybean production, up about 1MMT from the previous month and corn at 89.36 million, down 7MMT from June. If realized, soybean production would be 12 million

tons above year ago and corn down 13.2 million tons from 2020-21. -

Yesterday

it was reported Brazil June soybean exports fell to 11.112 million tons from 12.741 tons year earlier, and down about 26 percent from May, as China slows imports. Normally nearly three fourths of Brazil’s June soybean exports head to China, but last month

they accounted to 64 percent. -

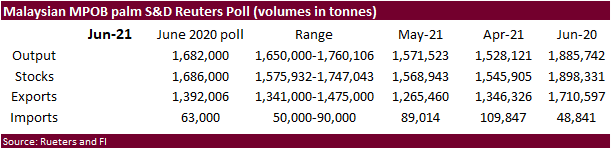

Malaysian

Palm Oil Association’s (MPOA’s) projected a 1.6% monthly rise in June palm production. This compares to a Reuters survey looking for a 7% increase, a supportive feature.

- None

reported

Updated

6/30/21

August

soybeans are seen in a $12.75-$15.00 range; November $11.75-$15.00

August

soybean meal – $330-$410; December $320-$425

August

soybean oil – 60-66; December 46-67 cent range

- US

wheat traded two-sided as well. US spring wheat was higher from a more than expected drop in US crop conditions and mixed forecasts for the far northern Great Plains and parts of the Canadian Prairies. Chicago wheat ended lower and KC unchanged to higher.

MN wheat was 5.75-14.75 cents higher. - North

Dakota wheat association mentioned some of the spring wheat crop could be abandoned and/or cut for hay. Yesterday’s crop conditions declined for the Dakota’s last week (2-3 points).

- Montana

spring crop conditions fell 14 points. USDA declared another 10 Montana counties under drought emergency, bringing the total to 26 out of the 56 in all.

- Agritel

sees the Russia wheat crop at 82.3 million tons, down 3 percent from last year, and up from their previous forecast of 78.1 million tons.

- The

association of German farmers reported Germany will harvest about 22.82 million tons of winter wheat in 2021, up 5% on the year. Rapeseed was expected to increase 6 percent to around 3.71 million tons.

- December

Paris milling wheat settled 1.75 euros higher, or 0.9%, at 201.75 euros ($238.02) a ton. Some traders noted buying after wheat hovered around the 200 level.

- The

Euro hit a 3-month low against the USD earlier.

- Algeria

seeks 50,000 tons of milling wheat on July 8 for July shipment, valid until July 9.

- Thailand

saw offers for 230,700 tons of animal feed wheat ($285-$287) for Aug-Sep shipment.

- South

Korea’s MFG bought 65,000 tons of feed wheat at $286.86/ton for Sep 20-Oct 10 shipment.

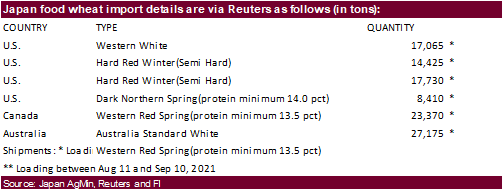

- Japan

seeks 80,000 tons of feed wheat and 100,000 tons of barley on July 14. - Japan’s

AgMin seeks 108,175 tons of food-quality wheat from the United States, Canada and Australia in a regular tender.

- Bangladesh’s

seeks 50,000 tons of milling wheat on July 15. - Bangladesh’s

seeks 50,000 tons of milling wheat on July 18.

- Ethiopia

seeks 400,000 tons of wheat on July 19.

Rice/Other

- Bangladesh

seeks 50,000 tons of rice from India.

Separately…

- Bangladesh

seeks 50,000 tons of rice on July 12.

Updated

6/30/21

September

Chicago wheat is seen in a $5.90-$7.00 range

September

KC wheat is seen in a $5.60-$6.70

September

MN wheat is seen in a $7.50-$9.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.