PDF Attached

https://www.cmegroup.com/trading/price-limits.html

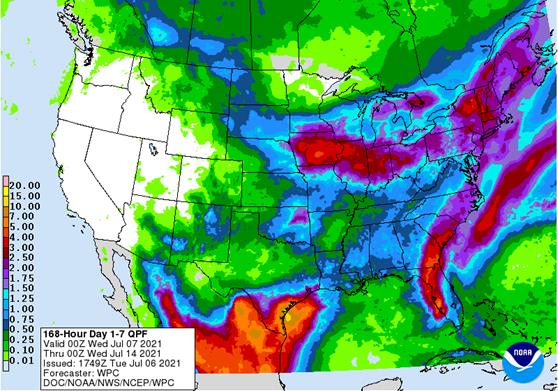

Sharply

lower close as the US will return to a normal summer weather pattern. Weekend rains for the US were as expected for majority of the crop areas and rain fell across the Dakota’s today.

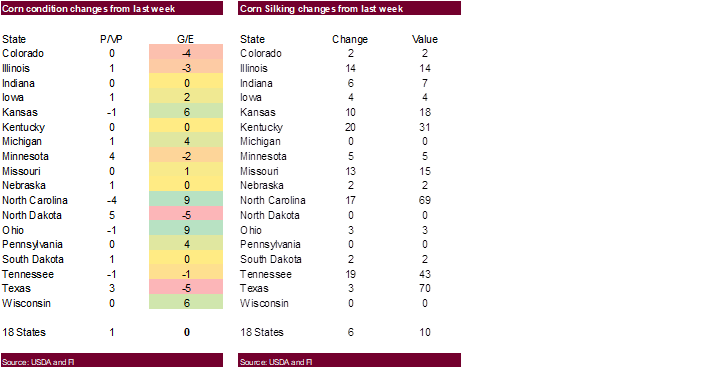

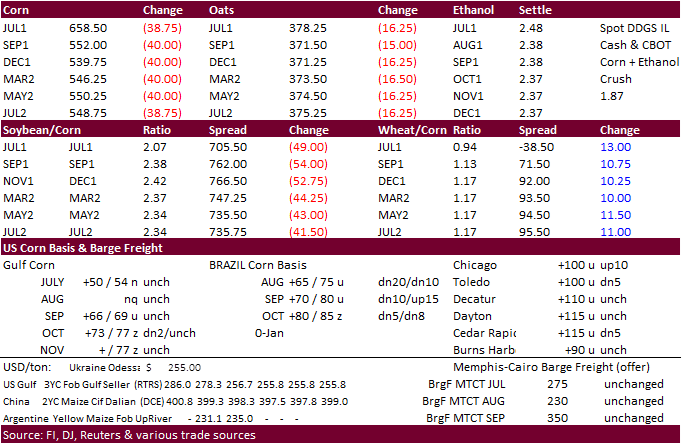

Corn

was limit lower. Synthetics as of around close

CU1

550.75 to 551

CZ1

538.25 to 538.75

CH2

546.5

More

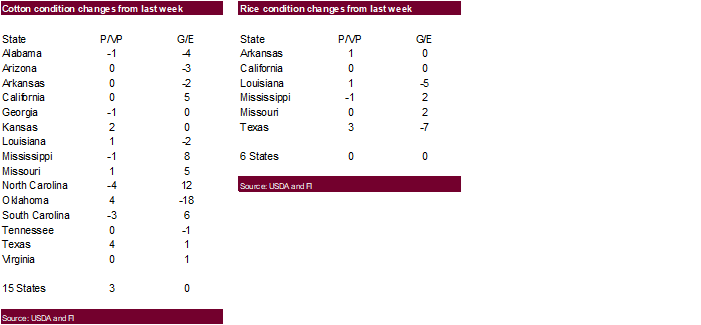

than expected drop in soybean, winter wheat and spring wheat conditions could provide a little support tonight but expect the trade to focus on upcoming rain events. We lowered our US soybean, corn and all-wheat yields. See attachments using updated USDA

harvested acres and our working yields.

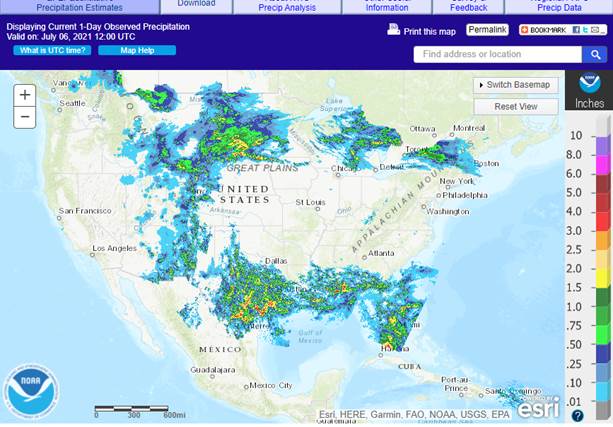

Weather

24-hours

MOST

IMPORTANT WEATHER OF THE DAY

- Weak

high pressure ridge over the western part of North America this week will also allow for some rain to fall in other parts of the southern Canada Prairies, the northern Plains, Minnesota and Iowa resulting in relief to those dry areas, as well

o

Rainfall this week will range from 0.50 to 1.50 inches with local totals of 2.00 to more than 3.00 inches possible.

- Iowa

and southeastern South Dakota should be among the wettest areas while totals in North Dakota and southern Saskatchewan will vary from 0.30 to 1.25 inches and locally more - Needed

rain fell in a part of southwestern Alberta during the weekend and two more waves of rain are expected in the same region bolstering topsoil moisture

o

Some local hail and flooding may impact the region

- Much

of the area impacted was from Nordegg through Red Deer to Hemruka, Alberta and then south through the Calgary area to Stavely, Alberta where rain totals varied from 0.60 to 1.57 inches with Leedale reporting 3.58 inches - The

area impacted was relatively small, but a generally important part of Alberta crop country - Spring

wheat and canola are produced the region among other crops

o

Additional rain will fall in this same region and immediate neighboring areas into Saturday offering additional rain to an area that had been previously advertised to be quite dry this month.

o

Most other rainfall in Alberta still avoided the driest areas in the south and that will continue

- Crop

improvements are expected in southwestern Alberta and in “some” areas from southern Saskatchewan to Iowa, Minnesota and South Dakota this week due to a couple of rounds of rain. The precipitation should bring relief to many dry spring wheat, sunseed, corn,

soybean, sugarbeet, canola and other crop areas, although some of the relief in North Dakota, Minnesota and Saskatchewan may only be temporary.

- Rain

is expected to fall significantly in northern parts of Kazakhstan and some neighboring areas of Russia’s New Lands

o

This precipitation coupled with that expected in southern Canada’s Prairies and the northern U.S. Plains will further re-enforce the bearish bias that may impact the commodity futures trade today

- Interior

western Russia, including the Volga Basin, will receive very little rain over the coming week

o

Dry conditions will also impact eastern portions of Russia’s Southern Region and in far western Kazakhstan

o

Temperatures will be warmer than usual this week which may accelerate the region’s drying trend and raising the potential for some crop stress

- U.S.

Midwest crop areas were mostly dry during the weekend with mild to warm temperatures

- Most

computer forecast models have suggested unsettled weather for Canada’s Prairies, the northern Plains and upper Midwest for as much as 10 days before ridge building occurs

o

The GFS Ensemble suggested ridge building would be under way by mid-week next week in the Rocky Mountains and Great Plains bringing less rain and warmer temperatures to the northern Plains and upper Midwest.

- An

unsettled weather pattern is also advertised for key U.S. Midwest, Delta and southeastern states grain and oilseed production areas during the next two weeks.

o

The outlook may continue bearish for the corn trade because of the implication that pollination would occur with a limited percentage of the Corn Belt too dry

- As

noted in a story released by World Weather, Inc. Friday afternoon, subsoil moisture is sufficient in the central and southeastern Midwest to carry corn and soybean development for two weeks without any rain and with seasonable to slightly cooler biased temperatures - Rain

is expected at one time or another over the next ten days in nearly all Midwestern crop areas which suggests subsoil moisture will be sufficient to carry crops for two weeks after the end of the ten day period – that translates to 24 days at which time most

of pollination should be completed except for the latest planted crops

o

Corn can still lose yield potential in a hot, dry, filling period in August, but the losses would not be nearly as great as they might have been had the moisture stress begun during pollination

o

Soybeans may have the greatest risk of production shortages if August and early September are hot and dry

- The

situation will continue to be closely monitored - Portions

of West Texas received significant rain again during the weekend.

o

The greatest amounts occurred in the southeastern and far western most crop areas in the region leaving some central and northeastern cotton, corn and sorghum areas with restricted precipitation and net drying

o

Conditions in West Texas are still very good and will improve with less rain, more sunshine and warmer temperatures over the coming ten days

- U.S.

temperatures this week will be warmer than usual in the western one-third of the nation and cooler than usual in the middle one third while near normal in the east

o

Similar temperatures are expected next week, although with some warming in the Plains during the second half of the week and into the following weekend

- Daily

highs in key crop areas east of the Rocky Mountains will be in the 70s and 80s through the weekend with a few lower 90s occasionally early this week and again during mid-week next week

- A

few highs will be limited to the upper 60s during mid-week in the north-central states and temperatures more solidly in the 90s are expected in the central Plains at times during mid-week this week and possibly again during mid-week next week - Brazil

and Argentina precipitation during the weekend was minimal - Argentina

will receive some rain periodically over the coming week which should benefit winter wheat and barley establishment - Brazil

will be dry this week and will receive rain in the far south during mid- to late-week next week ahead of cooler temperatures - Brazil

grain, sugarcane, coffee and citrus areas are not vulnerable to any threatening cold temperatures for at least the next ten days.

- Europe

will experience periodic rain from France and the U.K. to Scandinavia, Poland, Austria and northern Italy during the coming ten days

o

Net drying is expected in portions of the interior Balkans region

- Some

welcome rain will fall in a few of the drier areas of the Balkan Counties periodically over the next two weeks, but the greatest rain is likely at full week away - China

continued to receive frequent rainfall during the weekend, but it was erratic

o

Some very heavy rain occurred from Jiangxi into Jiangsu where extreme amounts since dawn Friday ranged from more than 7.00 inches to 21.25 inches resulting in some serious flooding

o

Rain also fell significantly enough to induce some flooding in northwestern Hunan to southeastern Guizhou and northeastern Guangxi

o

Pockets of isolated flooding also occurred from the Yellow River Valley into Heilongjiang and a few eastern Inner Mongolia locations.

o

Guangdong, Fujian, southern Hunan and a few other areas in the far south received minimal rainfall resulting in net drying

- All

of China will continue to receive frequent rainfall over the next two weeks raising the need for drying in many areas.

o

Additional flooding is expected

o

Rain amounts this week will be lighter than usual in Hunan, southeastern Guizhou, Guangxi, Guangdong and Fujian raising the need for rain soon

- Week

two precipitation is advertised to be much greater once again in these provinces providing timely relief from dryness - Xinjiang,

China weather during the weekend was dry and seasonably warm to hot

o

Highest temperatures were in the 90s Fahrenheit northeast and in the 90s to 100 Fahrenheit elsewhere

- This

was one of the most favorable weekends of weather seen in cotton and corn country in Xinjiang this summer - Xinjiang

weather will continue good for the next few days, but some thunderstorms are expected late this week and especially during the weekend in northeastern parts of the region

o

Seasonably warm temperatures will continue all of this week

- Northern

India will be dry through the end of this week and then rain will develop during the weekend and continue to expand across the north next week

o

The rain will be extremely important to the north where it has been quite dry recently.

o

Temperatures will be warm in the north and seasonable in the south.

- Tropical

Storm Elsa will move into the upper west coast of Florida’s Peninsula tonight and Wednesday with heavy rain from there through the Carolinas

o

Rainfall of 3.00 to 8.00 inches will occur from northern Florida through the eastern Carolinas where some flooding is expected

- Most

of the rain will not be more than 6.00 inches

o

Very little crop damage is expected from the storm, but flooding could hurt crops in low-lying areas

o

Citrus will not be harmed in most of Florida, but some minor fruit droppage in the north part of the state is possible

- The

key citrus areas will not be harmed

o

Cotton, peanut, corn and soybean crops will also be spared much damage from northern Florida to southeastern Virginia where not much wind is expected and the biggest risk will be brief flooding

- Tropical

Storm Elsa produced heavy rain in western Cuba Monday, but crop damage was suspected of being minimal in citrus and sugarcane areas - Tropical

Depression 07W formed during the weekend in the Philippines Sea moved into Fujian China early today producing some heavy rain in the province and neighboring areas - A

new tropical depression is forming in the East China Sea today and will move across Hainan, China tonight and early Wednesday before moving into northeastern Vietnam late Wednesday and Thursday

o

Heavy rain will result, but the storm will not have time to become a significant tropical cyclone producing damaging wind or serious flooding

- Southeast

Canada corn, soybean and wheat conditions have improved greatly in recent weeks

o

A more erratic and lighter rainfall bias is expected over the next ten days and temperatures will be seasonably cool maintaining good crop development potential

- North

Africa has been and will continue to be mostly dry supporting late season winter crop harvesting

- Australia

weather will continue well mixed over the next two weeks supporting improved winter crop establishment

o

Rain is needed in northwestern Victoria and South Australia

- Thailand,

Cambodia and Vietnam will experience greater rain this week

o

A general improvement in crop conditions, soil moisture and eventually the water supply is expected

- Thailand,

corn, rice, sugarcane and other crops were becoming stressed because of dryness recently. The same may be occurring in some Cambodia and Vietnam locations - Indonesia

and Malaysia rainfall is expected to be sufficient to maintain or improve soil moisture for all crops - Philippines

rainfall increased during the weekend with some heavy rain in southern Luzon island

o

More rain is needed throughout the nation and in particular the far north part of Luzon

- West

Africa rainfall from Ivory Coast and Ghana to Cameroon and Nigeria will be lighter than usual during the coming ten days, but timely rainfall will maintain favorable crop conditions - Erratic

rainfall has been and will continue to fall from Uganda and Kenya into parts of Ethiopia

o

A boost in precipitation is needed and expected

- Ethiopia

rainfall is expected to gradually improve while a boost in precipitation will continue needed in other areas - South

Africa will experience additional showers in the far west periodically this week

o

The moisture will be good for winter crops, but more moisture will be needed in Free State and other eastern wheat production areas

o

Summer crop harvesting has advanced well this year and the planting of winter grains has also gone well, but there is need for moisture in eastern winter crop areas

- Mexico

rainfall will be near to above average during the coming week improving soil moisture and crop production outlooks - Nicaragua

and Honduras have received some welcome rain recently, but moisture deficits are continuing in some areas

o

Additional improvement is needed and may come slowly

- Southern

Oscillation Index is mostly neutral at +4.64 and the index is expected to level off over the next few days.

- New

Zealand rainfall during the coming week to ten days will be erratic and mostly good for the nation.

Source:

World Weather, Inc.

Bloomberg

Ag Calendar

Tuesday,

July 6:

- CNGOIC

monthly report on Chinese grains & oilseeds - USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

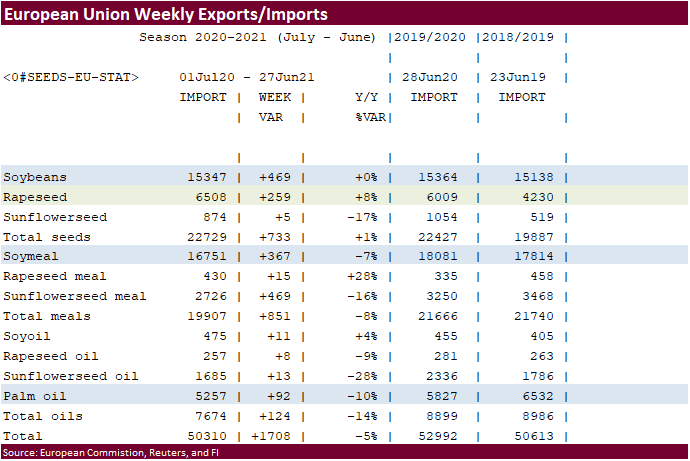

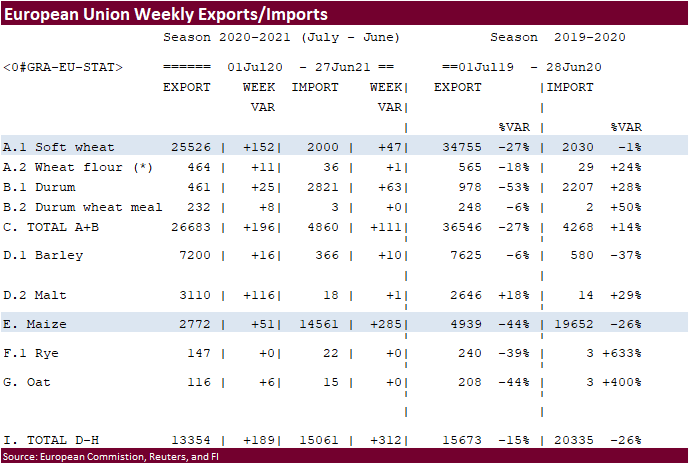

crop conditions — corn, cotton, soybeans, wheat, 4pm - EU

weekly grain, oilseed import and export data - Purdue

Agriculture Sentiment - New

Zealand global dairy trade auction

Wednesday,

July 7:

- No

major event scheduled

Thursday,

July 8:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Brazil’s

Conab releases data on yield, area and output of corn and soybeans - FAO

World Food Price Index - EIA

weekly U.S. ethanol inventories, production - Brazil

Coffee Council Conference, Sao Paulo - Port

of Rouen data on French grain exports - EARNINGS:

Suedzucker, Agrana

Friday,

July 9:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

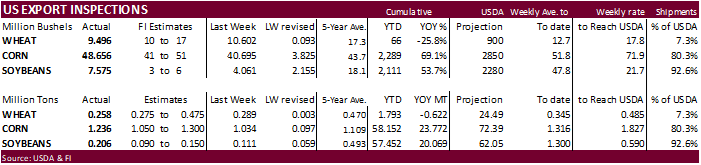

USDA

inspections versus Reuters trade range

Wheat

258,438 versus 275000-500000 range

Corn

1,235,931 versus 1000000-1500000 range

Soybeans

206,152 versus 90000-300000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING JUL 01, 2021

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 07/01/2021 06/24/2021 07/02/2020 TO DATE TO DATE

BARLEY

0 392 0 1,175 367

CORN

1,235,931 1,033,703 1,034,629 58,151,738 34,379,268

FLAXSEED

0 0 0 0 293

MIXED

0 0 0 0 0

OATS

100 0 100 100 400

RYE

0 0 0 0 0

SORGHUM

3,344 37,212 58,365 6,482,303 4,070,104

SOYBEANS

206,152 110,515 561,635 57,451,813 37,383,262

SUNFLOWER

0 0 0 240 0

WHEAT

258,438 288,548 413,895 1,792,539 2,414,848

Total

1,703,965 1,470,370 2,068,624 123,879,908 78,248,542

————————————————————————

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

US

ISM Services Index Jun: 60.1 (est 63.5; prev 64.0)

66

Counterparties Take $772.581 Bln At Fed’s Fixed-Rate Reverse Repo (prev $731.504 Bln, 69 Bidders)

RAISES

SOYBEAN FUTURES (S) MAINTENANCE MARGINS BY 2% TO $5,000 PER CONTRACT FROM $4,900 FOR AUGUST 2021

SAYS

INITIAL MARGIN RATES ARE 110% OF MAINTENANCE MARGIN RATES

SAYS

RATES WILL BE EFFECTIVE AFTER THE CLOSE OF BUSINESS ON JULY 7, 2021

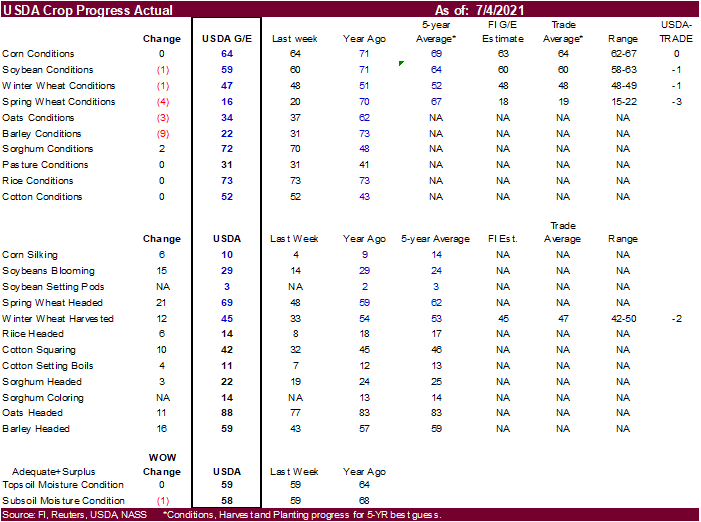

- US

corn futures

were limit lower shortly after the hard open after rains fell across key WCB growing areas. Today’s forecast called for more rain across the Dakota’s. The 1-7 day outlook is wetter than that of later last week. Some traders are eyeing

declining corn demand for the US and China. Summer ethanol sales, expanded under the Trump Administration, were rolled back last week by a federal appeals court.

- The

midday US weather update indicted a little less rainfall for the Midwest 1-5 day, drier Dakotas 6-10 day and drier and warmer conditions for the northern Plains 11-15 day. These model changes might have contributed to a rebound in corn synthetics around noon

CT. We will have to see if the evening models verify this. - CBOT

limits expand on Wednesday. - The

USD was sharply higher by midsession, up 35 points as of 10:20 am CT, before easing to 31 points at 2 pom CT.

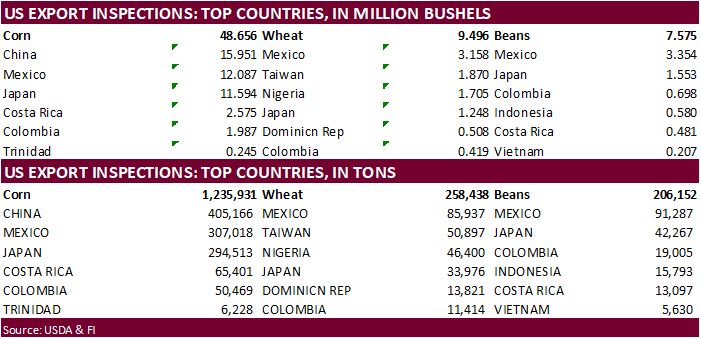

- USDA

US corn export inspections as of July 01, 2021 were 1,235,931 tons, within a range of trade expectations, above 1,033,703 tons previous week and compares to 1,034,629 tons year ago. Major countries included China for 405,166 tons, Mexico for 307,018 tons,

and Japan for 294,513 tons. - China

corn demand was lowered by two agencies over the past few days (Attaché and think tank), a bearish indication for corn. We may see USDA downward revise their China corn import forecast by some 4 million tons after reducing feed demand. This could prompt

USDA to lower new-crop US corn exports by 75 million bushels, which might be needed after the June Acreage report showed less than expected planted area.

- Back

to the think tank, China corn imports were left unchanged for this year and next year, at 28 and 20 million tons, respectively, but feed demand was cut for corn and sorghum.

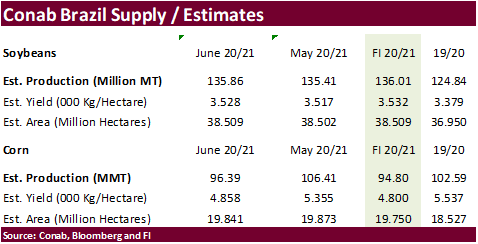

- Brazil’s

corn crop was estimated lower at 85.3MMT by AgRural. The second corn crop is about 13 percent harvested, below 23% year ago. Note USDA is at 98.5 million tons for the Brazil crop. About 49 percent of the winter crop has been sold, up from 42.7% June 7 and

well up from 20% year ago (17.9% 5-year average). - Late

last week a there was chatter Brazil could see corn export contracts “washed out” from shrinking production prospects.

Export

developments.

- Iran

bought corn and barley for Aug/Sep shipment. Original tender was for 60k each.

- Turkey

seeks 440,000 tons of feed barley on July 12 for shipment between July 29 and August 16.

- South

Korea’s FLC bought 65,000 tons of corn from the Black Sea region at $289.90/ton c&f. - China

plans to auction more than 130,000 tons of imported corn from the United States and Ukraine on July 9 (Sinograin). 123,954 US & 6,340 Ukraine.

Updated

07/01/21

September

corn is seen is a$4.50-$6.25 range.

December

corn is seen in a $4.25-$6.00 range.

-

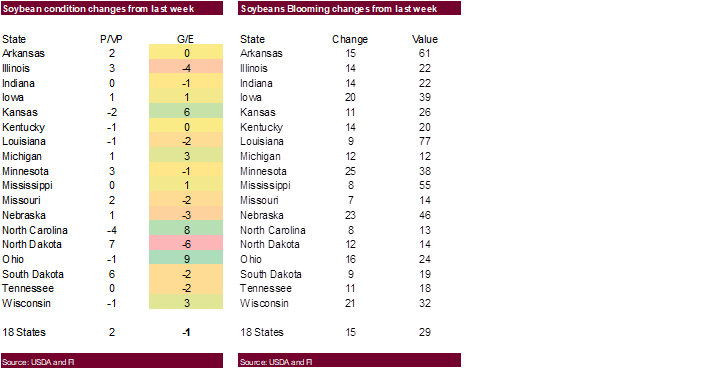

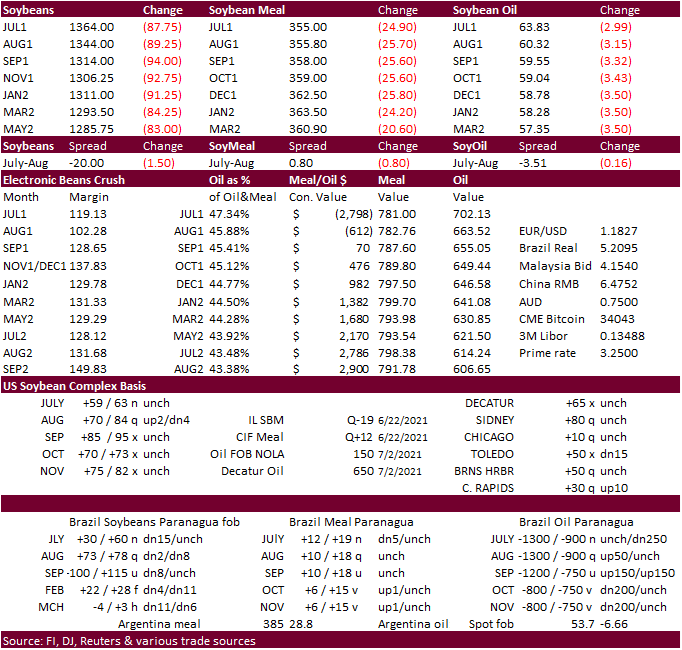

Soybeans

traded sharply lower after weekend rains fell across parts of the dry areas of the US WCB and Canadian canola country. The plunge in canola futures Monday into Tuesday added to the negative undertone. A slowdown in China soybean arrivals for the month of

June was also bearish. Products were also sharply lower. The selling may not be done for the balance of the week. We look for US soybean conditions to gradually improve over the next two weeks if it rains on and off across the majority of the US.

-

Limits

expand Wednesday for the soybean complex (SBO ended limit lower in at least three deferred contracts).

-

USDA

is due to update their S&D’s on July 12, but we look for minimal changes in the carryout. The 2020-21 US crush could be lowered 5 million bushels. We see no changes in the new-crop yield.

-

USDA

US soybean export inspections as of July 01, 2021 were 206,152 tons, within a range of trade expectations, above 110,515 tons previous week and compares to 561,635 tons year ago. Major countries included Mexico for 91,287 tons, Japan for 42,267 tons, and Colombia

for 19,005 tons. -

There

were rumors China bought US soybeans last week but there were no USDA announcements.

-

Brazil

June soybean exports fell to 11.112 million tons from 12.741 tons year earlier, and down about 26 percent from May, as China slows imports. Normally nearly three fourths of Brazil’s June soybean exports head to China, but last month they accounted to 64 percent.

-

Argentina

producers sold 23.7 million tons of soybeans this season, down from 26.3 million tons year ago.

Brazil’s

June selected commodity exports:

Commodity

June 2021 June 2020

CRUDE

OIL (TNS) 8,374,779 5,448,127

IRON

ORE (TNS) 33,679,523 30,018,846

SOYBEANS

(TNS) 11,118,713 12,741,608

CORN

(TNS) 92,169 312,210

GREEN

COFFEE(TNS) 174,239 141,557

SUGAR

(TNS) 2,750,338 2,714,111

BEEF

(TNS) 140,315 151,925

POULTRY

(TNS) 363,289 319,421

PULP

(TNS) 1,336,261 1,514,005

Source:

Reuters and AgriCensus

-

Keep

an eye out for the US biofuel RVO proposal announcement. Some think it will be out this week.

-

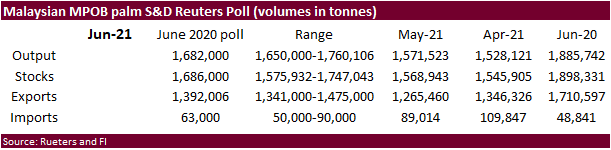

Malaysian

palm traded higher Monday but fell Tuesday ending a 5-day winning streak. India has been stepping up buying Indonesia palm oil after lowering import duties, but RBD cash prices have shot up about $35 per ton from the increased demand. RBD palm oil was around

$1,015 last week, but now $1,050 per ton.

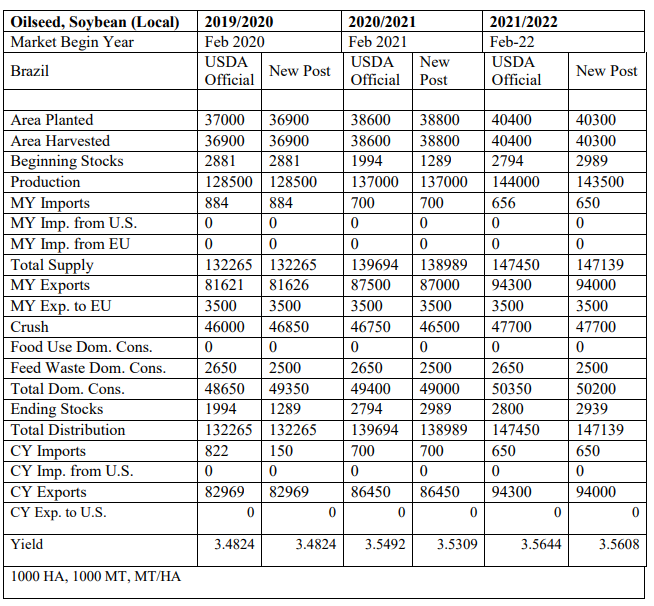

USDA

Attaché for Brazil oilseeds. 143.5MMT new-crop soybean production projected versus 137MMT this year. Exports 94MMT versus 87.0 to 87.5 seen for this year.

- South

Korea’s Agro-Fisheries & Food Trade Corp. bought around 15,600 tons of non-GMO soybeans for food use, at $844.64 and $738.69/ton c&f, for arrival between Aug 5 and Nov 30. - Turkey’s

TMO seeks440,000 tons of animal feed barley on July 12 for July and August shipment. - Iran

bought soybean meal for Aug/Sep shipment. They were in for 60k.

- Jordan

retendered for 120,000 tons of feed barley set to close July 7 for Nov/Dec 2021 shipment.

Updated

6/30/21

August

soybeans are seen in a $12.75-$15.00 range; November $11.75-$15.00

August

soybean meal – $330-$410; December $320-$425

August

soybean oil – 60-66; December 46-67 cent range

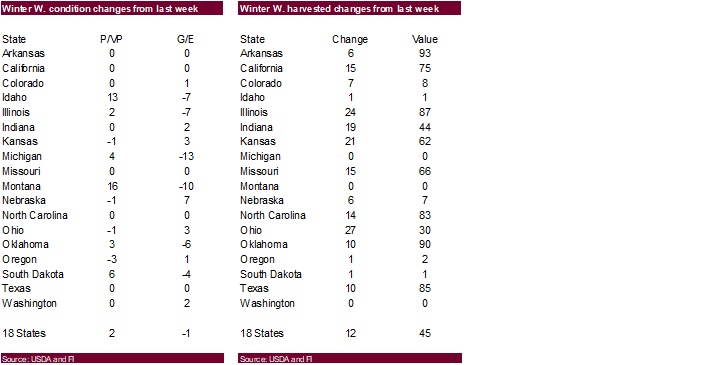

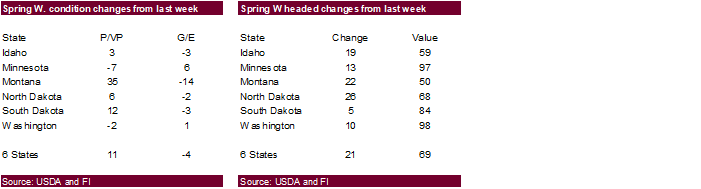

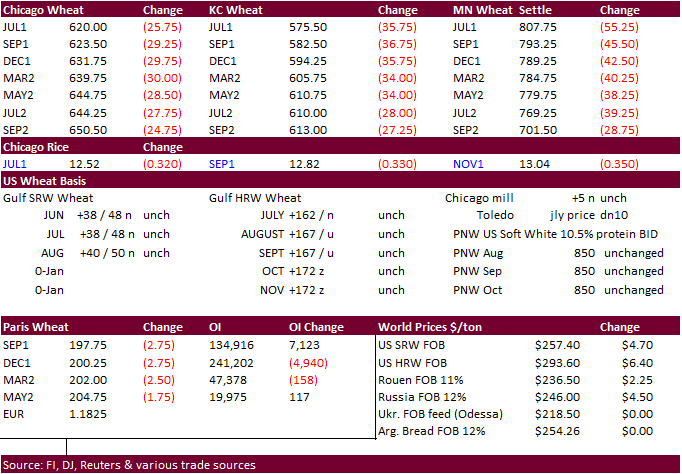

- US

wheat traded lower on improving North American weather. Northern Great Plains saw much needed rain over the weekend and the weather outlook is wetter for the Northern Plains and Canadian Prairies than that of last week.

- USDA

US all-wheat export inspections as of July 01, 2021 were 258,438 tons, below a range of trade expectations, below 288,548 tons previous week and compares to 413,895 tons year ago. Major countries included Mexico for 85,937 tons, Taiwan for 50,897 tons, and

Nigeria for 46,400 tons. - Several

import tenders were announced over the weekend. We expect more this week with the break in prices.

Algeria

announced one late today. - September

Paris milling wheat settled down 2.25 euros, or 1.1%, at 198.25 euros ($234.21) a ton, after earlier hitting a 3-month low at 196.25 euros.

- Egypt’s

GASC bought 240,000 tons of wheat for shipment Sept. 1-15. 180k was Romanian and 60k Russian.

- 60,000

tons of Russian wheat at $240.00 + $27.70 GTCS freight = $267.70 - 60,000

tons of Romanian wheat at $237.84 + $32.70 NNC freight = $270.54 - 60,000

tons of Romanian wheat at $237.84 + $32.70 NNC freight = $270.54 - 60,000

tons of Romanian wheat $237.84 + $32.70 NNC freight = $270.54

- Jordan

bought 60,000 tons of wheat for Jan/Feb 2022 shipment at $279.95/ton.

- Algeria

seeks 50,000 tons of milling wheat on July 9 for July shipment. - Thailand

seeks up to 230,700 tons of animal feed wheat on July 7 for Aug-Sep shipment.

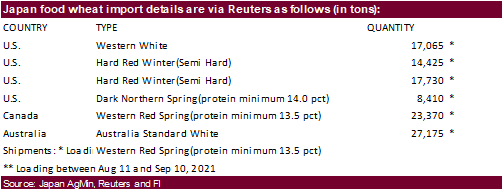

- Japan’s

AgMin seeks 108,175 tons of food-quality wheat from the United States, Canada and Australia in a regular tender.

- Iran

bought milling wheat (in for 60k) for Aug/Sep shipment. - Jordan

seeks 120,000 tons of wheat on July 27 for January and February shipment.

- Bangladesh’s

seeks 50,000 tons of milling wheat on July 15. - Bangladesh’s

seeks 50,000 tons of milling wheat on July 18.

- Ethiopia

seeks 400,000 tons of wheat on July 19.

Rice/Other

- Bangladesh

seeks 50,000 tons of rice from India.

Separately….

- Bangladesh

seeks 50,000 tons of rice on July 12.

September

Chicago wheat is seen in a $5.90-$7.00 range

September

KC wheat is seen in a $5.60-$6.70

September

MN wheat is seen in a $7.50-$9.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.