PDF Attached

CFTC

Commitment of Traders will be sent out over the weekend.

We

think adverse weather for the WCB and northern GP, along with PNW heat spell could impact the national corn yield and SW conditions.

Weather

Last

seven days as of Friday late morning

World

Weather Inc. warned La Nina may return late this year. That could increase the chance for above normal rains for southern South America and drier than normal conditions for the WCB and US Great Plains.

MOST

IMPORTANT WEATHER OF THE DAY

- U.S.

weather over the next two weeks

o

Net drying is expected in the western Corn Belt, despite scattered showers and thunderstorms

- Temperatures

will be warm this weekend and briefly cooler next week and then warm again during the second week of the forecast

o

Dryness will remain serious across much of the northern Plains with some expansion into Nebraska over time

o

A good mix of rain and sunshine is expected in the eastern Midwest

- Temperatures

will be seasonable during much of the two-week forecast period

o

U.S. Delta and southeastern states will see a mostly good mix of weather

- Hurricane

Else will move across Cuba this weekend then move toward Florida, Georgia and the eastern Carolinas during mid-week next week

- The

storm should be downgraded to tropical storm status as it moves across Cuba, and it may or may not regain intensity as a hurricane before effecting Florida - Heavy

rainfall is expected from west-central through northern Florida and then across southeastern Georgia and into the Carolinas during mid-week next week

- Rainfall

of 4.00 to 10.00 inches and locally more will result

o

U.S. citrus areas may not be seriously impacted by Elsa next week, but the storm’s movement will need to be closely monitored

- Tropical

storm force wind will be possible in the western counties of Florida citrus country which might lead to some fruit droppage, but unless the storm moves inland through the Peninsula damage is expected to be low

o

Florida sugarcane should not be seriously harmed by the passing tropical cyclone

o

West Texas will receive periodic showers and thunderstorms over the coming week maintaining wet fields in many areas

o

Other areas in the southern Plains will also get some significant rainfall

o

Far western U.S. will continue quite dry and not as hot as this past week, but still warmer than usual

- Hot

weather is expected to return with some degree of significance next week and into the following weekend

- Frost

was noted again this morning in Brazil’s Sul de Minas coffee areas, although temperatures were only borderline cold enough for frost in many areas and the impact on crops was not nearly what it might have been Thursday

o

No further frost threats are expected for the next ten days

- Canada’s

Prairies will continue to deal with dryness from southern Alberta through central and southern Saskatchewan and portions of Manitoba

o

There is a good chance for “some” rain in central and southeastern Manitoba late next week with a few showers possible this weekend

- All

of the rain will be welcome, but not enough to seriously change soil moisture or crop conditions - Western

and northern Alberta and northern Saskatchewan will experience some periodic showers and thunderstorms over the next two weeks

- Locally

severe storms will occur near the front range of the Rocky Mountains

- Hurricane

Storm Elsa was passing through the Windward Islands today

o

The storm will continue racing to the northwest and will bring heavy rain to southwestern Haiti Saturday into Sunday and to much of Cuba Sunday and Monday

o

Rainfall of 4.00 to 10.00 inches will occur in each of these areas with locally more in Cuba

- Cuba

property and crop damage may be greatest

- Flooding

will be common across central parts of the island

o

The storm’s fast forward speed and interaction with land will inhibit its intensification potential

- Some

weakening back to tropical storm status may occur as the storm moves over Cuba Sunday and Monday

- Southeast

Canada corn, soybean and wheat conditions have improved greatly this week with periods of rain

o

A more erratic and lighter rainfall bias is expected over the next ten days and temperatures will be seasonable maintaining good crop development potential

- Warming

is likely in much of southern Brazil into the weekend and during much of next week

o

No further frost threat is expected in key corn, wheat, citrus or sugarcane areas

- Canada’s

western Prairies were hot Thursday with extreme highs reaching 104 degrees Fahrenheit in southern Alberta and 102 in west-central Saskatchewan while cooling down in western Alberta to the upper 70s and 80s after extreme heat earlier this week

o

Highs in the 90s to 104 occurred in most of Alberta while in the middle 80s through the 90s occurred in Saskatchewan and Manitoba

o

Most of the Prairies were dry and the heat will expand to the east over the balance of this week

- Canada’s

Prairies and the northwestern U.S. Plains will experience excessive heat and dryness through the next few days with highs in the 90s to 106 degrees Fahrenheit

o

Some showers and thunderstorms will attempt to bring a little relief late this week and again next week

- Most

of the precipitation will not be great enough to change drought status and many areas will experience a further decline in crop conditions

- Not

much rain will fall in South America over the next ten days – at least not in key grain, coffee, citrus or sugarcane areas

o

Some moisture is still needed in wheat areas, although Argentina’s crop is still rated much better than that of the past couple of years

- China’s

weather remains well mixed, despite some flooding rain during the past weekend

o

Dryness is not likely to be a problem in the nation during the next two weeks

o

Additional bouts of flooding are most likely in the south, but some central areas will get a little too wet too

o

Northeastern grain and oilseed areas will be favorably moist

- Xinjiang,

China cotton, corn and other crop areas will experience improving weather over the next week to ten days with mostly dry and seasonably warm conditions likely

o

The improvement will be greatest in the northeast

- Russia’s

Southern Region and other areas in western Russia and Ukraine will receive welcome showers and thunderstorms into next week to help restore favorable topsoil moisture after the past week of very warm and dry conditions

o

However, the improving trend will be short-lived

o

A new ridge of high pressure is expected to evolve over northwestern Russia early next week and expand southward by late next week bringing drier and warmer conditions back into the region

- Ukraine

will receive some well-timed and significant rainfall to support its spring and summer crops quite favorably during the next week

o

Drying is likely after that for a little while

- Kazakhstan

crop weather has been quite dry and hot recently along with some neighboring southern Russia New Lands locations

o

Extreme highs reached 100 to 110 Fahrenheit this week in Kazakhstan

o

The excessive heat is breaking down and will continue doing so into the weekend and next week

- A

general soaking of rain is needed, but not very likely - Crop

stress will decrease because of less heat, but without greater rain the trend for deteriorating crop conditions will continue in unirrigated crop areas

- Most

other areas in Russia are expecting a good mix of weather preserving and protecting good production potentials - Europe

weather will be well remain well mixed over the next ten days except in the Mediterranean countries where dryness is expected

o

A part of the western Balkan Countries and areas northeast into Hungary and western Slovakia are trending too dry and rain is needed

- Not

much rain is expected in these areas for a while and stress will continue for unirrigated crops

- North

Africa has been and will continue to be mostly dry supporting late season winter crop harvesting

- India’s

monsoon will continue to underperform in the interior west and north, over the coming week to ten days and northwestern areas will stay drier biased through July 15.

o

Concern over crop development conditions will be rising from Gujarat through Rajasthan and into Punjab and Haryana

- Australia

weather will continue well mixed over the next two weeks supporting improved winter crop establishment - Thailand,

Cambodia and Vietnam will continue drier biased into the weekend with Vietnam getting greater rain next week possibly because of a tropical cyclone influencing the region

o

A general boost in precipitation is possible in many mainland areas of Southeast Asia next week, but confidence is decreasing

- Thailand,

corn, rice, sugarcane and other crops are all becoming stressed because of dryness. The same may be occurring in some Cambodia and Vietnam locations

- Indonesia

and Malaysia rainfall is expected to be sufficient to maintain or improve soil moisture for all crops - Philippines

rainfall will increase during the coming week because of tropical disturbance that will evolve as it moves across the region.

- West

Africa rainfall in Ivory Coast and Ghana will be near to below average during the coming ten days

o

Nigeria and Cameroon precipitation will also be a little lighter than usual, but no area will be too dry

- Erratic

rainfall has been and will continue to fall from Uganda and Kenya into parts of Ethiopia

o

A boost in precipitation is needed and expected

- Ethiopia

rainfall is expected to gradually improve while a boost in precipitation will continue needed in other areas

- South

Africa will experience additional showers in the far west periodically this week

o

The moisture will be good for winter crops, but more moisture will be needed in Free State and other eastern wheat production areas

o

Summer crop harvesting has advanced well this year and the planting of winter grains has also gone well, but there is need for moisture in eastern winter crop areas

- Mexico

rainfall will be near to above average during the coming week improving soil moisture and crop production outlooks - Nicaragua

and Honduras have received some welcome rain recently, but moisture deficits are continuing in some areas

o

Additional improvement is needed and may come slowly

- Southern

Oscillation Index is mostly neutral at +1.66 and the index is expected to move higher over the next few days. - New

Zealand rainfall during the coming week to ten days will be near to below average except along the west coast of South Island where it will be a little greater than usual.

Source:

World Weather, Inc.

Bloomberg

Ag Calendar

Monday,

July 5:

- OECD-FAO

Agricultural Outlook 2021-2030 report - Ivory

Coast cocoa arrivals - Malaysia

July 1-5 palm oil export data - New

Zealand Commodity Price - HOLIDAY:

U.S.

Tuesday,

July 6:

- CNGOIC

monthly report on Chinese grains & oilseeds - USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop conditions — corn, cotton, soybeans, wheat, 4pm - EU

weekly grain, oilseed import and export data - Purdue

Agriculture Sentiment - New

Zealand global dairy trade auction

Wednesday,

July 7:

- No

major event scheduled

Thursday,

July 8:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Brazil’s

Conab releases data on yield, area and output of corn and soybeans - FAO

World Food Price Index - EIA

weekly U.S. ethanol inventories, production - Brazil

Coffee Council Conference, Sao Paulo - Port

of Rouen data on French grain exports - EARNINGS:

Suedzucker, Agrana

Friday,

July 9:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

US

Change In Nonfarm Payrolls Jun: 850K (est 720K; prevR 583K; prev 559K)

US

Unemployment Rate Jun: 5.9% (est 5.6%; prev 5.8%)

US

Average Hourly Earnings (M/M) Jun: 0.3% (est 0.3%; prevR 0.4%; prev 0.5%)

US

Average Hourly Earnings (Y/Y) Jun: 3.6% (est 3.6%; prevR 1.9%; prev 2.0%)

US

Change In Private Payrolls Jun: 15K (est 615K; prevR 516K; prev 492K)

US

Change In Manufacturing Payrolls Jun: 662K (est 25K; prevR 39K; prev 23K)

US

Average Weekly Hours All Employees Jun: 34.7 (est 34.9; prevR 34.8; prev 34.9)

US

Labour Force Participation Rate Jun: 61.6% (est 61.7%; prev 61.6%)

US

Underemployment Rate Jun: 9.8% (prev 10.2%)

US

Trade Balance (USD) May: -71.2B (est -71.3B; prevR -69.1B; prev -68.9B)

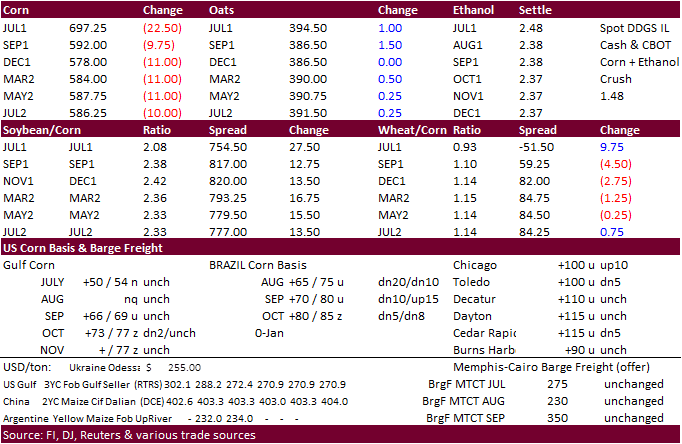

- US

corn futures

ended lower on profit taking. September contract (down 9.75 cents) erased some of the gains post bullish USDA report. Traders will be monitoring the position of the high-pressure ridge that is currently projected to develop over the

Great Plains for days 10-15. Ridging in this area suggests no improvement for the Dakota’s and parts of Minnesota as it may be hot and dry. Before that there is a slight chance for rain next week. IA’s weather outlook will also be monitored.

- Another

reason for the lower corn trade was a decision today by the D.C. Circuit Court of Appeals to vacate a rule that allowed for summer sales of E15. The EPA lifted restrictions on the sale of E15 during the Trump Administration (June 2019). - News

today was very light with some traders taking holiday early. CBOT markets will be closed Monday and we will see a hard open Tuesday morning.

- Brazil’s

frost events are likely over. - We

heard the Iowa department of Agriculture planned a mock AFS drill with pork producers as part of disaster preparation, and when that news leaked out, some people thought it was an actual outbreak.

RFA

Supports New Bill Reinforcing Intent Behind RFS Small Refinery Waivers

Export

developments.

- China

auctioned off 18% or 22,747 tons of US corn and 5,551 tons of Ukraine corn or 18%, out of a total 155,000 tons offered.

- Results

awaited: Iran in for 60,000 tons of corn and 60,000 tons barley for Aug/Sep shipment.

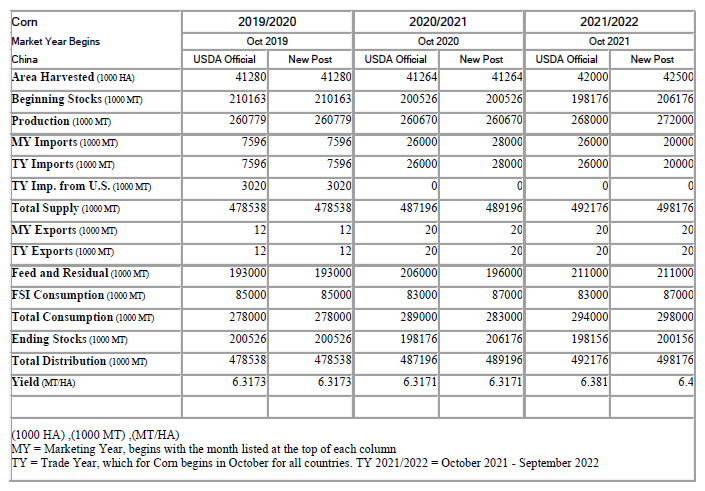

USDA

Attaché China grain and feed update – Imports of corn projected at 6 million tons, 6 below USDA official

Updated

07/01/21

September

corn is seen is a$4.50-$6.25 range.

December

corn is seen in a $4.25-$6.00 range.

-

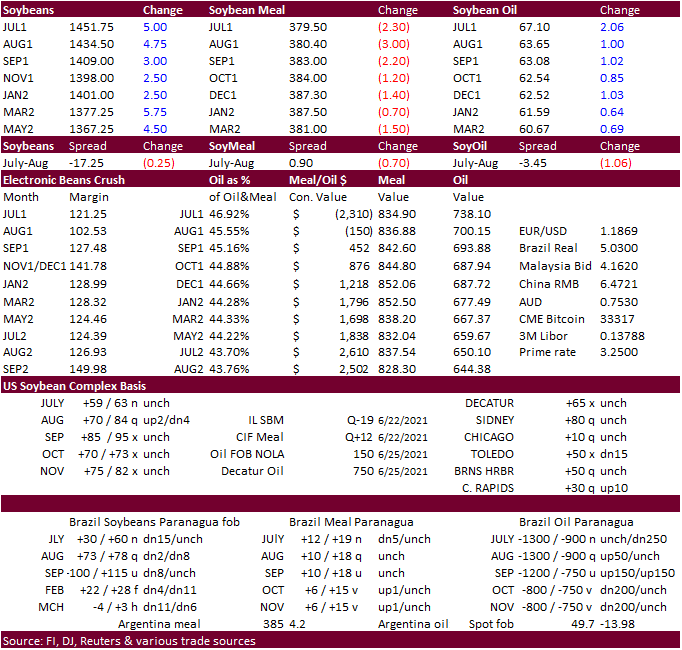

Soybeans

traded two-sided on a few occasions since they electronically opened Thursday evening. Lack of direction and profit taking was noted, but strength in soybean oil did underpin soybeans while keeping soybean meal on the defensive.

August

soybeans were up 3.50 cents, August meal down $1.90, and August soybean oil up 82 points. Volatility remains high.

-

SBO

was sharply higher earlier on US biofuel mandate talk and firmer Argentina soybean oil basis.

-

We

heard Argentina soybean oil basis firmed early morning on rumors of 3 to 4 SME cargos traded, around 110,000 for August and early October shipment. Basis was up somewhere between 50 and 100 points. At one point during the day, we heard values firmer than

that. -

Some

of the trade expect a US biofuel RVO proposal announcement soon. An unchanged to higher RVO requirement might be perceived bullish, IMO, by the trade sees it. But not all will think an unchanged RVO will be bullish though as biofuel production expansion

(Marathon plant, etc.) will generate more diesel RINs in 2021 and 2022 than that of 2020, putting pressure on RIN prices over the long term amid higher RIN supply.

-

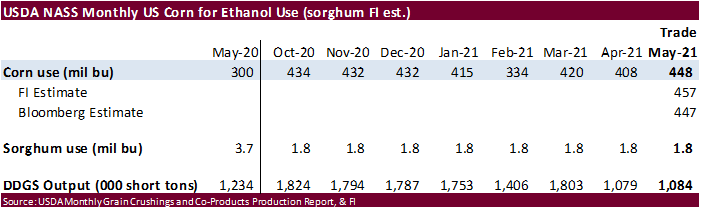

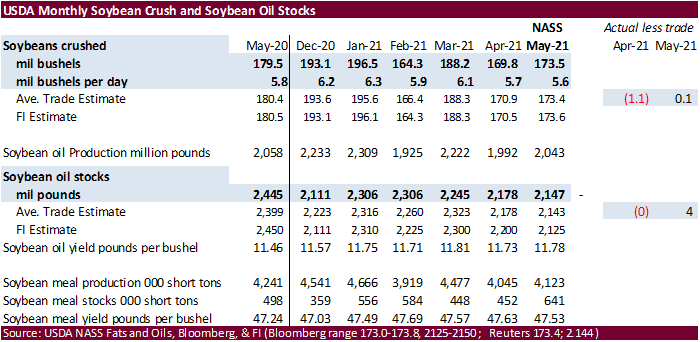

USDA

NASS US crush report showed no

surprises other than very large soybean meal stocks at the end of May. Table below and graphs attached.

-

Offshore

values this morning were leading soybean oil 155 points higher (76 higher for the week) and meal $2.30/short ton higher ($3.90 higher for the week).

-

Rotterdam

rapeseed and soybean oil prices were mostly 15-20 euros higher, and meal mostly 5-9 euros

- Results

awaited: Iran in for 60,000 tons of soybean meal for Aug/Sep shipment.

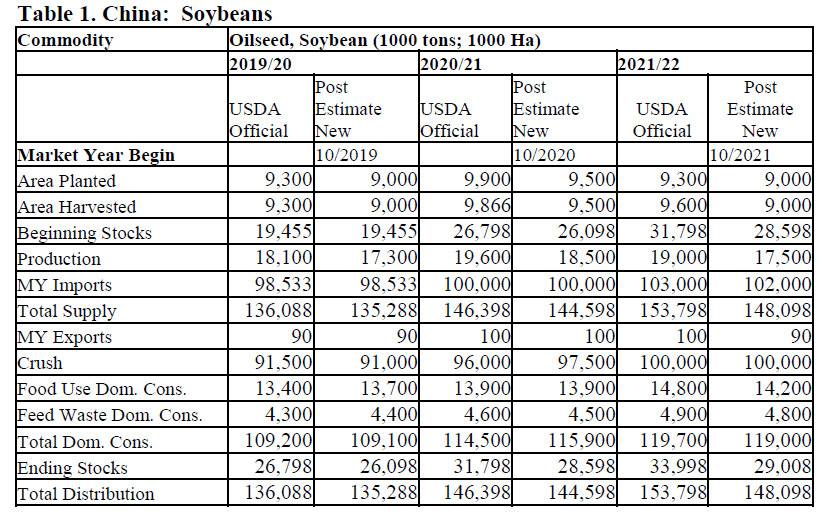

USDA

Attaché China oilseeds update – Soybean production down 1MMT Y-O-Y to 17.5, imports 102MMT versus 100MT this year

Updated

6/30/21

August

soybeans are seen in a $12.75-$15.00 range; November $11.75-$15.00

August

soybean meal – $330-$410; December $320-$425

August

soybean oil – 60-66; December 46-67 cent range

- US

Chicago wheat traded two-sided, ending lower on profit taking. KC was also lower on harvest pressure. MN traded two-sided but ended higher in September, December and March, while lower in May and July (spreading). There were no fresh export developments.

Chicago Sep was off 12.75 cents, KC Sep down 19.00 cents, and MN September up 3.50 cents.

- Northern

Great Plains will see some erratic showers in the first week of the outlook. The heat will last through Monday before cooler weather arrives temporarily Tuesday. - The

PNW heat spell finally broke but many areas will be without rain over the next several days. There are an abundant number of wildfires across the US PNW and British Columbia.

- Russia’s

Southern Region and eastern Ukraine will see improving rainfall into next week. Kazakhstan will continue struggling with heat and dryness.

- US

Wheat Associates: SRW wheat harvest nearly 60 percent complete and HRW just over 20 percent complete. Rainfall and high humidity slowed harvest progress in Texas, Oklahoma and Kansas this week. Winter soft white harvesting just started.

- Note

TX, OK, KS, CO, and NE make up 57 percent of the US winter wheat crop. - We

think USDA will report winter wheat conditions unchanged when updated Tuesday.

- US

spring wheat good/excellent conditions are expected to decline 2 points this week to record low 18 points, below 70 last year and 67 average.

- IHS

updated their US wheat production, and it was lowered to 1.8 billion bushels, according to the trade. Previous was 1.924 previous. Winter Wheat was pegged at 1.35 (1.300 previous), spring nearly 0.400 (previous 0.650), and durum 0.047 (previous 0.064).

- The

duty on wheat exports from Russia will total $41.2 per ton from July 7 to 13, the Agriculture Ministry reported on Friday. The duty on export of barley will amount to $37 per ton of corn – to $50.6 per ton. (Reuters) - Ukraine’s

weather is in good shape and selected agencies continue to upgrade crop prospects.

- French

wheat ratings were unchanged as of June 28 at 79%. Winter-barley was 2% harvested, versus 36% a year earlier.

- September

Paris wheat was down 2.25 euro at 206.50/ton.

-

Bangladesh’s

seeks 50,000 tons of milling wheat on July 15. In addition to… -

Bangladesh’s

seeks 50,000 tons of milling wheat on July 18. - Results

awaited: Iran seeks 60,000 tons of milling wheat on Wednesday for Aug/Sep shipment.

- Jordan

retendered for 120,000 tons of feed barley set to close July 7 for Nov/Dec 2021 shipment.

- Jordan

retendered for 120,000 tons of wheat set to close July 6 for Jan/Feb 2022 shipment.

- Ethiopia

seeks 400,000 tons of wheat on July 19.

Rice/Other

- Bangladesh

seeks 50,000 tons of rice from India.

Separately….

-

Bangladesh

seeks 50,000 tons of rice on July 12.

September

Chicago wheat is seen in a $5.90-$7.00 range

September

KC wheat is seen in a $5.60-$6.70

September

MN wheat is seen in a $7.50-$9.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.