PDF Attached

MARKET WEATHER MENTALITY FOR CORN AND SOYBEANS: A less threatening U.S. outlook today has already shifted some market mentality, but with the long weekend coming up and the potential that many crop areas in the U.S. Midwest will be drying down over the next ten days the premium will stay in the market place and concern about long term crop development will remain especially with pollination expected July 10 through July 30.

Good crop weather is occurring in India and northern China’s main corn, sorghum, soybean and groundnut production areas are seeing a good mix of weather to support crops. Weather in Brazil is not offering any major changes to unharvested corn.

Canola conditions are improving in parts of Canada’s Prairies and Australia’s canola is establishing relatively well.

Concern over France, Germany and areas from eastern Ukraine into Russia’s Southern region will remain on the minds’ of many traders.

Overall weather will likely contribute a little more mixed impact on market mentality today, but the bullish bias will likely remain.

MARKET WEATHER MENTALITY FOR WHEAT: Favorable wheat maturation and harvest conditions are occurring in the Black Sea region, but a little too much rain has been occurring in the Balkan Countries where drier conditions are needed to promote better harvest conditions and to protect grain quality.

Weather in Western Europe is more favorable for small grain filling and maturation. Weather is also favorable in the United States for hard red winter wheat maturation and harvest progress. Portions of the Midwest soft wheat in the U.S. will experience some improving crop maturation and harvest weather after the next few days pass due to drier and warmer weather.

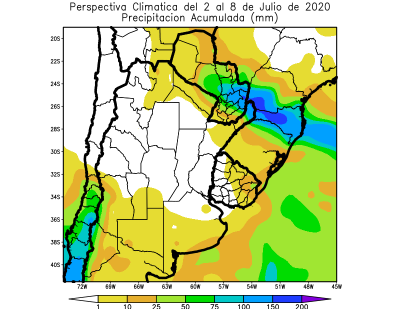

Wheat conditions in Canada are improving with rainfall this week and Australia crops remain in mostly good condition. There is need for rain in western Argentina, in many South Africa crop areas and in both Queensland and South Australia.

Overall, weather today will likely provide a mixed influence on market mentality.

Source: World Weather Inc. and FI

- UN FAO world food price index, 4am

- USDA weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am

- Port of Rouen data on French grain exports

- AB Foods trading update

FRIDAY, July 3:

- U.S. Independence Day Holiday

- ICE Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly update on crop conditions

Source: Bloomberg and FI

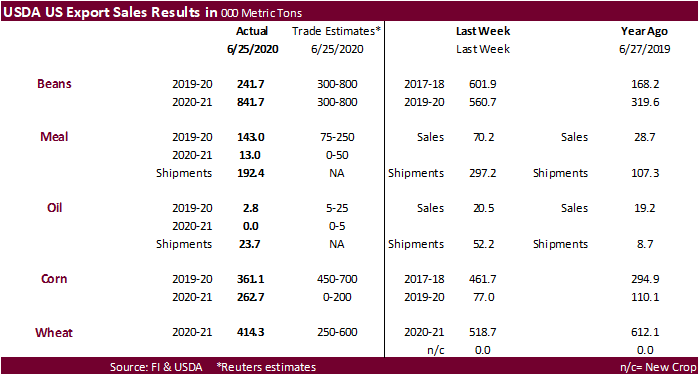

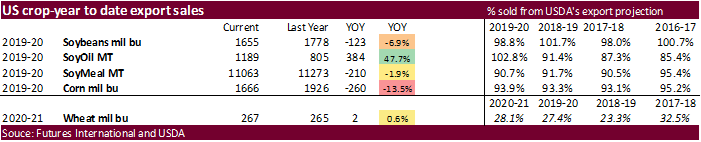

USDA export sales text can be found below the wheat comment. It was seen neutral for the soybean complex and wheat, slightly bearish for corn. Sorghum sales were good at 144,400 tons old crop and 68,000 new crop. China took 594,000 tons of new crop soybeans. Pork sales were 39,200 tons.

· US Change In Non-Farm Payrolls Jun: 4800K (est 3230K; prev 2509K)

· US Unemployment Rate Jun: 11.1% (est 12.5%; prev 13.3%)

· US Change In Private Payrolls Jun: 4767K (est 3000K; prevR 3232K; prev 3094K)

· US Change In Manufacturing Payrolls Jun: 356K (est 425K; prevR 250K; prev 225K)

· US Trade Balance (USD) May: 54.6B (est -53.2B; prevR -49.8B; prev -49.4B)

· US Census: Crude Oil Exports Fell To 2.93M B/D In May (vs. 3.08M In April)

· US Factory Orders (M/M) May: 8.0% (est 8.6%; prev R -13.5%)

– Factory Orders Ex-Trans May: 2.6% (est 6.5%; prev R -8.9%)

· US Durable Goods Orders (M/M) May F: 15.7% (est 15.8%; prev 15.8%)

– Durables Ex-Transportation (M/M) May F: 3.7% (est 4.0%; prev 4.0%)

– Cap Goods Orders Nondef Ex-Air May F: 1.6% (est 2.3%; prev 2.3%)

– Cap Goods Ship Nondef Ex-Air May F: 1.5% (prev 1.8%)

· Corn traded lower on profit-taking ahead of the long US holiday weekend following the bullish move from the stocks and acreage data earlier in the week. For the week, corn rallied almost 7.6% seeing the best week since mid-June last year.

· There was buying noted from weather bulls as the US will see hot and dry weather next week over the Corn Belt.

· The Sunday evening open may be active as we await the updated weather models this weekend. Today’s run showed some additional moisture next week which pressured ag prices into the close

· Funds sold an estimated net 9,000 corn contracts on Thursday.

· Satellite data company Planalytics reduced their US corn yield to 174.90/bu from 175.10/bu two weeks ago.

· The EPA has shelved a proposal for the amount of biofuel blending refiners are obligated to use in 2021. The anticipated target was 20.17 billion gallons for 2021 from the current 20.09 billion gallons annually.

· USDA export sales for corn of 361,100 tons were below expectations and new-crop of 262,700 tons were just above expectations. Shipments were a marketing year high of 1.44 million tons and included 144,300 for China-already known from the Monday export inspections report.

· Sorghum sales were good at 144,400 tons old crop and 68,000 new crop.

· Pork sales were 39,200 tons and included 21,639 tons for China.

· China sold all of its 4 million tons of corn out of reserves.

- Under the 24-hour announcement system, private exporters sold 202,000 tons of new-crop corn to China.

Updated 6/30/20

September corn is seen in a $3.20 and $3.65 range over the short term. December lows could reach $3.05 if US weather cooperates.

· August soybeans ended slightly lower on the session giving up earlier gains on profit-taking following the best week for soybeans since mid-September 2019. Soybeans finished the week up 3.6%.

· Also weighing on the market is the thought of reduced soybean exports to China.

- Under the 24-hour announcement system, private exporters sold 126,000 tons of new-crop soybeans to China.

· USDA export sales was seen neutral for the soybean complex. China took 594,000 tons of new crop soybeans. Meal shipments of just below 200,000 tons slowed from the previous week and soybean oil shipments of 23,700 tons were down from 52,200 tons from last week.

· Satellite data company Planalytics increased their US soybean yield to 49.90/bu from 49.70/bu two weeks ago.

· EU import data for 2019/2020 marketing year ending June 28 reported soybean imports at 15.21 million tons vs 14.96 million tons last year. Soymeal imports were stated at 17.86 million tons for the same period compared to 17.58 million tons last year. Rapeseed imports were conveyed at 5.84 million tons from 4.17 million tons a year earlier. Palm oil imports from were shown at 5.66 million tons for the same period, falling from the year earlier period of 6.42 million tons.

· Funds sold an estimated net 2,000 soybeans contracts, sold 1,000 meal and sold 2,000 soybean oil on the session.

- Under the 24-hour announcement system, private exporters sold 126,000 tons of new-crop soybeans to China.

- Results awaited: Syria will retender for 50,000 tons of soymeal and 50,000 tons of corn on June 24 for delivery within four months of contract.

Updated 7/1/20 – soy and meal revised higher

- August soybeans are seen in a $8.75-$9.15 range, over the medium term (MT).

- August soybean meal is seen in a $280 to $315 range over the short term. (ST)

- August soybean oil range is seen in a 27.50 to 29.00 range over the short term

· Wheat ending lower on continued harvest and technical selling. Also, pressuring was moisture in the Northern Great Plains aiding crop outlooks.

· USDA export sales for all wheat of 414,300 tons were within expectations, down from 518,700 tons week ago.

· Funds sold an estimated net 3,000 Chicago wheat contracts on Thursday.

- Paris December wheat ended 0.75 euro lower to 182.75.

- Argentina’s BA Exchange lowered the 2020/2021 area to 6.5 million hectares from 6.7 million hectares on dryness in the western Argentine farm belt.

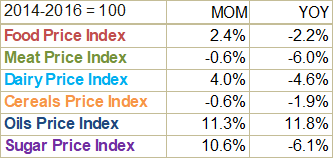

FAO world food price index showed a 2.2 percent increase for June from May

*Effective July 2020, the price coverage of the FFPI has been expanded and its base period revised to 2014-2016.

http://www.fao.org/3/ca9509en/ca9509en.pdf#page=78

- Jordan seeks 120,000 tons of wheat for November and December shipment on July 7.

- Syria seeks 200,000 tons of milling wheat from Russia by July 28.

- Yesterday Thailand bought over 100,000 tons (sought 236,800 tons) of feed wheat for Aug-Jan 2021 shipment. (3 consignments). $215.50-$219.00 / ton was noted.

- Japan seeks 80,000 tons of feed wheat and 100,000 tons of barley on Wednesday, July 8, for arrival by December 24.

- Ethiopia seeks 400,000 tons of wheat on July 10 for shipment within two months.

- None reported

Updated 6/30/20

- Chicago September is seen in a $4.70-$5.05 range, over the short term.

- KC September$4.10 support; $4.15-$4.55 range over the medium term.

- MN September $5.00-$5.40 range over the medium term with bias to upside.

This summary is based on reports from exporters for the period June 19-25, 2020.

Wheat: Net sales of 414,300 metric tons (MT) were reported for delivery in marketing year 2020/2021. Increases primarily for Taiwan (89,300 MT, including decreases of 700 MT), Yemen (80,000 MT), Japan (55,000 MT, including decreases of 100 MT), Nigeria (52,800 MT), and Mexico (40,200 MT, including decreases of 8,000 MT), were offset by reductions for unknown destinations (27,500 MT). For 2021/2022, net sales of 75,000 MT were reported for unknown destinations (67,000 MT) and Mexico (8,000 MT). Exports of 508,600 MT were primarily to the Philippines (166,300 MT), Japan (78,900 MT, including 13,100 MT late – see below), Indonesia (58,200 MT), Nigeria (45,300 MT), and Mexico (36,600 MT). Late Reporting: For 2020/2021, exports to Japan (13,100 MT) were reported late.

Corn: Net sales of 361,100 MT for 2019/2020 were down 22 percent from the previous week and 32 percent from the prior 4-week average. Increases primarily for Japan (240,100 MT, including 192,300 MT switched from unknown destinations and decreases of 1,800 MT), Mexico (168,300 MT, including 61,000 MT switched from unknown destinations and decreases of 14,900 MT), Colombia (75,100 MT, including 63,400 MT switched from unknown destinations and decreases of 200 MT), Peru (41,700 MT), and Tunisia (31,000 MT, including 30,000 MT switched from unknown destinations), were offset by reductions primarily for unknown destinations (282,600 MT). For 2020/2021, net sales of 262,700 MT were primarily for unknown destinations (109,900 MT), Japan (100,500 MT), Mexico (22,400 MT), and Taiwan (13,500 MT). Exports of 1,439,900 MT