PDF Attached

Wild

bearish trading session. CBOT soybean complex and grains settled sharply lower on fund selling amid good US weather. Many traders liquidated long positions ahead of the long holiday weekend. The USD was up sharply. Weakness in soybeans kicked off the selling.

The morning US weather outlook improved from that of yesterday for the Midwest and was unchanged for the Great Plains. We lowered our price floor for CZ by 75 cents to $5.50.

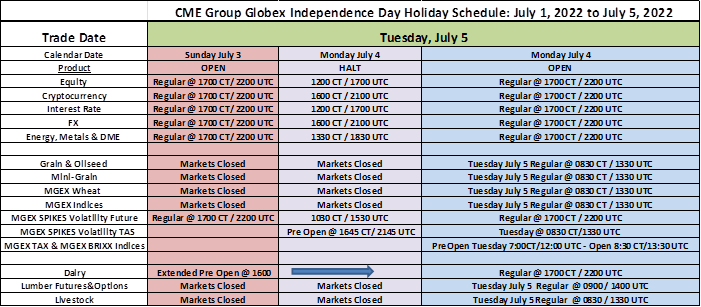

The

CBOT will be on holiday Monday and agriculture markets will have a hard open on Tuesday, July 5 @ 8:30 am, CT.

https://www.cmegroup.com/tools-information/holiday-calendar.html

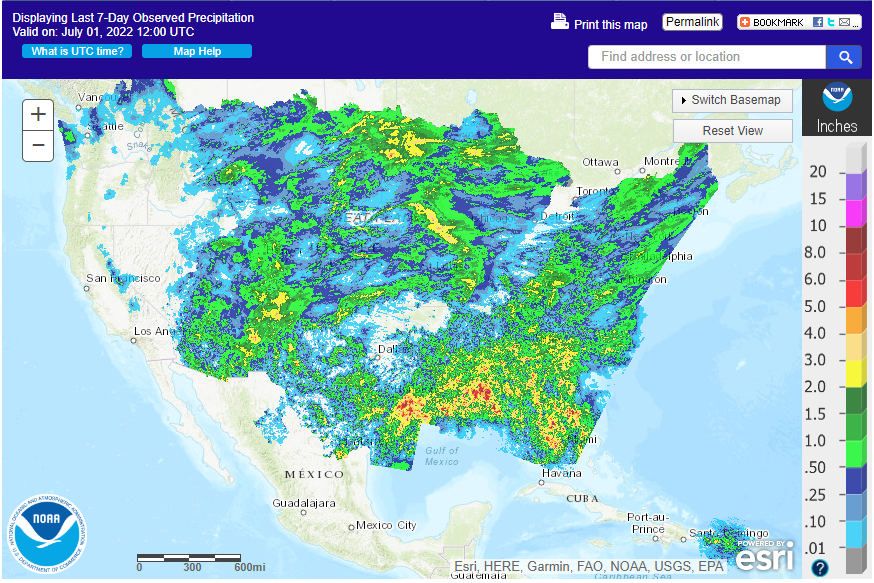

7-day

WEATHER

EVENTS AND FEATURES TO WATCH

- U.S.

Central and southern Plains will be dry and hot next week with highs in the 90s to lower 100s Fahrenheit expected - Some

rain will be possible this weekend, but after than any rain will be very limited - The

southwestern Corn and Soybean Belt and northern Delta will likely get caught up in the drier and warm biased conditions as well - U.S.

southwestern Corn Belt will get some rain tonight and Saturday that will help ease recent drying, but after that a net drying environment is expected for a week to nearly ten days - Periodic

showers and thunderstorms will impact the northern Plains and northern and eastern Midwest beginning late this weekend and lasting for ten days - The

advertised rain will be extremely important for the drier biased areas in Michigan, Indiana, Ohio, western Kentucky and southern Minnesota into northeastern Nebraska - The

commodity market will be watching closely the distribution of rainfall during the holiday weekend and will be looking for any changes in the scattered rainfall outlook for next week and the following week

- Texas

and Oklahoma crop areas will be dry and very warm to hot during much of the next ten days to two weeks

- The

lack of rain will threaten corn, soybean, sorghum, and cotton produced throughout the region - Irrigated

crops may also struggle with the heat and dryness - U.S.

Delta rainfall may be a little sporadic and light for a while because of a center of high pressure aloft over the region in this coming week - Some

areas will get rain while others are left dry - U.S.

southeastern states will experience a good mix of weather during the next two weeks - U.S.

Northern Plains and Canada’s Prairies will see periodic showers and thunderstorms over the next two weeks that should favor crop development

- Dryness

in central Saskatchewan should be eased in the next two weeks - South

Texas and northeastern Mexico will remain in a drought for the next ten days, despite some showers - Ontario

and Quebec, Canada will continue to experience a good mix of weather during the next ten days favoring normal crop development and fieldwork - Tropical

Storm Bonnie will reach the Costa Rica/Nicaragua coast late tonight and Saturday resulting in some very heavy rainfall and windy conditions

- Flooding

is the greatest risk with northern Costa Rica getting 5.00 to 12.00 inches of rain - No

damage expected to coffee, but flooding could negatively impact some rice, corn and sugarcane production areas - The

storm will then enter the eastern Pacific Ocean and move up the coast paralleling the Central America and lower western Mexico coast into next week - Tropical

Storm Chaba will bring torrential rain back to Guangdong, China this weekend with heavy rain also impacting Hunan and eastern Guangxi before moving northeast to Shandong as a remnant of the original storm - Flooding

will resume in Guangdong and southern Hunan - These

areas were flooding last week and earlier in June because of horrific rainfall periodically

- Tropical

Storm Aere will impact western Japan early next week with some heavy rain in rice and citrus areas from Kyushu to western Honshu and Shikoku

- Drought

will intensify in parts of the U.S. Pacific Northwest and in particular the Snake River system, but Yakima Valley and central parts of Oregon will get some rain - Argentina

will continue too dry for winter wheat emergence and establishment mostly in the west for at least the next ten days - Southern

Brazil, Uruguay, southern Paraguay and far northeastern Argentina will get rain periodically to support winter crops - There

is no risk of crop threatening cold in Brazil grain, coffee, sugarcane or citrus areas for the next two weeks - Dry

weather in Safrinha corn and cotton areas of Brazil will be good for maturation and harvest progress - Europe

weather will include scattered showers in eastern parts of the continent during much of the coming week to ten days, but the distribution of rain will not be ideal leaving need for more rain eventually - Net

drying is expected in the France and other western European nations through the next ten days

- Recent

rain in France improved topsoil moisture, but the trend will now reverse itself leading to net drying

- Spain,

Portugal, Peninsular Italy and portions of the Balkan Countries will also experience net drying over the next ten days, despite a few showers - Temperatures

in eastern Europe remained quite warm Thursday with many highs in the 90s Fahrenheit and a few extremes near 100 in the interior southeast part of the continent. - The

heat accelerated drying in parts of the region which raises the need for rain in some areas

- Areas

from Hungary to the lower Danube River Basin are driest - Eastern

Europe temperatures will cool down over the next few days - Far

western Europe may be just slightly cooler biased - Second

week temperatures will be warmer than usual in the west and closer to normal in the east - Europe

rainfall Thursday was restricted to France while random showers occurred elsewhere - Rain

totals varied from 0.05 to 0.40 inch with a few local totals to 1.10 inches - Other

areas were mostly dry with accelerated drying in the east - Western

CIS weather will be favorably mixed with sunshine and rain during the next two weeks - Temperatures

will be warmer than usual in this first week of the outlook - The

warmer weather will shift into the New Lands during the second week of the forecast as rain increases and cooling begins in the west - Rain

will fall in western Kazakhstan and the lower Volga River Valley today into the weekend offering some relief to persistent dryness - Additional

rainfall may impact a larger part of Russia’s New Lands after day ten of the outlook - Until

then net drying is expected, and temperatures will trend warmer than usual - The

bottom line for the CIS is mostly good, but dryness will remain in parts of Russia’s Southern Region (away from the Georgia Border and away from the Black Sea coast) as well as eastern Ukraine. These areas will need greater rain - China’s

North China Plain will experience a good mix of weather during the next two weeks supporting improved crop development after a dry late May and early to mid-June

- Southern

China’s weather has been improving since torrential rain ended last week, but Tropical Storm Chaba may bring excessive rain to Guangdong, eastern Guangxi and a part of Hunan during the weekend and early next week

- Southern

China weather will resume a more normal distribution of rain and sunshine next week after the tropical cyclone passes

- Northeastern

China will continue to see frequent rainfall during the next ten days maintaining wet field conditions in some areas - China’s

Xinjiang province continues to experience relatively good weather - A

few showers and thunderstorms are expected, but most of the region will be dry with temperatures varying greatly over the week - Some

cooler biased conditions may briefly evolve later this week and into the weekend - Central

and eastern Queensland and parts of New South Wales, Australia will get additional rain today through the weekend causing a delay to winter planting of wheat, barley and some canola, but the moisture should be good for crops that have already been planted - Southern

Australia weather will remain favorable for wheat, barley and canola planting and emergence during the next couple of weeks - India’s

monsoonal rainfall is expected to continue improving over the next couple of weeks

- Sufficient

rain is expected over the next two weeks to bolster soil moisture in many important summer grain, oilseed and cotton areas throughout the central, north and eastern parts of the nation - Rain

in the northwest will be slowest in coming, but rain is expected during the weekend and especially next week

- South

Korea rice areas will get a few periods of rain during the next ten days bringing partial relief after weeks of dryness - A

greater amount of rain will be needed - Mexico’s

monsoonal rainfall will be good in the west and north-central parts of the nation during the coming two weeks - Northeastern

Mexico drought relief may not occur without the help of a tropical cyclone - The

same may be true for far southern Texas - Southeast

Asia rainfall will continue abundant in many areas through the next two weeks - Local

flooding is possible - East-central

Africa rainfall will occur sufficiently to improve crop and soil conditions from Uganda and southwestern Kenya northward into western and southern Ethiopia - West-central

Africa rainfall has been and will continue sufficient to support coffee, cocoa, sugarcane, rice and cotton development normally - Some

needed relief to dryness has occurred in parts of Ivory Coast recently and more expected throughout west-central Africa during the next ten days - South

Africa’s crop moisture situation is favorable for winter crop emergence, although some additional rain might be welcome - Net

drying is expected for a - Winter

crops will continue to establish well. - Central

America rainfall will be abundant during the next ten days - Torrential

rain will bring flooding to Nicaragua and Costa Rica this weekend into early next week due to Tropical Storm Bonnie - El

Salvador, Honduras and Guatemala might also be impacted, but with lighter rainfall - Today’s

Southern Oscillation Index was +16.50 and it will move erratically higher during the coming week - New

Zealand rainfall will begin increasing late this weekend and during much of next week

Source:

World Weather INC

Friday,

July 1:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Monthly

coffee exports from Costa Rica and Honduras - International

Cotton Advisory Committee releases monthly world outlook report - USDA

soybean crush, DDGS production, corn for ethanol, 3pm - FranceAgriMer

weekly update on crop conditions - Australia

commodity index - HOLIDAY:

Canada, Hong Kong

Monday,

July 4:

- HOLIDAY:

US

Tuesday,

July 5:

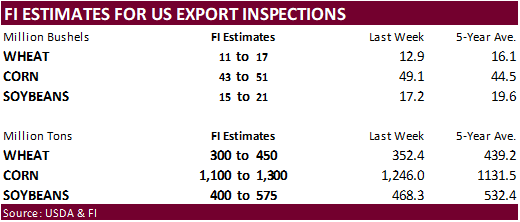

- USDA

export inspections – corn, soybeans, wheat, 11am

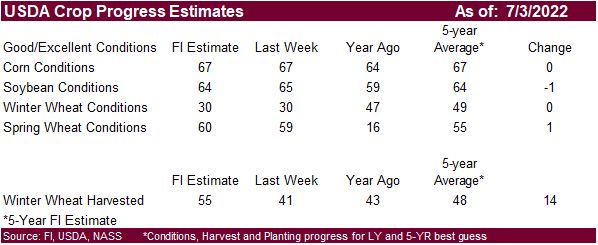

- US

crop condition for spring and winter wheat, corn, soybeans and cotton; crop progress for winter wheat, 4pm - Canada’s

Statcan publishes data on seeded area for wheat, durum, canola, barley and soybeans - New

Zealand commodity price - New

Zealand global dairy trade auction - EU

weekly grain, oilseed import and export data - US

Purdue agriculture sentiment - Malaysia’s

July 1-5 palm oil export data

Wednesday,

July 6:

- UN

annual state of food security report

Thursday,

July 7:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - EIA

weekly U.S. ethanol inventories, production, 11am - Vietnam’s

customs department releases coffee, rice and rubber export data for June - Brazil’s

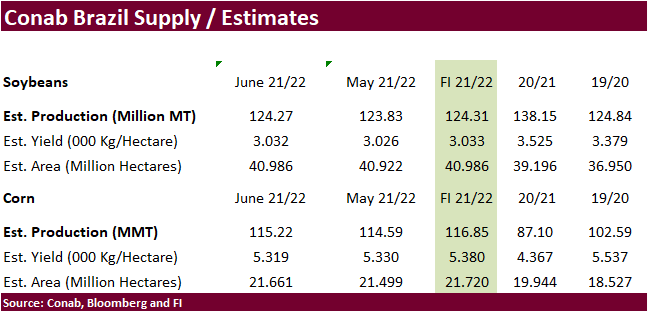

Conab releases data on area, yield and output of corn and soybeans

Friday,

July 8:

- FAO

world food price index, grains supply and demand outlook - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

Due

out Thursday

Brazil

selected June commodity exports:

Commodity

June 2022 June 2021

CRUDE

OIL (TNS) 5,880,360 8,133,882

IRON

ORE (TNS) 32,115,970 33,545,936

SOYBEANS

(TNS) 10,128,465 11,066,523

CORN

(TNS) 1,051,235 92,169

GREEN

COFFEE(TNS) 180,871 174,297

SUGAR

(TNS) 2,358,874 2,753,136

BEEF

(TNS) 152,656 140,315

POULTRY

(TNS) 399,961 362,946

PULP

(TNS) 1,468,090 1,332,657

Source:

Brazil AgMin, Reuters and FI

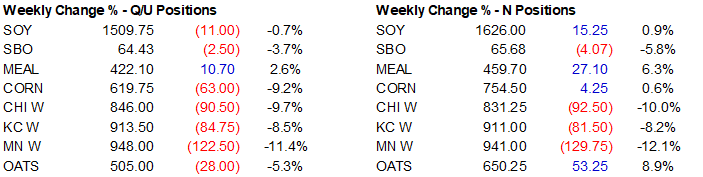

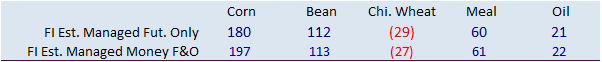

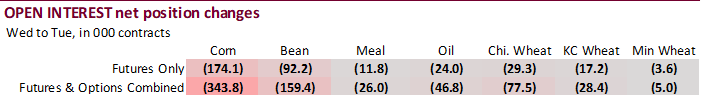

CFTC

Commitment of Traders

For

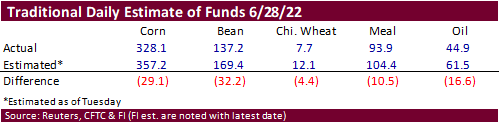

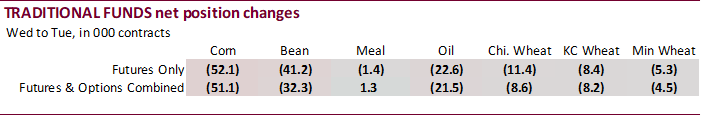

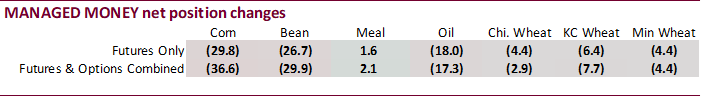

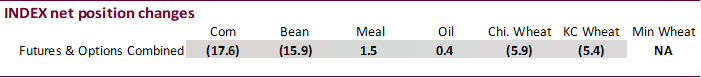

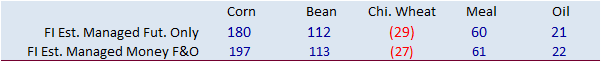

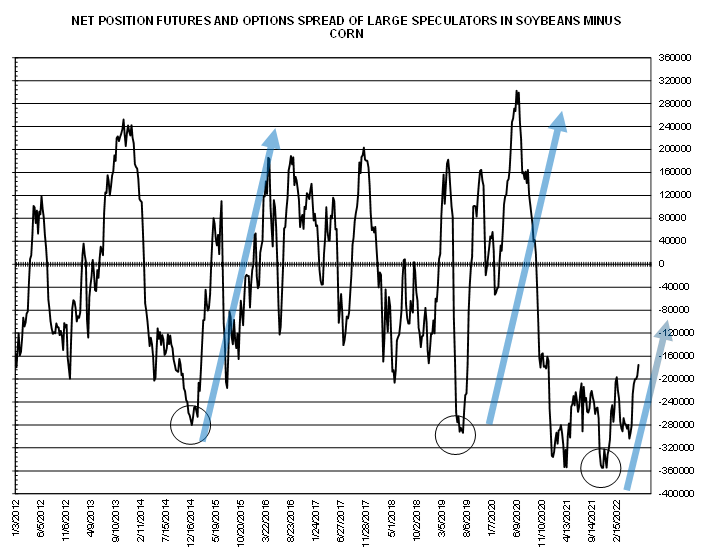

the week ending June 28, not only the traditional funds sold more longs than expected, but the index funds were heavy sellers, bias corn and soybeans, relative to other weeks. We are not surprised as many agriculture commodities rolled over last week. Largest

surprise we saw was the massive open interest move in combined futures and options for corn, down 343,800 contracts just over a one week period. We are unsure when the funds will be lifting the petal from long liquidation, as they have been good sellers over

the last two out of the three past trading sessions.

Reuters

table

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

138,437 -39,903 424,713 -17,567 -509,931 61,512

Soybeans

46,131 -20,153 181,376 -15,900 -193,334 42,589

Soyoil

15,219 -21,979 99,537 419 -123,016 23,904

CBOT

wheat -47,732 -5,361 136,032 -5,905 -82,798 13,263

KCBT

wheat -766 -2,861 55,361 -5,422 -51,832 6,760

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

228,615 -36,649 264,201 -2,828 -507,502 58,018

Soybeans

124,498 -29,914 104,904 -2,142 -191,916 40,938

Soymeal

62,457 2,076 81,979 -3,931 -188,397 6,599

Soyoil

33,605 -17,281 79,550 30 -130,039 23,765

CBOT

wheat 1,020 -2,914 57,006 1,095 -60,755 9,502

KCBT

wheat 24,856 -7,738 26,588 -1,644 -44,142 8,356

MGEX

wheat 8,086 -4,353 382 -334 -12,194 7,825

———- ———- ———- ———- ———- ———-

Total

wheat 33,962 -15,005 83,976 -883 -117,091 25,683

Live

cattle 24,265 -14,876 63,443 -3,695 -100,454 20,144

Feeder

cattle -5,320 -1,789 3,987 -195 5,498 1,499

Lean

hogs 30,639 1,825 53,251 -2,033 -71,689 -1,035

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

67,903 -14,499 -53,218 -4,043 1,855,971 -343,833

Soybeans

-3,313 -2,346 -34,174 -6,535 800,466 -159,397

Soymeal

20,574 -758 23,387 -3,986 430,815 -25,988

Soyoil

8,626 -4,169 8,258 -2,345 404,637 -46,817

CBOT

wheat 8,232 -5,686 -5,502 -1,997 375,548 -77,464

KCBT

wheat -4,539 -497 -2,763 1,523 171,480 -28,385

MGEX

wheat 3,060 -145 667 -2,993 67,349 -4,953

———- ———- ———- ———- ———- ———-

Total

wheat 6,753 -6,328 -7,598 -3,467 614,377 -110,802

Live

cattle 17,527 -2,480 -4,782 906 341,743 5,570

Feeder

cattle 296 -52 -4,461 538 54,108 -1,521

Lean

hogs -1,383 919 -10,818 324 241,543 2,817

Macros

US

ISM Manufacturing Jun: 53.0 (est 54.5; prev 56.1)

–

Prices Paid: 78.5 (est 80.0; prev 82.2)

–

New Orders: 49.2 (est 52.0; prev 55.1)

–

Employment: 47.3 (est 50.0; prev 49.6)

US

Construction Spending (M/M) May: -0.1% (est 0.4%; prev R 0.8%)

European

Central Bank reported inflation rose 8.6% in June from year earlier.

·

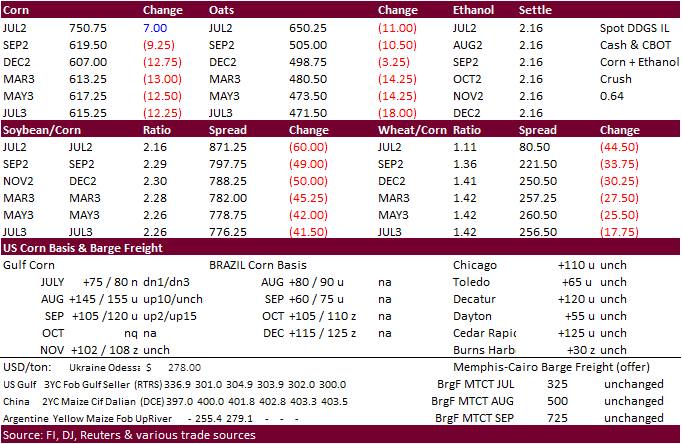

Earlier in the session corn futures

rebounded after hitting multi-month lows overnight before turning lower again during the day session from sharply lower soybeans. December led the market lower. Limited losses in September reflected talk of late planted corn across parts of the upper Midwest

might be running 2 to 3 weeks behind normal development. We are hearing corn across the Delta went in on time and look very healthy after seeing good rain last half June, so there should be no problem getting corn to the Gulf for export this September. The

Delta, however, will probably not see an early corn harvest this July, but August is looking good for cutting to start.

·

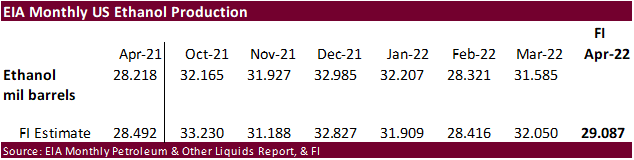

Some traders look for December corn to trade down to near $5.90/bu, its February insurance level. November soybeans are already trading below that insurance level.

·

News was light.

·

Funds sold an estimated net 14,000 corn contracts.

·

South Korea was back in the market, but they have been not buyers of US corn lately.

·

Traders shrugged off the US Supreme Court ruling that clipped the US EPA’s wings to curb power-plant emissions. If biofuel production is profitable, it will be made.

·

StoneX estimated the Brazil 2021-22 corn crop at 119.3 million tons versus 116.8 million in its previous forecast.

·

Brazil imported 4.15 million tons of fertilizer during June, up from 3.5 million tons during June 2021.

·

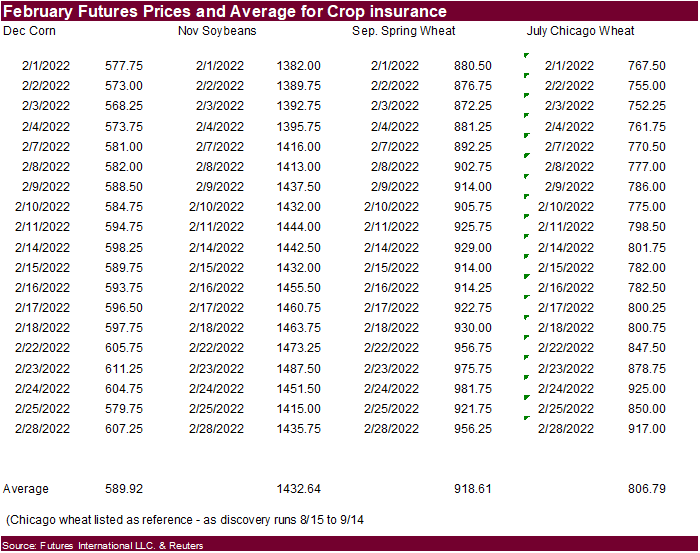

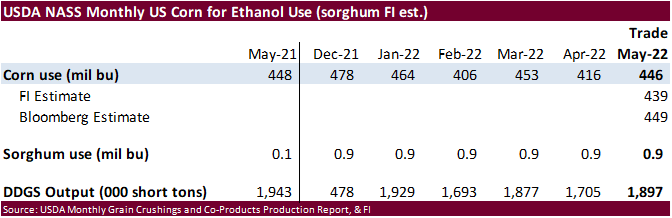

USDA NASS reported the May corn use for ethanol at 446 million bushels, 3 million below a Bloomberg trade guess and compares to 448 million a year ago. EIA monthly data for ethanol is delayed.

·

South Korea’s KFA bought 588,000 tons of optional origin corn at $343.49 c&f for arrival around October 15.

·

South Korea’s MFG bought 68,000 tons of optional origin corn at $337.25 c&f for arrival by October 17.

·

For comparison, South Korea’s NOFI yesterday bought 136,000 tons of South American corn at $348.88 c&f for Sep-Oct shipment, depending on origin.

EIA

monthly ethanol report is delayed

September

corn is seen in a $5.50 and $7.50 range

December

corn is seen in a wide $5.00-$8.00 range (lowered 75 front end and 25 on back end)

·

CBOT soybeans and its products fell hard on Friday on long liquidation ahead of the weekend, a sharply higher USD, and talk the US weather outlook could be beneficial for the US crop during July and August. US weather looks good

for the short-term, but pod development is far away.

·

August crush broke about 7 cents near the close after August soybean oil broke 35 points on 500 contracts, below its 200-day MA of 65.00 cents.

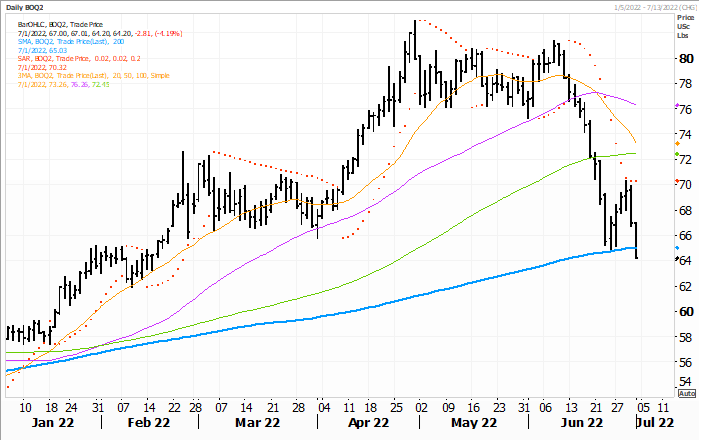

BOQ2

techs are bearish

Source:

Reuters and FI