PDF Attached

Early trade was continuation from the bullish USDA Stocks and Acreage Report, then near European close profit taking took hold. Midday weather model runs saw needed moisture in the Northern Plains. The reflation trade was talk in the macro markets as energies and agricultural markets saw some bullish flow.

CME margin changes:

RAISES SOYBEAN FUTURES (S) MAINTENANCE MARGINS BY 11.1% TO $5,000 PER CONTRACT FROM $4,500 FOR JULY 2021

SAYS INITIAL MARGIN RATES ARE 110% OF MAINTENANCE MARGIN RATES

SAYS RATES WILL BE EFFECTIVE AFTER THE CLOSE OF BUSINESS ON JULY 1, 2021

Soybean meal was also adjusted higher.

https://www.cmegroup.com/notices/clearing/2021/06/Chadv21-232.html

1-7 DAY TOTAL Precipitation Forecasts

WORLD WEATHER INC.

MOST IMPORTANT WEATHER OF THE DAY

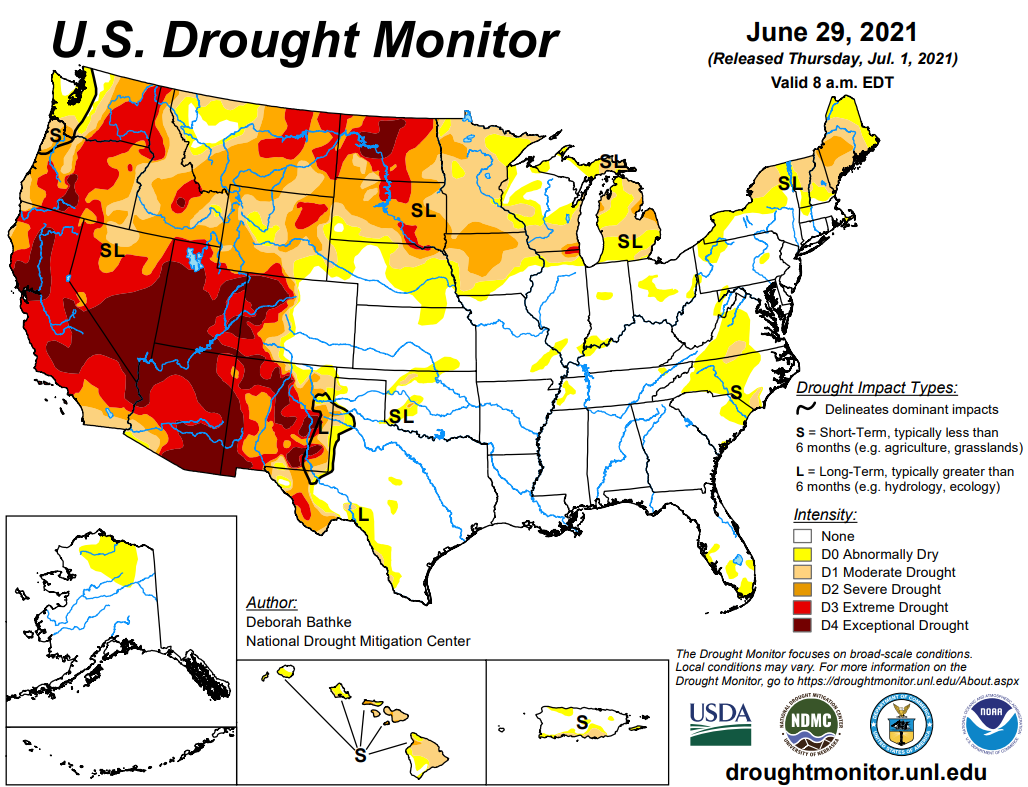

- European forecast model run is too wet in the northern Plains and upper Midwest during the coming ten days

- Concern over dryness in Canada’s Prairies, northern U.S. Plains and upper Midwest will remain through the next ten days to two weeks.

o Any showers that occur will be too brief and light to have a lasting impact on the region’s crops or production potential

o Falling yield potentials will continue in spring cereals and other early season crops with some pressure on corn, soybeans, flax, canola and other crops as well

- No dominating ridge of high pressure is expected in the U.S. Midwest corn or soybean production areas during the next two weeks

o Temperatures will be warm in the northwestern western Corn Belt for short period into the weekend, but other Midwest locations will experience mostly seasonable temperatures

o Cooler than usual weather is expected in the central and southern Plains and a part of the lower Midwest and Delta during the coming week with more seasonable readings in the second week of July

- Too much rain in the southern U.S. Plains may continue to pressure unharvested wheat quality and could reduce cotton, sorghum, corn and peanut conditions in West Texas for a little while

o Drier and warmer weather is needed and it should evolve, but not until the second week of July

- Soft red wheat conditions in the U.S. lower Midwest should improve with drier weather evolving Friday into next week

- U.S. Delta and southeastern states crop weather will be mostly good during the next two weeks, although Tropical Storm Elsa will have to be closely monitored

- Tropical Storm Elsa was located well to the southeast of the Windward Islands this morning, but it is racing to the northwest and will reach the islands during the middle of the day Friday producing strong wind speeds and heavy rainfall

o The storm will continue racing to the northwest and will bring heavy rain to southwestern Haiti Saturday into Sunday and to much of Cuba Sunday and Monday

o The storm’s fast forward speed and interaction with land will inhibit its intensification potential

- Excessive heat in western North America is expected to gradually ease over the next few days, but warmer than usual temperatures will continue in most of the western and north-central parts of the United States during the next two weeks as well as in much of Canada’s Prairies and far west

- Southeast Canada corn, soybean and wheat conditions have improved greatly this week with periods of rain

o A more erratic and lighter rainfall bias is expected over the next ten days and temperatures will be seasonable maintaining good crop development potential

- Western U.S. rainfall will be restricted over the next ten days except in the southwestern desert region and southern Rocky Mountains where monsoonal showers and thunderstorms will evolve periodically

- Frost and freezes occurred this morning in a portion of Brazil’s coffee country

o Sul de Minas reported most lows in the 30s and lower 40s Fahrenheit, although some harder freezes were noted in a few locations not far from coffee country

o An assessment of the damage will be made over the next few days

o Additional cool weather is expected through the weekend, although Friday is the only morning in which frost is again possible

o Northern Parana and southwestern Sao Paulo coffee areas also experienced a little frost today

- Warming is likely in much of southern Brazil Friday into the weekend, although low temperatures in Sul de Minas Friday will still be chilly enough for some frost

o No further negative impact is expected in key corn, wheat, citrus or sugarcane areas, although temperatures will still be cool enough for patches for soft frost

- Canada’s western Prairies were hot Wednesday with extreme highs reaching 106 degrees Fahrenheit in western Alberta

o Highs in the 90s to 104 occurred in most of Alberta while in the middle 80s through the 90s occurred in Saskatchewan and Manitoba

o Most of the Prairies were dry and the heat will expand to the east over the balance of this week

- Canada’s Prairies and the northwestern U.S. Plains will experience excessive heat and dryness through the next few days with highs in the 90s to 108 degrees Fahrenheit

o Some showers and thunderstorms will attempt to bring a little relief late this week and again next week

- Next week’s rainfall coverage and amounts may be greater than this week, but it will be hard for a soaking rain to take place without a good moisture source

- Not much rain will fall in South America over the next ten days – at least not in key grain, coffee, citrus or sugarcane areas

o Some moisture is still needed in wheat areas, although Argentina’s crop is still rated much better than that of the past couple of years

- China’s weather remains well mixed, despite some flooding rain during the past weekend

o Dryness is not likely to be a problem in the nation during the next two weeks

o Additional bouts of flooding are most likely in the south, but some central areas will get a little too wet too

o Northeastern grain and oilseed areas will be favorably moist

- Xinjiang, China cotton, corn and other crop areas will experience improving weather over the next week to ten days with mostly dry and warmer conditions likely

o The improvement will be greatest in the northeast

- Russia’s Southern Region and other areas in western Russia and Ukraine will receive welcome showers and thunderstorms later this week and into next week to help restore favorable soil moisture after the past week of very warm and dry conditions

o A new ridge of high pressure is expected to evolve over western Russia a week from now bringing drier and warmer conditions late next week and into the following weekend to move of Ukraine and western Russia

- Kazakhstan crop weather has been quite dry and hot recently along with some neighboring southern Russia New Lands locations

o Extreme highs reached 100 to 110 Fahrenheit Tuesday and Wednesday in Kazakhstan

o The excessive heat will break down during the weekend and some showers may evolve next week

- A general soaking of rain is needed, but not very likely

- Most other areas in Russia are expecting a good mix of weather preserving and protecting good production potentials

- Europe weather will be well remain well mixed over the next ten days except in the Mediterranean countries where dryness is expected

o A part of the western Balkan Countries and areas northeast into Hungary and western Slovakia are trending too dry and rain is needed

- Not much rain is expected in these areas for a while and stress will continue for unirrigated crops

- North Africa has been and will continue to be mostly dry supporting late season winter crop harvesting

- India’s monsoon will continue to underperform in the interior west and north, over the coming week to ten days and northwestern areas will stay drier biased through July 15.

o Concern over crop development conditions will be rising from Gujarat through Rajasthan and into Punjab and Haryana

- Australia weather will continue well mixed over the next two weeks supporting improved winter crop establishment

- Tropical Storm Enrique dissipated over southern Baja California overnight

- Thailand, Cambodia and Vietnam will continue drier biased this week with Vietnam getting greater rain next week possibly because of a tropical cyclone influencing the region

o A general boost in precipitation is possible in many mainland areas of Southeast Asia next week, but confidence is decreasing

- Thailand, corn, rice, sugarcane and other crops are all becoming stressed because of dryness. The same may be occurring in some Cambodia and Vietnam locations

- Indonesia and Malaysia rainfall is expected to be sufficient to maintain or improve soil moisture for all crops

- Philippines rainfall will increase during the coming week because of tropical disturbance that will evolve as it moves across the region.

- West Africa rainfall in Ivory Coast and Ghana will be near to below average during the coming ten days

o Nigeria and Cameroon precipitation will also be a little lighter than usual, but no area will be too dry

- Erratic rainfall has been and will continue to fall from Uganda and Kenya into parts of Ethiopia

o A boost in precipitation is needed and expected

- Ethiopia rainfall is expected to gradually improve while a boost in precipitation will continue needed in other areas

- South Africa will experience additional showers in the far west periodically this week

o The moisture will be good for winter crops, but more moisture will be needed in Free State and other eastern wheat production areas

o Summer crop harvesting has advanced well this year and the planting of winter grains has also gone well, but there is need for moisture in eastern winter crop areas

- Mexico rainfall will be near to above average during the coming week improving soil moisture and crop production outlooks

- Nicaragua and Honduras have received some welcome rain recently, but moisture deficits are continuing in some areas

o Additional improvement is needed and may come slowly

- Southern Oscillation Index is mostly neutral at +1.13 and the index is expected to move higher over the next few days.

- New Zealand rainfall during the coming week to ten days will be near to below average except along the west coast of South Island where it will be a little greater than usual.

Source: World Weather, Inc.

Bloomberg Ag Calendar

Thursday, July 1:

- USDA weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am

- World cotton outlook update from International Cotton Advisory Committee

- Costa Rica, Honduras monthly coffee exports

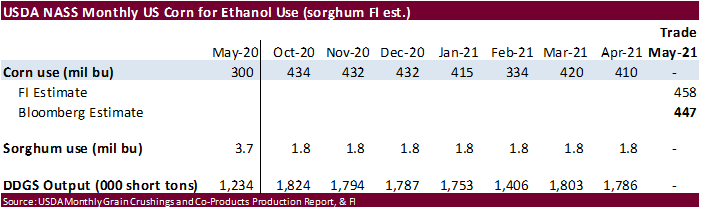

- U.S. corn for ethanol, DDGS production, 3pm

- USDA soybean crush, 3pm

- Port of Rouen data on French grain exports

- Australia Commodity Index

- AB Sugar trading update

- HOLIDAY: Canada, Hong Kong

Friday, July 2:

- ICE Futures Europe weekly commitments of traders report (6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly update on crop conditions

Monday, July 5:

- OECD-FAO Agricultural Outlook 2021-2030 report

- Ivory Coast cocoa arrivals

- Malaysia July 1-5 palm oil export data

- New Zealand Commodity Price

- HOLIDAY: U.S.

Tuesday, July 6:

- CNGOIC monthly report on Chinese grains & oilseeds

- USDA export inspections – corn, soybeans, wheat, 11am

- U.S. crop conditions — corn, cotton, soybeans, wheat, 4pm

- EU weekly grain, oilseed import and export data

- Purdue Agriculture Sentiment

- New Zealand global dairy trade auction

Wednesday, July 7:

- No major event scheduled

Thursday, July 8:

- USDA weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am

- Brazil’s Conab releases data on yield, area and output of corn and soybeans

- FAO World Food Price Index

- EIA weekly U.S. ethanol inventories, production

- Brazil Coffee Council Conference, Sao Paulo

- Port of Rouen data on French grain exports

- EARNINGS: Suedzucker, Agrana

Friday, July 9:

- ICE Futures Europe weekly commitments of traders report (6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly update on crop conditions

Source: Bloomberg and FI

Macros

US Initial Jobless Claims Jun 26: 364K (est 388K; prevR 415K; prev 411K)

US Continuing Claims Jun 19: 3469K (est 3340K; prevR 3413K; prev 3390K)

Brazil Markit Manufacturing PMI Jun: 56.4 (prev 53.7)

US Markit Manufacturing PMI Jun F: 62.1 (est 62.6; prev 62.6)

US Langer Consumer Comfort Index 27-Jun: 55.1 (prev 56.9)

US ISM Manufacturing Jun: 60.6 (est 60.9; prev 61.2)

– Prices Paid: 92.1 (est 87.0; prev 88.0)

– New Orders: 66.0 (est 65.0; prev 67.0)

– Employment: 49.9 (prev 50.9)

US Construction Spending (M/M) May: -0.3% (est 0.4%; prev R 0.1%)

USDA Export Sales

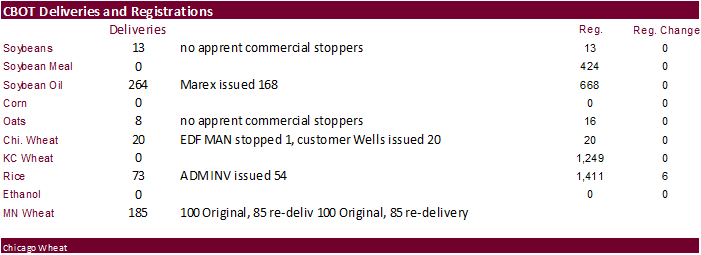

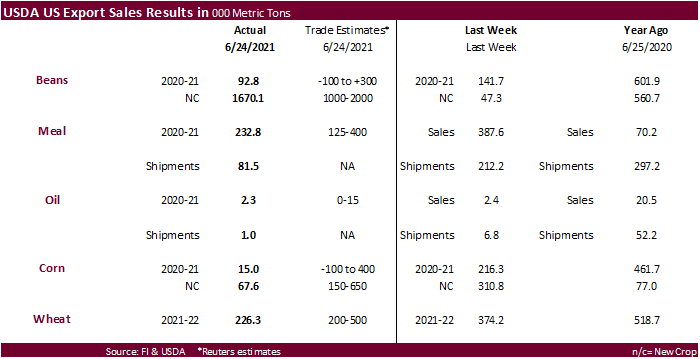

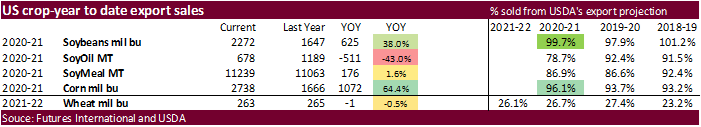

Unimpressive USDA export sales with exception of new-crop soybeans that came in as expected. Meal, soybean oil, and wheat sales were near the bottom end of trade expectations. Corn sales were very disappointing. Lower prices for the week ending June 24 appeared to have failed to attract new-crop business. We were looking for an increase in commitments but may see this next week after commodity prices rallied, prompting some importers to secure supplies amid outlook for tighter US supplies. China did buy 31,200 tons of old crop US soybeans and 1.147 million tons of new crop (as expected). Romania and Slovenia bought soybean meal. Pork sales were very good at 28,600 tons with Mexico committing to 17,700 tons.

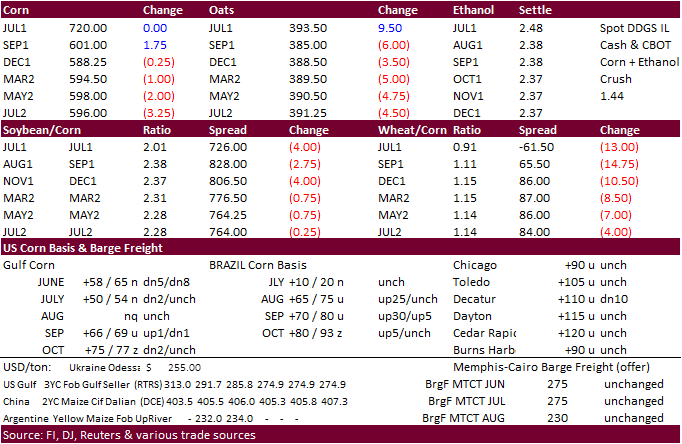

- US corn futures finished near unchanged as profit-taking was seen after yesterday’s limit-up move and earlier in the session hitting highest level seen since June 11.

- Export sales were disappointing at the low-end of estimates range.

- New month, new money, and the talk of reflation trade helped WTI crude oil and a weaker USD.

- After managed money reduced their net long positions over the past few weeks, we now look at this as an opportunity, or “room”, for them to add longs if additional bullish sentiment trickles into the market.

- We look for a tighter US new-crop corn stocks outlook over the long run while changes in the US soybean balance should be minimal over the short-term, at least for stocks until the August update.

- Funds were an estimated net seller of 1,000 net corn futures.

- FCM StoneX lowered their second crop corn for Brazil to 60.5 million tons from 62.0 million tons form last month on frost damage. Most of the reduction came from Parana and Mato Grosso do Sul.

- Corn for ethanol rose 9.6% MoM and 48.6% YoY to 447.558 million bushels. DDGS produced rose 9.7% MoM and 56.4% YoY to 1.939 million tons.

Klobuchar introduces 3 biofuel bills

http://www.ethanolproducer.com/articles/18373/klobuchar-introduces-3-biofuel-bills

Export developments.

- Results awaited: Iran in for 60,000 tons of corn and 60,000 tons barley for Aug/Sep shipment.

- China plans to auction off 155,000 tons of imported corn on July 2.

- 123,977 tons of US

- 31,539 tons of Ukraine origin

Updated 07/01/21

September corn is seen is a$4.50-$6.25 range.

December corn is seen in a $4.25-$6.00 range.

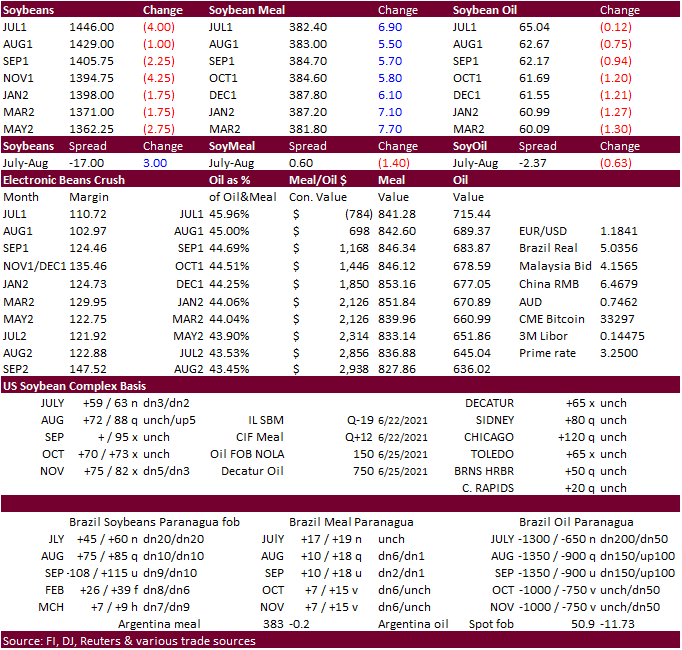

- Soybeans ended lower today on profit-taking following the bullish move from yesterday’s USDA report.

- Soybean oil was up nearly 200 points before profit-taking ended a three-session winning streak.

- Soybean meal saw the highest level at the 50-day MA, and the highest level since June 8th.

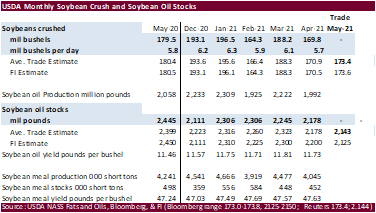

- USDA NASS crush for May was at 173.501 million bushels, slightly above analysts’ average estimate. Oil stocks were down 1.4% MoM and down 12.2% YoY for the May update.

- Malaysian palm futures were up 111 points and cash up $45/ton. SGS reported June palm oil exports for Malaysia at 1.546 million tons, a 10.8 percent increase from May.

- India CPO import margins are positive after they cut their import tax on crude palm oil to 10% from 15% for three months, effective June 30.

- Funds were an estimated net seller of 5,000 net soybean, 4,000 net beanoil and net buyers of 9,000 soymeal futures.

- Results awaited: Iran in for 60,000 tons of soybean meal for Aug/Sep shipment.

Updated 6/30/21

August soybeans are seen in a $12.75-$15.00 range; November $11.75-$15.00

August soybean meal – $330-$410; December $320-$425

August soybean oil – 60-66; December 46-67 cent range

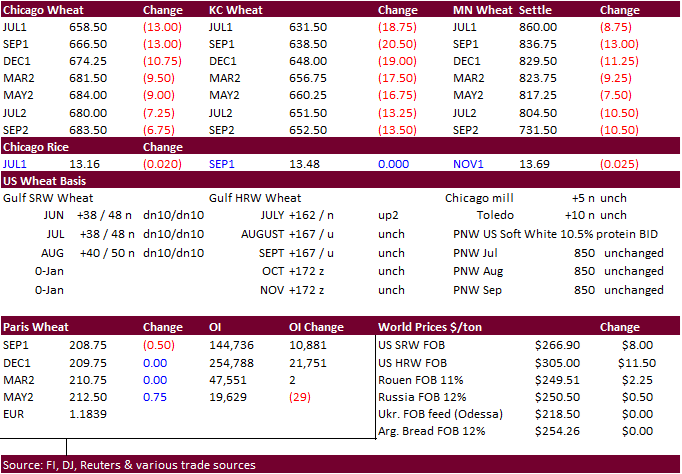

- US wheat rallied early in the session on higher corn and dry weather forecast for the US northern Great Plains, but as with corn and soybeans, we saw profit-taking causing wheat markets to finish lower. Talk of ridging next week for Russia’s wheat area and a weaker USD support.

- Ukraine’s AgMin mentioned the grain group could reach above 75 million tons, a record. Ukraine’s state weather forecaster sees the grain crop even higher at 75.8 million tons, up from 65 million tons in 2020 (2021 37.1 million tons of corn, 28.5 million tons of wheat, and 8.3 million ton of barley).

- Ukraine restored its value-added tax (VAT) rate of 20% will apply to livestock, milk, oilseeds, sugar beets. They left unchanged the rate of 14% for wheat, barley, corn, soybeans, sunflower seeds, rapeseed.

- Bulgaria expects the wheat crop to end up between 5.7 million and 5.8 million tons, a 20% annual increase from 4.7 million tons in 2020.

- December Paris wheat was down 0.25 euro at 209.50/ton.

- Funds were an estimated net seller of 10,000 SRW wheat futures.

- Crop watcher SovEcon raised Russia’s 2021-22 wheat exports by 1.8 million tons to 38.4 million tons factoring in the large crop and the current export tax situation remains in place for most of the 2021-22 season.

- Bangladesh’s seeks 50,000 tons of milling wheat on July 15. In addition to…

- Bangladesh’s seeks 50,000 tons of milling wheat on July 18.

- Results awaited: Iran seeks 60,000 tons of milling wheat on Wednesday for Aug/Sep shipment.

- Jordan retendered for 120,000 tons of feed barley set to close July 7 for Nov/Dec 2021 shipment.

- Jordan retendered for 120,000 tons of wheat set to close July 6 for Jan/Feb 2022 shipment.

- Ethiopia seeks 400,000 tons of wheat on July 19.

Rice/Other

- Bangladesh seeks 50,000 tons of rice from India. Separately….

- Bangladesh seeks 50,000 tons of rice on July 12.

September Chicago wheat is seen in a $5.90-$7.00 range

September KC wheat is seen in a $5.60-$6.70

September MN wheat is seen in a $7.50-$9.00

This summary is based on reports from exporters for the period June 18-24, 2021.

Wheat: Net sales of 226,300 metric tons (MT) were reported for delivery in marketing year 2021/2022. Increases primarily for Japan (148,700 MT), Mexico (31,100 MT, including decreases of 1,200 MT), unknown destinations (18,500 MT), Jamaica (9,400 MT, switched from unknown destinations and decreases of 300 MT), and Guyana (8,100 MT, switched from unknown destinations and decreases of 200 MT), were offset by reductions primarily for Nigeria (2,500 MT). Exports of 136,000 MT were primarily to Mexico (59,200 MT), Nigeria (27,500 MT), Japan (27,200 MT), Jamaica (9,400 MT), and Guyana (8,100 MT).

Corn: Net sales of 15,000 MT for 2020/2021 were down 93 percent from the previous week and 94 percent from the prior 4-week average. Increases primarily for Japan (99,700 MT, including 159,200 MT switched from unknown destinations and decreases of 4,500 MT), Mexico (94,700 MT, including decreases of 12,100 MT), Honduras (29,200 MT, including decreases of 6,000 MT), Nicaragua (22,500 MT), and Venezuela (8,400 MT, including 8,000 MT switched from unknown destinations), were offset by reductions primarily for unknown destinations (167,200 MT) and China (75,000 MT). For 2021/2022, net sales of 67,600 MT were for unknown destinations (50,000 MT), Honduras (12,000 MT), Mexico (4,500 MT), Canada (600 MT), and Taiwan (500 MT). Exports of 1,136,700 MT were down 33 percent from the previous week and 36 percent from the prior 4-week average. The destinations were primarily to China (335,000 MT), Japan (334,700 MT, including 60,700 MT – late), Mexico (252,500 MT), South Korea (61,300 MT), and Honduras (49,600 MT).

Optional Origin Sales: For 2020/2021, new optional origin sales of 65,000 MT were reported for South Korea. The current outstanding balance of 30,500 MT is for unknown destinations. For 2021/2022, the current outstanding balance of 125,000 MT is for South Korea (65,000 MT) and unknown destinations (60,000 MT).

Late Reporting: For 2020/2021, exports totaling 80,900 MT of corn were reported late to Japan (60,700 MT) and Guatemala (20,200 MT).

Barley: No net sales or exports were reported for the week.

Sorghum: Total net sales for 2020/2021 of 4,000 MT were for China. Exports of 100 MT–a marketing year low–were unchanged from the previous week, but down noticeably from the prior 4-week average. The destination was to South Korea.

Rice: Net sales of 15,600 MT for 2020/2021 were down 80 percent from the previous week and 63 percent from the prior 4-week average. Increases primarily for Mexico (19,700 MT, including decreases of 7,000 MT), Jordan (2,200 MT), Guatemala (2,000 MT), Canada (1,800 MT, including decreases of 700 MT), and Haiti (800 MT), were offset by reductions for Japan (12,000 MT). For 2021/2022, net sales of 20,200 MT were for Japan (12,000 MT), Mexico (7,000 MT), Canada (700 MT), and Taiwan (500 MT). Exports of 68,700 MT were up 61 percent from the previous week and 25 percent from the prior 4-week average. The destinations were primarily to Mexico (25,700 MT), Nicaragua (23,600 MT), Japan (12,400 MT), Canada (2,400 MT), and Saudi Arabia (1,800 MT).

Exports for Own Account: For 2020/2021, new exports for own account totaling 200 MT were for Canada. The current exports for own account outstanding balance is 200 MT, all Canada.

Soybeans: Net sales of 92,800 MT for 2020/2021 were down 35 percent from the previous week, but up 62 percent from the prior 4-week average. Increases primarily for China (31,200 MT, including decreases of 100 MT), Canada (19,800 MT), Mexico (7,300 MT, including decreases of 3,300 MT), unknown destinations (6,400 MT), and Vietnam (6,100 MT, including decreases of 100 MT), were offset by reductions for South Korea (100 MT). For 2021/2022, net sales of 1,670,100 MT reported for China (1,147,000 MT), unknown destinations (511,600 MT), Indonesia (9,000 MT), and Taiwan (3,000 MT), were offset by reductions for Canada (500 MT). Exports of 148,500 MT were down 39 percent from the previous week and 33 percent from the prior 4-week average. The destinations were primarily to Mexico (69,900 MT), Indonesia (23,100 MT), China (9,500 MT), Japan (8,900 MT), and Vietnam (7,500 MT).

Exports for Own Account: For 2020/2021, the current exports for own account outstanding balance is 5,800 MT, all Canada.

Export Adjustments: Accumulated exports of soybeans to Mexico were adjusted down 11,742 MT for week ending May 27th. This shipment was reported in error.

Late Reporting: For 2020/2021, exports totaling 4,000 MT of soybeans were reported late to Cuba.

Soybean Cake and Meal: Net sales of 232,800 MT for 2020/2021 were down 40 percent from the previous week, but up 1 percent from the prior 4-week average. Increases primarily for Vietnam (95,000 MT, including 50,000 MT switched from unknown destinations), Romania (45,000 MT), Slovenia (42,000 MT), Colombia (34,000 MT), and Mexico (21,400 MT, including decreases of 2,000 MT), were offset by reductions primarily for unknown destinations (44,300 MT), Ecuador (27,000 MT), and Costa Rica (3,500 MT). For 2021/2022, net sales of 184,500 MT were primarily for Ecuador (90,000 MT), Mexico (84,200 MT), Honduras (6,000 MT), and Costa Rica (3,500 MT). Exports of 81,500 MT were down 62 percent from the previous week and 63 percent from the prior 4-week average. The destinations were primarily to Mexico (29,300 MT), Canada (17,400 MT), Guatemala (12,200 MT), Panama (5,700 MT), and Sri Lanka (4,400 MT).

Soybean Oil: Net sales of 2,300 MT for 2020/2021 were down 2 percent from the previous week, but up 6 percent from the prior 4-week average. Increases were primarily for Mexico (1,300 MT, including decreases of 900 MT). Exports of 1,000 MT were down 85 percent from the previous week and 91 percent from the prior 4-week average. The destinations were to Canada (600 MT) and Mexico (400 MT).

Cotton: Net sales of 42,600 RB for 2020/2021 were down 43 percent from the previous week and 64 percent from the prior 4-week average. Increases primarily for Vietnam (10,500 RB, including 3,100 RB switched from China, 800 RB switched from Japan, 400 RB switched from Thailand, and decreases of 11,000 RB), Pakistan (7,800 RB), Turkey (5,900 RB), Bangladesh (4,100 RB), and China (3,400 RB, including 2,200 RB switched from Vietnam), were offset by reductions for Malaysia (300 RB). For 2021/2022, net sales of 133,900 RB were primarily for Mexico (54,800 RB), Bangladesh (46,800 RB), Pakistan (8,300 RB), China (7,700 RB), and Vietnam (4,400 RB). Exports of 274,000 RB were up 33 percent from the previous week, but down 3 percent from the prior 4-week average. Exports were primarily to Vietnam (77,800 RB), China (54,100 RB), Turkey (44,400 RB), Pakistan (22,500 RB), and Mexico (18,300 RB). Net sales of Pima totaling 2,200 RB–a marketing-year low–were down 76 percent from the previous week and 61 percent from the prior 4-week average. Increases primarily for Peru (1,600 RB), India (400 RB), and Turkey (300 RB), were offset by reductions for China (100 RB). Total net sales for 2021/2022 of 100 RB were for Japan. Exports of 10,400 RB were down 30 percent from the previous week and 27 percent from the prior 4-week average. The destinations were primarily to India (6,300 RB), China (2,300 RB), Turkey (500 RB), Peru (300 RB), and Pakistan (300 RB).

Exports for Own Account: For 2020/2021, the current exports for own account totaling 6,500 RB to Vietnam (4,500 RB), China (1,500 RB), and Bangladesh (400 RB) were applied to new or outstanding sales. The outstanding balance of 4,700 RB is for China.

Hides and Skins: Net sales of 964,300 pieces for 2021 were up noticeably from the previous week and from the prior 4-week average. Increases primarily for China (855,700 whole cattle hides, including decreases of 6,400 pieces), South Korea (36,200 whole cattle hides, including decreases of 4,800 pieces), Mexico (18,500 whole cattle hides, including decreases of 1,300 pieces), Brazil (16,000 whole cattle hides, including decreases of 200 pieces), and Japan (11,500 whole cattle hides, including decreases of 1,600 pieces), were offset by reductions for Spain (200 pieces). Total net sales of 11,200 kip skins were reported for Belgium. Exports of 351,900 pieces were up 2 percent from the previous week, but down 4 percent from the prior 4-week average. Whole cattle hides exports were primarily to China (243,300 pieces), South Korea (32,500 pieces), Mexico (23,800 pieces), Thailand (17,800 pieces), and Brazil (8,700 pieces).

Net sales of 114,300 wet blues for 2021 were down 45 percent from the previous week and 31 percent from the prior 4-week average. Increases primarily for China (74,000 unsplit, including decreases of 200 unsplit), Mexico (23,000 unsplit and 300 grain splits), and Vietnam (16,300 unsplit), were offset by reductions for Italy (100 unsplit). Exports of 154,800 wet blues were up 20 percent from the previous week, but down 3 percent from the prior 4-week average. The destinations were primarily to Italy (35,300 unsplit and 3,600 grain splits), China (38,600 unsplit), Vietnam (31,000 unsplit), Mexico (12,200 unsplit and 3,500 grain splits), and Thailand (13,500 unsplit). Net sales of 719,900 splits reported for Vietnam (600,000 pounds) and Taiwan (129,800 pounds), were offset by reductions for China (9,800 pounds). Exports of 122,600 pounds were to China.

Beef: Net sales of 12,100 MT reported for 2021 were down 28 percent from the previous week and 17 percent from the prior 4-week average. Increases were primarily for Japan (3,300 MT, including decreases of 500 MT), South Korea (2,800 MT, including decreases of 600 MT), China (2,100 MT, including decreases of 100 MT), Taiwan (1,500 MT, including decreases of 200 MT), and Canada (600 MT, including decreases of 200 MT). Exports of 18,900 MT were up 4 percent from the previous week and 9 percent from the prior 4-week average. The destinations were primarily to Japan (4,900 MT), South Korea (4,900 MT), China (4,200 MT), Taiwan (1,200 MT), and Mexico (1,100 MT).

Pork: Net sales of 28,600 MT reported for 2021 were unchanged from the previous week, but up 12 percent from the prior 4-week average. Increases primarily for Mexico (17,700 MT, including decreases of 900 MT), Japan (2,800 MT, including decreases of 400 MT), Canada (1,800 MT, including decreases of 800 MT), Colombia (1,600 MT, including decreases of 100 MT), and China (1,500 MT, including decreases of 1,000 MT), were offset by reductions for New Zealand (100 MT). Exports of 32,200 MT were down 4 percent from the previous week and 5 percent from the prior 4-week average. The destinations were primarily to Mexico (13,500 MT), China (5,100 MT), Japan (4,000 MT), South Korea (3,000 MT), and Canada (2,000 MT).

U.S. EXPORT SALES FOR WEEK ENDING 06/24/2021

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR |

CURRENT YEAR |

YEAR |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

91.2 |

1,549.4 |

1,932.9 |

99.8 |

519.4 |

838.6 |

0.0 |

0.0 |

|

SRW |

17.9 |

1,039.8 |

510.8 |

8.9 |

31.8 |

68.3 |

0.0 |

0.0 |

|

HRS |

93.8 |

1,562.6 |

1,621.1 |

26.9 |

353.1 |

464.2 |

0.0 |

0.0 |

|

WHITE |

23.5 |

1,078.2 |

1,098.8 |

0.4 |

231.1 |

319.3 |

0.0 |

0.0 |

|

DURUM |

0.0 |

8.4 |

225.0 |

0.0 |

26.3 |

85.0 |

0.0 |

0.0 |

|

TOTAL |

226.3 |

5,238.4 |

5,388.7 |

136.0 |

1,161.7 |

1,775.4 |

0.0 |

0.0 |

|

BARLEY |

0.0 |

23.7 |

40.3 |

0.0 |

1.1 |

1.3 |

0.0 |

0.0 |

|

CORN |

15.0 |

12,147.5 |

8,430.9 |

1,136.7 |

57,399.6 |

33,882.6 |

67.6 |

15,748.3 |

|

SORGHUM |

4.0 |

893.1 |

843.4 |

0.1 |

6,337.0 |

3,313.1 |

0.0 |

1,594.9 |

|

SOYBEANS |

92.8 |

3,567.7 |

7,745.1 |

148.5 |

58,272.9 |

37,076.7 |

1,670.1 |

9,279.4 |

|

SOY MEAL |

232.8 |

2,288.2 |

2,092.9 |

81.5 |

8,950.6 |

8,970.3 |

184.5 |

856.0 |

|

SOY OIL |

2.3 |

26.1 |

212.9 |

1.0 |

651.8 |

976.4 |

0.0 |

0.6 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

26.9 |

221.1 |

81.7 |

48.5 |

1,525.3 |

1,317.4 |

0.0 |

0.0 |

|

M S RGH |

-7.0 |

8.4 |

24.0 |

0.5 |

25.5 |

72.5 |

7.0 |

7.0 |

|

L G BRN |

-0.6 |

12.2 |

11.4 |

0.3 |

38.9 |

56.8 |

0.7 |

0.7 |

|

M&S BR |

0.1 |

23.0 |

31.6 |

0.1 |

133.7 |

86.4 |

0.0 |

0.0 |

|

L G MLD |

4.0 |

45.2 |

58.6 |

3.2 |

607.8 |

830.6 |

0.0 |

0.0 |

|

M S MLD |

-7.7 |

136.1 |

129.1 |

16.1 |

548.2 |

610.2 |

12.5 |

12.5 |

|

TOTAL |

15.6 |

446.0 |

336.4 |

68.7 |

2,879.5 |

2,973.9 |

20.2 |

20.2 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

42.6 |

2,425.4 |

4,441.8 |

274.0 |

13,638.7 |

12,551.1 |

133.9 |

2,427.1 |

|

PIMA |

2.2 |

121.5 |

126.0 |

10.4 |

700.8 |

448.4 |

0.1 |

4.1 |

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.