PDF Attached

USDA released their quarterly Grain Stocks and Acreage reports

Bottomline was the acreage was bullish for soybeans, corn and wheat.

Acreage, Grain Stocks and Rice Stocks (June 2020)

https://www.nass.usda.gov/Newsroom/Executive_Briefings/2020/06-30-2020.pdf

Implied 2020 US corn production suggests its down 1 billion bushels from June S&D after USDA lowered the planted area by 5.0 million acres from March Intentions. Soybean plantings increased 315,000 acres from March Intentions. The implied soybean production is near unchanged from the June S&D, while wheat is 50 million bushels below June. The cotton area was lowered 1.5 million acres. All wheat plantings declined 405,000 acres due to a reduction in spring wheat of 390,000 acres and winter wheat of 225,000 acres. The implied all-wheat production is 50 million bushels below the June S&D. The acreage of the 8-major crops came in at 246.7 million, 6.720 million below March and all principal crops were down 7.2 million from March. Some producers may have decided you can’t make as much money in some of these commodities than previous years. With corn 30 under in parts of IN, for example, yields $3.20 basis the December.

Attached are some summary tables, including state by state for corn. Area declined by most for the Dakota’s and Nebraska. More tables and charts will be released later this week.

US corn stocks as of June 1 of 5.224 billion bushels was 273 million above trade expectations. Soybean stocks of 1.386 billion were near expectations and all-wheat of 1.044 billion came in 64 million bushels above expectations. End of 2019-20 wheat and corn stocks were and are expected, respectively, are higher than what the trade projected. There were minimal changes to March 1 stocks.

We are under the opinion the loss in the June acres from March will not sit idle. Many of the producers may opt to take insurance this year, but some sort of cover crop could get planted. Many of the acres that were reduced for corn were in states that saw too much rain (WCB and northern Great Plains) where yield potential might be limited, leading to abandonment. Those state include Nebraska, South Dakota, and North Dakota, areas where corn basis has been depressed since the start of the 2019 harvest. Producers don’t buy land for steady annual returns, rather for land appreciation. Skipping a cycle is economically devastating but over the long run if history repeats, most producers will weather the storm. Look for a possible large second soybean crop planted this year for the Midwest and Delta.

We lowered our corn for feed by 150 million bushels to 5.500 billion, 200 million below USDA. Our corn carryout for 2019-20 is, for now, at 2.343 billion bushels, above USDA’s 2.103 billion estimate. The all-wheat carryout of 1.044 billion was much higher than expected, and implies feed use for the year could end up near 75 million bushels versus 135 million USDA was using in June. US soybean stocks of 1.386 million were near expectations.

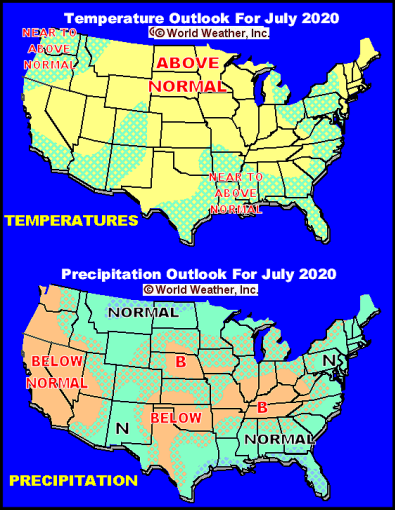

Weather and Crop Progress

MARKET WEATHER MENTALITY FOR CORN AND SOYBEANS: Concern over U.S. crop weather during the next few weeks is rising with many forecasters offering drier and warmer biased conditions for key corn and soybean production areas in the Midwest. This developing concern and worry over ongoing dryness in the eastern Black Sea region and developing dryness in France will raise some market interest. But for today, the USDA report will likely have more influence than the weather, but the remainder of this week and next week will likely be more about the weather than anything else.

Good crop weather is occurring in India and northern China’s main corn, sorghum, soybean and groundnut production areas are seeing a good mix of weather to support crops. Weather in Brazil is not offering any major changes to unharvested corn.

Canola conditions are improving in parts of Canada’s Prairies and Australia’s canola is establishing relatively well.

Overall weather will likely begin contributing a more bullish bias to market mentality as a new drying trend gets under way in the U.S. while France and the eastern Black Sea region’s deal with dryness as well.

MARKET WEATHER MENTALITY FOR WHEAT: Favorable wheat maturation and harvest conditions are occurring in the Black Sea region, but a little too much rain has been occurring in the Balkan Countries where drier conditions are needed to promote better harvest conditions and to protect grain quality.

Weather in Western Europe is more favorable for small grain filling and maturation. Weather is also favorable in the United States for hard red winter wheat maturation and harvest progress. Portions of the Midwest soft wheat in the U.S. will experience some improving crop maturation and harvest weather after the next few days pass due to drier and warmer weather.

Wheat conditions in Canada are improving with rainfall this week and Australia crops remain in mostly good condition. There is need for rain in western Argentina, in many South Africa crop areas and in both Queensland and South Australia.

Overall, weather today will likely provide a mixed influence on market mentality.

Source: World Weather Inc. and FI

- U.S. annual acreage planted – soybeans, wheat, cotton, corn

- USDA quarterly stocks of corn, wheat, barley, oat, sorghum and soybeans

- OECD annual agricultural policy monitoring and evaluation report

- U.S. agricultural prices paid, received, 3pm

- Malaysia’s palm oil export data for June 1-30

WEDNESDAY, July 1:

- EIA U.S. weekly ethanol inventories, production, 10:30am

- Brazil soybean exports

- Australia commodity index

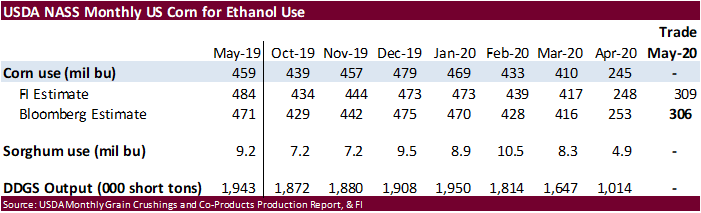

- U.S. soybean crush, DDGS output, corn for ethanol, 3pm

- Holiday: Canada, Hong Kong

THURSDAY, July 2:

- UN FAO world food price index, 4am

- USDA weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am

- Port of Rouen data on French grain exports

- AB Foods trading update

FRIDAY, July 3:

- U.S. Independence Day Holiday

- ICE Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly update on crop conditions

Source: Bloomberg and FI

· The CN21/CU21 traded out to 6 cents during the session, July premium, ending around 6 cents.

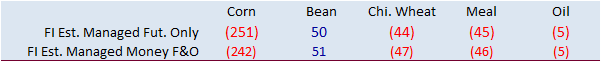

· Funds bought an estimated net 40,000 corn contracts on Tuesday after buying 33,000 on Monday.

· China is seeing a reemergence in African swine fever that is sending domestic pork prices higher.

· China looks to sell another 4 million tons of corn from reserves on Thursday. China corn prices remain near a 5-year high.

· Soybean and Corn Advisory increased his outlook for Brazilian corn for 2019-20 to 98 million tons from 96 million previously.

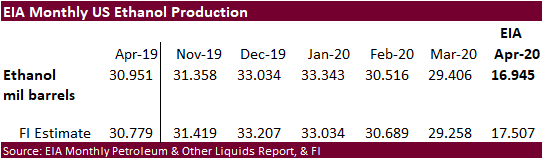

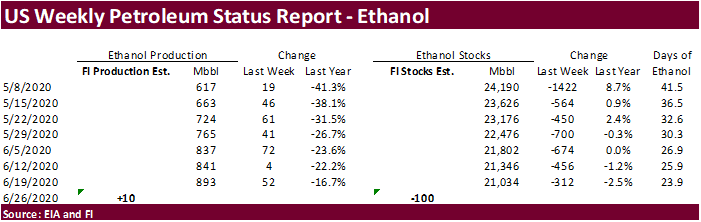

- A Bloomberg poll looks for weekly US ethanol production to be up 15,000 at 908,000 barrels (892-922 range) from the previous week and stocks to decrease 65,000 barrels to 21.099 million.

- None reported.

September corn is seen in a $3.20 and $3.65 range over the short term. December lows could reach $3.05 if US weather cooperates.