WASHINGTON,

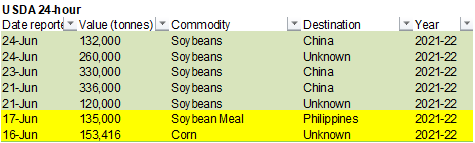

June 24, 2021—Private exporters reported to the U.S. Department of Agriculture the follow activity:

-

Export

sales of 132,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year; and -

Export

sales of 260,000 metric tons of soybeans for delivery to unknown destinations during the 2021/2022 marketing year.

The

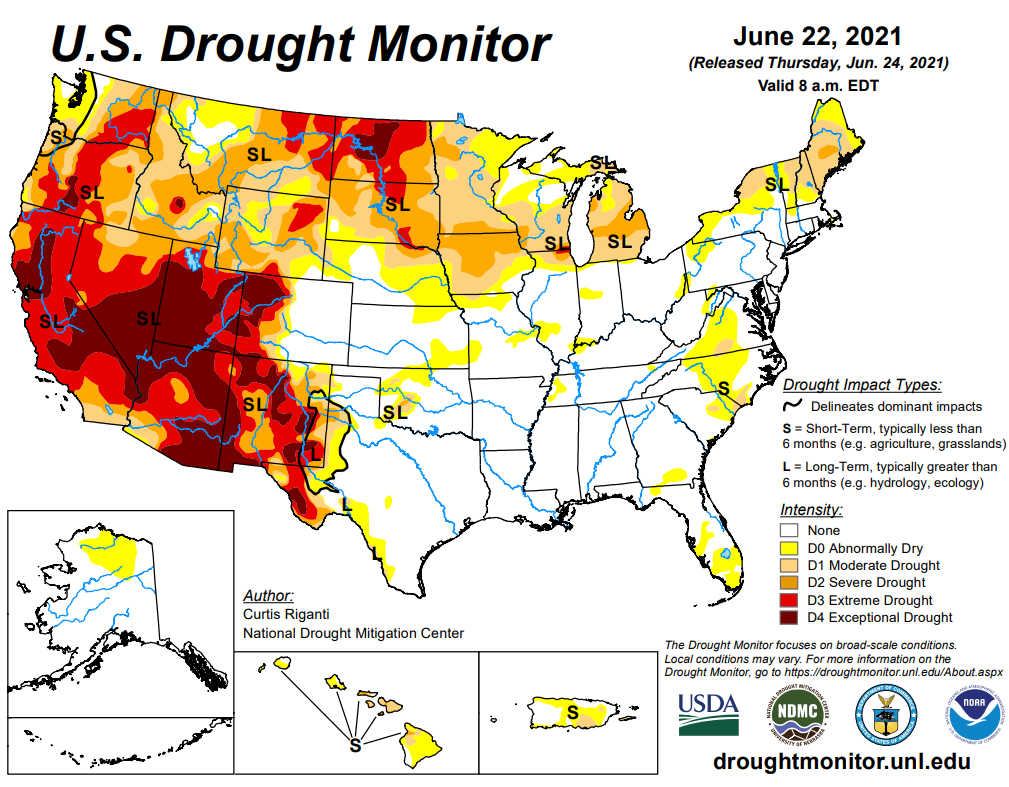

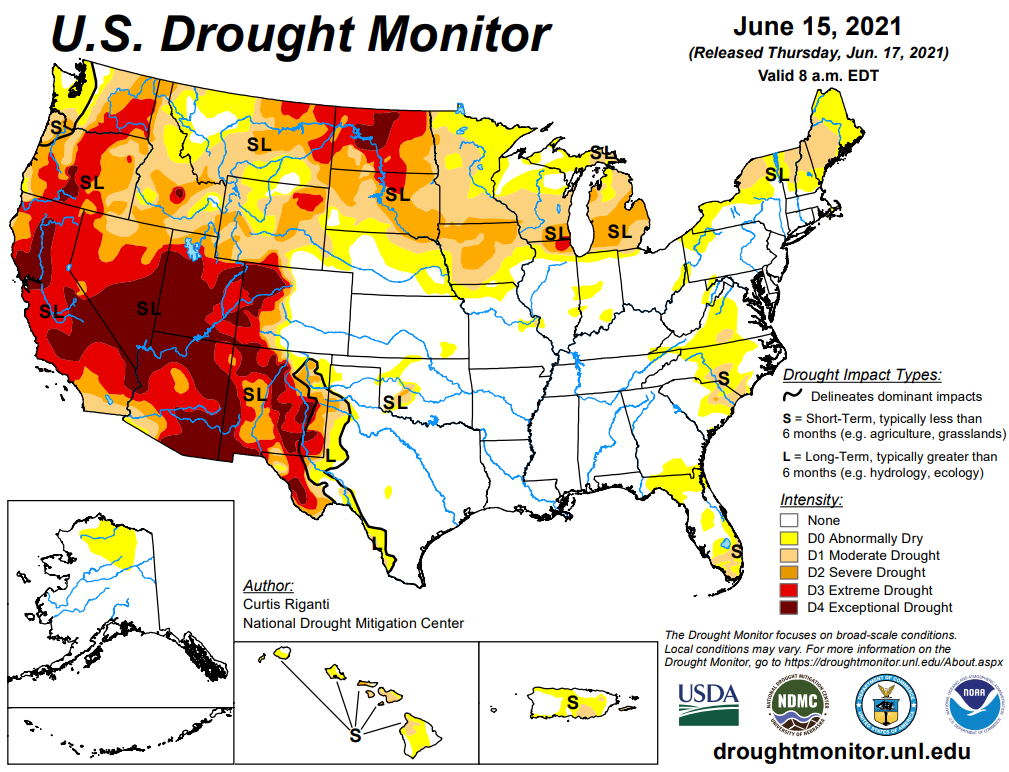

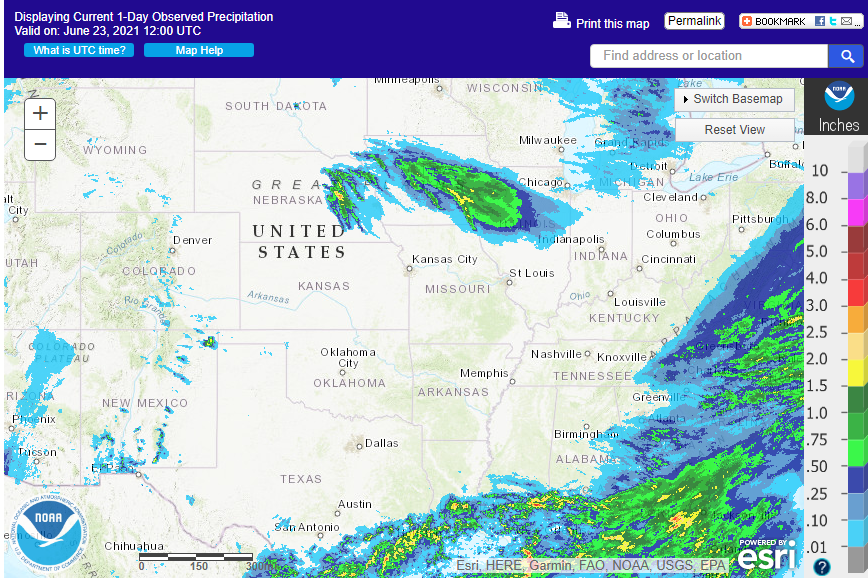

morning weather forecast improved for the Midwest. Rains will fall across the west central areas of the Midwest today, and north central and west central areas tomorrow through Monday.

![]()

We

caution reading into the drought monitor as it may not reflect the recent good rains that occurred since late last week.

Earlier…

MOST

IMPORTANT WEATHER OF THE DAY

- Excessive

rain will fall across parts of the Midwest during the next 2-3 days

o

Rain amounts of 2.00 to 6.00 inches and local totals over 10.00 inches will result

- Missouri,

Illinois, southeastern Iowa and parts of India will be most impacted by the greatest rainfall

o

Some hail and damaging wind will also be possible

- All

of the U.S. Midwest will get rain during the next ten days with all areas getting sufficient amounts to either saturate the ground or to notably increase soil moisture except in the northwestern Corn Belt

o

The Dakotas, Minnesota, northwestern Iowa and western Wisconsin will get some periodic rainfall, but it is not likely to be nearly as great as that in the lower and eastern Midwest

- Moisture

deficits will continue in some of these areas and the potential for greater drying and crop stress will be high in July and August - A

building heat wave in the U.S. Pacific Northwest and in British Columbia, Canada will be closely monitored this weekend into next week

o

Record setting heat is expected with extreme high temperatures getting into the 90s and over 100 degrees deeply into this region

- The

weekend and early part of next week will be hottest - Stress

to livestock and crops will become an extreme - Huge

energy demand is expected - A

few extreme temperatures may reach above 110 in the Yakima Valley of central Washington

o

Some of the excessive heat will shift into the western Canada Prairies next week and eventually into the U.S. northwestern Plains causing similar problems for crops and livestock

- The

drier areas in the region will experience horrific conditions when the hottest weather arrives and there will also be some high wind speeds as well - U.S.

crop conditions are also expected to be good through the next couple of weeks in the Delta and southeastern states due to well-timed rain and seasonably mild to slightly cool temperatures - West

Texas cotton, corn, sorghum and peanut production areas will get much needed thunderstorms this weekend into early next week

o

The resulting rainfall will improve topsoil moisture for a while

o

Relief to recent drying and moisture stress will be good for the region, but follow up rain will still be needed, especially in unirrigated crops in the southwest where previous rainfall failed to bolster subsoil moisture in a

significant manner

o

Rain totals Saturday into Monday will vary from 0.75 to 2.00 inches with a few 2.00- to 4.00-inch totals

- Some

hail damage is possible - Other

areas in the southern U.S. Plains will receive a good mix of weather during the next ten days to support most crop needs

o

South Texas may be a little too dry, though

- No

meaningful rain is expected in the far western United States over the next ten days - Monsoonal

rainfall will begin to reach into the southwestern United States during the coming week to ten days and that moisture feed will prove to be very important for the Rocky Mountain region and Great Plains during July

- Southeastern

Canada corn, soybean and wheat conditions are rated mostly good, although a greater boost in rainfall might be welcome at some point into time over the next few weeks.

o

Some of that precipitation need is expected over the coming week as rain from the U.S. Midwest streams into the region

- Western

Russia’s current heat and dryness bias is expected to continue for another day or two with eastern Ukraine and western Kazakhstan also being impacted

o

High temperatures in the 80s and 90s Fahrenheit with a few extremes over 100 are expected through the period

o

Cooling is likely along with a good chance for rain in northern parts of this dry region this weekend into next week

o

Southern areas of the dry region may have to wait a little longer for relief, but it should evolve in the last days of June and early July.

- Follow

up rain will be very important for Russia’s Southern Region because anticipated rainfall is not likely to be very great leaving the ground a little drier than desired for the best crop development - Russia’s

eastern spring wheat areas in the southern New Lands and northern Kazakhstan have received some relief from dryness and more is expected during the coming week

o

The moisture should have come in time to support better production potentials, although some yield loss may have already occurred in a few of the driest areas

o

Western portions of the spring wheat and sunseed production region of Kazakhstan and neighboring areas of Russia’s southwestern New Lands continue too dry and need rain

- China

drying is most likely from Jiangsu to Shaanxi and Shanxi during the next ten days

o

Subsoil moisture will carry on relatively normal crop development for a while

o

A good mix of rain and sunshine is likely elsewhere in east-central and northeastern China for the next couple of weeks

o

Far southern China may continue a little wetter than desired and some sunshine and warm weather is needed

- Western

Xinjiang, China weather has improved recently with warmer temperatures and less rain

o

Northeastern Xinjiang has turned much cooler than usual again and periods of showers and thunderstorms are expected through the weekend and into early next week keeping temperatures below average

o

Weather conditions will improve in northeastern Xinjiang later next week

o

Western Xinjiang weather is expected to be more favorable on a consistent basis, although temperatures may not be quite as warm as usual

- India’s

southwestern monsoon pattern has been weaker than usual so far this month keeping the interior west, far south and northwest drier than usual

o

This drier bias is expected to continue for the next couple of weeks

- Eventually,

the concern over limited soil moisture will grow and catch the attention of some traders, but dryness in June is not uncommon and as long as July rainfall improves the impact should be low - Eastern

India weather has been great for summer crop planting, emergence and early development with little change likely - Europe

weather is trending wetter and the moisture will prove to benefit many winter, spring and summer crops

o

Temperatures will be warmer than usual in eastern Europe and the western Commonwealth of Independent States into the weekend while cooling occurs in the far west parts of Europe

- France

will be cooler than usual

o

Well-timed precipitation is expected in most of the continent with the exception of some Mediterranean Sea countries where rainfall will be minimal

o

The bottom line in Europe will remain mostly very good as long as timely rain occurs as advertised. There may be some areas in the western Balkan Countries that will trend a little too dry raising some crop stress

- Australia

weather has been and will continue to be favorably mixed through the first week of July resulting in well-established wheat, barley and canola in most of the nation. There will be need for greater rain in parts of South Australia, northwestern Victoria and

Queensland as time moves along. - Southeast

Asia rainfall continues lighter and more sporadic than usual in the mainland crop areas and this week’s weather will not likely change much

o

Indonesia and Malaysia rainfall is expected to be sufficient to maintain or improve soil moisture for all crops

o

Philippines rainfall will be near to below average for at least the next ten days

- Some

areas may experience net drying

o

Western and southern Thailand (north of the Malay Peninsula) will be driest into next week along with some Vietnam locations

- West

Africa rainfall in Ivory Coast and Ghana will be near to above average during the coming ten days

o

Nigeria and Cameroon will see a mix of precipitation during the next ten days with most crops benefiting well from the pattern

- A

part of Nigeria will receive less than usual rainfall during this period, but timely rain is still expected - Erratic

rainfall has been and will continue to fall from Uganda and Kenya into parts of Ethiopia

o

A boost in precipitation is needed

- Ethiopia

rainfall is expected to gradually improve while a boost in precipitation will continue needed in other areas - South

Africa was dry Wednesday except for a few western coastal showers

o

Showers will increase in the far southwest the remainder of this week and into the weekend

- The

moisture will be good for winter crops, but more moisture will be needed in Free State and other eastern wheat production areas

o

Summer crop harvesting has advanced well this year and the planting of winter grains has also gone well, but there is need for moisture in eastern winter crop areas

- North

Africa will experience net drying for the next ten days which will be ideal in supporting winter crop harvest and other late season farming activities - Argentina

rainfall during the next ten days will be mostly confined to the northeast and east-central crop areas where 0.50 to 1.50 inches and locally more may fall from brief periods of rain today and again in the first days of July

o

Most other winter crop areas will be dry allowing fieldwork to advance without weather related delay

- There

is need for rain in western and some southern winter crop areas, but the situation is not critical

o

Temperatures will be seasonable

- Brazil

will experience alternating periods of rain and sunshine in southern parts of the nation through the next ten days while most areas to the north remain seasonably dry

o

The moisture will be good for wheat and other winter crops, although there is some potential for excessive rain in a few Rio Grande do Sul and Santa Catarina locations

o

Safrinha crops will gradually mature and be harvested during this period of time, although Cotton will continue to fill bolls in some areas

- Safrinha

crop areas are not expecting much, if any, rain

o

Harvesting of sugarcane, coffee and citrus will advance well

- Frost

and some freezes may occur from southern Parana into northeastern Rio Grande do Sul, Brazil during mid-week next week possibly threatening wheat - Mexico

rainfall will continue in southern parts of the nation over the coming week while some rain expands into the interior far west

o

Rain should increase and advance to the north during the June 27-July 4 period, but it will be erratic

- Nicaragua

and Honduras have received some welcome rain recently, but moisture deficits are continuing in some areas

o

Additional improvement is needed and may come slowly

- Southern

Oscillation Index is mostly neutral at -1.96 and the index is expected to trend higher over the coming week - New

Zealand rainfall during the coming week to ten days will be a little lighter than usual in eastern South Island and near to above normal in the west while a good mix of rain and sunshine occur in North Island

o

Temperatures will be near to above average

Source:

World Weather, Inc.

Bloomberg

Ag Calendar

Thursday,

June 24:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - International

Grains Council monthly report - Port

of Rouen data on French grain exports - USDA

hogs and pigs inventory, poultry slaughter, red meat production, 3pm

Friday,

June 25:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Malaysia

June 1-25 palm oil export data - U.S.

cattle on feed, 3pm

Source:

Bloomberg and FI

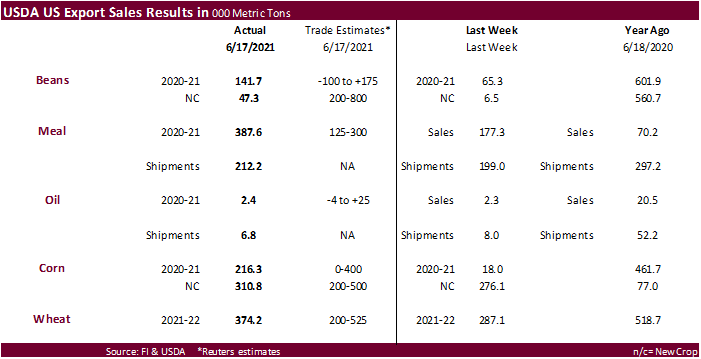

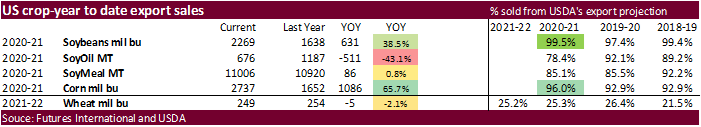

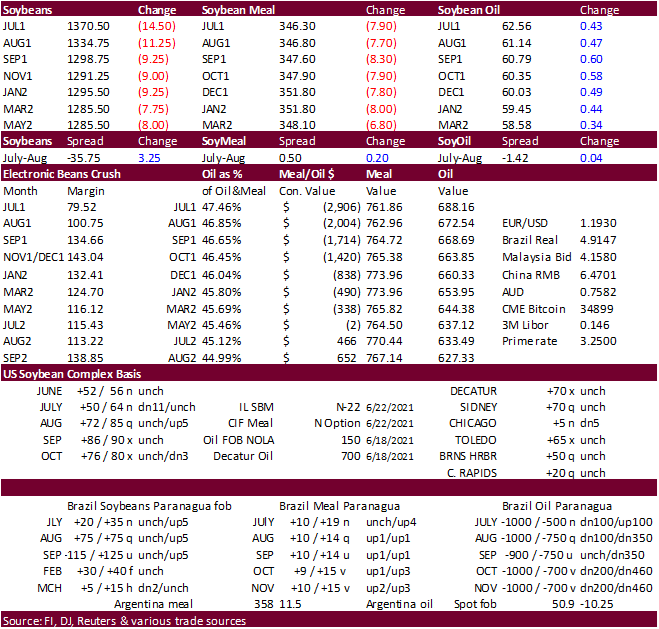

USDA

Export Sales

Soybean

meal sales of 387,600 tons exceeded expectations and included increases primarily for the Philippines (146,500 MT), Ecuador (109,800 MT, including decreases of 16,800 MT), Italy (30,000 MT), Honduras (20,300 MT), and El Salvador (19,500 MT, including 5,800

MT switched from Guatemala and 2,700 MT switched from Nicaragua). Soybean export sales were 141,700 tons old crop and only 47,300 tons new crop. China bought a cargo of old crop soybeans. Look for new-crop soybean sales to increase next week after China

shopped around. Soybean oil sales were 2,400 tons and shipments low at 6,800 tons. Corn sales were 216,300 tons old and 310,800 tons new. Combined they were ok. Corn sales for old crop included a lot of switches, including China (180,100 MT, including 132,000

MT switched from unknown destinations). Corn new crop included 242,800 tons for unknown. All wheat sales were within expectations at 374,200 tons.

Macros

US

Weekly Initial Jobless Claims Jun 19: 411K (est 380K; prev 412K)

US

Continuing Claims Jun 12: 3390K (est 3460K; prevR 3534K; prev 3518K)

US

Durable Goods Orders May P: 2.3% (est 2.8%; prevR -0.8%; prev -1.3%)

US

Durable Goods Ex-Transportation May P: 0.3% (est 0.7%; prevR 1.7%; prev 1.0%)

US

Cap Goods Orders Nondef Ex-Air May P: -0.1% (est 0.6%; prevR 2.7%; prev 2.2%)

US

Cap Goods Ship Nondef Ex-Air May P: 0.9% (est 0.8%; prevR 1.0%; prev 0.9%)

US

GDP Annualized (Q/Q) Q1 T: 6.4% (est 6.4%; prev 6.45)

US

GDP Price Index Q1 T: 4.3% (est 4.3%; prev 4.3%)

US

Core PCE (Q/Q) Q1 T: 2.5% (est 2.5%; prev 2.5%)

US

Advance Goods Trade Balance (USD) May: -88.1B (est -87.5B; prevR -85.7B; prev -85.2B)

US

Retail Inventories (M/M) May: -0.8% (est -0.5%; prev 1.6%)

US

Wholesale Inventories (M/M) May P: 1.1% (est 0.8%; prevR 1.0%; prev 0.8%)

US

Personal Consumption Q1 T: 11.4% (est 11.4%; prev 11.3%)

Canada

Wholesale Sales Rise 1.1% In May – StatCcan Flash

Canada

Factory Sales Rise 1.0% In May- StatCan Flash

Canada

Non-Farm Payrolls Rose 166.9K In April To 16.3 Mln

US

EIA Natural Gas Storage Change (BCF) 18-Jun: +55 (prev +16)

–

Salt Dome Cavern Natural Gas Storage Change (BCF): -4 (prev -3)

- US

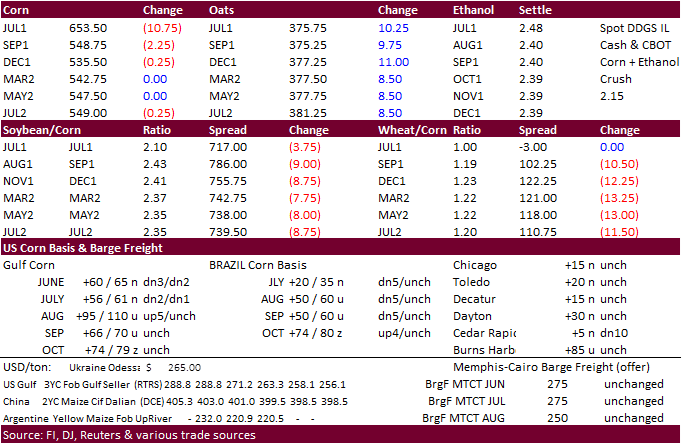

corn futures traded lower on a favorable US weather. September and December contracts during the session fell to nearly a month low. Western NE and IA saw good rains.

- Funds

sold an estimated net 3,000 corn. - Over

the next 2-3 days, Missouri, Illinois, southeastern Iowa and parts of Indiana may see 2-6 inches, up to 10 inches locally, accompanied with locally severe weather. Rest of the Midwest will see rain at some point over the next ten days. No meaningful rain

is expected in the far western United States over the next ten days - US

corn conditions could end up unchanged to up 2 points when reported Monday afternoon.

- Agroconsult:

Brazil second corn crop seen at 65.3 million tons versus 66.2 in May. - We

last heard the spot ethanol RIN price was around 1.67-1.68, up about 37-38 cents from the previous week.

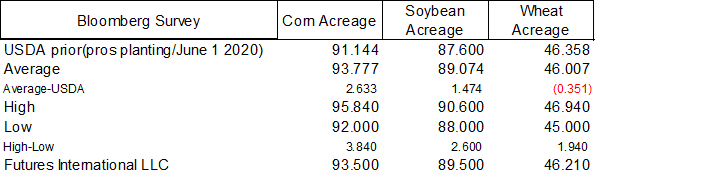

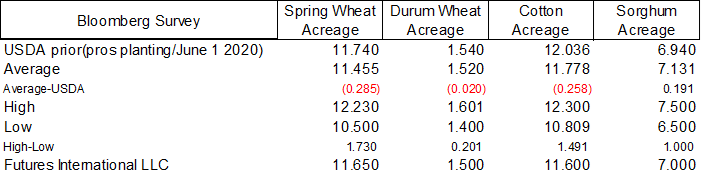

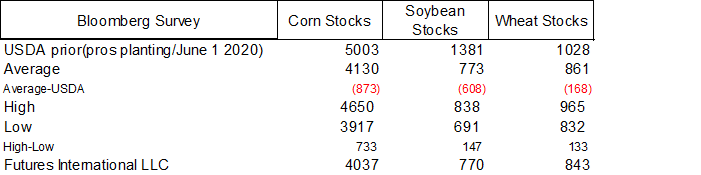

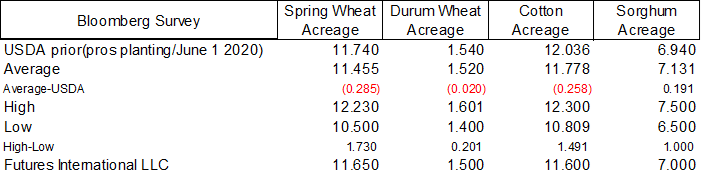

- Traders

started positioning ahead of the USDA June Acreage and Grain Stocks reports. Bloomberg trade averages are above. A Bloomberg survey calls for the corn area to increase 2.6 million acres to 93.8 million. Stocks as of June 1 were estimated 4.130

billion bushels, below 5.003 billion a year ago. - Yesterday

Farmers Business Network surveyed 2000 producers for US area and they have 92.9 million acres for corn and 86.5 million for soybeans. USDA is at 91.144 & 87.600 million, respectively. ProFarmer estimates also were released and they are using 93.6 for corn

and 88.7 for soybeans. - Buenos

Aires Grains Exchange: Argentina 2020-21 corn harvest 47.6%. - IGC

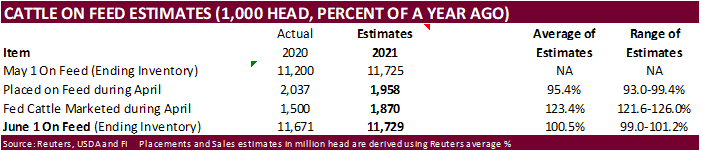

increased their world corn production by 7 million tons to 1.201 billion tons (large part China), and lowered wheat by 1 million tons to 789 million tons. - Cattle

on Feed id due out Friday afternoon.

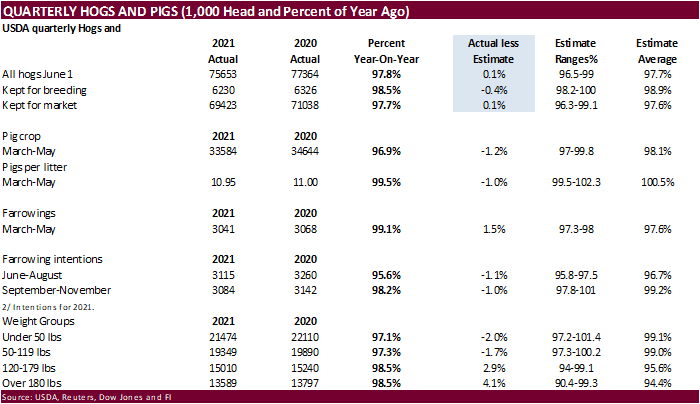

USDA

quarterly hogs and pigs – no surprises. Inventories are down from a year ago.

Export

developments.

- China’s

Sinograin plans to auction off 18,207 tons of imported Ukraine corn on June 25.

Updated

6/22/21

July

corn seen in a $6.00 (up 50) and $7.00 range

September

$5.00 and $6.75

December

corn is seen in a $4.75-$7.00 range.

Soybeans

-

The

soybean complex opened sharply lower led by soybeans and soybean oil but a rally in soybean oil paired some losses in soybeans. The trade initially reacted to very good rains that occurred overnight into this morning across Iowa and eastern NE (Omaha saw

about half inch). Higher RIN values supported soybean oil. We

last heard the spot biodiesel RIN price was around 1.75, up about 35 cents from the previous week.

-

There

were no opinions posted in the US Supreme Court website. Today was a conference day. Opinions will be released on Friday.

https://www.supremecourt.gov/opinions/slipopinion/20

-

Funds

sold an estimated net 7,000 soybean contracts, sold 7,000 soybean meal and bought 4,000 soybean oil contracts.

-

A

Bloomberg survey calls for the US soybean area to increase 1.5 million acres to 89.1 million. Stocks as of June 1 were estimated 0.773 billion bushels, below 1.381 billion a year ago.

-

Buenos

Aires Grains Exchange: Argentina 2020-21 soybean crop 43.5MMT, 100% harvested. Yield 2.67 tons/hectare.

-

This

morning were heard China bought 8-10 cargoes of soybeans last night off the PNW.

-

USDA

soybean export sales remained low this week for new-crop. Old crop were 141,700 tons but include a cargo to China. Soybean meal sales were good and included the Philippines that was anticipated from USDA 24-hour sales and trade talk last week. Soybean oil

sales were very low. -

Look

for at least 2 million tons of soybeans to be reported on a combined basis in next weeks report.

-

USDA

announced multiple 24-hour sales of soybeans to China & unknown this week. Today USDA announced 132,000 tons was sold to China and 260,000 tons to unknown, amounting to a total of 1.178 million tons since Monday.

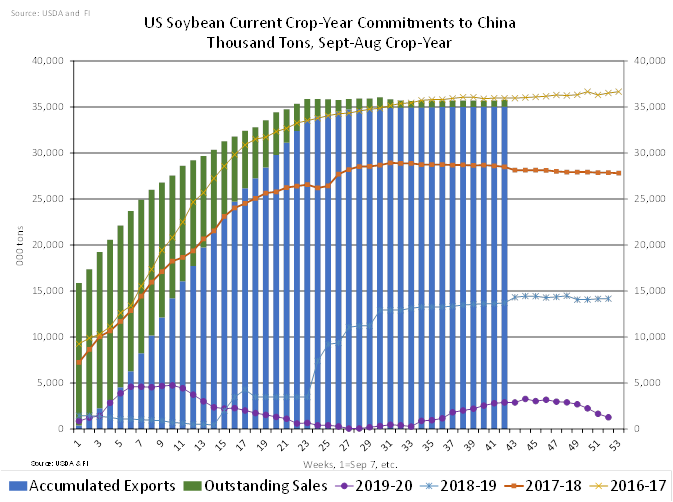

-

Combined

China old crop US soybean commitments and shipments have leveled off, in our opinion.

-

Argentina

ships up river can only load about 60-70 percent due to low water levels. -

Palm

futures were down 24MYR and cash was $10/ton lower. -

The

Malaysian Palm Oil Council (MPOC) sees Malaysia’s crude palm oil (CPO) production to rise marginally in the next few months and exports to pick up. They have a CPO price range between 3,500 ringgit-3,800 ringgit ($840.54-$912.58) in the next three months.

- Under

the 24-hour announcement system, USDA reported -

Export

sales of 132,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year; and - Export

sales of 260,000 metric tons of soybeans for delivery to unknown destinations during the 2021/2022 marketing year.

Updated

6/17/21

July

soybeans are seen in a $12.50-$15.50; November $12.00-$15.00

Soybean

meal – July $320-$400; December $320-$460

Soybean

oil – July 50.00-65.00; December 45-65 cent range

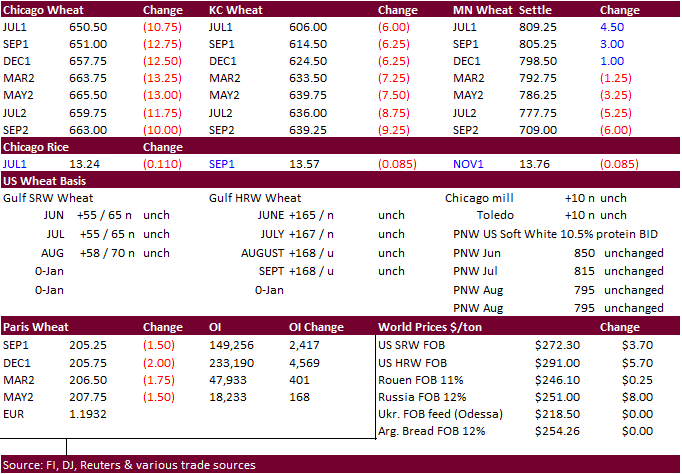

- At

the open, Chicago wheat was lower, leading KC and MN to the downside, but prices caught ta bid during the session after corn started pairing losses. MN ended higher in the front two months and lower in the December through May position. Chicago and KC prices

fell to close 10-12.50 and 6.0-8.75 cents lower, respectively. Chicago prices today were influenced by soybeans and corn despite heavy rainfall forecast for the US soft wheat growing areas of the Midwest that could slow harvesting progress and waterlog some

fields. - Funds

sold an estimated net 6,000 Chicago wheat contracts. - The

Pacific Northwest and British Columbia, Canada will see a heat wave over the weekend.

- Saskatchewan

(Canada) crop report released today mentioned “most farmers need more rain, especially in the southern and west central regions of the province, where it is needed to sustain crop and pasture growth…The topsoil moisture across the province is declining due

to very high temperatures and non-stop winds.” - Western

Russia, Belarus, northern Ukraine, and neighboring areas saw warm and dry weather during the past week, but soil moisture is ample enough to maintain favorable conditions. Look for harvesting progress to increase next week.

- Egypt’s

Minister said they have enough wheat for reserves to last 6.3 months. - The

European Commission on Thursday lowered its forecast for soft wheat production to 125.8 million tons from 126.2 million last month. Last year it was 117.2 million tons. - September

Paris milling wheat settled down 2.25 euros, or 1.1%, at 204.50 euros ($244.01) a ton.

- Nigeria

restricted the use of the US Dollar for wheat imports, forcing importers to circumvent that rule in order to help keep up with demand. Nigeria consumes about 4.7 million tons of wheat and producer only about 1 percent of that amount.

- Turkey’s

state grain board TMO bought around 320,000 tons of feed at around $264.90 a ton, c&f.

- Iran

bought 180,000-195,000 tons of optional origin wheat at €275-€280/mt CFR, (Russian or German) according to AgriCensus. They also mentioned an August Russian loading at $258/mt FOB NTT.

- Results

awaited: Taiwan seeks 55,000 tons of US million wheat on June 24 for Aug 12-26 shipment from the PNW.

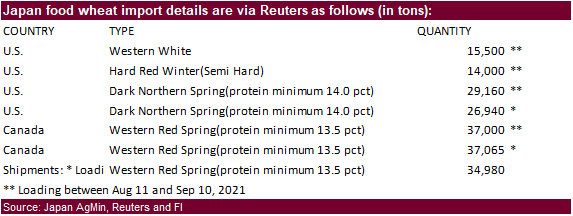

- Japan

bought 159,665 tons of food wheat.

- Jordan

retendered for 120,000 tons of wheat set to close July 6 for Jan/Feb 2022 shipment.

- Ethiopia

seeks 400,000 tons of wheat on July 19.

Rice/Other

- None

reported

Updated

6/15/21

September

Chicago wheat is seen in a $6.00-$7.00 range

September

KC wheat is seen in a $5.60-$6.70

September

MN wheat is seen in a $6.90-$8.50

This

summary is based on reports from exporters for the period June 11-June 17, 2021.

Wheat: Net

sales of 374,100 metric tons (MT) were reported for delivery in marketing year 2021/2022. Increases primarily for unknown destinations (110,600 MT), Mexico (94,500 MT, including decreases of 100 MT), Nigeria (76,600 MT), Japan (73,000 MT, including decreases

of 500 MT), and the Dominican Republic (15,100 MT, including 14,400 MT switched from unknown destinations), were offset by reductions primarily for the Philippines (7,400 MT) and Guatemala (3,300 MT). Exports of 590,800 MT were primarily to the Philippines

(154,600 MT), Mexico (112,700 MT), Nigeria (81,000 MT), Japan (67,200 MT), and Thailand (58,500 MT).

Corn:

Net sales of 216,300 MT for 2020/2021 were up noticeably from the previous week, but down 33 percent from the prior 4-week average. Increases primarily for China (180,100 MT, including 132,000 MT switched from unknown destinations, 70,300 MT switched from

Taiwan, and decreases of 30,100 MT), Japan (149,100 MT, including 99,200 MT switched from unknown destinations and decreases of 2,100 MT), Mexico (102,500 MT, including decrease of 20,600 MT), El Salvador (34,200 MT, including 18,400 MT switched from Guatemala

and 8,300 MT switched from Nicaragua), and Honduras (22,400 MT, including decreases of 22,200 MT), were offset by reductions primarily for unknown destinations (205,800 MT) and Taiwan (70,100 MT). For 2021/2022, net sales of 310,800 MT primarily for unknown

destinations (242,800 MT) and Japan (50,000 MT), were offset by reductions for Mexico (30,000 MT). Exports of 1,689,700 MT were up 2 percent from the previous week, but down 7 percent from the prior 4-week average. The destinations were primarily to China

(1,068,100 MT), Mexico (332,500 MT), Japan (139,800 MT), Guatemala (45,300 MT), and El Salvador (29,200 MT).

Optional

Origin Sales:

For 2020/2021, the current outstanding balance of 30,500 MT is for unknown destinations. For 2021/2022, the current outstanding balance of 60,000 MT is for unknown destinations.

Barley:

No net sales were reported for the week. Exports of 1,000 MT were to Japan (600 MT) and South Korea (400 MT).

Sorghum:

No net sales or exports were reported for the week.

Rice:

Net sales of 78,000 MT for 2020/2021 were up noticeably from the previous week and from the prior 4-week average. Increases primarily for Mexico (31,400 MT), Venezuela (26,000 MT), Haiti (12,200 MT), Jordan (3,200 MT), and Canada (1,700 MT), were offset by

reductions for El Salvador (500 MT). Exports of 42,700 MT were down 45 percent from the previous week and 32 percent from the prior 4-week average. The destinations were primarily to South Korea (24,800 MT), Mexico (7,400 MT), Japan (2,700 MT), Canada (2,400

MT), and Saudi Arabia (1,900 MT).

Soybeans:

Net sales of 141,700 MT for 2020/2021 were up noticeably from the previous week and from the prior 4-week average. Increases primarily for Japan (83,700 MT, including 48,000 MT switched from unknown destinations), Indonesia (66,200 MT, including 55,000 MT

switched from unknown destinations and decreases of 1,500 MT), China (66,000 MT), Malaysia (9,300 MT, including decreases of 100 MT), and Vietnam (8,900 MT), were offset by reductions for unknown destinations (103,000 MT). For 2021/2022, net sales of 47,300

MT primarily for Mexico (54,400 MT), unknown destinations (52,100 MT), Malaysia (6,000 MT), and Canada (500), were offset by reductions for China (66,000 MT). Exports of 243,200 MT were up 64 percent from the previous week and 3 percent from the prior 4-week

average. The destinations were primarily to Indonesia (88,300 MT), Mexico (65,200 MT), Japan (53,300 MT), Canada (13,900 MT), and Vietnam (8,200 MT).

Exports

for Own Account:

For 2020/2021, the current exports for own account outstanding balance is 5,800 MT, all Canada.

Soybean

Cake and Meal:

Net sales of 387,600 MT for 2020/2021 were up noticeably from the previous week and from the prior 4-week average. Increases primarily for the Philippines (146,500 MT), Ecuador (109,800 MT, including decreases of 16,800 MT), Italy (30,000 MT), Honduras (20,300

MT), and El Salvador (19,500 MT, including 5,800 MT switched from Guatemala and 2,700 MT switched from Nicaragua), were offset by reductions primarily for Guatemala (4,200 MT) and Belgium (1,200 MT). For 2021/2022, net sales of 22,000 MT were for unknown

destinations (19,000 MT) and the Philippines (3,000 MT). Exports of 212,200 MT were up 7 percent from the previous week, but down 1 percent from the prior 4-week average. The destinations were primarily to the Philippines (53,400 MT), Ecuador (32,300 MT),

Canada (25,600 MT), Venezuela (16,500 MT), and Guatemala (14,500 MT).

Soybean

Oil:

Net sales of 2,400 MT for 2020/2021 were up 8 percent from the previous week and 17 percent from the prior 4-week average. Increases were reported for Mexico (1,300 MT), Canada (1,000 MT), and India (100 MT). Exports of 6,800 MT were down 15 percent from

the previous week and 26 percent from the prior 4-week average. The destinations were primarily to Jamaica (4,000 MT) and Canada (1,500 MT).

Cotton:

Net sales of 74,700 RB for 2020/2021 were down 33 percent from the previous week and 48 percent from the prior 4-week average. Increases primarily for Pakistan (36,500 RB), China (14,000 RB, including decreases of 14,100 RB), Peru (10,200 RB), Vietnam (7,100

RB, including 1,400 RB switched from Japan), and Bangladesh (4,600 RB), were offset by reductions for Singapore (4,600 RB) and Japan (1,100 RB). For 2021/2022, net sales of 148,900 RB primarily for Pakistan (93,900 RB), Vietnam (26,300 RB), Peru (17,100 RB),

Mexico (9,500 RB), and Guatemala (5,300 RB), were offset by reductions for China (7,900 RB). Exports of 206,000 RB were down 32 percent from the previous week and 34 percent from the prior 4-week average. Exports were primarily to Vietnam (39,600 RB), China

(38,800 RB), Pakistan (34,900 RB), Turkey (30,800 RB), and Bangladesh (16,600 RB). Net sales of Pima totaling 9,100 RB were up noticeably from the previous week and up 39 percent from the prior 4-week average. Increases were primarily for India (6,500 RB),

Peru (900 RB), Bangladesh (600 RB), Turkey (600 RB), and China (400 RB). Exports of 15,000 RB were up 25 percent from the previous week, but unchanged from the prior 4-week average. The destinations were primarily to India (7,700 RB), China (2,200 RB), Peru

(1,800 RB), Turkey (1,100 RB), and Thailand (800 RB).

Exports

for Own Account:

For 2020/2021, the current exports for own account outstanding balance of 11,100 RB is for China (6,200 RB), Vietnam (4,500 RB), and Bangladesh (400 RB).

Hides

and Skins:

Net sales of 388,400 pieces for 2021 were up 61 percent from the previous week, but down 1 percent from the prior 4-week average. Increases primarily for China (294,500 whole cattle hides, including decreases of 2,500 pieces), South Korea (40,900 whole cattle

hides, including decreases of 900 pieces), Mexico (21,100 whole cattle hides, including decreases of 500 pieces), Thailand (9,300 whole cattle hides, including decreases of 700 pieces), and Brazil (6,200 whole cattle hides, including decreases of 100 pieces),

were offset by reductions for Japan (900 pieces). Total net sales reductions of 200 calf skins were reported for Italy. In addition, total net sales of 5,600 kip skins were reported for Belgium. Exports of 343,900 pieces were down 3 percent from the previous

week and 8 percent from the prior 4-week average. Whole cattle hides exports were primarily to China (202,000 pieces), South Korea (58,500 pieces), Mexico (29,600 pieces), Thailand (25,400 pieces), and Taiwan (13,600 pieces). In addition, exports of 1,800

calf skins were to Italy.

Net

sales of 208,400 wet blues for 2021 were up noticeably from the previous week and up 50 percent from the prior 4-week average. Increases were primarily for Mexico (45,200 unsplit and 26,000 grain splits), China (34,800 unsplit), Taiwan (32,900 unsplit), Vietnam

(27,300 unsplit), and Italy (22,300 unsplit, including decreases of 700 pieces). Exports of 128,600 wet blues were down 33 percent from the previous week and 11 percent from the prior 4-week average. The destinations were primarily to Italy (32,300 unsplit

and 3,600 grain splits), China (31,800 unsplit), Vietnam (27,300 unsplit), Mexico (13,000 unsplit and 12,000 grain splits), and Thailand (6,300 unsplit). Net sales of 85,900 splits reported for Taiwan (126,000 pounds), were offset by reductions for China

(40,100 pounds). Exports of 298,700 pounds were to Vietnam (160,000 pounds) and China (138,700 pounds).

Beef:

Net

sales of 16,900 MT reported for 2021 were up 31 percent from the previous week, but down 3 percent from the prior 4-week average. Increases primarily for South Korea (6,700 MT, including decreases of 400 MT), Japan (4,000 MT, including decreases of 500 MT),

China (1,600 MT, including decreases of 100 MT), Taiwan (1,400 MT, including decreases of 200 MT), and Hong Kong (900 MT, including decreases 100 MT), were offset by reductions for the Philippines (100 MT).

For

2022, total net sales of 400 MT were for Japan.

Exports of 18,200 MT were up 2 percent from the previous week and 3 percent from the prior 4-week average. The destinations were primarily to Japan (4,700 MT), South Korea (4,700 MT), China (4,100 MT), Mexico (1,100 MT), and Taiwan (1,100 MT).

Pork:

Net

sales of 28,600 MT reported for 2021 were down 2 percent from the previous week and 4 percent from the prior 4-week average. Increases were primarily for Mexico (11,500 MT, including decreases of 900 MT), Canada (5,200 MT, including decreases of 400 MT),

Japan (3,200 MT, including decreases of 500 MT), China (2,000 MT, including decreases of 800 MT), and South Korea (1,800 MT, including decreases of 500 MT). Exports of 33,600 MT were down 12 percent from the previous week and 10 percent from the prior 4-week

average. The destinations were primarily to Mexico (15,700 MT), China (7,400 MT), Japan (3,700 MT), South Korea (1,700 MT), and Canada (1,500 MT).

U.S. EXPORT SALES FOR WEEK ENDING 06/17/2021

FAX 202-690-3275

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR |

CURRENT YEAR |

YEAR |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

180.4 |

1,558.0 |

1,987.9 |

209.4 |

419.6 |

602.6 |

0.0 |

0.0 |

|

SRW |

33.6 |

1,030.9 |

600.7 |

18.3 |

22.9 |

43.2 |

0.0 |

0.0 |

|

HRS |

94.3 |

1,495.7 |

1,643.4 |

240.9 |

326.2 |

319.3 |

0.0 |

0.0 |

|

WHITE |

65.8 |

1,055.1 |

1,027.6 |

122.2 |

230.7 |

248.9 |

0.0 |

0.0 |

|

DURUM |

0.0 |

8.4 |

223.5 |

0.0 |

26.3 |

85.0 |

0.0 |

0.0 |

|

TOTAL |

374.1 |

5,148.1 |

5,483.0 |

590.8 |

1,025.7 |

1,299.0 |

0.0 |

0.0 |

|

BARLEY |

0.0 |

23.7 |

40.2 |

1.0 |

1.1 |

0.5 |

0.0 |

0.0 |

|

CORN |

216.3 |

13,269.2 |

9,509.7 |

1,689.7 |

56,262.9 |

32,442.7 |

310.8 |

15,680.7 |

|

SORGHUM |

0.0 |

889.2 |

830.3 |

0.0 |

6,336.9 |

3,181.8 |

0.0 |

1,594.9 |

|

SOYBEANS |

141.7 |

3,623.4 |

7,892.5 |

243.2 |

58,136.2 |

36,687.7 |

47.3 |

7,609.3 |

|

SOY MEAL |

387.6 |

2,136.8 |

2,142.3 |

212.2 |

8,869.1 |

8,778.0 |

22.0 |

671.5 |

|

SOY OIL |

2.4 |

24.8 |

233.8 |

6.8 |

650.8 |

952.7 |

0.0 |

0.6 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

56.4 |

242.7 |

99.5 |

6.9 |

1,476.8 |

1,279.8 |

0.0 |

0.0 |

|

M S RGH |

0.0 |

15.8 |

24.2 |

0.1 |

25.1 |

72.3 |

0.0 |

0.0 |

|

L G BRN |

0.1 |

13.1 |

11.8 |

0.3 |

38.6 |

56.3 |

0.0 |

0.0 |

|

M&S BR |

0.1 |

23.0 |

34.6 |

22.3 |

133.6 |

84.4 |

0.0 |

0.0 |

|

L G MLD |

15.3 |

44.4 |

59.0 |

3.5 |

604.6 |

827.6 |

0.0 |

0.0 |

|

M S MLD |

6.0 |

160.0 |

134.9 |

9.7 |

532.1 |

602.0 |

0.0 |

0.0 |

|

TOTAL |

78.0 |

499.0 |

364.1 |

42.7 |

2,810.8 |

2,922.3 |

0.0 |

0.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

74.7 |

2,656.8 |

4,651.5 |

206.0 |

13,364.7 |

12,274.2 |

148.9 |

2,293.2 |

|

PIMA |

9.1 |

129.7 |

125.8 |

15.0 |

690.4 |

443.9 |

0.0 |

4.0 |

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.