PDF Attached

Earlier

it was a lower

trade across the soybean complex and grains on improving US weather for the second week of the forecast and follow through selling in soybean oil. Wheat turned to trade mostly higher, perhaps on spreading against corn, short covering and renewed Black Sea

grain deal concerns. Soybean oil rallied late in the day to trade higher while meal saw a correction after rallying yesterday. Soybeans and corn made a slight recovery from session lows, but those markets ended sharply lower. The midday GFS model run didn’t

appear as wet for the WCB for the July 1-3 period. The morning forecast didn’t offer too much in the way of overall changes. Warmer than expected temperatures are seen for Kansas, Missouri, and Illinois. China is on holiday, returning Monday.

Fund

estimates as of June 22 (net in 000)

![]()

7-day

WEATHER

TO WATCH

- Central

France received some welcome rain overnight with 1.00 to 2.83 inches resulting in a band across the middle of the nation

Rain

from France will move to Germany, Belgium, Netherlands and Poland over the next few days bringing some “temporary” relief from persistent dryness

- More

rain will be needed after many weeks of limited precipitation and recent warm weather - Short

term relief is likely, but follow up rain will be necessary - Another

full week of drying is expected after the rain ends returning “some” crop moisture stress to “some: crop areas - No

excessive heat is expected anytime soon

- China

crop areas north of the Yellow River into Mongolia will experience net drying and warm temperatures over the next couple of weeks - Some

crop stress should be expected in unirrigated areas - Sugarbeets,

spring wheat, corn and other crops will be impacted, although this is not a major grain production region - Note:

The GFS model is much wetter in this region than the European model and a close watch on the forecast in the next few days is warranted for signs of change

- Southern

China may become excessively wet in the next couple of weeks resulting in a threat to early rice that is maturing and being harvested - Grain

quality declines are likely along with harvest delays - Sugarcane

in the region will also be negatively impacted along with minor corn and groundnut crops

- East-central

China may trend wetter in the last days of June and early July

- Xinjiang,

China crop weather has been much improved in recent weeks and little change is expected - Northeastern

production areas will see a little thundershower activity and slightly cooler conditions in the week ahead while western production areas remain dry with seasonable temperatures

- India’s

wetter biased weather expected over the weekend and through most of next week will seriously improve soil moisture for many areas from parts of Chhattisgarh through Madhya Pradesh to Rajasthan

- Poor

rainfall will continue from Maharashtra to Tamil Nadu and Andhra Pradesh, although at least some rain is expected - Rice,

sugarcane and a host of other crops in the west-central and far southern parts of the nation will need greater rain - Western

Thailand continues to receive much less than usual rainfall, although some rain does occur periodically - Low

water supply remains a concern and rice, corn and sugarcane among many other crops are not developing as well as usual - Not

much change in the pattern is expected for a while

- Another

dismal day of rainfall was noted across Indonesia and Malaysia Wednesday - This

week’s precipitation has been more sporadic and lighter than usual and a big boost in rainfall is needed to protect long term soil moisture and crop development potentials

- Canada’s

Prairies are still drier than desired with drought remaining in eastern and interior southern Alberta after welcome relief occurred to a part of the region this week - Most

of the Prairies are getting timely rainfall and crops are expected to perform relatively well, but greater rain is needed and my not evolve until the heart of July

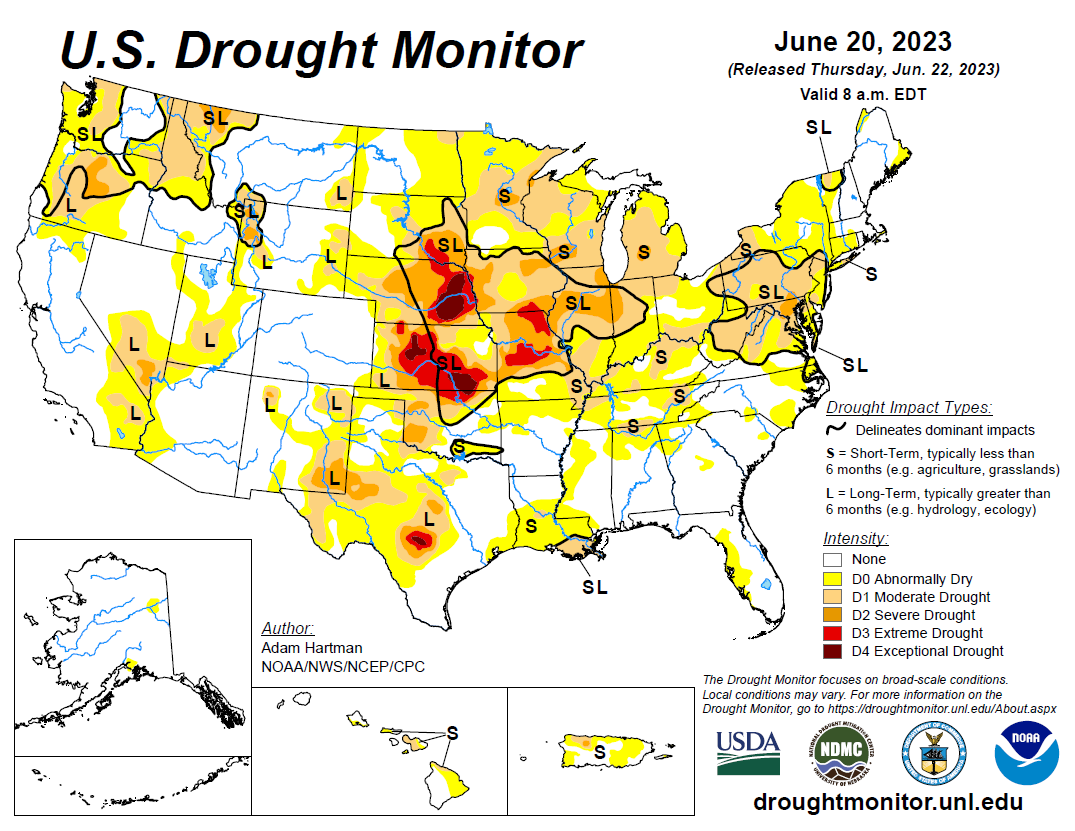

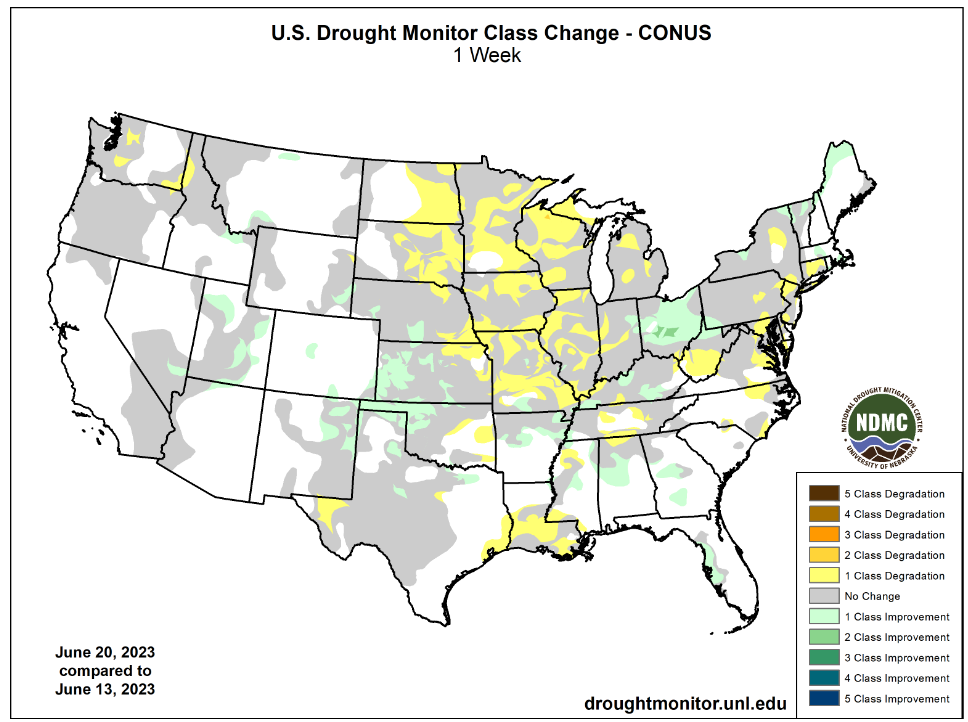

- U.S.

Northern Plains and upper Midwest will get some very important rainfall over the next week to ten days bolstering soil moisture for improved grain, oilseed and sugarbeet development - Dry

bean and other crops will also improve - There

will be some risk of strong thunderstorms producing hail and damaging wind

- Excessive

heat in Texas will prevail through the next week with some debate over whether there will be much change in the second week of the outlook

- Extreme

highs of 100 to 113 degrees Fahrenheit were common across the state again Wednesday with Cotulla, Texas reaching 117 - Similar

temperatures are expected through Thursday of next week and any relieve that occurs after that should be brief

- Livestock

stress is running very high with little change likely - Dryland

summer crops need significant rain soon to bolster soil moisture and reduce stress.

- U.S.

temperatures are unlikely to be excessively warm in the Midwest, northern Plains, or southeastern states, but a brief bout of hot weather is expected in the Delta and southwestern Corn Belt this weekend and again during mid-week next week

- West

Texas cotton, corn and sorghum conditions will steadily decline over the next two weeks as soil moisture is depleted - Southwestern

dryland areas will be most impacted initially - It

will take a while for the Texas Panhandle, southwestern Oklahoma and the northeastern Counties of West Texas to experience crop moisture stress

- U.S.

Midwest will experience unsettled weather during the weekend through the first week of July resulting in showers and thunderstorms - The

precipitation is expected to be highly variable, but confidence is not high over generalized rain of significance for the driest areas of Illinois and neighboring states - With

that said, the odds are high that least some rain will fall and short term opportunities for less stress and a little crop improvement may result - Forecast

models are in relatively good agreement and because of the erratic nature of the rain be extra cautious of the potential for surprisingly good or bad rainfall in this environment - Future

model runs should continue the potential unsettled part of the forecast, but there may not be much clarity over the “opportunity” for significant rain

- U.S.

southeastern states will experience a more normal mix of rain and sunshine over the next ten days to two weeks after excessive rain fell in this past week - The

region needs to dry down for a while, but the process will be slowed by some periodic rain during the next ten days

- Northern

U.S. Plains and Manitoba Canada along with parts of Minnesota will get dryness easing rainfall in this coming week

- Rainfall

of 1.00 to 3.00 inches and locally more will result which should help bolster soil moisture for improved crop development - Sugarbeets,

dry beans, corn, soybeans, sunseed, wheat, barley and oats will all benefit from the moisture along with canola and many other crops - Soil

moisture in these areas is very short in the top and subsoil

- U.S.

hard red winter wheat rainfall should become less frequent and less significant for a while which may help to improve crop maturation and harvest conditions in time

- Cool

temperatures occurred again in the Pacific Northwest today with frost noted in several areas from eastern Oregon into the upper Snake River Basin, but little to no damage resulted - Significant

warming is expected and that will translate into highs in the 80s and 90s by late next week

- Mexico’s

drought will last another week and then rain is expected - There

is evidence of developing monsoonal rainfall in the second week of the forecast

- Central

America rainfall has been timely recently and mostly good for crops, although many areas are still reporting lighter than usual amounts

- Drought

continues to impact Gatlin lake and the Panama Canal shipments with little change likely in future weeks/months

- Tropical

Storm Bret was 150 miles east of the Windward islands at 1200 GMT today moving westerly at 16 mph and producing maximum sustained wind speeds of 70 mph out 115 miles from the storm center - Bret

will move across the Lesser Antilles tonight and will begin to weaken in the Caribbean Sea during the latter part of this week and into the weekend - The

storm may not survive the wind shear expected over the Caribbean Sea with remnants of the storm eventually drifting into northern parts of Central America next week

- A

new tropical depression has formed 1300 miles east of the Lesser Antilles, but it will not be any more significant than Tropical Storm Bret and it will curve to the northeast of the northern Leeward Islands and dissipate without threatening land next week.

- The

system will become a tropical storm in the next couple of days

- Canada’s

Prairies will receive erratic rainfall in the coming week - Greater

rain is expected in the Prairies during July to further improve the moisture profile

- Rain

is expected in Russia’s eastern New Lands and neighboring areas of northern Kazakhstan in the second week of the outlook - Temperatures

will be cooler than usual this week.

- Russia’s

northeastern New Lands have been were cool enough for frost and a few light freezes recently, but the impact on crops was minimal.

- Indonesia

and Malaysia rainfall decreased notably Tuesday and Wednesday with net drying in many areas - An

erratic rain pattern is expected for a while

- Philippines

rainfall recently has been erratic and mostly light, but soil moisture was rated well.

- Vietnam

coffee, sugarcane and rice production areas in the Central Highlands need greater rain in unirrigated areas

- Australia

rainfall recently was greatest in the south - Winter

crop establishment is advancing well. - Timely

rainfall is expected over the next ten days in most crop areas maintaining a well-established crop

- South

Africa winter crops are still establishing well and timely rainfall is expected through the next ten days

- West-central

Africa crop conditions remain good with little change expected - Rain

will fall in a timely manner during the next two weeks

- East-central

Africa weather will continue favorable for coffee, cocoa, sugarcane, rice and other crops through the next two weeks

- Ontario

and Quebec weather should be favorably mixed over the next ten days - Summer

crop conditions are still rated favorably with little change likely

·

No changes in South America weather are expected over the coming week

o

Argentina rainfall will be limited leaving many areas from Cordoba into La Pampa and western Buenos Aires too dry for wheat emergence and establishment

§

Favorable field conditions will prevail in the eastern Argentina wheat areas due to previous rain and cool temperatures conserving the moisture through low evaporation rates

§

Rain is possible next week

o

Southern Brazil will continue plenty wet from southern Mato Grosso do Sul to northern and eastern Rio Grande do Sul and Parana over the next ten days

§

More limited rain is expected in center south crop areas while the north is left mostly dry

o

There is a very low risk of crop damaging cold for the next ten days in any grain, cotton, sugarcane, citrus or coffee area

·

Today’s Southern Oscillation Index was -11.35 and it will move lower over the next several days

Source:

World Weather, INC.

Thursday,

June 22:

- Port

of Rouen data on French grain exports - EIA

weekly US ethanol inventories, production, 10:30am - Grain

and Oilseeds MENA conference in Cairo, day 2 - Brazil

Unica cane crush, sugar production (tentative) - USDA

Red Meat Production, 3pm - HOLIDAY:

China,

Hong Kong

Friday,

June 23:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report - US

Cattle on Feed, 3pm - US

cold storage data for beef, pork and poultry - HOLIDAY:

China

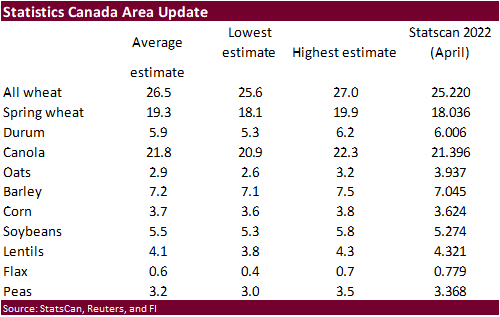

Canada

plantings. June 28 release (7:30 am CDT)

Macros

US

Initial Jobless Claims Jun 17: 264K (est 259K; prevR 264K)

US

Continuing Claims Jun 17: 1759K (est 1785K; prevR 1772K)

US

Current Account Balance Q1: -$219.3B (est -$217.1B; prevR -$216.2B)

US

Chicago Fed Nat Activity Index May: -0.15 (est -0.10; prevR 0.14)

103

Counterparties Take $1.995 Tln At Fed Reverse Repo Op.

The

Bank of England raised interest rates by a larger than expected half a percentage point.

Morgan

Stanley Expects BoE To Hike By 50 Bps In August And By 25 Bps In September For A Peak Rate Of 5.5%

·

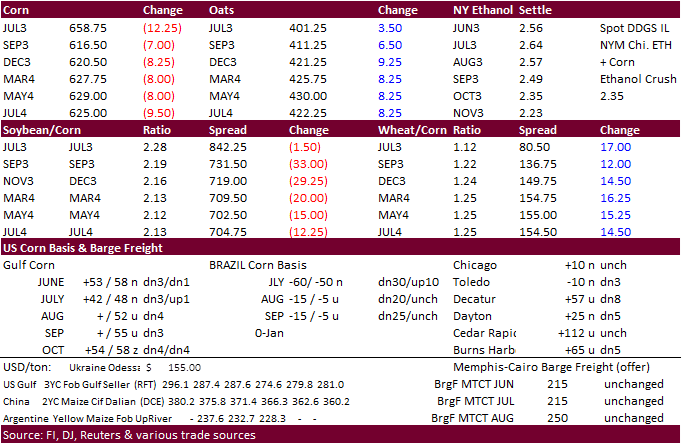

US corn was under pressure from a sharply lower US soybean complex, possible improvement for US weather for early July and lower energy markets. WTI crude oil was down more than $3.10 at the time ags closed.

·

US lawmakers suggested they may pass a short-term extension of the current farm bill that is set to expire September 30 due to delays in the draft. The farm bill is passed every five years. A draft might not be presented until

September.

·

Argentina 2022-23 corn production was seen at 34 million tons by the Buenos Aires Grains Exchange, down from 36 million tons previously.

·

We are hearing Argentina producers sold about 850,000 tons of corn last week, bringing sales to about 14 million tons (down from 28.4 million year ago). That could leave at least another 10 million tons left to sell.

·

There was chatter Argentina could roll out a corn dollar but many doubt that will happen.

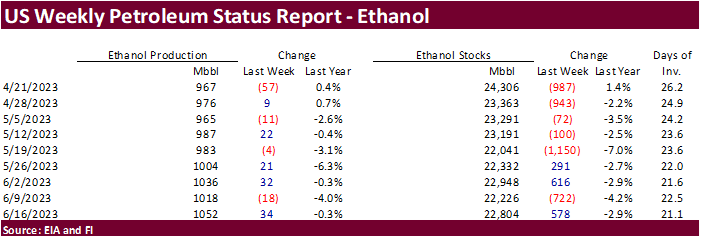

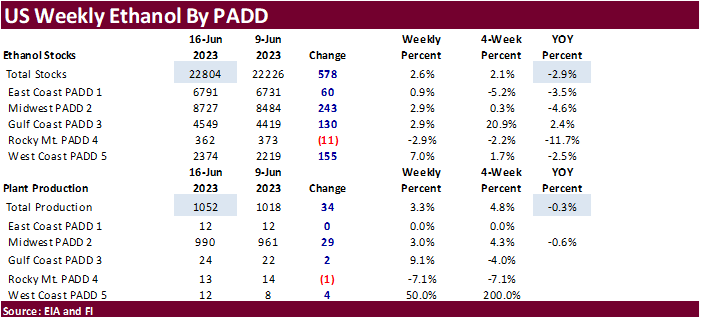

US

ethanol production

increased 34,000 barrels to 1.052 million, the highest since December 9, 2022. Ethanol stocks increased 578,000 barrels to 22.804 million after they declined 722,000 barrels the previous week. For comparison, a Bloomberg poll looked for weekly US ethanol production

to be up 5,000 thousand barrels to 1028k and stocks off 92,000 barrels. US Sep to date ethanol production is running 3 percent below the same period year earlier. US gasoline stocks increased 479,000 barrels to 221.4 million and are now up for four consecutive

weeks. Implied US gasoline demand increased 182,000 barrels to 9.375 million, above the previous 4-week average of 9.237 million barrels.

US

DoE Crude Oil Inventories (W/W) 16-Jun: -3831K (exp +450K; prev +7919K)

Distillate:

+434K (exp +1000K; prev +2123K)

Cushing:

-98K (prev +1554K)

Gasoline:

+479K (exp +800K; prev +2108)

Refinery

Utilization: -0.60% (exp -0.10%; prev -2.10%)

Due

out Friday

Export

developments.

-

Algeria

seeks 120,000 tons of corn on June 22 for shipment during July shipment and potentially another for FH August shipment.

Price

outlook (6/21/23)

July

corn $6.25-$7.25

September

corn $5.75-$7.25

December

corn $5.25-$7.25

·

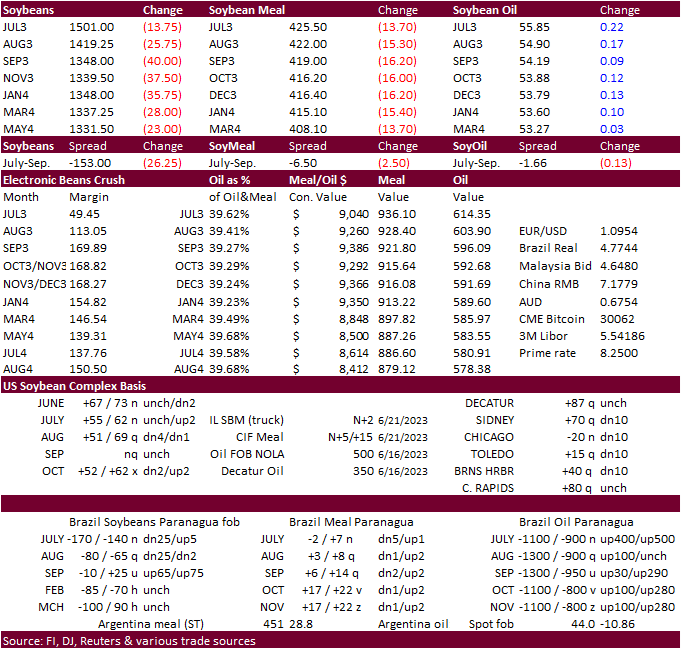

Lower trade across the soybean complex on improving US weather for the second week of the forecast and follow through selling in soybean oil. Soybean oil rebounded despite sharply lower WTI crude oil in large part to a reversal

in product spreading. We see support for November soybeans around $12.96/bu.

·

Traders were mulling over the possibility of a smaller than expected US soybean crush next season after advanced biofuel mandates saw a slight increase from the December proposal and recent decline new-crop crush margins.

·

China is on holiday, returning Monday.

·

A Reuters poll sees India June palm oil imports increasing 46 percent from May after palm oil imports of 439,173 tons fell to a 28-month low.

·

The Buenos Aires Grains Exchange sees the wheat planted area at 6.1 million hectares, down from 6.3 million previous.

Export

Developments

-

China

will auction off 306,700 tons of imported soybeans from state reserves on June 27.

Price

outlook (6/21/23)

Soybeans

– July $14.50-$15.50, November $12.50-$15.25

Soybean

meal – July $400-$475, December $375-$500

Soybean

oil – July 51.00-58.00, December 50.00-58.00

·

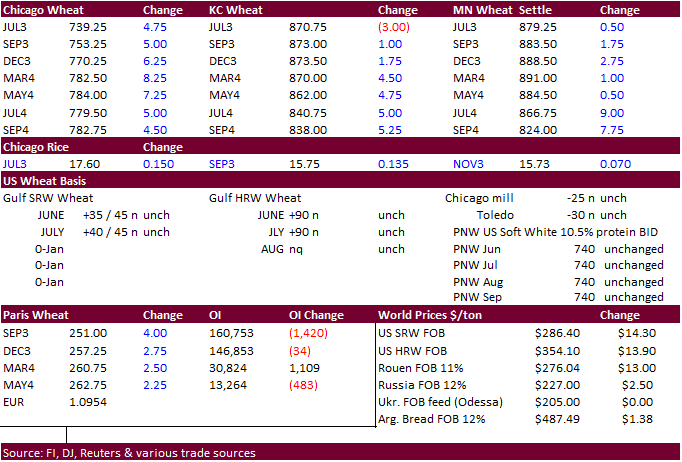

US wheat opened lower on weakness in corn and a rain forecast for the upper Great Plains over the next week. Prices ended mostly higher on short covering and spreading against corn/soybeans. The US PNW will remain dry and we

look for US spring wheat ratings to decline when updated early next week. Harvest pressure should be noted for winter wheat areas and was reflected in KC spreads.

·

Ukraine said they are 99.9% certain Russia may not extend the grain deal next month, because it no longer needs Ukrainian ports to export ammonia. (Reuters)

·

September Paris wheat futures were down 0.75 euro at 246.25 per ton.

Export

Developments.

·

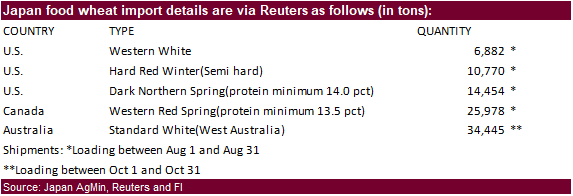

Japan bought 92,529 tons of milling wheat this week for Aug shipment.

Rice/Other

·

South Korea bought an estimated 16,800 tons of rice from Vietnam at an estimated $674.00 a ton c&f for arrival around Sept. 30, 2023.

Price

outlook (6/21/23)

Chicago Wheat

July $7.00-$7.75, September $7.00-$8.25

KC – July $8.25-$9.10, September $8.00-$9.50

MN – July $8.25-$9.25, September $8.00-$9.50

#non-promo