PDF Attached

PDF

attached include updated US soybean complex balances. Feedback welcome.

The

US will be on holiday Monday. US recession concerns sent many commodity markets lower. The USD was up more than 100 points as of 2 pm CT. WTI crude oil closed more than 6.8 percent lower. US weather will remain unfavorable for the balance of June and any changes

to the forecast should have influence on prices going forward.

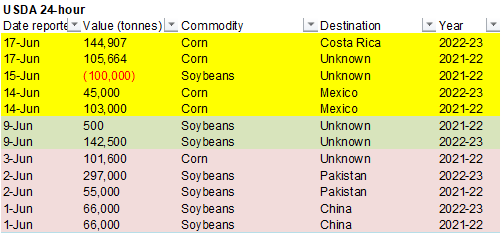

Private

exporters reported the following activity:

-144,907

metric tons of corn for delivery to Costa Rica during the 2022/2023 marketing year

-105,664

metric tons of corn for delivery to unknown destinations during the 2021/2022 marketing year

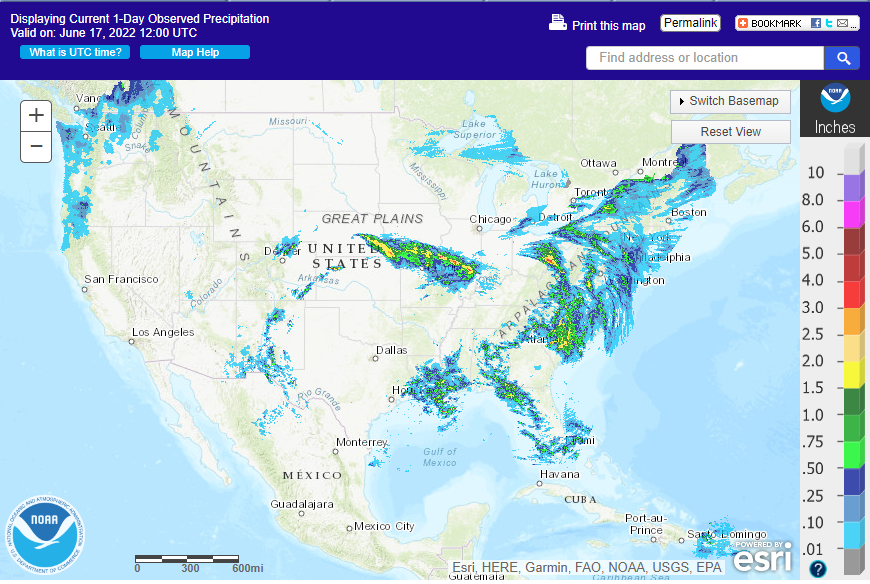

24-H

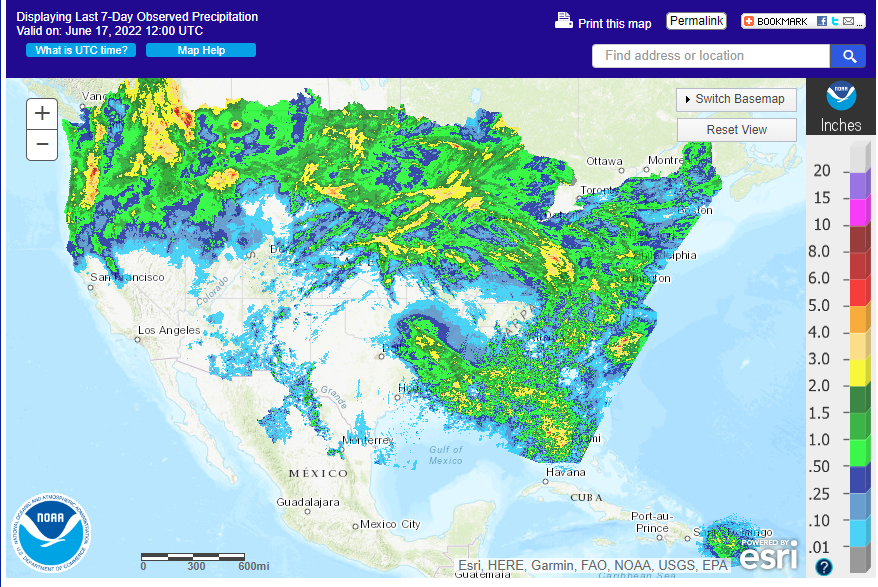

7-day

WEATHER

EVENTS AND FEATURES TO WATCH

- Not

much change was noted on the European model run for the United States overnight, but the GFS model run had adjusted some of its rainfall for the Midwest with the 06z model run reducing rain in Iowa and the upper Midwest while increasing it in parts of eastern

Midwest - The

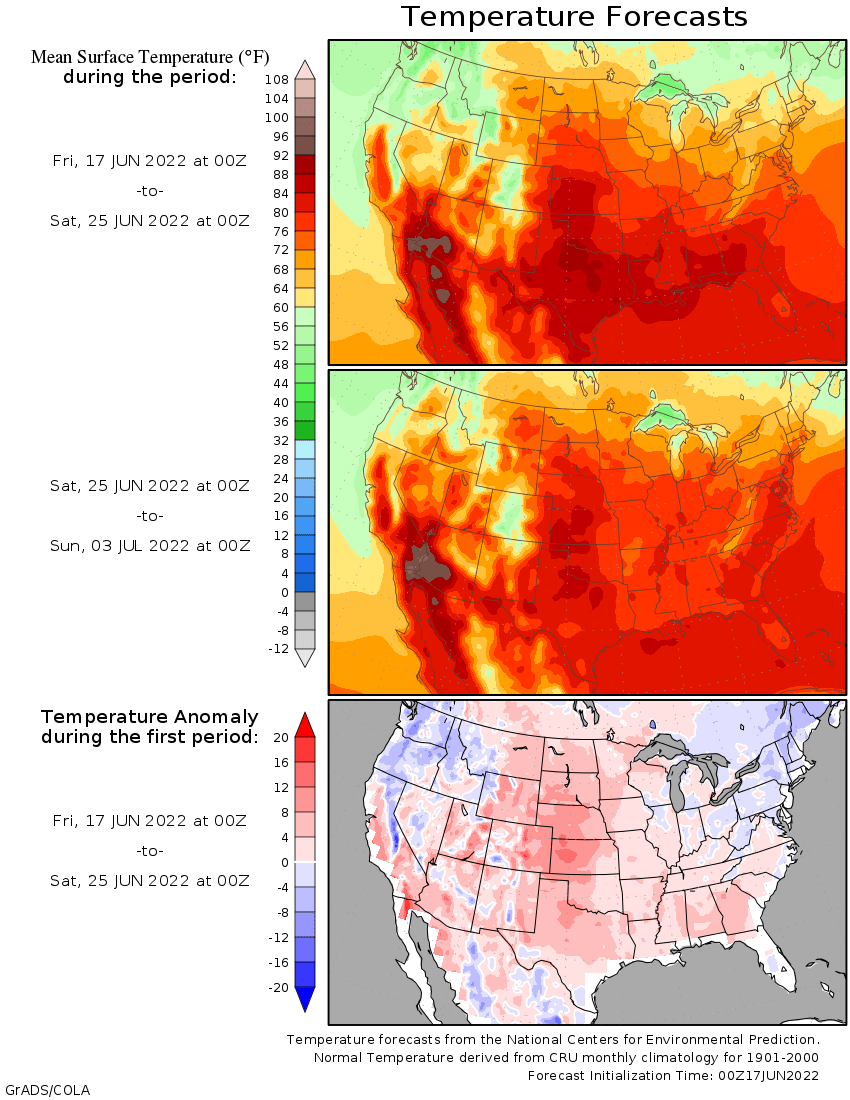

GFS is not the favored model right now - Hot

weather is expected through Monday from the U.S. Plains into the western Corn and Soybean Belt and the northern Plains - Some

of the expected heat will reach into Canada’s Prairies today through Sunday while the hottest weather in the U.S. Plains and western Midwest will be Saturday through Monday

- Extreme

highs of 95 to 105 degrees Fahrenheit will be common with a few readings to 108 in the central Plains and at least one location may reach 110 - U.S.

heat will retreat to the south early to mid-week next week with highs in the 90s to 105 degrees Fahrenheit in the southern Plains, Delta and southeastern states

- Cooling

in the northern U.S. Plains and upper Midwest next week should return a more seasonably warm temperature regime to the region - Scattered

showers and thunderstorms will be possible over a larger part of the northern U.S. Plains, northern and eastern Midwest and southeastern states after June 27, but it is still questionable how significant some of that rain will be - U.S.

Midwest, Great Plains, Delta and southeastern states’ soil moisture will be in decline during much of the coming ten days - A

few showers and thunderstorms will offer some slowing of the drying trend with Iowa, Nebraska and immediate neighboring areas still favored for the greatest rain in this first week of the outlook - U.S.

Plains and western Midwest livestock will be subjected to excessive heat this weekend and early next week raising the potential for animal illness and possible death - Livestock

losses should not be nearly as great as those of last weekend - Early

start to monsoon moisture in the southwestern U.S. is not likely to have much influence on U.S. crops, although some improved soil moisture will occur in eastern Arizona and southwestern New Mexico crop areas - Northeastern

Mexico will remain in a drought probably until a tropical cyclone evolves and impacts the region and there are none anticipated in the near future - Texas

drought conditions are worsening with many dryland crops still suffering moisture stress - No

meaningful rain is expected in West or South Texas, the Coastal Bend or Blacklands through the next ten days to possibly two weeks - Any

showers that pop up will be quickly lost to strong evaporation rates resulting from very warm to hot daily temperatures - U.S.

far western states will experience net drying during much of the next ten days, although some rain will fall in the Cascade Mountains and along the Washington and Oregon coast as well as the far northern Rocky Mountains - Canada’s

Prairies are not advertised to receive nearly as much rain as was predicted in Thursday’s forecast and the reduction was needed - Crop

development will continue to advance relatively well - A

good mix of rain and sunshine is expected for the next ten days - Central

and south-central Saskatchewan has the greatest need for rain - Rain

earlier this week in Alberta and western Saskatchewan was ideal in bolstering topsoil moisture for better spring seed germination, emergence and establishment in the previously driest areas of the Prairies - Ontario

and Quebec weather should be favorably mixed over the next two weeks - A

little drier and warmer bias would be most welcome and that is exactly what is expected - Western

and central Europe will experience net drying conditions through the weekend - Showers

and thunderstorms will slowly increase next week - The

resulting moisture will be extremely important for winter, spring and summer crops after previous days of drying

- Some

of the rain will be a little erratic leaving parts of the continent in a net drying mode while other areas get some welcome rain - Temperatures

will be warm during both weeks of the two-week outlook - Hot

temperatures are expected through the weekend in France, Spain and Portugal with extreme highs reaching into the 90s to 105 degrees Fahrenheit

- Parts

of Germany will also be impacted by some 90-degree warmth - Net

drying is expected in many interior parts of Russia’s Southern region, parts of south-central and southeastern Ukraine and western Kazakhstan through Tuesday - Some

rain is advertised for Wednesday through Friday of next week - Moisture

totals will be light and yet all of it will be welcome - Far

southern Russia and Georgia will experience frequent rain later this week into early next week resulting in a notable boost in soil moisture favoring long term crop development - Western

and northern parts of the Commonwealth of Independent States will experience frequent rainfall over the next ten days maintaining moisture abundance in the soil and good crop development potential - Rain

in northern Kazakhstan will be great for spring wheat and some sunseed crops - South

Korea rice areas continue critically dry and are in need of rain - Some

rain may begin to fall in the June 23-29 period - Far

southern China will continue to receive too much rain for another week resulting in more flooding and more concern over rice, sugarcane and some minor corn, soybean and groundnut production areas

- The

heaviest rain should be about over; however - Drying

is badly needed and some may occur next week - Northeast

China will continue to see rain routinely which may challenge summer crop planting since much of the region is already wet - Drying

will be most needed in Liaoning and Jilin where the ground is already a little too wet - China’s

Xinjiang province continues to experience relatively good weather, although warm conditions are expected early to mid-week this week before some welcome cooling occurs in the second half of this week and into the weekend - China’s

North China Plain will see limited rainfall for the coming week and then may get some scattered showers offering limited relief in the June 23-29 period - India’s

monsoonal rainfall will slowly increase during the next two weeks with amounts still below average in this first week of the outlook, although the coverage of rain is expected to increase

- Additional

increases in rainfall during the June 25-July 1 period should further improve field and crop conditions - Southern

Australia will receive waves of rain over the next ten days maintaining a very good outlook for wheat, barley and canola - Western

Argentina will remain mostly dry through next week raising concern over winter crop planting and establishment - A

few showers may occur briefly in the second half of the week, but much more will be needed - At

least some rain is needed in all wheat areas in the nation, although subsoil moisture is still rated well in the east and more rain is expected there in the second half of next week. Rain is needed to stimulate seed germination and plant emergence event in

the areas with good subsoil moisture. - Southern

Brazil will see more rain this weekend into next week - Drying

is needed to support Safrinha crop maturation and harvest progress - Mato

Grosso, Goias, Minas Gerais, Tocantins, Maranhao, Piaui and Bahia, Brazil will be mostly dry except for showers near the Atlantic coast - Mexico’s

monsoonal rainfall will improve in the west and north-central parts of the nation over the next ten days, but northeastern Mexico will remain in a drought of significance - Northeastern

Mexico drought relief may not occur without the help of a tropical cyclone - The

same may be true for southern Texas - Southeast

Asia rainfall will continue abundant in many areas through the next two weeks - Local

flooding will impact parts of the Philippines, Indonesia, Malaysia and western parts of Myanmar - Southern

Thailand and western Cambodia along with some central Vietnam crop areas will be driest, but not too dry for normal crop development - East-central

Africa rainfall will occur sufficiently to improve crop and soil conditions from Uganda and southwestern Kenya northward into western and southern Ethiopia - West-central

Africa rainfall has been and will continue sufficient to support coffee, cocoa, sugarcane, rice and cotton development normally - South

Africa’s rain in western parts of the nation next week will be good for wheat, barley and canola emergence and establishment - Central

America rainfall will be abundant during the next ten days

- Tropical

Storm Blas was located off the central west coast of Mexico and it will move away from North America this weekend - Some

rain will fall in coastal areas today and Saturday - Tropical

Depression Three-E has evolved off the coast of El Salvador and will parallel the upper west coast of Central America and the southwest coast of Mexico this weekend

- Some

rain from the storm will reach coastal areas, but no damaging wind or flooding rain is expected - Today’s

Southern Oscillation Index was +14.89 and it will move erratically over the coming week - New

Zealand rainfall will diminish to infrequent showers over the coming week; recent rain was welcome and beneficial.

Bloomberg

Ag Calendar

Saturday,

June 18:

- China’s

second batch of May trade data, including corn, pork and wheat imports

Monday,

June 20:

- China’s

third batch of May trade data, including soy, corn and pork imports by country - MARS

monthly EU crop conditions report - Malaysia’s

June 1-20 palm oil export data - Olam

holds extraordinary general meeting - HOLIDAY:

US, Argentina

Tuesday,

June 21:

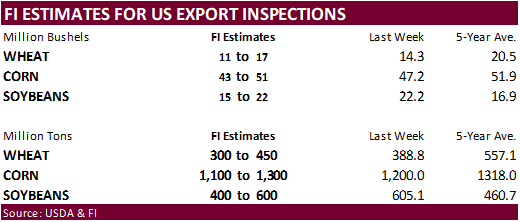

- USDA

export inspections – corn, soybeans, wheat, 11am - US

crop planting data for soybeans and cotton; winter wheat condition and harvesting, 4pm - US

cotton, corn, soybean and spring wheat conditions, 4pm - European

Food Safety Authority’s One Conference on food safety, Brussels and online, June 21-24 - New

Zealand global dairy trade auction - USDA

total milk production, 3pm - EU

weekly grain, oilseed import and export data

Wednesday,

June 22:

- Speciality

& Fine Food Asia trade show June 22-24 in Singapore

Thursday,

June 23:

- EIA

weekly U.S. ethanol inventories, production, 11am - US

cold storage data for beef, pork and poultry, 3pm - USDA

world coffee report - International

Grains Council’s monthly report - USDA

red meat production, 3pm

Friday,

June 24:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - FranceAgriMer

weekly update on crop conditions - Brazil’s

Unica to release cane crush and sugar output data (tentative) - US

cattle on feed, poultry slaughter - HOLIDAY:

New Zealand

Source:

Bloomberg and FI

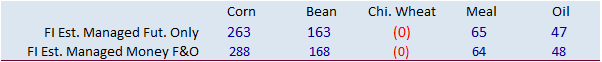

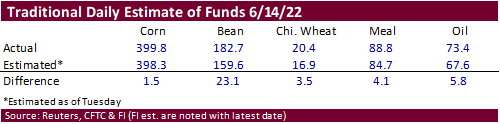

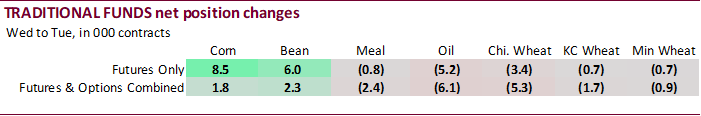

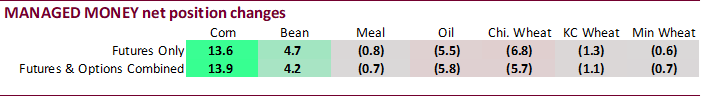

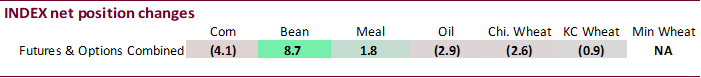

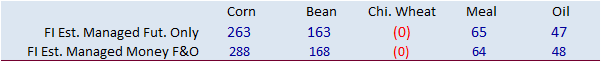

Traditional

funds were more long than expected for soybeans by 23,100 contracts. At 182,700 net long, they added 6,000 from the previous week. The other major commodities also posted more than expected net long positions but were near expectations.

Reuters

table

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

192,123 7,677 453,628 -4,138 -599,917 -2,738

Soybeans

77,630 -5,955 198,624 8,721 -247,712 -3,508

Soyoil

43,824 -3,434 101,071 -2,899 -158,962 9,003

CBOT

wheat -41,243 -689 145,720 -2,644 -102,590 1,447

KCBT

wheat 5,635 -1,115 62,894 -877 -66,147 2,935

=================================================================================

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

278,185 13,858 275,168 -223 -594,891 -747

Soybeans

163,146 4,217 106,264 -1,734 -243,400 -1,329

Soymeal

52,457 -712 87,840 -454 -190,462 2,415

Soyoil

62,996 -5,829 81,506 -722 -166,890 9,473

CBOT

wheat 6,939 -5,736 56,072 1,170 -74,683 2,251

KCBT

wheat 36,386 -1,113 28,425 152 -59,003 2,516

MGEX

wheat 13,191 -731 297 123 -23,380 1,858

———- ———- ———- ———- ———- ———-

Total

wheat 56,516 -7,580 84,794 1,445 -157,066 6,625

Live

cattle 31,926 10,576 69,441 -898 -113,635 -5,733

Feeder

cattle -3,553 1,354 4,431 -122 3,594 -858

Lean

hogs 18,832 -3,641 54,416 135 -63,339 2,939

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

87,372 -12,087 -45,834 -802 2,214,773 -2,902

Soybeans

2,532 -1,896 -28,542 741 971,426 -7,677

Soymeal

21,041 -1,644 29,124 396 435,560 5,718

Soyoil

8,321 -253 14,067 -2,671 453,471 -17,582

CBOT

wheat 13,560 430 -1,887 1,886 465,751 3,288

KCBT

wheat -3,426 -614 -2,382 -943 202,723 -2,615

MGEX

wheat 3,851 -217 6,041 -1,034 73,779 611

———- ———- ———- ———- ———- ———-

Total

wheat 13,985 -401 1,772 -91 742,253 1,284

Live

cattle 18,938 -2,500 -6,670 -1,445 332,773 -16,645

Feeder

cattle 432 -589 -4,906 215 55,684 -1,784

Lean

hogs -1,354 791 -8,556 -224 259,639 -5,193

Macros

US

Industrial Production (M/M) May: 0.2% (est 0.4%; prev 1.1%)

US

Capacity Utilisation May: 79.0% (est 79.2%; prev 79.0%)

US

Manufacturing (SIC) Production May: -0.1% (est 0.3%; prev 0.8%)

Canada

Industrial Product Price (M/M) May: 1.7% (est0.1%; prev 0.8%)

103

Counterparties Take $2.229 Tln At Fed Reverse Repo Op (prev $2.178 Tln, 97 Bids)

US

Crude Oil Futures Settle At $109.56/Bbl, Down $8.03 Or 6.83%

·

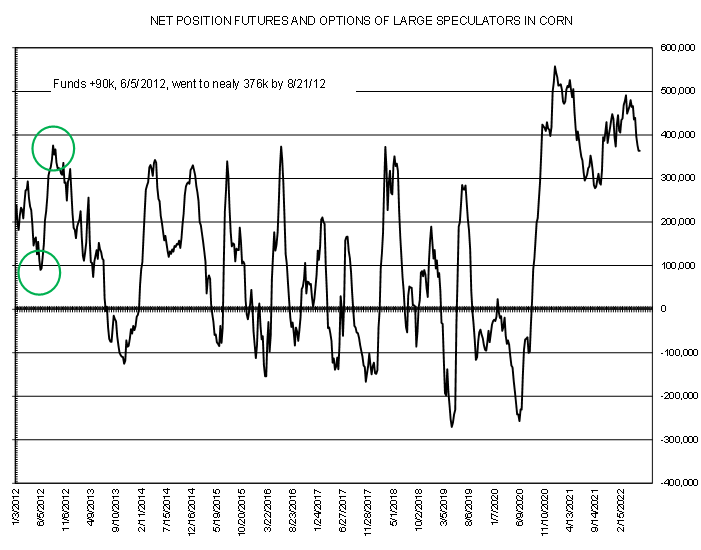

US corn futures traded two-sided. Initially it led the ag markets higher from unfavorable US weather but sold off to close lower on weakness in WTI crude oil, wheat, and soybeans. Energy markets were a big driver today for many

of the commodities.

·

Funds sold an estimated net 1,000 corn contracts.

·

US recession concerns hit many commodity markets.

·

July corn hit a session high of $8.00, then sold off. Note the July contract absolute contract high is $8.2450.

·

WTI crude oil settled $8.03 lower or 6.8%.

·

During the day, RBOB nearby futures fell to its lowest level since May 24, when Chicago regular reformulated retail gasoline prices were about 13 percent below last week’s average (last week Chicago retail gasoline prices were

up 79 percent from year ago).

·

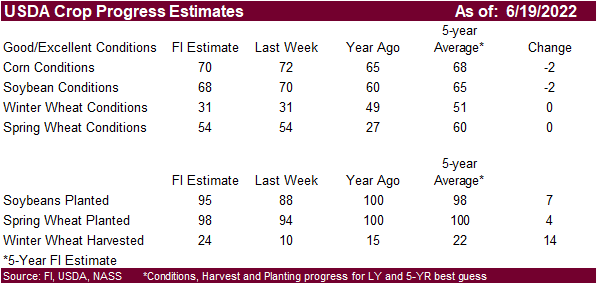

We look for a 1 point decline, revised from previous 2 point decline, in US corn and soybean ratings when updated Tuesday afternoon, and for wheat ratings to be unchanged for winter wheat and spring wheat to improve one point.

·

On Thursday the US House passed a vote on the Lower Food and Fuel Cost Act that includes year round E15 ethanol blending and $200 million in additional funding for higher blends infrastructure.

·

There were no notable export developments on Friday.

2012

July/September

2022

July/September – 46.50 cents

Export

developments.

·

Private exporters reported the following activity:

-144,907

metric tons of corn for delivery to Costa Rica during the 2022/2023 marketing yea

-105,664

metric tons of corn for delivery to unknown destinations during the 2021/2022 marketing year

·

China seeks to buy 40,000 tons of frozen pork for reserves on June 17.

Updated

6/14/22

July

corn is seen in a $7.00 and $8.25 range

December

corn is seen in a wide $5.75-$8.25 range