PDF Attached

Today

was not an ordinary day at the office. CBOT agriculture markets tanked, especially in the soybean complex where limits were expanded. Soybean oil and corn ended limit lower. Today we may have seen some margin problems for some positions as indicated in price

changes for July soybean options. USD was sharply higher. Erasing some 2021 CBOT agriculture market gains over a one-week period was on everyone’s mind. • CME RAISES CORN FUTURES (C) MAINTENANCE MARGINS BY 9.4 % TO $2,325 PER CONTRACT FROM $2,125 FOR JULY

2021

CME

RAISES SOYBEAN FUTURES (S) MAINTENANCE MARGINS BY 9.8% TO $4,500 PER CONTRACT FROM $4,100 FOR JULY 2021

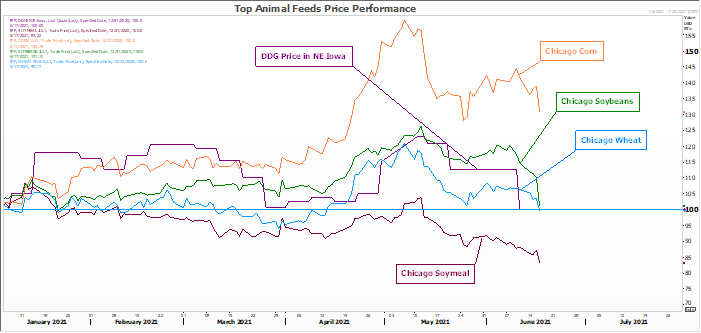

Below

chart – Jan 2021 = 100 Index

![]()

Corn

& July SBO settles synthetically

Corn

July 630 1/2

Sept

548 1/2

Dec

531

March

539

May22

543 3/4

SBO

July: BON1 syn 55.92

Limits

for the soybean complex will remain unchanged for Friday but corn expands to 60. Lumber and lean hogs expansions are in place as well.

https://www.cmegroup.com/trading/price-limits.html

Other

markets had huge moves or saw surprising headlines. Such as 68 Counterparties taking $755.800 Bln At Fixed-Rate Reverse Repo (prev $520.942 Bln, 53 Bidders).

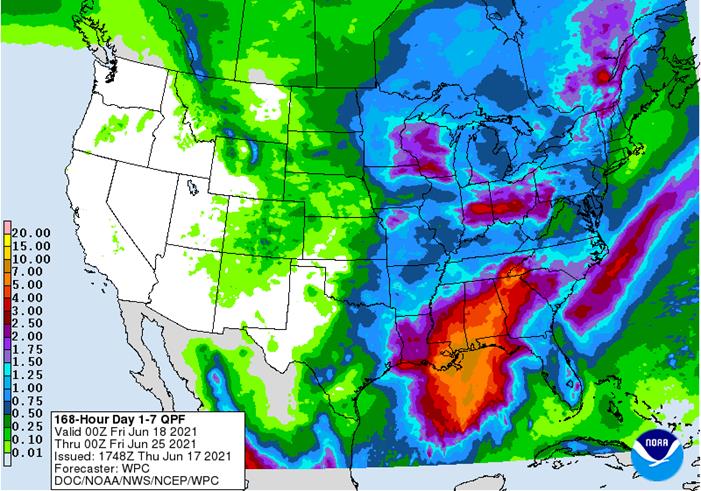

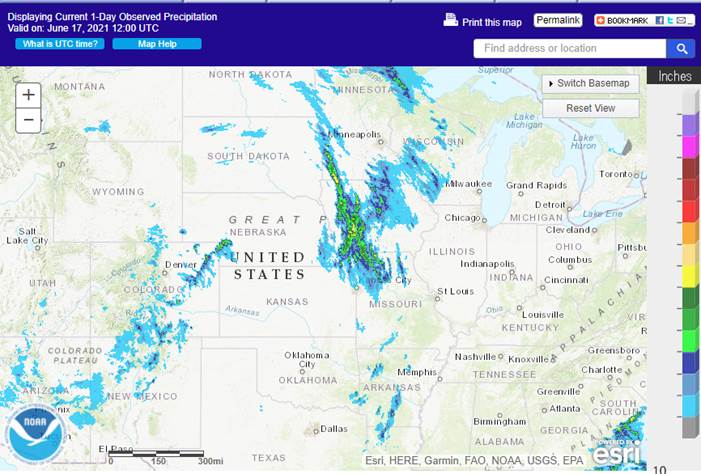

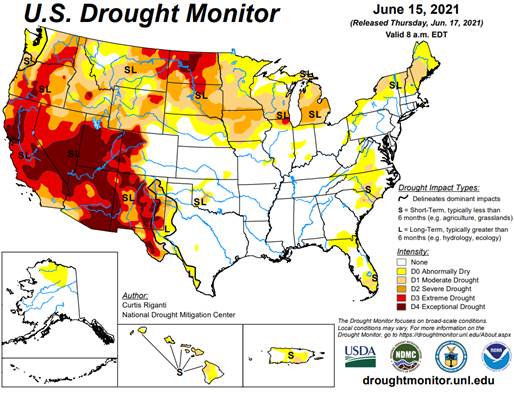

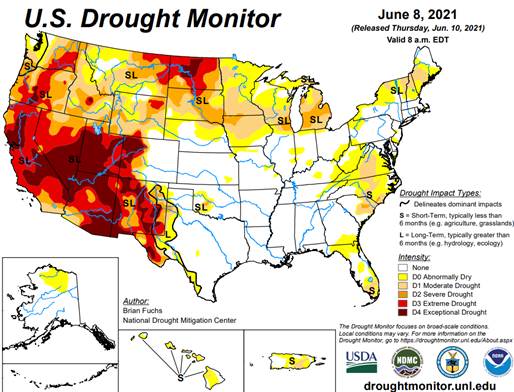

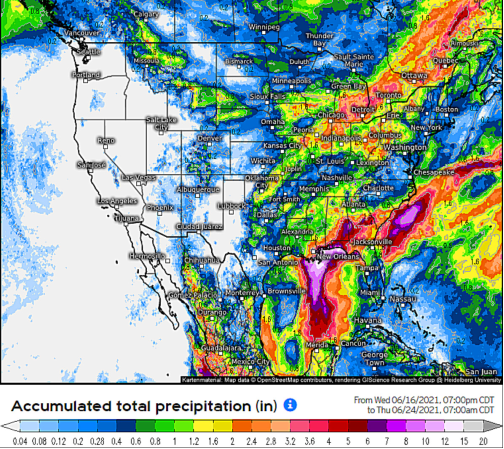

GFS

weather model was wetter for the US while the European model is not as optimistic as they are much drier. The trade looks as if they are agreeing with the GFS models that put good rains across the northern half of IA, lower WI, MI and other parts of the upper

Midwest. Not all the drought areas of the WCB may see soaking rains over the next ten days, if realized. Weather will continue to drive CBOT price fluctuations for a while. Other fundamentals have been widely ignored this week.

7-DAY

RAINFALL PREDICTED BY DAWN THURSDAY, JUNE 24, 2021

WORLD

WEATHER HIGHLIGHS FOR JUNE 17, 2021

MOST

IMPORTANT WEATHER OF THE DAY

- Developing

hot, dry, weather in western Kazakhstan and eastern parts of Russia’s Southern region will be closely monitored over the next few days

o

Highest temperatures will reach into the upper 80s and 90s Fahrenheit with hotter conditions in non-agricultural areas

o

The heat and dryness will slowly expand to the west and north during the weekend next week impacting the lower half of the Volga River Basin, the eastern two-thirds of Russia’s southern Region

- Temperatures

may eventually rise over 100 degrees Fahrenheit

o

Dryness could last through a big part of the next two weeks

- Southeastern

Russia’s New Lands and northern Kazakhstan spring wheat and sunseed areas will get cooling rainfall over the coming week easing long term dryness - Australia

will experience a good mix of rain and sunshine over the next ten days benefiting wheat, barley and canola establishment and late season planting

o

The long term outlook for establishment has been and will continue to improve as the drier areas of South Australia, northwestern Victoria, western New South Wales and Queensland gradually receiving improving rainfall

- Argentina’s

rainfall the past two days in parts of Cordoba and San Luis helped ease dryness in some winter wheat production areas, but more rain is needed

o

Wheat in Argentina still in much better condition than last year because of favorable soil moisture outside of the far west.

o

There is need for a little light rainfall to support recently planted crop germination and emergence

- Southwestern

Canada’s Prairies are still dry biased and need significant rain, but the outlook is drier biased for much of the coming week

o

Some rain “may” evolve in the last week of June

- Cooling

in eastern Canada’s Prairies this weekend into early next week could bring some patches of soft frost, but crop damage is not likely unless temperatures get colder than advertised - India’s

weather remains good in the bulk of central and eastern crop areas, but the outlook in the interior west and northwest is not good for much rain for a while

o

The situation is not a big concern for now, but if rainfall does not improve during July the situation could change

- U.S.

Plains and southwestern states experienced hot temperatures Wednesday and the heat will slowly recede to the southwest over the next few days

o

Extreme highs reached 107 Fahrenheit in western Nebraska and still reached into 100 to 118 degree range in the southwestern desert areas

o

The hottest conditions will be in the central and southern Plains today and mostly from the southern Plains into the southwestern desert region Friday through the weekend

- Cooling

in the central and eastern United States will be most significant this weekend and next week at which time temperatures will be well below average

o

The cool off will come with some needed rain will be good for summer crops by reducing evaporation, lifting topsoil moisture conserving soil moisture through slower drying rates

o

Northwestern and west-central parts of the Corn Belt will not get as much rain as other areas in the Midwest and that will leave them vulnerable to returning crop stress in July when temperatures are warmer once again and rainfall

is further diminished

- U.S.

rainfall will be greatest this weekend from southern Wisconsin and eastern Iowa to the Ohio River Valley where 0.50 to 1.50 inches and local totals well over 2.00 inches are possible

o

Rain in the last week of June may be significant in the central and northern parts of the Midwest once again with a similar amount of rain expected

- U.S.

Delta weather will continue improve as the developing tropical cyclone in the Gulf of Mexico takes a path more to the east of that predicted Wednesday

o

Flood damage to crops in southern Arkansas and parts of central and interior northern Mississippi was notable in a few areas last weekend and drier weather is expected to be welcome in the coming week

o

A few showers will set back the drying trend as frontal system moves into the Delta early next week

- U.S.

southeastern states will mostly benefit from the moisture coming from the tropical cyclone and two frontal systems that follow it during the next ten days

o

Too much rain is expected from southeastern Mississippi, southwestern Alabama and far western parts of the Florida Panhandle into northern Georgia

- Crop

damage is not likely to be very great unless the storm become more intense than expected

- Tropical

cyclone development is expected in the southwestern and central Gulf of Mexico late today and tonight, but the system will race inland Friday into Saturday from southeastern Louisiana into southern Alabama producing 3.00 to more than 8.00 inches of rainfall

and inducing some flooding

o

Damage from the system is not expected to be very great

o

Not much damaging wind expected

o

Flooding will be the greatest concern

- West

Texas will not see much precipitation for a while, but there are chances for rain evolving next week that may bring some temporary relief from recent warm to hot temperatures and dry conditions.

- U.S.

hard red winter wheat areas will not be seriously impacted by showers and thunderstorms that pop up next week when cooling is greatest in the region.

o

Harvest progress will advance around the precipitation.

- Drought

in the far western U.S. is not expected to change through the end of June

o

Monsoonal precipitation from Mexico should begin to stream into the southwestern desert region and southern Rocky Mountains during the second and third weeks in July

- Rain

is still needed for unirrigated winter crops in the U.S. Pacific Northwest, although it is quickly getting too late for much benefit

o

Most spring and summer crops are irrigated and water supply is sufficient for that purpose

- Brazil

rain will continue mostly in southern grain areas from Mato Grosso do Sul and parts of Sao Paulo into Rio Grande do Sul during the next two weeks

o

The precipitation will not harm Safrinha corn, although drying will soon be needed to support maturation and harvest progress

o

The rain will be very good for wheat production and potential yields are high

- Temperatures

will cool down in Argentina over the next few days and again next week with some cooling in southern Brazil during the latter days of June, but there is very little risk of frost or freezes in corn, sugarcane, citrus or coffee areas of Brazil for the coming

ten days

- India

rainfall will be lighter than usual in most of the nation over the next ten days except in Bihar, Jharkhand, eastern Madhya Pradesh, northeastern Chhattisgarh and West Bengal where amounts will be greater than usual

o

Crop conditions and planting prospects will be good in the central and east, but concern about moisture shortages in the interior west will slowly rise

- Flooding

rain will occur along the immediate west coast, but will not reach far enough inland to benefit many crop areas - Eastern

France, Germany, Poland and areas south into northern Italy and Slovenia and north to Scandinavia will be warmer than usual for another day or two and then cooling is expected from west to east across the continent

o

Rain is expected periodically across the continent favoring the west in this first seven days of the outlook and then favoring the east June 23-30

- The

situation looks good for most crop areas - Rain

will occur erratically across Southeast Asia during the coming week.

o

Most areas will get rain at one time or another by June 23.

- Rainfall

will be lighter than usual in the mainland areas of Southeast Asia and in parts of Philippines - West-central

Africa rainfall will remain supportive of coffee, cocoa, sugarcane, rice and cotton development

o

Some increase in rainfall frequency and intensity is expected especially near the coast

- East-central

Africa rainfall continues lighter than usual in Uganda, and parts of Ethiopia and changes are not likely to come anytime soon

o

Any precipitation will be welcome, but greater amounts are desired

- Mexico

rainfall will continue in southern parts of the nation over the coming week while some rain expands into the interior far west

o

Rain should increase and advance to the north during the June 23-29 period

- Nicaragua

and Honduras have been drier biased for the past month still have need greater rain

o

Some improvement is occurring and will continue over the next week

- North

Africa rainfall will be sporadic and light for another few days and then drier conditions are expected

o

The precipitation is not likely to have a big impact on unharvested winter crops

- Southern

Oscillation Index is mostly neutral at -1.411and the index is expected to continue rising into the weekend

- South

Africa weather was mostly dry Tuesday and little change was expected over the next ten days

o

Winter crop establishment has been favorable in the southwest, but unirrigated areas in Free State has been a little dry and rain is needed

- New

Zealand rainfall during the coming week to ten days will be a little lighter than usual in South Island and near to above normal in the north

o

Temperatures will be near to above average

Source:

World Weather, Inc.

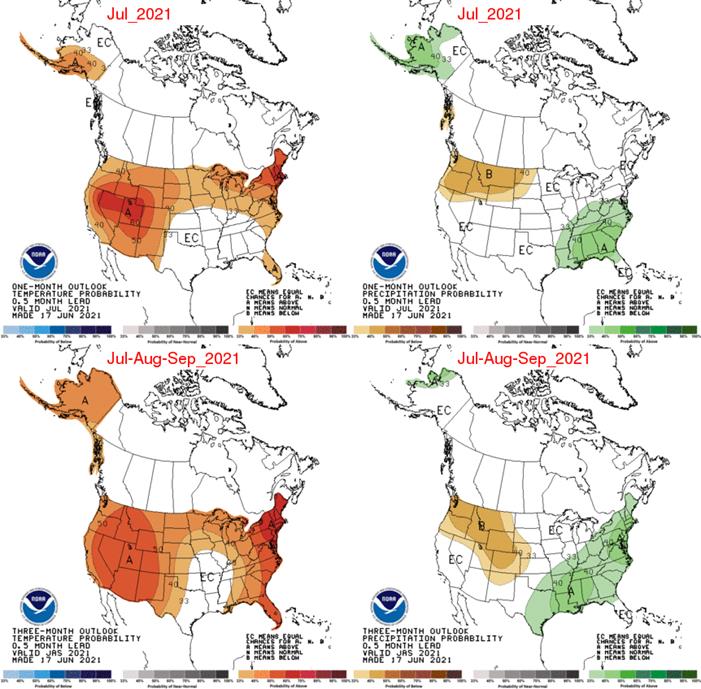

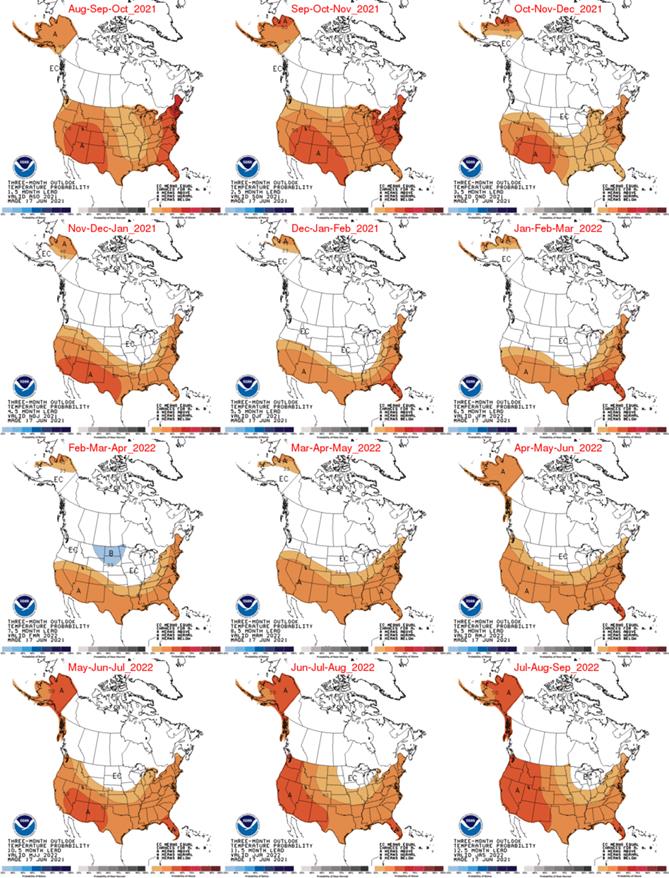

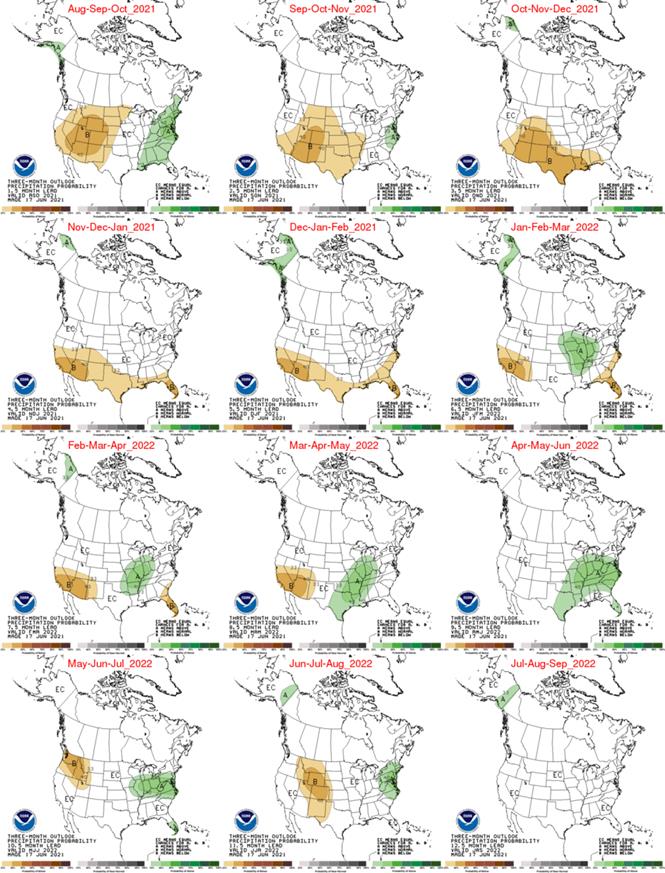

NOAA

OUTLOOK

Bloomberg

Ag Calendar

Thursday,

June 17:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - Itau

webinar on agribusiness outlook, Sao Paulo, Brazil - CNGOIC

oilseed conference, Chengdu, China, Day 2

Friday,

June 18:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China

customs to publish trade data, including imports of corn, wheat, sugar and pork - World

coffee market report by USDA’s Foreign Agricultural Service, 3pm - FranceAgriMer

weekly update on crop conditions - USDA

Total Milk Production

Source:

Bloomberg and FI

USDA

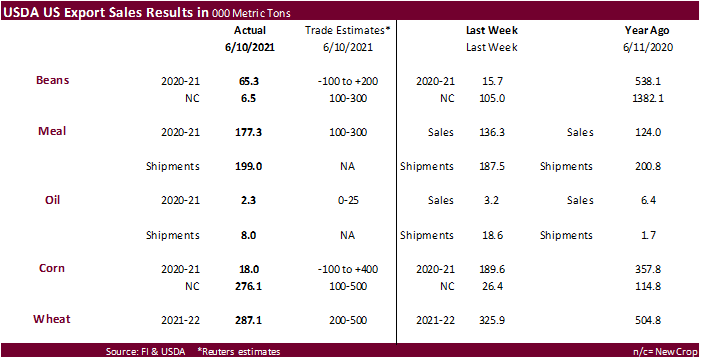

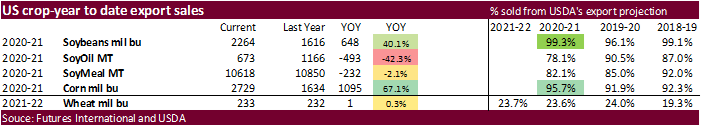

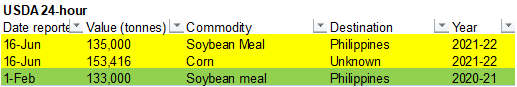

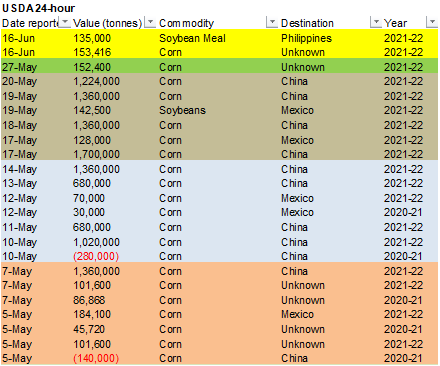

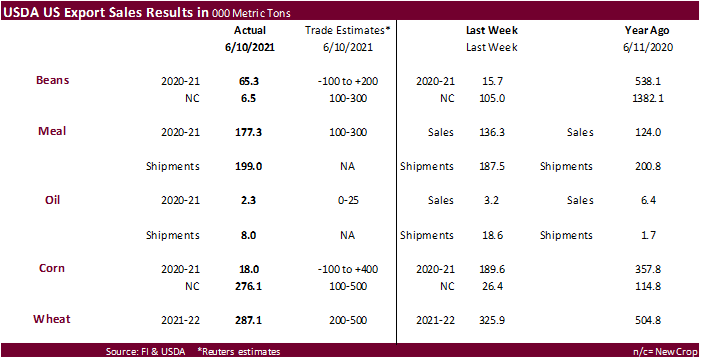

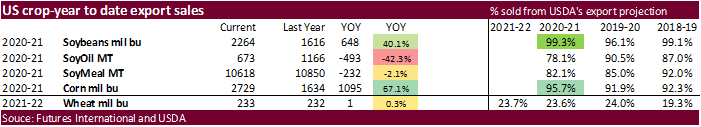

Export Sales

USDA

export sales were on the low side for many of the major commodities, but good meal shipments may provide a positive undertone for that commodity coupled by unwinding of oil/meal spreads. Soybean sales were only 65,300 tons, within expectations, and not a

surprise as commitments is running 99 percent of USDA’s projection. Corn sales of 18,000 old crop and 276,100 tons new crop were poor. All-wheat sales cooled last week to 287,100 tons from 325,900 tons, negative in our opinion. Soybean meal sales improved

to 177,300 tons and shipments were 199,000. Soybean oil commitments were only 2,300 tons and shipments were off from the previous week at 8,000 tons. We look for sales to improve next week amid break in futures prices.

68

Counterparties taking $755.800 Bln At Fixed-Rate Reverse Repo (prev $520.942 Bln, 53 Bidders).

US

Initial Jobless Claims Jun 12: 412K (est 360K; prevR 375K; prev 376K)

US

Continuing Claims Jun 5: 3518K (est 3425K; prevR 3517K; prev 3499K)

US

Philadelphia Fed Business Outlook Jun: 30.7 (est 31.0; prev 31.5)

Canadian

International Security Transactions Apr: 9.95B (prevR 4.12B; prev 3.25B)

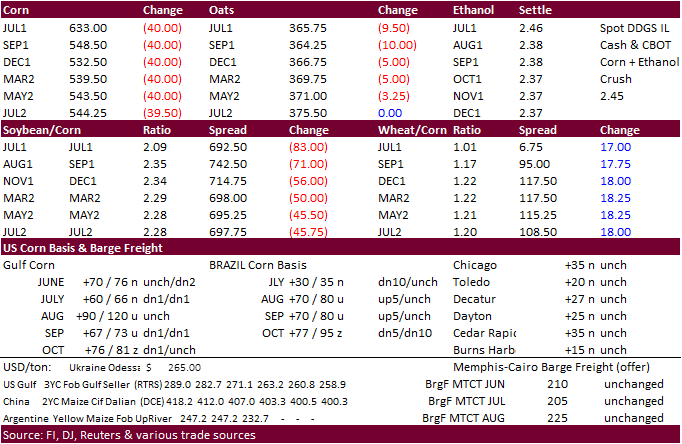

- US

corn futures ended limit lower on a wetter outlook by GFS model for the western Corn Belt and upper Midwest along with a sharply lower soybean complex (we get into more details in that section). European model remains drier than that of the GFS. Rain prospects

continue to improve for Iowa, southern Minn and the ECB. The GFS models show up to 5-10” rain in Iowa over the next 10 days. - CME

RAISES CORN FUTURES (C) MAINTENANCE MARGINS BY 9.4 % TO $2,325 PER CONTRACT FROM $2,125 FOR JULY 2021 - These

price movements make us wonder if the traditional fundamentals getting algo’d out.

- USD

was up sharply higher. The US Fed signaled interest rates could creep higher.

- Not

much news developed for the corn market. - Reuters

noted US merchant refiners racked up a shortfall of 1.6 billion dollars in biofuel credits. This comes after Delta airlines was said to have refused to buy biofuel credits, reported last month. We think end users expect the new administration to provide

relief for refiners. - Funds

sold an estimated net 30,000 corn contracts on Thursday. -

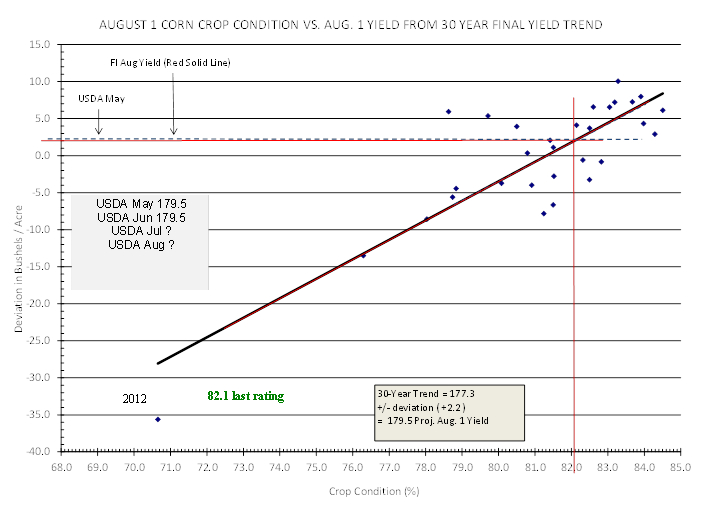

Earlier

this morning RIN prices were stable, around 130 D6 and 140 D4. - We

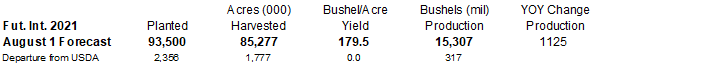

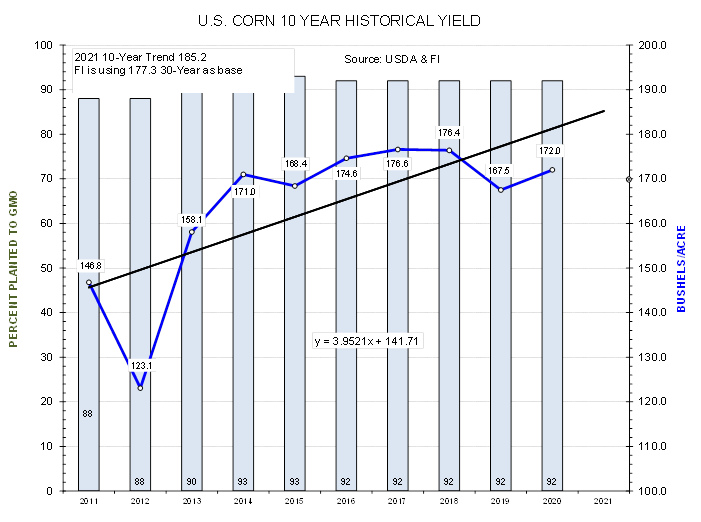

are using the 30-year trend of 177.3 to forecast the August 1 corn crop yield. The 10 year is 185.2. Based on the latest FI adjusted corn crop rating we estimate the US August corn yield at 179.5 bushels per acre, same as USDA. This will likely be lowered

over the next few weeks if US corn condition continue to decline. US corn supply estimates below.

Export

developments.

Updated

6/17/21

July

corn seen in a $5.50 and $7.00 range

September

$5.00

and $6.75

December

corn is seen in a $4.75-$7.00 range.

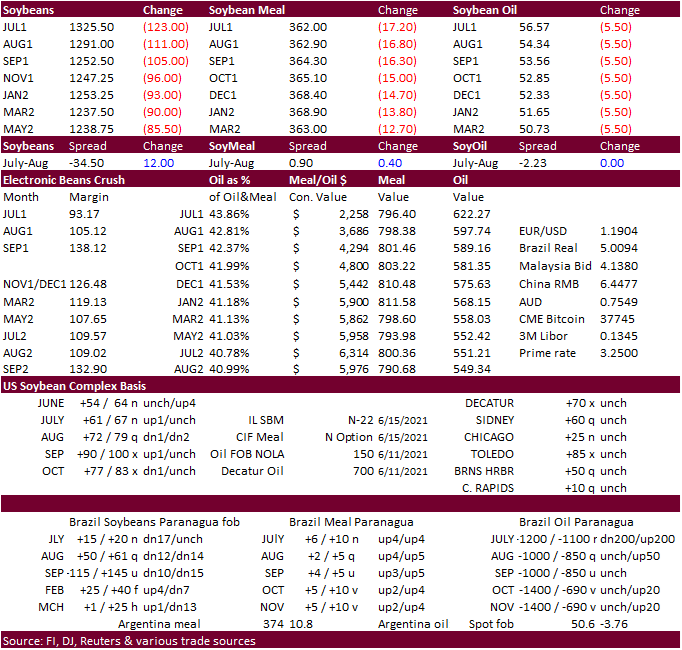

Soybeans

-

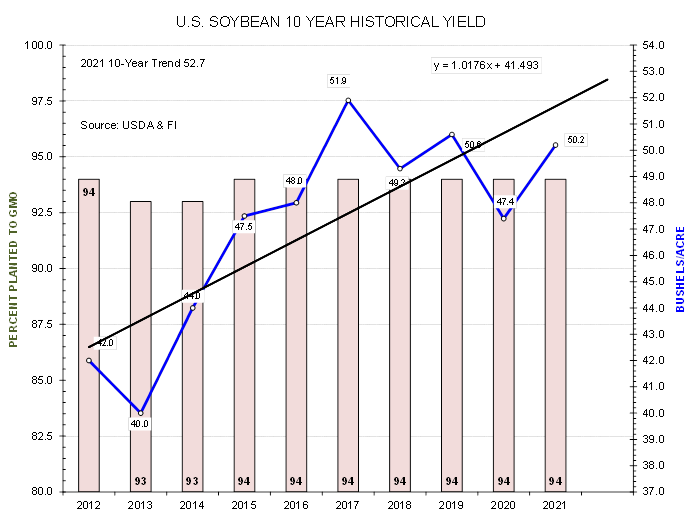

We

again lowered our trading range for July and December soybean oil as July broke through our 60 cent support level. December was lowered slightly to reflect the bearish undertone in the nearby positions. Soybeans basis July were taken down about 25 cents.

-

The

US soybean complex ended lower (limit 550 points lower in soybean oil) in large part on improving US weather and some positions blowing up, we speculate. Follow through selling should be noted. Despite decent USDA export sales for soybean meal and unwinding

of product spreads, meal closed sharply lower by $12.80-$17.20/short ton. For soybeans, they dropped 85-123 cents. At one point during the trade, soybeans dropped about 20 cents is just under one minute. US soybean complex limits will remain unchanged headed

into Friday. Corn they expand. ICE canola fell limit and price limit expands to $45/ton. We look for a lower trade but with the weekend around the corner, volume should be lighter than a typical day.

-

The

unpresented move in prices today has not been seen by many veteran traders in decades. A few months ago, we went back through daily soybean oil limit price movements from 1970 and found just over a handful of times soybean oil ended up or down limit for 2

or more consecutive days. We are not confident we will see a limit lower close on Friday but synthetics were about 100 points lower than the official July settlement.

-

Times

have changed and this volatility may last until the market settles down. We don’t know when the selling will end. It’s been a perfect storm that created this. Volatility is up sharply, option spread traders that utilize puts to fund positions are getting

hit with margin calls, headlines are bearish, global cash prices are easing, weather is improving, and algo trading is likely at or near an all time high. Also recall back in April position limits for managed money were increased, making the market more vulnerable

for large price changes if those positions were maximized.

Nearby

soybeans, rolling, weekly chart

-

We

are seeing some US crush downtime this month. A soybean crushing plant in Cedar Rapids, Iowa, was shut down for maintenance and may resume shortly.

-

Argentina

spot cash soybean oil fell from $1181 to $1115 as of early this morning, according to Oil World. AgriCensus this afternoon posted $1,012.75/ton, down $90/ton from yesterday.

-

Several

Argentine maritime workers unions and the grain receivers union Urgara announced a strike action for June 18 (AgriCensus). It will last for 24-hours, related to COVID-19 vaccines. This might be the 4th one in three weeks, but unsure as we have

officially lost count. We don’t see a price implication from this strike, unlike previous strikes.

-

Speaking

of which, it feels the fundamentals are getting algo’d out over the past week. There are many bearish factors going on the soybean oil market, but many of these are headlines over biofuel policy. They will not change my view the US SBO balance sheet getting

tighter. We so think SBO was overvalued relative to other global vegetable oils. US SBO was its own island a month ago. The selling started, IMO, with Argentina dumping SBO on the export market followed by waning India demand coupled with cheaper new-crop

sunflower oil offered out of the Black Sea. My US biofuel feedstock view will not change. If it were not profitable to produce and market the product, SBO use would have been much lower over the past year.

We think lawmakers might be looking at a long term rather than a short term fix. It may take years to overhaul the biofuel program, IMO.

-

Back

to soybean meal sales, Ireland was one of the reported destinations for soybean meal. Italy was not included. A cash broker told us Vietnam was a “surprise but given the weak Western Meal premiums, it shouldn’t be a surprise”. Ireland was reported as a

destination for soybean meal. Italy was not included. A cash broker told us that “Vietnam was a surprise but given the weak Western Meal premiums, it shouldn’t be a surprise”. Colombia bought meal and 68,800 tons were shipped to the Philippines, but both

country commitments are running 73% and 85% below the previous season pace, respectively. USDA later announced 135,000 tons of soybean meal to the Philippines.

-

Palm

was up overnight but fell after India announced they will hold off on lowering their import tax. China vegetable oils were down 1.7% and meal by only 0.7%. We expect Asian vegetable oil markets to collapse tonight. If they don’t, then our “island” point

above would be reinforced. -

CBOT

oil share grinded lower but ended well off today’s session lows.

-

Funds

on Thursday sold an estimated net 30,000 soybean contracts, sold 12,000 soybean meal and sold 15,000 soybean oil contracts.

-

Argentina

AgMin: 2020-21 soybean producer sales 21.8MMT, up 853,500 tons over the previous week, compared to 25.3MMT year earlier. BA Grain Exchange has a 43.5MMT soybean crop vs. 49MMT for 2019-20.

-

SGS

reported June 1-15 Malaysian palm oil export fell 7.9% from the same period a month ago.

The

downward pressure in soybean oil

due in large part to the Reuters story that broke earlier this week that the White House was looking into providing biofuel mandate relief to oil refiners has generated a great amount of interest. So, we wanted to share one of those questions we received

today. Is renewable diesel is part of the $1.00 biofuel—based diesel tax credit. The answer is yes.

Who

gets the credit? The credit goes to the party that blends from B100 to B99, so when its mixed, that is the point where the credit gets applied. From our understanding, most producers sell B100 so they get the value for the credit when the fuel ships. We

used to think the producers shared the credit with the blenders. EIA provided a nice overview of the credit here

https://www.eia.gov/todayinenergy/detail.php?id=42616

U.S.

lawmakers urge EPA to reject exempting refiners from biofuel mandates

Grassley

urges Biden to maintain RFS blend requirements

Export

Developments

- WASHINGTON,

June 17, 2021—Private exporters reported to the U.S. Department of Agriculture export sales of 135,000 metric tons of soybean cake and meal for delivery to the Philippines during the 2020/2021 marketing year. Last 24-hour soybean meal sale that was announced

was back on February 1, for the same destination.

- Today

the USDA CCC program seeks 25,000 tons of soybean meal for Bangladesh and 8,000 tons for Cambodia for July 15-25 shipment.

Updated

6/17/21

July

soybeans are seen in a $12.50-$15.50; November $12.00-$15.00

Soybean

meal – July $320-$400; December $320-$460

Soybean

oil – July 50.00-65.00; December 45-65 cent range

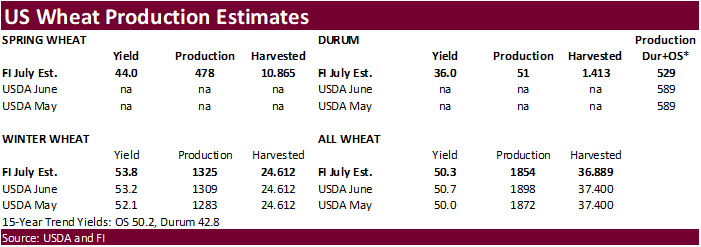

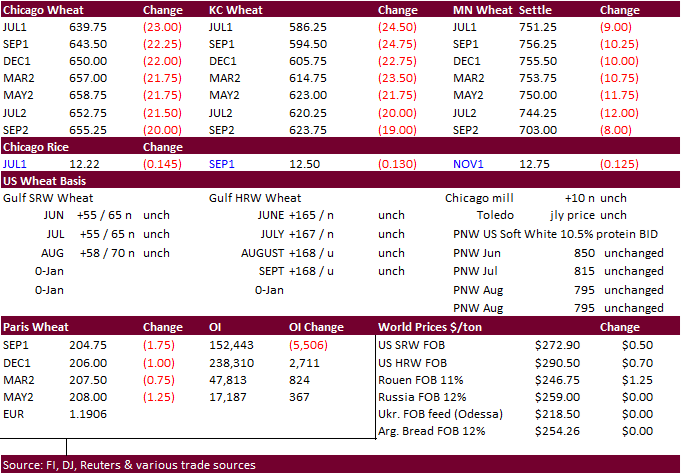

- US

wheat futures ended lower on improving North American weather and technical selling. Other than a couple import tender developments, news was light. Wheat appeared to have weathered the massive downward price movement in corn and soybean complex today.

Global demand remains good. USDA export sales commitments fell from the previous week.

- September

Paris wheat was 1.75 euros lower at 204.75. EU weather looks good. - Funds

on Thursday

bought an estimated net 15,000 SRW wheat contracts. - Pakistan

ECC department approved 3 million tons of wheat imports for 2021-22 for strategic stocks.

- Yesterday

it was announced Algeria

rejected a 27,000 ton French wheat cargo after 2 dead pigs were found in the cargo. We are curious how these animals ended up in the cargo.

- *Turkey

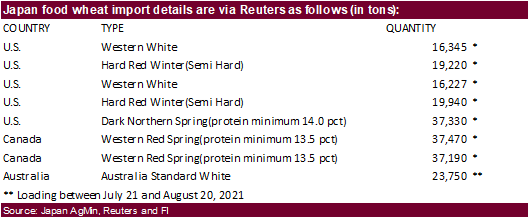

seeks 395,000 tons of wheat on June 30 for July through August shipment. - Japan

bought 207,472 tons of food wheat. Initial tender below:

- Egypt

retendered for wheat that includes shipment bids after cancelling their import tender yesterday. Lowest offer yesterday was $250.88 a ton for 60,000 tons of Russian wheat but it was cancelled due to high freight prices. There were at least 19 offers on Tuesday.

- Iran

seeks 60,000 tons of milling wheat for July and August shipment. - The

Philippines seeks 205,000 tons of milling wheat for Aug/Sep shipment. - Jordan

seeks 120,000 tons of wheat on June 22 for December shipment. - Jordan

is back in for feed barley on June 23 for Nov/Dec shipment.

Rice/Other

- Results

awaited: The lowest offer for Bangladesh in for 50,000 tons of rice was $399.90/ton CIF.

·

(Bloomberg) — National Food and Strategic Reserves Administration will release state reserves of metals including copper, aluminum and zinc in batches, according to a statement from the administration.

Updated

6/15/21

September

Chicago wheat is seen in a $6.00-$7.00 range

September

KC wheat is seen in a $5.60-$6.70

September

MN wheat is seen in a $6.90-$8.50

USDA export sales were on the low side for many of the major commodities, but good meal shipments

may provide a positive undertone for that commodity coupled by unwinding of oil/meal spreads. Soybean sales were only 65,300 tons, within expectations, and not a surprise as commitments is running 99 percent of USDA’s projection. Corn sales of 18,000 old

crop and 276,100 tons new crop were poor. All-wheat sales cooled last week to 287,100 tons from 325,900 tons, negative in our opinion. Soybean meal sales improved to 177,300 tons and shipments were 199,000. Soybean oil commitments were only 2,300 tons and

shipments were off from the previous week at 8,000 tons. We look for sales to improve next week amid break in futures prices.

U.S. EXPORT SALES FOR WEEK ENDING 6/10/2021

|

|

||||||||

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR

AGO |

CURRENT YEAR |

YEAR

AGO |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

130.6 |

1,587.0 |

2,038.7 |

150.6 |

210.2 |

288.5 |

0.0 |

0.0 |

|

SRW |

25.0 |

1,015.6 |

571.1 |

4.6 |

4.6 |

17.5 |

0.0 |

0.0 |

|

HRS |

81.6 |

1,642.3 |

1,767.1 |

63.4 |

85.3 |

130.0 |

0.0 |

0.0 |

|

WHITE |

50.4 |

1,111.5 |

1,059.4 |

53.7 |

108.5 |

174.5 |

0.0 |

0.0 |

|

DURUM |

-0.5 |

8.4 |

238.2 |

26.3 |

26.3 |

48.5 |

0.0 |

0.0 |

|

TOTAL |

287.1 |

5,364.7 |

5,674.4 |

298.6 |

434.8 |

658.9 |

0.0 |

0.0 |

|

BARLEY |

0.0 |

24.7 |

40.2 |

0.0 |

0.0 |

0.5 |

0.0 |

0.0 |

|

CORN |

18.0 |

14,742.5 |

10,361.1 |

1,661.6 |

54,573.3 |

31,129.7 |

276.1 |

15,369.9 |

|

SORGHUM |

-5.0 |

889.2 |

941.3 |

116.0 |

6,336.9 |

3,071.9 |

0.0 |

1,594.9 |

|

SOYBEANS |

65.3 |

3,724.9 |

7,593.0 |

148.3 |

57,893.0 |

36,385.4 |

6.5 |

7,562.1 |

|

SOY MEAL |

177.3 |

1,961.4 |

2,369.3 |

199.0 |

8,656.9 |

8,480.8 |

7.8 |

649.5 |

|

SOY OIL |

2.2 |

29.2 |

265.5 |

8.0 |

644.0 |

900.5 |

0.0 |

0.6 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

18.0 |

193.2 |

158.1 |

13.5 |

1,469.9 |

1,245.8 |

0.0 |

0.0 |

|

M S RGH |

0.0 |

15.9 |

26.2 |

0.2 |

25.0 |

70.2 |

0.0 |

0.0 |

|

L G BRN |

0.8 |

13.3 |

12.6 |

0.6 |

38.3 |

55.4 |

0.0 |

0.0 |

|

M&S BR |

0.1 |

45.2 |

38.0 |

0.1 |

111.4 |

80.9 |

0.0 |

0.0 |

|

L G MLD |

17.6 |

32.6 |

58.9 |

45.3 |

601.1 |

824.8 |

0.0 |

0.0 |

|

M S MLD |

1.3 |

163.6 |

144.8 |

18.5 |

522.4 |

584.5 |

0.0 |

0.0 |

|

TOTAL |

37.8 |

463.8 |

438.7 |

78.3 |

2,768.1 |

2,861.6 |

0.0 |

0.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

111.3 |

2,788.1 |

4,864.9 |

303.8 |

13,158.8 |

11,958.0 |

102.9 |

2,144.4 |

|

PIMA |

2.3 |

135.5 |

131.2 |

12.0 |

675.4 |

434.4 |

0.0 |

4.0 |

This

summary is based on reports from exporters for the period June 4-June 10, 2021.

Wheat: Net

sales of 287,100 metric tons (MT) were reported for delivery in marketing year 2021/2022. Increases primarily for Japan (95,100 MT, including decreases of 300 MT), unknown destinations (72,000 MT), Mexico (49,600 MT, including decreases of 100 MT), Thailand

(34,000 MT), and the Dominican Republic (14,600 MT), were offset by reductions primarily for Guatemala (2,000 MT) and Italy (600 MT). Exports of 298,600 MT were primarily to Nigeria (77,500 MT), Taiwan (42,700 MT), the Philippines (34,500 MT), Japan (34,200

MT), and Nicaragua (32,000 MT).

Optional

Origin Sales:

For 2021/2022, options were exercised to export 63,900 MT to Spain from other than the United States.

Corn:

Net sales of 18,000 MT for 2020/2021 were down 91 percent from the previous week and 95 percent from the prior 4-week average. Increases primarily for Japan (69,900 MT, including 138,200 MT switched from unknown destinations and decreases of 70,500 MT), Saudi

Arabia (57,500 MT), Colombia (44,000 MT, including 40,000 MT switched from unknown destinations), Mexico (35,700 MT, including decreases of 7,300 MT), and Nicaragua (31,400 MT, including 20,900 MT switched from El Salvador, 7,500 MT switched from Guatemala,

and decreases of 4,500 MT), were offset by reductions primarily for unknown destinations (152,200 MT) and Costa Rica (96,700 MT). For 2021/2022, net sales of 276,100 MT were primarily for Mexico (100,000 MT), Costa Rica (97,400 MT), Guatemala (42,200 MT),

Taiwan (21,500 MT), and Jamaica (6,900 MT). Exports of 1,661,600 MT were up 1 percent from the previous week, but down and 16 percent from the prior 4-week average. The destinations were primarily to China (615,000 MT), Japan (550,300 MT), Mexico (348,100

MT), Colombia (44,000 MT), and Morocco (34,400 MT).

Optional

Origin Sales:

For 2020/2021, the current outstanding balance of 30,500 MT is for unknown destinations. For 2021/2022, the current outstanding balance of 60,000 MT is for unknown destinations.

Barley:

No net sales or exports were reported for the week.

Sorghum:

Net sales reduction of 5,000 MT for 2020/2021 resulting in increases for China (63,000 MT, including 68,000 MT switched from unknown destinations and decreases of 5,000 MT), were more than offset by reductions for unknown

destinations (68,000 MT). Exports of 116,000 MT were up noticeably from the previous week, but down 10 percent from the prior 4-week average. The destination was China.

Rice:

Net sales of 37,800 MT for 2020/2021 were up 28 percent from the previous week, but down 19 percent from the prior 4-week average. Increases were primarily for Haiti (14,700 MT, including decreases of 600 MT), Mexico (7,900 MT, including decreases of 100

MT), Guatemala (5,000 MT), Honduras (5,000 MT), and Canada (2,200MT, including decreases of 400 MT). Exports of 78,300 MT were up 20 percent from the previous week and 29 percent from the prior 4-week average. The destinations were primarily to Haiti (37,400

MT), Japan (13,600 MT), Panama (10,200 MT), Mexico (4,500 MT), and Canada (3,100 MT).

Exports

for Own Account:

For 2020/2021, exports for own account totaling 100 MT to Canada were applied to new or outstanding sales.

Soybeans:

Net sales of 65,300 MT for 2020/2021 were up noticeably from the previous week and up 51 percent from the prior 4-week average. Increases primarily for Japan (15,500 MT, including 11,000 MT switched from unknown destinations), Colombia (15,000 MT, including

10,000 MT switched from unknown destinations), Indonesia (12,300 MT, including decreases of 1,500 MT), Saudi Arabia (9,500 MT), and Canada (9,400 MT), were offset by reductions for unknown destinations (10,000 MT). For 2021/2022, net sales of 6,500 MT resulting

in increases for unknown destinations (29,500 MT) and Taiwan (20,000 MT), were offset by reductions for China (43,000 MT). Exports of 148,300 MT–a marketing-year low–were down 47 percent from the previous week and 48 percent from the prior 4-week average.

The destinations were primarily to Japan (40,500 MT), Mexico (32,700 MT), Venezuela (17,700 MT), Indonesia (16,500 MT), and Colombia (12,500 MT).

Exports

for Own Account:

For 2020/2021, the current exports for own account outstanding balance is 5,800 MT, all Canada.

Soybean

Cake and Meal:

Net sales of 177,300 MT for 2020/2021 were up 30 percent from the previous week, but down 4 percent from the prior 4-week average. Increases primarily for Vietnam (50,000 MT), Ireland (40,000 MT), Canada (28,400 MT, including decreases of 1,900 MT), Colombia

(16,000 MT), and Mexico (9,500 MT, including decreases of 4,700 MT), were offset by reductions primarily for Honduras (3,000 MT) and Belgium (2,800 MT). For 2021/2022, net sales of 7,800 MT were for Jamaica (6,500 MT), Mexico (1,000 MT), and Canada (300 MT).

Exports of 199,000 MT were up 6 percent from the previous week and 5 percent from the prior 4-week average. The destinations were primarily to the Philippines (68,800 MT), the Dominican Republic (31,300 MT), Canada (26,300 MT), Mexico (21,100 MT), and Cote

D’Ivoire (16,500 MT).

Soybean

Oil:

Net sales of 2,200 MT for 2020/2021 were down 31 percent from the previous week, but up noticeably from the prior 4-week average. Increases reported for Mexico (1,900 MT) and Canada (700 MT, including decreases of 300 MT), were offset by reductions for Guatemala

(400 MT). Exports of 8,000 MT were down 57 percent from the previous week and 26 percent from the prior 4-week average. The destinations were primarily to Guatemala (6,700 MT) and Canada (1,200 MT).

Cotton:

Net sales of 111,300 RB for 2020/2021 were up 3 percent from the previous week, but down 22 percent from the prior 4-week average. Increases primarily for Pakistan (53,000 RB, including decreases of 100 RB), Turkey (17,800 RB), Indonesia (9,700 RB, including

400 RB switched from Japan), Mexico (6,500 RB, including decreases of 6,600 RB), and Vietnam (5,900 RB, including 400 RB switched from Japan), were offset by reductions for the Philippines (100 RB). For 2021/2022, net sales of 102,900 RB primarily for Pakistan

(84,600 RB), Turkey (7,900 RB), Indonesia (5,300 RB), Vietnam (4,800 RB), and Japan (3,600 RB), were offset by reductions for China (8,800 RB). Exports of 303,800 RB were up 18 percent from the previous week, but down 6 percent from the prior 4-week average.

Exports were primarily to Vietnam (97,800 RB), Turkey (49,100 RB), China (38,100 RB), Pakistan (31,200 RB), and Mexico (20,600 RB). Net sales of Pima totaling 2,300 RB–a marketing-year low–were down 40 percent from the previous week and 71 percent from

the prior 4-week average. Increases were primarily for China (900 RB), Bangladesh (400 RB), Thailand (400 RB), Germany (300 RB), and Vietnam (200 RB). Exports of 12,000 RB were down 28 percent from the previous week and 13 percent from the prior 4-week average.

The destinations were primarily to India (4,200 RB), Turkey (3,000 RB), Honduras (1,000 RB), Egypt (1,000 RB), and Japan (900 RB).

Exports

for Own Account:

For 2020/2021, the current exports for own account outstanding balance of 11,100 RB is for China (6,200 RB), Vietnam (4,500 RB), and Bangladesh (400 RB).

Hides

and Skins:

Net sales of 240,900 pieces for 2021 were down 49 percent from the previous week and 39 percent from the prior 4-week average. Increases primarily for China (149,300 whole cattle hides, including decreases of 2,100 pieces), South Korea (38,500 whole cattle

hides, including decreases of 1,200 pieces), Mexico (26,300 whole cattle hides, including decreases of 600 pieces), and Indonesia (13,900 whole cattle hides, including decreases of 100 pieces), were offset by reductions for Italy (200 pieces). Exports of

355,800 pieces were up 1 percent from the previous week, but down 3 percent from the prior 4-week average. Whole cattle hides exports were primarily to China (213,400 pieces), South Korea (62,000 pieces), Mexico (32,900 pieces), and Thailand (20,100 pieces).

Net

sales of 62,900 wet blues for 2021 were down 46 percent from the previous week and 54 percent from the prior 4-week average. Increases primarily for Vietnam (15,300 unsplit, including decreases of 100 unsplit), Italy (12,000 grain splits), Taiwan (12,000

unsplit), China (9,800 unsplit), and Mexico (7,900 MT grain splits and 1,000 unsplit), were offset by reductions for Italy (1,700 unsplit). Exports of 191,700 wet blues were up 76 percent from the previous week and 46 percent from the prior 4-week average.

The destinations were primarily to Vietnam (62,400 unsplit), Italy (44,300 unsplit and 3,600 grain splits), China (39,700 unsplit), Thailand (19,200 unsplit), and Mexico (11,800 grain splits and 7,300 unsplit). Net sales reductions of 2,000 splits were reported

for China (1,700 pounds) and Taiwan (300 pounds). Exports of 242,700 pounds were to Vietnam (200,000 pounds) and Taiwan (42,700 pounds).

Beef:

Net

sales of 12,800 MT reported for 2021 were down 20 percent from the previous week and 36 percent from the prior 4-week average. Increases primarily for Japan (4,400 MT, including decreases of 600 MT), China (3,600 MT, including decreases of 100 MT), South

Korea (1,700 MT, including decreases of 500 MT), Taiwan (1,200 MT, including decreases of 200 MT), and Canada (600 MT, including decreases of 200 MT), were offset by reductions for Turks and Caicos Islands (100 MT). Exports of 17,800 MT were down 16 percent

from the previous week and 2 percent from the prior 4-week average. The destinations were primarily to Japan (5,300 MT), South Korea (4,900 MT), China (3,000 MT), Taiwan (1,300 MT), and Mexico (1,000 MT).

Pork:

Net

sales of 29,300 MT reported for 2021 were up 49 percent from the previous week and 8 percent from the prior 4-week average. Increases primarily for Mexico (19,100 MT, including decreases of 700 MT), Japan (5,300 MT, including decreases 200 MT), South Korea

(2,300 MT, including decreases of 200), Canada (1,100 MT, including decreases of 600 MT), and the Dominican Republic (700 MT), were offset by reductions for China (400 MT). Exports of 38,100 MT were up 39 percent from the previous week and 4 percent from

the prior 4-week average. The destinations were primarily to Mexico (15,600 MT), China (8,800 MT), Japan (4,500 MT), South Korea (2,900 MT), and Canada (1,500 MT).

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.