PDF Attached

Weather

MARKET WEATHER MENTALITY FOR CORN AND SOYBEANS:

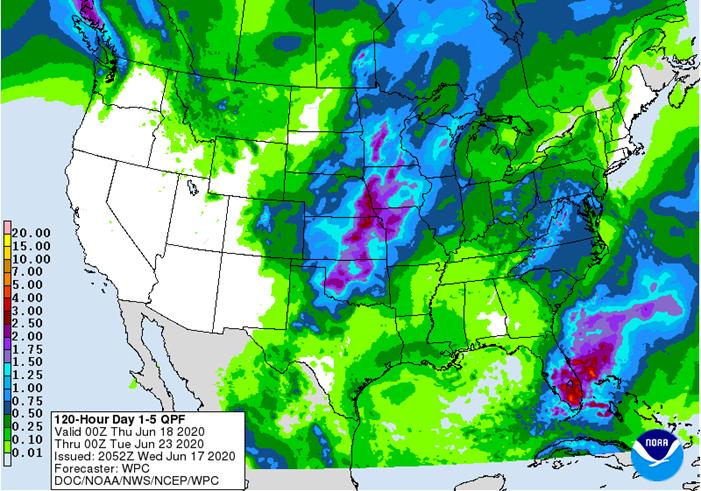

- U.S. crop weather remains mostly good and should stay that way through the next ten days. Southeastern Canada’s crop conditions will remain mostly good. Canola in Canada’s Prairies varies from being too wet in the west to too dry in the east. Some relief to the Prairies weather will occur over the next two weeks with less rain in the west and more in the east for a little while.

- India’s planting weather for coarse grain and oilseeds will be good over the next couple of weeks. Relief to dryness in east-central China last week has improved summer crop prospects in some areas. However, net drying in parts of the North China Plain and northern Yellow River Basin this week will raise unirrigated crop stress. Flooding in rapeseed areas recently may have reduced crop quality and certainly delayed harvesting.

- Australia’s weather will be favorable for canola areas over the next ten days. South Africa’s western canola benefited from some rain during the weekend, but more is needed.

- Argentina’s harvest has advanced well recently and will continue to move forward around periods of rain. Brazil’s Safrinha corn is maturing, although some late season filling occurred while dryness prevailed resulting in greater worry over late season yield and quality declines. Brazil’s weather has not been seriously impacting late season crops, but some small impact is expected.

- Europe weather is trending sufficiently wet to improve many crops. Net drying from the Volga River Basin into Kazakhstan could harm some summer coarse grain and oilseed crops if the trends last deeply into the summer.

- Overall, weather will likely have a bearish bias to market mentality because of anticipated better weather.

MARKET WEATHER MENTALITY FOR WHEAT:

- Periodic rain in Canada’s Prairies and eventually in the U.S. northern Plains will bring a little improvement to small grain crops, but more rain will be needed. Eastern and far south-central Saskatchewan and parts of Manitoba are still quite dry along with western North Dakota and eastern Montana. Additional opportunity for rain will evolve later this week for some of the drier areas. In the meantime, parts of Alberta are still too wet and will stay that way for a while this week.

- Quebec and eastern Ontario crop conditions will be mostly good over the next ten days.

- Good harvest weather is expected in U.S. hard red winter wheat areas and a favorable environment for late season filling will occur in Nebraska, northern Kansas as well as across the Midwest this week. Wetter conditions next week could interfere with some farming activity.

- Europe weather will be mostly good for winter crops, although there may be some need for drier weather in early maturing crop areas to protect small grains from wet weather disease. Drying from the Volga River Basin into Kazakhstan may be a threat to unirrigated winter crops, but most of the region’s crops are still rated favorably today. Spring wheat areas in the eastern Russia New Lands are also experiencing mostly favorable conditions, but some rain is needed near the Kazakhstan border.

- China’s southern wheat quality may be slipping because of recent heavy rainfall. Drier weather will be slow to return and that may prolong harvest delays and concern over grain quality.

- Australia’s recent rain was good for improving establishment for wheat and barley across the nation, although more rain is still needed in many areas.

- South Africa recent rain in the far west was welcome, but rain is needed in other winter crop production areas. Rain coming up in Argentina during mid-week this week will be a tremendous help for wheat germination and emergence.

- Overall, weather today will likely provide a mixed influence on market mentality.

Source: World Weather Inc. and FI

WPC 5-day Quantitative Precipitation Forecast

- USDA weekly crop net-export sales for corn, soybeans, wheat, cotton, 8:30am

- Brazil Conab releases 2nd estimate for 2020 coffee crop, Sao Paulo

- Port of Rouen data on French grain exports

- USDA total milk production, 3 pm

FRIDAY, June 19:

- ICE Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly update on crop conditions

- U.S. Cattle on Feed, 3pm

SATURDAY, June 20:

- Malaysia’s palm oil export data for June 1-20

Source: Bloomberg and FI

OPEC Says It Output Fell By 6.3Mln B/D To 24.195Mln B/D Last Month

US Housing Starts (May): 974K (est 1.1Mln, prevR 934K)

US Housing Starts (May) M/M: 4.3% (est 23.5%, prevR -26.4%)

Canada CPI NSA (M/M) May: 0.3% (est 0.7%, prev -0.7%)

Canada CPI (Y/Y) May: -0.4% (est prev 0.0%, prev -0.2%)

CPI Core – Median (Y/Y) May: 1.9% (est 1.9%, prev 2%)

CPI Core – Common (Y/Y) May: 1.4% (est 1.6%, prev 1.6%)

CPI Core Trim (Y/Y) May: 1.7% (est 1.7%, prev 1.8%)

US DoE Crude Oil Inventories (W/W) 12-Jun: 1215K (est 130K; prev 5720K)

– Distillate Oil Inventories (W/W) 12-Jun: -1358K (est 3000K; prev 1568K)

– Cushing OK Crude Inventories (W/W) 12-Jun: -2608K (prev -2279K)

– Gasoline Inventories (W/W) 12-Jun: -1666K (est -750K; prev 866K)

– Refinery Utilization (W/W) 12-Jun: 0.70% (est 0.50%; prev 1.30%)

USDA Cattle on Feed Survey

All figures, except headcount, for feedlots with 1,000-plus head of cattle shown as percentage vs year ago:

|

Range |

Average |

Mln head |

|

|

On feed June 1 |

95.5-100 |

98.7 |

11.587 |

|

Placements in May |

81.2-102.2 |

96.1 |

1.984 |

|

Marketings in May |

72.7-76.8 |

73.9 |

1.530 |

· Corn increased today on the EIA report which showed increasing production. Weighing on corn today was wheat and great weather across the Corn Belt.

· Funds were net buyers of 6,000 corn contracts on the session.

· China corn futures remain near a 5-year high despite corn reserve sales, a signal large imports from Ukraine and potentially from the US could be on deck during the 2020-21 marketing year, dependent on the size of this year’s domestic crop.

· China looks to sell 4 million tons of mostly 2015 crop-year corn from reserves on Thursday. Sinograin will offer 663,000 tons from the 2016 harvest.

· USDA May Cattle on Feed survey is calling for a 26.1% drop in marketings as meat plants slowed due to COVID-19.

· USTR Lighthizer told lawmakers today that the US will “act early and often” to enforce the USMCA which takes effect on July 1.

· China fertilizer production was seen at 4.97 million tons, down 2 percent year over year.

· Uzbekistan plans to buy over 3 million tons of grain for state reserves. This will be bought from the domestic market.

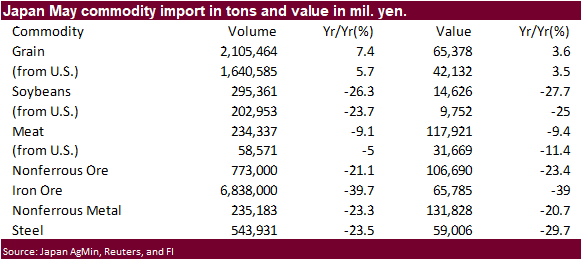

· Japan imported 2.105 million tons of grain during May, 3.6 percent higher than year earlier.

Corn Export Developments

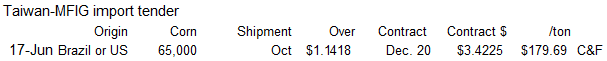

- Taiwan’s MFIG bought 65,000 tons of Brazilian corn at 141.77 cents over the December contract for October 2-21 shipment.

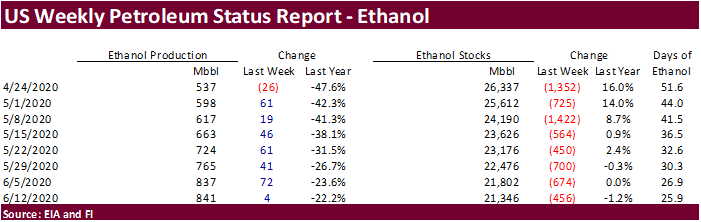

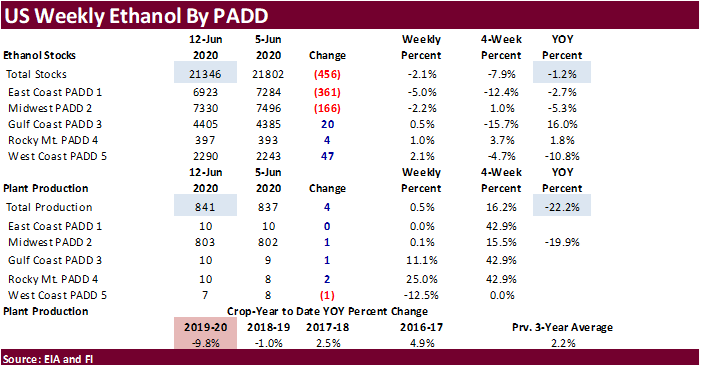

US ethanol production increased 4,000 barrels per day to 841,000. The trade was looking for a 39,000 barrel increase. Stocks decreased 456,000 barrels to 21.346 million, much larger than the 78,000 barrels the trade expected. Production is up 7 consecutive weeks and stocks have now fallen 8 consecutive weeks. Gasoline stocks fell 1.7 million barrels.

· July corn is seen in a $3.15 and $3.30 range. December lows could reach $2.90 if US weather cooperates.

- CBOT soybeans are under pressure on favorable US weather bias eastern Corn Belt. Soybean meal was slightly lower and soybean oil down 5-9 points despite a higher palm oil close for China and Malaysia. The USD was higher and WTI crude oil lower earlier this morning. China soybean crush margins were down again on our analysis. Unfavorable Canadian weather could limit downside in US soybean prices for the balance of the week.

- Funds were net buyers of 6,000 soybeans and 2,000 soybean oil, and sellers of 1,000 soymeal contracts.

- Oil World noted Argentina soybean oil stocks are piling up and this could lead to big Argentine soybean oil exports as the spread between palm and Argentina soybean oil average $38/ton in May versus $64/ton average, soybean oil premium. Argentina biodiesel shipments are down significantly from average, creating a glut in soybean oil stocks.

- The German association of farm cooperatives projected the 2020 rapeseed production up 13.3 percent to 3.20 million tons, slightly below 3.24 million tons estimated in May.

- Sunseed production for combined Russia and Ukraine is expected to easily top 30 million tons for 2020.

- We heard China bought additional US cargoes of soybeans on Tuesday out of the PNW for October through November shipment.

- We see China buying additional US soybeans this week as the price for Brazilian soybeans has increased in recent weeks.

- CBOT lowered soybean meal futures margin maintenance to $1000 from $1100 for the July contract.

- Canadian canola prices appreciated over the past week while soybeans and rapeseed (EU) prices seen downward pressure. Poor weather across Canada, where some areas saw too much rain and others not enough rain, have deteriorated conditions and forced producers to replant in some areas.

- Highlights from the weekly Manitoba, Canada, crop report:

- Strong winds have delayed herbicide application on all crops; crop staging is advancing and may prove challenging to spray within labelled application windows.

- Flea beetle, cutworm, and grasshopper spraying ongoing. Producers are closely monitoring insect pressure, and newly hatched grasshopper nymph populations in the Interlake and Eastern regions.

- Reseeding of some canola and soybean crops continues where crop damages excessive.

- SGS reported June 1-15 palm oil shipments at 916,871 tons, up 67.2 percent from the previous month.