PDF Attached

US

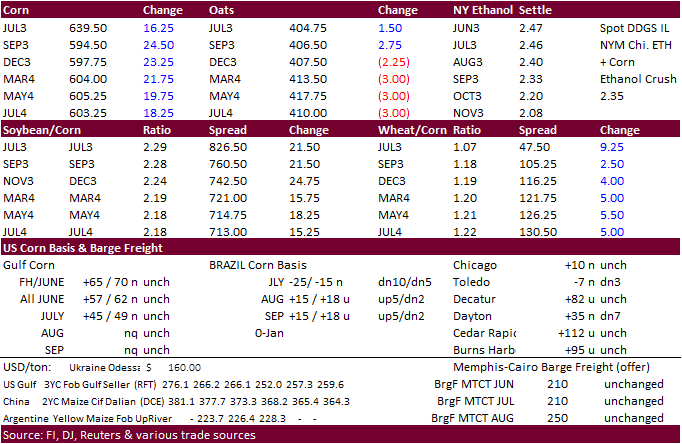

Markets will reopen Monday night. USD was up 19 points and WTI $1.06 higher.

Another

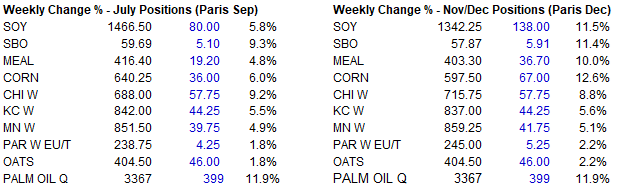

strong rally in CBOT ags on follow through buying from a dry US & EU weather outlook, good US demand and ongoing Black Sea shipping concerns. Temperatures will considerably warm up bias the southern US over the next week. Many CBOT future contracts made multi-month

highs today. Soybean meal rallied over soybean oil from profit taking in the oil share. Spreading was very active, especially in corn with traders getting out of the July position.

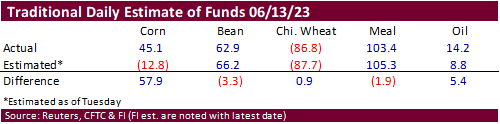

Fund

estimates as of June 16 (net in 000)

WEATHER

TO WATCH

-

Excessive

rain fell overnight in northern Florida and along the southern border of Georgia resulting in flooding -

Rain

amounts of 2.75 to 5.93 inches occurred most often with 7.60 inches at Cherry Lake, Florida and 9.84 inches at Pensacola, Fla.

-

Other

rain totals of 1.00 to 2.00 inches occurred from east-central Mississippi through southern Georgia with a few amounts over 3.00 inches which followed heavy rain from the previous night -

Some

of these areas were drier than usual earlier this week, but are now too wet -

Additional

waves of heavy rain will occur in the Gulf of Mexico Coast States from the middle and lower Delta to Florida and Georgia over the next week to ten days resulting in excessive moisture and flooding -

Some

crop damage will be possible -

Areas

from southeastern Mississippi to the northern Florida Peninsula will be wettest with another 4.00 to 8.00 inches possible spread out over the forecast period -

Not

much rain is advertised over the next ten days from eastern Iowa, southeastern Minnesota and southern Wisconsin through Illinois to Michigan, Ohio and northern Kentucky -

The

areas most likely to experience crop stress of significance will be in Illinois, eastern Iowa and immediate neighboring areas where soil moisture is already quite limited -

Excessive

rain is expected in western Alberta, Canada Sunday through Tuesday where multiple inches of rain may evolve -

Drought

will continue in east-central and southern Alberta, Canada through the next ten days with limited rainfall for at least the coming week

-

Production

cuts are likely from some of the driest areas where crops are already withering and dying -

Some

relief from dryness is expected over the coming week in the eastern Dakotas and a part of Minnesota with next week wettest -

West

Texas cotton, corn and sorghum areas will be dry and very warm to occasionally hot over the next ten days -

Extreme

temperatures reaching 100 to 108 are expected nearly every day in a portion of the state -

Similar

conditions are possible in the remainder of the state impacting the Blacklands, South Texas and possibly the Coastal Bend -

Livestock

and unirrigated crop stress is expected -

Ontario

and Quebec corn, soybean and wheat areas will experience mild to warm temperatures and restricted rainfall in the coming week -

Crop

conditions will remain fine -

Mexico

rainfall will continue minimal for the next ten days -

Drought

is delaying the planting of many crops and stressing sugarcane, citrus rice, cotton and coffee and other crops that are already developing -

Better

rainfall is expected in the last days of June and especially in July -

No

changes in South America weather are expected over the next ten days -

Argentina

rainfall will be limited leaving many areas from Cordoba into La Pampa and western Buenos Aires too dry for wheat emergence and establishment -

Favorable

field conditions will prevail in the eastern Argentina wheat areas due to previous rain and cool temperatures conserving the moisture through low evaporation rates -

Southern

Brazil will continue plenty wet from southern Mato Grosso do Sul to northern and eastern Rio Grande do Sul and Parana over the next ten days -

More

limited rain is expected in center south crop areas while the north is left mostly dry

-

There

is a very low risk of crop damaging cold for the next ten days in any grain, cotton, sugarcane, citrus or coffee area -

Europe

temperatures will be warmer than usual over the next ten days and showers and thunderstorms should occur periodically so that relief comes to dryness in northeastern France, Germany and neighboring countries.

-

Greater

rainfall might still be welcome throughout all of northern Europe after recent weeks of limited rain -

Unusually

cold air in Russia’s eastern New Lands this weekend and early next week will result in late season frost and freezes that may harm a few crops -

Russia’s

eastern New Lands and northern Kazakhstan may receive some needed moisture next week that could improve topsoil conditions for future wheat, sunseed and other crop development -

Tropical

Cyclone Biparjoy moved inland over northwestern Gujarat Thursday producing more than four inches through 0300 GMT, but since then there has been much greater rainfall resulting in some flooding

-

Remnants

of the storm will leave behind a swath of excessive rain varying from 3.00 to 8.00 inches with local totals to 12.00 inches from northern Gujarat, India and far southeastern Sindh, Pakistan through a large part of Rajasthan to Uttar Pradesh this weekend and

early next week -

The

moisture will cause some flooding temporarily, but the flood water should recede quickly -

Planting

of many summer crops will follow the event especially since monsoonal precipitation is quite restricted and will remain that way over this coming week -

India’s

Monsoon will attempt to kick in late next week into the early days of July, but its rain distribution may still be somewhat erratic for a while -

The

moisture boost will be extremely important for the planting of summer crops -

Thailand

rainfall continues well below normal threatening sugarcane, rice, corn and other crops especially in the west -

Little

change in this anomaly is expected for a while -

Vietnam

rainfall has been and will continue erratic and lighter than usual raising some concern for unirrigated coffee in the nation and that concern may continue for a while -

Indonesia,

Malaysia and Philippines rainfall will continue sufficient to support most crop needs over the next couple of weeks, despite a more erratic rainfall pattern -

Australia

weather has not changed overnight with showers and drizzle occurring often near the southern coast while interior crop areas see a more limited amount of moisture -

Winter

crops are establishing relatively well -

South

Africa weather will be dry or mostly dry during the coming ten days except in the far southwestern corner of the nation where some rain is expected -

Portions

of the U.S. Northern Plains will get rain periodically during the next two weeks, but resulting rainfall may not be evenly distributed -

Some

areas of moderate rain will occur while many other areas see only light amounts -

Follow

up rain will be very important -

Additional

warm to hot and dry weather is expected briefly this weekend into early next week before the next opportunity for rain arrives -

Extreme

highs in the 90s to over 100 may occur briefly in South Dakota’s dry region Sunday or Monday -

Only

partial relief to dryness is expected and much more rain will have to occur before crop conditions improve in a more general manner -

Washington’s

Yakima Valley and neighboring areas of north-central Oregon will be dry for much of the next ten days leaving a big need for rain in unirrigated crop areas -

Rainfall

in the Snake River Valley will also be limited during the coming ten days -

Showers

in much of Montana and Wyoming will be good for sugarbeets, dry beans and other crops produced in the region during the next ten days -

North

Africa’s rainy weather pattern of the past few weeks has ended -

Better

crop maturation and harvest conditions will now evolve -

Recent

wet weather has hurt the quality of some small grains -

West-central

Africa rainfall has been and will continue to be quite abundant during the next ten days favoring coffee, cocoa, sugarcane and rice development -

A

few areas have been trending a little too wet and less rain might be welcome -

Cotton

areas in Burkina Faso and Mali are trending much wetter -

East-central

Africa rainfall continues to occur routinely and mostly supports normal rice, coffee, cocoa and sugarcane development -

China’s

northern Yellow River Basin and neighboring areas of Inner Mongolia are trending drier and this pattern will prevail for a while possibly leading to crop moisture stress for wheat, coarse grains and oilseeds later this summer -

Southern

China will remain plenty wet and may become excessively wet soon -

This

will interfere with early rice maturation and harvesting with some crop quality declines possible -

Some

sugarcane areas will eventually be flooded -

Most

of the greatest rain will be south of rapeseed areas; though much of the rapeseed harvest has likely been completed -

Xinjiang,

China will experience seasonable temperatures over the next two weeks -

The

province struggled with coolness earlier this year and crop development is behind the usual pace -

Production

potentials were decreased because of some reduced area planted and due to the poor early season start to crop development -

There

is concern over early season frost and freeze potentials coming along before the crop is fully mature

-

Crop

conditions are improving because of the recent development of more seasonable temperatures -

Recent

high temperatures have been in the 90s to slightly over 100 Fahrenheit -

Australia

soil moisture is still mostly good for wheat, barley and canola emergence and establishment -

Weather

in the coming ten days will remain plenty wet in crop areas near the southern coast -

A

boost in rainfall will be needed in interior Western Australia (especially in northern crop areas) and in Queensland as well as a few interior South Australia locations -

Argentina

dryness remains a concern for Cordoba, western Buenos Aires and La Pampa while crop areas to the east have seen sufficient rain for aggressive planting and good early season emergence and establishment -

Rain

prospects are poor in Argentina for the next ten days -

Above

normal rain is expected from Mato Grosso to northern Rio Grande do Sul, Santa Catarina, Parana and Sao Paulo, Brazil during the coming week slowing fieldwork and inducing soggy field conditions in wheat and corn areas -

There

is no risk of crop damaging cold in the next ten days -

Drier

weather is needed to protect crop conditions -

Minas

Gerais, Espirito Santo and Rio de Janeiro crop areas of Brazil will be wetter than usual for a brief period of time today into Sunday

-

Delays

in sugarcane, coffee and citrus harvesting is expected, but improved weather should evolve next week to limit any concerns.

-

Central

America rainfall is expected to be abundant to excessive during the next ten days possibly leading to some areas of flooding -

Today’s

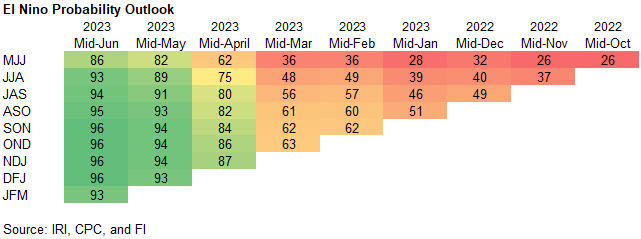

Southern Oscillation Index was -12.64 and it will move erratically higher over the next several days

Source:

World Weather, INC.

Friday,

June 16:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report

Sunday,

June 18

- China’s

2nd batch of May trade data, including agricultural imports

Monday,

June 19:

- MARS

monthly report on EU crop conditions - HOLIDAY:

US, Argentina

Tuesday,

June 20:

- USDA

export inspections – corn, soybeans, wheat, 11am - US

corn, cotton, soybean, spring wheat and winter wheat condition, 4pm - China’s

3rd batch of May trade data, including country breakdowns for commodities - US

planting data for cotton, spring wheat and soybeans, 4pm - New

Zealand global dairy trade auction - EU

weekly grain, oilseed import and export data - HOLIDAY:

Argentina

Wednesday,

June 21:

- Grain

and Oilseeds MENA conference in Cairo, day 1 - SIIA

Haze Outlook 2023 in Singapore - USDA

Total Milk Production

Thursday,

June 22:

- Port

of Rouen data on French grain exports - EIA

weekly US ethanol inventories, production, 10:30am - Grain

and Oilseeds MENA conference in Cairo, day 2 - Brazil

Unica cane crush, sugar production (tentative) - USDA

Red Meat Production, 3pm - HOLIDAY:

China,

Hong Kong

Friday,

June 23:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report - US

Cattle on Feed, 3pm - US

cold storage data for beef, pork and poultry - HOLIDAY:

China

EPA

U.S.

GENERATED 750 MLN BIODIESEL (D4) BLENDING CREDITS IN MAY, VS 603 MLN IN APRIL

U.S.

GENERATED 1.28 BLN ETHANOL (D6) BLENDING CREDITS IN MAY, VS 1.16 BLN IN APRIL

2022

U.S.

GENERATED 513 MLN BIODIESEL (D4) BLENDING CREDITS IN MAY, VS 499 MLN IN APRIL

U.S.

GENERATED 1.23 BLN ETHANOL (D6) BLENDING CREDITS IN MAY, VS 1.14 BLN IN APRIL

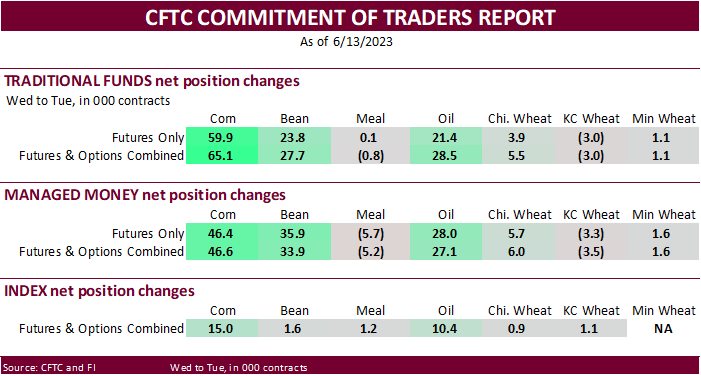

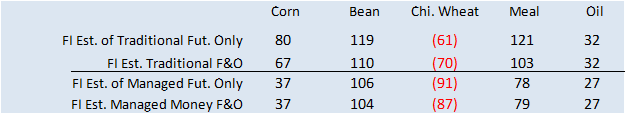

CFCT

Commitment of Traders

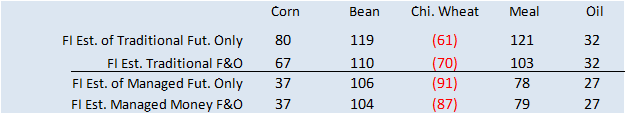

The

trade really missed it with the estimated net long position for the traditional and managed money net long position for corn.

Reuters

table

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

-63,782 47,039 318,468 15,012 -196,595 -54,214

Soybeans

27,786 28,903 109,674 1,649 -109,657 -27,190

Soyoil

-15,882 17,616 115,091 10,414 -97,118 -28,392

CBOT

wheat -102,396 4,308 74,967 943 19,721 -6,091

KCBT

wheat -10,975 -2,882 40,159 1,078 -23,643 2,418

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

2,145 46,636 233,118 -6,940 -207,452 -50,355

Soybeans

47,882 33,901 72,257 -4,988 -98,419 -19,300

Soymeal

60,608 -5,208 92,217 -194 -192,358 2,903

Soyoil

8,748 27,055 114,801 523 -126,824 -29,384

CBOT

wheat -113,430 6,044 70,792 451 17,375 -6,785

KCBT

wheat 3,616 -3,489 34,907 1,792 -26,221 1,779

MGEX

wheat -7,422 1,552 954 455 4,430 -386

———- ———- ———- ———- ———- ———-

Total

wheat -117,236 4,107 106,653 2,698 -4,416 -5,392

Live

cattle 119,921 5,285 49,392 935 -175,541 -5,592

Feeder

cattle 19,486 1,416 1,117 -28 -8,963 -653

Lean

hogs -4,630 11,543 50,369 -1,141 -40,428 -6,284

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

30,280 18,497 -58,090 -7,838 1,775,421 -9,951

Soybeans

6,083 -6,249 -27,802 -3,363 845,019 -9,053

Soymeal

24,497 4,433 15,036 -1,933 575,837 24,069

Soyoil

5,367 1,445 -2,092 361 607,403 -3,209

CBOT

wheat 17,555 -548 7,707 838 465,331 -23,832

KCBT

wheat -6,760 534 -5,541 -615 203,293 -8,894

MGEX

wheat 1,817 -411 221 -1,211 61,428 -1,784

———- ———- ———- ———- ———- ———-

Total

wheat 12,612 -425 2,387 -988 730,052 -34,510

Live

cattle 24,897 3,207 -18,669 -3,833 425,594 13,750

Feeder

cattle 1,650 -192 -13,290 -543 78,384 -766

Lean

hogs -3,337 -716 -1,974 -3,402 307,580 -17,530

US

Univ. Of Michigan Sentiment Jun P: 63.9 (exp 60.0; prev 59.2)

Current

Conditions: 68.0 (exp 65.1; prev 64.9)

Expectations:

61.3 (exp 55.2; prev 55.4)

1-Year

Inflation: 3.3% (exp 4.1%; prev 4.2%)

5-10

Year Inflation: 3.0% (exp 3.0%; prev 3.1%)

Canadian

Wholesale Trade Sales (M/M) Apr: -1.4% (exp 1.6%; R prev -1.1%)

Canadian

International Securities Transactions (CAD) Apr: 13.52B (R prev -19.72B)

·

Corn futures were higher on follow through buying led by new crop over US dry weather.

·

Traders were busy rolling out of the July position.

-

Patria

Agronegonegocios estimated Brazil’s second corn crop was 4.3 percent harvested, below 14.7% year earlier. Corn plantings were behind this season.

·

We look for a decline in US soybean and corn ratings when updated next week, and wheat to remain steady.

·

57 percent of the US corn area is experiencing some type of drought. 45 percent was previous week.

·

Ukraine’s 2023 spring sowing is nearly done over an estimated 13 million hectares

4

million hectares of corn.

271,100

hectares of spring wheat

810,000

hectares of barley

138,500

hectares of peas

146,200

hectares of oats

5.3

million hectares of sunflower

213,100

hectares of sugar beet

1.8

million hectares of soybeans.

USDA

Attache: Ukraine grain and feed

Export

developments.

-

Results

awaited: Iran seeks 120,000 tons of soybean meal and 120,000 tons of corn.

July

corn $5.85-$6.60

September

corn $5.00-$6.75

December

corn $4.50-$7.00

·

It was all about the US weather forecast. Talk today was the forecast calling for hotter temperatures during the second week of the forecast. Up until now, the US Midwest generally saw near or below average temperatures, for the

most part.

·

51% of the US soybean production area is experiencing some type of drought as of June 13, up from 39% previous week.

·

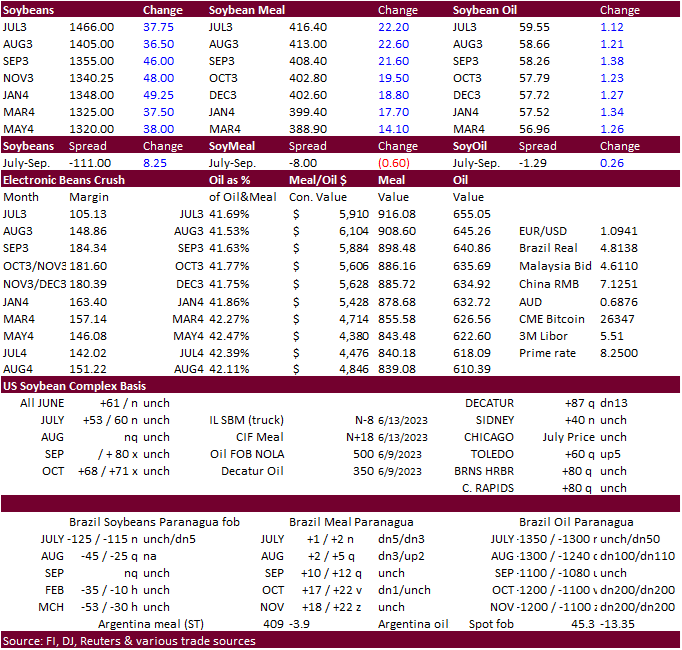

CBOT soybeans, meal and soybean oil traded higher on follow through buying. August soybeans hit an April 24 high overnight. Soybeans and soybean oil closed slightly off their intraday session highs on light end of week profit

taking, but still near the top end the ranges.

·

Russia plans to limit sunflower seed exports until their domestic processing plants are fully loaded.

·

The NOPA crush report yesterday showed US crush and soybean oil stocks implied good domestic demand.

·

Palm oil futures were up 11 percent on the week. Sabah, Malaysia’s largest producing state of the commodity, are experiencing water stress from early signs of El Nino (Reuters).

-

Results

awaited: Iran seeks 120,000 tons of soybean meal and 120,000 tons of corn on June 14.

Soybeans

– July $14.20-$15.15, November $11.00-$15.00

Soybean

meal – July $390-$440, December $290-$450

Soybean

oil – July 58.00-62.00, December 54-64

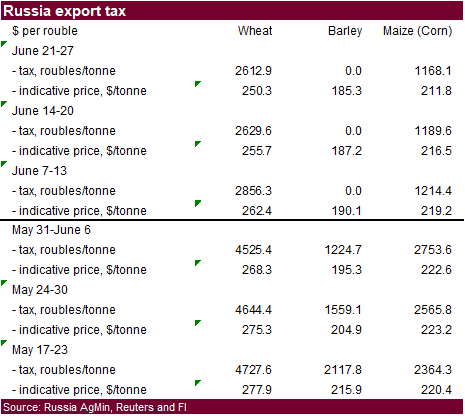

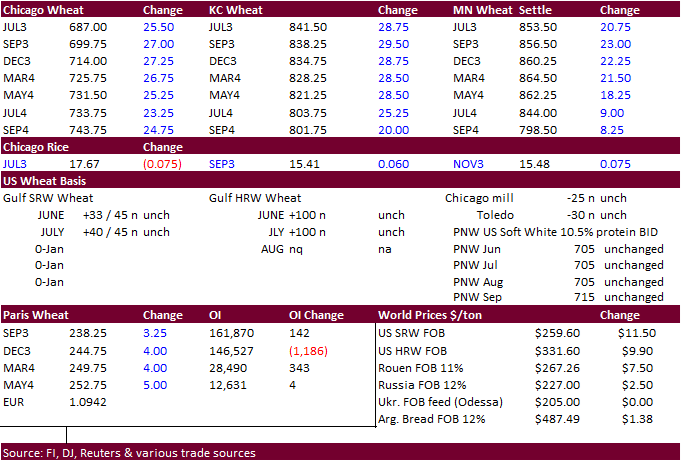

·

US wheat futures were higher on technical buying. US & EU weather and Black Sea shipping uncertainty was a feature this week. Russia officials indicated the grain deal is “not working” but they don’t intend to end the current

deal extension early.

·

Buenos Aires Grain Exchange warned Argentina producers in the west may miss the optimum planting window from dry conditions. Plantings are 40 percent complete, 18 points below last season.

·

French wheat conditions as of June 12 fell 3 points to 85 percent and compares to 65 percent year ago.

·

Yesterday Strategie Grains lowered its 2023-24 European Union soft wheat production estimate to 128.7 million tons from 130.0 million in May, about 3% above 2022-23. Barley was cut 2 million tons to 47.9 million tons, about 6%

below last year.

·

Russia sees 2023-24 grain exports up to 60 million tons and harvest around 130 million.

·

September Paris milling wheat officially closed 3.25 euros higher, or 1.4%, at 238.75 euros a ton (about $261.25 ton).

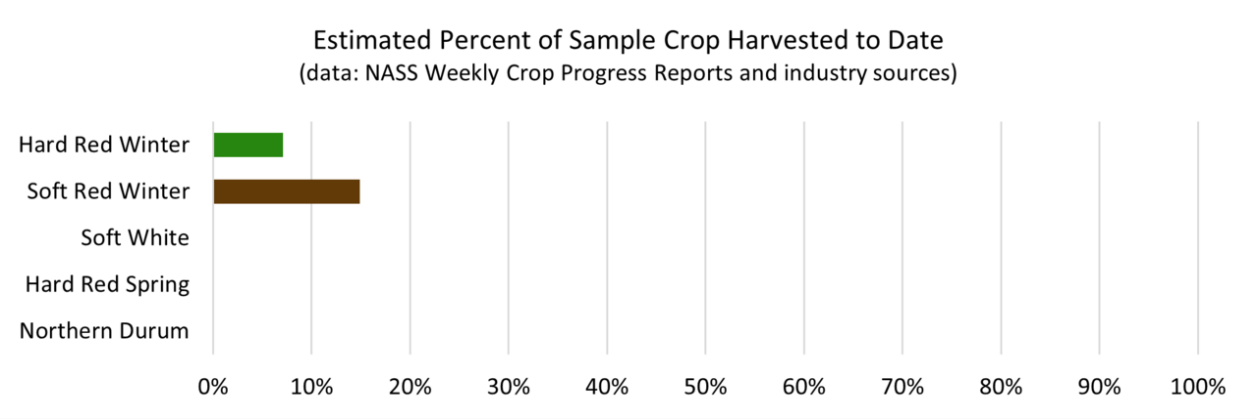

US

Wheat Associates

noted sporadic rain across TX and OK slowed HRW wheat harvest progress while SRW wheat progress moved forward.

Export

Developments.

·

Japan in a SBS import tender seeks 60,000 tons of feed wheat and 20,000 tons of barley on June 19 for arrival by November 30.

·

Results awaited: Morocco seeks 500,000 tons of feed barley.

Rice/Other

·

(Reuters) – Indonesian has signed an agreement with the Indian government to potentially import 1 million tons of rice if the El Nino weather pattern hits domestic supply, the trade minister was quoted as saying by news site Kompas.com

on Friday. The agreement would come on top of a 2 million tons rice import quota issued for state food procurement agency Bulog this year, Indonesian Trade Minister Zulkifli Hasan was quoted as saying.

Price

outlook (6/16/23)

Chicago Wheat

July $6.50-$7.15, September $6.00-$7.00

KC – July $8.00-$8.80, September $7.50-$9.00

MN – July $8.00-$8.80, September $7.25-$9.00

#non-promo