PDF Attached

Midday

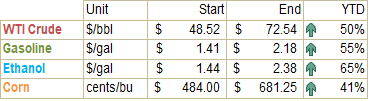

was wetter bias parts of the northern Great Plains, Upper Midwest, and IA. Soybean oil was on the defensive again creating a negative undertone for soybeans. Meal was higher. US corn futures rebounded from a snap 24-USDA corn sales announcement and Brazil

opening doors to US GMO corn imports (reported by AgriCensus) along with WCB crop growing concerns. US wheat was higher as Egypt retendered. Iran is in for 60,000 tons of wheat. SK’s KFA bought 60,000 tons of corn.

CBOT

price limits for hogs, pork, and entire soybean complex expands for tonight’s open.

https://www.cmegroup.com/trading/price-limits.html

The

short term GFS weather outlook also looks wetter for key summer growing states experiencing drought. Second day of the US precipitation outlook (Friday) increased rain into the upper Midwest. 1-7 day precipitation is not as wet as yesterday’s forecast.

Note the European models are drier.

WORLD

WEATHER HIGHLIGHTS FOR JUNE 16, 2021

- U.S.

weather expectations remain mostly the same as Wednesday – as far as this forecaster is concerned - Rain

is expected in much of the Midwest Corn Belt over the next ten days with western and far northern areas seeing the lightest precipitation with the most limited benefit - Areas

from eastern Iowa and southern Wisconsin into Ohio may experience the greatest rainfall during this period of time - Temperatures

will be cool enough to reduce evaporative moisture losses and support crops favorably - However,

the western fringes of the Corn Belt, the northern Plains and far northernmost Corn Belt may not do nearly as well with rainfall as other areas - Canada’s

western and northern Prairies will be in the best condition for a while, but rain will be needed in the south soon - Western

India should be on everyone’s radar if limited rainfall prevails into July as suggested - Areas

from Gujarat and Rajasthan into Maharashtra and western Madhya Pradesh can be drier biased in June and not be a huge deal, but continued poor monsoon performance in July would be interpreted differently for many producers and traders following cotton, soybeans

and groundnuts - Interior

Western India has not seen good rainfall very often this month, but it is still early

- Concern

about Sukhovei conditions in western Kazakhstan, eastern portions of Russia’s Southern Region and lower Volga River Basin remains today - The

Sukhovei that occurs in this first week of the outlook is weak and impacts a small part of the region’s crops

- The

real concern is over the potential for the hot, dry, wind to persist into a second week – that would result in a larger area being potentially impacted and a greater impact for those dealing with warm and dry conditions in this first week of the forecast - Relief

from dryness in southeastern Russia’s New Lands and eastern portions of northern Kazakhstan’s wheat and sunseed areas is still expected in this coming week, but western parts of the region will not get as much relief - China

weather is looking very good with most of the dryness from earlier this month now relieved - Australia

will see a good mix of weather during the next ten days, especially in the eat bringing support for better wheat, barley and canola establishment in New South Wales, Victoria and South Australia as well as some southeastern Queensland locations - Greater

rain is still needed though in Queensland and South Australia in particular - Western

Russia, Ukraine and Europe weather still looks to be good over the next ten days - No

threatening cold is expected in Brazil’s grain, sugar or coffee production areas during the next two weeks - Rain

is needed in greater quantities in east-central Africa coffee and cocoa production areas - Southeast

Asia weather has been mostly favorable of late and little change is expected - Argentina

still needs rain in wheat production areas, although crops are in much better shape than last year

Source:

World Weather, Inc.

Wednesday,

June 16:

- EIA

weekly U.S. ethanol inventories, production - FT

Commodities Global Summit, day 2 - Australia’s

Abares to release agricultural commodities report - Brazil’s

Unica may release cane crush, sugar production data (tentative) - CNGOIC

oilseed conference, Chengdu, China, Day 1

Thursday,

June 17:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - Itau

webinar on agribusiness outlook, Sao Paulo, Brazil - CNGOIC

oilseed conference, Chengdu, China, Day 2

Friday,

June 18:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China

customs to publish trade data, including imports of corn, wheat, sugar and pork - World

coffee market report by USDA’s Foreign Agricultural Service, 3pm - FranceAgriMer

weekly update on crop conditions - USDA

Total Milk Production

Source:

Bloomberg and FI

US

Housing Starts May: 1572K (est 1630K; prevR 1517K; prev 1569K)

US

Housing Starts (M/M) May: 3.6% (est 3.9%; prevR -12.1%; prev -9.5%)

US

Building Permits May: 1681K (est 1730K; prevR 1733K; prev 1760K)

US

Building Permits (M/M) May: -3.0% (est -0.2%; prevR -1.3%; prev 0.3%)

US

Housing Market Needs 5.5Mln More Units, Says New Report – CNBC

US

DoE Crude Oil Inventories (W/W) 11-Jun: -7355K (est -2500K; prev -5241K)

–

Distillate Inventories: -1023K (est 500K; prev 4412K)

–

Cushing Crude Inventories: -2150K (prev 165K)

–

Gasoline Inventories: 1954K (est -1000K; prev 7046K)

–

Refinery Utilization: 1.30% (est 0.25%; prev 2.60%)

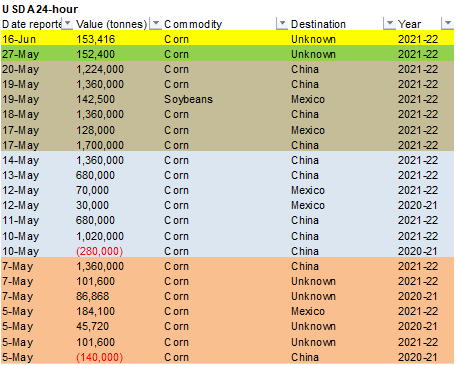

- July

corn futures ended higher while the back months ended lower. Corn started higher after USDA announced 24-hour corn sales, Brazil’s AgMin stating they are opening doors to US GMO corn imports (reported by AgriCensus) and WCB growing concerns, specifically

western IA. June 1 to date precipitation percent of normal for IA was about 9%, an incredible low figure, according to a map circulating around the trade. Earlier this week we heard some corn yields were on track for the western part of the state to end

up around 100 bushels per acre. We assume these are unirrigated areas. There is rain in the forecast but if they fail to develop over the next two weeks, futures are likely going to trend back higher. Talk of a high pressure ridge returning to the Midwest

in July added support to corn futures. - USD

was 57 points higher as of 1:30 CT and WTI up $0.68. - Lean

hogs fell limit 3 cents. China’s large herd data could have pressured the US hog market, an indication there might be less US exports to China on the horizon. In addition, the packer margins are tighter, and cutout was sharply lower. Note Aug hogs traded

a premium to Aug cattle not too long ago.

US

beef/pork packer margins – Hedgersedge – Reuters News

(In

dollars per head for cattle and hogs).

BEEF

–

Wednesday

Jun 16 + 848.70

Tuesday

Jun 15 + 860.60

Week

ago Jun 9 + 893.45

PORK

–

Wednesday

Jun 16 – 20.70

Tuesday

Jun 15 + 1.40

Week

ago Jun 9 + 23.25

- Reuters

noted China’s pig herd is up 23.5% in May from a year ago and the sow herd up 19.3% (reaching 97.4% of the stocks at the end of 2017). Recall 2019 hog herd fell about 40%. They mentioned China met its target to restore pig production. Note hog futures in

China this week fell to a record low and cash prices remain depressed. - (Bloomberg)

– China’s economic planning agency urges hog producers to keep “reasonable” hog production after recent pork price decline, according to a statement on NDRC website.

-

(Reuters)

– “China should keep grain prices at reasonable levels and curb rising prices of agricultural materials, the country’s Premier Li Keqiang said during his inspection tour in northeastern Jilin Province on June 15-16. Li said now was a critical time for grain

production, and effective measures should be taken to stabilize the price of agricultural materials. China should protect black soil and cultivate more fine grain varieties, Li added.” -

The

weekly USDA Broiler Report showed broiler type eggs set up 2 percent and chicks placed up 1 percent. Cumulative placements from the week ending January 9, 2021 through June 12, 2021 for the United States were 4.30 billion. Cumulative placements were up 1

percent from the same period a year earlier. -

The

US EPA reported the US generated 1.26 billion ethanol D6 RIN credits during May, up from 1.14 billion during April.

- Early

on Wednesday we heard D6 RINS were 125 and D4 RINS at 140, both down about 20 cents from yesterday.

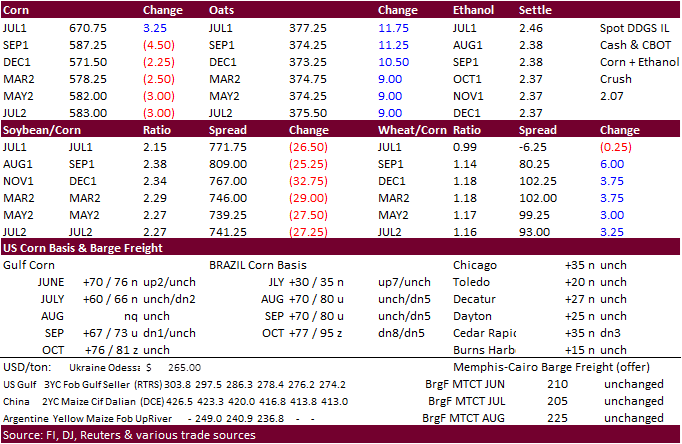

Weekly

US ethanol production

as of June 11 dropped a much more than expected 42,000 barrels per day from the previous week (a Bloomberg poll looked for only 4,000 barrels) to 1.025 million and stocks increased 642,000 barrels (poll was +189,000 barrels) to 20.602 million, highest since

April 2. Gasoline product supplied was up 880,000 barrels, a large amount, to 9.360 million, highest in a month and a good indicator demand was good for that week. The ethanol blend rate was 91%, up from 90.8% previous week. We see no reason for USDA to

make an adjustment to its 2020-21 US corn ethanol demand next month.

Export

developments.

- South

Korea’s KFA bought about 60,000 tons of South American corn at $315.00/ton for arrival in South Korea around Sept. 30.

- China’s

Sinograin plans to sell or auction off 37,126 tons of imported Ukrainian corn on June 18 to replenish tightening supplies and alleviate high prices.

Updated

6/15/21

July

corn seen in a $6.50 and $7.50 range

September

$5.50 and $6.75

December

corn is seen in a $4.75-$7.00 range.

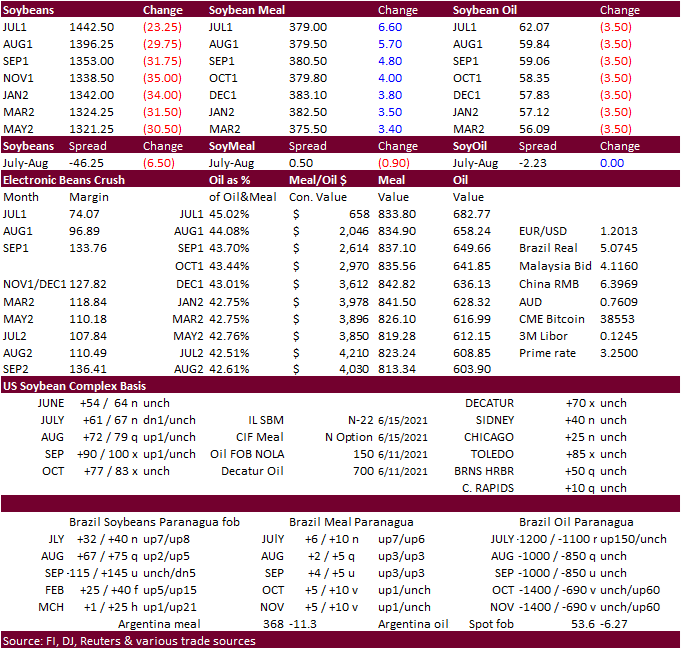

Soybeans

-

The

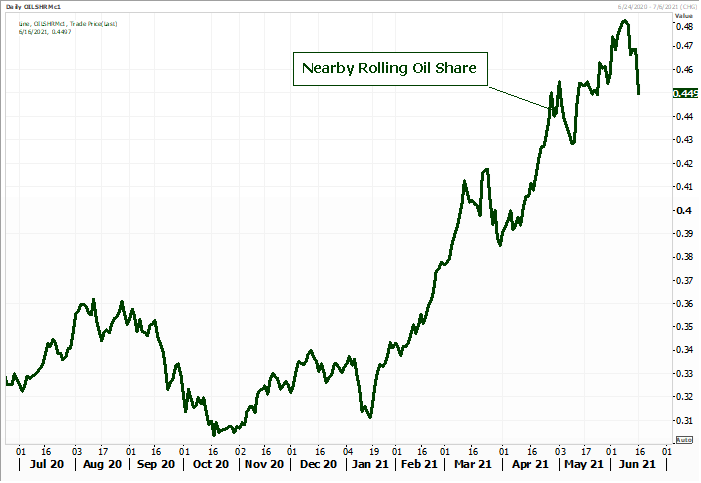

US soybean complex was mixed. Both soybean oil and soybean futures traded down led by a limit lower SBO market (July-December). Soybean oil futures were lower for the sixth consecutive day. July broke below our 67.50 cent low end trading range. Soybeans

were down 23.25-35.00 cents. Meal ended higher, sending the oil share sharply lower. Limits for hogs, pork, and entire soybean complex expands for tonight’s open.

https://www.cmegroup.com/trading/price-limits.html

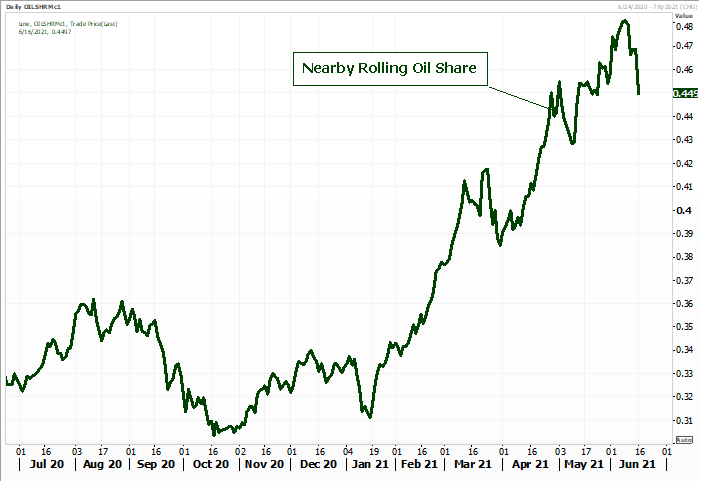

Nearby

rolling contract oil share

-

There

was chatter US officials may propose to leave unchanged or lower the upcoming 2021 (2021 biomass) EPA biofuel mandates, set to be released around this time of year. We are looking for unchanged. Link to current mandates

https://www.epa.gov/renewable-fuel-standard-program/renewable-fuel-annual-standards

-

EPA

reported the US generated 396 million biodiesel D4 RIN credits during May, up from 386 million during April. With USDA amending their soybean oil for biofuel use, it’s difficult to find a correlation between biodiesel D4 RIN generation and what will be reported

by EIA for SBO for biofuel use. -

We

think we are entering a medium term era where at least North America processors are crushing for soybean oil, but soybean oil futures price action over the past week has not suggested this. The selloff in soybean oil over the past several days is likely related

to an overheated market, for soybean oil futures and RIN prices. Soybean oil futures have been running at a wide premium over other global vegetable oil prices in recent months. Declining US RIN prices and cheaper offers for new-crop sunflower oil out of

the Black Sea are the latest fundamental that is setting a negative undertone to SBO this week, in addition to large moves in palm oil. It’s also important to note cash Argentina soybean oil premiums are much lower relative to last month. We view this setback

in soybean oil futures as natural but long term we think the US biofuel story should keep prices well above a 5-year yearly average.

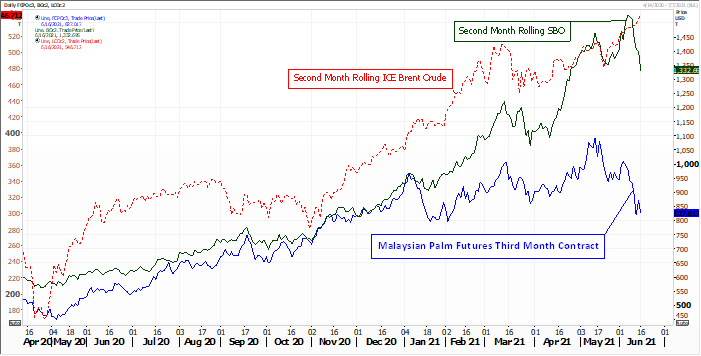

Brent

crude oil vs. palm & soybean oil futures

Nearby

rolling contract oil share

- There

is talk of US soybean meal business yesterday, but no confirmation. - USDA’s

CCC program seeks 25,000 tons of soybean meal for Bangladesh and 8,000 tons for Cambodia on June 17 for July 15-25 shipment.

- Today

USDA seeks 1,180 tons of packaged vegetable oil for export donation for July 16-Aug 15 shipment.

Updated

6/16/21

July

soybeans are seen in a $14.10-$15.50; November $12.75-$15.00

Soybean

meal – July $360-$400; December $380-$460

Soybean

oil – July 60.00-66.00;

December 54-70 cent range

-

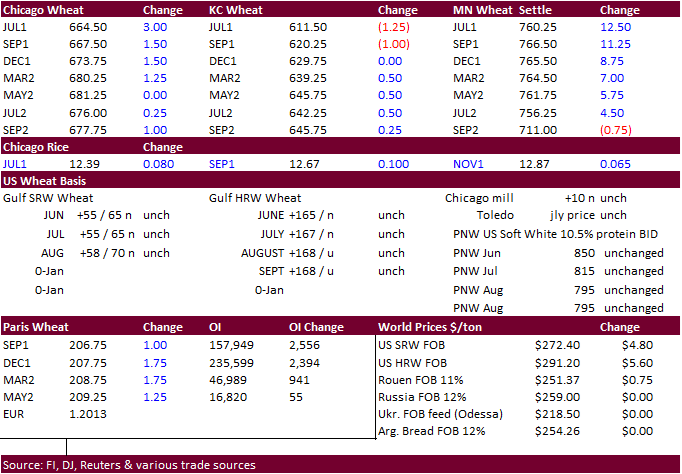

Earlier

US wheat futures traded higher on technical buying but ended mixed after the USD rallied 55 points by the CBOT close, and corn & soybean futures trended lower during the last half of the session. Chicago and KC settled mostly lower while MN ended higher.

Egypt is back in for wheat. - Algeria

rejected a 27,000 ton French wheat cargo after 2 dead animals were found in the cargo. IN early June Algeria rejected a 33,000 ton Canadian durum cargo stating it did not meet specifications.

- Russia’s

Deputy Prime Minister Viktoria Abramchenko – wheat crop is seen at more than 81 million tons (Bloomberg).

- September

Paris settled up 0.75 euro, or 0.4%, at 206.50 euros ($250.17) a ton.

Export

Developments. *NEW

- *Egypt

retendered for wheat that includes shipment bids after cancelling their import tender yesterday. Lowest offer yesterday was $250.88 a ton for 60,000 tons of Russian wheat but it was cancelled due to high freight prices. There were at least 19 offers on Tuesday.

- *Iran

seeks 60,000 tons of milling wheat for July and August shipment. - *The

lowest offer for Bangladesh in for 50,000 tons of wheat was $335/ton CIF. - *Japan

received no offers for 80,000 tons of feed wheat and 100,000 tons of barley under its SBS import system, for arrival in Japan by November 25.

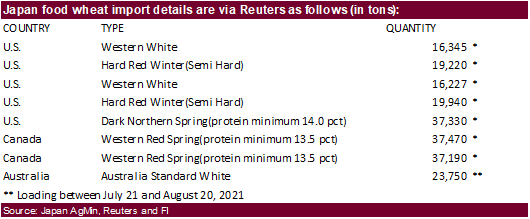

- Japan

seeks 207,472 tons of food wheat.

- The

Philippines seeks 205,000 tons of milling wheat for Aug/Sep shipment. - Jordan

seeks 120,000 tons of wheat on June 22 for December shipment. - Jordan

is back in for feed barley on June 23 for Nov/Dec shipment.

Rice/Other

- *The

lowest offer for Bangladesh in for 50,000 tons of rice was $399.90/ton CIF.

·

(Bloomberg) — National Food and Strategic Reserves Administration will release state reserves of metals including copper, aluminum and zinc in batches, according to a statement from the administration.

Updated

6/15/21

September

Chicago wheat is seen in a $6.00-$7.00 range

September

KC wheat is seen in a $5.60-$6.70

September

MN wheat is seen in a $6.90-$8.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.