PDF Attached

Fund estimates NA

North

American supply concerns, brighter outlook on US inflation, Black Sea grain deal update and EPA news drove CBOT ags higher. Midday weather outlook 6-10 for US was drier for the west central Midwest and wetter for a portion of the central and Northern Great

Plains. US crop concerns supported corn and soybeans. Funds are thought to be getting back into the long side of the market, especially for corn, whereas early this week held a (estimated) short position. Chicago wheat was higher. That market rallied after

President Putin said Russia was unlikely going to extend the grain deal, before a lower KC trade trimmed gains. The US Midwest weather outlook still calls for below normal rainfall over the next ten days. The decline of three points in US soybean and corn

ratings is supportive, despite the fact it is early in the crop season. However, the sharp early declines in G/E conditions is kicking up memories from the dry and hot 2012 crop year.

Note

Monday is a US holiday. No Sunday night or Monday trade until the Monday night session. Attached is the CME reminder and trading hours.

The

EPA delayed the release of biofuel mandates to at least June 21. They did not provide a reason for the delay (budget issue for the Bill?). We heard renewable diesel producers are lobbying for an increase in mandates as production of renewable diesel increased

rapidly over the past year. Regardless, we don’t expect any fireworks from this announcement but speculation there will be an increase in advanced biofuel mandates did get behind the rally in soybean oil today. Some traders noted December mandates proposed

for renewable are not high enough. We agree with where this renewable industry is headed. Remember economics will drive production in the long run. Burn food and prices will go higher. See EPA’s December announcement here.

https://www.epa.gov/renewable-fuel-standard-program/news-notices-and-announcements-renewable-fuel-standard

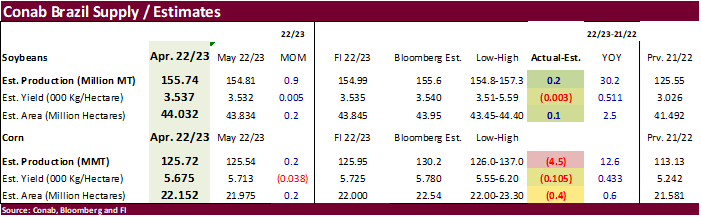

No

surprises for Conab Brazil supply

WEATHER

TO WATCH

-

U.S.

Midwest will not encounter any seriously warm or hot temperatures for a while -

Gulf

of Mexico will remain closed as a significant moisture source for the Midwest -

Rainfall

will continue lighter and more sporadic than usual for a while -

Rain

coming this weekend will be a very important event producing 0.25 to 0.75 inch of moisture and some locally greater amounts over 1.00 inch

-

The

moisture and that which occurred last weekend will keep Midwest crops viable even in the driest areas -

There

will continue to be a strong need for timely rainfall -

North

America high pressure ridge will relocate to the central United States in late June and its amplitude is expected to be low which should help rain fall in southern Canada’s Prairies, the northern U.S. Plains and in “some” Midwestern states -

A

close watch on the distribution of rain is warranted, but the situation will continue to keep excessive heat out of the Midwest -

World

Weather, Inc. stands firm on its statement in the past of limited days of hot weather in the Midwest this year and that – like 1976 – should protect production this year even though precipitation remains lighter than usual

-

That

does not mean a bumper crop and that does not mean some lost yield is not expected, but the environment will temper this year’s production so that it is not at either end of the extremes for production -

U.S.

Northern Plains and southeastern Canada’s Prairies will experience restricted rainfall over the next ten days resulting in some net drying; however, the precipitation that does occur will be timely and supportive of crop development -

Fieldwork

will advance well, but timely rain will be needed to ease developing dryness -

Some

rain will fall late this week and into the weekend offering a little relief to crop areas in the eastern Dakotas and Minnesota -

Portions

of Manitoba Canada and the western Dakotas may miss some of the coming week of rainfall -

Alberta,

Canada and some western Saskatchewan crop areas that have been drought stricken for a very long period of time will have opportunity to receive significant rain later this week and into the weekend -

No

drought busting rain is expected, but enough relief should occur to revitalize crops that have been withering in recent days and weeks -

Cooling

is likely Canada’s Prairies and a part of the northern U.S. Plains briefly later this week into early next week and that may help conserve soil moisture through lower evaporation rates -

U.S.

hard red winter wheat production areas will experience a good mix of rain and sunshine for summer crops produced in the region during the next ten days -

Some

of the moisture may not be welcome by maturing wheat -

Some

rain totals over the next ten days will vary from 0.75 to 2.50 inches -

Southwestern

U.S. Plains will be drying out during the next ten days to two weeks with little no rain and warmer than usual temperatures

-

High

temperatures will reach into the 90s and over 100 degrees in central and southern Texas most days this week -

Cotton,

corn and sorghum areas in West Texas will be planted aggressively and will endure some warmer biased weather for a while later this month into July which is likely to firm up the soil to some degree -

U.S.

Delta and southeastern states will experience a good mix of rain and sunshine during the next ten days to two weeks favoring normal crop development and fieldwork -

There

is potential for repetitive rainfall and some strong to severe storms producing heavy rainfall -

Local

flooding will be possible -

Washington’s

Yakima Valley and north-central Oregon will be drier biased over the next two weeks while rain falls periodically in Idaho, Wyoming and Montana -

California’s

central valley and the southwestern U.S. desert region will be mostly dry for the next couple of weeks with temperatures near to below average -

Ontario

and Quebec grain and oilseed areas will receive periodic rainfall during the next ten days supporting improved crop conditions after recent drying -

Warming

is needed, though readings over the next ten days will often be cooler than usual -

Europe

weather is expected to slowly improve this weekend and next week with rain “eventually” falling across the previously dry areas in northern and eastern parts of the continent

-

Next

week will be wetter than this week, but improvement is expected to gradually overspread the region -

Temperatures

will be warmer than usual over the two-week period especially in the north and that means crop moisture stress will be high in the Baltic Plain and neighboring areas until significant rain falls -

Southern

Europe will continue to experience the most frequent rain over the next two weeks, but it will not be excessively wet and crops should perform well during this period of time.

-

North

Africa will finally see less frequent and less significant rain after mid-week this week resulting in much improved winter crop maturation and harvest conditions -

Rain

will fall during mid-week this week in northeastern Algeria and northern Tunisia with rainfall of 0.50 to 2.00 inches resulting

-

Recent

weeks of wet weather has delayed harvesting and reduced grain quality especially in Morocco and northwestern Algeria -

Drying

in the western CIS over the next week to ten days will decrease topsoil moisture and raise a little crop moisture stress, but the impact is expected to be low -

Changing

weather should occur later this month returning needed rain to the region -

Eastern

Russia’s New Lands and a few northern Kazakhstan locations received some rain during the weekend -

Most

of the precipitation was too light for a serious improvement in soil moisture -

Weather

during the next ten days will be cooler than usual with rain shifting to the eastern New Lands leaving crop areas near the Ural Mountains and in northwestern Kazakhstan looking for greater rain -

Rain

is needed in Russia’s southern eastern New Lands, Kazakhstan and in a few Ukraine and Belarus locations -

Most

of the dryness is not critical except in Kazakhstan and a few areas immediately north in southeastern Russia’s spring wheat and sunseed region -

Some

showers are expected, but resulting rainfall will not fix the region’s moisture deficits -

Frost

and light freezes occurred later than usual in northwestern parts of Russia and the Baltic States during the weekend and again this morning in northern parts of Russia’s Eastern New Lands with lows in the 30s and one location slipping to 28 Fahrenheit -

The

impact on crops was low -

China’s

Northeast Provinces received rain Friday through Monday with highly varying amounts resulting -

The

moisture has been good for long term crop development, although more may be required soon because of seasonal warming -

Weather

in China over the next ten days will be dry and warm enough to allow dryness from interior eastern Inner Mongolia to expand west and southward over time.

-

The

situation will be closely monitored -

World

Weather, Inc. believes there is potential for the heart of central Inner Mongolia and the Yellow River Basin to be drier and warmer than usual at times this summer -

Southern

China will continue to experience frequent rain and thunderstorms with seasonable temperatures that may trend a little cooler than usual periodically -

Some

areas may become too wet -

The

environment will be good for future rice, but conditions may be a little too wet for early rice which may be maturing and getting ready for harvesting -

Xinjiang,

China will experience seasonable temperatures over the next two weeks -

The

province has struggled with coolness in recent weeks and crop development is behind the usual pace -

Production

potentials have decreased because of some reduced area planted and due to the poor early season start to crop development -

There

is concern over early season frost and freeze potentials coming along before the crop is fully mature

-

Crop

conditions are improving because of the recent development of more seasonable temperatures -

Recent

high temperatures have been in the 90s to slightly over 100 Fahrenheit -

India’s

monsoon will continue underperforming over the next ten days -

Rain

is likely in many areas, but resulting amounts will be well below average -

Next

week’s rainfall will be greatest in central areas -

This

week’s rain will be greatest along the lower west coast and from Sindh Pakistan into Rajasthan -

Tropical

Cyclone Biparjoy was roughly 198 miles southwest of the northwest coast of Gujarat, India at 1345 GMT today moving north northerly over open water and producing sustained wind speeds of 105 mph -

Biparjoy

will turn to the northeast today and begin weakening -

A

turn to the northeast is possible Tuesday afternoon and Wednesday which may bring the storm inland to the northwestern Gujarat crop region around 0900 GMT Thursday -

The

storm may still be a tropical cyclone at the time of landfall with wind speeds sustained at more than 80 mph -

Heavy

rain could begin to impact northwestern Gujarat later today and Wednesday and may also impact a part of Sindh, Pakistan Wednesday and Thursday -

Remnants

of the storm will bring heavy rain to Rajasthan, India later this week -

Tropical

Storm Guchol has passed the main islands of Japan and will weaken today as it moves away from eastern Asia -

Australia

weather is expected to be relatively quiet this week and early next week with rain occurring in southern coastal areas mostly -

Any

showers that occur farther inland will be too brief and light to have much impact -

Recent

rain has winter crops establishing well -

South

Africa will experience rain in its important southwestern wheat, barley and canola production areas this week resulting in further assurance of a well-established crop.

-

Light

rain of limited significance is likely elsewhere in the nation -

Thailand

needs greater rain to reduce crop stress in important rice, corn and some sugarcane production areas -

Rain

is needed and some is expected, but its distribution will be lighter than usual leaving many of the driest areas drier than usual for an extended period of time -

Laos

and Cambodia are experiencing better distributed rainfall than western Thailand and this will continue for a while -

Vietnam

rainfall will be restricted for a while leading to some net drying -

Indonesia

and Malaysia rainfall has become a little more sporadic and light recently, but soil moisture remains favorably rated

-

Southern

parts of Indonesia would benefit from greater rain -

Philippines

weather remains good for most of its crops with little change likely for a while -

Central

Africa weather continues mostly near normal, although there is need for greater rain in some Kenya and Uganda locations -

Mexico

rainfall continued below average in many western and central crop areas in the nation recently -

Rain

is needed in both areas, but has been well below normal in most of the western crop areas for at least the past 90 days -

Delayed

summer crop planting is expected this year until seasonal rains arrive which are already later than usual -

Some

citrus, sugarcane and other fruit and vegetable crops are already being hurt by drought -

Argentina

weather over the next ten days will not provide much rainfall which will favor fieldwork in many areas, but no relief from dryness is likely in the southwest -

Brazil

weather during the coming will be more unsettled than in previous weeks resulting in some increases in topsoil moisture from Mato Grosso do Sul to Sao Paulo and southward into northern Rio Grande do Sul -

The

wet bias will maintain wet field conditions in wheat production areas as well as some Safrinha corn production areas -

Drier

weather is needed to support normal corn maturation and eventual harvest conditions -

Rain

elsewhere in Brazil will be too light and infrequent to have a big impact other than some short term disruptions to fieldwork -

Today’s

Southern Oscillation Index was -13.83 and it will move erratically higher over the next several days

Source:

World Weather, INC.

Tuesday,

June 13:

- France

agriculture ministry’s report on field crops - IGC

grains conference, London, day 2 - EU

weekly grain, oilseed import and export data - Brazil’s

Conab issues production, area and yield data for corn and soybeans

Wednesday,

June 14:

- FranceAgriMer

monthly grains balance sheet - New

Zealand food prices - EIA

weekly US ethanol inventories, production, 10:30am

Thursday,

June 15:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports

Friday,

June 16:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report

Soybean

and Corn Advisory

2023

U.S. Corn Yield Lowered 1.0 Bushel to 178.0 bu/ac

2023

U.S. Soybean Yield Lowered 0.5 Bushel to 51.5 bu/ac

2022/23

Brazil Soybean Estimate Unchanged at 155.0 Million Tons

2022/23

Brazil Corn Estimate Unchanged at 129.0 Million Tons

2022/23

Argentina Soybean Estimate Unchanged at 22.0 Million Tons

2022/23

Argentina Corn Estimate Unchanged at 35.0 Million Tons

US

CPI was near expectations. A rate hike is unlikely.

105

Counterparties Take $2.075 Tln At Fed Reverse Repo Op.