PDF Attached

FI’s US corn and wheat balance sheets are attached.

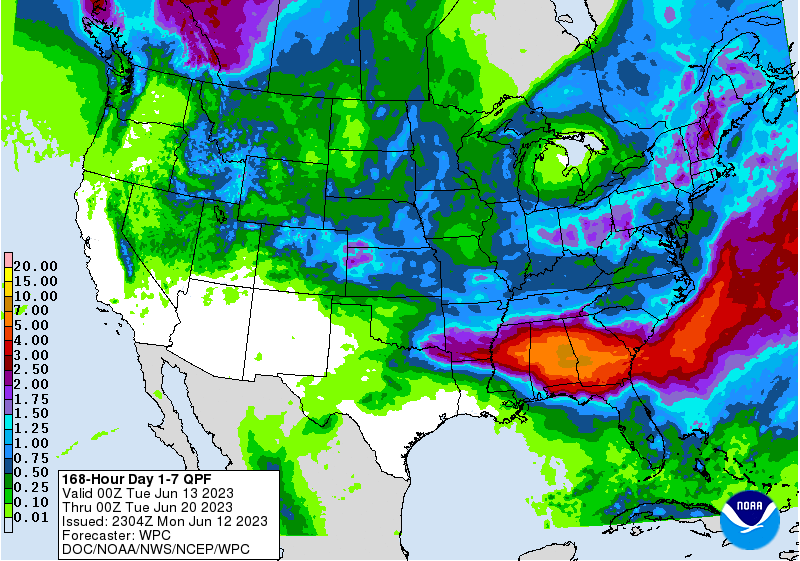

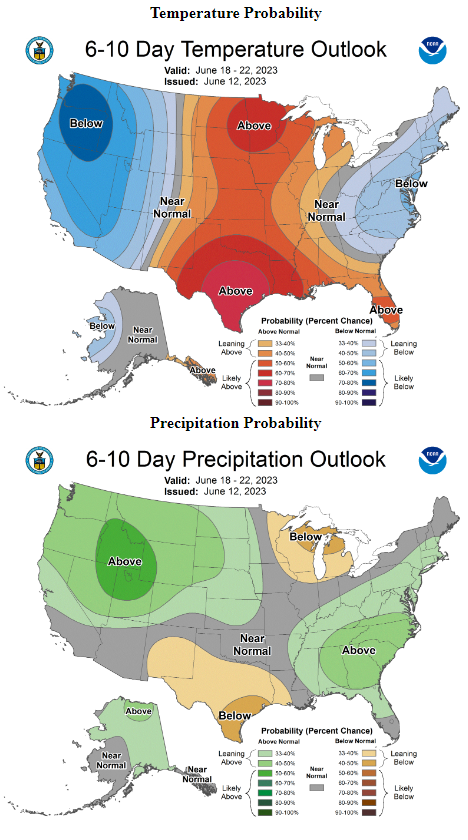

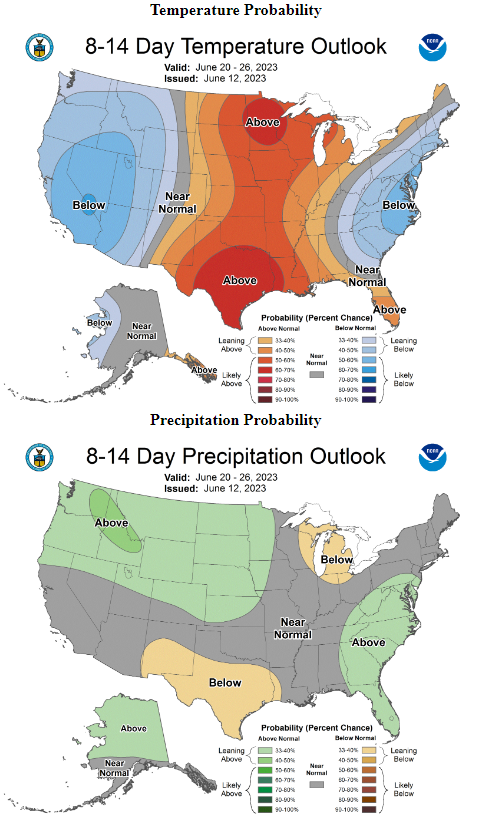

The market put the weekend rains and the WASDE report in the rear-view mirror today as traders focused on the next rain event for the Corn Belt on Thursday-Saturday this week and the potential dryness on the 11-14 day outlook. S&P and NASDAQ closed at the highest level since April 2022 on hopes of a Fed pause this week, but ignored tomorrow’s CPI report.

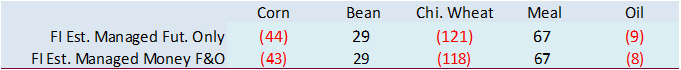

Fund estimates as of June 12 (net in 000)

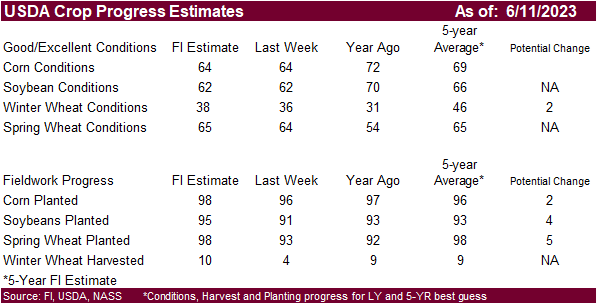

US corn 61% G/E (exp 62%) 72% yr ago

US soybean 59% G/E (exp 60%) 70% yr ago

US soybean planting 96% (exp 96%) 86% 5yr avg

US spring wheat 60% G/E (exp 63%) 54% yr ago

US spring wheat planting 97% (exp 97%) 97% 5yr avg

US winter wheat 38% G/E (exp 37% G/E) 31% yr ago

US winter wheat harvested 8% (exp 10%) 9% yr ago

The headline drop for corn and soy G/E from last week of 3 points may cause the bulls to come in tonight, but these worse estimates were priced in post WASDE Friday and today as the market has dealt with the dryness the past few sessions. Winter wheat’s uptick in G/E won’t matter as production has already been marked down this season.

Past 7-days

WORLD WEATHER HIGHLIGHTS FOR JUNE 12, 2023

- U.S. Midwest precipitation will continue lighter than usual over the next ten days, although mild temperatures early this week will conserve soil moisture for a little while

- Ridge building is expected over a part of the U.S. Plains and western Corn Belt during the second week of the outlook which may warm temperatures and keep rainfall lighter than usual

- U.S. Midwest corn and soybean crop stress will be rising this week because of limited rainfall and the return of warmer temperatures late this week

- Tropical Cyclone Biparjoy may bring rain to northern Gujarat, southeastern Pakistan and Rajasthan, India later this week and that could prove to be helpful to get cotton, rice and groundnut planting under way to help head off the potential for early withdrawing monsoonal rain late this summer

- Rainfall elsewhere in India will continue much lighter than usual

- China dryness may expand to the southwest from interior eastern Inner Mongolia over the balance of June

- Western Thailand rice, corn and some sugarcane areas are missing rain routinely and are still drier than usual

- Vietnam rainfall will continue a little lighter and more sporadic than usual over the next ten days

- Rain in northern and eastern Europe will come slowly during the next two weeks and some crop moisture stress is likely in the drier areas this week as temperatures continue warmer than usual while rainfall is restricted

- Weekend frost and freezes in northern Russia or the Baltic States should not have had a big impact on crops

- NOAA’s ENSO models have been reducing the intensity of El Nino in the fourth quarter this year relative to previous forecasts

- Argentina weather will continue drier than usual this week favoring fieldwork of all kinds, but rain is needed in western wheat areas

- Southern Brazil may get a little too wet later this week and drier weather may be needed

- Alberta Canada and some western Saskatchewan, Canada crop areas may get some needed rain later this week and into the weekend easing dryness and re-vitalizing some crops that have been withering recently

- Flooding rain occurred in a part of eastern Cuba impacting some minor crop areas

- Flooding also occurred along the coast of Ivory Coast and in southwestern Ghana during the weekend

Source: World Weather, INC.

Bloomberg Ag calendar

Monday, June 12:

- IGC grains conference, London, day 1

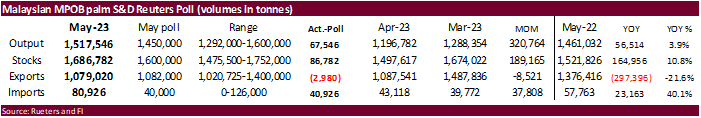

- Malaysian Palm Oil Board’s monthly report on stockpiles, production and exports

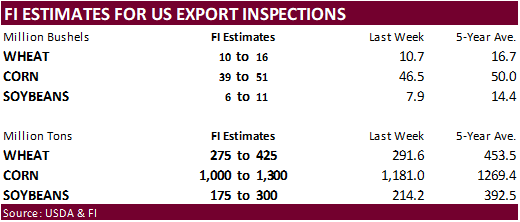

- USDA export inspections – corn, soybeans, wheat, 11am

- US corn, cotton, soybean, spring wheat and winter wheat condition, 4pm

- US planting data for corn, cotton, spring wheat and soybeans, 4pm

- Incorporated Society of Planters conference, Kuala Lumpur, June 12-14

- Brazil Unica cane crush and sugar production report (tentative)

- HOLIDAY: Australia

Tuesday, June 13:

- France agriculture ministry’s report on field crops

- IGC grains conference, London, day 2

- EU weekly grain, oilseed import and export data

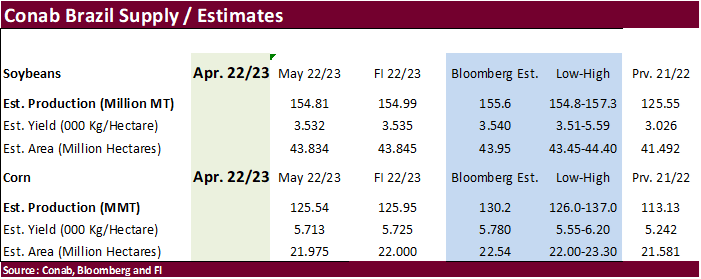

- Brazil’s Conab issues production, area and yield data for corn and soybeans

Wednesday, June 14:

- FranceAgriMer monthly grains balance sheet

- New Zealand food prices

- EIA weekly US ethanol inventories, production, 10:30am

Thursday, June 15:

- USDA weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- Port of Rouen data on French grain exports

Friday, June 16:

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various US futures and options, 3:30pm

- FranceAgriMer’s weekly crop condition report

Macros

US Monthly Budget Statement May: -$240.3B (est -$236.0B; prev $176.2B)

106 Counterparties Take $2.127 Tln At Fed Reverse Repo Op.

EIA: US Total Shale Regions Oil Production For July Seen Up About 9.3K Bpd At 9.376M Bpd (Vs +40K Bpd In June)

NY Fed: Short-Term Inflation Expectations Decline Further; Households Become Slightly More Pessimistic About Credit Conditions

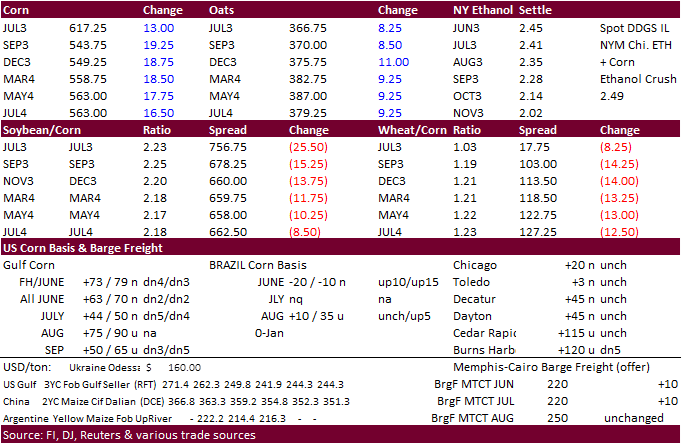

Corn

· AgRural reported 2023 second corn crop harvest progress at 2.2 percent for the center-south region, down from 6.6 percent year earlier.

· The Rosario grains exchange noted Argentina ports so far, this local marketing season are seeing its lowest number of truck arrivals in at least 22 years.

· USDA reported corn inspections in-line with expectations at 1,169,134 metric tons.

· Day 4 of the Goldman roll.

Export developments.

- Algeria bought an unknown amount of corn over the weekend. They were in for up to 140,000 tons of corn for July-Aug 15 shipment. Price was believed to be around $260/ton c&f.

September corn $4.50-$5.75

December corn $4.25-$5.75

· CBOT soybeans traded higher early in the session but new-crop soybeans only managed to hold gains. July futures ended up 20 cents off the highs to close down 13.75c while November closed up 4.75c.

· US weather forecast calling for less than expected precipitation for the US Midwest during the 6-10 period.

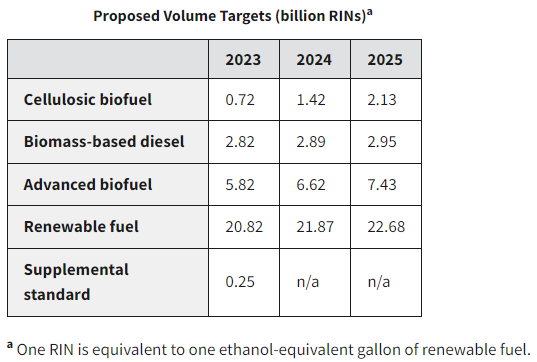

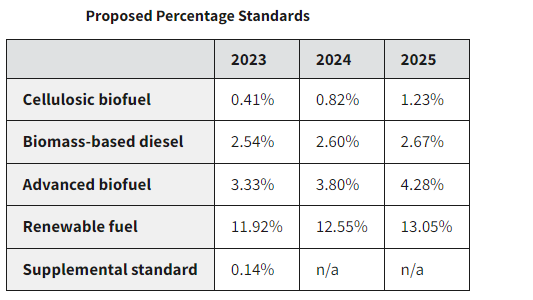

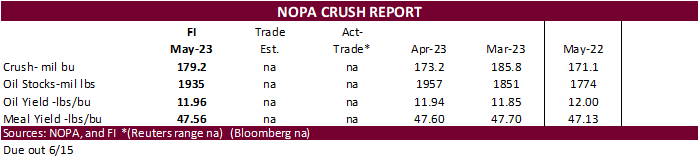

· Soybean meal rose marginally and soybean oil fell 0.61c on mild profit-taking as the market awaits the EPA mandate announcement by June 14th.

· Malaysian palm oil stocks increased for the first time in four months due to a rebound in May production. Table below and charts are attached.

US mandate update

The EPA has up until the June 14th deadline to release mandates. “While the final targets are expected to be higher than the 2.82 billion gallon requirement originally proposed for this year, they are unlikely to hit the much higher volumes sought by biodiesel producers…”

Final results when released will be posted here: https://www.epa.gov/renewable-fuel-standard-program/news-notices-and-announcements-renewable-fuel-standard

December proposed below

· Results awaited: Algeria is in for 35,000 tons of soybean meal for July 1-15 shipment.

· Egypt seeks vegetable oil on June 13 for July 20-August 5 arrival. There are also in for a small amount of local vegetable oils.

Soybeans – July $13.00-$14.25, November $11.00-$14.50

Soybean meal – July $360-$415, December $290-$450

Soybean oil – July 52.50-56.00, December 43-53

· Chicago wheat futures closed higher following corn, while KC HRW closed down 1.25c.

· Rain was limited across the upper Great Plains over the weekend.

· India will limit the amount of wheat stocks traders can hold to help ease domestic prices. They said they have no need to import wheat this season. Production should end up larger than expected despite unfavorable late season weather.

· Canadian Prairies have an opportunity for rain for the western and central areas mid to late this week as the high-pressure ridge breaks down.

· December Paris wheat futures closed up 4.00 euros at 243.75 per ton.

· UN Sec-Gen Guterres said he is concerned Russia will quit the Black Sea Grain Deal on July 17 when it expires.

Export Developments.

· Morocco seeks 500,000 tons of feed barley on June 14.

· Taiwan seeks about 56,000 tons of US wheat from the US on June 14 for July 31-August 14 shipment off the PNW.

Rice/Other

· Results awaited: South Korea seeks about 62,200 tons of rice, 44,400 tons from China and rest from Vietnam, on June 8, for arrival between September 1-30.

(updated 6/9)

July $5.85-$6.50, September $5.50-$6.75

KC – July $7.60-$8.50, September $7.50-$9.00

MN – July $7.75-$8.50, September $7.25-$9.00

| Terry Reilly Senior Commodity Analyst – Grain and Oilseeds |

| Futures International One Lincoln Center 18W140 Butterfield Rd. Suite 1450 Oakbrook terrace, Il. 60181 |

| Work: 312.604.1366 ICE IM: treilly1 Skype IM: fi.treilly |

| treilly@futures-int.com

|

| DISCLAIMER: The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. This communication may contain links to third party websites which are not under the control of FI and FI is not responsible for their content. Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results. |