PDF Attached

MARKET

WEATHER MENTALITY FOR CORN AND SOYBEANS:

Net

drying is expected for a while. Soil moisture will be favorable for good crop development in most areas, although slowly declining soil moisture in the eastern Midwest, the far southwestern Corn Belt and parts of the Tennessee River Basin will be closely monitored.

Timely rain will be very important for all of these areas late this month and in July.

Canada’s Prairies are too wet in the west and a little too dry in parts of the south-central and east. Some canola and other late season planting has stopped in the wetter areas of Alberta and those fields may be abandoned because of too much moisture and

the lateness of the season. Rain in the eastern Prairies late this weekend into early next week may offer some relief.

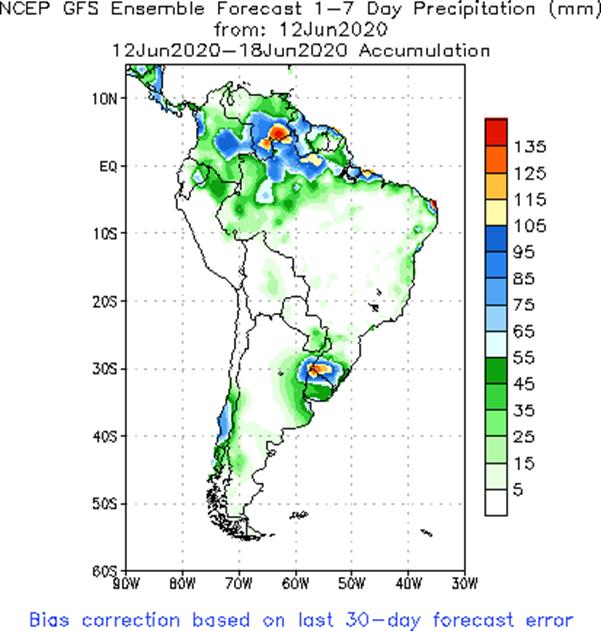

South America weather remains mostly good for maturing crops and their harvest. Dryness in some eastern and northern Safrinha crops may have harmed late season yields. Argentina’s harvesting will continue aggressively, although rain in the east will induce

some disruption.

Rain is needed in South Africa and Australia to improve canola planting conditions. Some rain is expected in Australia beginning in the west today and reaching the east Friday into Saturday.

Philippines rainfall is being boost by a tropical disturbance with additional dryness relief expected in Luzon Island over the next few days.

Most

of Malaysia and Indonesia rainfall is still rated favorably and likely to prevail for a while.

Europe weather will remain mostly good for coarse grain and oilseed development, although some additional warming is needed in Eastern Europe and a boost in rain is still needed in France, parts of the U.K. and Germany. Some of that needed rain is coming.

Drying in Russia’s Southern Region, Kazakhstan and central and eastern Ukraine will raise some interest for soybeans, corn and sunseed development, but the region is not too dry today except in parts of Kazakhstan and eastern parts of Russia’s Southern Region.

Overall, weather today will likely have a mixed influence on market mentality.

MARKET

WEATHER MENTALITY FOR WHEAT:

Too

much rain recently in Alberta, Canada has raised concern over small grain conditions and additional rain slated for the next several days will induce some additional concern and crop damage. Eastern parts of the Prairies may get some needed rain late this

weekend into early next week, but many areas will be looking for greater rain.

U.S. hard red winter wheat is finishing out relatively well, but dryness and frost damage in the southwestern Plains has left production low in some areas. Rain in Nebraska, parts of Kansas and a few Colorado locations earlier this week benefited late season

crop development.

Rain in Europe has improved small grain conditions in recent weeks, although there is need for more rain in France, the U.K. and parts of Germany. Eastern Europe would benefit from some warmer temperatures. Spring cereals are still rated favorably in many

areas outside of northwestern Europe with little change expected through the coming week. There will be some interest in eastern Russia’s spring wheat as time moves along this summer, but for now the environment is still mostly good. Net drying in central

and eastern Ukraine will raise some concern over small grain crop conditions later this month, but conditions today are still good.

Australia’s rain event expected from west to east over the next few days should improve some crops, but there will be an ongoing need for greater moisture. A follow up rain event in the west during mid-week next week will improve some crops.

South

Africa and parts of Argentina still need greater rainfall to support wheat planting and establishment. Eastern Argentina wheat areas should get some beneficial rain next week.

Overall, weather today will likely provide a mixed influence on market mentality.

Source:

World Weather Inc. and FI

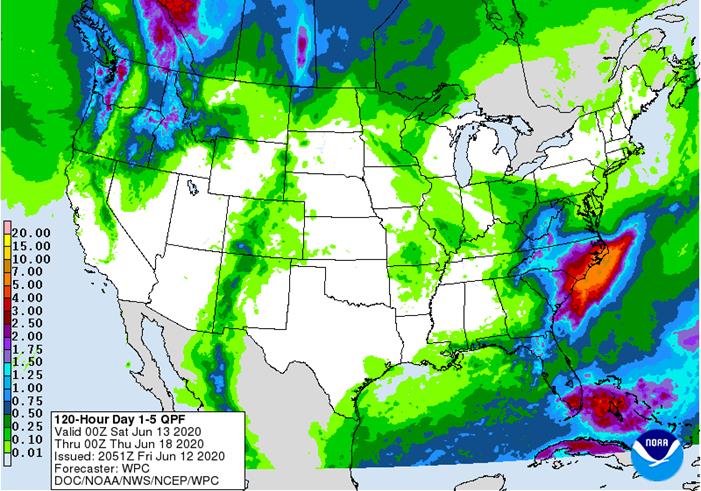

WPC

5-day Quantitative Precipitation Forecast

Source:

World Weather Inc. and FI

Source:

World Weather Inc. and FI

Bloomberg

Ag Calendar

- ICE

Futures Europe weekly commitments of traders report on coffee, cocoa, sugar positions - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - New

Zealand food prices - Shanghai

exchange’s weekly commodities inventory - HOLIDAY:

Russia

MONDAY,

June 15:

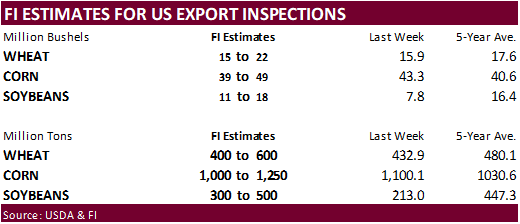

- Monthly

MARS bulletin on crop conditions in Europe - USDA

weekly corn, soybean, wheat export inspections, 11am - USSEC’s

Asia Trade Exchange 2020, day 1 - U.S.

crop progress — corn, soybean plantings, winter wheat conditions, 4pm - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals - Malaysia’s

palm oil export data for June 1-15

TUESDAY,

June 16:

- New

Zealand global dairy trade auction - Abares

agricultural commodities report for June quarter 2020 - Asia

Trade Exchange 2020, day 2

WEDNESDAY,

June 17:

- EIA

U.S. weekly ethanol inventories, production, 10:30am - Asia

Trade Exchange 2020, day 3

THURSDAY,

June 18:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, 8:30am - Brazil

Conab releases 2nd estimate for 2020 coffee crop, Sao Paulo - Port

of Rouen data on French grain exports - USDA

total milk production, 3 pm

FRIDAY,

June 19:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - U.S.

Cattle on Feed, 3pm

SATURDAY,

June 20:

- Malaysia’s

palm oil export data for June 1-20

Source:

Bloomberg and FI

·

July corn rose only a quarter-cent today in a quiet trade. With mild weather currently and the crop in great shape, there is no impetus to move.

·

Weather should be in focus for the upcoming week. Warmer and drier weather may stress some of the crop that missed rain across the far western Corn Belt.

·

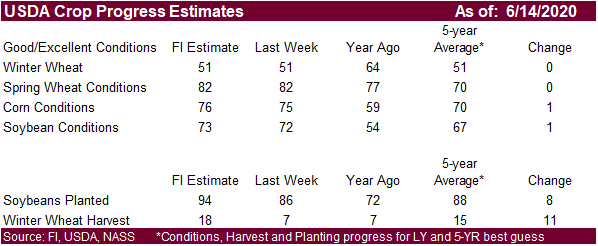

We look for soybean and corn crop conditions to improve when reported by USDA on Monday, but with dry weather on horizon, they could decline the following two to three weeks. Conditions are already

at high levels for this time of year for both crops.

·

APK-Inform increased its forecast for Ukraine corn production to 35.4 million tons from 35.1 million a month ago and compares to 35.8 million tons in 2019. They will likely dominate the Chinese

import market for at least three years running.

·

CFTC reported that corn specs increased their net shorts by 17,066 contracts to short 332,285 contracts for the week ending June 9.

·

Funds were net sellers of 2,000 net corn contracts on the session.

·

Flint Hills Resources announced the closure of its 120 MLN gallon/year ethanol facility in Camila, Georgia which has been idled since May because of COVID-19 caused demand destruction.

-

None

reported