PDF attached

Best

cure for high prices, are high prices

Canada’s

Prairies will see favorable rain early next week but unfortunately the northern US Great Plains will mostly dry down next workweek. Parts of North Dakota saw rain Thursday and Friday, but some areas were dry. ECB conditions look good, including central IL,

according to a coworker report over the weekend. WCB is mixed. We are concerned about the state of crops from northwestern IA through the Dakota’s. (Northwestern IA will see rain next week). Parts of the central Delta (Mississippi & Arkansas) that are in

low lying areas lost acres over the past 48 hours with fields under water, impacting cotton, soybeans (can replant) and to less extent corn. Rice will be ok.

Reuters

in a story said the U.S. EPA was considering ways to provide relief to U.S. oil refiners from biofuel blending mandates. RIN offers crashed after the early morning story broke. For the rest of Friday’s session, SBO led the markets lower, and meal found support

from unwinding of oil/meal spreading. Meal ended the day higher while most markets were lower.

Saturday

afternoon forecast for Sunday-Saturday:

Past

7 days

NOT

MUCH CHANGE OVERNIGHT

- Rain

fell significantly in northwestern and north-central North Dakota into southwestern Manitoba overnight with 1.00 to 2.00 inches resulting and local amounts to 4.00 inches - Portions

of the U.S. Red River Valley of the North received rain with 0.30 to 1.00 inch of rain and local totals of 1.00 to 2.00 inches overnight

o

The precipitation was welcome and will be supportive of crop improvements for a while, but net drying is expected

o

Central North Dakota rainfall was mostly 0.20 to 0.70 inch with one amount of 1.18 inches

o

South Dakota, southeastern and central Montana and the heart of Minnesota did not get much rain in the past 24 hours ending at dawn today

- Canada’s

eastern Prairies will get some rain of significance today with 0.50 to 1.50 inches and local totals of up to 2.50 inches will result from eastern Saskatchewan into west-central and northern Manitoba.

o

Crop and soil moisture improvements will be widespread in these areas

o

Overall, during the past week many areas in the Prairies received rain, but amounts were a little light in southern Alberta and in a few southwestern into central Saskatchewan locations

- Portions

of central through northeastern Alberta were wettest and need to dry down for a while - Southeastern

Manitoba will be driest today into Saturday, but field conditions will remain good due to previous rainfall - Canada’s

Prairies will turn drier after today and it will last through much of next week except in Alberta where some additional showers are likely

- Much

of the U.S. Midwest Corn and Soybean Belt will experience a net decline in soil moisture over the next ten days to possibly two weeks

o

Scattered showers and thunderstorms are expected periodically, but resulting rainfall may have a tough time countering evaporation

o

The European forecast model is quite dry for the Midwest with hot weather in the northern Plains early next week and in the western and central Corn Belt during mid- to late week

- Some

of the heat and dryness is a little extreme, but the trend is correct

o

The GFS model run has a little too much rain in the outlook and not enough heat; so, as usual there is need for a compromise in the models

o

Net drying is the bottom line with increasing crop stress in the north and western Corn Belt with a few pockets of exception

- Too

much rain in the U.S. this week damaged some summer crops and replanting may be necessary

o

Southern Arkansas into west-central through interior northern Mississippi where most impacted

o

Slowly improving weather is expected this weekend into next week

- A

tropical cyclone will form in the southwestern Gulf of Mexico next week and it will possibly move toward the central U.S. Gulf Coast with landfall a week from now or during the following weekend

o

European model favors landfall near the Texas/Louisiana border

o

GFS model favors landfall in southeastern Mississippi before moving into Alabama while diminishing

- Hot

temperatures occurred in the Dakotas today and Montana Thursday ahead of the overnight thunderstorms

o

Today will be much cooler with highs in the 70s and 80s compared to the upper 80s and 90s

o

Extreme highs Thursday varied from 100 to 105 in southeastern Montana

- Excessive

heat will return to the north-central U.S. and Canada’s Prairies early to mid-week next week with more 90- to lower 100-degree heat expected - West

Texas will be hot over the next two days with highs of 100 to 108 Fahrenheit

o

Scattered showers will pop up during the weekend and next week as the region cools back down for a little while

- Far

western U.S. crop areas will continue quite dry during the next ten days with temperatures turning warmer than usual next week and continuing into the following weekend - Russia’s

southeastern New Lands and northern Kazakhstan spring wheat and sunseed production areas will receive very little rain over the next week with some rain showers possible after that

o

No excessive heat is presently expected which will help keep crop stress low as the region dries down

- India’s

monsoon depression will produce but moderate to heavy rain from Odisha to Madhya Pradesh this weekend into next week

o

The risk of widespread, serious, flooding has reduced, but local flooding is still expected and the rain will disrupt planting of summer crops with a few of the wettest areas having need for a little replanting

- Interior

western and southern India will continue drier than usual for this time of year and this trend may continue into late June raising some eventual concern over delayed rainfall and delayed planting - East-central

China, including the Yellow River Basin and North China, will receive rain this weekend through all of next week to ease the region from recent dryness

o

Crop stress relief is expected

- China’s

greatest rain Thursday occurred in Liaoning and Jilin where 1.00 to nearly 5.00 inches resulted.

o

Rain also fell significantly in the interior south from Yunnan to Hunan, Jiangxi and southern Zhejiang

- Northeast

China crop weather will be mostly good over the next two weeks with a mix of rain and sunshine while temperatures are little warmer than usual - Southern

China will remain plenty wet for the next two weeks - Xinjiang,

China will trend a little cooler than usual in the northeast during the coming week with periods of rain possible

o

Extreme lows in northeastern Xinjiang will slip to the 40s Fahrenheit Saturday morning

- Rainfall

Thursday varied up to 0.50 inch and high temperatures were confined to the lower 80s Fahrenheit

o

Southwestern areas will see a little cooler bias in temperatures and limited rain potential; these temperatures will be much closer to normal than in the northeast part of the province

- Mexico

rainfall will continue confined to southern parts of the nation during the next week leaving drought in dominance of western, central and northern Mexico

o

Rain should increase and advance to the north during the June 19-25 period

- Nicaragua

and Honduras have been drier biased for the past month and need rain

o

Some improvement is occurring and will continue over the next week

- Safrinha

corn areas of Brazil will experience no serious weather changes over the next ten days

o

Dryness will remain in Mato Grosso, Goias, southwestern Minas Gerais and northern Sao Paulo

o

Showers and thunderstorms farther to the south in Brazil periodically will be good for wheat and late Safrinha crops

o

Safrinha corn and cotton production will be down this year, despite periodic rainfall in the south

- Argentina’s

summer crop harvest has advanced well in recent weeks

o

Winter wheat areas are drying down and there are some areas in Cordoba that need significant moisture

- The

dry bias will prevail over the next week to ten days - Australia

will see some periodic showers and some sunshine during the next two weeks

o

Greater volumes of rain are needed especially in South Australia, Queensland and, northwestern Victoria and western New South Wales

- Portions

of Western Europe will be trending drier over the coming week

o

Temperatures will be warm, but not excessively hot

o

Drying will raise the need for rain in time

- The

North Sea region will be one of the drier biased areas - Southeast

Asia rainfall increased additionally in the mainland areas Thursday while staying light in Philippines, Indonesia and Malaysia

o

The rain was welcome

- Much

of Southeast Asia is expecting bouts of rain through the next ten days, although amounts will be lighter than usual at times.

- A

tropical depression has evolved in the South China Sea and may bring significant rain to Hainan, China early this weekend and then to northern Vietnam and northern Laos late this weekend into Monday

o

The system should become a tropical storm before moving inland

- South

Africa rain will be minimal for a while supporting summer crop harvesting and winter crop planting

o

A boost in rain is always needed in winter crop areas

- West

Africa rainfall fall periodically over the next ten days

o

Greater rain is needed in many areas; including Ghana and some west-central Ivory Coast coffee, cocoa, rice and sugarcane production areas

- A

boost in cotton rainfall would also be welcome

o

Rainfall will continue lighter than usual, but at least some showers will occur periodically

- East-central

Africa has been drying down and needs greater rain soon to maintain the best coffee, cocoa, rice, sugarcane and other crop production potentials

o

Rainfall will increase in Ethiopia this week while little change occurs elsewhere

- Southern

Oscillation Index is mostly neutral at -1.07 and the index is expected to begin leveling off this weekend

- North

Africa weather will trend a little wetter in northern Algeria and Tunisia this weekend and early next week

o

No winter crop quality issues are expected

- New

Zealand weather during the coming week to ten days will be drier and warmer than usual

o

the exception will be along the west coast of South Island where rain is expected this weekend into next week

Source:

World Weather, Inc.

Monday,

June 14:

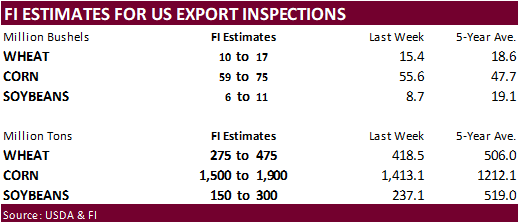

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop condition — corn, cotton, soybeans, wheat, 4pm - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals - HOLIDAY:

Australia, China, Hong Kong

Tuesday,

June 15:

- FT

Commodities Global Summit, day 1 - Malaysia

June 1-15 palm oil export data - Malaysia

CPO export tax for July (tentative) - New

Zealand Food Prices - New

Zealand global dairy trade auction

Wednesday,

June 16:

- EIA

weekly U.S. ethanol inventories, production - FT

Commodities Global Summit, day 2 - Australia’s

Abares to release agricultural commodities report - Brazil’s

Unica may release cane crush, sugar production data (tentative) - CNGOIC

oilseed conference, Chengdu, China, Day 1

Thursday,

June 17:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - Itau

webinar on agribusiness outlook, Sao Paulo, Brazil - CNGOIC

oilseed conference, Chengdu, China, Day 2

Friday,

June 18:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China

customs to publish trade data, including imports of corn, wheat, sugar and pork - World

coffee market report by USDA’s Foreign Agricultural Service, 3pm - FranceAgriMer

weekly update on crop conditions - USDA

Total Milk Production

Source:

Bloomberg and FI

From

Friday evening:

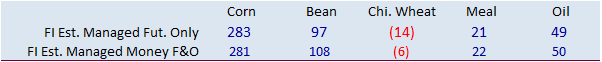

CFTC

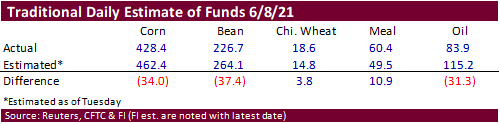

Commitment of Traders

Funds

were less long than expected in corn, soybeans, and soybean oil as of last Tuesday.

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

236,556 -14,075 426,777 -6,239 -641,420 17,454

Soybeans

95,060 3,677 184,049 -1,451 -281,763 -10,158

Soyoil

54,738 -2,083 123,413 -4,598 -195,649 6,887

CBOT

wheat -36,635 416 158,139 -2,206 -114,974 -2,543

KCBT

wheat 5,040 411 62,527 -77 -65,795 -1,982

=================================================================================

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

275,599 -14,337 235,797 -9,171 -603,651 24,640

Soybeans

141,483 2,695 85,432 -3,749 -255,023 -8,754

Soymeal

26,720 5,835 84,162 1,801 -162,187 -3,221

Soyoil

81,320 -4,764 114,404 -83 -216,444 7,275

CBOT

wheat -1,374 -4,600 76,633 -6,339 -86,537 3,187

KCBT

wheat 19,713 626 41,182 -1,460 -58,111 -988

MGEX

wheat 13,590 128 3,936 229 -28,048 -1,199

———- ———- ———- ———- ———- ———-

Total

wheat 31,929 -3,846 121,751 -7,570 -172,696 1,000

Live

cattle 52,940 2,741 86,390 -700 -153,269 -2,544

Feeder

cattle 3,273 -840 6,659 150 -1,159 835

Lean

hogs 84,621 1,989 63,431 777 -153,804 -4,421

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

114,168 -3,992 -21,914 2,860 2,559,044 31,373

Soybeans

25,454 1,878 2,654 7,931 1,195,861 30,125

Soymeal

23,225 -1,776 28,081 -2,638 463,283 6,083

Soyoil

3,221 -2,222 17,498 -206 667,461 17,150

CBOT

wheat 17,809 3,418 -6,531 4,334 524,595 14,429

KCBT

wheat -1,012 173 -1,772 1,648 227,637 -13,332

MGEX

wheat 1,177 117 9,345 725 88,510 3,325

———- ———- ———- ———- ———- ———-

Total

wheat 17,974 3,708 1,042 6,707 840,742 4,422

Live

cattle 23,650 717 -9,712 -213 339,017 -24,991

Feeder

cattle 1,564 -690 -10,337 546 49,388 931

Lean

hogs 14,196 1,710 -8,445 -54 381,717 9,730

=================================================================================

Source:

CFTC, Reuters and FI

Canadian

Capacity Utilization Rate Q1: 81.7% (est 80.5%; prev 79.2%)

Mexican

Industrial Production SA (M/M) Apr: -0.2% (est 0.3%; prev 0.7%)

Mexican

Industrial Production NSA (Y/Y) May: 36.6% (est 37.6%; prevR 1.7%)

Mexican

Manufacturing Production NSA (Y/Y) Apr: 52.0% (est 53.2%; prevR 6.3%; prev 6.2%)

US

Univ. Of Michigan Sentiment Jun P: 86.4 (est 84.4; prev 82.9)

–

Current Conditions: 90.6 (est 91.3; prev 89.4)

–

Expectations: 83.8 (est 78.7; prev 78.8)

–

1-Year Inflation: 4.0% (est 4.7%; prev 4.6%)

–

5-10 Year Inflation: 2.8% (prev 3.0%)

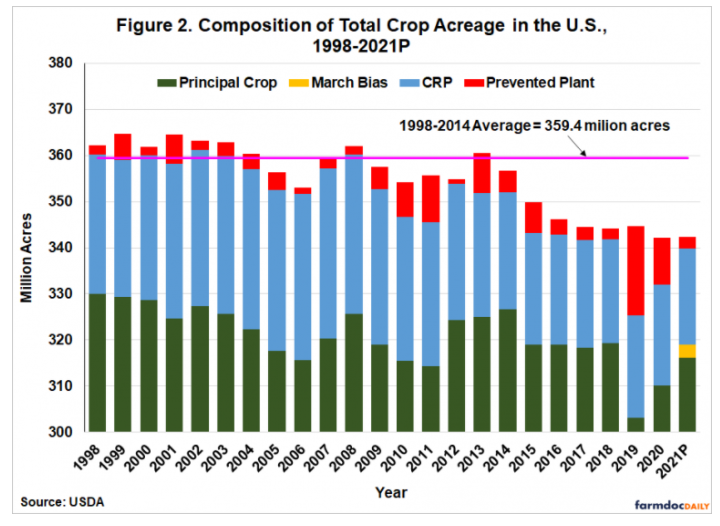

Farmdoc

Estimating

Total Crop Acres in the U.S. Irwin, S. “Estimating Total Crop Acres in the U.S..”

farmdoc daily (11):91, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 10, 2021.

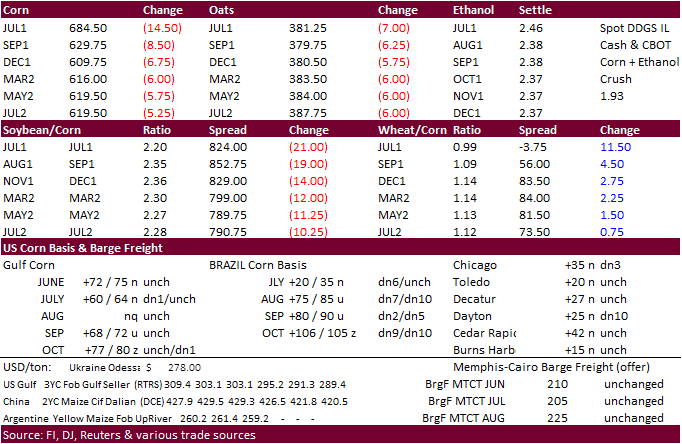

Corn

- Corn

were leading the CBOT ags lower this morning before SBO dropped limit. Corn found additional bearish sentiments after a bearish Reuters article was published citing the White House is looking into relief for oil refiners that struggle with biofuel blending

requirements. Oil Refinery lobby groups have been campaigning for some type of relief from blending credits after RIN prices traded near their 13-year lifespan high in recent weeks. Some refiners even threatened bankruptcy. Friday morning U.S. renewable

fuel credits fell about 15 percent from $2 to $1.75 but rebounded to $1.85 by late morning.

- Today

was the last day of the Goldman Roll and July corn fell 14.50 cents while September was down 8.50 cents.

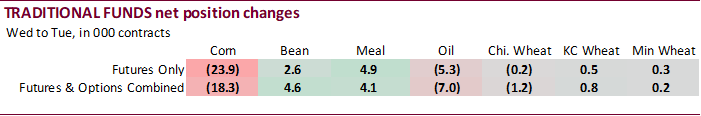

- Funds

on Friday sold an estimated net 15,000 corn contracts. - Funds

were less long than expected in corn, soybeans, and soybean oil as of last Tuesday.

- USD

was 44 points higher as of 3:00 pm CT. - Argentina’s

corn harvest advanced to 38 percent complete las of late last week and that country may see a rush in short term corn exports amid speculation the government will increase export taxes. BA Grains Exchange increased their production outlook yesterday.

- Argentina’s

Grains Exchange raised their corn crop forecast to 48 million tons from 46 million previous. USDA is at 47 million tons.

-

IHS

Markit: 2021 corn plantings according to trade: 96,539 million vs. 96.847 million previous and 91.144 USDA.

Export

developments.

- On

Friday China’s Sinograin offered 11,058 tons of Ukrainian imported corn at auction from reserves.

Updated

6/10/21

July

corn seen in a $6.50 and $7.50 range

December

corn is seen in a $4.75-$7.00 range.

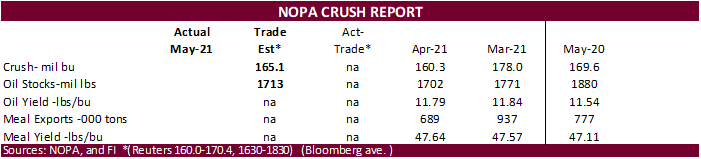

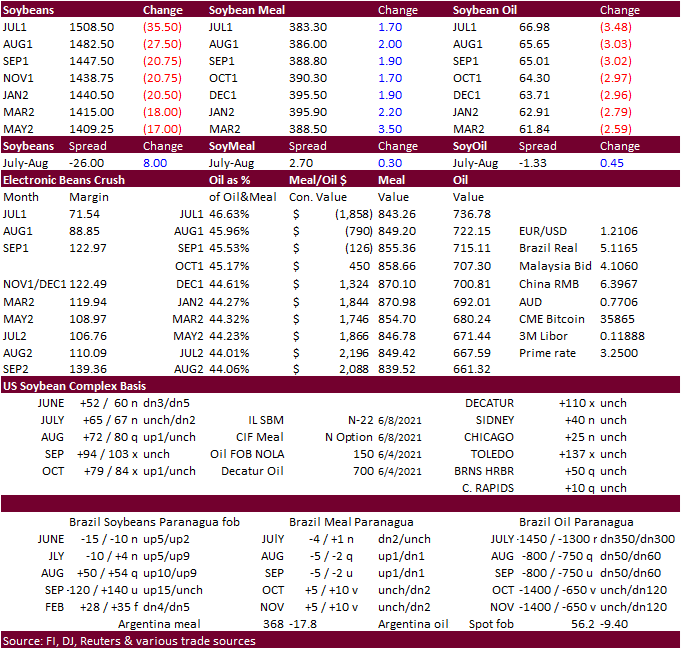

Soybeans

-

The

soybean complex was lower throughout much of the day but soybean meal ended higher on unwinding of oil/meal spreading. The bearish undertone was kicked off as prices trended lower following a drop in outside markets, improving Canadian canola weather, and

recent rain across the ECB. But additional selling pressure was led by soybean oil after Reuters put out a story that the White House is looking into providing relief from biofuel blending laws to oil refiners impacted by high cost RIN prices amid biofuel

blending mandates. We do not know what this might entail, and details were lacking. We think this will adversely affect biodiesel and renewable diesel production, at least of the short term, and still expect US soybean oil stocks will tighten form this year

through the end of new-crop. -

July

soybean oil finished 348 points lower. We think this was overdone. -

Funds

on Friday sold an estimated net 15,000 soybean contracts, bought 2,000 soybean meal and sold 25,000 soybean contracts.

-

Funds

were less long than expected in corn, soybeans, and soybean oil as of last Tuesday.

-

ICE

Canola fell for the third straight day. -

Argentina

soybean oil spot cash price as of Friday morning was last $1240, down 3 percent over the previous week.

-

We

look for a decline in US soybean and corn conditions this upcoming Monday may limit losses.

-

IHS

Markit: 2021 soybean plantings according to trade: 89,065 million vs. 88.485 million previous and 87.600 USDA.

- No

fresh export developments. - USDA

seeks 1,180 tons of packaged vegetable oil for export donation on June 15 for July 16-Aug 15 shipment.

Updated

6/10/21

July

soybeans are seen in a $15.00-$16.25; November $12.75-$15.00

Soybean

meal – July $360-$410; December $380-$460

Soybean

oil – July 68-74; December 57-70 cent range

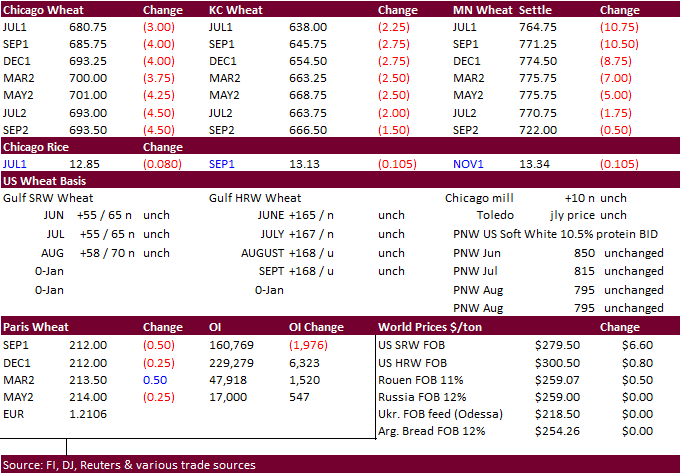

- Wheat

ended lower after rain fell across the Dakota’s, firm USD, and upward revisions to Russia’s wheat crop. French wheat crop conditions also improved one point from the previous week to 81% good/excellent.

- Funds

sold an estimated net 3,000 SRW wheat contracts. - Good

rains fell across parts of the Dakotas overnight bias northwestern North Dakota Thursday into Friday before moving into the eastern areas. The outlook for the next ten days calls for restricted rain again bias the Dakota’s.

- IHS

Markit: 2021 spring wheat plantings (excluding durum) at 11.510 million acres, down from its May 14 figure of 11.610 million and below the USDA’s March 31 estimate of 11.740 million acres. (Reuters) - US

SRW harvest pace is picking up with combines rolling in five states, according to the US Wheat Associates.

- SovEcon

sees the Russian wheat crop at 82.1 million tons, up 1.5MMT from previous. On Thursday IKAR pegged the Russia wheat crop 82 million tons, up 2 million tons from previous and below 85.9 million produced in 2020.

- September

Paris wheat market basis September settled

down 1.25 euros, or 0.6%, at 211.25 euros a ton. The contract was down 1.6 percent for the week.

- Cancelled:

Ethiopia seeks 400,000 tons of milling wheat on June 14, two lots of 200,000 tons each with delivery within 70 to 90 days of contract date. They may float another import tender soon.

- South

Korea’s MFG bought 65,000 tons of feed wheat at $313.00 for July or August shipment.

- Jordan

seeks 20,000 tons of wheat bran on June 15 for July/August shipment. - Japan

seeks 80,000 tons of feed wheat and 100,000 tons of barley on June 16 under its SBS import system, for arrival in Japan by November 25.

- Jordan

seeks 120,000 tons of wheat on June 22 for December shipment. - Jordan

is back in for feed barley on June 23 for Nov/Dec shipment.

Rice/Other

·

None reported

Updated

6/10/21

July

Chicago wheat is seen in a $6.30-$7.15 range

July

KC wheat is seen in a $5.95-$6.70

July

MN wheat is seen in a $7.50-$8.25

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.