PDF Attached

US

FED may leave interest rate unchanged through 2020. China buys Q4 US PNW soybeans (up to 10 for week), record US corn production prospects pressure futures, and wheat is higher from an uptick in global import demand.

![]()

MARKET

WEATHER MENTALITY FOR CORN AND SOYBEANS: Once remnants of Tropical Depression Cristobal leave the Corn Belt, net drying is expected for a while. Soil moisture will be favorable for good crop development in most areas, although slowly declining soil moisture

in the eastern Midwest, the far southwestern Corn Belt and parts of the Tennessee River Basin will be closely monitored. Timely rain will be very important for all of these areas late this month and in July.

Canada’s

Prairies are too wet in the west and a little too dry in parts of the south-central and east. Some canola and other late season planting has stopped in the wetter areas of Alberta and those fields may be abandoned because of too much moisture and the lateness

of the season. Rain in the eastern Prairies late this weekend into early next week may offer some relief.

South

America weather remains mostly good for maturing crops and their harvest. Dryness in some eastern and northern Safrinha crops may have harmed late season yields. Argentina’s harvesting will continue aggressively.

Rain is needed in South Africa and Australia to improve canola planting conditions. Some rain is expected in Australia beginning in the west today and Thursday and reaching the east Friday into Saturday.

Philippines rainfall has become erratic and light and needs to be bolstered in a major way. A tropical disturbance will bring relief to Luzon Island over the next few days.

Most

of Malaysia and Indonesia rainfall is still rated favorably and likely to prevail for a while.

Europe

weather will remain mostly good for coarse grain and oilseed development, although some additional warming is needed in Eastern Europe and a boost in rain is still needed in France, parts of the U.K. and Germany. Some of that needed rain is coming.

Drying in Russia’s Southern Region, Kazakhstan and central and eastern Ukraine will raise some interest for soybeans, corn and sunseed development, but the region is not too dry today except in parts of Kazakhstan and eastern parts of Russia’s Southern Region.

The

bottom line will make weather a growing interest for coarse grain and oilseed development around the world, although it does not seem like there is an immediate threat to production. Just enough concern may help induce some rising market premium as time moves

along.

MARKET

WEATHER MENTALITY FOR WHEAT: Too much rain recently in Alberta, Canada has raised concern over small grain conditions, but drying over the next few days will bring some improvement. More rain this weekend will induce some additional concern and crop damage.

Eastern parts of the Prairies may get some needed rain late this weekend into early next week, as well.

U.S.

hard red winter wheat is finishing out relatively well, but dryness and frost damage in the southwestern Plains has left production low in some areas. Rain in Nebraska, parts of Kansas and a few Colorado locations Tuesday will benefit late season crop development.

Rain

in Europe has improved small grain conditions in recent weeks, although there is need for more rain in France, the U.K. and parts of Germany. Eastern Europe would benefit from some warmer temperatures. Spring cereals are still rated favorably in many areas

outside of northwestern Europe with little change expected through the coming week. There will be some interest in eastern Russia’s spring wheat as time moves along this summer, but for now the environment is still mostly good. Net drying in central and eastern

Ukraine will raise some concern over small grain crop conditions later this month, but conditions today are still good.

Australia’s

rain event expected from west to east over the next few days should improve some crops, but there will be an ongoing need for greater moisture. South Africa and parts of Argentina still need greater rainfall to support wheat planting and establishment.

Overall,

weather today will likely provide a mixed influence on market mentality.

Source:

World Weather Inc. and FI

Bloomberg

Ag Calendar

WEDNESDAY,

June 10:

- EIA

U.S. weekly ethanol inventories, production, 10:30am - International

Grains Council virtual conference - FranceAgriMer

crop report and press briefing - Malaysia

MPOB palm oil stockpiles, export, production data for May - Cargo

surveyors release Malaysia export numbers for June 1-10

THURSDAY,

June 11:

- USDA’s

monthly World Agricultural Supply and Demand (Wasde) report, noon - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, 8:30am - China

CASDE monthly crop supply and demand report - Vietnam’s

coffee, rice and rubber export data for May - Malaysian

Palm Oil Council webinar: Palm oil in post- pandemic - HOLIDAY:

Brazil

FRIDAY,

June 12:

- ICE

Futures Europe weekly commitments of traders report on coffee, cocoa, sugar positions - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - New

Zealand food prices - Shanghai

exchange’s weekly commodities inventory - HOLIDAY:

Russia

Source:

Bloomberg and FI

·

US CPI (M/M) May: -0.1% (est 0.0%; prev -0.8%)

US

CPI Ex Food, Energy (M/M) May: -0.1% (est 0.0%; prev -0.4%)

·

US CPI (Y/Y) May: 0.1% (est 0.3%; prev 0.3%)

US

CPI Ex Food, Energy (Y/Y) May: 1.2% (est 1.3%; prev 1.4%)

·

US Real Avg Hourly Earnings (Y/Y) May: 6.5% (prevR 7.6%; prev 7.5%)

US

Real Avg Weekly Earnings (Y/Y) May: 7.4% (prevR 7.0%; prev 6.9%)

·

US DoE Crude Oil Inventories (W/W) 05-Jun: 5720K (est -1850K; prev -2077K)

–

Distillate (W/W): 1568K (est 3500K; prev 9934K)

–

Cushing (W/W): -2279K (prev -1739K)

–

Gasoline (W/W): 866K (est -1000K; prev 2795K)

–

Refinery Utilzation (W/W): 1.30% (est 0.60%; prev 0.50%)

·

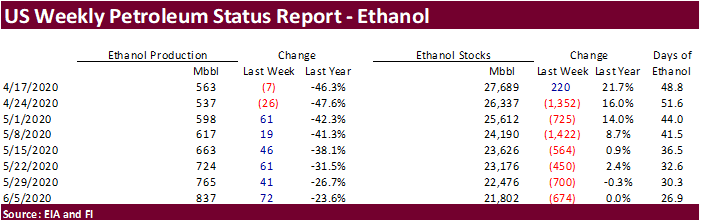

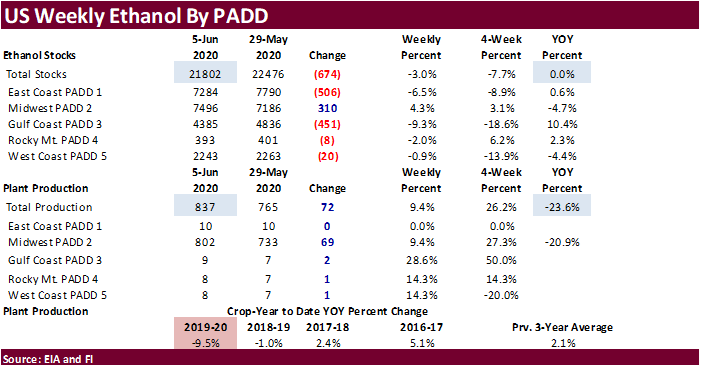

EIA-U.S. WEEKLY ETHANOL OUTPUT UP 72,000 BPD TO 837,000 BPD

·

EIA-U.S. WEEKLY ETHANOL STOCKS OFF 674,000 BBLS TO 21.8 MLN BBLS

·

EIA-U.S. WEEKLY GASOLINE OUTPUT UP 360,000 BPD TO 8.14 MLN BPD

·

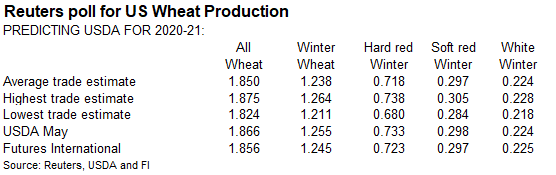

Although US ethanol production increased by most since at least 2010, CBOT corn ended lower on favorable weather prospects. USD was down 40 points after the close amid Fed leaving interest rates

unchanged for the rest of the year. Feds also warned of a 6.5 percent contraction for GDP, near expectations. WTI turned higher ending up moderately. There were a lot of corn call buying early during the day session.

·

Funds

sold an estimated net 8,000 corn contracts.

·

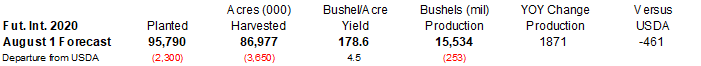

Based on the latest US crop rating, we are using 178.6 bushels per acre, above a 20-year trend of 174.6 bushels and one-tenth of a bushel above USDA May. Production is projected at a record 15.534

billion bushels, above 15.148 billion previous record in 2016-17.

·

Goldman Roll ends Thursday.

·

A Reuters story mentioned China bought Argentine sorghum. At least two cargoes were bought for July arrival. This is on top of 32,716 tons bought earlier this year. In all of 2019, shipments were

139,564 tons, up from 1,045 in 2018. In comparison, China imported 783,393 tons of US sorghum during the Jan-Apr period.

·

State-run Brazilian Institute of Geography and Statistics estimated 2020 grain & oilseed production at 245.9 million tons, 1.8% higher than 2019 (241.5MMT). 92.2% of the 2020 production consists

of soybeans, corn and rice.

- The

USDA Broiler Report showed eggs set in the US down slightly and chicks placed down 3 percent from a year earlier. Cumulative placements from the week ending January 4, 2020 through June 6, 2020 for the United States were 4.26 billion. Cumulative placements

were down 1 percent from the same period a year earlier. - China

said they are close to making an effective vaccine for African swine fever.

-

None

reported

-

July

corn is seen in a $3.20 and $3.40 range. December lows could reach $2.90 if US weather cooperates.