PDF Attached

Attached

are our US soybean complex balance sheets.

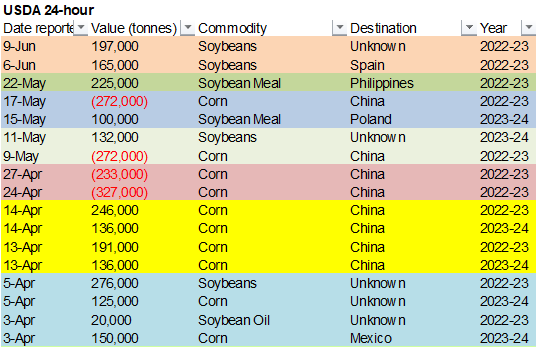

USDA:

Private exporters reported sales of 197,000 metric tons of soybeans for delivery to unknown destinations during the 2022/2023 marketing year.

US

mandate update

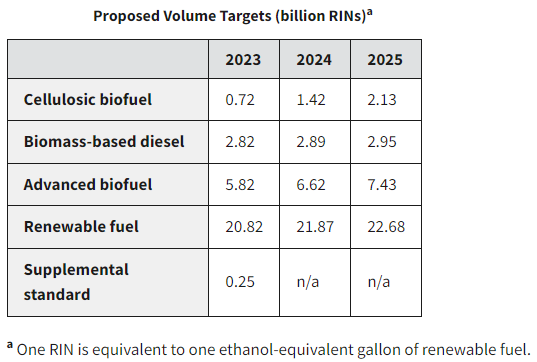

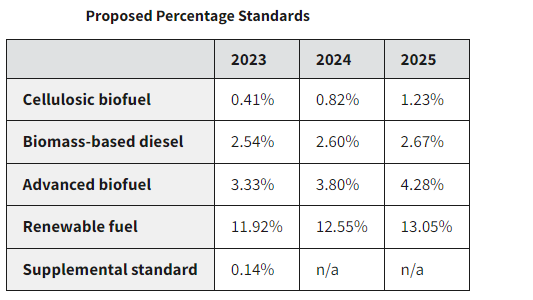

A

late afternoon Bloomberg article reported that the Biden Administration is expected to roll out biodiesel quotas short of what the industry was pushing for after a “lobbying crush.”

https://www.bloomberg.com/news/articles/2023-06-09/biden-plans-modest-biodiesel-quota-boost-after-lobbying-crush

The

EPA has up until the June 14th deadline to release mandates. “While the final targets are expected to be higher than the 2.82 billion gallon requirement originally proposed for this year, they are unlikely to hit the much higher volumes sought by

biodiesel producers…”

Final

results when released will be posted here: https://www.epa.gov/renewable-fuel-standard-program/news-notices-and-announcements-renewable-fuel-standard

December

proposed below

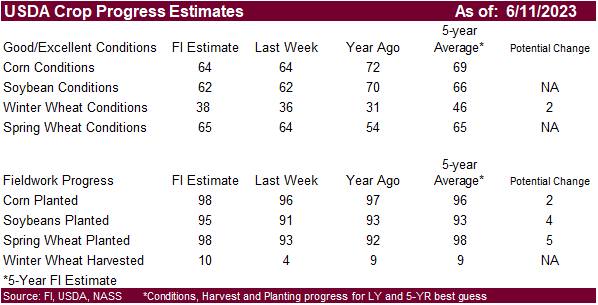

The

neutral USDA report did little for initial price reaction to CBOT soybean complex and grains. Traders today were focused on spot US soybean demand, technical breakout in soybean oil, product spreading, US weather, slow corn export demand, and USDA’s outlook

for ample global wheat supplies. Technical buying entered the Chicago wheat market post USDA report.

Neutral

overall with exception of global wheat supplies increasing 10.4 million tons from the previous month to 800.2 million tons, 11.7 million tons above 2022-23. This is one of the most uneventful USDA monthly reports we have seen in a while. Prices were little

changed after the report hit the wires, but soybeans and soybean oil rallied thereafter and grains remain mostly under pressure. The trade is already back to trading weather and demand. Next major report will be the June 1 stocks report which should give the

trade a glimpse if USDA overstated the 2022 US soybean and corn crops.

USDA

NASS briefing

https://www.nass.usda.gov/Newsroom/Executive_Briefings/index.php

USDA

OCE Secretary’s Briefing

https://www.usda.gov/oce/commodity-markets/wasde/secretary-briefing

there

were no changes in US soybean supply, as expected. Same goes with corn. All wheat production increased 6 million bushels from May with HRW up 11 million, partially offset by a reduction in SRW by 4 million and WW by 1 million. USDA made no changes to any other

wheat supply and demand categories for the old and new crop balance sheets. US all-wheat ending stocks were raised 6 million bushels. The trade was looking for a 7-million-bushel decrease. Look for minor adjustments to old crop all-wheat after the next round

of trade balance data and food use is released. The US old crop corn carryout was increased 35 million bushels due to a 15-million-bushel reduction in imports that was more than offset by a 50 million decrease in exports. The 50 million drop in exports was

more than we expected. USDA did not address the US corn for ethanol use of 5.250 billion bushels. We think they are still overstating this by at least 25 million, so we look for another increase in US 2022-23 corn stocks by at least that amount in the July

update, assuming USDA does not deviate much from actual June 1 corn stocks when updated at the end of this month. New-crop US corn carryout increased 35 million tons to 2.257 billion, 55 percent greater than 2022-23. Look for new-crop prices to continue

to grind lower if US weather improves. USDA lowered 2022-23 US soybean exports by 15 million bushels despite a higher-than-expected April Census export figure. With old crop commitments drying up, this could be justified, but it will all come down to how much

of the current crop year commitments will be rolled into new-crop. USDA made no changes to its new-crop US soybean balance sheet. Overall US ending stocks for wheat, corn, and soybeans for both old and new crop came in near trade expectations.

The

world balance sheets for 2022-23 reflected several minor changes to production and stocks. The carryout for all three major commodities came in near expectations as production estimates for Argentina corn and soybeans were near trade expectations. 2022-23

Argentina corn production was lowered 2 million tons to 35 million and soybeans lowered 2 million tons to 25 million tons. With nearly all the Argentina soybean crop collected, we think USDA has room to lower output next month by 2-3 million tons, based on

much of the trade penciling in a 21-million-ton estimate. For corn, Argentina collected a third of its crop, so the outcome of the size of the crop is yet to be determined. What was interesting in this report was 2023-24 global wheat production. At 800.2

million tons, that is 10.4 million above May, and 11.7 million above year ago. Global wheat stocks were upward revised 6.4 million tons to 270.7 million, a 1.5% increase from 2022-23. The question remains how much of that 2023 global wheat production will

be food grade wheat. JCI via Bloomberg article mentioned China could lose 10 million tons of food grade wheat from recent heavy rains, that will be used for feed. China wheat imports were raised 1.5 MMT to 12.0 MMT. USDA will likely address some of the global

supply issues in their upcoming reports over the summer. Note there was no change to Australian wheat production of 29 million tons, which could be overstated 3-3.5 million tons. Russia wheat output was raised to 85 MMT from 81.5 previous.

For

the rest of the month look for the trade to be sensitive to spot US demand and changes in the Northern Hemisphere weather outlooks.

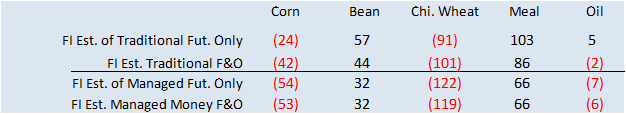

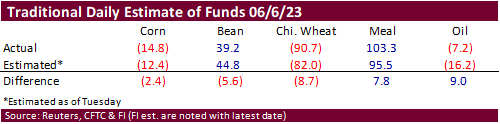

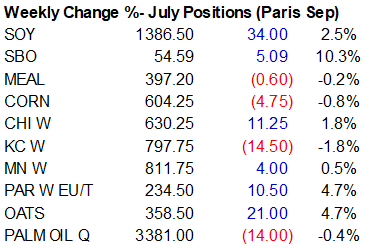

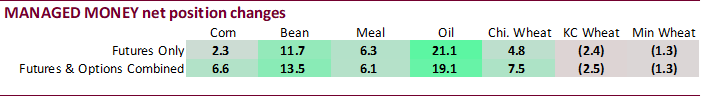

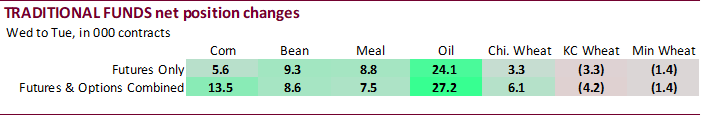

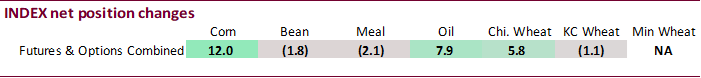

Fund

estimates as of June 9 (net in 000)

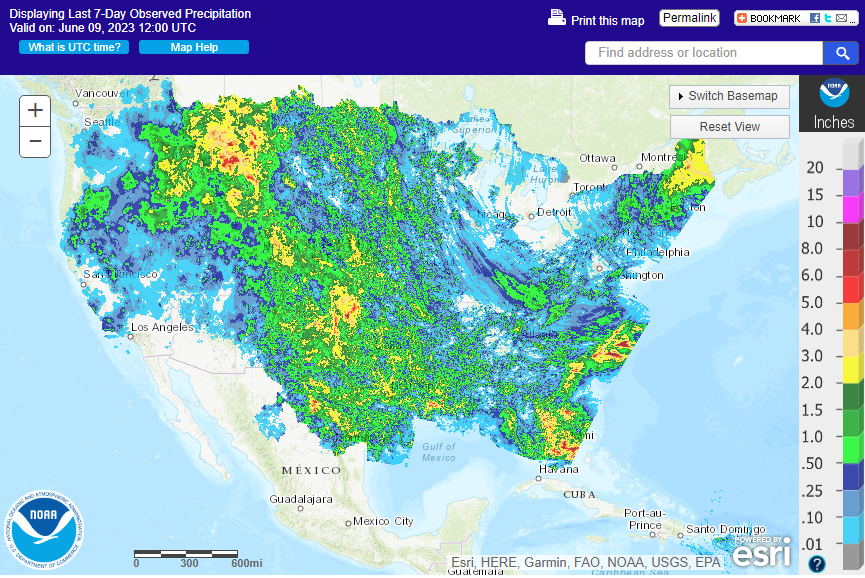

Past

7-days

WEATHER

TO WATCH

-

Frost

and freezes are expected in northwestern Russia Sunday and Monday, although the impact on production should be low -

Most

crops in the region will handle the cool weather without experiencing any serious damage to production potential -

Wheat

is not as far advanced in northwestern Russia as it is in southern areas where there is no risk of frost -

Tropical

Cyclone Biparjoy remains over the central Arabian Sea today and continues to disrupt the normal southwest monsoon flow across the region keeping India drier than usual in the south and eastern parts of the nation -

The

cyclone is expected to drift slowly to the north during the weekend and early next week staying over open water in the northern Arabian Sea by Tuesday -

Typhoon

Guchol remains over open water in the East Philippines Sea with very little potential for land impact -

The

storm will turn to the northeast this weekend and continue in that direction next week staying well to the southeast of Japan’s main islands -

Tropical

Cyclone 03B was located over the northern Bay of Bengal today and will drift into northwestern Myanmar this weekend with a low impact of moderate to heavy rain and no damaging wind -

Rice

and sugarcane will be impacted, but no crop damage is expected -

A

tropical disturbance moving into southwestern China produced torrential rain and serious flooding over the past two days with roughly 42 inches of rain being reported at one location in southern Guangxi -

There

are no tropical disturbances that have potential for development in the eastern Pacific Ocean, Caribbean Sea, Gulf of Mexico or Atlantic Ocean during the coming week -

U.S.

Midwest will experience cooler temperatures this weekend with a short term bout of reinforcing coolness early next week -

High

temperatures may come down to the upper 60s and 70s for a few days reducing crop stress, but rain does not fall significantly enough to bolster soil moisture in a major way leaving concern about the long term outlook -

West

Texas weather will trend warmer with only a few showers expected for a while -

This

trend will favor great planting and early season crop development potential after recent rain -

Southwestern

parts of West Texas never received heavy rainfall, but enough fell for dryland crop planting

-

Follow

up rain will be needed especially with temperatures reaching the 90s and getting closer to 100 next week -

Southeastern

U.S. and Delta are expecting periodic rain and seasonable temperatures during the next two weeks supporting good summer crop development -

U.S.

hard red winter wheat areas and other crops in the central Plains will experience a good mix of weather during the next ten days to two weeks -

Summer

crops will thrive in this environment -

Winter

crop filling, maturation and harvesting should advance well -

High

pressure ridge over western Canada this weekend and early next week will induce another five days of very warm temperatures and limited rainfall in the Prairies and across a part of the northern U.S. Plains -

High

temperatures in the 80s and lower to a few middle 90s are expected -

High

pressure ridge in western Canada breaks down during the middle part of next week and a trough of low pressure comes into to replace it -

This

situation raises the potential for cooling in much of Canada’s Prairies -

Showers

and thunderstorms should increase in the Prairies during the middle to latter part of next week, although atmospheric moisture in the region will be restricted -

Alberta

will get some needed rain during the middle to latter part of next week resulting in the potential for temporary relief from chronic dryness -

Sufficient

rain will fall in Alberta, Canada’s driest region during the second half of next week to stop the decline in crop conditions and induce a short term bout of crop improvement -

Follow

up rain will be very important -

U.S.

northern Plains and Canada’s southern Prairies will receive some needed rain in the latter part of next week and into the following weekend which may temporarily help improve topsoil moisture, but a better opportunity for rain should evolve early in the week

of June 19 -

Ontario

and Quebec, Canada will get some welcome rain next week while dry and mild to cool weather occurs over the balance of this week and during the weekend -

Mexico

drought will continue over the next ten days with rain only falling in eastern parts of the nation and in the far south -

Seasonal

rains are normally moving northward through southern and some central parts of the nation by now -

Northwestern

Europe will get some rain this weekend and then dry down again for a while next week -

The

moisture will provide a short term bout of improved crop development, though more rain is needed -

Northeastern

Europe will continue too dry and crop stress will prevail as temperatures get to warmer than usual levels while rain is largely limited -

Southern

Europe remains favorably moist and established crops are performing well -

There

is some need for greater sunshine and warmer weather, but most crops are dealing with the milder and wetter scenario relatively well -

Eastern

Russia’s New Lands and northern Kazakhstan will experience some showers and thunderstorms over the next week ten days, but greater rain will be needed to reduce concern over long term crop development after recent hot and dry conditions -

India

rainfall will continue limited away from the coastal areas for much of the next ten days -

Rainfall

so far this month has been well below normal in the southern half of the nation and in some far eastern production areas -

Southeast

Asia rainfall continues to occur routinely enough to support most crops favorably -

Northern

Europe temperatures will be warmer than usual this week and that will create a more stressful environment for crops as they deal with another week of dry conditions

-

Southern

Europe has been receiving frequent rainfall in recent weeks and the trend will continue for another week

-

Eastern

CIS New Lands will begin to receive some timely rainfall the remainder of this week bringing some relief to the drier biased areas of Kazakhstan and Russia’s eastern New Lands -

The

precipitation will be sporadic helping some areas more than others -

Kazakhstan

is not likely to get nearly as much rain and unirrigated crop stress will continue -

Russia’s

Volga River Basin will be drier than usual for this first week of the two week outlook raising crop moisture stress for some crops since the ground is already drying out -

There

is some potential for relief after June 14 -

Summer

crops in China are expected to see a mostly good mix of rain and sunshine during the next ten days -

Some

far southern China crop areas may become a little too wet during the next ten days.

-

Northeast

China will see sufficient rain to maintain a good outlook for corn, soybeans, sugarbeets and spring wheat -

There

is a dryness concern from northern Jilin into Inner Mongolia and “some” relief is possible in the next couple of weeks, although more rain will be needed -

Xinjiang,

China will experience more seasonable temperatures over the next two weeks -

The

province has struggled with coolness in recent weeks and crop development is behind the usual pace -

Production

potentials have decreased because of some reduced area planted and due to the poor early season start to crop development -

There

is concern over early season frost and freeze potentials coming along before the crop is fully mature

-

Monsoonal

rainfall is expected to occur in the mainland areas of Southeast Asia during the next two weeks resulting in improved sugarcane, rice and coffee conditions among other crops like corn -

Some

caution is needed since some of the computer forecast model data is exaggerating the anticipated rainfall

-

Philippines,

Indonesia and Malaysia will see a favorable mix of weather during the next two weeks supporting most crop needs -

Australia

weather over the next ten days trend a little drier, but recent rain has improved crop and field conditions in many production areas -

The

moisture will be ideal for wheat, barley and canola establishment -

A

boost in rainfall will be needed in Queensland and in interior South Australia and in some northern and eastern Western Australia crop areas -

South

Africa rainfall will be restricted over the next ten days, though some rain will benefit southwestern winter wheat, barley and canola production areas -

West-Central

Africa rainfall will be favorably distributed for coffee, cocoa, sugarcane and cotton as well as rice during the next ten days -

East-central

Africa has been and will continue to be favorably distributed from Uganda and southwestern Kenya to Ethiopia through the next ten days with western Ethiopia wettest relative to normal -

Argentina

weather over the next ten days will not provide much rainfall which will favor fieldwork in many areas, but no relief from dryness is likely in the southwest -

Brazil

weather during the coming will be more unsettled than in previous weeks resulting in some increases in topsoil moisture

-

Rain

is expected in southern Brazil and Paraguay Sunday into Wednesday of next week, June 11-14 -

A

greater amount of rain may impact areas from Parana to northern Rio Grande do Sul -

There

are no tropical cyclones in the Atlantic Ocean Basin today and none are expected -

Tropical

Cyclone Guchol in the Philippine Sea poses no threat to land -

Today’s

Southern Oscillation Index was -17.90 and it will move higher over the next week

Source:

World Weather, INC.

Bloomberg

Ag calendar

Friday,

June 9:

- USDA’s

World Agricultural Supply & Demand Estimates (WASDE), 12pm - China’s

agriculture ministry (CASDE) releases monthly supply and demand report - Sustainable

World Resources conference in Singapore - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report - Russia

grain union conference in Gelendzhik, day 4

Monday,

June 12:

- IGC

grains conference, London, day 1 - Malaysian

Palm Oil Board’s monthly report on stockpiles, production and exports - USDA

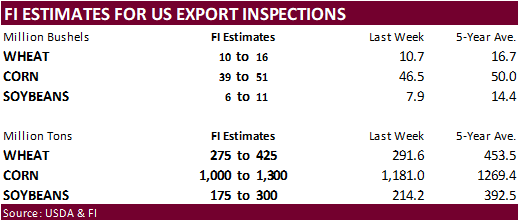

export inspections – corn, soybeans, wheat, 11am - US

corn, cotton, soybean, spring wheat and winter wheat condition, 4pm - US

planting data for corn, cotton, spring wheat and soybeans, 4pm - Incorporated

Society of Planters conference, Kuala Lumpur, June 12-14 - Brazil

Unica cane crush and sugar production report (tentative) - HOLIDAY:

Australia

Tuesday,

June 13:

- France

agriculture ministry’s report on field crops - IGC

grains conference, London, day 2 - EU

weekly grain, oilseed import and export data - Brazil’s

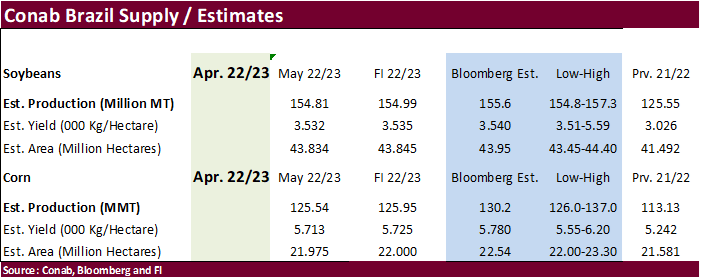

Conab issues production, area and yield data for corn and soybeans

Wednesday,

June 14:

- FranceAgriMer

monthly grains balance sheet - New

Zealand food prices - EIA

weekly US ethanol inventories, production, 10:30am

Thursday,

June 15:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports

Friday,

June 16:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report

CFTC

Commitment of Traders

Reuters

Table

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

-110,821 1,224 303,457 12,013 -142,381 -15,214

Soybeans

-1,116 9,844 108,025 -1,851 -82,469 -12,011

Soyoil

-33,498 20,398 104,677 7,888 -68,726 -26,777

CBOT

wheat -106,704 3,511 74,024 5,846 25,811 -9,761

KCBT

wheat -8,093 -1,094 39,081 -1,058 -26,061 654

=================================================================================

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

-44,492 6,573 240,058 -6,234 -157,097 -9,253

Soybeans

13,981 13,451 77,245 -7,356 -79,119 -5,293

Soymeal

65,816 6,140 92,412 -4,455 -195,261 -4,834

Soyoil

-18,306 19,143 114,277 854 -97,441 -26,510

CBOT

wheat -119,474 7,525 70,341 2,706 24,161 -9,228

KCBT

wheat 7,106 -2,523 33,116 1,242 -28,000 1,461

MGEX

wheat -8,974 -1,271 499 -1,058 4,815 1,454

———- ———- ———- ———- ———- ———-

Total

wheat -121,342 3,731 103,956 2,890 976 -6,313

Live

cattle 114,637 6,802 48,457 -1,862 -169,949 -719

Feeder

cattle 18,070 639 1,145 195 -8,310 -2,544

Lean

hogs -16,173 14,936 51,510 1,123 -34,144 -8,640

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

11,782 6,936 -50,253 1,978 1,785,372 23,490

Soybeans

12,333 -4,820 -24,440 4,018 854,072 6,205

Soymeal

20,065 1,389 16,969 1,761 551,768 12,989

Soyoil

3,922 8,022 -2,452 -1,508 610,612 -2,920

CBOT

wheat 18,102 -1,407 6,869 404 489,163 13,293

KCBT

wheat -7,295 -1,678 -4,926 1,498 212,187 7,580

MGEX

wheat 2,228 -123 1,432 997 63,213 1,567

———- ———- ———- ———- ———- ———-

Total

wheat 13,035 -3,208 3,375 2,899 764,563 22,440

Live

cattle 21,690 -6,835 -14,836 2,613 411,844 103

Feeder

cattle 1,841 1,232 -12,747 479 79,149 -568

Lean

hogs -2,620 -4,566 1,428 -2,855 325,110 -13,954

Macros

102

Counterparties Take $2.128 Tln At Fed Reverse Repo Op. (prev 108 Counterparties Take $2.162 Tln)

Canadian

Net Change In Employment May: -17.3K (est 21.3K; prev 41.4K)

Canadian

Unemployment Rate May: 5.2% (est 5.1%; prev 5.0%)

Canadian

Hourly Wage Rate Permanent Employees (Y/Y) May: 5.1% (est 5.1%; prev 5.2%)

Canadian

Participation Rate May: 65.5% (est 65.6%; prev 65.6%)

Canadian

Full Time Employment Change May: -32.7K (prev -6.2K)

Canadian

Part Time Employment Change May: 15.5K (prev 47.6K)

Canadian

Capacity Utilization Rate Q1: 81.9% (est 82.0%; prevR 81.8%)

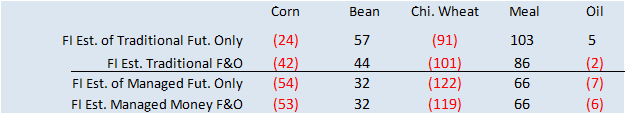

Corn

·

July/September corn spreads eased today by 2 cents on profit taking and an unchanged US new crop balance sheet other than a higher carrying resulting in a 35 million bushel increase in 2023-24 stocks.

·

Today was day 3 of the Goldman roll.

·

Buenos Aires Grains Exchange reported about a third of the Argentina corn crop had been collected and production at 36 million tons. The wheat crop is expected to total 18 million tons.

·

USDA will update their S&D estimates later today. For South America, look for them to cut current crop year Argentina soybean and corn production by 3 and 1 million tons, respectively. No changes are expected for Brazil corn and

soybean production, for 2022-23. We expect no change to US 2023 corn or soybean harvested & yields from May.

Export

developments.

-

Results

are awaited for Algeria seeking up to 140,000 tons of corn for July-Aug 15 shipment.

September

corn $4.50-$5.75

December

corn $4.25-$5.75

·

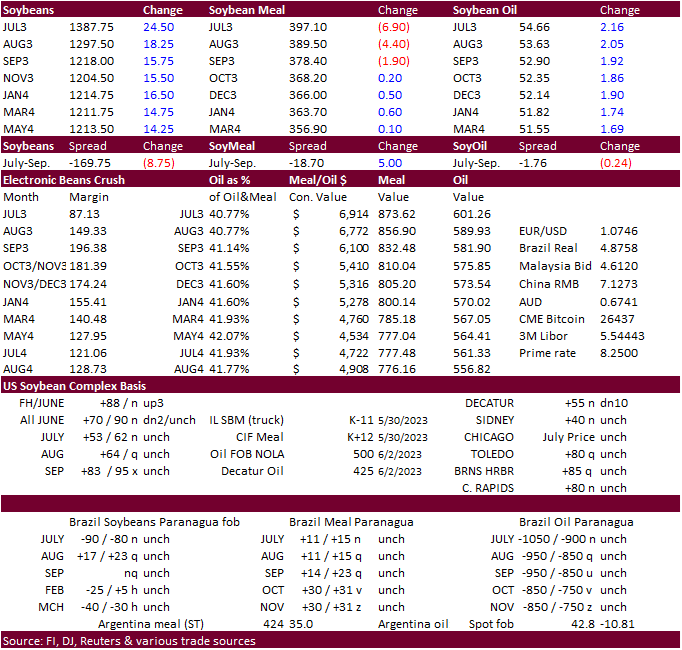

During the session soybean meal turned and ended mixed. Soybean oil ended 169 to 209 points higher (bull spreading). Earlier this week there was talk US food end users were seeking coverage for soybean oil. Meanwhile, biofuel

companies have been actively seeking coverage for a few weeks.

·

There are rumors that the EU is importing US soybeans to crush and sell back biodiesel to the US. This already happened before.

·

On paper US soybean oil stocks are large and there is no need to currently increase domestic crush to get to the oil, but US industrial and food demand for the product has increased this month.

·

China in its monthly S&D update raised 2022-23 edible vegetable oil production by 690,000 tons to 29.9 million tons in large part to an upward revision to rapeseed oil production. With a rise in rapeseed imports and higher rapeseed

oil output, China lowered their soybean oil import estimate for 2023-24 by 700,000 tons to 500,000 tons, a 58 percent decrease from the previous month, but still 100,000 tons above the 2022-23 season. Rapeseed oil production for 2022-23 was projected at 7.2

million tons, up from the May outlook of 6.5 million tons. China rapeseed imports since January 1 are running at around 1.2 million tons, about 35 percent above the same period year earlier. China’s CASDE reflected minor changes to other commodity estimates

for 2022-23 and for 2023-24, there were no changes in commodity estimates other than the lower soybean oil import projection.

·

(Reuters) Canada will join dispute settlement consultations between the U.S. and Mexico over genetically modified (GM) corn as a third party…”Canada shares the concerns of the U.S. that Mexico’s measures are not scientifically

supported and have the potential to unnecessarily disrupt trade in the North American market,” Canadian Agriculture Minister Marie-Claude Bibeau and International Trade Minister Mary Ng said in a joint statement.

·

Buenos Aires Grains Exchange reported Argentina’s soybean harvest progress at 94 percent complete and production at 21 million tons.

·

Rosario grains exchange noted truck arrivals into ports were down 62 percent during the March-May period from a 5-year average.

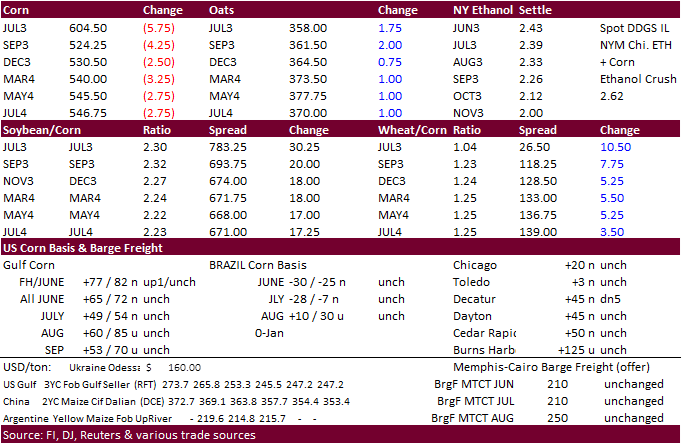

July/August

soybean oil spread.

This was at a carry a couple weeks ago. Talk of US industrial then food processor demand fueled this big move this week.

Source:

Eikon and FI

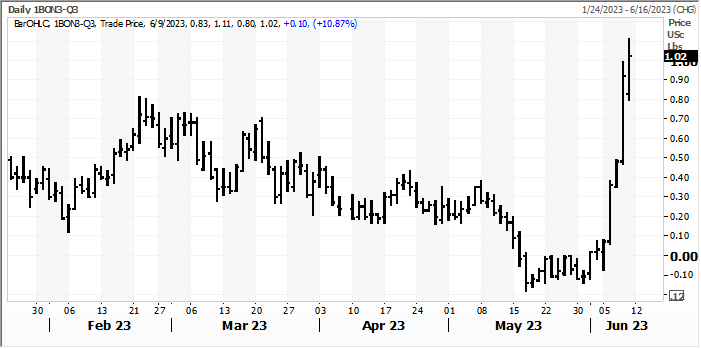

August

soybean oil share

Source:

Eikon and FI

·

Under the 24-hour announcement system, US exporters sold 197,000 tons of soybeans to unknown for 2022-23 delivery.

·

Iran was thought to have passed on 120,000 tons of soybean meal from Brazil for July and/or August shipment.

·

Algeria is in for 35,000 tons of soybean meal today for July 1-15 shipment.

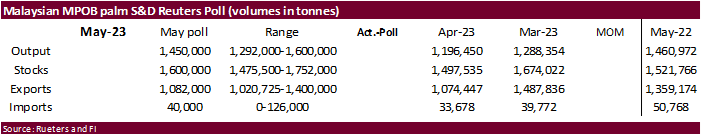

Reuters

MPOB estimates

Soybeans

– July $13.00-$14.25, November $11.00-$14.50

Soybean

meal – July $360-$415, December $290-$450

Soybean

oil – July 52.50-56.00, December 43-53

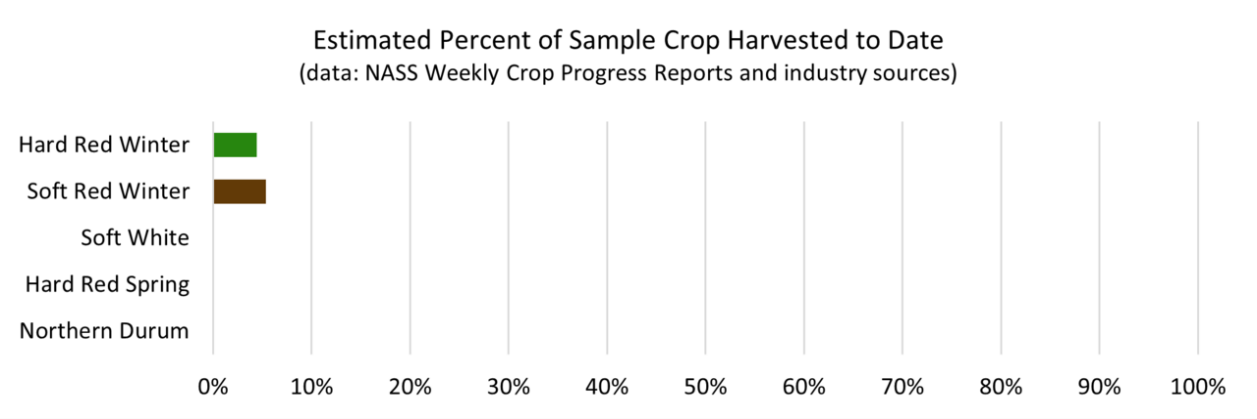

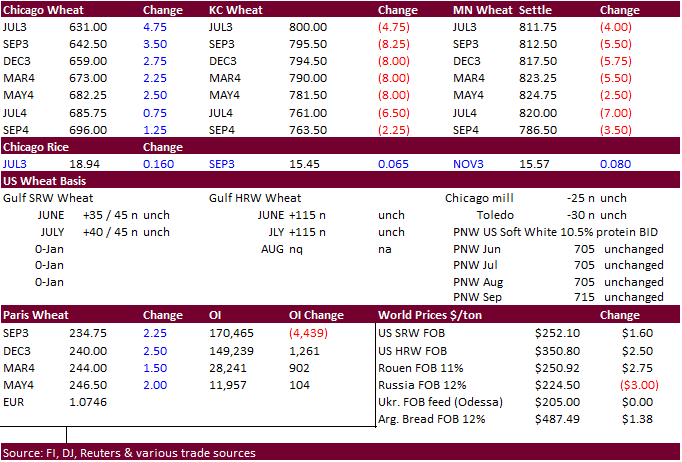

Wheat

·

US wheat futures ended mixed with Chicago higher (technical buying) and KC &MN lower despite rain expected for the Great Plains one time or another through late next workweek. Not all areas will see rain but any precipitation

will be welcome for the central and northern growing areas.

·

Canadian Prairies have an opportunity for rain for the western and central areas mid to late next week as the high-pressure ridge breaks down.

·

A Bloomberg article citing JCI mentioned the share of China’s feed wheat will likely increase by 10 million tons to about 35 million, that could increase import demand. USDA left their China 2023-24 China wheat production estimate

unchanged at 140 million tons, but raised imports by 1.5 million tons to 12.0 million (137.7 and 14.0 million, respectively, for 2022-23).

·

US Wheat Associates noted HRW wheat harvesting progress will advance across central OK during the upcoming wheat and that SW in the Pacific Northwest is in stable condition.

·

September Paris milling wheat officially closed 2.25 euros higher, or 1.0%, at 234.50 euros a ton (about $252.00 ton).

·

French wheat crop ratings for the week ending June 5 fell to 88 percent G/E from 91 percent previous week and 93 percent two weeks ago. Year ago, its was at 66 G/E.

Export

Developments.

·

Tunisia passed on 100,000 tons of soft milling wheat for July 1 through August 15 shipment.

·

Morocco seeks 500,000 tons of feed barley on June 14.

·

Taiwan seeks about 56,000 tons of US wheat from the US on June 14 for July 31-August 14 shipment off the PNW.

Rice/Other

·

Results awaited: South Korea seeks about 62,200 tons of rice, 44,400 tons from China and rest from Vietnam, on June 8, for arrival between September 1-30.

(updated 6/9)

July $5.85-$6.50, September $5.50-$6.75

KC – July $7.60-$8.50, September $7.50-$9.00

MN – July $7.75-$8.50, September $7.25-$9.00

#non-promo