PDF Attached

The

6–10-day precipitation outlook for the US Midwest turned drier. Rain will fall across WI on Friday & Saturday, IA Saturday, and the central areas Sunday, before lingering in the east Monday. A good portion of the Great Plains is still slated to see rain. NOAA’s

prediction of El Nino does not necessarily mean US summer crops are in any imminent danger (see weather section). The USD was down 74 points, supportive for CBOT ags. Export sales were mostly within expectations. There was technical buying and positioning

today ahead of the USDA report. Soybean oil was sharply higher on talk of lack of US end user coverage.

Fund

estimates as of June 8 (net in 000)

![]()

US

CPC: El Nino update – 56% chance during November-January, and an 84% chance of exceeding moderate strength.

NOAA’s

prediction of 56% chance of peak strength joins Australia’s weather group (BOM) to officially declare El Nino has begun. The

last strong El Nino event was back in 2016, when Pacific waters warmed near the central areas of the ocean. But we note

in 2016, US corn and soybean yields came in above trend (see attached SST’s versus yields & trend after the text).

WEATHER

TO WATCH

-

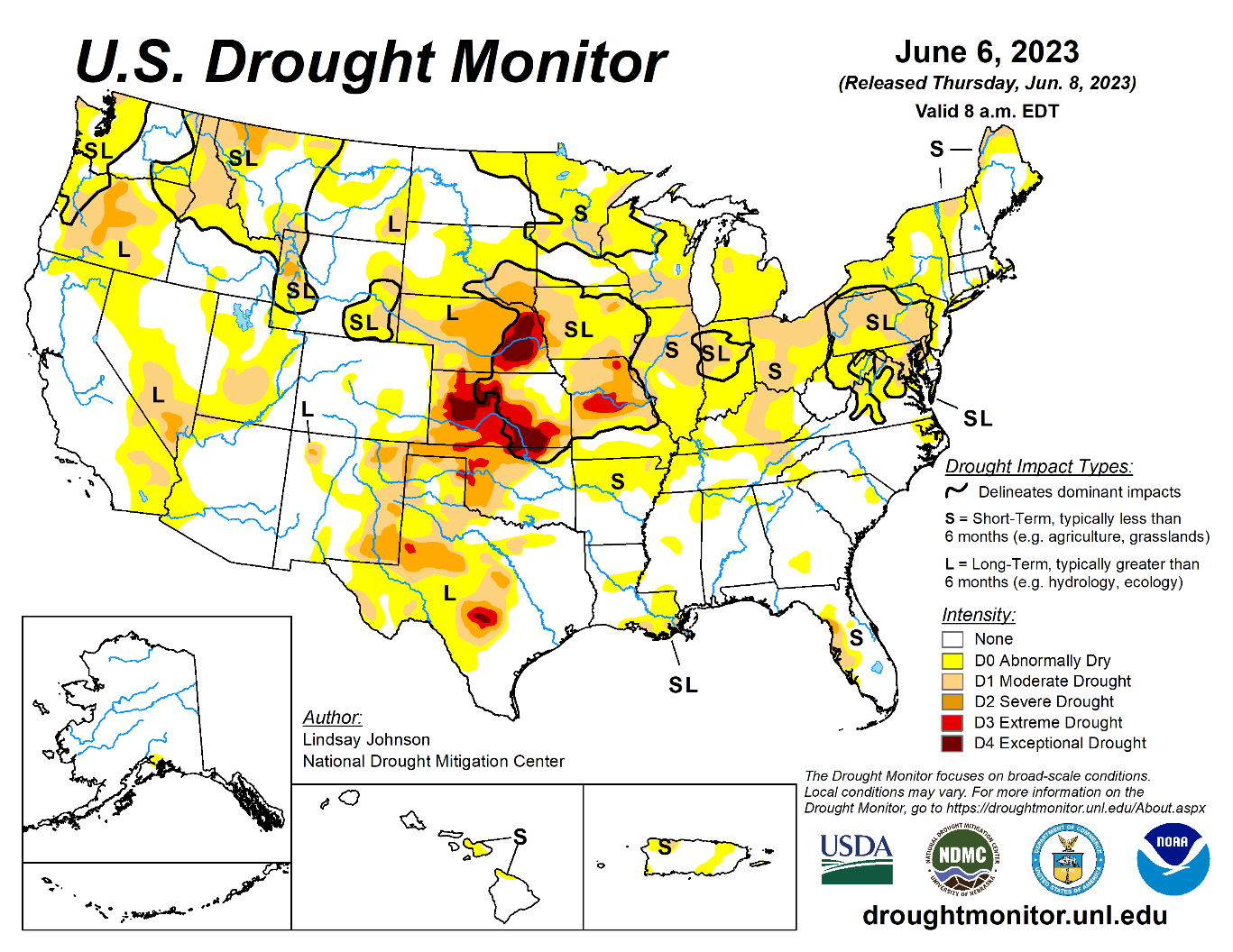

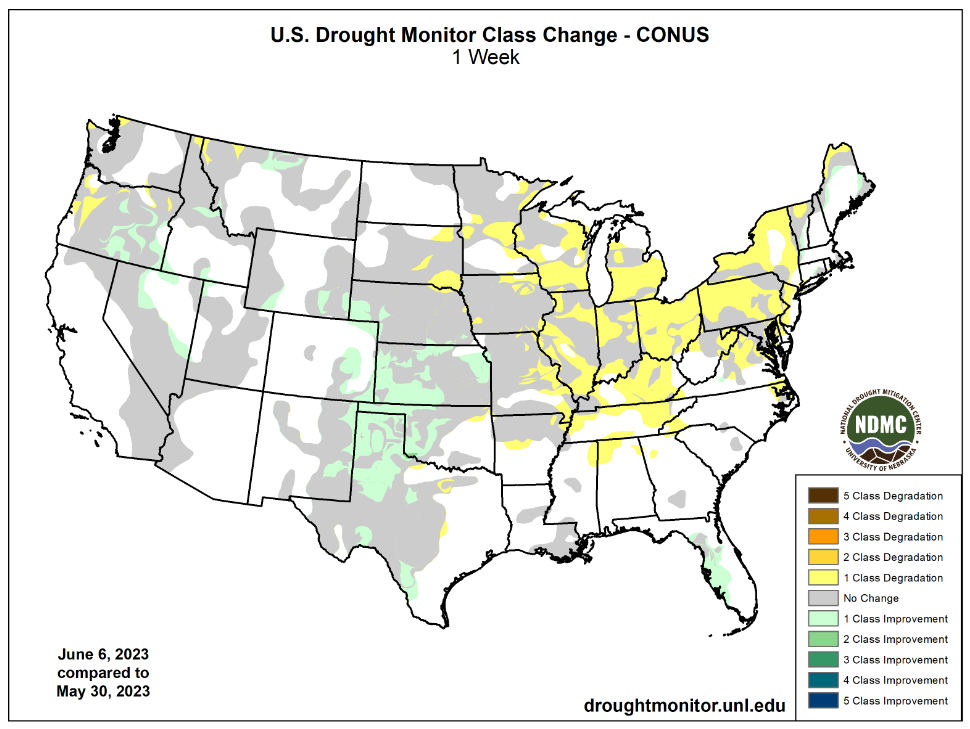

Low

soil moisture in the U.S. crop areas and recent warm weather has expanded crop stress and raised more market worry over the fate of crops -

Cooling

in the next week will reduce that stress and even though rain is advertised it is likely to be sporadic and light enough to maintain some concern over crop conditions and production potential especially in the longer range outlook since this is only June and

there is a lot of summer weather still yet to come -

GFS

model is predicting too much rain for the U.S. Midwest, Delta and southeastern states during days 11-15 -

The

European model is preferred in the first ten days of the outlook -

Rain

in the U.S. Midwest will begin in the western Corn Belt this weekend and advance to the east next week -

Rainfall

may prove a little disappointing for some areas and a close watch on its distribution is warranted -

Cooler

temperatures in the U.S. Midwest will help conserve soil moisture through lower evaporation rates -

Most

of the U.S. Midwest rainfall in the coming ten days will not be enough to seriously bolster soil moisture, but enough will occur in conjunction with milder temperatures to support a some improvement in crop conditions -

Keeping

crops viable prior to reproduction can leave production potentials quite high, but serious moisture shortages prior to reproduction can result in greater production cuts if and when reproduction occurs without an improvement in precipitation -

Less

rain and more sunshine in U.S. hard red winter wheat areas in the next two weeks should bode well for improved crop and field conditions -

Rain

will still fall relatively often, but with better drying between rain events -

West

Texas cotton, corn and sorghum areas will experience a good mix of light showers and sunshine, though there is need for greater warmth -

Some

southwestern counties in West Texas did not get adequate relief from dryness and still need greater rain -

Temperatures

will continue cooler than usual into the weekend, but next week’s temperatures will be a little closer to normal -

The

longer range outlook will promote less rain and greater warmth in West Texas presenting a more favorable outlook for crop development later this summer -

Soil

and crop conditions in the heart of central, eastern and southern Texas are mostly good for developing cotton, corn and sorghum -

Canada’s

southwestern Prairies will not likely get much drought relief for a little while, although some sporadic showers are expected -

Ontario

and Quebec, Canada will get some welcome rain next week while dry and mild to cool weather occurs over the balance of this week and during the weekend -

Mexico’s

drought remains serious with western and central parts of the nation quite warm to hot and dry over the next week to ten days -

Tropical

Cyclone Biparjoy in the Arabian Sea will spend several days over open water and it will disrupt normal monsoon rainfall in southern and eastern parts of the nation -

There

are no tropical cyclones in the Atlantic Ocean Basin today and none are expected -

Tropical

Cyclone Guchol in the Philippine Sea poses no threat to land -

Tropical

Cyclone Biparjoy will remain over the open water of the Arabian Sea through June 13, though it still has potential to impact Pakistan and Oman -

Southeast

Asia rainfall continues to occur routinely enough to support most crops favorably -

Northern

Europe temperatures will be warmer than usual this week and that will create a more stressful environment for crops as they deal with another week of dry conditions

-

Southern

Europe has been receiving frequent rainfall in recent weeks and the trend will continue for another week

-

Eastern

CIS New Lands will begin to receive some timely rainfall the remainder of this week bringing some relief to the drier biased areas of Kazakhstan and Russia’s eastern New Lands -

The

precipitation will be sporadic helping some areas more than others -

Kazakhstan

is not likely to get nearly as much rain and unirrigated crop stress will continue -

Russia’s

Volga River Basin will be drier than usual for this first week of the two week outlook raising crop moisture stress for some crops since the ground is already drying out -

There

is some potential for relief after June 14 -

Summer

crops in China are expected to see a mostly good mix of rain and sunshine during the next ten days -

Some

far southern China crop areas may become a little too wet during the next ten days.

-

Northeast

China will see sufficient rain to maintain a good outlook for corn, soybeans, sugarbeets and spring wheat -

There

is a dryness concern from northern Jilin into Inner Mongolia and “some” relief is possible in the next couple of weeks, although more rain will be needed -

Xinjiang,

China will experience more seasonable temperatures over the next two weeks -

The

province has struggled with coolness in recent weeks and crop development is behind the usual pace -

Production

potentials have decreased because of some reduced area planted and due to the poor early season start to crop development -

There

is concern over early season frost and freeze potentials coming along before the crop is fully mature

-

Monsoonal

rainfall is expected to occur in the mainland areas of Southeast Asia during the next two weeks resulting in improved sugarcane, rice and coffee conditions among other crops like corn -

Some

caution is needed since some of the computer forecast model data is exaggerating the anticipated rainfall

-

Philippines,

Indonesia and Malaysia will see a favorable mix of weather during the next two weeks supporting most crop needs -

Australia

weather over the next ten days trend a little drier, but recent rain has improved crop and field conditions in many production areas -

The

moisture will be ideal for wheat, barley and canola establishment -

A

boost in rainfall will be needed in Queensland and in interior South Australia and in some northern and eastern Western Australia crop areas -

South

Africa rainfall will be restricted over the next ten days, though some rain will benefit southwestern winter wheat, barley and canola production areas -

West-Central

Africa rainfall will be favorably distributed for coffee, cocoa, sugarcane and cotton as well as rice during the next ten days -

East-central

Africa has been and will continue to be favorably distributed from Uganda and southwestern Kenya to Ethiopia through the next ten days with western Ethiopia wettest relative to normal -

Argentina

weather over the next ten days will not provide much rainfall which will favor fieldwork in many areas, but no relief from dryness is likely in the southwest -

Brazil

weather during the coming will be more unsettled than in previous weeks resulting in some increases in topsoil moisture

-

Rain

is expected in southern Brazil and Paraguay Sunday into Wednesday of next week, June 11-14 -

A

greater amount of rain may impact areas from Parana to northern Rio Grande do Sul -

Today’s

Southern Oscillation Index was -18.80 and it will move higher over the next week

Source:

World Weather, INC.

Friday,

June 9:

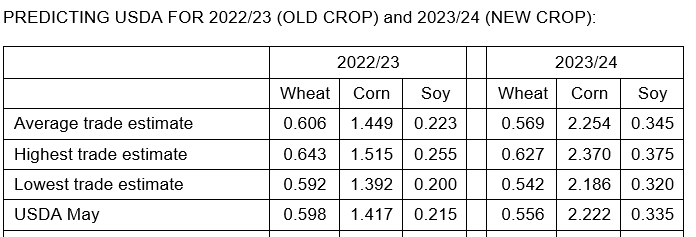

- USDA’s

World Agricultural Supply & Demand Estimates (WASDE), 12pm - China’s

agriculture ministry (CASDE) releases monthly supply and demand report - Sustainable

World Resources conference in Singapore - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report - Russia

grain union conference in Gelendzhik, day 4

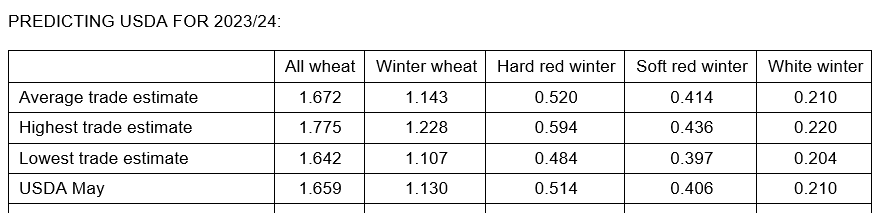

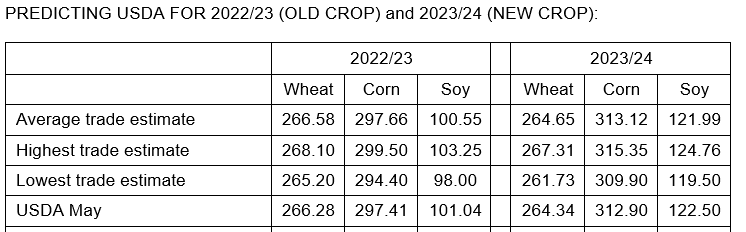

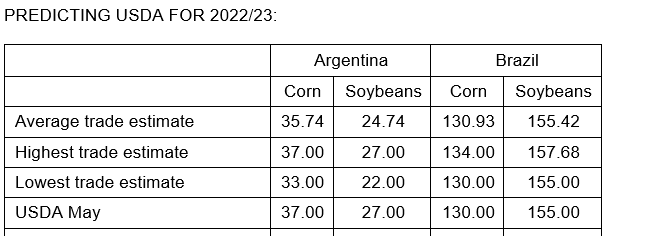

Reuters

estimates for USDA S&D

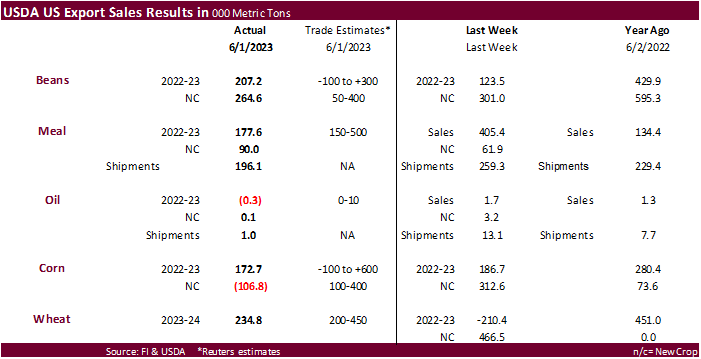

USDA

export sales

Wheat

new-crop

Macros

US

Jobless Claims Rose To 261,000 Jun 3 Week (Consensus 235,000) From 233,000 Prior Week (Previous 232,000)

US

Jobless Claims 4-Wk Avg Rose To 237,250 Jun 3 Week From 229,750 Prior Week (Previous 229,500)

US

Continued Claims Fell To 1.757 Mln May 27 Week (Con. 1.800 Mln) From 1.794 Mln Prior Week (Prev 1.795 Mln)

US

Insured Unemployment Rate Unchanged At 1.2% May 27 Week From 1.2% Prior Week (Prev 1.2%)

US

Freddie Mac 30-Year Fixed Rate Mortgages 08-Jun Wk: 6.71% (prev 6.79%)

US

Household Change In Net Worth (USD) Q1: 3.026T (prev R 1.619T)

104

Counterparties Take $2.142 Tln At Fed Reverse Repo Op. (prev 108 Counterparties Take $2.162 Tln)

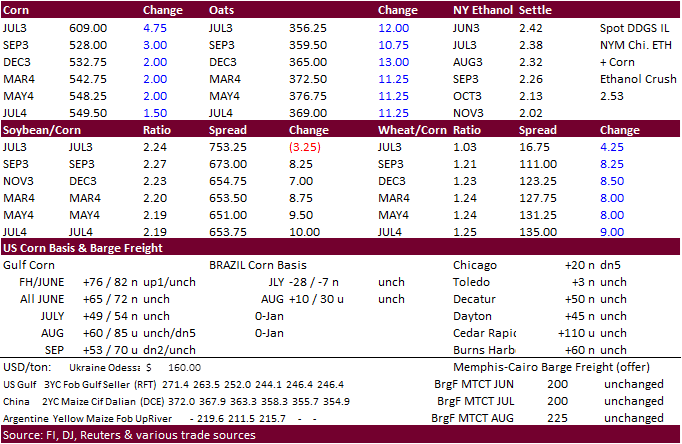

Corn

·

Day 2 of the Goldman roll.

·

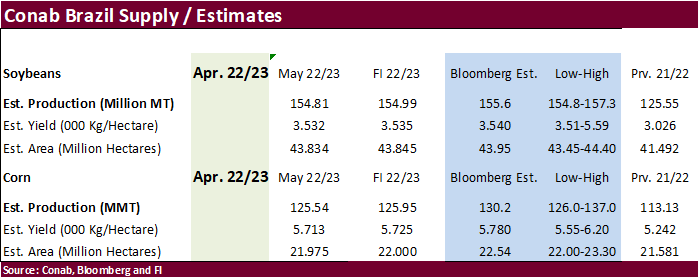

USDA will update their S&D estimates on Friday. For South America, look for them to cut current crop year Argentina soybean and corn production by 3 and 1 million tons, respectively. No changes are expected for Brazil corn and

soybean production, for 2022-23. We expect no change to US 2023 corn or soybean harvested & yields from May.

University

of Illinois – Brazil Harvesting Record Second Corn Crop, As Prices Fall and Sales Stall

Colussi,

J., N. Paulson, G. Schnitkey and J. Baltz. “Brazil Harvesting Record Second Corn Crop, As Prices Fall and Sales Stall.”

farmdoc daily (13):104, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 7, 2023.

EIA:

Increased U.S. renewable and natural gas generation likely to reduce summer coal demand

U.S.

Energy Information Administration – EIA – Independent Statistics and Analysis

Adjusting

Reference Prices Based on Changes in Cost of Production.

Bart

Fischer, Texas A&M University

Export

developments.

-

South

Korea’s NOFI group bought 66,000 tons of South American or South African corn at $244.89/ton c&f for arrival around October 30.

-

South

Korea’s MFG group bought 132,000 tons of South American corn at $244.33/ton c&f for arrival around October 28.

-

The

Philippines bought an estimated 50,000 tons of South American corn at $350 to $280 per ton c&f for August shipment.

-

Results

are awaited on Algeria seeking up to 140,000 tons of corn for July-Aug 15 shipment.

Updated

06/6/23

July

corn $5.75-$6.35

September

corn $4.50-$5.75

December

corn $4.25-$5.75

·

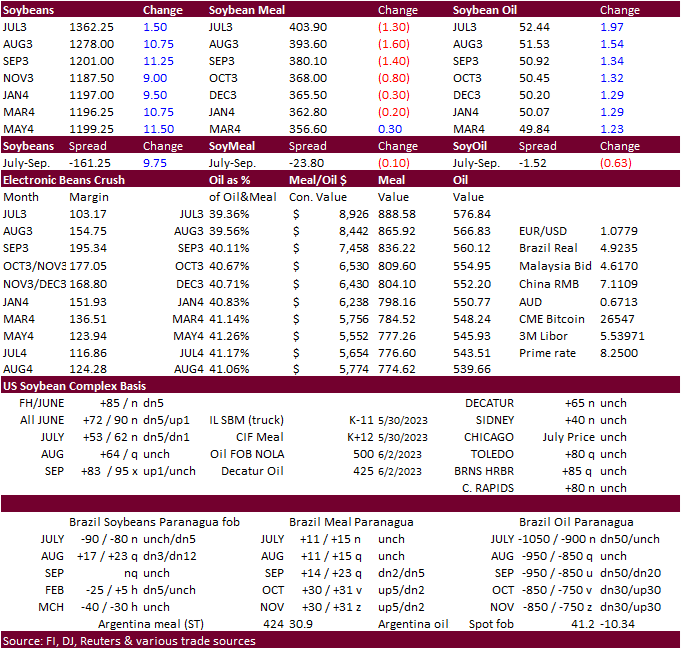

CBOT soybeans closed higher after a lower open on technical buying and strength in soybean oil which rallied 130 to 203 points. We heard some US domestic end users were not fully covered. August soybean oil broke out of a downward

trend channel during the session and was trading near its 50-day MA late session. Nearby soybean spread profit taking occurred during the session. Soybean meal closed lower in the 2023 contracts on product spreading.

·

Don’t discount USDA lowering their 2022-23 US carryout post June 1 quarterly stocks report. They left the US carryout unchanged in their monthly update after March 1 stocks were reported below trade expectations.

·

August Malaysia palm futures decreased 56 ringgit to 3264 and Aug. cash fell $10.00 to $765/ton.

Export

Developments

·

Results awaited: Iran seeks 120,000 tons of soybean meal from Brazil for July and/or August shipment.

·

Algeria is in for 35,000 tons of soybean meal today for July 1-15 shipment.

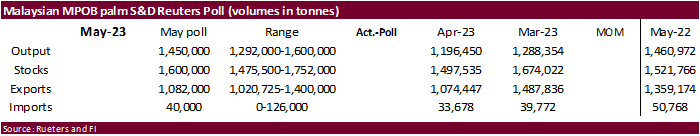

Reuters

MPOB estimates

Soybeans

– July $13.00-$14.00, November $11.00-$14.50

Soybean

meal – July $370-$420, December $290-$450

Soybean

oil – July 50-54,

December 43-53

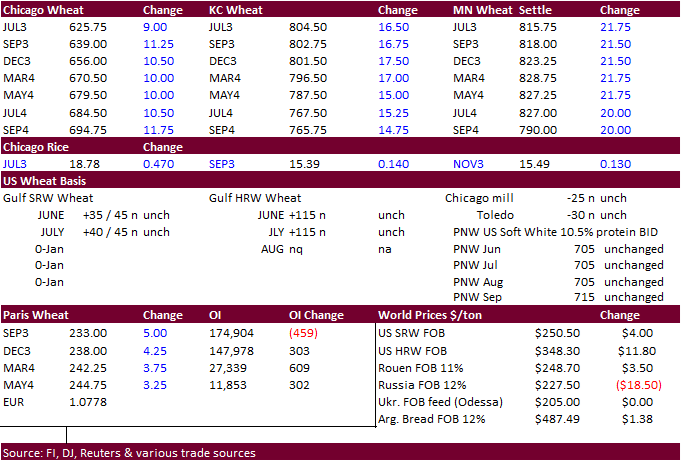

Wheat

·

US wheat futures were higher on technical buying (was down sharply Wednesday) and global supply concerns. Ukraine said they could lose millions of tons of crops from flooding and lack of irrigation after the dam collapsed.

·

The US Great Plains will see rain one time or another over the next seven days.

·

December Paris wheat futures are up 0.50 euro earlier at 230.75 per ton.

·

Kazakhstan shipped its first wheat cargo to China. They look to export up to 1 million tons per this marketing year per recent agreement.

·

Egypt bought 3.2 million tons of local wheat so far this crop season. A senior government official told Reuters that Egypt will not achieve local purchases of 4 million tons this season.

·

Egypt’s latest import tender, a cargo from Russia, might be cancelled over a price dispute related to Russia’s minimum export price on wheat.

·

Iraq bought 3 million tons of wheat in the local market out of 4.0-4.5 million tons expected to be produced.

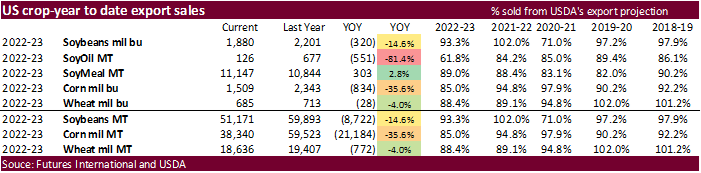

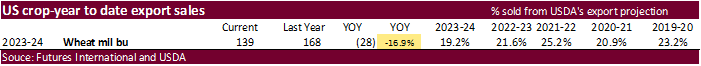

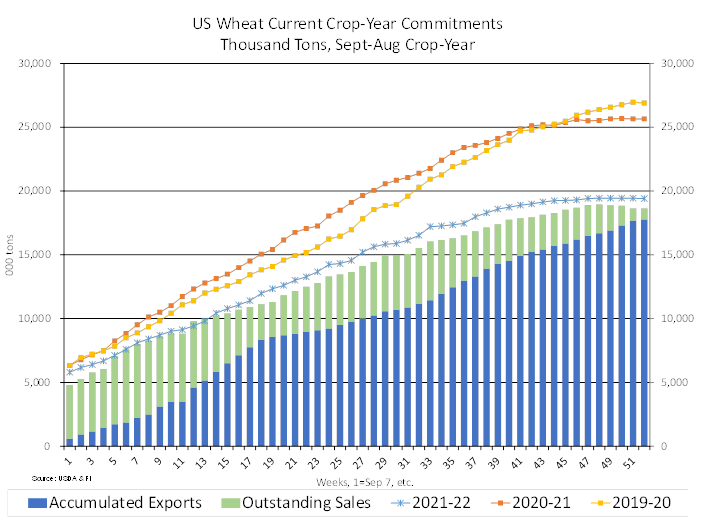

2022-23

complete crop year US wheat commitments versus previous three years

Export

Developments.

·

Tunisia seeks 100,000 tons of soft milling wheat on June 9 for July 1 through August 15 shipment.

·

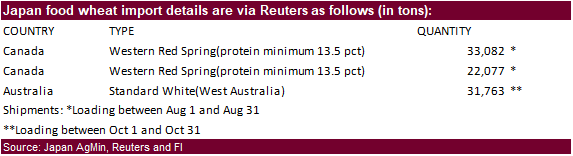

Japan bought 86,922 tons of food wheat this week for August shipment. Original tender details as follows.

·

Morocco seeks 500,000 tons of feed barley on June 14.

·

Taiwan seeks about 56,000 tons of US wheat from the US on June 14 for July 31-August 14 shipment off the PNW.

Rice/Other

·

South Korea seeks about 62,200 tons of rice, 44,400 tons from China and rest from Vietnam, on June 8, for arrival between September 1-30.

Chicago

Wheat – July $5.75-$6.50, September $5.50-$6.75

KC

– July $7.75-$8.75, September $7.50-$9.00

MN

– July $7.75-$8.75,

September $7.25-$9.00

U.S.

EXPORT SALES FOR WEEK ENDING 6/1/2023

|

|

CURRENT |

NEXT |

||||||

|

COMMODITY |

NET |

OUTSTANDING |

WEEKLY |

ACCUMULATED |

NET |

OUTSTANDING |

||

|

CURRENT |

YEAR AGO |

CURRENT |

YEAR AGO |

|||||

|

WHEAT |

THOUSAND |

|||||||

|

HRW |

18.2 |

674.0 |

1,160.1 |

53.4 |

53.4 |

62.8 |

0.0 |

0.0 |

|

|

56.6 |

1,076.2 |

919.6 |

26.7 |

26.7 |

31.2 |

0.0 |

0.0 |

|

|

152.8 |

1,123.1 |

1,367.0 |

81.9 |

81.9 |

60.0 |

0.0 |

0.0 |

|

|

7.2 |

628.4 |

835.8 |

28.1 |

28.1 |

58.0 |

0.0 |

0.0 |

|

|

0.0 |

94.4 |

64.4 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

|

234.8 |

3,596.1 |

4,346.8 |

190.1 |

190.1 |

212.0 |

0.0 |

0.0 |

|

BARLEY |

0.0 |

9.3 |

13.8 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

CORN |

172.7 |

6,553.3 |

11,840.2 |

1,244.7 |

31,785.5 |

47,681.9 |

-106.8 |

2,958.4 |

|

SORGHUM |

65.2 |

436.2 |

914.6 |

50.8 |

1,405.9 |

5,889.7 |

0.2 |

63.2 |

|

SOYBEANS |

207.2 |

2,792.8 |

9,883.4 |

247.6 |

48,377.8 |

50,008.7 |

264.6 |

3,117.3 |

|

SOY |

177.6 |

2,740.5 |

2,606.5 |

196.1 |

8,406.8 |

8,237.8 |

90.0 |

606.9 |

|

SOY |

-0.3 |

49.2 |

98.1 |

1.0 |

77.0 |

578.7 |

0.1 |

3.9 |

|

RICE |

|

|

|

|

|

|

|

|

|

|

1.5 |

104.2 |

125.3 |

49.0 |

623.3 |

1,139.8 |

16.0 |

22.0 |

|

|

0.0 |

32.7 |

7.5 |

0.7 |

25.3 |

13.4 |

0.0 |

5.0 |

|

|

0.1 |

5.5 |

5.0 |

0.5 |

18.7 |

49.0 |

0.0 |

0.0 |

|

|

0.0 |

21.6 |

9.9 |

0.0 |

24.0 |

77.6 |

0.0 |

0.0 |

|

|

9.1 |

94.7 |

62.0 |

19.9 |

623.5 |

705.7 |

0.0 |

40.0 |

|

|

0.7 |

75.2 |

169.6 |

0.7 |

240.2 |

350.6 |

0.0 |

40.2 |

|

|

11.4 |

333.9 |

379.3 |

70.8 |

1,555.0 |

2,336.1 |

16.0 |

107.2 |

|

COTTON |

|

THOUSAND |

|

|||||

|

|

480.4 |

3,730.1 |

5,073.4 |

317.0 |

9,781.0 |

10,438.8 |

30.8 |

1,715.9 |

|

|

2.1 |

41.0 |

73.8 |

11.7 |

272.2 |

403.1 |

0.0 |

4.7 |

|

FINAL |

||||

|

COMMODITY |

NET |

CARRYOVER SALES |

05/31/2023 EXPORTS |

ACCUMULATED EXPORTS |

|

WHEAT |

|

|

|

|

|

|

-8.6 |

236.1 |

28.7 |

4,872.4 |

|

|

-0.7 |

149.8 |

19.3 |

2,694.9 |

|

|

12.7 |

321.8 |

28.2 |

5,381.9 |

|

|

0.9 |

154.2 |

9.6 |

4,413.9 |

|

|

0.7 |

15.5 |

1.4 |

395.4 |

|

|

5.0 |

877.4 |

87.3 |

17,758.5 |

|

BARLEY |

0.0 |

3.3 |

0.0 |

8.7 |

|

|

|

|

|

|

Export

Sales Highlights

This

summary is based on reports from exporters for the period May 26-June 1, 2023.

Wheat:

Net sales of 234,800 metric tons (MT) for the 2023/2024 marketing year, which began June 1, primarily for Taiwan (56,000 MT), Colombia (40,800 MT, including decreases of 9,700 MT), Mexico (36,400 MT, including decreases of 11,400 MT), Jamaica (22,000 MT),

and the Philippines (21,500 MT), were offset by reductions for the Dominican Republic (1,400 MT). A total of 877,400 MT in sales were carried over from the 2022/2023 marketing year, which ended May 31. Exports for the period ending May 31, of 87,300 MT brought

accumulated exports to 17,758,500 MT, down 5 percent from the prior year’s total of 18,668,900 MT. The destinations were primarily to South Korea (35,200 MT), Thailand (18,600 MT), Colombia (17,400 MT), Mexico (14,400 MT), and Japan (700 MT). Exports for June

1 of 190,100 MT were primarily to the Philippines (71,500 MT), Mexico (44,600 MT), Venezuela (21,000 MT), Sri Lanka (19,800 MT), and Honduras (16,800 MT).

Corn:

Net sales of 172,700 MT for 2022/2023 were down 8 percent from the previous week, but up noticeably from the prior 4-week average. Increases primarily for Japan (117,500 MT, including 66,200 MT switched from unknown destinations and decreases of 7,600 MT),

Mexico (44,700 MT, including decreases of 59,200 MT), South Korea (32,000 MT, including 30,000 MT switched from unknown destinations and decreases of 1,700 MT), Honduras (28,500 MT, including 6,500 MT switched from Costa Rica and decreases of 37,500 MT), and

El Salvador (22,600 MT, including 16,600 MT switched from Nicaragua), were offset by reductions for unknown destinations (89,600 MT), Nicaragua (16,600 MT), and Colombia (3,600 MT). Net sales reductions of 106,800 MT for 2023/2024 resulting in increases for

Canada (22,000 MT) and Mexico (10,700 MT), were more than offset by reductions for Mexico (119,900 MT), Honduras (19,100 MT), and Guatemala (500 MT). Exports of 1,244,700 MT were down 13 percent from the previous week and 4 percent from the prior 4-week average.

The destinations were primarily to China (403,400 MT), Mexico (276,900 MT), Japan (198,400 MT), South Korea (161,300 MT), and Honduras (43,500 MT).

Barley:

No net sales were reported for the 2023/2024 marketing year, which began June 1. A total of 3,300 MT in sales were carried over from the 2022/2023 marketing year, which ended May 31. Accumulated exports were 8,700 MT, down 43 percent from the prior year’s

total of 15,300 MT. There were no exports for the period ending May 31 and June 1.

Sorghum:

Net sales of 65,200 MT for 2022/2023 were down 50 percent from the previous week, but up 43 percent from the prior 4-week average. Increases reported for unknown destinations (68,000 MT), were offset by reductions for China (2,800 MT). Total net sales of 200

MT for 2023/2024 were for Japan. Exports of 50,800 MT were up 39 percent from the previous week, but down 21 percent from the prior 4-week average. The destination was to China.

Rice:

Net sales of 11,400 MT for 2022/2023 were down 32 percent from the previous week, but unchanged from the prior 4-week average. Increases were primarily for Saudi Arabia (8,600 MT), Honduras (1,500 MT), Canada (1,000 MT), Mexico (200 MT), and American Samoa

(100 MT). Total net sales of 16,000 MT for 2023/2024 were for Honduras. Exports of 70,800 MT were up noticeably from the previous week and from the prior 4-week average. The destinations were primarily to Panama (29,600 MT), Honduras (17,100 MT), Haiti (10,000

MT), Saudi Arabia (9,200 MT), and Mexico (3,300 MT).

Soybeans:

Net sales of 207,200 MT for 2022/2023 were up 68 percent from the previous week and up noticeably from the prior 4-week average. Increases primarily for Japan (97,100 MT, including 26,000 MT switched from unknown destinations and decreases of 1,000 MT), Germany

(68,700 MT, including 62,000 MT switched from unknown destinations), Egypt (32,800 MT, including 31,000 MT switched from unknown destinations), South Korea (21,000 MT, including 20,000 MT switched from unknown destinations), and Canada (10,900 MT), were offset

by reductions for unknown destinations (47,900 MT) and Mexico (1,400 MT). Net sales of 264,600 MT for 2023/2024 were primarily for China (131,000 MT), Mexico (60,000 MT), Taiwan (25,700 MT), Japan (20,000 MT), and Thailand (15,800 MT). Exports of 247,600 MT

were up 7 percent from the previous week, but down 7 percent from the prior 4-week average. The destinations were primarily to Germany (68,700 MT), Mexico (47,900 MT), Japan (46,200 MT), Egypt (32,800 MT), and South Korea (21,200 MT).

Optional

Origin Sales:

For 2022/2023, the current outstanding balance of 300 MT, all South Korea.

Export

for Own Account: For

2022/2023, the current exports for own account outstanding balance of 1,600 MT are for Canada (1,400 MT) and Taiwan (200 MT).

Soybean

Cake and Meal:

Net sales of 177,600 MT for 2022/2023 were down 56 percent from the previous week and 42 percent from the prior 4-week average. Increases primarily for Colombia (46,000 MT, including decreases of 400 MT), the Dominican Republic (36,000 MT), Israel (28,500

MT), Ecuador (20,000 MT), and El Salvador (11,800 MT, including 12,000 MT switched from Nicaragua and decreases of 200 MT), were offset by reductions for Nicaragua (8,800 MT), Belgium (1,300 MT), and Trinidad and Tobago (300 MT). Total net sales of 90,000

MT for 2023/2024 were for Ecuador. Exports of 196,100 MT were down 24 percent from the previous week and 18 percent from the prior 4-week average. The destinations were primarily to the Philippines (49,400 MT), Mexico (31,800 MT), Saudi Arabia (25,000 MT),

Canada (22,300 MT), and El Salvador (11,800 MT).

Late

Reporting:

For 2022/2023, exports of 1,172 MT of soybean cake and meal were late to Panama.

Soybean

Oil:

Net sales reductions of 300 MT for 2022/2023 were down noticeably from the previous week and from the prior 4-week average. Increases for Sri Lanka (300 MT), were more than offset by reductions for Canada (500 MT) and Mexico (100 MT). Total net sales of 100

MT for 2023/2024 were for Mexico. Exports of 1,000 MT were down 93 percent from the previous week and 79 percent from the prior 4-week average. The destinations were primarily to Canada (500 MT), Sri Lanka (200 MT), and the Dominican Republic (200 MT).

Cotton:

Net sales of 480,400 RB for 2022/2023–a marketing-year high–were up 79 percent from the previous week and up noticeably from the prior 4-week average. Increases primarily for China (384,700 RB), Pakistan (51,600 RB, including 900 RB switched from China and

decreases of 100 RB), Turkey (18,800 RB, including 900 RB switched from South Korea and decreases of 100 RB), Bangladesh (13,300 RB), and Vietnam (6,500 RB, including 2,400 RB switched from China, 1,500 RB switched from South Korea, and decreases of 100 RB),

were offset by reductions for South Korea (2,400 RB) and Guatemala (2,000 RB). Net sales of 30,800 RB for 2023/2024 were primarily for Turkey (20,700 RB), Peru (4,000 RB), Guatemala (2,700 RB), China (2,200 RB), and Indonesia (900 RB). Exports of 317,000 RB

were up 12 percent from the previous week and 4 percent from the prior 4-week average. The destinations were primarily to Turkey (89,500 RB), Vietnam (75,800 RB), Pakistan (33,700 RB), China (32,700 RB), and Mexico (16,100 RB). Net sales of Pima totaling 2,100

RB for 2022/2023 were down 43 percent from the previous week and 71 percent from the prior 4-week average. Increases were primarily for Vietnam (900 RB) and India (900 RB). Exports of 11,700 RB were down 56 percent from the previous week and 35 percent from

the prior 4-week average. The destinations were to India (8,200 RB), Vietnam (1,300 RB), Bangladesh (900 RB), Pakistan (900 RB), and Turkey (400 RB).

Optional

Origin Sales: For

2022/2023, options were exercised to export 800 RB to Malaysia. The current outstanding balance of 300 RB, all Malaysia.

Export

for Own Account: For

2022/2023, decreases of 6,500 RB were for China. The current exports for own account outstanding balance of 105,800 RB are for China (74,200 RB), Vietnam (21,500 RB), Pakistan (5,000 RB), South Korea (2,400 RB), India (1,500 RB), and Turkey (1,200 RB).

Hides

and Skins:

Net sales of 396,800 pieces for 2023 were down 13 percent from the previous week and 18 percent from the prior 4-week average. Increases were primarily for China (317,800 whole cattle hides, including decreases of 5,200 pieces), Mexico (48,500 whole cattle

hides, including decreases of 2,300 pieces), South Korea (13,300 whole cattle hides, including decreases of 1,300 pieces), Thailand (5,000 whole cattle hides), and Turkey (5,000 whole cattle hides). Exports of 455,200 pieces were up 18 percent from the previous

week and 14 percent from the prior 4-week average. Whole cattle hides exports were primarily to China (300,900 pieces), South Korea (63,400 pieces), Mexico (36,500 pieces), Brazil (32,400 pieces), and Thailand (9,500 pieces).

Net

sales of 210,100 wet blues for 2023 were up noticeably from the previous week and from the prior 4-week average. Increases primarily for China (81,600 unsplit, including decreases of 200 unsplit), Hong Kong (50,000 unsplit), Italy (42,000 unsplit, including

decreases of 10,500 unsplit), Taiwan (11,700 unsplit), and Vietnam (9,600 unsplit), were offset by reductions for India (200 unsplit) and Brazil (100 grain splits). Exports of 93,600 wet blues were down 33 percent from the previous week and 29 percent from

the prior 4-week average. The destinations were primarily to Italy (28,800 unsplit), Vietnam (16,100 unsplit), Hong Kong (12,000 unsplit), China (11,400 unsplit), and Thailand (8,500 unsplit). Net sales of 35,600 splits reported for China (42,000 pounds),

were offset by reductions for Hong Kong (3,500 pounds) and Vietnam (2,900 pounds). Exports of 73,900 pounds were to Hong Kong (37,100 pounds) and Vietnam (36,800 pounds).

Beef:

Net sales of 12,800 MT for 2023 were down 29 percent from the previous week and 27 percent from the prior 4-week average. Increases primarily for Japan (3,900 MT, including decreases of 400 MT), South Korea (3,900 MT, including decreases of 400 MT), Mexico

(1,900 MT), Taiwan (1,000 MT, including decreases of 200 MT), and Canada (900 MT), were offset by reductions for China (100 MT). Exports of 15,400 MT were down 3 percent from the previous week and 6 percent from the prior 4-week average. The destinations were

primarily to Japan (4,000 MT), South Korea (3,700 MT), China (2,500 MT), Mexico (1,200 MT), and Canada (1,200 MT).

Pork:

Net sales of 25,500 MT for 2023 were up 13 percent from the previous week, but down 11 percent from the prior 4-week average. Increases primarily for Mexico (9,100 MT, including decreases of 800 MT), China (8,100 MT, including decreases of 300 MT), Japan (3,200

MT, including decreases of 300 MT), South Korea (2,000 MT, including decreases of 800 MT), and Colombia (1,500 MT, including decreases of 100 MT), were offset by reductions for Nicaragua (500 MT), Australia (500 MT), and Taiwan (100 MT). Exports of 25,100

MT were down 26 percent from the previous week and 31 percent from the prior 4-week average. The destinations were primarily to Mexico (7,400 MT), Japan (4,000 MT), China (3,900 MT), South Korea (2,600 MT), and Canada (1,500 MT).

#non-promo